TIDMBVS

RNS Number : 2017I

Bovis Homes Group PLC

08 March 2010

BOVIS HOMES GROUP PLC

PRELIMINARY RESULTS FOR THE YEAR ENDED 31 DECEMBER 2009

Issued 8 March 2010

The Board of Bovis Homes Group PLC today announced its preliminary results for

2009 which have been prepared in accordance with International Financial

Reporting Standards as adopted by the EU ('IFRS').

· Pre tax profit for the year of GBP4.8 million (2008: pre tax loss of

GBP78.7 million)

· Basic earnings per share of 2.8p (2008: basic loss per share 49.1p)

· Pre-exceptional pre tax profit of GBP7.5 million (2008: GBP14.4 million)

· Pre-exceptional basic earnings per share of 4.4p (2008: 9.2p per share)

· Net inventory provision release of GBP11.6 million in the second half

year

· Total exceptional charges of GBP2.7 million (2008: GBP93.1 million)

· GBP112 million of net cash at 31 December 2009 (2008: GBP108 million net

debt pre issue costs)

· Cheaper, longer term and more flexible banking facilities agreed at the

end of 2009

· Overheads cut by 34% versus 2008 and by circa 45% relative to base at

start of 2008

· Land acquisition recommenced, with four consented sites acquired and

terms agreed in principle on further 15 sites at 31 December 2009

· 12,042 plots of land with planning consent (2008: 13,545 plots) and

16,363 potential plots of strategic land (2008: 18,972 potential plots)

Commenting on the results, David Ritchie, the Chief Executive of Bovis Homes

Group PLC said:

"The Group has successfully delivered on its strategic objectives for 2009:

achieving a pre tax profit, increasing private homes reservations in the year by

82%, reducing overheads by 34% and generating GBP221 million of cash inflow

including the GBP59 million benefit of an equity placing. The Group is also

pleased to announce the first release of previously taken inventory provisions,

reflecting recovery of site viability in certain locations arising from improved

sales prices and reduced construction costs.

The Group has recommenced investment in land and is pleased with the progress

made to date, with four consented sites acquired in the last quarter of 2009 and

terms agreed in principle at the year end on a further 15 sites, all of which

have been progressed during the early part of 2010. With GBP112 million of net

cash in hand at 31 December 2009 the Group is well positioned to increase its

output capacity, as markets recover, supporting future profitable growth."

+------------+----------------------+-------------+-----------------------------+

| Enquiries: | David Ritchie, Chief | Results | Andrew Best / Peter |

| | Executive | issued by | Edsinger |

+------------+----------------------+-------------+-----------------------------+

| | Neil Cooper, Finance | | Shared Value Limited |

| | Director | | |

+------------+----------------------+-------------+-----------------------------+

| | Bovis Homes Group | | On Monday 8 March - tel: |

| | PLC | | 020 7321 5022/5038 |

+------------+----------------------+-------------+-----------------------------+

| | On Monday 8 March - tel: 020 7321 | |

| | 5010 | |

+------------+------------------------------------+-----------------------------+

| | Thereafter - tel: 01474 876200 | |

+------------+----------------------+-------------+-----------------------------+

2009 Overview

With the backdrop of the UK housing market continuing to be challenging, the

Group is pleased to be able to report on a successful year in 2009. Good

progress was made in delivery of the strategic objectives laid out by the Group

at the start of 2009: progress which leaves the Group well placed to deliver

profitable growth looking ahead.

The Group achieved strong year over year growth during 2009 in both the number

of private homes legally completed and the private reservations taken in the

year. It benefited from new initiatives such as the upgrading of sales systems

and by innovations in how the Group marketed and sold its homes, including

methods to assist customers in raising the necessary mortgage deposits. During

2009, the Group achieved 1,801 private reservations, representing an 82%

increase in sales levels compared to the 989 private reservations taken in 2008.

For the year ended 31 December 2009, the Group generated GBP281.5 million of

revenue (2008: GBP282.3 million) from the legal completion of 1,803 homes (2008:

1,817 homes). The Group achieved a pre-exceptional pre tax profit of GBP7.5

million in 2009 (2008: GBP14.4 million) with pre-exceptional basic earnings per

share at 4.4p (2008: 9.2p per share).

On a pre-exceptional basis, the Group achieved an operating margin of 6.2% in

2009 (2008: 7.5%). A 9% decline in private home prices impacted gross margins,

though this was substantially offset by the Group's strong performance in

controlling costs and reducing overhead. Overhead levels were reduced by 34% on

the prior year and by circa 45% compared to the overhead base of the Group at

the start of 2008.

There was a GBP2.7 million pre tax exceptional charge for the year

following the release in the second half of GBP11.6 million of inventory

provision not now required. This provision release offset an GBP8.9 million

inventory provision charged in the first half of 2009. There was also a GBP4.2

million exceptional interest charge linked to the refinancing of the Group's

facility agreement, which was agreed in December 2009 and signed in January

2010, and GBP1.2 million of other items.

Taking exceptional items into account, the Group achieved a pre tax profit of

GBP4.8 million (2008: pre tax loss GBP78.7 million) and a basic earnings per

share of 2.8p (2008: basic loss per share of 49.1p).

The Group's net assets increased from GBP632.3 million at the start of 2009 to

GBP692.6 million at 31 December 2009, equating to a net asset value of GBP5.20

per share. The major element of the net asset movement over the year of GBP60.3

million was the net GBP59.0 million raised by the Group's equity placing in

September. Retained earnings increased by GBP1.2 million including retained

profit in the year of GBP3.5 million and the reserves adjustment for the Group's

pension deficit which increased from GBP6.8 million to GBP8.9 million.

The Group constructed 911 units worth of production during 2009, with only 221

units built in the first half, and a further 690 units in the second half as the

market backdrop generally improved. This has enabled the Group to free up

considerable cash from working capital, as nearly 900 more units were legally

completed than were built. As planned, the level of work in progress held at

the year end has fallen sharply, from 1,878 units worth of production at the end

of 2008 to 986 units worth of production at the end of 2009. Within this work

in progress, the number of unsold finished stock units has also been reduced

sharply. Looking ahead, the Group expects that levels of production will

broadly match the levels of legal completions, such that there is not likely to

be further substantial release of cash from work in progress, but equally, the

Group will be vigilant to ensure that it does not invest unnecessary levels of

capital in work in progress.

As at 31 December 2009, the Group had net cash in hand of GBP112 million. Given

the financial position of the Group at the start of the year, with GBP108

million of net debt pre issue costs, this represents GBP221 million cash inflow

over the year as a whole including GBP59 million from the Group's placing in

September: a positive outcome reflecting well on the focus of the Group in this

area.

At the end of the year, the Group had in place a GBP220 million committed

syndicated banking facility, which was due to step down to GBP180 million in

February 2010 and to GBP160 million in September 2010 and which was due to

mature in March 2011. Well ahead of this maturity, the Group chose to refinance

this facility, taking advantage of improved credit conditions in the banking

marketplace. As at 31 December 2009, the Group had received credit approval for

a new facility which it entered into in January 2010, at which point its

existing facility was cancelled. The new facility is a GBP150 million committed

syndicated facility with a longer term, maturing in September 2013, with more

flexible borrowing terms and a cheaper cost.

The Group is now well placed to use its balance sheet strength to acquire new

land for homes to support future growth.

Revenue

The Group delivered GBP278.8 million of housing revenue in 2009, 1.8% ahead of

the prior year (2008: GBP274.0 million). There was no income from land sales in

2009 (2008: GBP4.9 million). Together with GBP2.7 million of other income

(2008: GBP3.4 million) the Group's total revenue for 2009 was GBP281.5 million

which was broadly in line with total revenue in 2008 at GBP282.3 million.

With 1,803 legal completions achieved during 2009, the Group's performance was

similar to its performance in the previous year (2008: 1,817 legal completions).

This comparison masks the success achieved by the Group in increasing its

volume of private homes in 2009 by 25%, with 1,527 legal completions in 2009

versus 1,223 units in 2008. Given the lower private home forward sales position

at the start of 2009 as compared to the start of 2008, this improvement in

private legal completions arose from an 82% increase in the number of private

homes reserved in 2009, with 1,801 private home reservations as compared to 989

private home reservations in 2008. Offsetting this was a fall in the volume of

social homes legally completed, from 594 units (33% of total volume) in 2008 to

276 units in 2009 (15% of total volume). The Group expects that the social

housing mix will rise in 2010 as new sites are started.

As a result of this reduction in social housing in the mix, the Group's average

sales price increased by 3% to GBP154,600 (2008: GBP150,800). The average sales

price of the Group's private legal completions in 2009 was GBP165,500, a 9%

decline on the average sales price seen in 2008 (GBP181,000) and a 20% decline

on the average sales price in 2007 (GBP206,200). The average sales price of the

Group's social legal completions was GBP94,600, a 7% increase on the equivalent

in 2008 (GBP88,500).

Given an increase in the average size of the Group's private homes from 972

square feet in 2008 to 993 square feet in 2009, the underlying sales price per

square foot fell by 11%. Overall, the average size of the Group's legally

completed homes increased from 909 square feet in 2008 to 958 square feet in

2009, showing the effect of the reduction in social mix, given the smaller

average size of social legal completions at 762 square feet per unit.

Pre-exceptional operating profit

The Group delivered a pre-exceptional operating profit for the year ended 31

December 2009 of GBP17.4 million at an operating margin of 6.2%, as compared to

GBP21.3 million in the previous year, at an operating margin of 7.5%.

Pre-exceptional gross margins fell by circa six percentage points, from

22.4% in 2008 to 16.1% in 2009, largely driven by a reduction in private home

profit margins as the average sales price on private legal completions fell by

9% in 2009 as compared to 2008. Largely offsetting this, the Group's

pre-exceptional overhead ratio to revenue improved by circa five percentage

points to 9.9% from 14.9% in 2008. As the Group increases its volume of

housebuilding and land acquisition, it is anticipated that overheads will rise

in 2010 as essential land buying and technical resources are added to the

business to support growth.

With no land sales in 2009, net option costs were GBP1.5 million, as

compared to GBP1.3 million of land sales profit less option costs in 2008.

Exceptional and non-recurring costs

The Group discloses items as exceptional when the Board deems them material by

size or nature, non-recurring and of such significance that they require

separate disclosure.

Periodically, the Group reviews its inventory

carrying values on a site by site basis, taking into account local management

and the Board's estimates of current achievable pricing in local markets. Where

this gives rise to a situation where the then current carrying costs of the

asset plus estimated costs to complete are higher than the estimated net

realisable value, a provision is recognised for the difference. Where a

subsequent review indicates a net realisable value in excess of the carrying

cost plus estimated costs to complete, any remaining un-utilised provision is

required to be released.

The Group has reviewed the carrying value of its assets and liabilities as at 31

December 2009. Following this year end review, the Group has released GBP11.6

million of provisions held against the carrying costs of inventory. This

release increases the land cost base going forward which is expected to impact

2010 cost of sales by circa GBP5 million. Of the Group's GBP11.6 million

provision release in the second half, there was a gross release of GBP14.0

million offset by an additional further provision of GBP2.4 million.

Taking into account the GBP11.6 million year end inventory provision release,

and the GBP8.9 million inventory provision charged in the first half of 2009,

the net inventory provision release for the year as a whole was GBP2.7 million.

Offsetting this, the Group has written off the GBP4.2 million remaining

un-amortised element of the one-off fee paid to its banking syndicate in

relation to the facility agreement entered into in December 2008 following the

agreement of a new deal, approved in December 2009 and entered into during

January 2010. The Group has also taken a GBP1.0 million provision relating to a

potential onerous land contract and a GBP0.2 million impairment on the carrying

value of its available for sale asset portfolio.

In total, the Group has taken GBP2.7 million of exceptional items before

tax in 2009 (2008: GBP93.1 million)

Pre tax profit and earnings per share

The Group achieved pre-exceptional profit before tax of GBP7.5 million, with

pre-exceptional operating profit of GBP17.4 million and net financing charges of

GBP9.9 million. This compares to GBP21.3 million of pre-exceptional operating

profit and GBP6.9 million of net financing charges in 2008 which generated

GBP14.4 million of pre-exceptional profit before tax in that year.

After accounting for GBP2.7 million of exceptional charges (2008: exceptional

charges of GBP93.1 million) the Group made a pre tax profit of GBP4.8 million

for the year as a whole (2008: GBP78.7 million pre tax loss).

Pre-exceptional basic earnings per share for the year was 4.4p and basic

earnings per share after exceptional charges was 2.8p. This is as compared to

pre-exceptional basic earnings per share of 9.2p and basic loss per share after

exceptional charges of 49.1p in 2008.

Land

Given the caution shown by the Group in the consented land market since 2006,

and the uncertainty engendered by market conditions more recently, sales outlet

numbers have fallen over 2009, with 85 sales outlets on average during the year.

The Group has commented that this average is likely to fall in 2010 to around

70 outlets. The challenge ahead for the Group is to use its balance sheet

strength to acquire residential land and thus grow its sales outlet count:

either through consented land purchase or via conversion of the existing

strategic land the Group controls. To this end, four new consented sites were

acquired in the final quarter of 2009, with terms agreed in principle on a

further 15 sites by 31 December 2009.

The Group held a consented land bank of 12,042 plots at 31 December 2009,

over six and a half years supply at current levels of activity, although it has

reduced over the year from 13,545 plots at 31 December 2008, demonstrating the

impact of the Group's aforementioned caution in land acquisition. The consented

land bank reduced by virtue of the 1,803 legal completions during 2009 whilst

there were 300 net plots added after adjusting for the effect of replanning.

The average consented land plot cost at the start of 2009 was GBP35,000. This

has increased over the year, following a net inventory provision release over

2009, to GBP35,200 at 31 December 2009.

The strategic land bank at 31 December 2009 amounted to 16,363 potential

plots as compared to 18,972 potential plots at 31 December 2008. Given the

relatively low levels of additions into the strategic land bank during the year,

and the transfer of only one site into the consented land bank, the major factor

in this movement has been the removal of a large option-controlled site from the

potential plot numbers as views on the delivery of an acceptable residential

planning consent in that location have been revised. The remaining un-amortised

option costs relating to this site were written off during the year.

Financing & cashflow

Pre-exceptional net financing charges were GBP9.9 million in 2009 (2008: GBP6.9

million). Net bank charges for 2009 were GBP8.6 million, which included the

amortisation of arrangement fees (GBP4.3 million) and commitment fee charges

(GBP3.2 million). This compares to GBP5.6 million of net charges in 2008. On

average during 2009, the Group had GBP9 million of net debt, as compared to an

average net debt of GBP97 million in 2008, the improvement arising from strong

working capital and other expenditure control as well as from the positive

impact of the Group's equity placing in September 2009. The Group was net cash

positive from August 2009. The Group incurred a GBP1.7 million finance charge

(2008: charge of GBP2.5 million), reflecting the difference between the cost and

nominal price of land bought on deferred terms which is charged to the income

statement over the life of the deferral of the consideration payable. The Group

benefited from a GBP0.2 million net pension financing credit during 2009. This

credit arose as a result of the expected return on scheme assets being in excess

of the interest on the scheme obligations. The equivalent credit in 2008 was

GBP1.1 million. The Group also benefited from a finance credit of GBP0.5

million arising from the unwinding of the discount on its available-for-sale

financial assets during 2009 (2008: GBP0.1 million). There were also GBP0.3

million of other financing charges during the year.

The Group started the year with GBP108.4 million of net debt before issue costs.

As at 31 December 2009, the Group held GBP114.6 million of cash in hand, offset

by a GBP2 million loan received as part of the Government's Kickstart programme,

aimed at supporting national housebuilders and encouraging increased levels of

production, and a GBP0.3 million interest rate swap fair value adjustment: in

total GBP112.3 million. As the Group had substantial cash in hand at the year

end, there was no year end gearing.

Having commenced the year with a number of strategies designed to strengthen its

balance sheet through maximisation of cashflow generation, the circa GBP221

million of cash inflow achieved by the Group in the year demonstrates good

success in this area. There were a number of factors enabling the Group to

deliver this strong cash inflow: firstly and most significantly, successful

working capital management enabled the Group to reduce work in progress by

GBP105 million. Secondly, the Group received GBP22 million of tax rebates

following its post exceptional loss in 2008. Finally, the Group raised GBP59

million of new equity capital during the year as a result of its placing in

September 2009.

Taxation

The Group has recognised a tax charge of GBP1.3 million on pre tax profits of

GBP4.8 million at an effective rate of 27.1% (2008: tax credit of GBP19.7

million at an effective rate of 25.1%). Of this, a GBP2.0 million charge has

arisen on pre-exceptional pre tax profits of GBP7.5 million, and a GBP0.7

million tax credit has arisen on pre tax exceptional items of GBP2.7 million.

The Group continues to recognise a current tax asset of GBP0.8 million in its

closing balance sheet as at 31 December 2009 (2008: GBP23.6 million).

Pensions

Following a roll-forward of the valuation of the Group's pension scheme, with

latest estimates provided by the Group's actuarial advisors, the Group's pension

scheme had a deficit of GBP8.9 million at 31 December 2009, an increase of

GBP2.1 million on the opening deficit of GBP6.8 million at 31 December 2008.

Whilst scheme assets grew strongly over the year, from GBP58.7 million to

GBP67.6 million, the scheme liabilities increased to a greater extent, from

GBP65.5 million to GBP76.5 million, impacted by a fall in bond yields. As well

as benefiting from a generally stronger stock market in 2009, scheme assets

benefited from a GBP1.9 million special cash contribution made by the Group into

the scheme in December 2009.

Net assets

Net assets per share as at 31 December 2009 was GBP5.20 as compared to

GBP5.23 at 31 December 2008.

+---------------------------------------+---+-+-------+-+-------+-+-------+-+

| Analysis of net assets | | |

+---------------------------------------+---------------+-------------------+

| | | | 2009 | 2008 |

+---------------------------------------+-----+---------+---------+---------+

| | | | GBPm | GBPm |

+---------------------------------------+-----+---------+---------+---------+

| | | | | | | | | |

+---------------------------------------+---+-+-------+-+-------+-+-------+-+

| Net assets at 1 January | | | | | 632.3 | | 723.7 | |

+---------------------------------------+---+-+-------+-+-------+-+-------+-+

| Pre-exceptional profit after tax for | | | | | 5.5 | | 11.1 | |

| the year | | | | | | | | |

+---------------------------------------+---+-+-------+-+-------+-+-------+-+

| Exceptional charges net of tax | | | | | (2.0 | )| (70.1 | )|

+---------------------------------------+---+-+-------+-+-------+-+-------+-+

| Dividends | | | | | - | | (27.0 | )|

+---------------------------------------+---+-+-------+-+-------+-+-------+-+

| Share capital issued | | | | | 59.1 | | 0.5 | |

+---------------------------------------+---+-+-------+-+-------+-+-------+-+

| Net actuarial movement on pension | | | | | (3.0 | )| (6.4 | )|

| scheme through reserves | | | | | | | | |

+---------------------------------------+---+-+-------+-+-------+-+-------+-+

| Current tax recognised directly in | | | | | - | | 0.5 | |

| equity | | | | | | | | |

+---------------------------------------+---+-+-------+-+-------+-+-------+-+

| Adjustment to reserves for share | | | | | 0.7 | | - | |

| based payments | | | | | | | | |

+---------------------------------------+---+-+-------+-+-------+-+-------+-+

| Net assets at 31 December | | | | | 692.6 | | 632.3 | |

+---------------------------------------+---+-+-------+-+-------+-+-------+-+

Dividends

As previously announced, having regard to trading conditions, the Board did not

recommend payment of a final dividend for 2008, and did not pay an interim

dividend in 2009. No cash payments have therefore been made in 2009 relating

to dividends. The Board does not propose payment of a final dividend for 2009

although it recognises the importance of dividends to shareholders, and

anticipates that delivery of the Group's trading and investment plans will

create a solid basis for the resumption of dividends.

Employees and the Board

Following on from what was a challenging year for its employees in 2008, the

Group would like to thank its employees for their hard work and commitment

during 2009, a year in which the Group made real progress in strengthening its

balance sheet so as to enable it to compete successfully in the future. The

Board recognises that in 2009 its employees were working in a business with

substantially reduced headcount, focussing on cash preservation and generation

whilst also taking actions to facilitate future business growth. Those actions

to generate savings also impacted on the suppliers and sub-contractors of the

Group and the Board would like to thank them for their contribution to the

performance of the Group.

There were no changes to the Board during 2009, although the Group Finance

Director, Mr Neil Cooper, announced his intention in November 2009 to leave the

Group in order to pursue career options elsewhere. Mr Cooper will continue

serving with the Group until the 2009 Annual General Meeting on 6 May 2010. The

Board would like to thank Mr Cooper for his significant contribution to the

Board and to the robust performance of the Group in the current challenging

market conditions. The Board would also like to thank Mrs Lesley MacDonagh, who

steps down at the upcoming AGM, for her contribution to the success of the Group

since 2003.

Market conditions & prospects

The Group expects that a degree of stabilisation in house prices evidenced in

the marketplace in later 2009 will continue into 2010. Statistics would suggest

the market as a whole has seen the commencement of modest pricing growth in the

second half of 2009, although the Group remains somewhat cautious due to the

relatively low levels of second hand stock supporting price growth in the second

hand market which appears to have moved ahead at a faster rate than the new

build sector during 2009.

Pricing is a function of both supply and demand. Whilst supply as evidenced by

second hand stocks appears to have been relatively lower than demand over 2009,

absolute demand in 2009 has been limited by reduced mortgage availability.

Positively, the number of mortgages being approved for home purchase has grown

during 2009 although it still remains difficult for first time buyers to access

the market given the large shift in deposit requirements, and the absolute level

of mortgages approved for home purchase still remains below historical levels.

Overall, therefore, the Group expects that the pricing environment in 2010,

whilst potentially volatile month by month, will be relatively stable taking the

year as a whole.

The Group entered 2010 with a stronger forward sales position than in the prior

year, reflecting its focus on delivering early sales activity to support volume

aspirations for 2010 as a whole. Given the already mentioned lower number of

sales outlets available to the Group in 2010 and the prevailing market

conditions, the Group has made a solid start to 2010 in terms of reservations.

For the first nine weeks of 2010, the Group has achieved an average private

sales rate of 0.42 net reservations per site per week. This compares with an

average private sales rate per site per week throughout 2009 of 0.41 and an

average in the first nine weeks of 0.39. As at 5 March 2010, reflecting the

strong opening position, the Group held 969 net sales for legal completion in

2010, as compared to 772 net sales at the same point in 2009. Within the

current year total, private sales amount to 701 units (2009: 515 units) and

social sales amount to 268 units (2009: 257 units).

The Group is strongly placed with the financial capability to acquire consented

land which will enable it to grow its output capacity as measured by sales

outlet numbers, without relying on a resurgence in the housing market, thus

increasing both revenue and profit in the mid term. In 2009 the Group's

strategy was clear: control of working capital and cash generation. The

strategy for 2010 is equally clear: investment in new land to generate strong

future returns.

Bovis Homes Group PLC

Group income statement

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| For the year ended | 2009 | 2008 |

| 31 December | | |

+--------------------+--------------------------------------------+-----------------------------------------------+

| | Before | | Exceptional | | | | Before | | Exceptional | | | |

| | exceptional | | items | | | | exceptional | | items | | | |

| | items | | | | | | items | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| | GBP000 | | GBP000 | | GBP000 | | GBP000 | | GBP000 | | GBP000 | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Revenue | 281,505 | | - | | 281,505 | | 282,326 | | - | | 282,326 | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Cost of sales | (236,339 | )| 1,471 | | (234,868 | )| (219,011 | )| (76,487 | )| (295,498 | )|

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Gross | 45,166 | | 1,471 | | 46,637 | | 63,315 | | (76,487 | )| (13,172 | )|

| profit/(loss) | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Administrative | (27,769 | )| - | | (27,769 | )| (42,018 | )| (16,641 | )| (58,659 | )|

| expenses | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Operating | 17,397 | | 1,471 | | 18,868 | | 21,297 | | (93,128 | )| (71,831 | )|

| profit/(loss) | | | | | | | | | | | | |

| before financing | | | | | | | | | | | | |

| costs | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Financial income | 2,304 | | - | | 2,304 | | 1,389 | | - | | 1,389 | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Financial expenses | (12,178 | )| (4,197 | )| (16,375 | )| (8,292 | )| - | | (8,292 | )|

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Net financing | (9,874 | )| (4,197 | )| (14,071 | )| (6,903 | )| - | | (6,903 | )|

| costs | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Profit/(loss) | 7,523 | | (2,726 | )| 4,797 | | 14,394 | | (93,128 | )| (78,734 | )|

| before tax | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Income tax | (2,070 | )| 763 | | (1,307 | )| (3,319 | )| 23,058 | | 19,739 | |

| (expense)/credit | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Profit/(loss) for | 5,453 | | (1,963 | )| 3,490 | | 11,075 | | (70,070 | )| (58,995 | )|

| the period | | | | | | | | | | | | |

| attributable to | | | | | | | | | | | | |

| equity holders of | | | | | | | | | | | | |

| the parent | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Earnings/(loss) | | | | | | | | | | | | |

| per share | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Basic | 4.4p | | (1.6p | )| 2.8p | | 9.2p | | (58.3p | )| (49.1p | )|

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Diluted | 4.4p | | (1.6p | )| 2.8p | | 9.2p | | (58.3p | )| (49.1p | )|

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| Dividend per share | | | | | | | | | | | | |

| charged in period | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| 2008 interim paid | | | | | - | | | | | | 5.0p | |

| November 2008 | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| 2007 final paid | | | | | - | | | | | | 17.5p | |

| May 2008 | | | | | | | | | | | | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

| | | | | | - | | | | | | 22.5p | |

+--------------------+-------------+-+-------------+-+----------+-+-------------+--+-------------+--+----------+--+

Bovis Homes Group PLC

Group statement of comprehensive income

+-----------------------------------+---------+--+---------+--+---------+--+

| For the year ended 31 December | | | | |

| | | | | |

+------------------------------------------------+---------+--+---------+--+

| | | | 2009 | | 2008 | |

+-----------------------------------+---------+--+---------+--+---------+--+

| | | | GBP000 | | GBP000 | |

+-----------------------------------+---------+--+---------+--+---------+--+

| | | | | | | |

+-----------------------------------+---------+--+---------+--+---------+--+

| Profit / (loss) for the period | 3,490 | | (58,995 | )|

+------------------------------------------------+---------+--+---------+--+

| Actuarial loss on defined benefits pension | (4,210 | )| (8,820 | )|

| scheme | | | | |

+------------------------------------------------+---------+--+---------+--+

| Deferred tax on actuarial movements on defined | 1,179 | | 2,470 | |

| benefits pension scheme | | | | |

+------------------------------------------------+---------+--+---------+--+

| Total comprehensive income and expense for the | 459 | | (65,345 | )|

| period | | | | |

| attributable to equity holders of the parent | | | | |

+-----------------------------------+---------+--+---------+--+---------+--+

Bovis Homes Group PLC

Group balance sheet

+-----------------------------------+----------+--+----------+--+----------+--+

| At 31 December | | | 2009 | | 2008 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| | | | GBP000 | | GBP000 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| | | | | | | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Assets | | | | | | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Property, plant and equipment | | | 11,574 | | 12,347 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Investments | | | 22 | | 22 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Deferred tax assets | | | 6,446 | | 5,548 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Trade and other receivables | | | 2,213 | | 2,418 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Available for sale financial | | | 21,291 | | 6,030 | |

| assets | | | | | | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Total non-current assets | | | 41,546 | | 26,365 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Inventories | | | 630,709 | | 780,808 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Trade and other receivables | | | 30,771 | | 37,947 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Cash | | | 114,595 | | 11,634 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Current tax assets | | | 831 | | 23,550 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Total current assets | | | 776,906 | | 853,939 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Total assets | | | 818,452 | | 880,304 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Equity | | | | | | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Issued capital | | | 66,570 | | 60,497 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Share premium | | | 210,181 | | 157,127 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Retained earnings | | | 415,815 | | 414,654 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Total equity attributable to | | | 692,566 | | 632,278 | |

| equity holders of the parent | | | | | | |

+-----------------------------------+----------+--+----------+--+----------+--+

| | | | | | | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Liabilities | | | | | | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Bank and other loans | | | 2,337 | | 111,730 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Trade and other payables | | | 23,077 | | 24,907 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Retirement benefit obligations | | | 8,910 | | 6,790 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Provisions | | | 1,700 | | 1,623 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Total non-current liabilities | | | 36,024 | | 145,050 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Trade and other payables | | | 87,698 | | 101,964 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Provisions | | | 2,164 | | 1,012 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Total current liabilities | | | 89,862 | | 102,976 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Total liabilities | | | 125,886 | | 248,026 | |

+-----------------------------------+----------+--+----------+--+----------+--+

| | | | | | | |

+-----------------------------------+----------+--+----------+--+----------+--+

| Total equity and liabilities | | | 818,452 | | 880,304 | |

+-----------------------------------+----------+--+----------+--+----------+--+

These accounts were approved by the Board of directors on 5 March 2010.

Bovis Homes Group PLC

Group statement of changes in equity

+---------------------+----------+--+---------+---------+---------+--+

| | Total | | Issued | Share | Total | |

+---------------------+----------+--+---------+---------+---------+--+

| For the twelve | retained | | capital | premium | | |

| months ended | earnings | | | | | |

| 31 December | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| | GBP000 | | GBP000 | GBP000 | GBP000 | |

+---------------------+----------+--+---------+---------+---------+--+

| Balance at 1 | 506,594 | | 60,415 | 156,734 | 723,743 | |

| January 2008 | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Total comprehensive | (65,345 | )| - | - | (65,345 | )|

| income and expense | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Deferred tax on | (22 | )| - | - | (22 | )|

| other employee | | | | | | |

| benefits | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Current taxation | 498 | | - | - | 498 | |

| recognised directly | | | | | | |

| in equity | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Issue of share | - | | 82 | 393 | 475 | |

| capital | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Share based | (22 | )| - | - | (22 | )|

| payments | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Dividends paid to | (27,049 | )| - | - | (27,049 | )|

| shareholders | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Balance at 31 | 414,654 | | 60,497 | 157,127 | 632,278 | |

| December 2008 | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Balance at 1 | 414,654 | | 60,497 | 157,127 | 632,278 | |

| January 2009 | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Total comprehensive | 459 | | - | - | 459 | |

| income and expense | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Deferred tax on | (2 | )| - | - | (2 | )|

| other employee | | | | | | |

| benefits | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Issue of share | - | | 6,073 | 53,054 | 59,127 | |

| capital | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Share based | 704 | | - | - | 704 | |

| payments | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Dividends paid to | - | | - | - | - | |

| shareholders | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

| Balance at 31 | 415,815 | | 66,570 | 210,181 | 692,566 | |

| December 2009 | | | | | | |

+---------------------+----------+--+---------+---------+---------+--+

Bovis Homes Group PLC

Group statement of cash flows

+------------------------------------+--+--+----------+--+---------+--+

| For the year ended 31 December | | | | | | |

| | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| | | | 2009 | | 2008 | |

+------------------------------------+--+--+----------+--+---------+--+

| | | | GBP000 | | GBP000 | |

+------------------------------------+--+--+----------+--+---------+--+

| | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Cash flows from operating | | | | | | |

| activities | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Profit/(loss) for the year | | | 3,490 | | (58,995 | )|

+------------------------------------+--+--+----------+--+---------+--+

| Depreciation | | | 769 | | 1,168 | |

+------------------------------------+--+--+----------+--+---------+--+

| Impairment of goodwill | | | - | | 10,036 | |

+------------------------------------+--+--+----------+--+---------+--+

| Impairment of assets | | | 245 | | 2,241 | |

+------------------------------------+--+--+----------+--+---------+--+

| Financial income | | | (2,304 | )| (1,389 | )|

+------------------------------------+--+--+----------+--+---------+--+

| Financial expense | | | 16,375 | | 8,292 | |

+------------------------------------+--+--+----------+--+---------+--+

| Loss/(profit) on sale of property, | | | 3 | | (146 | )|

| plant and equipment | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Equity-settled share-based payment | | | 704 | | (22 | )|

| expense / (credit) | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Income tax expense / (credit) | | | 1,307 | | (19,739 | )|

+------------------------------------+--+--+----------+--+---------+--+

| (Release) / write-down of | | | (2,664 | )| 75,202 | |

| inventories | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Operating profit before changes in | | | 17,925 | | 16,648 | |

| working capital and provisions | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| (Increase) / Decrease in trade and | | | (7,555 | )| 8,924 | |

| other receivables | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Decrease in inventories | | | 152,762 | | 13,345 | |

+------------------------------------+--+--+----------+--+---------+--+

| Decrease in trade and other | | | (17,173 | )| (43,444 | )|

| payables | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| (Decrease) / Increase in | | | (611 | )| 702 | |

| provisions and employee benefits | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Cash generated from operations | | | 145,348 | | (3,825 | )|

+------------------------------------+--+--+----------+--+---------+--+

| | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Interest paid | | | (6,684 | )| (8,769 | )|

+------------------------------------+--+--+----------+--+---------+--+

| Income taxes received / (paid) | | | 21,688 | | (16,924 | )|

+------------------------------------+--+--+----------+--+---------+--+

| Net cash from operating activities | | | 160,352 | | (29,518 | )|

+------------------------------------+--+--+----------+--+---------+--+

| | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Cash flows from investing | | | | | | |

| activities | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Interest received | | | 1,481 | | 187 | |

+------------------------------------+--+--+----------+--+---------+--+

| Acquisition of property, plant and | | | (44 | )| (143 | )|

| equipment | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Proceeds from sale of plant and | | | 45 | | 214 | |

| equipment | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Net cash from investing activities | | | 1,482 | | 258 | |

+------------------------------------+--+--+----------+--+---------+--+

| | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Cash flows from financing | | | | | | |

| activities | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Dividends paid | | | - | | (27,049 | )|

+------------------------------------+--+--+----------+--+---------+--+

| Proceeds from the issue of share | | | 60,662 | | 475 | |

| capital | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Costs associated with share | | | (1,535 | )| - | |

| placing | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| (Repayment) / drawdown of | | | (118,000 | )| 79,000 | |

| borrowings | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Costs associated with refinancing | | | - | | (8,290 | )|

+------------------------------------+--+--+----------+--+---------+--+

| Net cash from financing activities | | | (58,873 | )| 44,136 | |

+------------------------------------+--+--+----------+--+---------+--+

| | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Net increase in cash and cash | | | 102,961 | | 14,876 | |

| equivalents | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Cash and cash equivalents at 1 | | | 11,634 | | (3,242 | )|

| January | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

| Cash and cash equivalents at 31 | | | 114,595 | | 11,634 | |

| December | | | | | | |

+------------------------------------+--+--+----------+--+---------+--+

Notes to the accounts

1 Basis of preparation

Bovis Homes Group PLC ('the Company') is a company domiciled in the United

Kingdom. The consolidated financial statements of the Company for the year

ended 31 December 2009 comprise the Company and its subsidiaries (together

referred to as 'the Group') and the Group's interest in associates.

The consolidated financial statements were authorised for issue by the directors

on 5 March 2010. The accounts were audited by KPMG Audit Plc.

The financial information set out above does not constitute the company's

statutory accounts for the years ended 31 December 2009 or 2008 but is derived

from those accounts. Statutory accounts for 2008 have been delivered to the

registrar of companies, and those for 2009 will be delivered in due course. The

auditors have reported on those accounts; their reports were (i) unqualified,

(ii) did not include a reference to any matters to which the auditors drew

attention by way of emphasis without qualifying their report and (iii) did not

contain a statement under section 237 (2) or (3) of the Companies Act 1985 in

respect of the accounts for 2008 nor a statement under section 498 (2) or (3) of

the Companies Act 2006 in respect of the accounts for 2009.

The consolidated financials statements have been prepared in accordance with

IFRS as adopted by the EU, and the accounting policies have been applied

consistently for all periods presented in the consolidated financial

statements.

The preparation of financial statements in conformity with IFRS requires

management to make judgements, estimates and assumptions that affect the

application of policies and reported amounts of assets and liabilities, income

and expenses. The estimates and associated assumptions are based on historical

experience and various other factors that are believed to be reasonable under

the circumstances, the results of which form the basis of making judgements

about carrying values of assets and liabilities that are not readily apparent

from other sources. Actual results may differ from these estimates.

2 Basis of consolidation

The consolidated financial statements incorporate the accounts of the Company

and entities controlled by the Company (its subsidiaries) made up to 31

December. Control is achieved where the Company has the power to govern the

financial and operating policies of an entity so as to obtain benefits from its

activities. The existence and effect of potential voting rights that are

currently exercisable or convertible are considered when assessing whether the

Group controls another entity.

Associates are those entities in which the Group has significant influence, but

not control, over the financial and operating policies. The consolidated

financial statements include the Group's share of the total recognised gains and

losses of associates on an equity accounted basis, from the date that

significant influence commences until the date that significant influence

ceases.

3 Accounting policies

There have been no changes to the Group's accounting policies. These accounting

policies will be disclosed in full within the Group's forthcoming financial

statements.

4 Exceptional items

Inventory carrying

value

The Group has reviewed the carrying value of its inventory items, comparing the

carrying cost of the asset against estimates of net realisable value. Net

realisable value has been arrived at using the Board's estimates of achievable

selling prices taking into account current market conditions, and after

deduction of an appropriate amount for selling costs. This has given rise in

the second half to an GBP11.6 million release of previously taken provision:

this release comprised a gross release of GBP14.0 million and a further

provision of GBP2.4 million. Taken together with the GBP8.9 million provision

taken in the first half, the net inventory provision release for the year as a

whole was GBP2.7 million (2008: GBP75.2 million provision taken).

Financing charge

Following the credit approval of a new banking facility in December 2009

followed by the entering into of that agreement during January 2010, the Group

has written off the GBP4.2 million remaining un-amortised element of the one-off

and other capitalised transaction fees in relation to the facility agreement

entered into in December 2008 (2008: GBPnil).

Other exceptional items

The Group has taken a GBP0.2 million impairment charge relating to

available-for-sale assets (2008: GBP1.2 million) and a GBP1.0 million provision

for a potential onerous land contract (2008: GBPnil).

Other items in 2008 included a GBP10.0 million goodwill write-off, a GBP1.0

million fixed asset impairment and a GBP5.7 million restructuring charge.

Total exceptional charges for 2009 are GBP2.7 million (2008: GBP93.1 million).

5 Reconciliation of net cash flow to net debt

+------------------------------------+--+--+---------------+-+----------+-+

| | | | 2009 | | 2008 | |

+------------------------------------+--+--+---------------+-+----------+-+

| | | | GBP000 | | GBP000 | |

+------------------------------------+--+--+---------------+-+----------+-+

| | | | | | | |

+------------------------------------+--+--+---------------+-+----------+-+

| Net increase in net cash and cash | | | 102,961 | | 14,876 | |

| equivalents | | | | | | |

+------------------------------------+--+--+---------------+-+----------+-+

| Repayment/(drawdown) of borrowings | | | 118,000 | | (70,730 | )|

+------------------------------------+--+--+---------------+-+----------+-+

| Fair value adjustments to interest | | | (337) | | - | |

| rate swaps | | | | | | |

+------------------------------------+--+--+---------------+-+----------+-+

| Movement in financing prepayment | | | (8,270 | )| - | |

+------------------------------------+--+--+---------------+-+----------+-+

| Net debt at start of period | | | (100,096 | )| (44,242 | )|

+------------------------------------+--+--+---------------+-+----------+-+

| Net cash/(debt) at end of period | | | 112,258 | | (100,096 | )|

+------------------------------------+--+--+---------------+-+----------+-+

| | | | | | | |

+------------------------------------+--+--+---------------+-+----------+-+

| Analysis of net cash/(debt): | | | | | | |

+------------------------------------+--+--+---------------+-+----------+-+

| Cash and cash equivalents | | | 114,595 | | 11,634 | |

+------------------------------------+--+--+---------------+-+----------+-+

| Unsecured bank and other loans | | | (2,000 | )| (120,000 | )|

+------------------------------------+--+--+---------------+-+----------+-+

| Fair value of interest rate swaps | | | (337 | )| - | |

+------------------------------------+--+--+---------------+-+----------+-+

| Issue Costs | | | - | | 8,270 | |

+------------------------------------+--+--+---------------+-+----------+-+

| Net cash/(debt) | | | 112,258 | | (100,096 | )|

+------------------------------------+--+--+---------------+-+----------+-+

6 Income taxes

Current tax

Current tax is the expected tax payable or receivable on the taxable income or

loss for the year, calculated using a corporation tax rate of 28.0% applied to

the pre-tax income or loss, adjusted to take account of deferred taxation

movements and any adjustments to tax payable for previous years. Current tax

receivable for current and prior years is classified as a current asset.

7 Dividends

The following dividends were paid by the Group.

+----------------------------------------+---+-----+----------+--+----------+

| | | | | | |

| | | | 2009 | | 2008 |

+----------------------------------------+---+-----+----------+--+----------+

| | | | GBP000 | | GBP000 |

+----------------------------------------+---+-----+----------+--+----------+

| | | | | | |

+----------------------------------------+---+-----+----------+--+----------+

| Prior year final dividend per share of | | | - | | 21,031 |

| nil (2008: 17.5p) | | | | | |

+----------------------------------------+---+-----+----------+--+----------+

| Current year interim dividend per | | | - | | 6,018 |

| share of nil (2008: 5.0p) | | | | | |

+----------------------------------------+---+-----+----------+--+----------+

| Dividend cost | | | - | | 27,049 |

+----------------------------------------+---+-----+----------+--+----------+

The Board has decided not to propose a final dividend in respect of 2009.

8 Earnings or Loss per share

Basic earnings per ordinary share before exceptional items for the year ended 31

December 2009 is calculated on pre-exceptional profit after tax of GBP5,453,000

(year ended 31 December 2008 profit: GBP11,075,000) over the weighted average of

124,179,686 (year ended 31 December 2008: 120,268,986) ordinary shares in issue

during the period.

Basic loss per ordinary share on exceptional items for

the year ended 31 December 2009 is calculated on an exceptional loss after tax

of GBP1,963,000 for 2009 (year ended 31 December 2008 loss: GBP70,070,000) over

the weighted average of 124,179,686 (year ended 31 December 2008: 120,268,986)

ordinary shares in issue during the period.

Basic earnings per ordinary

share for the year ended 31 December 2009 is calculated on profit after tax of

GBP3,490,000 (year ended 31 December 2008 loss: GBP58,995,000) over the weighted

average of 124,179,686 (year ended 31 December 2008: 120,268,986) ordinary

shares in issue during the period.

Diluted earnings per ordinary share before exceptional items for the year ended

31 December 2009 is calculated on pre-exceptional profit after tax of

GBP5,453,000 (year ended 31 December 2008 profit: GBP11,075,000) expressed over

the diluted weighted average of 124,203,192 (year ended 31 December 2008:

120,314,451) ordinary shares potentially in issue during the period.

Diluted loss per ordinary share on exceptional items for the year ended 31

December 2009 is calculated on an exceptional loss after tax of GBP1,963,000

(year ended 31 December 2008 loss: GBP70,070,000) expressed over the weighted

average of 124,179,686 ordinary shares in issue during the period (year ended 31

December 2008: 120,268,986).

Diluted earnings per ordinary share for the year ended 31 December 2009 is

calculated on profit after tax of GBP3,490,000 (year ended 31 December 2008

loss: GBP58,995,000) expressed over the diluted weighted average of 124,203,192

ordinary shares potentially in issue during the period (year ended 31 December

2008: 120,268,986).

The average number of shares is diluted in reference to the average number of

potential ordinary shares held under option during the period. This dilutive

effect amounts to the number of ordinary shares which would be purchased using

the aggregate difference in value between the market value of shares and the

share option exercise price. The market value of shares has been calculated

using the average ordinary share price during the period. Only share options

which have met their cumulative performance criteria have been included in the

dilution calculation. A loss per share cannot be further reduced through

dilution.

In a manner consistent with IAS33, the Group has reviewed the

impact of its equity placing in September 2009 on its prior year earnings per

share disclosures. As the impact is immaterial, no prior year restatement has

occurred.

9 Circulation to shareholders

The consolidated financial statements will be sent to shareholders on or about 6

April 2010. Further copies will be available on request from the Company

Secretary, Bovis Homes Group PLC, The Manor House, North Ash Road, New Ash

Green, Longfield, Kent DA3 8HQ.

Further information on Bovis Homes Group PLC can be found on the Group's

corporate website www.bovishomes.co.uk/plc, including the slide presentation

document which will be presented at the Group's results meeting on 8 March 2010.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR JAMLTMBJMBTM

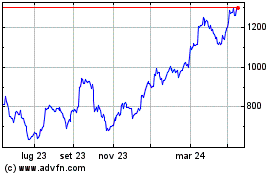

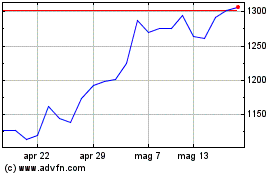

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2024 a Ago 2024

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Ago 2023 a Ago 2024