TIDMBVS

RNS Number : 4582Z

Bovis Homes Group PLC

14 January 2011

14 January 2011

Bovis Homes Group PLC

("The Group")

Trading update: 2010 profits ahead of consensus

Overview

Bovis Homes Group PLC is today issuing the following trading

update ahead of reporting its preliminary results for the year

ended 31 December 2010 on Monday 14 March 2011.

The Group has achieved a significant improvement in profits in

2010 and has made strong progress in implementing its land

investment strategy.

Sales and profits growth

In line with management expectations, the Group legally

completed 1,901 homes in 2010 (2009: 1,803 homes), an increase of

5%, of which 1,592 were private homes (2009: 1,527 homes) and 309

were social homes (2009: 276 social homes). The Group's average

sales price in 2010 was GBP160 700, 4% higher than the equivalent

of GBP154,600 in 2009. This increase was driven by growth in the

Group's average private sales price in 2010 to GBP172,400 from

GBP165,500 in 2009. Improved sales prices during the year combined

with the benefit of build cost savings primarily on second half

legal completions have increased the gross margin. With overheads

in line with expectations, the Group expects the operating profit

margin for 2010 to be at least 7%. Given the Group's strong

performance, it is anticipated that the profit for 2010 will be

ahead of consensus1 expectations as at the date of this trading

update.

At 1 January 2011, the Group held a forward sales order book for

2011 delivery of 420 homes. The forward sales position at the start

of 2010 was 643 homes, including a non recurring sale of 215 homes

sold to a joint venture in which the Group holds a 50% stake.

Excluding this from the comparative, the 2011 forward sales

position was consistent with the prior year notwithstanding the

lower number of active outlets: 66 on average during 2010 versus 85

on average during 2009. The significant investments made in

consented land during 2010 are anticipated to provide a growth of

around 15% in the number of active outlets with an estimated

average for 2011 of 76 active outlets.

The Group has achieved its target of substantially matching

production with legal completion volumes in 2010. As at 31 December

2010, the Group held housing work in progress equivalent to 1,093

homes (2009: 986 homes). This will facilitate the early legal

completion of homes reserved in the first half of 2011 and will

support the overall growth aspirations of the Group for the

year.

Strong balance sheet; land acquisitions to fuel growth

The cash position of the Group as at 31 December 2010 remained

strong, with net cash of GBP52 million, having started 2010 with

GBP113 million of net cash. The overall cash outflow was

contributed to by payments during the year of c.GBP138 million

relating to land investment, with strong operating cash inflows

pre-land expenditure of c.GBP93 million.

The Group has outlined its growth strategy to acquire good

quality residential land which will provide an increase in sales

outlets to support volume growth, and based on current market

conditions will deliver growth in profits and improved financial

returns. The Group has been successful in 2010 in acquiring

consented land, adding c.3,700 plots to the land bank at a cost of

GBP203 million and with a gross profit potential of GBP181 million.

This land has been purchased based on acquisition appraisals using

current day sales prices and costs and which generate financial

returns in line with the Group's investment 'hurdle' rates. The

land acquired has been geographically focused with 80% of the plots

in the South of England. Furthermore, the Group has terms agreed

for the acquisition of an additional c.2,500 plots.

Return to dividend

The Group has delivered early success with its growth strategy

and the Board is confident in its further delivery, based on

current market conditions. Given this confidence, the Board has

decided to recommence the payment of dividends to shareholders.

Based on the anticipated 2010 profits and the Group's robust

balance sheet position, the Group will declare a dividend for 2010,

subject to approval by shareholders at the 2011 Annual General

Meeting, which will be paid in May 2011.

Market conditions

The Group continues to expect trading conditions in 2011 to be

subdued relative to historical levels, with ongoing economic

uncertainty. Mortgage approval volumes remain weak, with mortgage

providers requiring high levels of deposit, particularly from first

time buyers. This all said, the long term imbalance between the

demand and supply of housing remains positive for the housebuilding

sector. With the strong investments made during 2010 and the

ability to continue land investment at attractive rates of return

into 2011, the Group is confident of its ability to deliver on its

growth strategy, which will add significantly to future shareholder

value.

Near the end of 2010, the Group reviewed its arrangements with

advisors and is delighted to announce the appointment of Moelis

& Co as its financial advisor and MHP Communications as its

financial PR advisor. Deutsche Bank and RBS Hoare Govett will

continue as joint brokers to the Group.

Commenting on the progress achieved in 2010, David Ritchie,

Chief Executive of Bovis Homes, said:

"We are pleased with the positive Group performance in 2010 and

remain confident of our growth strategy through the acquisition of

good quality residential land at attractive rates, which will

provide an increase in sales outlets to support volume growth.

Based on current market conditions this will deliver growth in

profits and improved financial returns which will add significantly

to future shareholder value."

1: Reuters mean consensus of pre tax profit (pre exceptional)

for 2010 financial year at 13 January 2011 of GBP16.3 million.

Conference call for analysts and investors

David Ritchie, Chief Executive and Jonathan Hill, Group Finance

Director of Bovis Homes will host a conference call at 08:30am

today, Friday 14 January 2011, to discuss the trading update.

To access the call please dial 020 3140 0668 and enter pincode

192105# when prompted. Please dial in five minutes prior to the

start of the conference call to allow time for registration. A

recording of the conference call will be available until midnight

on Friday 10 February 2011. To access the playback facility, please

dial 020 3140 0698 and enter conference reference 375671# when

prompted.

Certain statements may be forward looking statements. Forward

looking statements involve evaluating a number of risks,

uncertainties or assumptions that could cause actual results to

differ materially from those expressed or implied by those

statements. Forward looking statements regarding past trends,

results or activities should not be taken as a representation that

such trends, results or activities will continue in the future.

Undue reliance should not be placed on forward looking

statements.

-ENDS-

Enquiries: David Ritchie, Chief Executive

Jonathan Hill, Group Finance Director

Bovis Homes Group PLC

Tel: 01474 876200

Andrew Jaques, James White, Giles Robinson

MHP Communications

Tel: +44 (0)20 3128 8100

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFSDLTIVLIL

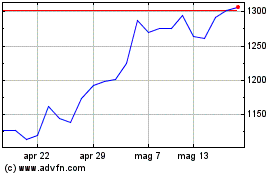

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Giu 2024 a Lug 2024

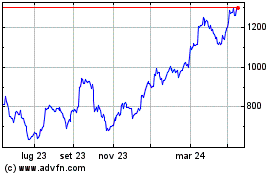

Grafico Azioni Vistry (LSE:VTY)

Storico

Da Lug 2023 a Lug 2024