BW20020908002012 20020909T060051Z UTC

( BW)(BOVIS-HOMES-GROUP)(BVS) Interim Results

Business Editors

UK REGULATORY NEWS

LONDON--(BUSINESS WIRE)--Sept. 9, 2002--

BOVIS HOMES GROUP PLC

INTERIM RESULTS

Unaudited results for the six months ended 30 June 2002

Issued 9 September 2002

The Board of Bovis Homes Group PLC today announced its interim results for 2002.

o Pre tax profit increased 45% to #41.5 million (2001: #28.6 million)

o Earnings per share increased by 44% to 25.2p (2001: 17.5p)

o Operating margin increased to 22.1% (2001: 21.8%)

o Plots with planning consent at 10,406 plots (Dec 2001: 10,326 plots)

o Strategic land holdings increased to 20,118 potential plots (Dec 2001: 19,847 potential plots)

o Interim dividend increased by 9.5% to 4.6 pence net per ordinary share (2001: 4.2 pence)

o Period end net borrowings of #33.0 million (9.1% gearing)

Commenting on the results, Malcolm Harris, the Chief Executive of

Bovis Homes Group PLC said:

"The first six months results are excellent with all key

objectives having been met or exceeded. The planned expansion of

the business is on track to deliver the anticipated increase in

turnover and profit underpinned by additional investment in both

consented and strategic land holdings. Cash management has been

particularly successful notwithstanding the further strengthening

of the asset base of the Group.

Sales reservations, contract exchanges and legal completions to

date are well ahead of the comparable period last year. Based upon

current market conditions we are confident of the prospects for

the Group for the full year and are well placed to deliver good

results in 2003."

Enquiries: Results issued by:

Malcolm Harris, Chief Executive Andrew Best / Emily Bruning

Bovis Homes Group PLC Shared Value Limited

on Monday 9 September on Monday 9 September

Tel: 020 7321 5010 Tel: 020 7321 5010

thereafter

Tel: 01474 872427

Chairman's interim statement

Bovis Homes has generated excellent results during the first half of

2002 substantially increasing pre tax profits, enhancing the operating

margin and delivering a strong positive cash flow. The Group has made

progress towards one of its major objectives of balancing profits

between the first and second trading periods.

Results

For the six months ended 30 June 2002 the Group achieved a pre tax

profit of #41.5 million representing an increase of 45% over the pre

tax profit of #28.6 million for the same period in 2001. Earnings per

share improved by 44% to 25.2 pence. The Group's operating margin

increased to 22.1% compared with 21.8% for the first six months of

2001.

An expanding part of the Group's business is related to the provision

of affordable housing on land owned by third parties. This activity

provides positive cash flow and high return on capital employed. A

breakdown of the Group's activities segregating this element of the

business will, we believe, provide shareholders with additional

helpful information.

The balance of the Group's business is targeted at owner occupation

with developments located in major conurbations or within easy

commuting thereto. The Group has a risk management policy resulting in

there being no current schemes in central London.

The Group achieved turnover of #201.2 million compared with #145.2

million in the prior year. Within this figure, there was land sales

income of #1.0 million and other income of #6.8 million which included

turnover of #4.4 million arising from contracts where the Group has

built on third party owned land. Such turnover has previously been

included within housing turnover.

The Group's average sales price rose to #169,300 for the current year

compared to #139,900, excluding affordable housing units constructed

on third party owned land (#138,000 if included), for the comparable

six months of 2001. The average size of unit legally completed

increased by 15% and included an increase in contribution from `room

in the roof' and three storey properties which now represent an

integral part of the Group's business. This increase in average size

represented the most significant reason for the 21% rise in average

sales price. Average sales price per square foot increased by 5.3%.

As advised in the Group's trading update on 27 June 2002, the Group

anticipated progress in the medium term strategy of improving the

balance of profits between the two reporting periods. In the first six

months of 2002, the Group legally completed 1,142 homes on land which

it controls and 73 homes on land controlled by third parties. This

compared with 955 legal completions on Group controlled land and 24

legal completions on third party controlled land in the same period

last year.

Dividends

The interim dividend of the Company will amount to 4.6 pence net per

share, an increase of 9.5% over 2001's interim dividend. This dividend

will be paid on 22 November 2002 to holders of ordinary shares on the

register at the close of business on 25 October 2002.

Cash flow

The Group has generated positive cash flow from operating activities

during the six months to 30 June 2002 of #44.1 million compared with

an outflow of #24.6 million in the comparable period of 2001. The

strength of this operating cash flow allowed the Group to reduce its

net borrowings to #33.0 million compared with the opening position of

#57.2 million. This level of net borrowing represented a net

debt/equity ratio of 9.1% compared with 17.0% at the start of the

year.

Land

There continued to be focus during the first half of 2002 on securing

land in prime locations. At 30 June 2002 the Group held 10,406 plots

of consented land compared with 10,326 plots at the start of the year.

The strategic land bank stood at 20,118 potential plots at 30 June

2002, an increase on the 19,847 potential plots held at the start of

the year.

There has been considerable management effort in providing future land

to replace the current land bank on affordable terms. The most

significant transaction during the first half year arose when the

Group exchanged a legal agreement to acquire 150 acres of land at

Filton, Bristol where the Group will progress planning to build a new

village of approximately 2,200 homes.

The Group's site at Hatfield, which was acquired in 2001, is now fully

serviced following completion of the provision of infrastructure. The

first phase consisting of 211 homes, has received detailed planning

consent. Construction of the first phase has commenced and is

proceeding in line with original projections, enabling a good profit

contribution to be made in 2003.

Market conditions

Housing market activity in the first half of 2002 was strong with the

Group achieving growth in cumulative sales reservations compared with

the prior year and the Group's current 2002 forecast. During the first

half of 2002, there was widespread coverage of the potential for an

increase in interest rates and press speculation regarding the impact

that such a rate rise may have on the housing market. More recently,

the speculation has been that the base interest rate may remain stable

at its current rate of 4%.

Inflation remains under control, with underlying inflation of 2.0% at

July 2002, below the 2.5% target given to the Monetary Policy

Committee. Headline earnings growth as reported in July 2002 stood at

3.9% with marginal increases in unemployment. Continuity of low base

interest rates should maintain consumer confidence and interest in

home ownership.

Structure

As reported in the 2001 annual report and accounts, the Board of the

Company was reconstituted in early 2002 to three executive directors

along with myself and two fellow non executive directors. This change

has facilitated greater focus from the managing directors of each

region on their respective regional businesses. This is important

during a period when new regions are being established and existing

regions are increasing trading activity. The Northern region has

performed well since its launch on 1 January 2002. A new Eastern

region managing director has been appointed and plans are progressing

for the launch of this new region in 2003.

Prospects

The changes that are being made to expand the business are being

implemented on the basis of projected added shareholder value. The

Group will continue to apply its strategies aimed at maximising

shareholder return through optimising the utilisation of our land and

designing added value products.

Demand for our homes remains strong with sales reservations, contract

exchanges and legal completions ahead of the comparable period last

year. Based upon current market conditions continuing we are confident

of the prospects of the Group for the full year.

Nigel Mobbs

Chairman

9 September 2002

-0-

*T

Group profit and loss account

For the six months ended 30 June 2002 Six months Six months Year

ended ended ended

30 June 2002 30 June 2001 31 Dec 2001

(unaudited) (unaudited) (audited)

#000 #000 #000

------------------------------------------------------------------------------------------------------

Turnover - continuing operations 201,166 145,231 358,543

Cost of sales (138,950) (99,416) (243,284)

------------------------------------------------------------------------------------------------------

Gross profit 62,216 45,815 115,259

Administrative expenses (17,696) (14,091) (30,034)

------------------------------------------------------------------------------------------------------

Operating profit - continuing operations 44,520 31,724 85,225

Profit on sale of freehold property - - 1,213

------------------------------------------------------------------------------------------------------

Profit before interest 44,520 31,724 86,438

Interest receivable and similar income 143 119 172

Interest payable and similar charges (3,124) (3,258) (6,604)

------------------------------------------------------------------------------------------------------

Profit on ordinary activities before taxation 41,539 28,585 80,006

Taxation on profit on ordinary activities (12,500) (8,684) (23,677)

------------------------------------------------------------------------------------------------------

Profit on ordinary activities after taxation 29,039 19,901 56,329

Dividends proposed/paid (5,458) (4,817) (14,549)

------------------------------------------------------------------------------------------------------

Retained profit for the financial period 23,581 15,084 41,780

------------------------------------------------------------------------------------------------------

------------------------------------------------------------------------------------------------------

Basic earnings per ordinary share 25.2p 17.5p 49.4p

------------------------------------------------------------------------------------------------------

Diluted earnings per ordinary share 24.9p 17.3p 48.8p

------------------------------------------------------------------------------------------------------

Note of Group historical cost profits and losses

For the six months ended 30 June 2002 Six months Six months Year

ended ended ended

30 June 2002 30 June 2001 31 Dec 2001

(unaudited) (unaudited) (audited)

#000 #000 #000

------------------------------------------------------------------------------------------------------

Profit on ordinary activities before taxation 41,539 28,585 80,006

Realisation of property revaluation gains of - - 614

previous years

------------------------------------------------------------------------------------------------------

Historical cost profit on ordinary 41,539 28,585 80,620

activities before taxation

------------------------------------------------------------------------------------------------------

Historical cost profit on ordinary 23,581 15,084 42,394

activities after taxation and dividends

------------------------------------------------------------------------------------------------------

Comparative figures have been restated to reflect a prior year

adjustment necessary as a result of the adoption of the new accounting

standard FRS 19: "Deferred tax" in the current period.

Group balance sheet

At 30 June 2002 30 June 2002 30 June 2001 31 Dec 2001

(unaudited) (unaudited) (audited)

#000 #000 #000

------------------------------------------------------------------------------------------------------

Fixed assets

Tangible assets 7,542 9,913 6,844

Investments 1,436 1,514 1,356

------------------------------------------------------------------------------------------------------

8,978 11,427 8,200

------------------------------------------------------------------------------------------------------

Current assets

Stocks and work in progress 549,842 552,764 544,000

Debtors due within one year 8,001 6,041 10,134

Debtors due after more than one year 8,260 8,830 8,465

Cash and short term deposits 52,224 2 6,386

------------------------------------------------------------------------------------------------------

618,327 567,637 568,985

------------------------------------------------------------------------------------------------------

Creditors: amounts falling due within one (182,693) (108,993) (128,810)

year

------------------------------------------------------------------------------------------------------

Net current assets 435,634 458,644 440,175

------------------------------------------------------------------------------------------------------

Total assets less current liabilities 444,612 470,071 448,375

Creditors: amounts falling due after more (79,396) (160,075) (111,305)

than one year

Provisions for liabilities and charges (1,800) (1,326) (1,552)

------------------------------------------------------------------------------------------------------

Net assets 363,416 308,670 335,518

------------------------------------------------------------------------------------------------------

Capital and reserves

Called up share capital 58,358 57,411 57,444

Share premium 138,974 135,452 135,571

Revaluation reserve 203 817 203

Profit and loss account 165,881 114,990 142,300

------------------------------------------------------------------------------------------------------

Equity shareholders' funds 363,416 308,670 335,518

------------------------------------------------------------------------------------------------------

Comparative figures have been restated to reflect a prior year

adjustment necessary as a result of the adoption of the new accounting

standard FRS 19: "Deferred tax" in the current period.

Group cash flow statement

For the six months ended 30 June 2002 Six months Six months Year

ended ended ended

30 June 2002 30 June 2001 31 Dec 2001

(unaudited) (unaudited) (audited)

#000 #000 #000

------------------------------------------------------------------------------------------------------

Net cash inflow/(outflow) from operating 44,074 (24,644) 43,908

activities

Returns on investments and servicing of

finance

Interest received 143 119 172

Interest paid (2,302) (3,263) (6,720)

------------------------------------------------------------------------------------------------------

(2,159) (3,144) (6,548)

------------------------------------------------------------------------------------------------------

Taxation paid (10,600) (7,600) (23,491)

------------------------------------------------------------------------------------------------------

Capital expenditure and financial investment

Purchase of tangible fixed assets (1,523) (2,282) (3,368)

Sale of tangible fixed assets 287 125 4,797

Purchase of investments (400) (665) (668)

Sale of fixed asset investments 42 - 36

------------------------------------------------------------------------------------------------------

(1,594) (2,822) 797

------------------------------------------------------------------------------------------------------

Equity dividend paid (9,842) (8,878) (13,678)

------------------------------------------------------------------------------------------------------

------------------------------------------------------------------------------------------------------

Cash inflow/(outflow) before management 19,879 (47,088) 988

of liquid resources and financing

Management of liquid resources and financing

Increase in short term deposits (43,000) - (6,000)

Increase in borrowings 18,000 42,151 2,000

Issue of ordinary share capital 4,317 2,643 2,795

------------------------------------------------------------------------------------------------------

(20,683) 44,794 (1,205)

------------------------------------------------------------------------------------------------------

Decrease in cash (804) (2,294) (217)

------------------------------------------------------------------------------------------------------

Group reconciliation of movements in shareholders' funds

For the six months ended 30 June 2002 Six months Six months Year

ended ended ended

30 June 2002 30 June 2001 31 Dec 2001

(unaudited) (unaudited) (audited)

#000 #000 #000

------------------------------------------------------------------------------------------------------

Opening shareholders' funds 335,518 290,052 290,052

Prior year adjustment to recognise deferred - 891 891

tax asset

Issue of ordinary shares 4,317 2,643 2,795

Total recognised gains and losses for the 29,039 19,901 56,329

period

Dividends paid and proposed (5,458) (4,817) (14,549)

------------------------------------------------------------------------------------------------------

Closing shareholders' funds 363,416 308,670 335,518

------------------------------------------------------------------------------------------------------

Group reconciliation of operating profit to operating cash flows

For the six months ended 30 June 2002 Six months Six months Year

ended ended ended

30 June 2002 30 June 2001 31 Dec 2001

(unaudited) (unaudited) (audited)

#000 #000 #000

------------------------------------------------------------------------------------------------------

Operating profit 44,520 31,724 85,225

Depreciation and amortisation 833 1,044 2,050

Profit on disposal of tangible fixed assets (17) (16) (67)

Increase in stocks (5,842) (94,179) (85,415)

Decrease/(increase) in debtors 2,317 (509) (4,430)

Increase in creditors 2,263 37,292 46,545

------------------------------------------------------------------------------------------------------

Net cash inflow/(outflow) from operating 44,074 (24,644) 43,908

activities

------------------------------------------------------------------------------------------------------

Group reconciliation and analysis of net debt

For the six months ended 30 June 2002 Six months Six months Year

ended ended ended

30 June 2002 30 June 2001 31 Dec 2001

(unaudited) (unaudited) (audited)

#000 #000 #000

------------------------------------------------------------------------------------------------------

Decrease in cash (804) (2,294) (217)

Cash inflow/(outflow) from change in net debt 25,000 (42,151) 4,000

------------------------------------------------------------------------------------------------------

Change in net debt 24,196 (44,445) 3,783

Opening net debt (57,228) (61,011) (61,011)

------------------------------------------------------------------------------------------------------

Closing net debt (33,032) (105,456) (57,228)

------------------------------------------------------------------------------------------------------

Analysis of net debt:

Cash 3,224 2 386

Bank overdraft (4,256) (2,307) (614)

Short term deposits 49,000 - 6,000

Borrowings (81,000) (103,151) (63,000)

------------------------------------------------------------------------------------------------------

(33,032) (105,456) (57,228)

------------------------------------------------------------------------------------------------------

Notes to the accounts

1 Basis of preparation

The interim accounts have been prepared on a basis consistent with

the accounting policies adopted for the year ended 31 December

2001 including the classification of borrowings under bilateral

committed revolving loan facilities as long term. These policies

are set out in the Group's Annual Report and Accounts. The Group

has adopted the new accounting standard FRS19: "Deferred Tax"

during the first half of 2002. As a result of the implementation

of this standard a previously unrecognised deferred tax asset has

now been recognised. In the current year, a deferred tax asset of

#593,000 has been recognised and the tax charge has been adjusted

to take account of #21,000 of deferred taxation arising from the

reversal of timing differences in the first half of 2002. The

opening profit and loss reserve has been increased to reflect the

opening deferred tax asset, which would have been recognised as at

31 December 2001, amounting to #614,000. There were no other

recognised gains or losses in the current and preceding periods

other than this prior year adjustment in respect of deferred tax.

The comparative figures for the six months ended 30 June 2001 and

the year ended 31 December 2001 have been restated to reflect the

recognition of the deferred tax asset.

The interim accounts do not constitute statutory accounts within

the meaning of Section 240 of the Companies Act 1985. The interim

accounts for the six months ended 30 June 2001 and 30 June 2002

have not been audited. The abridged information in these interim

accounts relating to the year ended 31 December 2001 is derived

from the full accounts upon which the auditors issued an

unqualified opinion and which have been delivered to the Registrar

of Companies.

2 Earnings per share

Basic earnings per ordinary share for the six months ended 30 June

2002 is calculated on profit after tax of #29,039,000 (six months

ended 30 June 2001: #19,901,000; year ended 31 December 2001:

#56,329,000) over the weighted average of 115,257,326 (six months

ended 30 June 2001: 113,693,156; year ended 31 December 2001:

113,977,097) ordinary shares in issue during the period.

Diluted earnings per ordinary share is calculated on profit after

tax of #29,039,000 (six months ended 30 June 2001: #19,901,000;

year ended 31 December 2001: #56,329,000) over the diluted

weighted average of 116,482,160 (six months ended 30 June 2001:

114,765,827; year ended 31 December 2001: 115,391,819) ordinary

shares potentially in issue during the year. The diluted average

number of shares is calculated in accordance with FRS 14 "Earnings

Per Share". The dilutive effect relates to the average number of

potential ordinary shares held under option during the year. This

dilutive effect amounts to the number of ordinary shares which

would be purchased using the aggregate difference in value between

the market value of shares and the share option exercise price.

The market value of shares has been calculated using the average

ordinary share price during the year. Only share options which

have met their cumulative performance criteria have been included

in the dilution calculation. There is no dilutive effect on the

profit after tax used in the diluted earnings per share

calculation.

3 Dividends

The interim dividend of 4.6 pence net per ordinary share will be

paid on 22 November 2002 to holders of ordinary shares on the

register at the close of business on 25 October 2002.

4 Taxation

The rate of corporation tax applied was 30% for the six months to

30 June 2002 and for the six months ended 30 June 2001, as

adjusted to take account of deferred taxation movements.

*T

Short Name: Bovis Homes Group

Category Code: IR

Sequence Number: 00000756

Time of Receipt (offset from UTC): 20020906T144348+0100

--30--sm/uk*

CONTACT: Bovis Homes Group PLC

KEYWORD: UNITED KINGDOM INTERNATIONAL EUROPE

INDUSTRY KEYWORD: BUILDING/CONSTRUCTION REAL ESTATE EARNINGS

SOURCE: Bovis Homes Group

Today's News On The Net - Business Wire's full file on the Internet

with Hyperlinks to your home page.

URL: http://www.businesswire.com

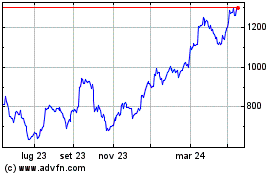

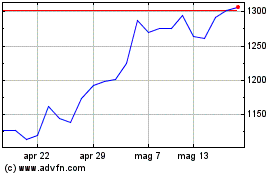

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2024 a Ago 2024

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Ago 2023 a Ago 2024