RNS Number:7085S

Bovis Homes Group PLC

11 March 2002

BOVIS HOMES GROUP PLC

PRELIMINARY RESULTS

FOR THE YEAR ENDED 31 DECEMBER 2001

Issued 11 March 2002

The Board of Bovis Homes Group PLC today announced its preliminary

results for 2001.

* Operating profit increased by 20.5% to £85.2 million (2000: £70.7

million)

* Pre tax profit increased by 19.2% to £80.0 million (2000: £67.1

million)

* Earnings per share increased by 18.3% to 49.7p (2000: 42.0p)

* Operating margin increased to 23.8% (2000: 23.2%)

* Return on average capital employed of 23.0% (2000: 23.2%)

* Plots with planning consent at 10,326 plots (4.3 years' supply on

2001 completions)

* Strategic landholdings of 19,847 potential plots (8.2 years' supply

on 2001 completions)

* Final dividend of 8.5p net per ordinary share making 12.7p for the

year (3.9 times covered)

* Year end net borrowings of £57.2 million (17.1% gearing)

Commenting on the results, Malcolm Harris, the Chief Executive of Bovis

Homes Group PLC said:

'The Group has delivered another excellent set of results, improving

profits, operating margins and earnings per share. Additional

investments in prime landholdings during the year have further

strengthened the Group's consented and strategic landholdings, providing

a firm base to expand the business.

The current year has started well with cumulative sales reservations

over 10% ahead in terms of volume compared with 2001. Sales prices

achieved to date are above budget and the comparable period last year.

Housing affordability remains good due to low interest rates and a

competitive mortgage market.

Based upon our trading experience to date and the current economic

outlook, the Board is confident of 2002 being another successful year.'

Enquiries:

Malcolm Harris, Chief Executive

Bovis Homes Group PLC

Tel: 020 7321 5010 on Monday 11 March

Tel: 01474 872427 thereafter

Andrew Best / Emily Bruning

Shared Value Limited

Tel: 020 7321 5010

Chairman's statement

The Group achieved a further year of strong performance reacting quickly

to changes in market conditions and managing effectively the period of

uncertainty arising from the tragic events on 11 September in the United

States. The solid progress reported at the interim stage of 2001 was

enhanced with a strong second half year.

Results

Profit on ordinary activities before taxation for the year ended 31

December 2001 rose by 19.2% to £80.0 million, compared with £67.1

million in 2000. This result was achieved from total turnover of £358.5

million, 17.5% greater than the previous year primarily from a 3%

increase in volume of legal completions and a 14% increase in average

selling price.

For the year, the operating margin was increased to 23.8% and return on

capital employed, which has again surpassed the Group's minimum target,

stood at 23.0%. Basic earnings per share increased by 18.3% in 2001 to

49.7 pence.

Dividend

The Board proposes a final dividend for the year ended 31 December 2001

of 8.5 pence to be paid on 24 May 2002 to shareholders on the register

at the close of business on 26 April 2002. This dividend when added to

the interim dividend of 4.2 pence paid on 23 November 2001 totals 12.7

pence for the year and is covered 3.9 times by the basic earnings per

share of 49.7 pence. The total dividend per share for the year

represents an increase of 8.5% over the total dividend for 2000.

Market conditions

The housing market remained buoyant during 2001, notwithstanding the

potential for decline raised by the terrorist attacks in the United

States. Significant forecasting by market commentators of a UK

recession only threatened to damage consumer confidence which remained

resilient assisted by the 200 basis point interest rate reduction during

2001.

The reduction in interest rates fed through rapidly to mortgage rates

and reduced the share of household disposable income being used to

service the home mortgage. At the end of the third quarter of 2001,

affordability trend indicators reported that the first year mortgage

interest payments as a percentage of average net earnings for a two

income couple were 18%. As a result of reduced mortgage payments, house

affordability has remained strong even after the reported increases in

house prices.

In January 2002 the Halifax reported annual growth in new house prices

of 9.5% for the year ended 31 December 2001.

Strategy

In 2001 the Group was successful in growing its operating margins and at

the same time increasing its volume of legal completions. The Board has

established an expansion plan which it has started to implement. From 1

January 2002, the Northern area of operation has been launched as a new

region. Further regional launches are planned, subject to market

conditions, which will further expand the Group's geographic coverage.

The Group's strategy is to grow its activity levels through regional

expansion whilst retaining its well established financial objectives.

The Group will continue to employ its core strategies across the

expanded Group, focusing on consistent investment in prime land and

continuous improvement programmes in respect of products and processes.

Research and development into new build techniques and materials will

continue in the Group's pursuit of multi-skilling the work force to

improve the build process and delivering to customers a quality product

which is synonymous with the Bovis Homes' name.

The Group anticipates through its regional expansion to permit high

calibre management within the Group to advance to positions of increased

responsibility, gaining good experience whilst adding value in new,

challenging and exciting roles.

The Board

The Board has been reconstituted and now comprises three executive

directors; Malcolm Harris, Chief Executive; Ron Walford, Finance

Director; and Stephen Brazier, Group Operations Director, and three non

executive directors including myself as Chairman. During 2001, Jim

Ditheridge retired from office and Mike Johnson resigned from the Board,

whilst retaining operational responsibility for Central region. Since

the year end, Mike Sharpe has retired from office and Peter Baker has

resigned from the Board, whilst retaining operational responsibility for

South West region. John Emery retired on 3 January 2002 after 25 years

service with the Group.

Ron Walford has notified the Board of his intention to retire from the

Company effective from 30 June 2002. Ron has been with the Group for

30 years and was appointed Finance Director in 1974. I am pleased

to advise that from 1 July 2002, David Ritchie will be appointed as

Finance Director. David has been the Group's Financial Controller since

1998, having joined the Group soon after flotation.

On behalf of the Board I would like to express my thanks to Ron Walford,

John Emery and Mike Sharpe for their service with the Group and

contribution to the Board. I would also like to thank Mike Johnson and

Peter Baker for their contribution as Board members and look forward to

their continuing support as Managing Directors of their respective

regions.

Employees

These results could not have been achieved without a great deal of hard

work and effort from our employees, for which the Board expresses

thanks. Such dedication provides great confidence for the future.

After careful consideration, the Board decided to introduce a new

defined contribution pension scheme effective from 1 January 2002. New

employees joining the Group after that date are being offered membership

of the new scheme. Existing members of the defined benefit scheme

continue to be members of that scheme.

The Group has for many years advanced the concept of employee share

ownership through the Inland Revenue approved Profit Sharing Scheme.

This scheme has been phased out by the Government, however, the Group

intends to launch a new Share Incentive Plan (SIP), subject to Inland

Revenue approval. At the forthcoming annual general meeting the Board

will seek approval from the shareholders to do this.

Prospects

The UK economy to date has surprised many with its resilience against

recession. Consumer confidence has been reported recently as having

recovered to levels comparable with the record levels reached in July

2001, before the tragedies unfolded in the United States. However,

latest GDP forecasts suggest limited output growth during 2002 with the

manufacturing sector being more susceptible to contraction.

Underlying inflation is forecast for 2002 to remain below the 2.5%

benchmark rate used by the Monetary Policy Committee which may lead to

reticence in respect of increases in interest rates. This along with

earnings growth forecasts as published by the Halifax in its February

2002 Economic Outlook of 4.0% for 2002 will assist in maintaining

affordability in the housing market.

In the same Economic Outlook, the Halifax has forecast a reduction in

house price increases during 2002 compared with 2001 which should assist

stability in the housing market.

Given the Group's trading experience to date in 2002 with reservations

and site visitors ahead of the same period in 2001 and the prevailing

economic picture, the Board is confident that 2002 will be another

successful year.

Nigel Mobbs

Chairman

Chief Executive's operational review

Trading environment

The United Kingdom's overall economy performed remarkably well during

2001 particularly when compared with the world economic climate.

Underlying inflation ended the year considerably below the Government's

target of 2.5%. Bank base interest rates remained at 6.0% until

February before decreasing steadily to a low of 4.0% in November where

they remained until the end of the year. Strong growth in high street

spending and increases in average earnings and employment provided a

strong consumer base.

Consumer confidence was adversely affected by the outbreak and

protraction of the foot and mouth epidemic which caused restrictions on

the movement of people and vehicles and severe hardship in areas

dependant upon farming and tourist activity. The poor weather

conditions experienced during 2000 continued through the first quarter

of 2001 resulting in extensive flooding in many parts of the country

which impacted upon the Group's production resulting in the profit split

being strongly biased towards the second half of the year.

The tragedies experienced in the United States on 11 September had a

world-wide impact, the consequences of which will take time to fully

evaluate.

Affordability remained good throughout 2001 due to low interest rates,

improvements in average earnings and a very competitive mortgage market.

The average house price increase for new homes for the year ended 31

December 2001, as reported by the Halifax, was 9.5% with significant

regional price variations.

Group performance

Operating in a reasonable, but challenging, housing market the Group

produced an excellent performance further strengthening the operating

base to facilitate the planned expansion of the business. The Group's

operating margin improved to 23.8% from 23.2% in 2000 as a result of the

combined effects of new products, process improvements, specification

changes and increased volumes. The Group legally completed 2,429

houses, a 3% increase in unit throughput whilst at the same time it

pursued opportunities to trade commercial landholdings and successfully

completed a sale at Cambourne near Cambridge.

The Group's average house sales price increased by 14% compared with

2000. After taking account of an 8% increase in the average size of

unit to 1,053 square feet, sales price per square foot, net of

incentives, increased by 6%. By comparison, construction costs per

square foot increased by 7% including specification upgrades. The

significant increase in average unit size reflects the ongoing increase

in contribution from the Group's range of three storey townhouses and

room in the roof homes, which contributed 15% of the legal completions

during 2001 (2000: 4%). This contribution is demonstrated in the

product mix of the Group's legal completions where five bedroom units

have increased to 8% of total legal completions reflective of the

flexible room in the roof space designed over a traditional two storey

four bed unit.

Product mix and average

sales price 2001 2000

% Units Average % Units Average

Year ended 31 December sales sales

price price

£ £

House type

---- ---- ------- ---- ------ ------

Two bedroom 17 420 97,100 17 416 84,700

Three bedroom 26 636 118,600 25 592 105,600

Four bedroom 34 834 165,400 38 890 152,200

Five or more bedroom 8 200 275,700 4 98 249,600

Social Housing 10 229 63,900 10 230 57,600

Retirement Homes 5 110 160,200 6 134 150,200

---- ---- -------- ---- ------ ------

Group 100 2,429 140,600 100 2,360 123,300

---- ----- -------- ---- ------ ------

Regional performance

The planned growth within Central region facilitated the first stage of

the expansion plan with the launch of the Northern region on 1 January

2002. The Central region results included 156 legal completions from

the Northern area with a gross housing profit contribution of £4.0

million (2000: 120 legal completions and £3.2 million gross housing

profit).

Unit completions and average sales price

Year ended 31 December 2001 2000

Units Average Units Average

sales sales

price price

£ £

------ -------- ------ -------

Central 769 150,000 650 135,200

South East 867 149,500 931 124,600

South West 683 115,600 645 103,800

Retirement Homes 110 160,200 134 150,200

------ ------ ------ -------

Group 2,429 140,600 2,360 123,300

------ ------- ------ -------

Operating margins

Year ended 31 December 2001 2000

% %

-------- --------

Central 26.4 22.7

South East 25.1 26.4

South West 16.9 18.1

Retirement Homes 25.6 25.8

-------- --------

Group 23.8 23.2

--------- ---------

The South West region results included 107 social housing units, 45

units more than the previous year representing a far greater percentage

of the region's activity and contributing more significantly to the

Group's social housing throughput. Of these, 92 units were built on

land that was not in the region's ownership.

Land and planning

The cost of processing planning applications and the time periods

involved have increased considerably. Despite these impositions, the

Group managed to increase its landholdings with planning consent to

10,326 plots as at 31 December 2001 which represented 4.3 years' supply

based upon 2001 legal completion levels.

The re-positioning of the Group's land bank continued during the year

with a significant investment at Hatfield where the Group intends

building the major part of a new village which will consist of a minimum

of 1,000 homes.

The average plot cost of the consented land bank (excluding social

housing) was £36,300 which represented 24.4% of the average selling

price in the year of £148,600 (excluding social housing). The plots

held with consent at 31 December 2001 are anticipated to generate a

higher average sales price as new products are developed in prime

locations.

The strategic landholdings as at the end of the financial year improved

to 19,847 potential plots after transferring 411 plots from strategic to

consented land during the year at a 15.0% discount to market value.

Despite continuing planning difficulties a large number of strategic

schemes are now at an advanced stage. Therefore, it is anticipated that

there will be a substantial increase in the transfer of plots to

consented land during 2002/2003. Unit completions originating from

strategic land contributed 52% (2000: 49%) of the Group's development

profit in the year. 28% (2000: 31%) of the unit completions in the year

were built on previously used land.

Consented land bank

Total plots as at 31 December 2001 2000

Plots Plots

--------- --------

Central 4,288 4,294

South East 3,470 3,385

South West 2,200 2,083

Retirement Homes 368 371

-------- --------

Group 10,326 10,133

-------- --------

Years' supply based upon completions in 4.3 4.3

the year -------- --------

Strategic land bank

Total potential plots as at 31 December 2001 2000

Plots Plots

------- --------

Central 4,103 3,495

South East 11,259 10,446

South West 4,485 4,000

Retirement Homes - 75

--------- ---------

Group 19,847 18,016

-------- --------

Years' potential supply based upon 8.2 7.6

completions in the year

--------- ---------

Included in strategic landholdings are 8,327 potential plots in

strategic "growth locations". Growth locations are areas designated for

development within draft or adopted development plans by local, county

or unitary planning authorities.

Total potential plots in "growth 2001 2000

locations" as at 31 December Plots Plots

Central 1,507 1,128

South East 5,334 5,439

South West 1,486 2,014

Retirement Homes - 75

--------- ---------

Group 8,327 8,656

--------- ---------

Pursuant to the publication of PPG3 the Group has acquired a number of

investments which are potential re-development sites not allocated for

residential use in the current plan which should receive planning

consent in the short to medium term.

Research and development

The Group undertakes continuous reviews of all of its activities with an

objective of achieving a safe working environment whilst maximising

efficiency and profitability. In addition to process reviews, an

extensive research and development programme is underway relating to

site based activities, the objective of which is to:

* achieve construction in all weather conditions;

* attain consistent high quality;

* maximise mechanical handling and use of factory finished components;

* minimise waste by utilising lean, efficient construction techniques;

* develop multi-skilled team working and new trade sequencing;

* achieve partnering agreements involving suppliers, skilled tradesmen,

industry bodies and Government, to develop new products and methods

of operating.

During 2001 significant progress has been made by the Group in these

areas with increased usage of pre-assembled and pre-finished components

and targets have been established for 2002.

Component usage Average Target Average Target

total total

Year Year Year Year

2000 2001 2001 2002

------ ------ ------ ------

Factory pre-finished, pre glazed

windows 31% 85% 87% 95%

Factory pre-finished soffits,

fascias, barge boards 30% 85% 87% 95%

Factory pre-assembled, pre-finished

GRP porches 97% 97% 98% 99%

Factory pre-assembled, pre-finished

GRP dormers 2% 83% 46% 81%

Factory assembled pre-glazed

external steel doorsets 14% 74% 81% 99%

Factory assembled internal

doorsets - 25% 16% 62%

Factory assembled pre-glazed

cassette doorsets 4% 66% 71% 88%

Factory assembled pre-glazed

external feature doorsets 58% 85% 77% 92%

Factory pre-finished garage doors 100% 100% 100% 100%

Factory pre-fabricated engineered

joist sets - 57% 62% 91%

Factory finished radiators 100% 100% 100% 100%

Factory pre-assembled stair

parts/balusters 57% 100% 98% 100%

New technology snap fit plumbing 48% 86% 82% 97%

Factory pre-plumbed thermal

store cylinders 61% 81% 82% 91%

------ ------ ------ ------

A new dimension in mechanical handling has been extensively trialled in

the form of a unique rough terrain telescopic forklift truck with 360

degrees rotational ability, giving the operatives on-site ability to

handle heavy materials including autoclaved aerated concrete components

being developed in partnership with one of the Group's suppliers.

The Group is participating in several Partners In Innovation (P.I.I.)

projects in various stages of completion. These projects, part funded

by Government, are designed to promote innovation and continuous

improvement:

* Using superdried timber in construction (Lead Partner: BRE, Centre

for Timber Technology & Construction)

* New environmentally friendly exterior building components for Medium

Density Fibreboard (MDF) (Lead Partner: BRE, Centre for Timber

Technology & Construction)

* Adding value to UK timber: Development and demonstration of glued

laminated products (Lead Partner: BRE, Centre for Timber Technology &

Construction)

* Development of a new energy efficient system for the whole house

(a.a.c.) (Lead Partner: Leading aircrete manufacturer)

The erection of a demonstration unit for the whole house (a.a.c.)

partnership will form part of the prestigious ZETHUS project, a

collection of innovative dwelling constructions being erected during

2002 at the University of Greenwich (Faculty of Build Environment).

Ahead of the ZETHUS project, the Group trialled the use of aircrete

components in the South West region utilising aircrete storey height

panels, floor beams and stair components. Finishing works are

progressing and trials have commenced with thin coat spray plasters.

The Group is currently experimenting with innovative construction

sequences, utilising multi-skilled labour for superstructure erection

and finishing teams.

The Group is working with major supply chain partners in many areas

including the development of solid wall constructions and modular pre-

fabricated brickwork.

Social housing

The Group provides quality homes serving a wide socio-economic customer

base and is focusing upon the social housing sector as an area of

expansion. Partnership agreements with housing associations offer

significant benefits in terms of price, build quality, low maintenance

and deliverability within short time scales. Additional resources are

being deployed to this sector of the business. Details relating to a

number of the schemes that the Group has been involved in during the

past twelve months are presented within the 2001 report and accounts.

Health, safety and environment

Best practice in health, safety and environmental awareness and

management is an important element in the continuing success of the

Group. The objective is to maintain the highest practical levels of

health and safety and effective environmental policies.

The Health, Safety and Environmental Consultative Committee oversees

these important matters, formulating and promulgating policy to all

stakeholders. The Committee is chaired by a Bovis Homes Limited

director by annual rotation to ensure that fresh ideas and initiatives

are constantly introduced, assessed and, where appropriate, implemented

on a consistent basis. The Chairman is supported by a committee

comprising Group employees from numerous disciplines complemented by the

Health and Safety Director and external independent professional

advisers.

During 2001 the Committee instigated a new S.M.A.R.T. audit regime,

covering every site, which allows detailed, progressive and cumulative

analysis of performance and focus for constant improvement.

A revitalised health and safety competition was launched in 2001

entitled the "Bovis Homes Health and Safety Marathon". The high profile

competition is progressively and cumulatively judged to stimulate,

motivate and improve health and safety standards.

Whether on site or at its offices, Bovis Homes promotes all aspects of

safety and environmental management throughout its operations in the

interests of all stakeholders. Its record of success was once again

recognised in 2001 with the Gold Medal Award from the Royal Society for

the prevention of Accidents and the National Award from the British

Safety Council.

Bovis Homes' objective is to achieve sustainable construction and reduce

environmental impact. The Group seeks to protect and, wherever

possible, improve the environment by retaining mature landscaping and

introducing new planting and habitats. It is also committed to planning

for the most efficient and effective use of development land. The Group

has introduced higher density properties with flexible accommodation

which addresses the changing lifestyles of its customers including the

ability to work from home.

The Group has issued to employees within the Group an Environmental

Management Manual containing the Environmental Policy, Environmental

Effects Document and Best Practice Checklists. It is a comprehensive

approach consolidating policies, procedures and systems, explaining how

all employees can assist the Group in achieving its environmental aims

and make a positive contribution to the environment.

Further information in respect of health and safety, environmental

management, sustainable development and detailed progress against

previously set environmental targets can be found in the Group's

inaugural free standing Corporate Report on policies, procedures and

performance.

Group and management structure

A framework has been established to enable the Group to expand. David

Durling has been appointed as Managing Director of the new Northern

region which is based at Wilmslow and covers the north west and north

east of England. Geoff Coleman has been appointed as Managing Director

of the South East region following Mike Sharpe's retirement from office.

Regardless of where and when elements of the Group's expansion plan

occur, all systems, methods of operating, procurement and processes are

standardised in line with the Group operational model which is subject

to regular review and, where appropriate, improvement.

The operational model is founded upon the concept of empowerment,

fostering regional management's entrepreneurial flair within a

prescribed method of operating, to purchase land in the right location

using local knowledge, to specify products to meet local needs, to

market these products to the identified customer base and maximise

profitability.

As part of the expansion plan and to further improve the Group's

efficiency, Castle Bromwich Hall, the regional office for the Central

operation, was sold in 2001 and a new purposely designed office is being

built at Coleshill, near Birmingham, which will be occupied in the

summer of 2002. The relocation will provide space for expansion, a net

cash saving for the business, improve operating efficiency and reduce

office running costs compared with the previous location.

Further area and regional offices will be opened as and when

appropriate. The effect of these changes will add volume and profit,

improving the overall overhead recovery level of the Group.

Turning to the management of the growing business, the Board of the

Company has been reconstituted since the 2001 year end to three

executive directors and three non executive directors. These changes

have focused all regional Managing Directors efforts to the main

operating company whilst I, along with the Group Operations Director and

Finance Director concentrate on overseeing the entire Group activity.

The expansion plan of the Group will be assisted by the new Board

structure.

The framework outlined for expansion will be underpinned by the Group's

ability to sustain the business long term and to consistently improve

the level of earnings per share. Structural and operational changes

will continue to be made only where there is a sound business case for

such actions.

Employees

Bovis Homes is a people business. It is essential therefore that the

right individuals are recruited, trained and motivated. The objective

is to ensure that the Group employs the highest calibre of employees who

add value to the business and are sensitive to the demands and

requirements of the Group's customers whilst having the entrepreneurial

drive and flair to move the operation forward without compromising good

corporate governance.

Training is an essential element of the Group's business strategy.

Employees have a personal development plan which is formulated in

consultation with their manager to support their individual aspirations

whilst matching and complementing the needs of the Group. Once the plan

has been formulated there is further appraisal to ensure that the aims

and objectives are successfully achieved.

An action plan has been formulated to facilitate the development of key

staff in the business to allow both succession for current executives

and the fulfilment of new senior positions arising from the proposed

expansion. It is hoped that the majority of future senior appointments

will be resourced through promotion from within the Group. All

appointments, however, will be made upon merit, ability and experience

and progress maintained to ensure that the business does not, and will

not, rely upon any particular individual for its future success.

On 1 January 2002, the Group launched a new defined contribution pension

scheme which will be offered to new employees joining the Group. The

Scheme is intended to offer these employees the surety of a pension and

provide the Group with certainty of contribution levels. All employees

currently in the existing Bovis Homes' defined benefit pension scheme

continue to be members of that scheme.

Planning legislation

The further deterioration in the planning system has been acknowledged

by the Government who published a Planning Green Paper on 12 December

2001, the objective of which is to deliver a fundamental change to the

planning system in England. The Group previously responded positively

to the opportunities that arose pursuant to the publication of PPG3. It

welcomes the review and trusts that the Green Paper will provide

opportunities for government at local and national level to work with

the industry to find practical solutions to improve the planning system.

Taxation

The housebuilding industry continues to be adversely affected by new or

increased Government taxes.

Aggregate tax

A new levy on aggregate materials is to be implemented in April 2002 set

at £1.60 per tonne. This additional burden will add considerable cost

to all infrastructure, roads and sewers as well as construction work.

Landfill tax

The current tax cost is £2 per tonne for inactive and £12 per tonne for

active waste. During 2002 the active waste tax is to be increased by £1

per tonne. Further increases are proposed for 2003 and 2004.

Climate change levy

Additional taxes have been imposed on electricity, gas, liquefied

petroleum gas and solid fuels:

* Electricity 0.43 pence per kWh

* Gas 0.15 pence per kWh

* LPG 0.96 pence per kg (0.07 pence per kWh)

* Solid fuel 1.17 pence per kg (0.15 pence per kWh)

These taxes make British made products more expensive to manufacture and

adds further costs to the housebuilding industry.

The Group has budgeted in 2002 for an additional £2 per square foot,

representing over 3% of budgeted construction costs, to allow for the

aforementioned tax increases and building regulation changes.

Outlook for 2002

Bovis Homes commenced the new year in a strong position with an

excellent land bank and product range, efficient processes and a good

forward sales position. The new Northern region has started strongly

supporting the Group's plans to add further operations to improve

shareholder value.

Most importantly the Group is supported by able, enthusiastic, committed

employees led by a very capable management team, confident of their

ability to deliver ongoing, positive results for the Group's

shareholders.

Malcolm Harris

Chief Executive

Financial review

Overview

2001 was a year of good growth for the Group notwithstanding the tragic

events in the United States on 11 September 2001 and the aftermath.

Turnover increased by 17.5% and pre tax profit was raised by 19.2%.

Earnings per share increased by 18.3% to 49.7 pence. The balance sheet

ended the year in very sound condition with a strong land bank and low

borrowings relative to shareholders' funds and total bank facilities.

Review of results

The profit on ordinary activities before taxation for the year ended 31

December 2001 amounted to £80.0 million inclusive of a profit arising on

the sale of freehold property of £1.2 million. This compares with £67.1

million in the previous year and excluding this year's exceptional

profit represents an increase of 17.4% year on year.

Total turnover rose from £305.0 million in 2000 to £358.5 million in

2001. 2,429 profit units were completed at an average selling price of

£140,600 compared with 2,360 units and £123,300 in the previous year.

The 14% increase in average selling price reflected the larger

proportion of three storey and room in the roof properties which

represented 15% of unit output in the year, against 4% in the previous

year. Overall, the average selling price per square foot increased by

6% and the average size of unit increased by 8%.

Operating profit increased by 20.5% to £85.2 million (2000: £70.7

million), and showed an enhanced operating margin of 23.8% on turnover,

compared with 23.2% in the previous year. Land sale and other income

accounted for £17.0 million turnover compared with £14.0 million in

2000. Land sales contributed a profit less option costs of £2.7 million

in 2001 (2000: £2.3 million).

A profit of £1.2 million arose from the sale of a regional office near

Birmingham.

Net interest payable amounted to £6.4 million, and was covered 13 times

by profit before interest.

The net corporation tax charge for the year amounting to £23.4 million,

was after crediting an adjustment in respect of prior years amounting to

£0.3 million.

Dividends paid and proposed totalled £14.5 million (2000: £13.3 million)

resulting in a retained profit for the financial year of £42.1 million

(2000: £34.1 million).

Review of balance sheet

Shareholders' funds increased during the year by £44.8 million to £334.9

million and net borrowings reduced by £3.8 million to £57.2 million.

The additional capital employed was essentially invested in land held

for development, offset by an increase in land creditors and relatively

small reductions in work in progress and part exchange properties, as

follows:

As at 31 December 2001 2000 Increase/

(decrease)

£m £m £m

-------- -------- --------

Land held for development 397.9 309.6 88.3

Land creditors (102.9) (62.7) (40.2)

--------- -------- --------

Net investment in land 295.0 246.9 48.1

Raw materials and work in progress 120.2 121.2 (1.0)

Part exchange properties 23.7 27.3 (3.6)

-------- -------- --------

The Group has maintained over 4 years' supply of land, based on the

previous year's profit unit output, negotiating deferred land payment

terms wherever possible. Closing work in progress has been held at a

similar level to that at the beginning of the year, whilst the book

value of part exchange properties has been reduced by 13%. The

strategies applied during the year, including the level of investment in

land and work in progress, have enabled the Group to achieve a return on

average capital employed of 23.0%.

Review of cash flow

Cash inflow from operating activities amounted to £43.9 million,

compared with an outflow of £23.4 million in 2000. The strength of the

cash flow in the year allowed the Group to reduce its net borrowings at

31 December 2001 by £3.8 million to £57.2 million. This represented a

net debt/equity ratio of 17.1%, compared with 21.0% at the start of the

year. This level of debt is well below the bank facilities now

available to the Group. It currently has total bank facilities

amounting to £224.0 million, of which £5.0 million is an overdraft

facility, and £219.0 million is comprised of a number of bilateral

revolving credit facilities of which £20.0 million matures on 2 November

2002, £35 million on 10 December 2005, £124 million on 9 January 2007,

£20 million on 5 February 2007 and £20 million on 10 December 2007.

Accounting standards

The Group has adopted the new accounting standard FRS 18: "Accounting

Policies", and commenced the implementation of FRS 17: "Retirement

Benefits", in accordance with the standard.

Under FRS 18 the Group has reviewed its accounting policies to ensure

that they remain the most appropriate to its particular circumstances

for the purpose of giving a true and fair view.

In respect of FRS 17 an independent actuary has valued the Group's

defined benefit scheme, as at 31 December 2001, in accordance with the

standard. The valuation shows a gross deficit in the scheme of £3.97

million, with a deferred tax asset of £1.19 million leaving a net

pension deficit of £2.78 million. This is a disclosure item only in the

2001 report and accounts as required by the standard.

Pensions

A triennial valuation of the Group's defined benefit pension scheme as

at 30 June 2001 showed that the total market value of the assets was

sufficient to cover 97.5% of the benefits that had accrued to members at

that date, after allowing for assumed future increases in earnings. On

the basis of this valuation and advice from the scheme's independent

actuary the Group increased its contribution rate from 15% to 20% of

pensionable earnings (less one and a half times the lower earnings limit

where appropriate) with effect from 1 July 2001. The Group's pension cost

was calculated under the existing accounting standard SSAP 24.

Ron Walford

Finance Director

Group profit and loss account

Continuing operations

For the year ended 31 December 2001 2001 2000

£000 £000

-------- --------

Turnover 358,543 304,996

Cost of sales (243,284) (207,170)

-------- --------

Gross profit 115,259 97,826

Administrative expenses (30,034) (27,135)

-------- ---------

Operating profit 85,225 70,691

Profit on sale of freehold property 1,213 -

-------- --------

Profit before interest 86,438 70,691

Interest receivable and similar income 172 88

Interest payable and similar charges (6,604) (3,710)

-------- --------

Profit on ordinary activities before

taxation 80,006 67,069

Taxation on profit on ordinary activities (23,400) (19,700)

--------- --------

Profit on ordinary activities after

taxation 56,606 47,369

Dividends paid and proposed (14,549) (13,252)

-------- ---------

Retained profit for the financial year 42,057 34,117

======== =======

Basic earnings per ordinary share 49.7p 42.0p

-------- --------

Diluted earnings per ordinary share 49.1p 41.5p

-------- --------

In both the current and preceding financial periods there were no other

recognised gains or losses.

Note of Group historical cost profit and losses

Continuing operations

For the year ended 31 December 2001 2001 2000

£000 £000

-------- --------

Profit on ordinary activities before

taxation 80,006 67,069

Realisation of property revaluation gains

of previous years 614 -

-------- --------

Historical cost profit on ordinary

activities before taxation 80,620 67,069

-------- --------

Historical cost profit for the year

retained after taxation and dividends 42,671 34,117

-------- --------

Group balance sheet

As at 31 December 2001 2001 2000

£000 £000

-------- --------

Fixed assets

Tangible assets 6,844 8,584

Investments 1,356 1,051

-------- --------

8,200 9,635

-------- --------

Current assets

Stock and work in progress 544,000 458,585

Debtors due within one year 10,134 8,671

Debtors due after more than one year 7,851 4,884

Cash and short term deposits 6,386 1,039

-------- --------

568,371 473,179

-------- ---------

Creditors: amounts falling due within one

year (128,810) (113,428)

--------- --------

Net current assets 439,561 359,751

-------- --------

Total assets less current liabilities 447,761 369,386

Creditors: amounts falling due after more

than one year (111,305) (77,861)

Provisions for liabilities and charges (1,552) (1,473)

-------- --------

Net assets 334,904 290,052

======== ========

Capital and reserves

Called up share capital 57,444 56,785

Share premium 135,571 133,435

Revaluation reserve 203 817

Profit and loss account 141,686 99,015

-------- --------

Equity shareholders' funds 334,904 290,052

======== ========

Group cash flow statement

For the year ended 31 December 2001 2001 2000

£000 £000

-------- --------

Net cash inflow/(outflow) from operating

activities 43,908 (23,395)

Returns on investments and servicing of

finance

Interest received 172 88

Interest paid (6,720) (3,424)

-------- --------

(6,548) (3,336)

-------- ---------

Taxation paid (23,491) (18,096)

-------- --------

Capital expenditure and financial

investment

Purchase of tangible fixed assets (3,368) (2,040)

Sale of tangible fixed assets 4,797 234

Purchase of investments (668) (586)

Sale of fixed asset investments 36 5

--------- ---------

797 (2,387)

-------- --------

Equity dividend paid (13,678) (12,518)

--------- ---------

Cash inflow/(outflow) before management of 988 (59,732)

liquid resources and financing

Management of liquid resources and

financing

Increase in short term deposits (6,000) -

Increase in borrowings 2,000 61,000

Issue of ordinary share capital 2,795 1,000

-------- --------

(1,205) 62,000

--------- --------

(Decrease)/increase in cash (217) 2,268

========= ========

Group reconciliation of movements in shareholders' funds

For the year ended 31 December 2001 2001 2000

£000 £000

-------- --------

Opening shareholders' funds 290,052 254,935

Issue of ordinary shares 2,795 1,000

Total recognised gains and losses for the

year 56,606 47,369

Dividends paid and proposed (14,549) (13,252)

-------- --------

Closing shareholders' funds 334,904 290,052

======== ========

Group reconciliation of operating profit to operating cash flows

For the year ended 31 December 2001 2001 2000

£000 £000

-------- --------

Operating profit 85,225 70,691

Depreciation and amortisation 2,050 1,831

Profit on disposal of non property tangible (67) (13)

fixed assets

Increase in stocks (85,415) (98,310)

Increase in debtors (4,430) (374)

Increase in creditors 46,545 2,780

---------- ---------

Net cash inflow/(outflow) from operating 43,908 (23,395)

activities =========== =========

Group reconciliation and analysis of net debt

For the year ended 31 December 2001 2001 2000

£000 £000

-------- --------

(Decrease)/increase in cash in the year (217) 2,268

Cash outflow/(inflow) from change in debt 4,000 (61,000)

-------- --------

Change in net debt 3,783 (58,732)

Opening net debt (61,011) (2,279)

--------- --------

Closing net debt (57,228) (61,011)

======== ========

Analysis of net debt:

Cash 386 1,039

Short term deposits 6,000 -

Bank overdraft (614) (1,050)

Borrowings (63,000) (61,000)

-------- --------

(57,228) (61,011)

======== ========

Notes to the accounts

1. Basis of preparation

The Group accounts include the accounts of the Company and its

subsidiary undertakings all of which are made up to 31 December 2001.

The financial information included within this statement does not

constitute the Company's statutory accounts for the year ended 31

December 2001 or 2000. The information contained in this statement has

been extracted from the statutory accounts of Bovis Homes Group PLC for

the year ended 31 December 2001, which have not yet been filed with the

Registrar of Companies, on which the auditors have given an unqualified

audit report, not containing statements under section 237(2) or (3) of

the Companies Act 1985.

The Group has adopted the new accounting standard FRS 18: "Accounting

Policies" during the year. There has been no material effect on the

Group's results in the year arising from the implementation of this

standard. The Group has implemented stage one of the transitional rules

of FRS 17: "Retirement Benefits" during the year. Required disclosures

arising from this implementation are included in the Company's statutory

accounts for the year ended 31 December 2001.

In line with the Urgent Issues Task Force Information Sheet No. 48 dated

5 July 2001, assets related to long term incentive plans have been

classified in investments for the current and prior year results.

2. Earnings per ordinary share

Basic earnings per ordinary share for the year ended 31 December 2001 is

calculated on profit after tax of £56,606,000 (2000: £47,369,000) over

the weighted average of 113,977,097 (2000: 112,735,747) ordinary shares

in issue during the year.

Diluted earnings per ordinary share is calculated on profit after tax of

£56,606,000 (2000: £47,369,000) over the diluted weighted average of

115,391,819 (2000: 114,184,319) ordinary shares potentially in issue

during the year. The diluted average number of shares is calculated in

accordance with FRS 14: "Earnings Per Share". The dilutive effect

relates to the average number of potential ordinary shares held under

option during the year. This dilutive effect amounts to the number of

ordinary shares which would be purchased using the aggregate difference

in value between the market value of shares and the share option

exercise price. The market value of shares has been calculated using

the average ordinary share price during the year. Only share options

which have met their cumulative performance criteria have been included

in the dilution calculation. There is no dilutive effect on the profit

after tax used in the diluted earnings per share calculation.

The weighted average number of shares excludes shares held in employee

share trusts where dividends have been waived.

3. Taxation

2001 2000

£000 £000

-------- --------

Current tax for the year 23,728 20,200

Adjustment in respect of prior years (328) (500)

-------- --------

23,400 19,700

======== ========

The rate of corporation tax applied was 30% for the year to 31 December

2001 and the year to 31 December 2000. During the year prior year tax

positions were finalised leading to the release of a tax provision

amounting to £328,000 (2000: £500,000).

4. Dividends

The proposed final dividend of 8.5 pence net per ordinary share will be

paid on 24 May 2002 to holders of ordinary shares on the register at the

close of business on 26 April 2002. The dividend when added to the

already paid interim dividend of 4.2 pence, totals 12.7 pence for the

year.

This information is provided by RNS

The company news service from the London Stock Exchange

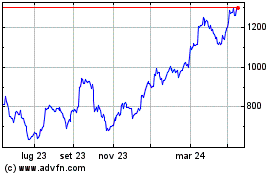

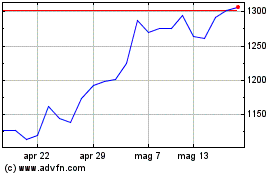

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024