Sierra Bancorp Announces Share Repurchase Program and Declares Quarterly Cash Dividend

18 Ottobre 2024 - 2:01PM

Business Wire

Sierra Bancorp (Nasdaq: BSRR), parent of Bank of the Sierra,

announced that its Board of Directors has approved a new share

repurchase program authorizing the Company to repurchase up to one

million (1,000,000) shares of its outstanding common stock, from

time to time, commencing after the current share repurchase program

expires on October 31, 2024, and continuing until October 31, 2025.

This share repurchase program replaces and supersedes the prior

share repurchase program. Shares may be repurchased in open-market

transactions or privately negotiated transactions executed in

compliance with applicable federal and state securities laws. The

timing of the repurchases and the number of shares repurchased

under the program will depend on a variety of factors including

price, trading volume, corporate and regulatory requirements, and

market conditions. The Board further authorized Management to enter

into a 10b5-1 Plan with a nationally recognized broker-dealer to

facilitate share repurchases as appropriate.

The Company also announced that its Board of Directors has

declared a regular quarterly cash dividend of $0.24 per share. The

dividend was approved subsequent to the Board’s review of the

Company’s financial performance and capital for the quarter ended

September 30, 2024, and will be paid on November 12, 2024, to

shareholders of record as of October 31, 2024. Counting dividends

paid by Bank of the Sierra prior to the formation of Sierra Bancorp

the Company has paid regular cash dividends to shareholders every

year since 1987, comprised of annual dividends through 1998 and

quarterly dividends thereafter. The dividend noted in today’s

announcement marks the Company’s 103rd consecutive quarterly cash

dividend.

Sierra Bancorp is the holding Company for Bank of the Sierra

(www.bankofthesierra.com), which is in its 47th year of operations

and is one of the largest independent banks headquartered in the

South San Joaquin Valley. Bank of the Sierra is a community-centric

regional bank, which offers a broad range of retail and commercial

banking services through full-service branches located within the

counties of Tulare, Kern, Kings, Fresno, Ventura, San Luis Obispo,

and Santa Barbara. The Bank also maintains an online branch and

provides specialized lending services through an agricultural

credit center in Templeton, California, and a dedicated loan

production office in Roseville, California. In 2024, Bank of the

Sierra was recognized as one of the strongest and top-performing

community banks in the country, with a 5-star rating from Bauer

Financial.

Forward-Looking

Statements

The statements contained in this release that are not historical

facts are forward-looking statements based on management's current

expectations and beliefs concerning future developments and their

potential effects on the Company. Readers are cautioned not to

unduly rely on forward looking statements. Actual results may

differ from those projected. These forward-looking statements

involve risks and uncertainties including but not limited to the

health of the national and local economies including the impact to

the Company and its customers resulting from changes to, and the

level of, inflation and interest rates; changes in laws, rules,

regulations, or interpretations to which the Company is subject;

the Company’s ability to maintain and grow its deposit base; loan

demand and continued portfolio performance, the Company's ability

to attract and retain skilled employees, customers' service

expectations; cyber security risks: the Company's ability to

successfully deploy new technology, the success of acquisitions and

branch expansion; operational risks including the ability to detect

and prevent errors and fraud; the effectiveness of the Company’s

enterprise risk management framework; the impact of adverse

developments at other banks, including bank failures, that impact

general sentiment regarding the stability and liquidity of banks

that could affect stock price; changes to valuations of the

Company’s assets and liabilities including the allowance for credit

losses, earning assets, and intangible assets; changes to the

availability of liquidity sources including borrowing lines and the

ability to pledge or sell certain assets; costs related to

litigation; the effects of severe weather events, pandemics, other

public health crises, acts of war or terrorism, and other external

events on our business; and other factors detailed in the Company's

SEC filings, including the "Risk Factors" and "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" sections of the Company's most recent Form 10‑K and

Form 10‑Q.

Category: Financial Source: Sierra Bancorp

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241018507008/en/

Kevin McPhaill, President/Chief Executive Officer (559) 782-4900

or (888) 454-BANK www.sierrabancorp.com

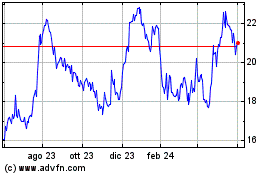

Grafico Azioni Sierra Bancorp (NASDAQ:BSRR)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Sierra Bancorp (NASDAQ:BSRR)

Storico

Da Dic 2023 a Dic 2024