0001734342false00017343422024-04-242024-04-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 24, 2024

Amerant Bancorp Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Florida | | 001-38534 | | 65-0032379 |

(State or other jurisdiction

of incorporation | | (Commission

file number) | | (IRS Employer

Identification Number) |

| | | | | | | | |

| | |

| | |

| 220 Alhambra Circle | | |

Coral Gables, Florida | | 33134 |

| (Address of principal executive offices) | | (Zip Code) |

(305) 460-8728 (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbols | Name of exchange on which registered |

| Class A Common Stock | AMTB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On April 24, 2024, Amerant Bancorp Inc. (the "Company") issued a press release to report the Company’s financial results for the fiscal quarter ended March 31, 2024. The release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference to this Item 2.02.

In accordance with General Instruction B.2. of Form 8-K, the information in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure

On April 25, 2024, the Company will hold a live audio webcast to discuss its financial results for the fiscal quarter ended March 31, 2024. In connection with the webcast, the Company is furnishing to the U.S. Securities and Exchange Commission the earnings slide presentation attached as Exhibit 99.2 to this Current Report on Form 8-K and incorporated by reference to this Item 7.01.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 attached hereto, is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

On April 24, 2024, the Company announced that, on April 24, 2024, its Board of Directors declared a cash dividend of $0.09 per share of common stock. The dividend is payable on May 30, 2024 to shareholders of record at the close of business on May 15, 2024. A copy of the press release is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits | | | | | |

Number | Exhibit |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| Date: April 24, 2024 | | Amerant Bancorp Inc. |

| | | | |

| | | By: | | /s/ Julio V. Pena |

| | | | | Name: Julio V. Pena |

| | | | | Title: Senior Vice President, Securities Counsel and Corporate Secretary |

| | | | | | | | |

| | CONTACTS: |

| | Investors |

| | Laura Rossi |

| | InvestorRelations@amerantbank.com |

| | (305) 460-8728 |

| | |

| | Media |

| | Alexis Dominguez |

| | MediaRelations@amerantbank.com |

| | (305) 441-5541 |

AMERANT REPORTS FIRST QUARTER 2024 RESULTS

Board of Directors Declares Quarterly Cash Dividend of $0.09 per Common Share

CORAL GABLES, FLORIDA, April 24, 2024. Amerant Bancorp Inc. (NYSE: AMTB) (the “Company” or “Amerant”) today reported net income attributable to the Company of $10.6 million in the first quarter of 2024, or $0.31 per diluted share, compared to a net loss attributable to the Company of $17.1 million, or $0.51 per diluted share, in the fourth quarter of 2023.

“We continued to invest in our future in the first quarter of 2024, opening new locations in Tampa and Ft. Lauderdale, while adding 12 new team members to our already talented business development teams across south Florida,” stated Jerry Plush, Chairman and CEO. “In addition to our recently announced sale of our Houston franchise, we also executed on our strategic initiatives, resulting in strong organic loan and deposit growth.”

•Total assets were $9.8 billion, an increase of $101.4 million, or 1.0%, compared to 4Q23.

•Total gross loans were $7.01 billion, a decrease of $258.5 million, or 3.6%, compared to $7.26 billion in 4Q23. This decrease reflects the completion of the sale of $401 million of Houston-based multifamily loans, offsetting $142.5 million in organic production for the quarter.

•Cash and cash equivalents were $659.7 million, up $337.8 million, or 104.9%, compared to $321.9 million in 4Q23.

•Total deposits were $7.88 billion, down $16.6 million, or 0.2%, compared to $7.89 billion in 4Q23. Organic deposit growth, which includes all deposits except institutional and brokered deposits, was $331.8 million, partially offset by declines in brokered deposits of $86.4 million and institutional deposits of $262 million.

•Total advances from Federal Home Loan Bank (“FHLB”) were $715.0 million, up $70.0 million, or 10.9%, compared to $645.0 million in 4Q23. The Bank had an additional $2.2 billion in availability from the FHLB as of March 31, 2024.

•Average yield on loans decreased to 7.05% in 1Q24, compared to 7.09% in 4Q23.

•Total non-performing assets were $50.5 million, down $4.1 million, or 7.5%, compared to $54.6 million as of 4Q23.

•The allowance for credit losses ("ACL") was $96.1 million, an increase of $0.5 million, or 0.6%, compared to $95.5 million as of 4Q23.

•Core deposits were $5.63 billion, up $35.4 million, or 0.6%, compared to $5.60 billion in 4Q23. This increase includes the net reduction of $262 million in institutional deposits.

•Average cost of total deposits increased to 3.00% in 1Q24 compared to 2.88% in 4Q23.

•Loan to deposit ratio was 88.93% in 1Q24 compared to 92.02% in 4Q23.

•Assets Under Management and custody (“AUM”) totaled $2.36 billion, up $68.5 million, or 3.0%, from $2.29 billion in 4Q23.

•Pre-provision net revenue (“PPNR”)(1) was $25.9 million in 1Q24 compared to negative $7.6 million in 4Q23.

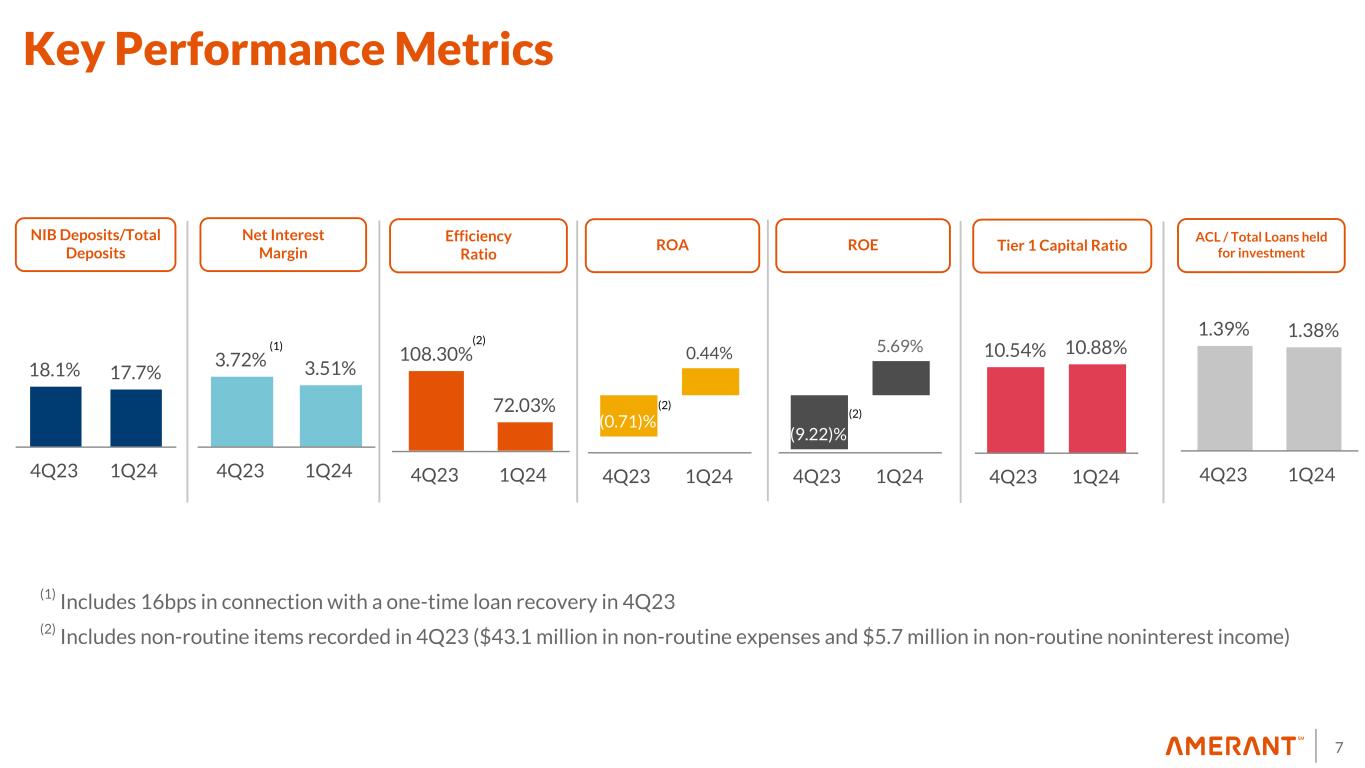

•Net Interest Margin (“NIM”) was 3.51% in 1Q24 compared to 3.72% in 4Q23, which included 16 basis points from a loan recovery received in the previous period.

•Net Interest Income (“NII”) was $78.0 million, down $3.7 million, or 4.5%, from $81.7 million in 4Q23.

•Provision for credit losses was $12.4 million in 1Q24, down $0.1 million, or 0.8%, compared to $12.5 million in 4Q23.

•Non-interest income was $14.5 million in 4Q23, down $5.1 million, or 26.1%, from $19.6 million in 4Q23.

•Non-interest expense was $66.6 million, down $43.1 million, or 39.3%, from $109.7 million in 4Q23.

•The efficiency ratio was 72.0% in 1Q24 compared to 108.3% in 4Q23.

•Return on average assets (“ROA”) was 0.44% in 1Q24 compared to negative 0.71% in 4Q23.

•Return on average equity (“ROE”) was 5.69% in 1Q24 compared to negative 9.22% in 4Q23.

•The Company’s Board of Directors declared a cash dividend of $0.09 per share of common stock on April 24, 2024. The dividend is payable on May 30, 2024, to shareholders of record on May 15, 2024.

Additional details on first quarter 2024 results can be found in the Exhibits to this earnings release, and the earnings presentation available under the Investor Relations section of the Company’s website at https://investor.amerantbank.com.

1 Non-GAAP measure, see “Non-GAAP Financial Measures” for more information and Exhibit 2 for a reconciliation to GAAP measures.

First Quarter 2024 Earnings Conference Call

The Company will hold an earnings conference call on Thursday, April 25, 2024 at 9:00 a.m. (Eastern Time) to discuss its first quarter 2024 results. The conference call and presentation materials can be accessed via webcast by logging on from the Investor Relations section of the Company’s website at https://investor.amerantbank.com. The online replay will remain available for approximately one month following the call through the above link.

About Amerant Bancorp Inc. (NYSE: AMTB)

Amerant Bancorp Inc. is a bank holding company headquartered in Coral Gables, Florida since 1979. The Company operates through its main subsidiary, Amerant Bank, N.A. (the “Bank”), as well as its other subsidiaries: Amerant Investments, Inc., Elant Bank and Trust Ltd., and Amerant Mortgage, LLC. The Company provides individuals and businesses in the U.S. with deposit, credit and wealth management services. The Bank, which has operated for over 40 years, is the largest community bank headquartered in Florida. The Bank operates 24 banking centers – 17 in South Florida, 1 in Tampa, FL and 6 in the Houston, Texas area. For more information, visit investor.amerantbank.com.

Cautionary Notice Regarding Forward-Looking Statements

This press release contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future.

Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2023 filed on March 7, 2024 (the “Form 10-K”), and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov.

Interim Financial Information

Unaudited financial information as of and for interim periods, including the three months ended March 31, 2024, December 31, 2023, and March 31, 2023, may not reflect our results of operations for our fiscal year ending, or financial condition, as of December 31, 2024, or any other period of time or date.

Non-GAAP Financial Measures

The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as “pre-provision net revenue (PPNR)”, “core pre-provision net revenue (Core PPNR)”, “core noninterest income”, “core noninterest expenses”, “core net income”, “core earnings per share (basic and diluted)”, “core return on assets (Core ROA)”, “core return on equity (Core ROE)”, “core efficiency ratio”, “tangible stockholders’ equity (book value) per common share”, “tangible common equity ratio, adjusted for unrealized losses on debt securities held to maturity”, and “tangible stockholders' equity (book value) per common share, adjusted for unrealized losses on debt securities held to maturity”. This supplemental information is not required by, or is not presented in accordance with GAAP. The Company refers to these financial measures and ratios as “non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein.

We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued in 2024, including the effect of non-core banking activities such as the sale of loans and securities and other repossessed assets, the valuation of securities, derivatives, loans held for sale and other real estate owned and repossessed assets, the early repayment of FHLB advances, impairment of investments, Bank owned life insurance restructure and other non-routine actions intended to improve customer service and operating performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies.

Exhibit 2 reconciles these non-GAAP financial measures to GAAP reported results.

Exhibit 1- Selected Financial Information

The following table sets forth selected financial information derived from our interim unaudited and annual audited consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(in thousands) | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 |

| Consolidated Balance Sheets | | | (audited) | | | | | | |

| Total assets | $ | 9,817,772 | | $ | 9,716,327 | | $ | 9,345,700 | | $ | 9,519,526 | | $ | 9,495,302 |

| Total investments | 1,578,568 | | 1,496,975 | | 1,314,367 | | 1,315,303 | | 1,347,697 |

| | | | | | | | | |

Total gross loans (1) | 7,006,383 | | 7,264,912 | | 7,142,596 | | 7,216,958 | | 7,115,035 |

| Allowance for credit losses | 96,050 | | 95,504 | | 98,773 | | 105,956 | | 84,361 |

| Total deposits | 7,878,243 | | 7,894,863 | | 7,546,912 | | 7,579,571 | | 7,286,726 |

Core deposits (2) | 5,633,165 | | 5,597,766 | | 5,244,034 | | 5,498,017 | | 5,357,386 |

| Advances from the Federal Home Loan Bank | 715,000 | | 645,000 | | 595,000 | | 770,000 | | 1,052,012 |

| Senior notes | 59,605 | | 59,526 | | 59,447 | | 59,368 | | 59,289 |

| Subordinated notes | 29,497 | | 29,454 | | 29,412 | | 29,369 | | 29,326 |

| Junior subordinated debentures | 64,178 | | 64,178 | | 64,178 | | 64,178 | | 64,178 |

Stockholders' equity (3)(4) | 738,085 | | 736,068 | | 719,787 | | 720,956 | | 729,056 |

Assets under management and custody (5) | 2,357,621 | | 2,289,135 | | 2,092,200 | | 2,147,465 | | 2,107,603 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | |

(in thousands, except percentages, share data and per share amounts) | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | | | | |

| | | | | | | | | | | | | | |

Consolidated Results of Operations | | | | | | | | | | | | | | |

| Net interest income | $ | 77,968 | | $ | 81,677 | | $ | 78,577 | | $ | 83,877 | | $ | 82,333 | | | | | |

Provision for credit losses (6) | 12,400 | | 12,500 | | 8,000 | | 29,077 | | 11,700 | | | | | |

| Noninterest income | 14,488 | | 19,613 | | 21,921 | | 26,619 | | 19,343 | | | | | |

| Noninterest expense | 66,594 | | 109,702 | | 64,420 | | 72,500 | | 64,733 | | | | | |

Net income (loss) attributable to Amerant Bancorp Inc. (7) | 10,568 | | (17,123) | | 22,119 | | 7,308 | | 20,186 | | | | | |

Effective income tax rate | 21.50% | | 14.21% | | 22.57% | | 21.00% | | 21.00% | | | | | |

| | | | | | | | | | | | | | |

Common Share Data | | | | | | | | | | | | | | |

| Stockholders' book value per common share | $ | 21.90 | | $ | 21.90 | | $ | 21.43 | | $ | 21.37 | | $ | 21.56 | | | | | |

Tangible stockholders' equity (book value) per common share (8) | $ | 21.16 | | $ | 21.16 | | $ | 20.63 | | $ | 20.66 | | $ | 20.84 | | | | | |

Tangible stockholders' equity (book value) per common share, adjusted for unrealized losses on debt securities held to maturity (8) | $ | 20.60 | | $ | 20.68 | | $ | 19.86 | | $ | 20.11 | | $ | 20.38 | | | | | |

Basic earnings (loss) per common share | $ | 0.32 | | $ | (0.51) | | $ | 0.66 | | $ | 0.22 | | $ | 0.60 | | | | | |

Diluted earnings (loss) per common share (9) | $ | 0.31 | | $ | (0.51) | | $ | 0.66 | | $ | 0.22 | | $ | 0.60 | | | | | |

| Basic weighted average shares outstanding | 33,538,069 | | 33,432,871 | | 33,489,560 | | 33,564,770 | | 33,559,718 | | | | | |

Diluted weighted average shares outstanding (9) | 33,821,562 | | 33,432,871 | | 33,696,620 | | 33,717,702 | | 33,855,994 | | | | | |

Cash dividend declared per common share (4) | $ | 0.09 | | $ | 0.09 | | $ | 0.09 | | $ | 0.09 | | $ | 0.09 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | | | | | | | |

Other Financial and Operating Data (10) | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Profitability Indicators (%) | | | | | | | | | | | | | | | | | |

Net interest income / Average total interest earning assets (NIM) (11) | 3.51% | | 3.72% | | 3.57 | % | | 3.83 | % | | 3.90 | % | | | | | | | | |

Net income (loss) / Average total assets (ROA) (12) | 0.44% | | (0.71) | % | | 0.92 | % | | 0.31 | % | | 0.88 | % | | | | | | | | |

Net income (loss) / Average stockholders' equity (ROE) (13) | 5.69% | | (9.22) | % | | 11.93 | % | | 3.92 | % | | 11.15 | % | | | | | | | | |

Noninterest income / Total revenue (14) | 15.67% | | 19.36% | | 21.81% | | 24.09% | | 19.02% | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Capital Indicators (%) | | | | | | | | | | | | | | | | | |

Total capital ratio (15) | 12.50% | | 12.12% | | 12.70 | % | | 12.39 | % | | 12.36 | % | | | | | | | | |

Tier 1 capital ratio (16) | 10.88% | | 10.54% | | 11.08 | % | | 10.77 | % | | 10.88 | % | | | | | | | | |

Tier 1 leverage ratio (17) | 8.73% | | 8.84% | | 9.05 | % | | 8.91 | % | | 9.04 | % | | | | | | | | |

Common equity tier 1 capital ratio (CET1) (18) | 10.11% | | 9.79% | | 10.30 | % | | 10.00 | % | | 10.10 | % | | | | | | | | |

Tangible common equity ratio (19) | 7.28% | | 7.34% | | 7.44 | % | | 7.34 | % | | 7.44 | % | | | | | | | | |

Tangible common equity ratio, adjusted for unrealized losses on debt securities held to maturity (20) | 7.10% | | 7.18% | | 7.18% | | 7.16% | | 7.29% | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Liquidity Ratios (%) | | | | | | | | | | | | | | | | | |

Loans to Deposits (21) | 88.93% | | 92.02% | | 94.64 | % | | 95.22 | % | | 97.64 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Asset Quality Indicators (%) | | | | | | | | | | | | | | | | | |

Non-performing assets / Total assets (22) | 0.51% | | 0.56% | | 0.57 | % | | 0.71 | % | | 0.51 | % | | | | | | | | |

Non-performing loans / Total gross loans (1) (23) | 0.43% | | 0.47% | | 0.46 | % | | 0.65 | % | | 0.31 | % | | | | | | | | |

Allowance for credit losses / Total non-performing loans (23) | 317.01% | | 277.63% | | 297.55 | % | | 224.51 | % | | 380.31 | % | | | | | | | | |

| Allowance for credit losses / Total loans held for investment | 1.38% | | 1.39% | | 1.40 | % | | 1.48 | % | | 1.20 | % | | | | | | | | |

Net charge-offs / Average total loans held for investment (24) | 0.69% | | 0.85% | | 0.82 | % | | 0.42 | % | | 0.64 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Efficiency Indicators (% except FTE) | | | | | | | | | | | | | | | | | |

| Noninterest expense / Average total assets | 2.75% | | 4.57% | | 2.69 | % | | 3.06 | % | | 2.82 | % | | | | | | | | |

| Salaries and employee benefits / Average total assets | 1.36% | | 1.38% | | 1.31 | % | | 1.45 | % | | 1.52 | % | | | | | | | | |

Other operating expenses/ Average total assets (25) | 1.39% | | 3.20% | | 1.38 | % | | 1.62 | % | | 1.30 | % | | | | | | | | |

Efficiency ratio (26) | 72.03% | | 108.30% | | 64.10 | % | | 65.61 | % | | 63.67 | % | | | | | | | | |

Full-Time-Equivalent Employees (FTEs) (27) | 696 | | 682 | | 700 | | 710 | | 722 | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

(in thousands, except percentages and per share amounts) | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | | | |

Core Selected Consolidated Results of Operations and Other Data (8) | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Pre-provision net revenue (PPNR) | $ | 25,862 | | | $ | (7,595) | | | $ | 36,456 | | | $ | 38,258 | | | $ | 37,187 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Core pre-provision net revenue (Core PPNR) | $ | 26,068 | | | $ | 29,811 | | | $ | 35,880 | | | $ | 39,196 | | | $ | 37,103 | | | | | |

Core net income | $ | 10,730 | | | $ | 15,272 | | | $ | 21,664 | | | $ | 8,048 | | | $ | 20,120 | | | | | |

Core basic earnings per common share | 0.32 | | | 0.46 | | | 0.65 | | | 0.24 | | | 0.60 | | | | | |

Core earnings per diluted common share (9) | 0.32 | | | 0.46 | | | 0.64 | | | 0.24 | | | 0.59 | | | | | |

Core net income / Average total assets (Core ROA) (12) | 0.44% | | 0.64% | | 0.91 | % | | 0.34 | % | | 0.88 | % | | | | |

Core net income / Average stockholders' equity (Core ROE) (13) | 5.78% | | 8.23% | | 11.69 | % | | 4.32 | % | | 11.11 | % | | | | |

Core efficiency ratio (28) | 71.87% | | 69.67% | | 62.08 | % | | 60.29 | % | | 62.47 | % | | | | |

__________________

(1) Total gross loans include loans held for investment net of unamortized deferred loan origination fees and costs, as well as loans held for sale. As of March 31, 2024, December 31, 2023, September 30, 2023, June 30, 2023 and March 31, 2023, mortgage loans held for sale carried at fair value totaled $48.9 million, $26.2 million, $26.0 million, $49.9 million and $65.3 million, respectively. In addition, December 31, 2023 and September 30, 2023, includes $365.2 million and $43.3 million in loans held for sale carried at the lower of estimated fair value or cost.

(2) Core deposits consist of total deposits excluding all time deposits.

(3) In the fourth quarter of 2022, the Company announced that the Board of Directors authorized a new repurchase program pursuant to which the Company may purchase, from time to time, up to an aggregate amount of $25 million of its shares of Class A common stock (the “2023 Class A Common Stock Repurchase Program”). There were no repurchases of Class A common stock in the first quarter of 2024 and fourth quarter of 2023. In the third, second and first quarters of 2023, the Company repurchased an aggregate of 142,188 shares of Class A common stock, 95,262 shares of Class A common stock and 22,403 shares of Class A common stock, respectively, at a weighted average price of $19.05 per share, $17.42 per share and $25.25 per share, respectively, under the 2023 Class A Common Stock Repurchase Program. In the third, second and first quarters of 2023, the aggregate purchase price for these transactions was approximately $2.7 million, $1.7 million and $0.6 million, respectively, including transaction costs.

(4) For the first quarter of 2024 as well as each of the fourth, third, second and first quarters of 2023, the Company’s Board of Directors declared cash dividends of $0.09 per share of the Company’s common stock and paid an aggregate amount of $3.0 million per quarter in connection with these dividends. The dividend declared in the first quarter of 2024 was paid on February 29, 2024 to shareholders of record at the close of business on February 14, 2024. See 2023 Form 10-K for more information on previous dividend payments in 2023.

(5) Assets held for clients in an agency or fiduciary capacity which are not assets of the Company and therefore are not included in the consolidated financial statements.

(6) In the first quarter of 2024 and in the fourth and third quarter of 2023, includes, $12.4 million, $12.0 million and $7.4 million of provision for credit losses on loans. Provision for unfunded commitments (contingencies) in the fourth and third quarter of 2023, were $0.5 million and $0.6 million, respectively, while there was none in the first quarter of 2024. For all other periods shown, includes provision for credit losses on loans. There was no provision for credit losses on unfunded commitments in the second quarter of 2023. In the first quarter of 2023, the provision for credit losses on unfunded commitments was $0.3 million.

(7) In the three months ended December 31, 2023, September 30, 2023, June 30, 2023 and March 31, 2023, net income excludes losses of $0.8 million, $0.4 million, $0.3 million and $0.2 million, respectively, attributable to a minority interest in Amerant Mortgage LLC. In the fourth quarter of 2023, the Company increased its ownership interest in Amerant Mortgage to 100% from 80% at September 30, 2023. This transaction had no material impact to the Company’s results of operations in the three months ended December 31, 2023. In connection with the change in ownership interest, which brought the minority interest share to zero, the Company derecognized the equity attributable to noncontrolling interest of $3.8 million at December 31, 2023, with a corresponding reduction to additional paid-in capital.

(8) This presentation contains adjusted financial information determined by methods other than GAAP. This adjusted financial information is reconciled to GAAP in Exhibit 2 - Non-GAAP Financial Measures Reconciliation.

(9) In all the periods shown, potential dilutive instruments consisted of unvested shares of restricted stock, restricted stock units and performance stock units. Potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share in all the periods shown, fewer shares would have been purchased than restricted shares assumed issued. Therefore, in

those periods, such awards resulted in higher diluted weighted average shares outstanding than basic weighted average shares outstanding, and had a dilutive effect in per share earnings.

(10) Operating data for the periods presented have been annualized.

(11) NIM is defined as NII divided by average interest-earning assets, which are loans, securities, deposits with banks and other financial assets which yield interest or similar income.

(12) Calculated based upon the average daily balance of total assets.

(13) Calculated based upon the average daily balance of stockholders’ equity.

(14) Total revenue is the result of net interest income before provision for credit losses plus noninterest income.

(15) Total stockholders’ equity divided by total risk-weighted assets, calculated according to the standardized regulatory capital ratio

calculations.

(16) Tier 1 capital divided by total risk-weighted assets. Tier 1 capital is composed of Common Equity Tier 1 (CET1) capital plus outstanding qualifying trust preferred securities of $62.3 million at each of all the dates presented.

(17) Tier 1 capital divided by quarter to date average assets.

(18) CET1 capital divided by total risk-weighted assets.

(19) Tangible common equity is calculated as the ratio of common equity less goodwill and other intangibles divided by total assets

less goodwill and other intangible assets. Other intangible assets primarily consist of naming rights and mortgage servicing rights and are included in other assets in the Company’s consolidated balance sheets.

(20) Calculated in the same manner described in footnote 19 but also includes unrealized losses on debt securities held to maturity in the balance of common equity and total assets.

(21) Calculated as the ratio of total loans gross divided by total deposits.

(22) Non-performing assets include all accruing loans past due by 90 days or more, all nonaccrual loans and other real estate owned (“OREO”) properties acquired through or in lieu of foreclosure, and other repossessed assets.

(23) Non-performing loans include all accruing loans past due by 90 days or more and all nonaccrual loans

(24) Calculated based upon the average daily balance of outstanding loan principal balance net of unamortized deferred loan origination fees and costs, excluding the allowance for credit losses. See 2023 Form 10-K for more details on charge-offs for all previous periods.

(25) Other operating expenses is the result of total noninterest expense less salary and employee benefits.

(26) Efficiency ratio is the result of noninterest expense divided by the sum of noninterest income and NII.

(27) As of March 31, 2024, December 31, 2023, September 30, 2023, June 30, 2023 and March 31, 2023, includes 65, 67, 98, 93, and 94 FTEs for Amerant Mortgage LLC, respectively.

(28) Core efficiency ratio is the efficiency ratio less the effect of restructuring costs and other non-routine items, described in Exhibit 2 - Non-GAAP Financial Measures Reconciliation.

Exhibit 2- Non-GAAP Financial Measures Reconciliation

The following table sets forth selected financial information derived from the Company’s interim unaudited and annual audited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related to tax deductible restructuring costs, provision for (reversal of) credit losses, provision for income tax expense (benefit), the effect of non-core banking activities such as the sale of loans and securities and other repossessed assets, the valuation of securities, derivatives, loans held for sale and other real estate owned and repossessed assets, the early repayment of FHLB advances, impairment of investments, Bank owned life insurance restructure and other non-routine actions intended to improve customer service and operating performance. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended, | | |

(in thousands) | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | | | |

| | | | | | | | | | | | | |

| | | | | | | |

Net income (loss) attributable to Amerant Bancorp Inc. | $ | 10,568 | | | $ | (17,123) | | | $ | 22,119 | | | $ | 7,308 | | | $ | 20,186 | | | | | |

Plus: provision for credit losses (1) | 12,400 | | | 12,500 | | | 8,000 | | | 29,077 | | | 11,700 | | | | | |

Plus: provision for income tax expense (benefit) | 2,894 | | | (2,972) | | | 6,337 | | | 1,873 | | | 5,301 | | | | | |

| Pre-provision net revenue (PPNR) | 25,862 | | | (7,595) | | | 36,456 | | | 38,258 | | | 37,187 | | | | | |

| Plus: non-routine noninterest expense items | — | | | 43,094 | | | 6,303 | | | 13,383 | | | 3,372 | | | | | |

| | | | | | | | | | | | | |

| Less: non-routine noninterest income items | 206 | | | (5,688) | | | (6,879) | | | (12,445) | | | (3,456) | | | | | |

| Core pre-provision net revenue (Core PPNR) | $ | 26,068 | | | $ | 29,811 | | | $ | 35,880 | | | $ | 39,196 | | | $ | 37,103 | | | | | |

| | | | | | | | | | | | | |

| Total noninterest income | $ | 14,488 | | | $ | 19,613 | | | $ | 21,921 | | | $ | 26,619 | | | $ | 19,343 | | | | | |

| Less: Non-routine noninterest income items: | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Derivatives (losses) gains, net | (152) | | | (151) | | | (77) | | | 242 | | | 14 | | | | | |

| Securities gains (losses), net | (54) | | | 33 | | | (54) | | | (1,237) | | | (9,731) | | | | | |

Bank owned life insurance charge (2) | — | | | (655) | | | — | | | — | | | — | | | | | |

| Gains on early extinguishment of FHLB advances, net | — | | | 6,461 | | | 7,010 | | | 13,440 | | | 13,173 | | | | | |

| | | | | | | | | | | | | |

| Total non-routine noninterest income items | $ | (206) | | | $ | 5,688 | | | $ | 6,879 | | | $ | 12,445 | | | $ | 3,456 | | | | | |

| Core noninterest income | $ | 14,694 | | | $ | 13,925 | | | $ | 15,042 | | | $ | 14,174 | | | $ | 15,887 | | | | | |

| | | | | | | | | | | | | |

| Total noninterest expenses | $ | 66,594 | | | $ | 109,702 | | | $ | 64,420 | | | $ | 72,500 | | | $ | 64,733 | | | | | |

| Less: non-routine noninterest expense items | | | | | | | | | | | | | |

Restructuring costs (3): | | | | | | | | | | | | | |

Staff reduction costs (4) | — | | | 1,120 | | | 489 | | | 2,184 | | | 213 | | | | | |

Contract termination costs (5) | — | | | — | | | — | | | 1,550 | | | — | | | | | |

Consulting and other professional fees and software expenses(6) | — | | | 1,629 | | | — | | | 2,060 | | | 2,690 | | | | | |

Disposition of fixed assets (7) | — | | | — | | | — | | | 1,419 | | | — | | | | | |

Branch closure expenses and related charges (8) | — | | | — | | | 252 | | | 1,558 | | | 469 | | | | | |

| | | | | | | | | | | | | |

| Total restructuring costs | $ | — | | | $ | 2,749 | | | $ | 741 | | | $ | 8,771 | | | $ | 3,372 | | | | | |

| Other non-routine noninterest expense items: | | | | | | | | | | | | | |

Losses on loans held for sale carried at the lower cost or fair value (9) | — | | | 37,495 | | | 5,562 | | | — | | | — | | | | | |

Loss on sale of repossessed assets and other real estate owned valuation expense (10) | — | | | — | | | — | | | 2,649 | | | — | | | | | |

| Goodwill and intangible assets impairment | — | | | 1,713 | | | — | | | — | | | — | | | | | |

Bank owned life insurance enchancement costs (2) | — | | | 1,137 | | | — | | | — | | | — | | | | | |

| Impairment charge on investment carried at cost | — | | | — | | | — | | | 1,963 | | | — | | | | | |

| Total non-routine noninterest expense items | $ | — | | | $ | 43,094 | | | $ | 6,303 | | | $ | 13,383 | | | $ | 3,372 | | | | | |

| Core noninterest expenses | $ | 66,594 | | | $ | 66,608 | | | $ | 58,117 | | | $ | 59,117 | | | $ | 61,361 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended, | | |

(in thousands, except percentages and per share amounts) | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | | | |

| | | |

Net income (loss) attributable to Amerant Bancorp Inc. | $ | 10,568 | | $ | (17,123) | | $ | 22,119 | | $ | 7,308 | | $ | 20,186 | | | | |

| Plus after-tax non-routine items in noninterest expense: | | | | | | | | | | | | | |

| Non-routine items in noninterest expense before income tax effect | — | | 43,094 | | 6,303 | | 13,383 | | 3,372 | | | | |

Income tax effect (11) | — | | (8,887) | | (1,486) | | (2,811) | | (708) | | | | |

| Total after-tax non-routine items in noninterest expense | — | | 34,207 | | 4,817 | | 10,572 | | 2,664 | | | | |

| Less after-tax non-routine items in noninterest income: | | | | | | | | | | | | | |

| Non-routine items in noninterest income before income tax effect | 206 | | (5,688) | | (6,879) | | (12,445) | | (3,456) | | | | |

Income tax effect (11) | (44) | | 1,032 | | 1,607 | | 2,613 | | 726 | | | | |

| Total after-tax non-routine items in noninterest income | 162 | | (4,656) | | (5,272) | | (9,832) | | (2,730) | | | | |

BOLI enhancement tax impact (2) | — | | 2,844 | | — | | — | | — | | | | |

Core net income | $ | 10,730 | | $ | 15,272 | | $ | 21,664 | | $ | 8,048 | | $ | 20,120 | | | | |

| | | | | | | | | | | | | |

Basic (loss) earnings per share | $ | 0.32 | | $ | (0.51) | | $ | 0.66 | | $ | 0.22 | | $ | 0.60 | | | | |

Plus: after tax impact of non-routine items in noninterest expense and BOLI tax impact (13) | — | | 1.11 | | 0.14 | | 0.31 | | 0.08 | | | | |

| (Less): after tax impact of non-routine items in noninterest income | — | | (0.14) | | (0.15) | | (0.29) | | (0.08) | | | | |

Total core basic earnings per common share | $ | 0.32 | | $ | 0.46 | | $ | 0.65 | | $ | 0.24 | | $ | 0.60 | | | | |

| | | | | | | | | | | | | |

Diluted (loss) earnings per share (12) | $ | 0.31 | | $ | (0.51) | | $ | 0.66 | | $ | 0.22 | | $ | 0.60 | | | | |

Plus: after tax impact of non-routine items in noninterest expense and BOLI tax impact (13) | — | | 1.11 | | 0.14 | | 0.31 | | 0.08 | | | | |

| (Less): after tax impact of non-routine items in noninterest income | 0.01 | | (0.14) | | (0.16) | | (0.29) | | (0.09) | | | | |

Total core diluted earnings per common share | $ | 0.32 | | $ | 0.46 | | $ | 0.64 | | $ | 0.24 | | $ | 0.59 | | | | |

| | | | | | | | | | | | | |

Net income (loss) / Average total assets (ROA) | 0.44 | % | | (0.71) | % | | 0.92 | % | | 0.31 | % | | 0.88 | % | | | | |

Plus: after tax impact of non-routine items in noninterest expense and BOLI tax impact (13) | — | % | | 1.55 | % | | 0.20 | % | | 0.45 | % | | 0.12 | % | | | | |

Plus (less): after tax impact of non-routine items in noninterest income | — | % | | (0.20) | % | | (0.21) | % | | (0.42) | % | | (0.12) | % | | | | |

Core net income / Average total assets (Core ROA) | 0.44 | % | | 0.64 | % | | 0.91 | % | | 0.34 | % | | 0.88 | % | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Net income (loss) / Average stockholders' equity (ROE) | 5.69 | % | | (9.22) | % | | 11.93 | % | | 3.92 | % | | 11.15 | % | | | | |

Plus: after tax impact of non-routine items in noninterest expense and BOLI tax impact (13) | — | % | | 19.96 | % | | 2.60 | % | | 5.68 | % | | 1.47 | % | | | | |

Plus (less): after tax impact of non-routine items in noninterest income | 0.09 | % | | (2.51) | % | | (2.84) | % | | (5.28) | % | | (1.51) | % | | | | |

Core net income / Average stockholders' equity (Core ROE) | 5.78 | % | | 8.23 | % | | 11.69 | % | | 4.32 | % | | 11.11 | % | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Efficiency ratio | 72.03 | % | | 108.30 | % | | 64.10 | % | | 65.61 | % | | 63.67 | % | | | | |

| (Less): impact of non-routine items in noninterest expense | — | % | | (42.54) | % | | (6.27) | % | | (12.11) | % | | (3.32) | % | | | | |

| | | | | | | | | | | | | |

(Less) plus: impact of non-routine items in noninterest income | (0.16) | % | | 3.91 | % | | 4.25 | % | | 6.79 | % | | 2.12 | % | | | | |

| Core efficiency ratio | 71.87 | % | | 69.67 | % | | 62.08 | % | | 60.29 | % | | 62.47 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Three Months Ended, | | | | |

(in thousands, except percentages, share data and per share amounts) | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Stockholders' equity | $ | 738,085 | | $ | 736,068 | | $ | 719,787 | | $ | 720,956 | | $ | 729,056 | | | | | | | |

Less: goodwill and other intangibles (14) | (24,935) | | (25,029) | | (26,818) | | (24,124) | | (24,292) | | | | | | | |

| Tangible common stockholders' equity | $ | 713,150 | | $ | 711,039 | | $ | 692,969 | | $ | 696,832 | | $ | 704,764 | | | | | | | |

| Total assets | 9,817,772 | | 9,716,327 | | 9,345,700 | | 9,519,526 | | 9,495,302 | | | | | | | |

Less: goodwill and other intangibles (14) | (24,935) | | (25,029) | | (26,818) | | (24,124) | | (24,292) | | | | | | | |

| Tangible assets | $ | 9,792,837 | | $ | 9,691,298 | | $ | 9,318,882 | | $ | 9,495,402 | | $ | 9,471,010 | | | | | | | |

| Common shares outstanding | 33,709,395 | | 33,603,242 | | 33,583,621 | | 33,736,159 | | 33,814,260 | | | | | | | |

| Tangible common equity ratio | 7.28 | % | | 7.34 | % | | 7.44 | % | | 7.34 | % | | 7.44 | % | | | | | | | |

| Stockholders' book value per common share | $ | 21.90 | | $ | 21.90 | | $ | 21.43 | | $ | 21.37 | | $ | 21.56 | | | | | | | |

| Tangible stockholders' equity book value per common share | $ | 21.16 | | $ | 21.16 | | $ | 20.63 | | $ | 20.66 | | $ | 20.84 | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Tangible common stockholders' equity | $ | 713,150 | | $ | 711,039 | | $ | 692,969 | | $ | 696,832 | | $ | 704,764 | | | | | | | |

Less: Net unrealized accumulated losses on debt securities held to maturity, net of tax (15) | (18,729) | | (16,197) | | (26,138) | | (18,503) | | (15,542) | | | | | | | |

| Tangible common stockholders' equity, adjusted for net unrealized accumulated losses on debt securities held to maturity | $ | 694,421 | | $ | 694,842 | | $ | 666,831 | | $ | 678,329 | | $ | 689,222 | | | | | | | |

| Tangible assets | $ | 9,792,837 | | $ | 9,691,298 | | $ | 9,318,882 | | $ | 9,495,402 | | $ | 9,471,010 | | | | | | | |

Less: Net unrealized accumulated losses on debt securities held to maturity, net of tax (15) | (18,729) | | (16,197) | | (26,138) | | (18,503) | | (15,542) | | | | | | | |

| Tangible assets, adjusted for net unrealized accumulated losses on debt securities held to maturity | $ | 9,774,108 | | $ | 9,675,101 | | $ | 9,292,744 | | $ | 9,476,899 | | $ | 9,455,468 | | | | | | | |

| Common shares outstanding | 33,709,395 | | 33,603,242 | | 33,583,621 | | 33,736,159 | | 33,814,260 | | | | | | | |

| | | | | | | | | | | | | | | | |

| Tangible common equity ratio, adjusted for net unrealized accumulated losses on debt securities held to maturity | 7.10 | % | | 7.18 | % | | 7.18 | % | | 7.16 | % | | 7.29 | % | | | | | | | |

| Tangible stockholders' book value per common share, adjusted for net unrealized accumulated losses on debt securities held to maturity | $ | 20.60 | | $ | 20.68 | | $ | 19.86 | | $ | 20.11 | | $ | 20.38 | | | | | | | |

| | | | | | | | | | | | | | | | |

____________

(1) In the first quarter of 2024 and in the fourth and third quarter of 2023, includes $12.4 million, $12.0 million and $7.4 million of provision for credit losses on loans, respectively. Provision for unfunded commitments (contingencies) in the fourth and third quarter of 2023, were $0.5 million and $0.6 million, respectively, while there was none in the first quarter of 2024. For all other periods shown, includes provision for credit losses on loans. There was no provision for credit losses on unfunded commitments in the second quarter of 2023. In the first quarter of 2023, the provision for credit losses on unfunded commitments was $0.3 million.

(2) In the fourth quarter of 2023, the Company completed a restructuring of its bank-owned life insurance (“BOLI”) program. This was executed through a combination of a 1035 exchange and a surrender and reinvestment into higher-yielding general account with a new investment grade insurance carrier. This transaction allowed for higher team member participation through an enhanced split-dollar plan. Estimated improved yields resulting from the enhancement have an earn-back period of approximately 2 years. In the fourth quarter of 2023, we recorded total additional expenses and charges of $4.6 million in connection with this transaction, including: (i) a reduction of $0.7 million to the cash surrender value of BOLI; (ii) transaction costs of $1.1 million, and (iii) income tax expense of $2.8 million.

(3) Expenses incurred for actions designed to implement the Company’s business strategy. These actions include, but are not limited to reductions in workforce, streamlining operational processes, rolling out the Amerant brand, implementation of new technology system applications, decommissioning of legacy technologies, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities.

(4) Staff reduction costs consist of severance expenses related to organizational rationalization.

(5) Contract termination and related costs associated with third party vendors resulting from the Company’s engagement of FIS.

(6) In the three months ended December 31, 2023, includes an aggregate of $1.6 million of nonrecurrent expenses in connection with the engagement of FIS and, to a lesser extent, software expenses related to legacy applications running in parallel to new core banking applications. There were no significant nonrecurrent expenses in connection with engagement of FIS in the three months ended March 31, 2024 and September 30, 2023. In the three months ended June 30, 2023 and March 31, 2023, includes expenses of $2.0 million and $2.6 million, respectively, in connection with the engagement of FIS.

(7) Includes expenses in connection with the disposition of fixed assets due to the write off of in-development software in the three months ended June 30, 2023.

(8) In the three months ended September 30, 2023, consists of expenses in connection with the closure of a branch in Houston, Texas in 2023. In addition, in the three months ended June 30, 2023 includes $0.9 million of accelerated amortization of leasehold improvements and $0.6 million of right-of-use, or ROU asset impairment, associated with the closure of a branch in Miami, FL in 2023. Furthermore, in the three months ended March 31, 2023, includes $0.5 million of ROU asset impairment associated with the closure of a branch in Houston, Texas in 2023.

(9) In the three months ended December 31, 2023, includes (i) fair value adjustment of $35.5 million related to an aggregate of $401 million in Houston-based CRE loans held for sale which are carried at the lower of fair value or cost, and (ii) a loss on sale of $2.0 million related to a New York-based CRE loan previously carried at the lower of fair value or cost. In the three months ended September 30, 2023, includes a fair value adjustment of $5.6 million related to a New York-based CRE loan held for sale carried at the lower of fair value or cost.

(10) In the three months ended June 30, 2023, amount represents the loss on sale of repossessed assets in connection with our equipment-financing activities.

(11) In the three months ended March 31, 2024 and March 31, 2023, amounts were calculated based upon the effective tax rate for the period of 21.50% and 21.00%, respectively. For all of the other periods shown, amounts represent the difference between the prior and current period year-to-date tax effect.

(12) Potential dilutive instruments consisted of unvested shares of restricted stock, restricted stock units and performance stock units. In all the periods presented, potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share in those periods, fewer shares would have been purchased than restricted shares assumed issued. Therefore, in those periods, such awards resulted in higher diluted weighted average shares outstanding than basic weighted average shares outstanding, and had a dilutive effect on per share earnings.

(13) In the three months ended December 31, 2023, per share amounts and percentages were calculated using the after-tax impact of non-routine items in noninterest expense of $34.2 million and BOLI tax impact of $2.8 million in the same period. In all other periods shown, per share amounts and percentages were calculated using the after tax impact of non-routine items in noninterest expense.

(14) At March 31, 2024, December 31, 2023 and September 30, 2023, other intangible assets primarily consist of naming rights of $2.4 million, $2.5 million and $2.7 million, respectively, and mortgage servicing rights (“MSRs”) of $1.4 million, $1.4 million and $1.3 million, respectively. At June 30, 2023 and March 31, 2023, other intangible assets primarily consist of MSRs of $1.3 million and $1.4 million, respectively. Other intangible assets are included in other assets in the Company’s consolidated balance sheets.

(15) As of March 31, 2024, December 31, 2023, September 30, 2023, June 30, 2023 and March 31, 2023, amounts were calculated based upon the fair value on debt securities held to maturity, and assuming a tax rate of 25.40%, 25.36%, 25.51%, 25.46% and 25.53%, respectively.

Exhibit 3 - Average Balance Sheet, Interest and Yield/Rate Analysis

The following tables present average balance sheet information, interest income, interest expense and the corresponding average yields earned and rates paid for the periods presented. The average balances for loans include both performing and nonperforming balances. Interest income on loans includes the effects of discount accretion and the amortization of non-refundable loan origination fees, net of direct loan origination costs, accounted for as yield adjustments. Average balances represent the daily average balances for the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| March 31, 2024 | | December 31, 2023 | | March 31, 2023 |

| (in thousands, except percentages) | Average

Balances | | Income/

Expense | | Yield/

Rates | | Average Balances | | Income/ Expense | | Yield/ Rates | | Average

Balances | | Income/

Expense | | Yield/

Rates |

| Interest-earning assets: | | | | | | | | | | | | | | | | | |

| Loan portfolio, net (1)(2) | $ | 6,995,974 | | | $ | 122,705 | | | 7.05 | % | | $ | 7,107,222 | | | $ | 127,090 | | | 7.09 | % | | $ | 6,901,352 | | | $ | 108,501 | | | 6.38 | % |

| Debt securities available for sale (3) (4) | 1,239,762 | | | 13,186 | | | 4.28 | % | | 1,060,113 | | | 11,603 | | | 4.34 | % | | 1,058,831 | | | 10,173 | | | 3.90 | % |

| Debt securities held to maturity (5) | 224,877 | | | 1,967 | | | 3.52 | % | | 227,765 | | | 1,951 | | | 3.40 | % | | 240,627 | | | 2,112 | | | 3.56 | % |

| Debt securities held for trading | — | | | — | | | — | % | | — | | | — | | | — | % | | 18 | | | — | | | — | % |

| Equity securities with readily determinable fair value not held for trading | 2,477 | | | 55 | | | 8.93 | % | | 2,450 | | | 12 | | | 1.94 | % | | 4,886 | | | — | | | — | % |

| Federal Reserve Bank and FHLB stock | 50,180 | | | 883 | | | 7.08 | % | | 49,741 | | | 894 | | | 7.13 | % | | 57,803 | | | 1,014 | | | 7.11 | % |

| Deposits with banks | 422,841 | | | 5,751 | | | 5.47 | % | | 265,657 | | | 3,940 | | | 5.88 | % | | 302,791 | | | 3,330 | | | 4.46 | % |

| Other short-term investments | 5,932 | | | 78 | | | 5.29 | % | | 5,928 | | | 79 | | | 5.29 | % | | — | | | — | | | — | % |

| Total interest-earning assets | 8,942,043 | | | 144,625 | | | 6.50 | % | | 8,718,876 | | | 145,569 | | | 6.62 | % | | 8,566,308 | | | 125,130 | | | 5.92 | % |

| Total non-interest-earning assets (6) | 812,523 | | | | | | | 794,844 | | | | | | | 739,522 | | | | | |

| Total assets | $ | 9,754,566 | | | | | | | $ | 9,513,720 | | | | | | | $ | 9,305,830 | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| March 31, 2024 | | December 31, 2023 | | March 31, 2023 |

| (in thousands, except percentages) | Average

Balances | | Income/

Expense | | Yield/

Rates | | Average Balances | | Income/ Expense | | Yield/ Rates | | Average

Balances | | Income/

Expense | | Yield/

Rates |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | |

| Checking and saving accounts | | | | | | | | | | | | | | | | | |

| Interest bearing DDA | $ | 2,445,362 | | | $ | 17,736 | | | 2.92 | % | | $ | 2,435,871 | | | $ | 16,350 | | | 2.66 | % | | $ | 2,342,620 | | $ | 12,855 | | | 2.23 | % |

| Money market | 1,431,949 | | | 14,833 | | | 4.17 | % | | 1,259,859 | | | 13,917 | | | 4.38 | % | | 1,333,465 | | 7,881 | | | 2.40 | % |

| Savings | 262,528 | | | 28 | | | 0.04 | % | | 271,307 | | | 30 | | | 0.04 | % | | 299,501 | | 46 | | | 0.06 | % |

| Total checking and saving accounts | 4,139,839 | | | 32,597 | | | 3.17 | % | | 3,967,037 | | | 30,297 | | | 3.03 | % | | 3,975,586 | | 20,782 | | | 2.12 | % |

| Time deposits | 2,290,587 | | | 26,124 | | | 4.59 | % | | 2,276,720 | | | 24,985 | | | 4.35 | % | | 1,767,603 | | 12,834 | | | 2.94 | % |

| Total deposits | 6,430,426 | | | 58,721 | | | 3.67 | % | | 6,243,757 | | | 55,282 | | | 3.51 | % | | 5,743,189 | | 33,616 | | | 2.37 | % |

| Securities sold under agreements to repurchase | — | | | — | | | — | % | | 106 | | | 2 | | | 7.49 | % | | — | | — | | | — | % |

| Advances from the FHLB (7) | 644,753 | | | 5,578 | | | 3.48 | % | | 635,272 | | | 6,225 | | | 3.89 | % | | 959,392 | | 6,763 | | | 2.86 | % |

| Senior notes | 59,567 | | | 943 | | | 6.37 | % | | 59,488 | | | 941 | | | 6.28 | % | | 59,250 | | 942 | | | 6.45 | % |

| Subordinated notes | 29,476 | | | 361 | | | 4.93 | % | | 29,433 | | | 361 | | | 4.87 | % | | 29,306 | | 361 | | | 5.00 | % |

| Junior subordinated debentures | 64,178 | | | 1,054 | | | 6.61 | % | | 64,178 | | | 1,081 | | | 6.68 | % | | 64,178 | | 1,115 | | | 7.05 | % |

| Total interest-bearing liabilities | 7,228,400 | | | 66,657 | | | 3.71 | % | | 7,032,234 | | | 63,892 | | | 3.60 | % | | 6,855,315 | | 42,797 | | | 2.53 | % |

| Non-interest-bearing liabilities: | | | | | | | | | | | | | | | | | |

| Non-interest bearing demand deposits | 1,435,226 | | | | | | | 1,381,157 | | | | | | | 1,377,966 | | | | |

| Accounts payable, accrued liabilities and other liabilities | 344,197 | | | | | | | 363,711 | | | | | | | 338,351 | | | | |

| Total non-interest-bearing liabilities | 1,779,423 | | | | | | | 1,744,868 | | | | | | | 1,716,317 | | | | |

| Total liabilities | 9,007,823 | | | | | | | 8,777,102 | | | | | | | 8,571,632 | | | | |

| Stockholders’ equity | 746,743 | | | | | | | 736,618 | | | | | | | 734,198 | | | | |

| Total liabilities and stockholders' equity | $ | 9,754,566 | | | | | | | $ | 9,513,720 | | | | | | | $ | 9,305,830 | | | | |

| Excess of average interest-earning assets over average interest-bearing liabilities | $ | 1,713,643 | | | | | | | $ | 1,686,642 | | | | | | | $ | 1,710,993 | | | | |

| Net interest income | | | $ | 77,968 | | | | | | | $ | 81,677 | | | | | | | $ | 82,333 | | | |

| Net interest rate spread | | | | | 2.79 | % | | | | | | 3.02 | % | | | | | | 3.39 | % |

| Net interest margin (8) | | | | | 3.51 | % | | | | | | 3.72 | % | | | | | | 3.90 | % |

| Cost of total deposits (9) | | | | | 3.00 | % | | | | | | 2.88 | % | | | | | | 1.91 | % |

| Ratio of average interest-earning assets to average interest-bearing liabilities | 123.71 | % | | | | | | 123.98 | % | | | | | | 124.96 | % | | | | |

| Average non-performing loans/ Average total loans | 0.46 | % | | | | | | 0.49 | % | | | | | | 0.46 | % | | | | |

___________

(1) Includes loans held for investment net of the allowance for credit losses, and loans held for sale. The average balance of the allowance for credit losses was $92.3 million, $92.7 million, and $81.4 million in the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively. The average balance of total loans held for sale was $180.5 million, $100.7 million and $66.4 million in the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively.

(2) Includes average non-performing loans of $32.6 million, $35.1 million and $31.8 million for the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively.

(3) Includes the average balance of net unrealized gains and losses in the fair value of debt securities available for sale. The average balance includes average net unrealized losses of $101.5 million, $142.1 million, and $104.9 million in the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively.

(4) Includes nontaxable securities with average balances of $18.3 million, $17.8 million and $19.7 million for the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively. The tax equivalent yield for these nontaxable securities was 4.68%, 4.78% and 4.56% for the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively. In 2024 and 2023, the tax equivalent yields were calculated assuming a 21% tax rate and dividing the actual yield by 0.79.

(5) Includes nontaxable securities with average balances of $48.5 million, $48.9 million and $50.7 million for the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively. The tax equivalent yield for these nontaxable

securities was 4.25%, 4.26% and 4.20% for the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively. In 2024 and 2023, the tax equivalent yields were calculated assuming a 21% tax rate and dividing the actual yield by 0.79.

(6) Excludes the allowance for credit losses.

(7) The terms of the FHLB advance agreements require the Bank to maintain certain investment securities or loans as collateral for these advances.

(8) NIM is defined as net interest income divided by average interest-earning assets, which are loans, securities, deposits with banks and other financial assets which yield interest or similar income.

(9) Calculated based upon the average balance of total noninterest bearing and interest bearing deposits.

Exhibit 4 - Noninterest Income

This table shows the amounts of each of the categories of noninterest income for the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | |

| March 31, 2024 | | December 31, 2023 | | | | | | | March 31, 2023 | | | | | |

| (in thousands, except percentages) | Amount | | % | | Amount | | % | | | | | | | | | | | Amount | | % | | | | | | | |

| | | | | | | | |

| Deposits and service fees | $ | 4,325 | | | 29.9 | % | | $ | 4,424 | | | 22.5 | % | | | | | | | | | | | $ | 4,955 | | | 25.6 | % | | | | | | | |

| Brokerage, advisory and fiduciary activities | 4,327 | | | 29.9 | % | | 4,249 | | | 21.7 | % | | | | | | | | | | | 4,182 | | | 21.6 | % | | | | | | | |

Change in cash surrender value of bank owned life insurance (“BOLI”)(1) | 2,342 | | | 16.2 | % | | 849 | | | 4.3 | % | | | | | | | | | | | 1,412 | | | 7.3 | % | | | | | | | |

| Cards and trade finance servicing fees | 1,223 | | | 8.4 | % | | 1,238 | | | 6.3 | % | | | | | | | | | | | 533 | | | 2.8 | % | | | | | | | |

| Gain on early extinguishment of FHLB advances, net | — | | | — | % | | 6,461 | | | 32.9 | % | | | | | | | | | | | 13,173 | | | 68.1 | % | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities (losses) gains, net (2) | (54) | | | (0.4) | % | | 33 | | | 0.2 | % | | | | | | | | | | | (9,731) | | | (50.3) | % | | | | | | | |

Loan-level derivative income (3) | 466 | | | 3.2 | % | | 837 | | | 4.3 | % | | | | | | | | | | | 2,071 | | | 10.7 | % | | | | | | | |

Derivative (losses) gains, net (4) | (152) | | | (1.1) | % | | (151) | | | (0.8) | % | | | | | | | | | | | 14 | | | 0.1 | % | | | | | | | |

Other noninterest income (5) | 2,011 | | | 13.9 | % | | 1,673 | | | 8.5 | % | | | | | | | | | | | 2,734 | | | 14.1 | % | | | | | | | |

| Total noninterest income | $ | 14,488 | | | 100.0 | % | | $ | 19,613 | | | 100.0 | % | | | | | | | | | | | $ | 19,343 | | | 100.0 | % | | | | | | | |

__________________

(1) Changes in cash surrender value of BOLI are not taxable. In the three months ended, December 31, 2023, includes a charge of $0.7 million in connection with the enhancement/restructuring of BOLI in the fourth quarter of 2023.

(2) Includes net loss of $0.1 million and $9.5 million in the three months ended December 31, 2023 and March 31, 2023, respectively, in connection with the sale of debt securities available for sale. There were no sales of debt securities available for sale in the three months ended March 31, 2024. In addition, includes unrealized losses of $0.1 million and unrealized gains of $0.1 million in the three months ended March 31, 2024 and December 31, 2023, respectively, related to the change in fair value of equity securities with readily available fair value not held for trading which are recorded in results of the period. In addition, in the three months ended March 31, 2023, the Company sold all of its equity securities with readily available fair value not held for trading, with a total fair value of $11.2 million at the time of sale, and recognized a net loss of $0.2 million in connection with this transaction.

(3) Income from interest rate swaps and other derivative transactions with customers. The Company incurs expenses related to derivative transactions with customers which are included as part of noninterest expenses under loan-level derivative expense. See Exhibit 5 for more details.

(4) Net unrealized gains and losses related to uncovered interest rate caps with clients.

(5) Includes mortgage banking income of $1.1 million, $0.6 million and $1.8 million in the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively, primarily consisting of net gains on sale, valuation and derivative transactions associated with mortgage loans held for sale activity, and other smaller sources of income related to the operations of Amerant Mortgage. Other sources of income in the periods shown include foreign currency exchange transactions with customers and valuation income on the investment balances held in the non-qualified deferred compensation plan.

Exhibit 5 - Noninterest Expense

This table shows the amounts of each of the categories of noninterest expense for the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| March 31, 2024 | | December 31, 2023 | | | | | | March 31, 2023 | | | | | | |

| (in thousands, except percentages) | Amount | % | | Amount | % | | | | | | | | | | Amount | % | | | | | | | | |

| | | | | | | | | |

Salaries and employee benefits (1) | $ | 32,958 | | 49.5 | % | | $ | 33,049 | | 30.1 | % | | | | | | | | | | $ | 34,876 | | 53.9 | % | | | | | | | | |

Occupancy and equipment | 6,476 | | 9.7 | % | | 7,015 | | 6.4 | % | | | | | | | | | | 6,798 | | 10.5 | % | | | | | | | | |

Professional and other services fees (2) | 10,963 | | 16.5 | % | | 14,201 | | 12.9 | % | | | | | | | | | | 7,628 | | 11.8 | % | | | | | | | | |

Loan-level derivative expense (3) | 4 | | — | % | | 182 | | 0.2 | % | | | | | | | | | | 1,600 | | 2.5 | % | | | | | | | | |

Telecommunications and data processing (4) | 3,533 | | 5.3 | % | | 3,838 | | 3.5 | % | | | | | | | | | | 3,064 | | 4.7 | % | | | | | | | | |

| Depreciation and amortization | 1,477 | | 2.2 | % | | 1,480 | | 1.3 | % | | | | | | | | | | 1,292 | | 2.0 | % | | | | | | | | |

| FDIC assessments and insurance | 3,008 | | 4.5 | % | | 2,535 | | 2.3 | % | | | | | | | | | | 2,737 | | 4.2 | % | | | | | | | | |

Losses on loans held for sale carried at the lower cost or fair value (5) | — | | — | % | | 37,495 | | 34.2 | % | | | | | | | | | | — | | — | % | | | | | | | | |

| Advertising expenses | 3,078 | | 4.6 | % | | 3,169 | | 2.9 | % | | | | | | | | | | 2,586 | | 4.0 | % | | | | | | | | |

Other real estate owned and repossessed assets (income) expense, net (6)(7) | (354) | | (0.5) | % | | (205) | | (0.2) | % | | | | | | | | | | — | | — | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Other operating expenses (8) | 5,451 | | 8.2 | % | | 6,943 | | 6.4 | % | | | | | | | | | | 4,152 | | 6.4 | % | | | | | | | | |

Total noninterest expense (9) | $ | 66,594 | | 100.0 | % | | $ | 109,702 | | 100.0 | % | | | | | | | | | | $ | 64,733 | | 100.0 | % | | | | | | | | |

___

(1) Includes staff reduction costs of $1.1 million and $0.2 million in the three months ended December 31, 2023 and March 31, 2023, respectively, which consist of severance expenses primarily related to organizational rationalization.

(2) Includes additional non-routine expenses of $1.2 million and $2.6 million in the three months ended December 31, 2023 and March 31, 2023, respectively, related to the engagement of FIS. Additionally, the three months ended March 31, 2024 and December 31, 2023, include recurring service fees in connection with the engagement of FIS.

(3) Includes services fees in connection with our loan-level derivative income generation activities.

(4) In the three months ended December 31, 2023, includes $0.4 million of software expenses related to legacy applications running in parallel to new core banking applications.

(5) In the three months ended December 31, 2023, includes $35.5 million in total valuation allowance as a result of changes in their fair value, and $2.0 million in losses on the sale of these loans.

(6) Includes OREO rental income of $0.4 million and $0.4 million in the three months ended March 31, 2024 and December 31, 2023, respectively. We had no OREO rental income in the three months ended March 31, 2023.

(7) Beginning in the three months ended June 30, 2023, OREO and repossessed assets expense is presented separately in the Company’s consolidated statement of operations and comprehensive (loss) income.

(8) In the three months ended December 31, 2023, includes goodwill and intangible assets impairments totaling $1.7 million related to two of our subsidiaries (Amerant Mortgage and Elant, a Cayman-based trust company). In addition, in the three months ended December 31, 2023, includes additional costs of $1.1 million in connection with the restructuring of the Company’s BOLI. In all of the periods shown, includes mortgage loan origination and servicing expenses, charitable contributions, community engagement, postage and courier expenses, and debits which mirror the valuation income on the investment balances held in the non-qualified deferred compensation plan in order to adjust the liability to participants of the deferred compensation plan and other small expenses.

(9) Includes $3.1 million, $3.5 million and $3.9 million in the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively, related to Amerant Mortgage, primarily consisting of salaries and employee benefits, mortgage lending costs and professional and other services fees.

Exhibit 6 - Consolidated Balance Sheets

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands, except share data) | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 |

| | | | | | | | | |

| Assets | | | (audited) | | | | | | |

| Cash and due from banks | $ | 41,231 | | | $ | 47,234 | | | $ | 48,145 | | | $ | 45,184 | | | $ | 41,489 | |

| Interest earning deposits with banks | 577,843 | | | 242,709 | | | 202,946 | | | 365,673 | | | 411,747 | |

| Restricted cash | 33,897 | | | 25,849 | | | 51,837 | | | 34,204 | | | 32,541 | |

| Other short-term investments | 6,700 | | | 6,080 | | | 6,024 | | | — | | | — | |

| Cash and cash equivalents | 659,671 | | | 321,872 | | | 308,952 | | | 445,061 | | | 485,777 | |

| Securities | | | | | | | | | |

| Debt securities available for sale, at fair value | 1,298,073 | | | 1,217,502 | | | 1,033,797 | | | 1,027,676 | | | 1,045,883 | |

| Debt securities held to maturity, at amortized cost (1) | 224,014 | | | 226,645 | | | 230,254 | | | 234,369 | | | 239,258 | |

| Trading securities | — | | | — | | | — | | | 298 | | | — | |

| Equity securities with readily determinable fair value not held for trading | 2,480 | | | 2,534 | | | 2,438 | | | 2,500 | | | — | |

| Federal Reserve Bank and Federal Home Loan Bank stock | 54,001 | | | 50,294 | | | 47,878 | | | 50,460 | | | 62,556 | |

| Securities | 1,578,568 | | | 1,496,975 | | | 1,314,367 | | | 1,315,303 | | | 1,347,697 | |

| Loans held for sale, at lower of fair value or cost (2) | — | | | 365,219 | | | 43,257 | | | — | | | — | |

| Mortgage loans held for sale, at fair value | 48,908 | | | 26,200 | | | 25,952 | | | 49,942 | | | 65,289 | |

| Loans held for investment, gross | 6,957,475 | | | 6,873,493 | | | 7,073,387 | | | 7,167,016 | | | 7,049,746 | |

| Less: Allowance for credit losses | 96,050 | | | 95,504 | | | 98,773 | | | 105,956 | | | 84,361 | |

| Loans held for investment, net | 6,861,425 | | | 6,777,989 | | | 6,974,614 | | | 7,061,060 | | | 6,965,385 | |

| Bank owned life insurance | 237,314 | | | 234,972 | | | 232,736 | | | 231,253 | | | 229,824 | |

| Premises and equipment, net | 44,877 | | | 43,603 | | | 43,004 | | | 43,714 | | | 42,380 | |

| Deferred tax assets, net | 48,302 | | | 55,635 | | | 63,501 | | | 56,779 | | | 46,112 | |

| Operating lease right-of-use assets | 117,171 | | | 118,484 | | | 116,763 | | | 116,161 | | | 119,503 | |

| Goodwill | 19,193 | | | 19,193 | | | 20,525 | | | 20,525 | | | 20,525 | |

| Accrued interest receivable and other assets (3) | 202,343 | | | 256,185 | | | 202,029 | | | 179,728 | | | 172,810 | |

| Total assets | $ | 9,817,772 | | | $ | 9,716,327 | | | $ | 9,345,700 | | | $ | 9,519,526 | | | $ | 9,495,302 | |

| Liabilities and Stockholders' Equity | | | | | | | | | |

| Deposits | | | | | | | | | |

| Demand | | | | | | | | | |

| Noninterest bearing | $ | 1,397,331 | | | $ | 1,426,919 | | | $ | 1,370,157 | | | $ | 1,293,522 | | | $ | 1,360,626 | |

| Interest bearing | 2,619,115 | | | 2,560,629 | | | 2,416,797 | | | 2,773,120 | | | 2,489,565 | |

| Savings and money market | 1,616,719 | | | 1,610,218 | | | 1,457,080 | | | 1,431,375 | | | 1,507,195 | |

| Time | 2,245,078 | | | 2,297,097 | | | 2,302,878 | | | 2,081,554 | | | 1,929,340 | |

| Total deposits | 7,878,243 | | | 7,894,863 | | | 7,546,912 | | | 7,579,571 | | | 7,286,726 | |

| Advances from the Federal Home Loan Bank | 715,000 | | | 645,000 | | | 595,000 | | | 770,000 | | | 1,052,012 | |

| Senior notes | 59,605 | | | 59,526 | | | 59,447 | | | 59,368 | | | 59,289 | |

| Subordinated notes | 29,497 | | | 29,454 | | | 29,412 | | | 29,369 | | | 29,326 | |