HOD HASHARON, Israel, May 14 /PRNewswire-FirstCall/ -- Allot

Communications Ltd. (NASDAQ:ALLT), a leader in IP service

optimization solutions based on deep packet inspection (DPI)

technology, today announced financial results for the first quarter

ended March 31, 2008. Total revenues for the first quarter of 2008

were $8.3 million, similar to the revenues reported in the first

quarter of 2007, and a 5% decrease from the $8.7 million revenues

reported for the fourth quarter of 2007. On a GAAP basis, net loss

for the first quarter of 2008 was $4.8 million, or $0.22 per share

(basic and diluted), as compared with a net loss of $0.4 million,

or $0.02 per share (basic and diluted), in the first quarter of

2007, and a net loss of $6.7 million, or $0.31 per share (basic and

diluted), for the fourth quarter of 2007. The net loss and earnings

per share for the fourth quarter of 2007 reflect a reclassification

of the previously announced devaluation of certain Auction Rate

Securities (ARS) as described below in further detail. On a

non-GAAP basis, excluding the impact of share-based compensation

expenses, the impact of expenses related to a law suit, the impact

of amortization of intangible assets acquired from Esphion and the

impact of impairment charges related to certain securities,

non-GAAP net loss for the first quarter of 2008 totaled $1.9

million, or $0.09 per share (basic and diluted), as compared with a

net loss of $112 thousand, or $0.00 per share (basic and diluted),

for the first quarter of 2007. These non-GAAP measures should be

considered in addition to, and not as a substitute for, comparable

GAAP measures. A full reconciliation between non-GAAP and GAAP net

loss is provided in the accompanying Table 2. The Company provides

these non-GAAP financial measures because management believes that

they present a better measure of the Company's core business and

management uses the non-GAAP measures internally to evaluate the

Company's ongoing performance. Accordingly, the Company believes

that they are useful to investors in enhancing an understanding of

the Company's operating performance. "During the quarter we

achieved our goals of continued expansion of our global customer

base and continued acceptance of the new Service Gateway,"

commented Rami Hadar, Allot's President and Chief Executive

Officer. "We were pleased to see strong demand for our Service

Gateway, which received Technology Marketing Corporation's (TMC(R))

Unified Communications Magazine 2007 Product of the Year Award. The

product delivers DPI services with true 10Gb performance. Its open

architecture has attracted the attention of current and potential

customers, as it offers a fully upgradeable platform which can also

offer integrated value added services. During the quarter it made a

meaningful contribution to our revenues, and we expect it to

continue to be one of our main growth drivers during 2008 and

beyond," concluded Hadar. During the quarter the Company achieved

the following milestones: - Continued successful deployment of

Service Gateway - Omega at major carriers in Europe and the

Asia-Pacific region; - Completed the acquisition of the business of

Esphion Ltd., a developer of network protection solutions for

carriers and internet service providers, and it is anticipated that

a unified solution will be released at the end of the second

quarter of 2008; and - Added two Tier 1 mobile carriers and several

national carriers to its worldwide customer base. On January 8,

2008, the Company closed the previously announced acquisition of

Esphion. Under the terms of the agreement, the Company paid a total

of $3.9 million in cash for the purchase of Esphion's assets as

well as for related expenses. As of March 31, 2008, the Company's

cash and cash equivalents, including short and long-term deposits

and investments in marketable securities, totaled $63.2 million of

which $33.2 million were ARS. Since the announcement of our results

for the fourth quarter and full year of 2007, the credit and

capital markets have further deteriorated and reflected continued

uncertainty. Recent external valuations showed a further

devaluation of the majority of our ARS portfolio. As a result, the

Company recorded an impairment charge of $2.2 million in its profit

and loss statement, in respect of ARS the devaluation of which is

considered "other than temporary." In addition, based upon recent

valuations and market trends, the Company reclassified the

devaluation of certain ARS for the fourth quarter and the full year

of 2007 reflected in the Company's previous earnings release dated

February 12, 2008, as "other than temporary." This reclassification

resulted in an additional impairment charge of $1.2 million in the

Company's profit and loss statement for the fourth quarter and the

full year of 2007. Accordingly, on a GAAP basis, net loss for the

fourth quarter of 2007 was $6.7 million instead of the previously

reported $5.5 million, or $0.31 per share (basic and diluted)

instead of the previously reported $0.25 per share (basic and

diluted). On a GAAP basis, net loss in 2007 totaled $9.9 million

instead of the previously reported $8.7 million, or $0.46 per share

(basic and diluted) instead of the previously reported $0.41 per

share (basic and diluted). This reclassification has no impact on

the non-GAAP net loss and earnings per share previously reported

for the fourth quarter and full year of 2007. The ARS held by the

Company are subject to the risks and uncertainties regarding market

conditions, liquidity, impairment and ratings as previously

reported by the Company. The Company believes that based on its

current cash, cash equivalents and marketable securities balances

at March 31, 2008 and expected operating cash flows, the current

lack of liquidity of these securities will not have a material

impact on the Company's liquidity, cash flow or its ability to fund

its operations. Conference Call & Webcast The Company's

management team plans to host a live conference call and webcast

today, May 14, 2008, at 8:30 AM EST to discuss the financial

results as well as management's outlook for the business. To access

the conference call, please dial one of the following numbers: US:

1-866-966-5335, International: +44-20-3003-2666, Israel:

1-809-216-213. A replay of the conference call will be available

from 12:01 am EST on May 15, 2008 through June 14, 2008 at 11:59 pm

EST. To access the replay, please dial: +44-20-8196-1998, access

code: 650204# A live webcast of the conference call can be accessed

on the Allot Communications website at http://www.allot.com/. The

webcast will also be archived on the website following the

conference call. About Allot Communications Allot Communications

Ltd. (NASDAQ:ALLT) is a leading provider of intelligent IP service

optimization solutions for DSL, wireless and mobile broadband

carriers, service providers, and enterprises. Allot's rich

portfolio of hardware platforms and software applications utilizes

deep packet inspection (DPI) technology to transform broadband

pipes into smart networks that can rapidly and efficiently deploy

value added Internet services. Allot's scalable, carrier-grade

solutions provide the visibility, security, application control and

subscriber management that are vital to managing Internet service

delivery, guaranteeing quality of experience (QoE), containing

operating costs, and maximizing revenue in broadband networks. For

more information, visit http://www.allot.com/. Safe Harbor

Statement Information provided in this press release may contain

statements relating to current expectations, estimates, forecasts

and projections about future events that are "forward-looking

statements" as defined in the Private Securities Litigation Reform

Act of 1995. These forward-looking statements generally relate to

the Company's plans, objectives and expectations for future

operations, including the anticipation for the release of a unified

solution of the Service Gateway - Omega and the Esphion solution at

the end of the second quarter, the expectation that revenues from

the Services Gateway will continue to be one of the Company's main

growth drivers during 2008 and beyond, and the Company's belief

that based on its current cash, cash equivalents and marketable

securities balances and expected operating cash flows, the current

lack of liquidity of the ARS will not have a material impact on its

liquidity, cash flow or its ability to fund its operations. These

forward-looking statements are based upon management's current

estimates and projections of future results or trends. Actual

future results may differ materially from those projected as a

result of certain risks and uncertainties. These factors include,

but are not limited to: the possibility of further deterioration in

the credit and capital markets or additional ratings downgrades of

investments in the Company's portfolio (including on ARS) resulting

in the Company incurring additional impairments to its investment

portfolio; changes in general economic and business conditions and,

specifically, a decline in demand for the Company's products; the

Company's inability to timely integrate the Esphion solution into

the Service Gateway or develop and introduce new technologies,

products and applications; loss of market; and other factors

discussed under the heading "Risk Factors" in the Company's annual

report on Form 20-F filed with the Securities and Exchange

Commission. These forward-looking statements are made only as of

the date hereof, and the Company undertakes no obligation to update

or revise the forward-looking statements, whether as a result of

new information, future events or otherwise. TABLE - 1 ALLOT

COMMUNICATIONS LTD. AND ITS SUBSIDIARIES CONSOLIDATED STATEMENTS OF

OPERATIONS (U.S. dollars in thousands, except share and per share

data) Three Months Ended March 31, 2008 2007 (Unaudited) Revenues $

8,259 $ 8,276 Cost of revenues 2,142 1,974 Gross profit 6,117 6,302

Operating expenses: Research and development costs, net 3,097 2,453

Sales and marketing 5,044 4,194 General and administrative 1,499

1,043 In-process research and development 244 - Total Operating

expenses 9,884 7,690 Operating loss (3,767) (1,388) Financial and

other income (expenses), net (1,015) 957 Loss before income tax

expenses (4,782) (431) Income tax expenses 31 3 Net loss (4,813)

(434) Basic net loss per share ($0.22) ($0.02) Diluted net loss per

share ($0.22) ($0.02) Weighted average number of shares used in

computing basic net loss per share 22,026,771 21,009,705 Weighted

average number of shares used in computing diluted net loss per

share 22,026,771 21,009,705 TABLE - 2 ALLOT COMMUNICATIONS LTD. AND

ITS SUBSIDIARIES RECONCILATION OF GAAP TO NON-GAAP CONSOLIDATED

STATEMENTS OF OPERATIONS (U.S. dollars in thousands, except per

share data) Three Months Ended March 31, 2008 2007 (Unaudited) GAAP

net loss as reported $ (4,813) $ (434) Non-GAAP adjustments: Cost

of revenues Expenses recorded for stock-based compensation 14 11

Core technology amortization 28 - 42 11 Research and development

costs, net Expenses recorded for stock-based compensation 75 50

Sales and marketing Expenses recorded for stock-based compensation

128 119 General and administrative Expenses recorded for

stock-based compensation 208 142 Expenses related to a law suit 21

- 229 142 In-process research and development 244 - Total

adjustments to operating loss 718 322 Financial and other income

(expenses), net Impairment of auction rate securities 2,150 - Total

adjustments 2,868 322 Non-GAAP net loss (1,945) (112) Non- GAAP

basic and diluted loss per share ($0.09) ($0.00) TABLE - 3 ALLOT

COMMUNICATIONS LTD. AND ITS SUBSIDIARIES CONSOLIDATED BALANCE

SHEETS (U.S. dollars in thousands) March 31, December 31, 2008 2007

(Unaudited) ASSETS CURRENT ASSETS: Cash and cash equivalents $

23,938 $ 28,101 Marketable securities and short term deposits 6,062

7,305 Trade receivables 6,103 6,122* Other receivables and prepaid

expenses 4,580 3,915 Inventories 4,196 4,789 Total current assets

44,879 50,232 LONG-TERM ASSETS: Marketable securities 33,185 35,371

Severance pay fund 3,571 3,302 Other assets 1,175 1,169 Total

long-term assets 37,931 39,842 PROPERTY AND EQUIPMENT, NET 4,883

4,619 GOODWILL AND INTANGIBLE ASSETS, NET 3,791 239 Total assets

91,484 94,932 LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Trade payables $ 3,340 $ 3,409 Deferred revenues 3,929

3,968* Other payables and accrued expenses 6,364 5,791 Total

current liabilities 13,633 13,168 LONG-TERM LIABILITIES: Deferred

revenues 1,464 1,404* Accrued severance pay 3,523 3,175 Total

long-term liabilities 4,987 4,579 SHAREHOLDERS' EQUITY 72,864

77,185 Total liabilities and shareholders' equity 91,484 94,932 *

reclassified Investor Relations Contact: Doron Arazi Chief

Financial Officer International access code +972-9-761-9203

DATASOURCE: Allot Communications Ltd CONTACT: Investor Relations

Contact: Doron Arazi, Chief Financial Officer, International access

code +972-9-761-9203,

Copyright

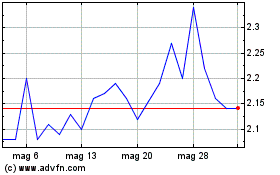

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Allot (NASDAQ:ALLT)

Storico

Da Lug 2023 a Lug 2024