Research shows audience-based buying and

targeting becoming more important as demonstrated by a 39% YoY

growth of ad views using audience targeting for streaming

campaigns

Advertisers rank viewer experience, targeting,

and premium content as key factors when planning multiscreen

campaigns

Today, Comcast Advertising released its annual Comcast

Advertising Report, revealing data-based, actionable insights

gleaned from billions of multiscreen TV impressions into how

viewers are viewing, buyers are buying, and sellers are selling

today to inform and improve the media buying process of tomorrow.

The report shows that as advertisers start planning for 2025, over

half rank maximizing specific reach and frequency in their TV and

video buys as their biggest challenge heading into the new

year.

“While TV advertising continues to be a highly desirable way for

brands to get in front of consumers, delivering campaigns to the

right audiences at the optimal frequency and scale can feel

daunting,” said James Rooke, President of Comcast Advertising.

“Success in today’s ecosystem requires a strategy built around

premium data, quality media, sophisticated technology, and, most

importantly, a focus on transparency throughout. Without these, you

risk marring your brand with a suboptimal TV experience.”

Targeting and Measurement

While many different signal and identity solutions have emerged

in recent years, first-party data and contextual solutions are

securing the most attention from advertisers. Over two-thirds of

them are actively using first-party data and contextual advertising

solutions, while less than half are relying on traditional

identifiers, IP addresses or universal IDs.

According to the report, 56% of advertisers say they’d increase

their video advertising spend if it came with better measurement,

attribution or optimization capabilities. This comes as more

advertisers turn to multiscreen TV as a full-funnel solution, not

just a vehicle for cheap reach.

Insights Into Buyer Trends Driving Success

According to the latest report, 97% of advertisers plan to

increase or maintain their streaming TV spend in the next 12

months, while 74% plan to do the same with traditional TV.

Additionally, about a third of advertisers are looking to increase

their spend in free ad-supported streaming TV (FAST.)

The report reinforces that advertisers are increasingly looking

to solutions such as addressable TV advertising and programmatic to

more effectively reach audiences. In fact, 53% of advertisers now

consider addressable TV a must-buy, while data shows that

advertisers are increasing their use of programmatic, showing 15%

YoY growth.

Additional key findings of the report include:

- Advertisers rank overall viewer experience (76%), targeting

capabilities (82%), and content (88%) as some of the most important

factors when planning multiscreen TV campaigns.

- It’s all about the big screen: Over 87% of viewers prefer

watching streaming content on the TV screen – across paid TV

streaming and free streaming.

- Sellers are enabling more streaming inventory to be transacted

programmatically, with 21% of streaming video ads today being

programmatic.

- Audience-based buying and targeting is becoming more important

for advertisers indicated by the 39% YoY growth of ad views using

audience targeting for streaming campaigns.

- 56% of advertisers rank delivering specific reach and frequency

as one of their top two factors for measuring success,

demonstrating the need for providers with sophisticated technology

that can enable effective campaign delivery and transparent

performance reporting.

- As access to reliable identifiers becomes more challenging, 89%

of advertisers are actively using or planning to use contextual

advertising solutions to deliver relevant experiences.

What Will Drive Advertising Success in 2025

The report posits that multiscreen TV advertising success in

2025 will lie at the intersection of good data, good media, and

good technology. The report goes on to define each of these terms,

using the findings of the research to qualify what defines the best

kinds of data, media, and technology.

The report concludes with several industry predictions for the

year to come. Among the predictions is that live events like sports

will shape the streaming landscape, especially as programmatic

activation increases; addressable will continue on its growth

trajectory as advertiser look for accuracy, accountability, and

unification across screens; viewers will expect better advertising

experiences; and multiscreen TV will be embraced as a full-funnel

performance engine that can drive awareness, consideration, and

action, while providing transparent measurement.

The Comcast Advertising Report is based on an in-depth analysis

of impressions from Comcast’s advertising sales division, Effectv,

and from its advertising technology platform, FreeWheel, as well as

commissioned research into viewing and buying habits from research

partners.

To view the full findings as outlined in Comcast Advertising’s

latest report, visit here.

Note: The full list of sources can be found in the 2024 Comcast

Advertising Report.

About Comcast Advertising

Comcast Advertising is the advertising division of Comcast

Cable. As a global leader in media, technology, and advertising,

Comcast Advertising fosters powerful connections between brands and

their audiences as well as among publishers, distributors, MVPDs,

agencies and other industry players. Effectv, its advertising sales

division, helps local, regional, and national advertisers connect

with their audiences on every screen by using advanced data to

drive targeting and measurement of their campaigns. FreeWheel, its

media and technology arm, provides the technology, data enablement,

and convergent marketplaces required to ensure buyers and sellers

can transact across all screens, all data types, and all sales

channels, in order to ensure the ultimate goal – results for

marketers. Comcast Advertising, along with NBCUniversal and Sky, is

part of the Comcast Corporation (NASDAQ: CMCSA). Visit

http://comcastadvertising.com/ to learn more.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209340655/en/

Media Contacts Emily Miller Emily_Miller@comcast.com

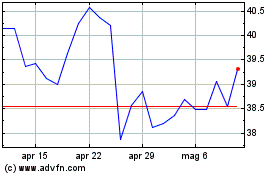

Grafico Azioni Comcast (NASDAQ:CMCSA)

Storico

Da Nov 2024 a Dic 2024

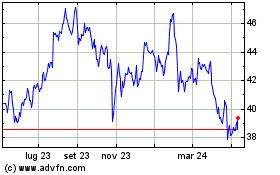

Grafico Azioni Comcast (NASDAQ:CMCSA)

Storico

Da Dic 2023 a Dic 2024