UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 6, 2024

Hennessy Capital Investment Corp. VI

(Exact name of Registrant as specified in its

charter)

| Delaware |

|

001-40846 |

|

86-1626937 |

| (State of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

195 US Hwy 50, Suite 309

Zephyr Cove, NV |

|

89448 |

| (Address of principal executive offices) |

|

(Zip Code) |

(775) 339-1671

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which

Registered |

| Shares of Class A common stock, par value $0.0001 per share |

|

HCVI |

|

The Nasdaq Stock Market LLC |

| Redeemable warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 |

|

HCVIW |

|

The Nasdaq Stock Market LLC |

| Units, each consisting of one share of Class A common stock and one-third of one redeemable warrant |

|

HCVIU |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

As previously reported, on June 17, 2024, Hennessy

Capital Investment Corp. VI, a Delaware corporation (“SPAC”), Namib Minerals, an exempted company limited by shares incorporated

under the laws of the Cayman Islands (“PubCo”), Midas SPAC Merger Sub Inc., a Delaware corporation and a direct wholly-owned

subsidiary of PubCo, Cayman Merger Sub Ltd., an exempted company limited by shares incorporated under the laws of the Cayman Islands and

a direct wholly-owned subsidiary of PubCo, and Greenstone Corporation, an exempted company limited by shares incorporated under the laws

of the Cayman Islands ( “Greenstone”), entered into a business combination agreement (the “Business Combination Agreement”),

pursuant to which the parties thereto will enter into a business combination transaction (the “Business Combination”).

On December 6, 2024, the parties to the Business

Combination Agreement entered into an amendment to the Business Combination Agreement (the “Amendment”). The Amendment extends

the outside date for consummating the Business Combination from December 16, 2024 to March 31, 2025.

The foregoing description of the Amendment does

not purport to be complete and is qualified in its entirety by the full text of the Amendment filed as Exhibit 2.1 to this Current Report

on Form 8-K (this “Current Report”) and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On December 9, 2024, PubCo and SPAC issued a joint

press release announcing that PubCo and Greenstone, as co-registrant, have filed with the U.S. Securities and Exchange Commission (the

“SEC”) a registration statement on Form F-4 (the “Registration Statement”) relating to the Business Combination.

A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report and incorporated herein by reference.

Furnished herewith as Exhibit 99.2 to this Current

Report and incorporated herein by reference is an amended investor presentation that SPAC, PubCo and Greenstone have prepared for use

in connection with the Business Combination, and which amends the investor presentation that was furnished to the SEC on September 24,

2024.

The foregoing (including Exhibits 99.1 and 99.2

to this Current Report) and the information set forth therein are being furnished pursuant to Item 7.01 and shall not be deemed to be

“filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise be subject to the liabilities of that section, nor shall they be deemed to be incorporated by reference in any filing under

the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act.

************

Important Information for Investors and Stockholders

In connection with the Business Combination, PubCo

and Greenstone, as co-registrant, have filed with the SEC the Registration Statement, which includes a prospectus with respect to PubCo’s

securities to be issued in connection with the Business Combination and a proxy statement to be distributed to holders of SPAC’s

common stock in connection with SPAC’s solicitation of proxies for the vote by SPAC’s stockholders with respect to the Business

Combination and other matters to be described in the Registration Statement (the “Proxy Statement”). After the SEC declares

the Registration Statement effective, SPAC plans to file the definitive Proxy Statement with the SEC and to mail copies to stockholders

of SPAC as of a record date to be established for voting on the Business Combination. This Current Report and Exhibits 99.1 and 99.2 furnished

herewith do not contain all the information that should be considered concerning the Business Combination and is not a substitute for

the Registration Statement, the Proxy Statement or for any other document that PubCo or SPAC may file with the SEC. Before making any

investment or voting decision, investors and security holders of SPAC and Greenstone are urged to read the Registration Statement and

the Proxy Statement, and any amendments or supplements thereto, as well as all other relevant materials filed or that will be filed with

the SEC in connection with the Business Combination as they become available because they will contain important information about Greenstone,

SPAC, PubCo and the Business Combination.

Investors and security holders will be able to

obtain free copies of the Registration Statement, the Proxy Statement and all other relevant documents filed or that will be filed with

the SEC by PubCo and SPAC through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by PubCo and SPAC

may be obtained free of charge from SPAC’s website at hennessycapllc.com or by directing a request to Nicholas Geeza, Chief Financial

Officer, PO Box 1036, 195 US Hwy 50, Suite 309, Zephyr Cove, Nevada 89448 or by telephone at (775) 339-1671. The information contained

on, or that may be accessed through, the websites referenced in this Current Report is not incorporated by reference into, and is not

a part of, this Current Report.

Participants in the Solicitation

Greenstone, SPAC, PubCo and their respective directors,

executive officers and other members of management and employees may, under the rules of the SEC, be deemed to be participants in the

solicitations of proxies from SPAC’s stockholders in connection with the Business Combination. For more information about the names,

affiliations and interests of SPAC’s directors and executive officers, please refer to SPAC’s annual report on Form 10-K filed

with the SEC on March 29, 2024 and the Registration Statement, the Proxy Statement and other relevant materials filed with the SEC in

connection with the Business Combination from time to time. Additional information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests, which may, in some cases, be different than those of SPAC’s stockholders

generally, are included in the Registration Statement and the Proxy Statement. Stockholders, potential investors and other interested

persons should read the Registration Statement and the Proxy Statement carefully before making any voting or investment decisions. You

may obtain free copies of these documents from the sources indicated above.

Forward Looking Statements

This Current Report includes, or incorporates by

reference, forward-looking statements. All statements other than statements of historical facts contained in this Current Report are forward-looking

statements. Any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including

any underlying assumptions, are also forward-looking statements. In some cases, you can identify forward-looking statements by words such

as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,”

“anticipate,” “believe,” “seek,” “strategy,” “future,” “opportunity,”

“may,” “target,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result,” “preliminary,” or similar expressions that predict or indicate future events

or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements include, without limitation, Greenstone’s, SPAC’s, PubCo’s, or their respective management

teams’ expectations concerning the outlook for their or PubCo’s business, productivity, plans, and goals for future operational

improvements and capital investments, operational performance, future market conditions, or economic performance and developments in the

capital and credit markets and expected future financial performance, including the restart of Greenstone’s Mazowe mine and Redwing

mine and related expansion plans, capital expenditure plans and timeline, the development and goals of the prospective exploration licenses

in the Democratic Republic of Congo (the “DRC”), mineral reserve and resource estimates, production, and other operating results,

productivity improvements, expected net proceeds, expected additional funding, the percentage of redemption of SPAC’s public stockholders,

growth prospects and outlook of PubCo’s operations, individually or in the aggregate, including the achievement of project milestones,

commencement and completion of commercial operations of certain of Greenstone’s exploration and production projects, as well as

any information concerning possible or assumed future results of operations of PubCo. Forward-looking statements also include statements

regarding the expected benefits of the Business Combination. The forward-looking statements are based on the current expectations of the

respective management teams of PubCo and SPAC, as applicable, and are inherently subject to uncertainties and changes in circumstance

and their potential effects. There can be no assurance that future developments will be those that have been anticipated. These forward-looking

statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially

different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited

to, (i) the risk that the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price

of SPAC’s securities; (ii) the risk that the Business Combination may not be completed by SPAC’s business combination deadline

and the potential failure to obtain an extension of the business combination deadline if sought by SPAC; (iii) the failure to satisfy

the conditions to the consummation of the Business Combination, including the adoption of the Business Combination Agreement by the stockholders

of SPAC and Greenstone, the satisfaction of the $25 million minimum cash amount following redemptions by SPAC’s public stockholders

and the receipt of certain regulatory approvals; (iv) market risks, including the price of gold; (v) the occurrence of any event, change

or other circumstance that could give rise to the termination of the Business Combination Agreement; (vi) the effect of the announcement

or pendency of the Business Combination on Greenstone’s business relationships, performance, and business generally; (vii) the outcome

of any legal proceedings that may be instituted against Greenstone, PubCo or SPAC related to the Business Combination Agreement or the

Business Combination; (viii) failure to realize the anticipated benefits of the Business Combination; (ix) the inability to maintain the

listing of SPAC’s securities or to meet listing requirements and maintain the listing of PubCo’s securities on the Nasdaq;

(x) the inability to remediate the identified material weaknesses in Greenstone’s internal control over financial reporting, which,

if not corrected, could adversely affect the reliability of Greenstone’s and PubCo’s financial reporting; (xi) the risk that

the price of PubCo’s securities may be volatile due to a variety of factors, including changes in the highly competitive industries

in which PubCo plans to operate, variations in performance across competitors, changes in laws, regulations, technologies, natural disasters

or health epidemics/pandemics, national security tensions, and macro-economic and social environments affecting its business, and changes

in the combined capital structure; (xii) the inability to implement business plans, forecasts, and other expectations after the completion

of the Business Combination, identify and realize additional opportunities, and manage growth and expanding operations; (xiii) the risk

that PubCo may not be able to successfully develop its assets, including expanding the How Mine, restarting and expanding its other mines

in Zimbabwe or developing its exploration permits in the DRC; (xiv) the risk that PubCo will be unable to raise additional capital to

execute its business plan, which may not be available on acceptable terms or at all; (xv) political and social risks of operating in Zimbabwe

and the DRC; (xvi) the operational hazards and risks that Greenstone faces; and (xvii) the risk that additional financing in connection

with the Business Combination may not be raised on favorable terms, in a sufficient amount to satisfy the $25 million (post-redemptions)

minimum cash amount condition to the Business Combination Agreement, or at all. The foregoing list is not exhaustive, and there may be

additional risks that neither SPAC nor PubCo presently know or that SPAC and PubCo currently believe are immaterial. You should carefully

consider the foregoing factors, any other factors discussed in this Current Report and the other risks and uncertainties described in

the “Risk Factors” section of SPAC’s Annual Report on Form 10-K for the year ended December, 31, 2023, which was filed

with the SEC on March 29, 2024, the risks described in the Registration Statement, which includes the Proxy Statement, and those discussed

and identified in filings made with the SEC by SPAC and PubCo, from time to time. PubCo and SPAC caution you against placing undue reliance

on forward-looking statements, which reflect current beliefs and are based on information currently available as of the date a forward-looking

statement is made. Forward-looking statements set forth in this Current Report speak only as of the date of this Current Report. None

of SPAC or PubCo undertakes any obligation to revise forward-looking statements to reflect future events, changes in circumstances, or

changes in beliefs. In the event that any forward-looking statement is updated, no inference should be made that SPAC or PubCo will make

additional updates with respect to that statement, related matters, or any other forward-looking statements. Any corrections or revisions

and other important assumptions and factors that could cause actual results to differ materially from forward-looking statements, including

discussions of significant risk factors, may appear, up to the consummation of the Business Combination, in SPAC’s or PubCo’s

public filings with the SEC, which are or will be (as appropriate) accessible at www.sec.gov, and which you are advised to review carefully.

No Offer or Solicitation

This Current Report shall not constitute an offer

to sell or exchange, the solicitation of an offer to buy or a recommendation to purchase, any securities, or a solicitation of any vote,

consent or approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation

or sale may be unlawful under the laws of such jurisdiction. No offering of securities in the Business Combination shall be made except

by means of a prospectus meeting the requirements of the Securities Act or an exemption therefrom.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Number |

|

Description |

| |

|

|

| 2.1 |

|

Amendment No. 1 to the Business Combination Agreement, dated as of December 6, 2024, by and among Hennessy Capital Investment Corp. VI, Namib Minerals, Midas SPAC Merger Sub Inc., Cayman Merger Sub Ltd., and Greenstone Corporation. |

| 99.1 |

|

Press Release, dated December 9, 2024. |

| 99.2 |

|

Investor Presentation, dated December 2024. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| HENNESSY CAPITAL INVESTMENT CORP. VI |

|

| |

|

|

| By: |

/s/ Nicholas Geeza |

|

| Name: |

Nicholas Geeza |

|

| Title: |

Chief Financial Officer |

|

Dated: December 9, 2024

5

Exhibit 2.1

amendMENT

No. 1

to THE

BUSINESS COMBINATION AGREEMENT

______________

This AMENDMENT NO. 1 (this “Amendment”),

dated as of December 6, 2024, to the Business Combination Agreement, dated as of June 17, 2024 (as amended, the “Business Combination

Agreement”), is by and among Hennessy Capital Investment Corp. VI (“SPAC”), Namib Minerals, Midas SPAC Merger

Sub Inc., Cayman Merger Sub Ltd., and Greenstone Corporation (the “Company”). Capitalized terms not otherwise

defined in this Amendment have the meanings given to such terms in the Business Combination Agreement.

WHEREAS, Section 11.12 of the Business Combination

Agreement permits the amendment of the Business Combination Agreement in accordance with the terms set forth therein; and

WHEREAS, the parties hereto desire to amend the Business

Combination Agreement as set forth below.

NOW, THEREFORE, in consideration of the foregoing

and the mutual covenants and agreements herein contained, and intending to be legally bound hereby, the parties hereto hereby agree as

follows:

ARTICLE I

AMENDMENT TO THE BUSINESS COMBINATION AGREEMENT

1. Amendment

and Restatement of Section 10.1(i). Section 10.1(i) of the Business Combination Agreement is hereby amended and restated in its entirety

to read as follows:

“(i) by

written notice from either SPAC or the Company to the other, if the Transactions shall not have been consummated on or prior to March

31, 2025 (the “Outside Date”); provided that the right to terminate this Agreement pursuant to this Section

10.1(i) will not be available to any party whose breach of any provision of this Agreement primarily caused or resulted in the

failure of the Transactions to be consummated by such time.”

ARTICLE II

MISCELLANEOUS

1. No Further

Amendment. Except as expressly amended hereby, the Business Combination Agreement is in all respects ratified

and confirmed and all the terms, conditions, and provisions thereof shall remain in full force and effect. This Amendment is limited precisely

as written and shall not be deemed to be an amendment to any other term or condition of the Business Combination Agreement or any of the

documents referred to therein.

2. Effect

of Amendment. This Amendment shall form a part of the Business Combination Agreement for all purposes, and

each party thereto and hereto shall be bound hereby. From and after the execution of this Amendment by the parties hereto, any reference

to the Business Combination Agreement shall be deemed a reference to the Business Combination Agreement as amended hereby. Notwithstanding

the foregoing, references to the date of the Business Combination Agreement, “the date hereof” and “the date of this

Agreement” shall in all instances continue to refer to June 17, 2024.

3. Governing

Law. This Amendment, and any claim or cause of action hereunder based upon, arising out of or related to this

Amendment (whether based on law, in equity, in contract, in tort or any other theory) or the negotiation, execution, performance or enforcement

of this Amendment, shall be governed by and construed in accordance with the laws of the State of Delaware, without giving effect to the

principles of conflicts of laws that would otherwise require the application of the law of any other state.

4. Consent

to Jurisdiction. THE PARTIES HERETO IRREVOCABLY SUBMIT TO THE EXCLUSIVE JURISDICTION OF THE STATE OR FEDERAL

COURTS OF THE STATE OF DELAWARE SOLELY IN RESPECT OF THE INTERPRETATION AND ENFORCEMENT OF THE PROVISIONS OF THIS AMENDMENT.

5. Severability.

If any provision of this Amendment is held invalid or unenforceable by any court of competent jurisdiction, the other provisions of

this Amendment shall remain in full force and effect. The parties hereto further agree that if any provision contained in this

Amendment is, to any extent, held invalid or unenforceable in any respect under the laws governing this Amendment, they shall take

any actions necessary to render the remaining provisions of this Amendment valid and enforceable to the fullest extent permitted by

law and, to the extent necessary, shall amend or otherwise modify this Amendment to replace any provision contained in this

Amendment that is held invalid or unenforceable with a valid and enforceable provision giving effect to the intent of the parties

hereto.

6. Counterparts;

Electronic Signatures. This Amendment may be executed in two or more counterparts, and by different parties

in separate counterparts, with the same effect as if all parties hereto had signed the same document, but all of which together shall

constitute one and the same instrument. Copies of executed counterparts of this Amendment transmitted by electronic transmission (including

by email or in .pdf format) or facsimile as well as electronically or digitally executed counterparts (such as DocuSign) shall have the

same legal effect as original signatures and shall be considered irrevocable originally executed counterparts of this Amendment.

[Signature Page Follows.]

IN WITNESS WHEREOF the parties hereto have hereunto

caused this Amendment to be duly executed as of the date first above written.

| |

HENNESSY CAPITAL INVESTMENT CORP. VI |

| |

|

| |

By: |

/s/

Daniel J. Hennessy |

| |

Name: |

Daniel J. Hennessy |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

CAYMAN MERGER

SUB LTD. |

| |

|

| |

By: |

/s/ Tulani Sikwila |

| |

Name: |

Tulani Sikwila |

| |

Title: |

Director |

| |

|

|

| |

MIDAS SPAC

MERGER SUB INC. |

| |

|

| |

By: |

/s/ Ibrahima

Tall |

| |

Name: |

Ibrahima Tall |

| |

Title: |

President |

| |

|

|

| |

NAMIB MINERALS |

| |

|

| |

By: |

/s/ Tulani Sikwila |

| |

Name: |

Tulani Sikwila |

| |

Title: |

Director |

| |

|

|

| |

GREENSTONE

CORPORATION |

| |

|

| |

By: |

/s/ Tulani Sikwila |

| |

Name: |

Tulani Sikwila |

| |

Title: |

Director |

[Signature Page to Amendment]

Exhibit 99.1

Namib Minerals and

Hennessy Capital Investment Corp. VI Announce Filing of Registration Statement in Connection with their Proposed Business

Combination and Namib Minerals’ Planned Nasdaq Listing

| ● | Namib

Minerals and co-registrant Greenstone Corporation (“Greenstone”) filed a registration statement on Form F-4 (the “Registration

Statement”) with the U.S. Securities Exchange Commission (the “SEC”), a critical step in advancing their previously

announced proposed business combination with Hennessy Capital Investment Corp. VI (Nasdaq: HCVI) (“HCVI” or “Hennessy

Capital”), and planned Nasdaq listing of Namib Minerals’ ordinary shares under the ticker “NAMM.” |

| | |

| ● | The

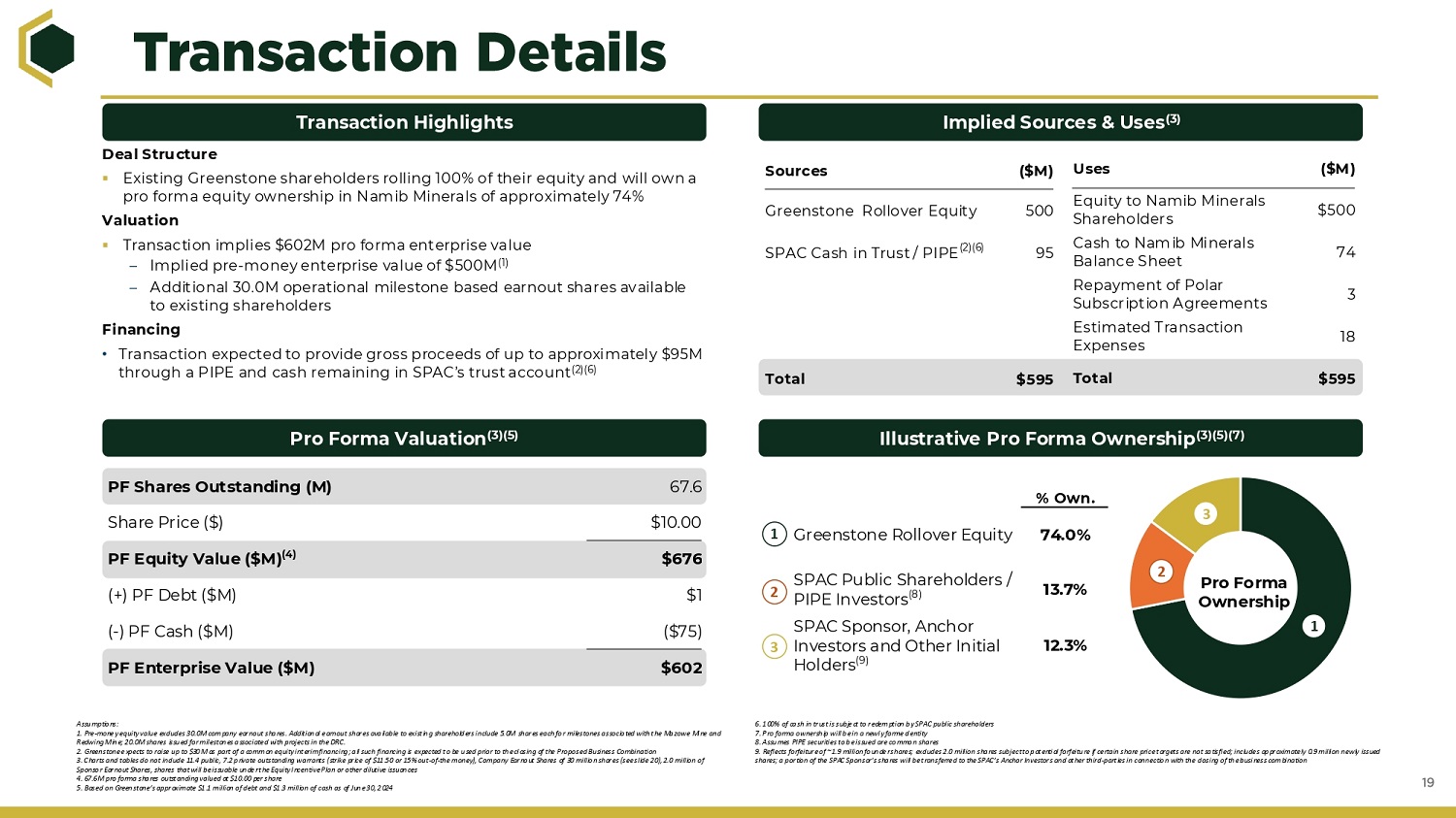

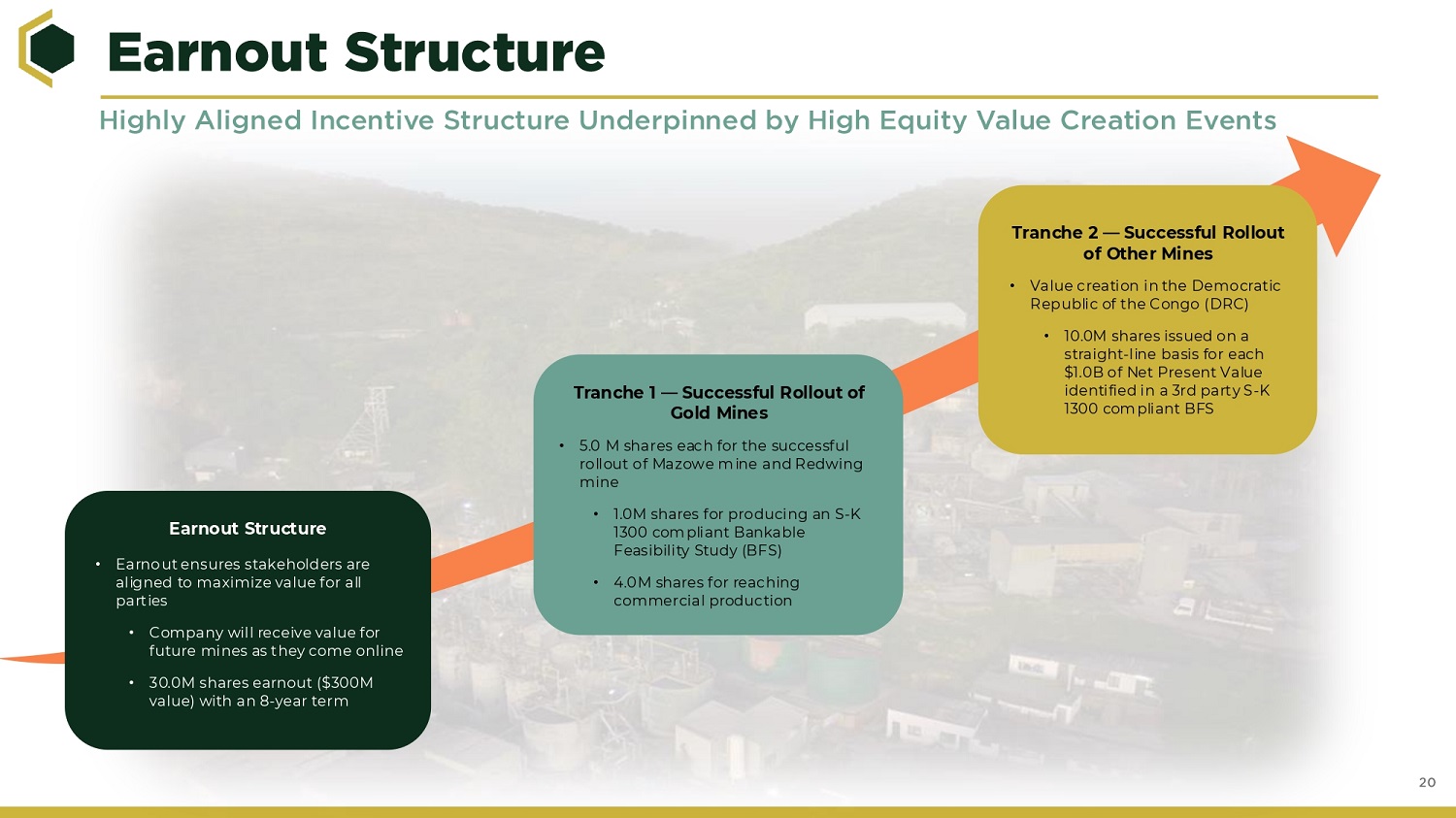

proposed business combination values Namib Minerals at a pre-money enterprise value of $500 million with up to an additional 30 million

of contingent ordinary shares tied to the completion of operational milestones.(1) |

| | |

| ● | Transaction

proceeds are intended to be used to accelerate Namib Minerals’ growth plans for Greenstone’s assets, including the restart

of two gold mines in Zimbabwe and expansion into prospective battery metal assets, including copper and cobalt, in the Democratic Republic

of Congo (the “DRC”). |

| | |

| ● | How

mine, a high-grade cash-generating gold asset currently owned by Greenstone, supports low-cost production, while restart efforts at the

Mazowe and Redwing mines aim to establish Namib Minerals as a multi-asset producer in Africa. |

NEW YORK, Dec. 9, 2024 (GLOBE NEWSWIRE)

- Namib Minerals, which would become a public company upon consummation of the proposed business combination, Greenstone, an affiliate

of Namib Minerals and an established African gold producer with an attractive portfolio of mining assets in Zimbabwe, and HCVI, a Nasdaq

listed special purpose acquisition company, today announced the filing of the Registration Statement with the SEC on Friday, December

6, 2024. This filing represents a key milestone in connection with their previously announced proposed business combination, which is

expected to result in Namib Minerals listing its ordinary shares and warrants on Nasdaq under the ticker symbols “NAMM” and

“NAMMW,” respectively, subject to approval of its listing application. While the Registration Statement has not yet become

effective and the information contained therein is subject to change, it provides important information about Namib Minerals, Greenstone,

HCVI, and the proposed business combination.

Upon completion of the transaction, Namib Minerals

will own Greenstone’s mining and exploration assets and plans to accelerate its growth strategy and build out its portfolio of mining

assets. Located strategically in the Bulawayo Greenstone Belt of Southern Zimbabwe, Greenstone’s cash flow generating How mine has

produced over 1.8Moz of gold between 1941 and 2023. Restart efforts at the Mazowe and Redwing mines, historically producing gold mines

currently on care and maintenance, aim to diversify Namib Minerals’ production scale upon the mines’ recommencement. The Mazowe

and Redwing mines have total measured and indicated resource estimates of 291koz at 7.77 g/t Au and 1,188koz at 3.83 g/t Au, respectively,

and inferred resource estimates of 915koz at 8.65 g/t Au and 1,328koz at 2.61 g/t Au, respectively, based on technical report summaries

for each mine prepared in compliance with Subpart 1300 of Regulation S-K promulgated by the SEC (“S-K 1300”). Greenstone also

currently holds interests in 13 battery metals exploration permits in the DRC, including six initial diamond drilling holes that show

potential for copper and cobalt. Located in the resource-rich Haut Katanga and Lualaba Provinces, these assets position Namib Minerals

to capitalize on the rising global demand for battery metals.

Greenstone Snapshot:

| ● | Established, well-known African gold producer

– Produced ~589koz from 2012 to 2023(2) |

| | | |

| ● | Operating in Zimbabwe since 2002 – Greenstone

brings a proven management team with operational and developmental success |

| | | |

| ● | Producing positive cash flow – 1H

2024 Revenue: $42M(3) / 2023 Revenue: $65M(4); 1H 2024 Profit: $9.2M(3) / 2023 Profit: $3.6M(4);

1H 2024 Adj. EBITDA: $17M(5) / 2023 Adj. EBITDA: $20M(5) |

| | | |

| ● | One production stage asset, two exploration

stage assets – As of December 31, 2023, total measured and indicated mineral resources: 1.6Moz at 3.92 g/t Au(6);

total inferred mineral resources: 2.4Moz(6) |

| | | |

| ● | Well-positioned to unlock shareholder value

as a multi-asset producer in Africa – Preparation works and feasibility studies underway at the Mazowe and Redwing mines |

| | | |

| ● | Certified to ISO Standards(7)

– 0.86 lost time injury frequency rate in 2023(8) |

“As Namib Minerals takes this significant

step toward becoming a publicly traded company, we remain dedicated to our mission of creating safe, sustainable, and profitable mining

operations,” said Ibrahima Tall, Chief Executive Officer and Director of Namib Minerals. “This transaction positions us to

advance our strategy, from restarting the Mazowe and Redwing gold mines to expanding our focus on copper and cobalt potential in the DRC.

We are excited about the opportunities this partnership creates to deliver long-term value to our stakeholders while contributing responsibly

to the communities where we operate.”

“Filing the Registration Statement marks

an important milestone in the proposed Namib-Hennessy Capital business combination,” said Daniel Hennessy, Chief Executive Officer

and Chairman of Hennessy Capital. “We are proud to support Namib Minerals as it continues to build a leading Pan-African platform

for precious and critical metals production. Namib Minerals stood out as a compelling partner due to its history of mining in

precious metals, opportunities for future expansion and its mission to create safe, sustainable and profitable operations in the

communities it serves. With its strong portfolio of assets and clear growth strategy, Namib Minerals is well-positioned to capitalize

on increasing global demand for these essential resources.”

Proposed Transaction Highlights

The proposed business

combination implies a pro forma combined enterprise value of Namib Minerals at approximately $602 million, excluding additional earnout

consideration, assuming no further redemptions of HCVI’s public shares and $60 million in targeted PIPE funding to be obtained prior

to the closing of the transaction. The boards of directors of HCVI, Greenstone, and Namib Minerals have approved the proposed transaction,

which is expected to be completed in the first quarter of 2025, subject to, among other things, the approvals by stockholders of HCVI

and Greenstone and satisfaction or waiver of the other conditions set forth in the business combination agreement, dated June 17, 2024

(as amended on December 6, 2024, the “Business Combination Agreement”). At closing of the proposed business combination, Greenstone’s

existing shareholders will exchange their equity in Greenstone for approximately 74% of the equity of Namib Minerals.

Net proceeds from the

transaction are expected to enable Namib Minerals to invest further into the How mine, while also contributing to the restart of production

at the Mazowe and Redwing mines, each in Zimbabwe, and to help fund the expansion of operations into the DRC.

Additional

information about the proposed business combination, including a copy of the Business Combination Agreement, is available on the Current

Report on Form 8-K, dated June 17, 2024, filed by HCVI with the SEC on June 18, 2024 and available at www.sec.gov.

References:

| (1) | Pre-money equity value of $500 million excludes additional 30 million of contingent ordinary shares ($300M

value) to be issued by Namib Minerals to current Greenstone shareholders upon the completion of operational milestones. |

| | | |

| (2) | Internal historical production numbers aligning with the How Mine S-K 1300 Technical Report Summary, December

2024; Mazowe Mine S-K 1300 Technical Report Summary, December 2024; Redwing Mine S-K 1300 Technical Report Summary, December 2024. |

| | | |

| (3) | Unaudited interim financial statements and notes of Greenstone as of and for the six months ended June

30, 2024. |

| | | |

| (4) | Audited financial statements and notes of Greenstone as of and for the year ended December 31, 2023. |

| | | |

| (5) | Adjusted EBITDA is a non-International Financial Reporting Standards (“IFRS”) measure, which

should not be considered in isolation or as a substitute for IFRS measures. See “Use of Non-IFRS Financial Measures” below

for more information. |

| | | |

| (6) | How Mine S-K 1300 Technical Report Summary, December 2024, exclusive of Mineral Reserves; Mazowe Mine

S-K 1300 Technical Report Summary, December 2024; Redwing Mine S-K 1300 Technical Report Summary, December 2024. |

| | | |

| (7) | Unaudited Greenstone 2023 Annual Report, Recertification achieved on all three international standards-based

management systems; ISO 14001 of 2015: Environmental Management Systems (EMS), ISO 9001 of 2015: Quality Management Systems (QMS) and

ISO 45001 of 2018: Occupational Safety and Health Management Systems (OHSMS). |

| | | |

| (8) | How Mine internal management safety reporting. |

Advisors

Cohen & Company Capital Markets is serving

as exclusive financial advisor and lead capital markets advisor to Greenstone and Namib Minerals, while Jett Capital Advisors LLC is serving

as financial advisor to HCVI. Greenberg Traurig, LLP is serving as U.S. legal counsel to Greenstone and Namib Minerals, Sidley Austin

LLP is serving as legal counsel to HCVI, and Appleby (Cayman) Ltd. is serving as Cayman Islands legal counsel to Greenstone and Namib.

BDO South Africa Inc. is serving as auditor to Greenstone and Namib Minerals, and Alliance Advisors Investor Relations is serving as investor

relations advisor for the transaction.

About Greenstone Corporation and Namib Minerals

Greenstone is a gold producer, developer and explorer

with operations focused in Zimbabwe. Greenstone is a significant player in Zimbabwe’s mining industry, driving sustainable growth

and innovation across the sector. Currently Greenstone operates an underground mine in Zimbabwe, with additional exploration assets in

Zimbabwe and the DRC. Greenstone operates using conventional mining as well as modern processes and is seeking alternative areas of growth.

Upon the closing of the proposed business transaction, Namib Minerals will hold all of Greenstone’s assets.

For additional information, please visit namibminerals.com

About Hennessy Capital Investment Corp. VI

Hennessy Capital Investment Corp. VI is a special

purpose acquisition company (SPAC) listed on the Nasdaq Global Market (NASDAQ: HCVI). HCVI was formed by Daniel J. Hennessy for the purpose

of acquiring, and introducing to the public markets, a strong and competitive company operating in the industrial sector.

For additional information, please visit hennessycapitalgroup.com

Forward Looking Statements

All statements other than statements of

historical facts contained in this press release, including statements regarding HCVI’s, Greenstone’s, or Namib

Minerals’ future financial position, results of operations, business strategy, and plans and objectives of their respective

management teams for future operations, are forward-looking statements. Any statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any underlying assumptions, are also forward-looking statements. In

some cases, you can identify forward-looking statements by words such as “estimate,” “plan,”

“project,” “forecast,” “intend,” “expect,” “anticipate,”

“believe,” “seek,” “strategy,” “future,” “opportunity,”

“may,” “target,” “should,” “will,” “would,” “will be,”

“will continue,” “will likely result,” “preliminary,” or similar expressions that predict or

indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that

a statement is not forward-looking. Forward-looking statements include, without limitation, HCVI’s, Greenstone’s, or

their respective management teams’ expectations concerning the outlook for their or Namib Minerals’ business,

productivity, plans, and goals for future operational improvements and capital investments, operational performance, future market

conditions, or economic performance and developments in the capital and credit markets and expected future financial performance,

including the restart of the Mazowe mine and the Redwing mine and related expansion plans, capital expenditure plans and timeline,

the development and goals of the prospective exploration licenses in the DRC, mineral reserve and resource estimates, production and

other operating results, productivity improvements, expected net proceeds, expected additional funding, the percentage of

redemptions of HCVI’s public stockholders, growth prospects and outlook of Namib Minerals’ operations, individually or

in the aggregate, including the achievement of project milestones, commencement and completion of commercial operations of certain

of Namib Minerals’ exploration and production projects, as well as any information concerning possible or assumed future

results of operations of Namib Minerals. Forward-looking statements also include statements regarding the expected benefits of the

proposed business combination. The forward-looking statements are based on the current expectations of the respective management

teams of Greenstone and HCVI, as applicable, and are inherently subject to uncertainties and changes in circumstance and their

potential effects. There can be no assurance that future developments will be those that have been anticipated. These

forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or

performance to be materially different from those expressed or implied by these forward-looking statements. These risks and

uncertainties include, but are not limited to, (i) the risk that the proposed business combination may not be completed in a timely

manner or at all, which may adversely affect the price of HCVI’s securities; (ii) the risk that the proposed business

combination may not be completed by HCVI’s business combination deadline and the potential failure to obtain an extension of

the business combination deadline if sought by HCVI; (iii) the failure to satisfy the conditions to the consummation of the proposed

business combination, including the adoption of the Business Combination Agreement by the stockholders of HCVI and Greenstone, the

satisfaction of the $25 million minimum cash amount following redemptions by HCVI’s public stockholders and the receipt of

certain regulatory approvals; (iv) market risks, including the price of gold; (v) the occurrence of any event, change or other

circumstance that could give rise to the termination of the Business Combination Agreement; (vi) the effect of the announcement or

pendency of the proposed business combination on Greenstone’s business relationships, performance, and business generally;

(vii) the outcome of any legal proceedings that may be instituted against Greenstone or HCVI related to the Business Combination

Agreement or the proposed business combination; (viii) failure to realize the anticipated benefits of the proposed business

combination; (ix) the inability to maintain the listing of HCVI’s securities or to meet listing requirements and maintain the

listing of Namib Minerals’ securities on the Nasdaq; (x) the inability to remediate the identified material weaknesses in

Greenstone’s internal control over financial reporting, which, if not corrected, could adversely affect the reliability of

Greenstone’s and Namib Minerals’ financial reporting; (xi) the risk that the price of Namib Minerals’ securities

may be volatile due to a variety of factors, including changes in the highly competitive industries in which Greenstone plans to

operate, variations in performance across competitors, changes in laws, regulations, technologies, natural disasters or health

epidemics/pandemics, national security tensions, and macro-economic and social environments affecting its business, and changes in

the combined capital structure; (xii) the inability to implement business plans, forecasts, and other expectations after the

completion of the proposed business combination, identify and realize additional opportunities, and manage its growth and expanding

operations; (xiii) the risk that Greenstone may not be able to successfully develop its assets, including expanding the How mine,

restarting and expanding its other mines in Zimbabwe or developing its exploration permits in the DRC; (xiv) the risk that

Greenstone will be unable to raise additional capital to execute its business plan, which may not be available on acceptable terms

or at all; (xv) political and social risks of operating in Zimbabwe and the DRC; (xvi) the operational hazards and risks that Namib

Minerals faces; and (xvii) the risk that additional financing in connection with the proposed business combination may not be raised

on favorable terms, in a sufficient amount to satisfy the $25 million (post-redemptions) minimum cash amount condition to the

Business Combination Agreement, or at all. The foregoing list is not exhaustive, and there may be additional risks that neither HCVI

nor Greenstone presently know or that HCVI and Greenstone currently believe are immaterial. You should carefully consider the

foregoing factors, any other factors discussed in this press release and the other risks and uncertainties described in the

“Risk Factors” section of HCVI’s Annual Report on Form 10-K for the year ended December, 31, 2023, which was filed

with the SEC on March 29, 2024, the risks described in the Registration Statement, which includes a preliminary proxy

statement/prospectus, and those discussed and identified in filings made with the SEC by HCVI and Namib Minerals from time to time.

Greenstone and HCVI caution you against placing undue reliance on forward-looking statements, which reflect current beliefs and are

based on information currently available as of the date a forward-looking statement is made. Forward-looking statements set forth in

this press release speak only as of the date of this press release. None of Greenstone, HCVI, or Namib Minerals undertakes any

obligation to revise forward-looking statements to reflect future events, changes in circumstances, or changes in beliefs. In the

event that any forward-looking statement is updated, no inference should be made that Greenstone, HCVI, or Namib Minerals will make

additional updates with respect to that statement, related matters, or any other forward-looking statements. Any corrections or

revisions and other important assumptions and factors that could cause actual results to differ materially from forward-looking

statements, including discussions of significant risk factors, may appear, up to the consummation of the proposed business

combination, in HCVI’s or Namib Minerals’ public filings with the SEC, which are or will be (as appropriate) accessible

at www.sec.gov, and which you are advised to review carefully.

Important Information for Investors and Stockholders

In connection with the proposed business combination, Namib Minerals

and Greenstone, as co-registrant, have filed with the SEC the Registration Statement, which includes a prospectus with respect to Namib

Minerals’ securities to be issued in connection with the proposed business combination and a proxy statement to be distributed to

holders of HCVI’s common stock in connection with HCVI’s solicitation of proxies for the vote by HCVI’s stockholders

with respect to the proposed business combination and other matters to be described in the Registration Statement (the “Proxy Statement”).

After the SEC declares the Registration Statement effective, HCVI plans to file the definitive Proxy Statement with the SEC and to mail

copies to stockholders of HCVI as of a record date to be established for voting on the proposed business combination. This press release

does not contain all the information that should be considered concerning the proposed business combination and is not a substitute for

the Registration Statement, Proxy Statement or for any other document that Namib Minerals or HCVI may file with the SEC. Before making

any investment or voting decision, investors and security holders of HCVI and Namib Minerals are urged to read the Registration Statement

and the Proxy Statement, and any amendments or supplements thereto, as well as all other relevant materials filed or that will be filed

with the SEC in connection with the proposed business combination as they become available because they will contain important information

about Greenstone, HCVI, Namib Minerals and the proposed business combination. Investors and security holders will be able to obtain free

copies of the Registration Statement, the Proxy Statement and all other relevant documents filed or that will be filed with the SEC by

Namib Minerals and HCVI through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by Namib Minerals and

HCVI may be obtained free of charge from HCVI’s website at hennessycapllc.com or by directing a request to Nicholas Geeza, Chief

Financial Officer, PO Box 1036, 195 US Hwy 50, Suite 309, Zephyr Cove, Nevada 89448; Tel: (775) 339-1671. The information contained on,

or that may be accessed through, the websites referenced in this press release is not incorporated by reference into, and is not a part

of, this press release.

Participants in the Solicitation

Greenstone, HCVI, Namib Minerals and their respective directors, executive

officers and other members of management and employees may, under the rules of the SEC, be deemed to be participants in the solicitations

of proxies from HCVI’s stockholders in connection with the proposed business combination. For more information about the names,

affiliations and interests of HCVI’s directors and executive officers, please refer to HCVI’s annual report on Form 10-K filed

with the SEC on March 29, 2024 and the Registration Statement, Proxy Statement and other relevant materials filed with the SEC in connection

with the proposed business combination from time to time. Additional information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests, which may, in some cases, be different than those of HCVI’s stockholders

generally, are included in the Registration Statement and the Proxy Statement. Stockholders, potential investors and other interested

persons should read the Registration Statement and the Proxy Statement carefully before making any voting or investment decisions. You

may obtain free copies of these documents from the sources indicated above.

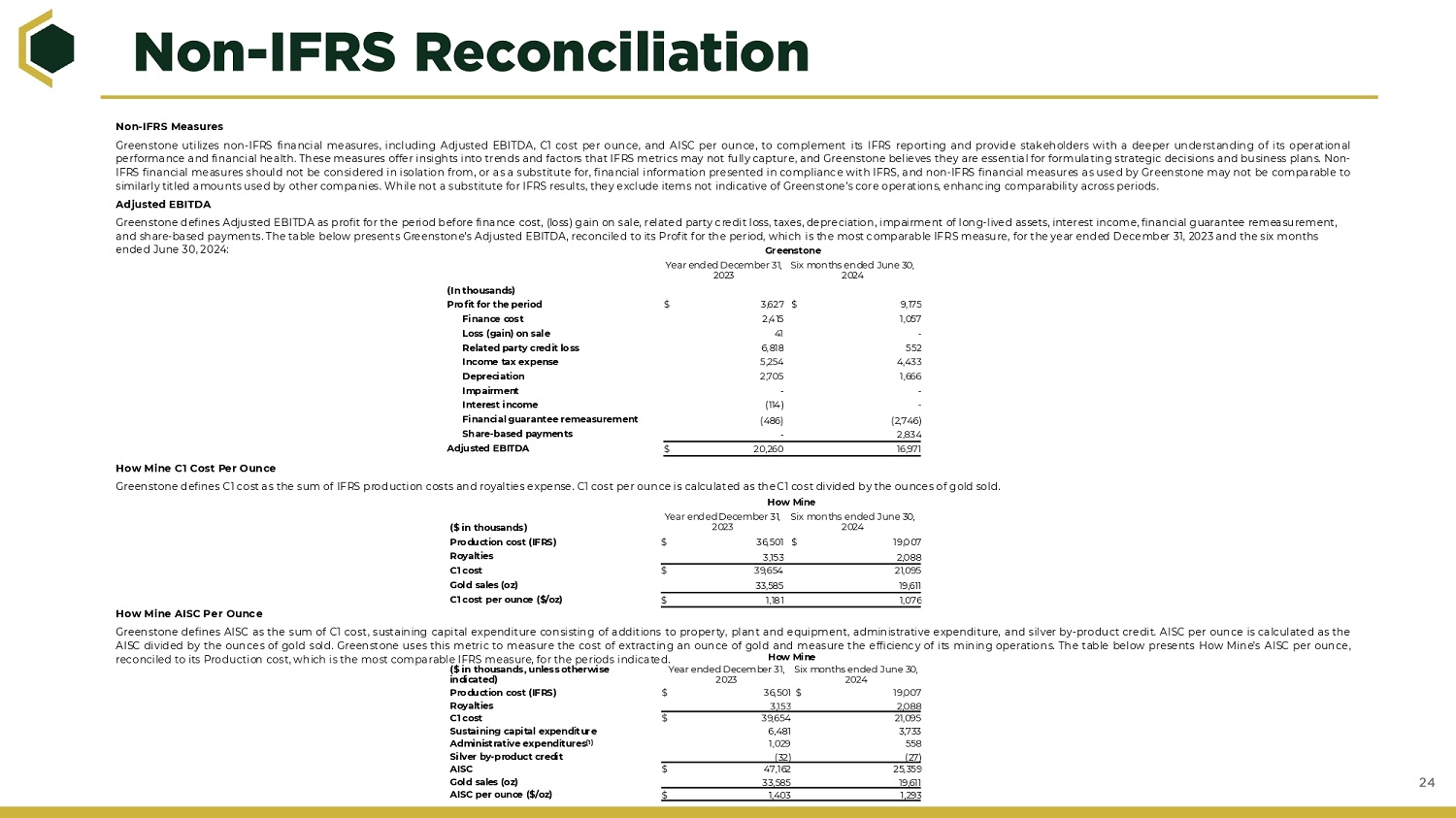

Use of Non-IFRS Financial Measures

Greenstone utilizes non-IFRS financial measures,

including Adjusted EBITDA, to complement its IFRS reporting and provide stakeholders with a deeper understanding of its operational performance

and financial health. These measures offer insights into trends and factors that IFRS metrics may not fully capture, and Greenstone believes

they are essential for formulating strategic decisions and business plans. Non-IFRS financial measures should not be considered in isolation

from, or as a substitute for, financial information presented in compliance with IFRS, and non-IFRS financial measures as used by Greenstone

may not be comparable to similarly titled amounts used by other companies. While not a substitute for IFRS results, they exclude items

not indicative of Greenstone’s core operations, enhancing comparability across periods. Greenstone defines Adjusted EBITDA as profit

for the period before finance cost, loss on sale, related party credit loss, taxes, depreciation, impairment of long lived assets, interest

income, financial guarantee remeasurement, and share-based payments. The table below presents Greenstone’s Adjusted EBITDA for the

year ended December 31, 2023 and the six-month period ended June 30, 2024, reconciled to Greenstone’s Profit for the year ended

December 31, 2023 and the six-month period ended June 30, 2024, respectively, which is the most comparable IFRS measure:

| (In thousands) | |

31-Dec-23 | | |

30-Jun-24 | |

| Profit for the period ended | |

$ | 3,627 | | |

| 9,175 | |

| Finance cost | |

| 2,415 | | |

| 1,057 | |

| Loss on sale | |

| 41 | | |

| — | |

| Related party credit loss | |

| 6,818 | | |

| 552 | |

| Income tax expense | |

| 5,254 | | |

| 4,433 | |

| Depreciation | |

| 2,705 | | |

| 1,666 | |

| Impairment | |

| — | | |

| — | |

| Interest income | |

| (114 | ) | |

| — | |

| Financial guarantee remeasurement | |

| (486 | ) | |

| (2,746 | ) |

| Share-based payments | |

| — | | |

| 2,834 | |

| Adjusted EBITDA | |

$ | 20,260 | | |

| 16,971 | |

Cautionary Note Regarding Mineral Resources and Mineral Reserves

Estimates of “measured”, “indicated,” and “inferred”

mineral resources as well as “mineral reserves” shown in this press release are defined in S-K 1300. The estimation of measured

resources and indicated resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven

and probable mineral reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic

viability than the estimation of other categories of resources. Investors are cautioned not to assume that any or all of the mineral resources

are economically or legally mineable or that these mineral resources will ever be converted into mineral reserves. You are cautioned that

mineral resources do not have demonstrated economic viability.

No Offer or Solicitation

This press release shall not constitute an offer

to sell or exchange, the solicitation of an offer to buy or a recommendation to purchase, any securities, or a solicitation of any vote,

consent or approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation

or sale may be unlawful under the laws of such jurisdiction. No offering of securities in the proposed business combination shall be made

except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom.

Contacts

Greenstone Corporation/Namib Minerals:

info@namibminerals.com

Hennessy Capital Investment Corp. VI:

Nicholas Geeza

ngeeza@hennessycapitalgroup.com

Investor Relations:

Caroline Sawamoto

NamibIR@allianceadvisors.com

5

Exhibit 99.2

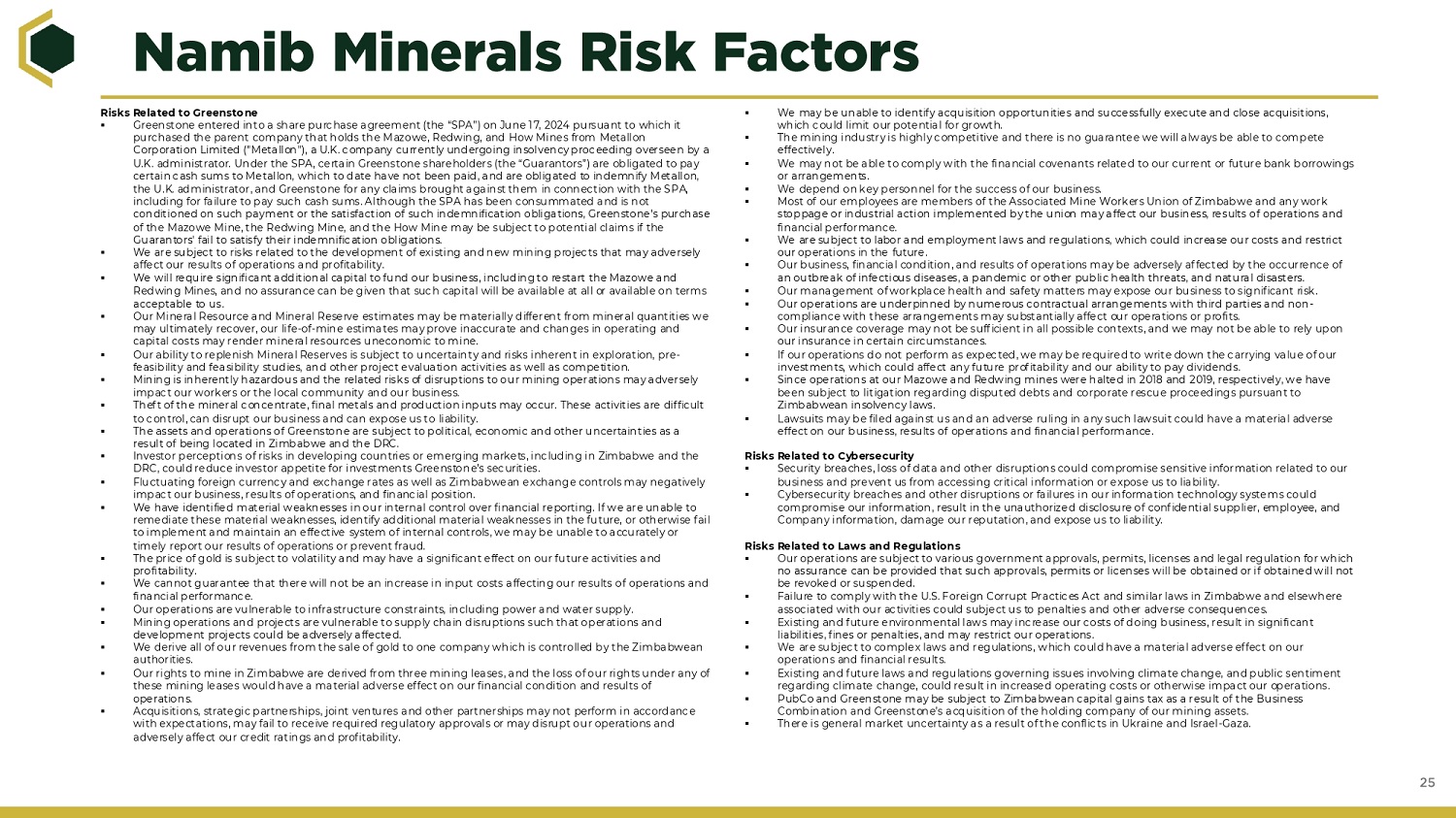

December 2024

All statements other than statements of historical facts contained in this presentation (together with oral statements made in connection herewith, this “Presentation”) are, including statements regarding Greenstone Corporation’s (Greenstone” or the “Company”), Hennessy Capital Investment Corp. VI’s (“SPAC”), or Namib Minerals’ (“Namib Minerals” or “PubCo”) future financial position, results of operations, business strategy, market demand and plans and objectives of their respective management teams for future operations, forward - looking statements. Any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are also forward - looking statements. In some cases, you can identify forward - looking statements by words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “strategy,” “future,” “opportunity,” “may,” “target,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” “preliminary,” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward - looking. Forward - looking statements include, without limitation, Greenstone’s, SPAC’s, PubCo’s, or their respective management teams’ expectations concerning the outlook for their or PubCo’s business, productivity, plans, and goals for future operational improvements and capital investments, operational performance, future market conditions, or economic performance and developments in the capital and credit markets and expected future financial performance, including the restart of the Mazowe Mine and the Redwing Mine and related expansion plans, capital expenditure plans and timeline, the development and goals of the prospective exploration licenses in the Democratic Republic of the Congo (the “DRC”), 2024 estimates of financial and operational performance, economic outlook for the gold mining industry, mineral reserve and resource estimates, outlook for investing in Zimbabwe, expectations regarding gold prices and exchange rates, production, total cash costs, all - in costs, cost savings and other operating results, productivity improvements, expected net proceeds, expected additional funding, the percentage of redemption of SPAC’s public stockholders, growth prospects and outlook of Pubco’s operations, individually or in the aggregate, includ ing the achievement of project milestones, commencement and completion of commercial operations of certain of Greenstone exploration and production projects, as well as any information concerning possible or assumed future results of operations of PubCo. Forward - looking statements also include statements regarding the expected benefits of the proposed business combination between Greenstone and SPAC, which will include Greenstone and SPAC becoming wholly - owned subsidiaries of PubCo, and related transactions (the "Proposed Business Combination") pursuant to the Business Combination Agreement among Greenstone, SPAC, PubCo, Midas SPAC Merger Sub Inc. and Cayman Merger Sub Ltd. (the “Business Combination Agreement”). The forward - looking statements are based on the current expectations of the respective management teams of Greenstone and SPAC, as applicable, and are inherently subject to uncertainties and changes in circumstance and their potential effects. There can be no assurance that future developments will be those that have been anticipated. These forward - looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward - looking statements. These risks and uncertainties include, but are not limited to, (i) the risk that the Proposed Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of SPAC’s securities; (ii) the risk that the Proposed Business Combination may not be completed by SPAC’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by SPAC; (iii) the failure to satisfy the conditions to the consummation of the Proposed Business Combination, including the adoption of the Business Combination Agreement by the stockholders of SPAC and Greenstone, the satisfaction of the $25 million minimum cash amount following redemptions by SPAC’s public stockholders and the receipt of certain regulatory approvals; (iv) market risks, including the price of gold; (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the Business Combination Agreement; (vi) the effect of the announcement or pendency of the Proposed Business Combination on Greenstone’s business relationships, performance, and business generally; (vii) the outcome of any legal proceedings that may be instituted against Greenstone or SPAC related to the Business Combination Agreement or the Proposed Business Combination; (viii) failure to realize the anticipated benefits of the Proposed Business Combination; (ix) the inability to maintain the listing of SPAC’s securities or to meet listing requirements and maintain the listing of PubCo’s securities on the Nasdaq; (x) the inability to remediate the identified material weaknesses in Greenstone’s internal control over financial reporting, which, if not corrected, could adversely affect the reliability of Greenstone’s and Namib’s financial reporting; (xi) the risk that the price of PubCo’s securities may be volatile due to a variety of factors, including changes in the highly competitive industries in which Greenstone plans to operate, variations in performance across competitors, changes in laws, regulations, technologies, natural disasters or health epidemics/pand emics, national security tensions, and macro - economic and social environments affecting its business, and changes in the combined capital structure; (xii) the inability to implement business plans, forecasts, and other expectations after the completion of the Proposed Business Combination, identify and realize additional opportunities, and manage its growth and expanding operations; (xiii) the risk that Greenstone may not be able to successfully develop its assets, including expanding the How Mine, restarting and expanding its other mines in Zimbabwe or developing its exploration permits in the DRC; (xiv) the risk that Greenstone will be unable to raise additional capital to execute its business plan, which many not be available on acceptable terms or at all; (xv) political and social risks of operating in Zimbabwe and the DRC; (xvi) the operational hazards and risks that Greenstone faces; and (xvii) the risk that additional f inancing in connection with the Proposed Business Combination may not be raised on favorable terms, in a sufficient amount to satisfy the $25 million (post - redemptions) minimum cash amount condition to the Business Combination Agreement, or at all. The foregoing list is not exhaustive, and there may be additional risks that neither SPAC nor Greenstone presently know or that SPAC and Greenstone believe are immaterial. You should carefully consider the foregoing factors, any other factors discussed in this Presentation and the other risks and uncertainties described in the “Risk Factors” section of SPAC’s annual report on Form 10 - K for the year ended December 31, 2023 , which was filed with the U.S. Securities and Exc hange Commission (the "SEC") on March 29, 2024, the risks described in the registration statement on Form F - 4 relating to the Proposed Business Combination filed by Pubco and Greenstone on December 6, 2024 (the “Registration Statement”), and those discussed and identified in filings made with the SEC by SPAC and PubCo from time to time. Greenstone and SPAC caution you against placing undue reliance on forward - looking statements, which reflect current beliefs and are based on information currently available as of the date a forward - looking statement is made. Forward - looking statements set forth in this Presentation speak only as of the date of this Presentation. None of Greenstone, SPAC, or PubCo undertakes any obligation to revise forward - looking statements to reflect future events, changes in circumstances, or changes in beliefs. In the event that any forward - looking statement is updated, no inference should be made that Green stone, SPAC, or PubCo will make additional updates with respect to that statement, related matters, or any other forward - looking statements. Any corrections or revisions and other important assumptions and factors that could cause actual results to differ materially from forward - looking statements, including discussions of significant risk factors, may appear, up to the consummation of the Proposed Business Combination, in SPAC’s or PubCo’s public filings with the SEC, which are or will be (as appropriate) accessible at www.sec.gov, and which you are advised to review carefully.

Our Vision To build a leading gold mining company by creating sustainable value for our investors, stakeholders, and communities. Through responsible environmental stewardship and innovation, our goal is to maximize returns while preserving the planet for future generations.

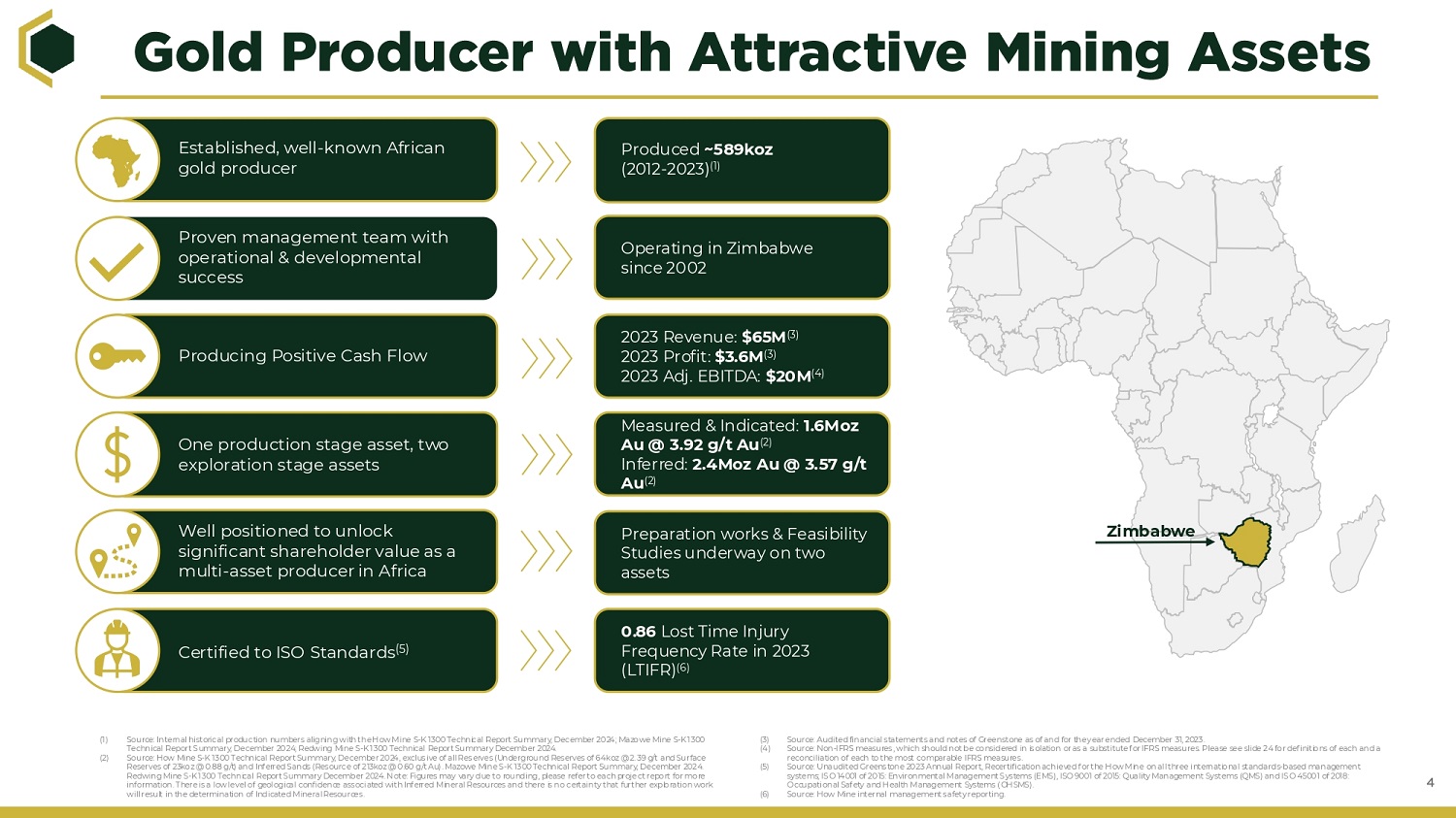

Well positioned to unlock significant shareholder value as a multi - asset producer in Africa Preparation works & Feasibility Studies underway on two assets One production stage asset, two exploration stage assets Measured & Indicated: 1.6Moz Au @ 3.92 g/t Au (2) Inferred: 2.4Moz Au @ 3.57 g/t Au (2) Producing Positive Cash Flow 2023 Revenue: $65M (3) 2023 Profit: $3.6M (3) 2023 Adj. EBITDA: $20M (4) Proven management team with operational & developmental success Operating in Zimbabwe since 2002 Established, well - known African gold producer Produced ~589koz (2012 - 2023) (1) Certified to ISO Standards (5) 0.86 Lost Time Injury Frequency Rate in 2023 (LTIFR) (6) (1) Source: Internal historical production numbers aligning with the How Mine S - K 1300 Technical Report Summary, December 2024; Mazowe Mine S - K 1300 Technical Report Summary, December 2024; Redwing Mine S - K 1300 Technical Report Summary December 2024. (2) Source: How Mine S - K 1300 Technical Report Summary, December 2024, exclusive of all Reserves (Underground Reserves of 64koz @ 2.39 g/t and Surface Reserves of 23koz @ 0.88 g/t) and Inferred Sands ( Resource of 213koz @ 0.60 g/t Au). Mazowe Mine S - K 1300 Technical Report Summary, December 2024. Redwing Mine S - K 1300 Technical Report Summary December 2024. Note: Figures may vary due to rounding, please refer to each project report for more information. There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources. (3) Source: Audited financial statements and notes of Greenstone as of and for the year ended December 31, 2023. (4) Source: Non - IFRS measures, which should not be considered in isolation or as a substitute for IFRS measures. Please see slide 24 for definitions of each and a reconciliation of each to the most comparable IFRS measures. (5) Source: Unaudited Greenstone 2023 Annual Report, Recertification achieved for the How Mine on all three international standards - based management systems; ISO 14001 of 2015: Environmental Management Systems (EMS), ISO 9001 of 2015: Quality Management Systems (QMS) and ISO 45001 of 2018: Occupational Safety and Health Management Systems ( OHSMS). (6) Source: How Mine internal management safety reporting. Zimbabwe

Ibrahima Tall | CEO & Director Sphesihle Mchunu | General Counsel & Director ▪ Will serve as a Director and the General Counsel of Namib Minerals. ▪ Strong experience in corporate law with a specific focus on renewable energy, construction, and mining. ▪ Served as Associate at Hogan Lovells. 10 years of experience with a focus in energy, infrastructure, and mining. ▪ Will serve as a Director and the Chief Executive Officer of Namib Minerals. ▪ Ibrahima began his mining career at the Kiniero Gold Mine in Guinea, a JV between Managem and Semafo, advancing to the Assistant Managing Director. ▪ In 2005, contributed to the development of Semafo’s Samira Hill mine in Niger, corrected stability issues and trained technical personnel. ▪ From 2007 to 2018, shifted to the Mana project in Burkina Faso serving as the Technical Services Manager. Pivotal role in expanding the company's operations from 75kozpa in 2008 to 255kozpa through 3 plant expansion processes. ▪ In 2020, Endeavour Mining (TSX:EDV) acquired Semafo for ~US$735M. ▪ Joined Greenstone and its predecessor companies in January 2019 as COO, has served as CEO since June 2022. Tulani Sikwila | CFO & Director ▪ Will serve as a Director and the Chief Financial Officer of Namib Minerals. ▪ 20 years of operational, accounting and finance expertise with 19+ years of experience at Greenstone and its predecessor companies, including roles as Chief Financial Officer, Chief Executive Officer and Director. ▪ Responsible for the company’s investment management, corporate finance, tax and compliance functions. Daniel Hennessy | Leading SPAC Sponsor ▪ Hennessy Capital Investment Corp. VI is led by Chairman & CEO Daniel Hennessy. ▪ Investment thesis centered around efficient and sustainable gold production led by world - class team. ▪ Visited mines alongside team of consultants in April/May 2024.

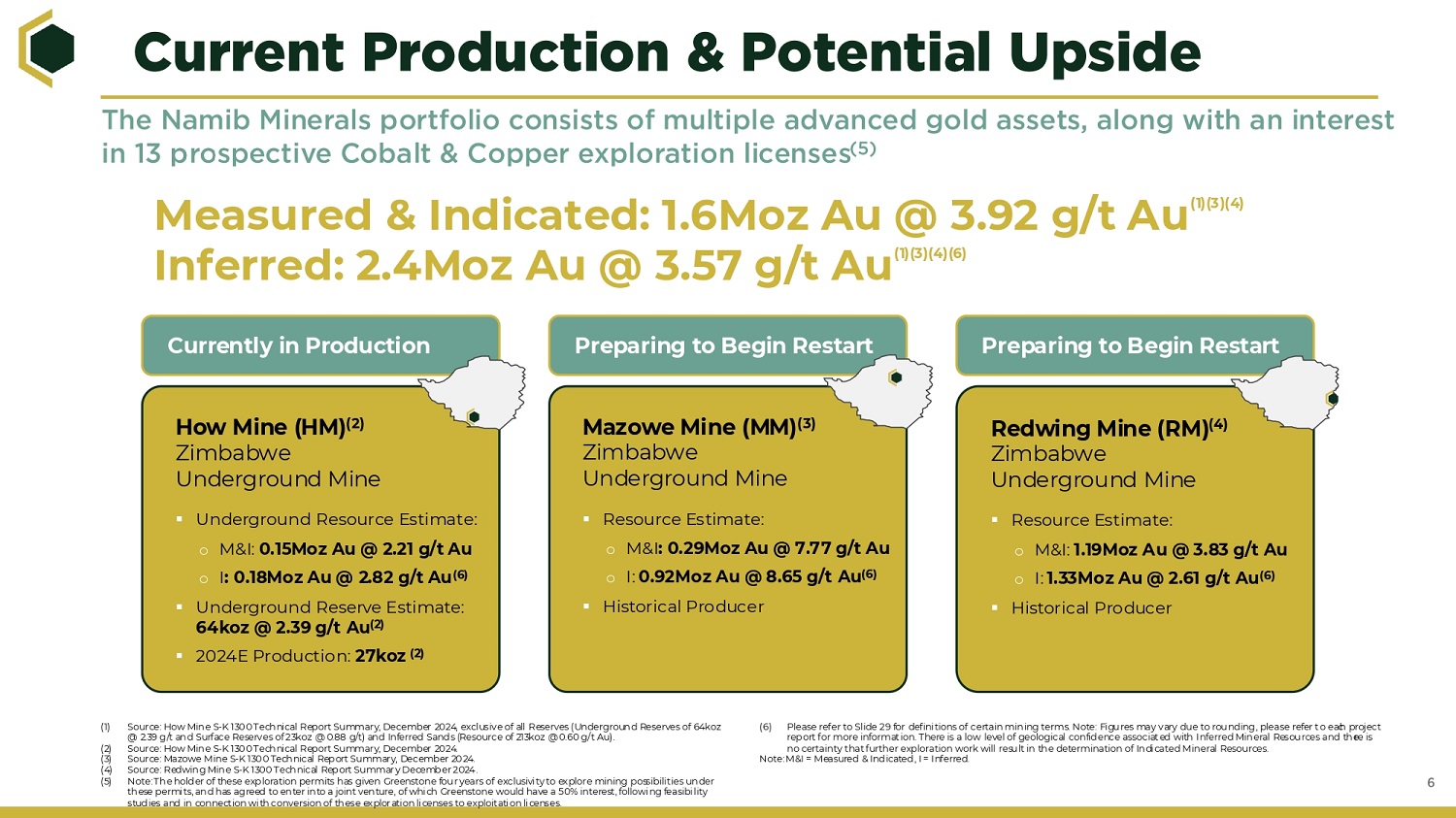

(1) Sour ce: How Mine S - K 1300 Technical Report Summary, December 2024, exclusive of all Reserves (Underground Reserves of 64koz @ 2.39 g/t and Surface Reserves of 23koz @ 0.88 g/t) and Inferred Sands (Resource of 213koz @ 0.60 g/t Au). (2) Sour ce: How Mine S - K 1300 Technical Report Summary, December 2024. (3) Source: Mazowe Mine S - K 1300 Technical Report Summary, December 2024. (4) Sour ce: Redwing Mine S - K 1300 Technical Report Summary December 2024. (5) Note: The holder of these exploration permits has given Greenstone four years of exclusivity to explor e mining possibilit ies under these permits, and has agreed to enter into a joint venture, of which Greenstone would have a 50% interest, following feasibi lity studies and in connect ion with conversion of these explor ati on licenses to exploit ati on licenses. (6) Please refer to Slide 29 for definitions of certain mining terms. Note: Figures may vary due to rounding, please refer to each project report for more informat ion. There is a low level of geological confidence associat ed with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources. Note: M&I = Measured & Indicated, I = Inferred. How Mine (HM) (2) Zimbabwe Underground Mine ▪ Underground Resource Estimate: o M&I: 0.15Moz Au @ 2.21 g/t Au o I : 0.18Moz Au @ 2.82 g/t Au (6) ▪ Underground Reserve Estimate: 64koz @ 2.39 g/t Au (2) ▪ 2024E Production: 27koz (2) Mazowe Mine (MM) (3) Zimbabwe Underground Mine ▪ Resource Estimate: o M&I : 0.29Moz Au @ 7.77 g/t Au o I: 0.92Moz Au @ 8.65 g/t Au (6) ▪ Historical Producer Redwing Mine (RM) (4) Zimbabwe Underground Mine ▪ Resource Estimate: o M&I: 1.19Moz Au @ 3.83 g/t Au o I: 1.33Moz Au @ 2.61 g/t Au (6) ▪ Historical Producer Currently in Production Preparing to Begin Restart Preparing to Begin Restart Measured & Indicated: 1.6Moz Au @ 3.92 g/t Au (1)(3)(4) Inferred: 2.4Moz Au @ 3.57 g/t Au (1)(3)(4)(6)

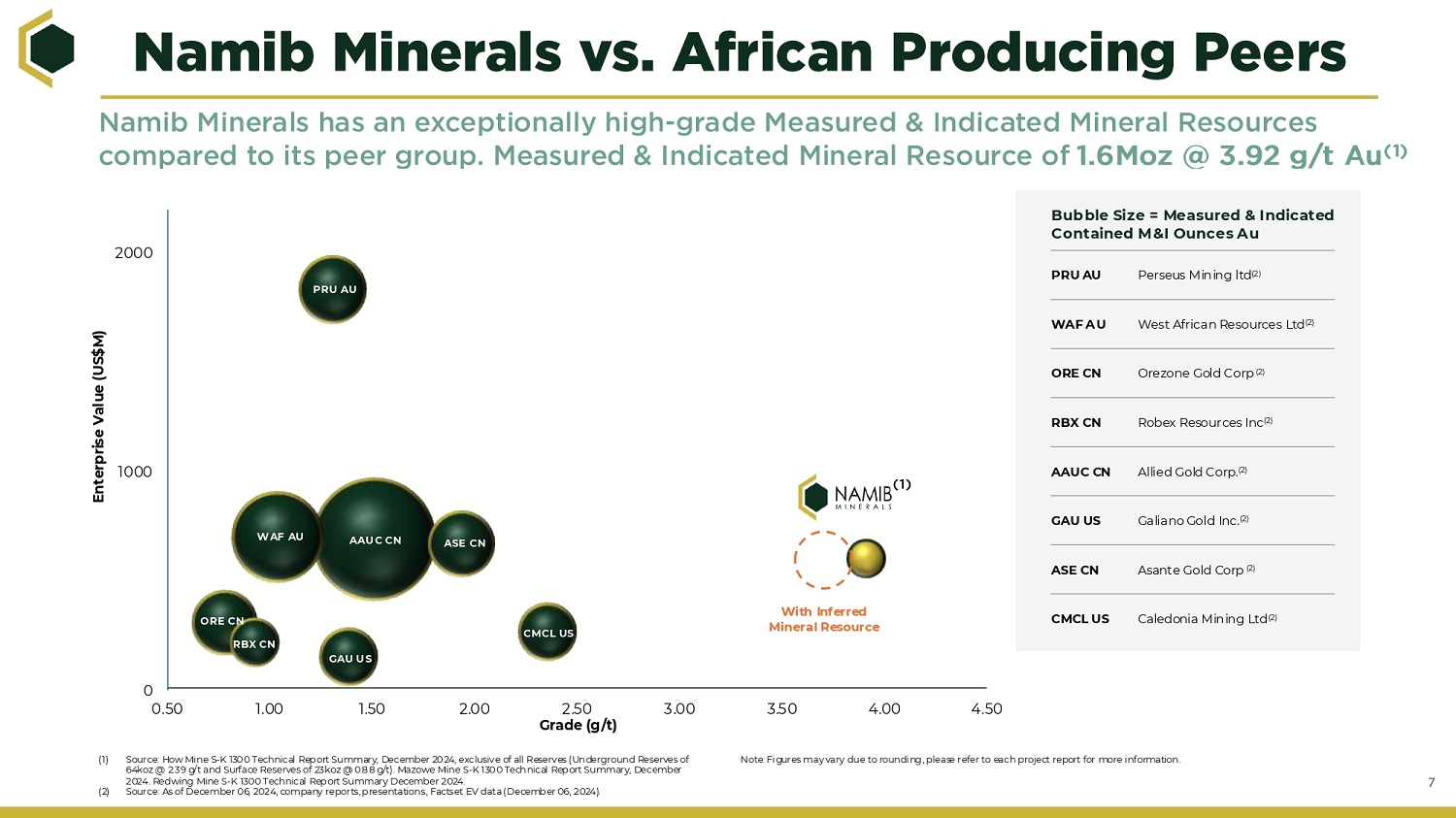

0 1000 2000 0.50 1.00 1.50 2.00 2.50 Grade (g/t) 3.00 3.50 4.00 4.50 Enterprise Value (US$M) (1) Source: How Mine S - K 1300 Technical Report Summary, December 2024, exclusive of all Reserves (Underground Reserves of 64koz @ 2.39 g/t and Surface Reserves of 23koz @ 0.88 g/t). Mazowe Mine S - K 1300 Technical Report Summary, December 2024. Redwing Mine S - K 1300 Technical Report Summary December 2024. (2) Source: As of December 06, 2024, company reports, presentations, Factset EV data (December 06, 2024). Note: Figures may vary due to rounding, please refer to each project report for more information. PRU AU WAF AU AAUC CN Bubble Size = Measured & Indicated Contained M&I Ounces Au GAU US ORE CN RBX CN ASE CN CMCL US Perseus Mining ltd (2) PRU AU West African Resources Ltd (2) WAF AU Orezone Gold Corp (2) ORE CN Robex Resources Inc (2) RBX CN Allied Gold Corp. (2) AAUC CN Galiano Gold Inc. (2) GAU US Asante Gold Corp (2) ASE CN Caledonia Mining Ltd (2) CMCL US With Inferred Mineral Resource

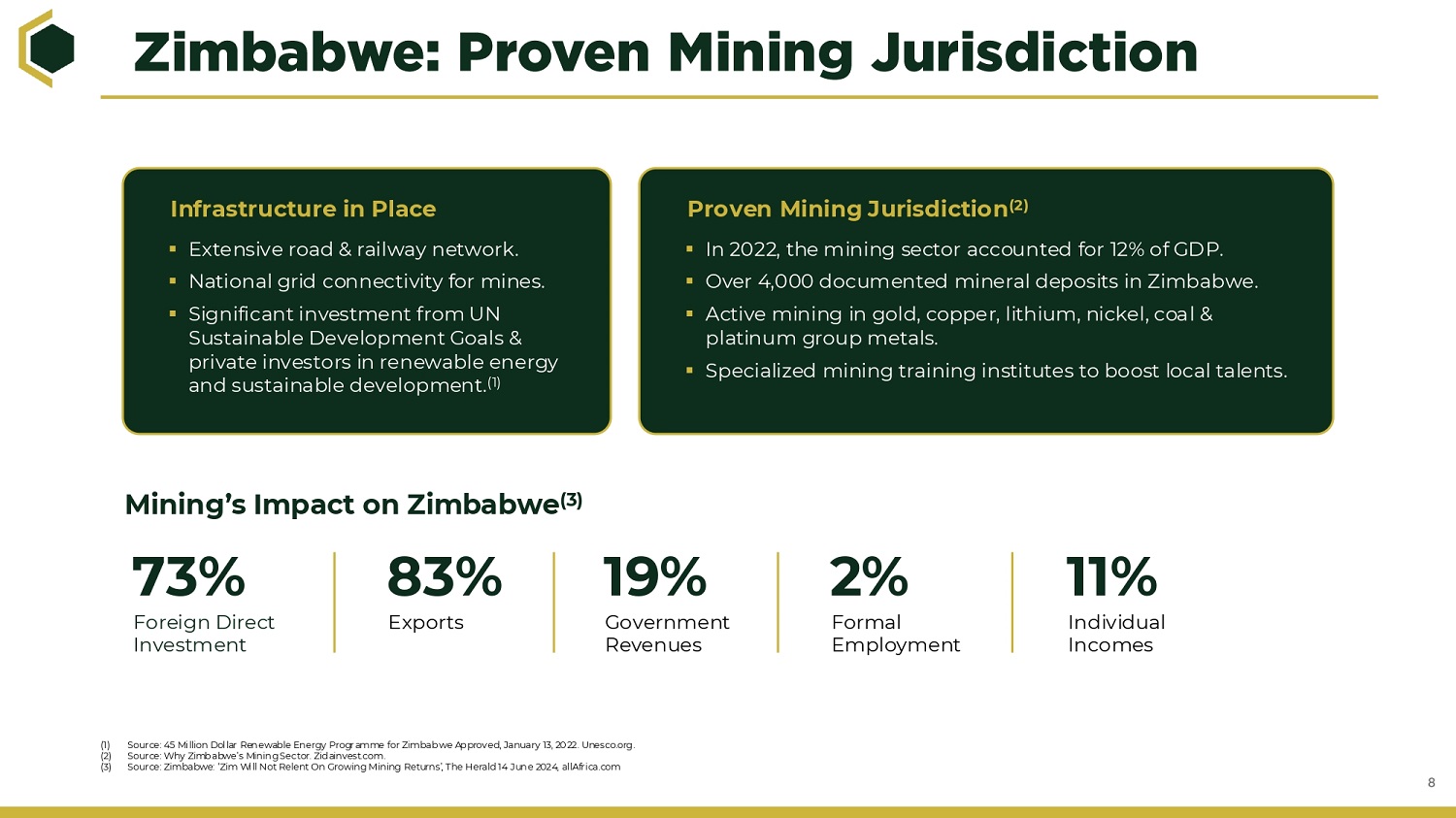

Mining’s Impact on Zimbabwe (3) 73% Foreign Direct Investment Infrastructure in Place ▪ Extensive road & railway network. ▪ National grid connectivity for mines. ▪ Significant investment from UN Sustainable Development Goals & private investors in renewable energy and sustainable development. (1) Proven Mining Jurisdiction (2) ▪ In 2022, the mining sector accounted for 12% of GDP. ▪ Over 4,000 documented mineral deposits in Zimbabwe. ▪ Active mining in gold, copper, lithium, nickel, coal & platinum group metals. ▪ Specialized mining training institutes to boost local talents. 83% Exports 19% Government Revenues 2% Formal Employment 11% Individual Incomes (1) Sour ce: 45 Million Dol lar Renewable Energy Progr amme for Zimbabwe Approved, January 13, 2022. Unesco.org. (2) Source: Why Zimbabwe’s Mining Sector. Zidainvest.com. (3) Source: Zimbabwe: ‘Zim Will Not Relent On Growing Mining Returns’, The Herald 14 June 2024, allAfrica.com

Companies Operating in Zimbabwe (1) Source: Government allocates ZW$132.7 billion to the Ministry of Mines, December 1, 2023. miningzimbabwe.com. (2) Sour ce: Mnangagwa Launches Responsible Mining Initiative, May 12, 2023. miningzimbabwe.com. (3) Source: Why Zimbabwe’s Mining Sector. Zidainvest.com. (4) Neither Namib Minerals nor Greenstone currently possesses a Special Mining Lease (“SML”). Supportive Legislation (1)(2)(3) ▪ Realignment of legislation to encourage foreign direct investment. ▪ The Zimbabwe government allocated US$364M to create a conducive environment for mining. ▪ President of Zimbabwe has set forth a US$12B mining sector revenue goal. ▪ In May 2023, President of Zimbabwe launched the Responsible Mining Initiative to combat illegal mining activities in Zimbabwe. ▪ The government of Zimbabwe grants priority power supply to the mining sector to boost production and exports. ▪ Acquisition of special mining lease (“SML”) allows producers to make direct exports of gold at spot prices. (4) ▪ Zimbabwe legal requirements for a SML mandates a minimum US$100M investment and stipulates that the produced output must be designated for export. ▪ Impala Platinum Holdings Limited (Implats) ▪ Delta Corporation Limited ▪ Old Mutual ▪ Econet Wireless Zimbabwe ▪ Stanbic Bank ▪ Unilever ▪ Anglo American Plc ▪ Caledonia Mining Corporation Plc ▪ Ecobank ▪ Tongaat Hulett ▪ Total Energy ▪ Ajako Ltd. ▪ EDF

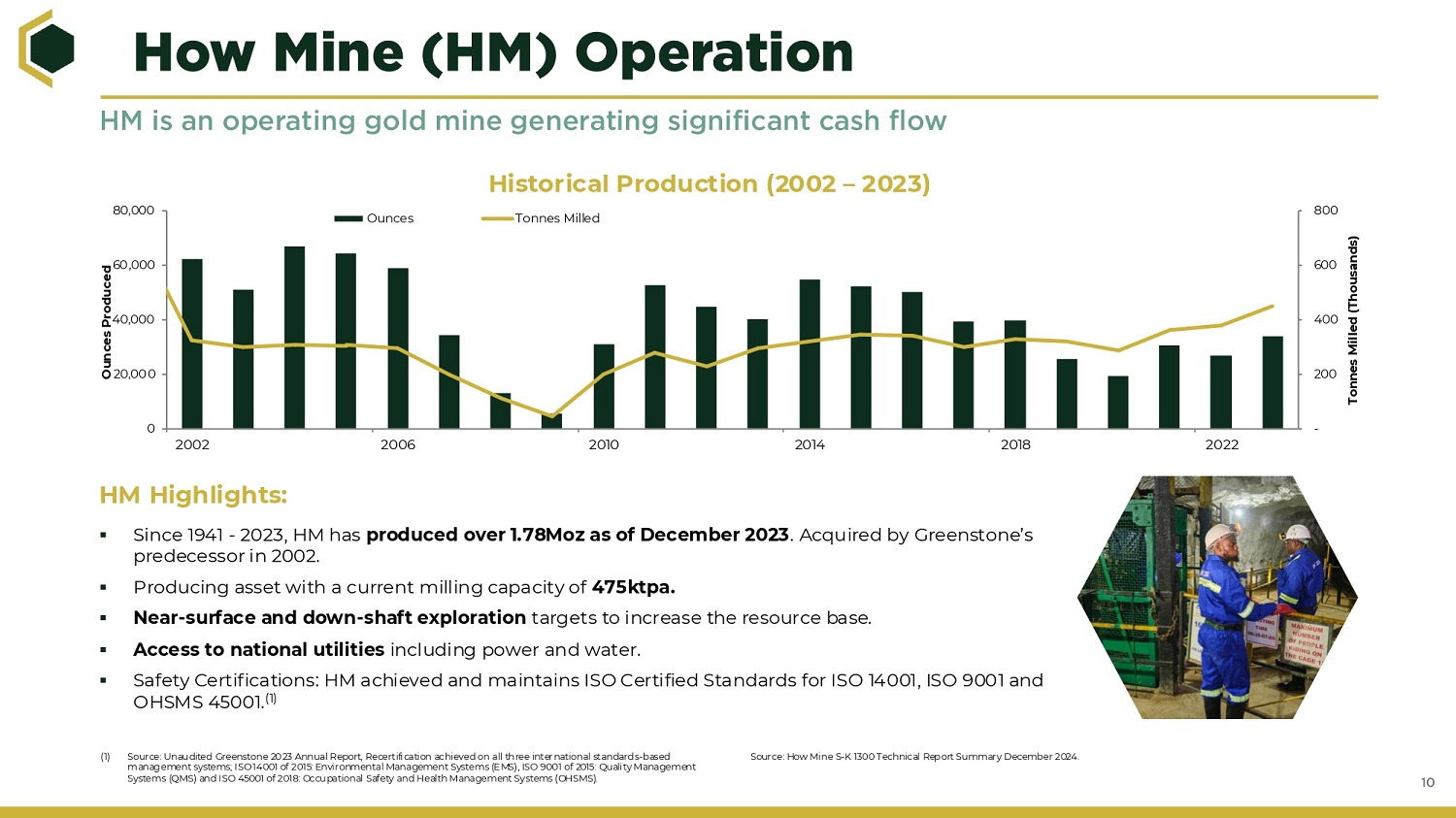

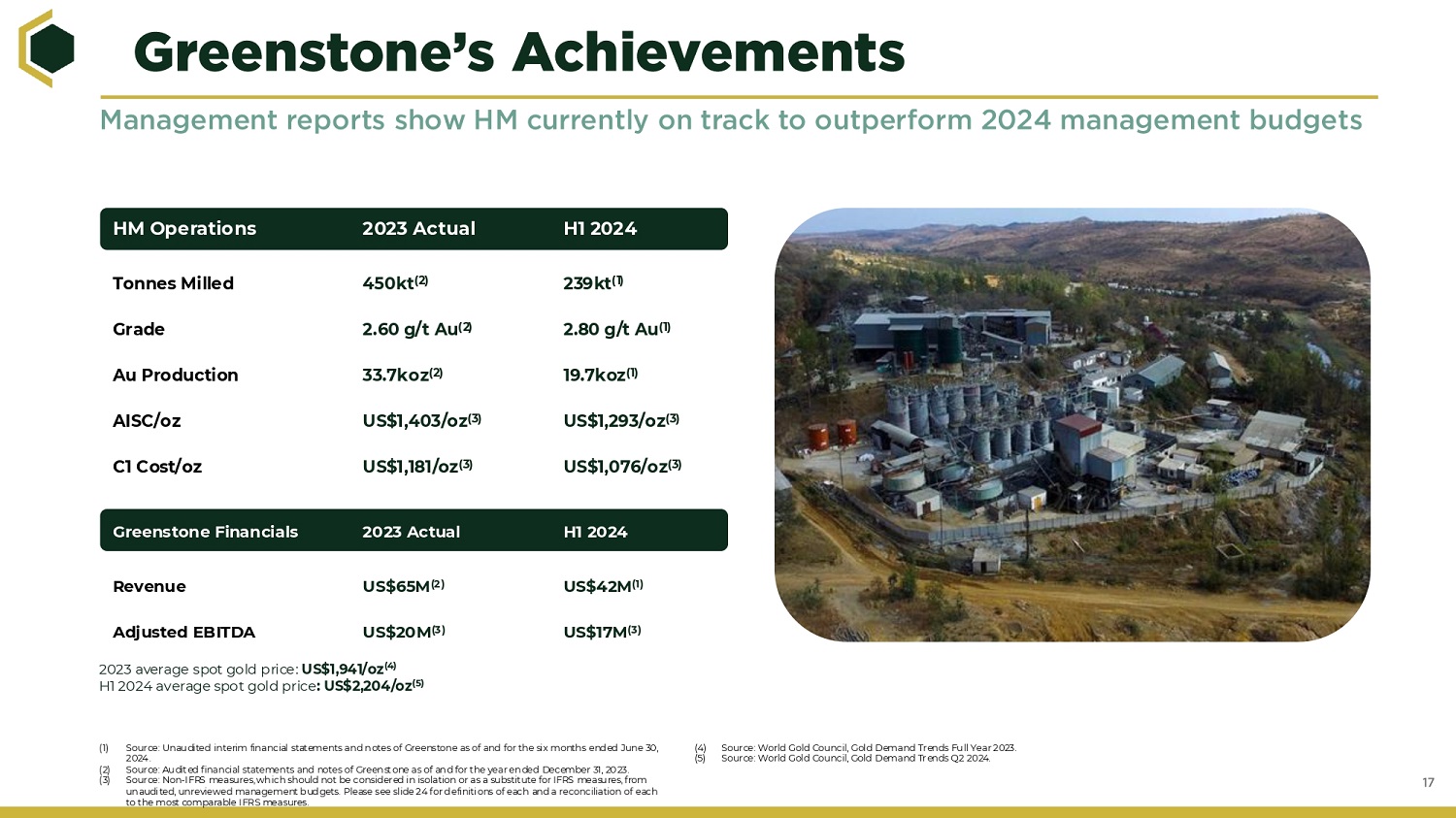

- 200 400 600 800 0 20,000 40,000 60,000 80,000 2002 2006 2010 2014 2018 2022 Tonnes Milled (Thousands) Ounces Produced Ounces Tonnes Milled Historical Production (2002 – 2023) HM Highlights: ▪ Since 1941 - 2023, HM has produced over 1.78Moz as of December 2023 . Acquired by Greenstone’s predecessor in 2002. ▪ Producing asset with a current milling capacity of 475ktpa. ▪ Near - surface and down - shaft exploration targets to increase the resource base. ▪ Access to national utilities including power and water. ▪ Safety Certifications: HM achieved and maintains ISO Certified Standards for ISO 14001, ISO 9001 and OHSMS 45001. (1) (1) Source: Unaudited Greenstone 2023 Annual Report, Recertification achieved on all three international standards - based management systems; ISO 14001 of 2015: Envir onmental Management Systems (EMS), ISO 9001 of 2015: Quality Management Systems (QMS) and ISO 45001 of 2018: Occupational Safety and Health Management Systems (OHSMS). Source: How Mine S - K 1300 Technical Report Summary December 2024.

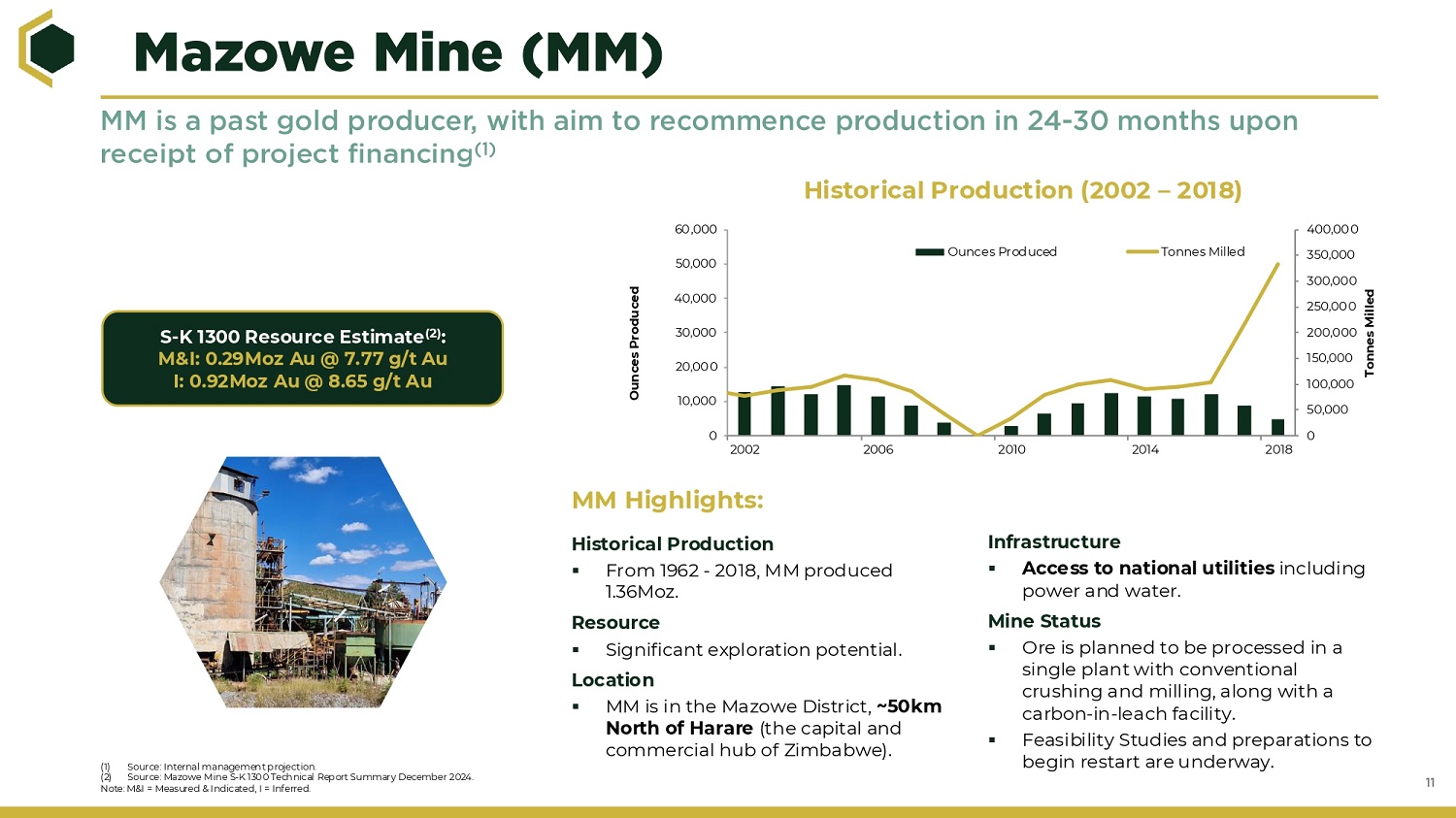

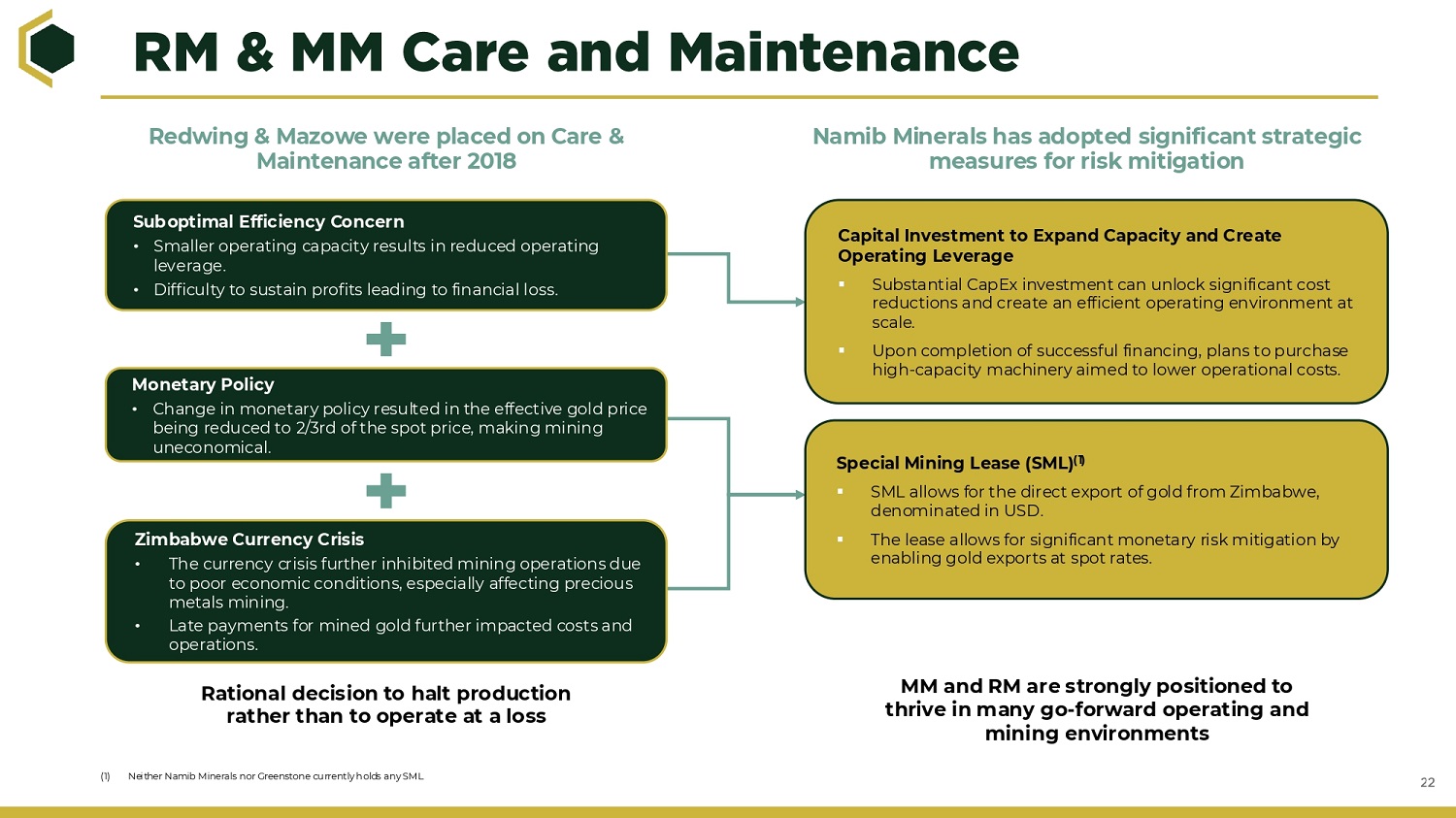

Historical Production (2002 – 2018) (1) Sour ce: Internal management project ion. (2) Sour ce: Mazowe Mine S - K 1300 Technical Report Summary December 2024. Note: M&I = Measured & Indicated, I = Inferred. 400,000 350,000 300,000 250,000 200,000 150,000 100,000 50,000 0 0 10,000 20,000 30,000 40,000 50,000 60,000 2002 2006 2010 2014 2018 Tonnes Milled Ounces Produced Ounces Produced Tonnes Milled S - K 1300 Resource Estimate (2) : M&I: 0.29Moz Au @ 7.77 g/t Au I: 0.92Moz Au @ 8.65 g/t Au MM Highlights: Historical Production ▪ From 1962 - 2018, MM produced 1.36Moz. Resource ▪ Significant exploration potential. Location ▪ MM is in the Mazowe District, ~50km North of Harare (the capital and commercial hub of Zimbabwe). Infrastructure ▪ Access to national utilities including power and water. Mine Status ▪ Ore is planned to be processed in a single plant with conventional crushing and milling, along with a carbon - in - leach facility. ▪ Feasibility Studies and preparations to begin restart are underway.

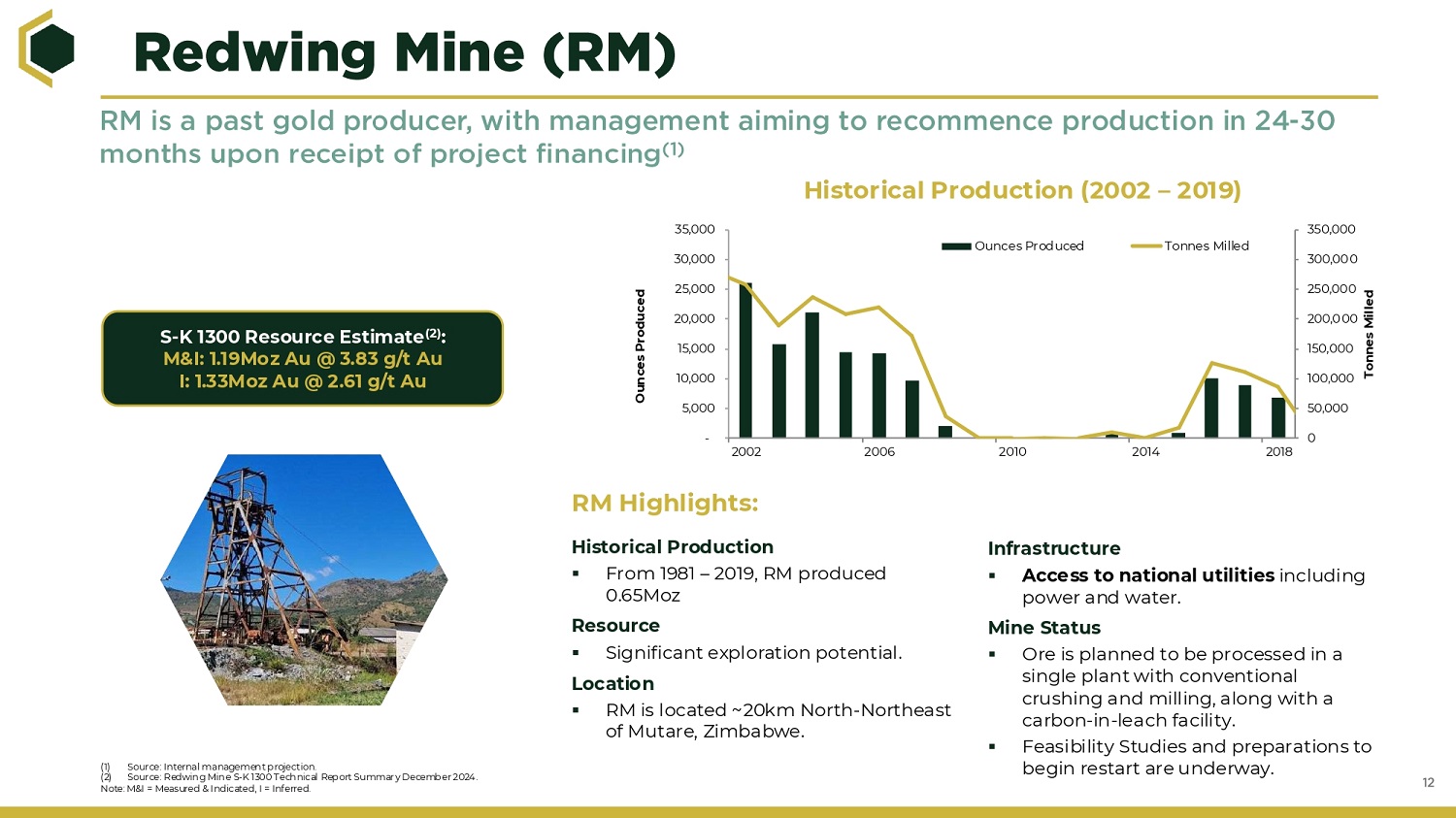

(1) Sour ce: Internal management project ion. (2) Sour ce: Redwing Mine S - K 1300 Technical Report Summary December 2024. Note: M&I = Measured & Indicated, I = Inferred. RM Highlights: Historical Production ▪ From 1981 – 2019, RM produced 0.65Moz Resource ▪ Significant exploration potential. Location ▪ RM is located ~20km North - Northeast of Mutare, Zimbabwe. Infrastructure ▪ Access to national utilities including power and water. Mine Status ▪ Ore is planned to be processed in a single plant with conventional crushing and milling, along with a carbon - in - leach facility. ▪ Feasibility Studies and preparations to begin restart are underway. 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 - 5,000 10,000 15,000 20,000 25,000 30,000 35,000 2002 2006 2010 2014 2018 Tonnes Milled Ounces Produced Ounces Produced Tonnes Milled S - K 1300 Resource Estimate (2) : M&I: 1.19Moz Au @ 3.83 g/t Au I: 1.33Moz Au @ 2.61 g/t Au Historical Production (2002 – 2019)

Location ▪ Located in the Haut Katanga and Lualaba Provinces, in the Democratic Republic of the Congo ("DRC") spanning a total area of 205km 2 . ▪ Located near Ivanhoe & Zijin’s Kamoa - Kakula Copper Complex, one of the world’s largest copper operations. (1) Mine Strategy ▪ Work has started across 13 granted exploration permits. ▪ Six initial holes have been drilled identifying Copper & Cobalt potential. ▪ Current drilling has identified Copper mineralization in intervals up to 3.28% Copper within 150m of surface; follow up step - out drilling will test further mineralization. ▪ Utilize cash flows to further develop DRC copper projects. Permits ▪ Namib Minerals granted 4 years of exclusivity over the exploration permits . ▪ The expected receipt of a favorable feasibility study and conversion of the exploration permits into exploitation permits, Namib Minerals and the holder of the exploration permits expect to establish an operating joint venture, of which Namib Minerals would hold 50 % . Sour ce: Internal management data. (1) Source: Ivanhoe Mines Kamoa - Kakula Copper Complex. DRC DRC Copper Exploration Kamoa - Kakula Copper Complex Democratic Republic of the Congo

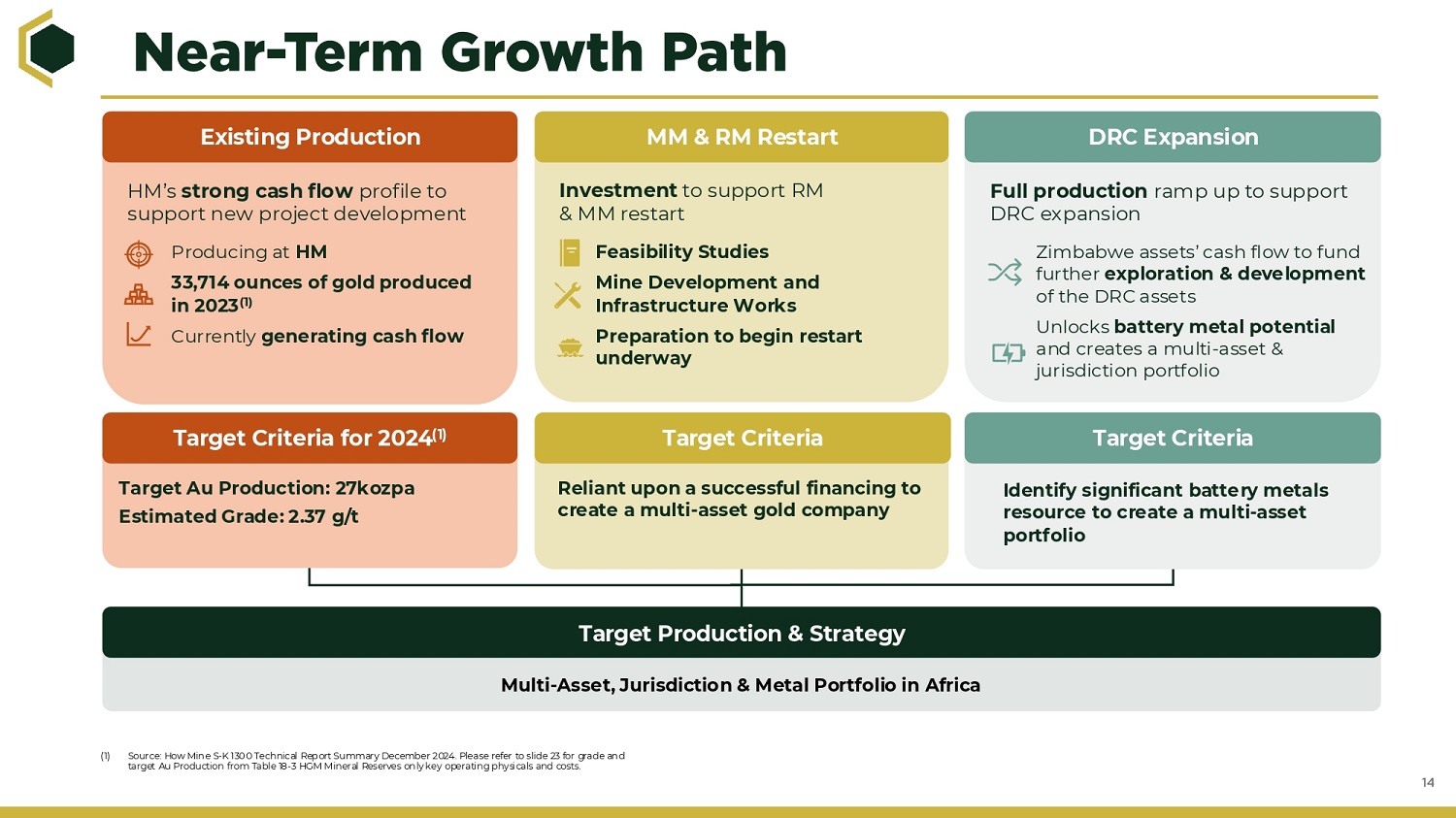

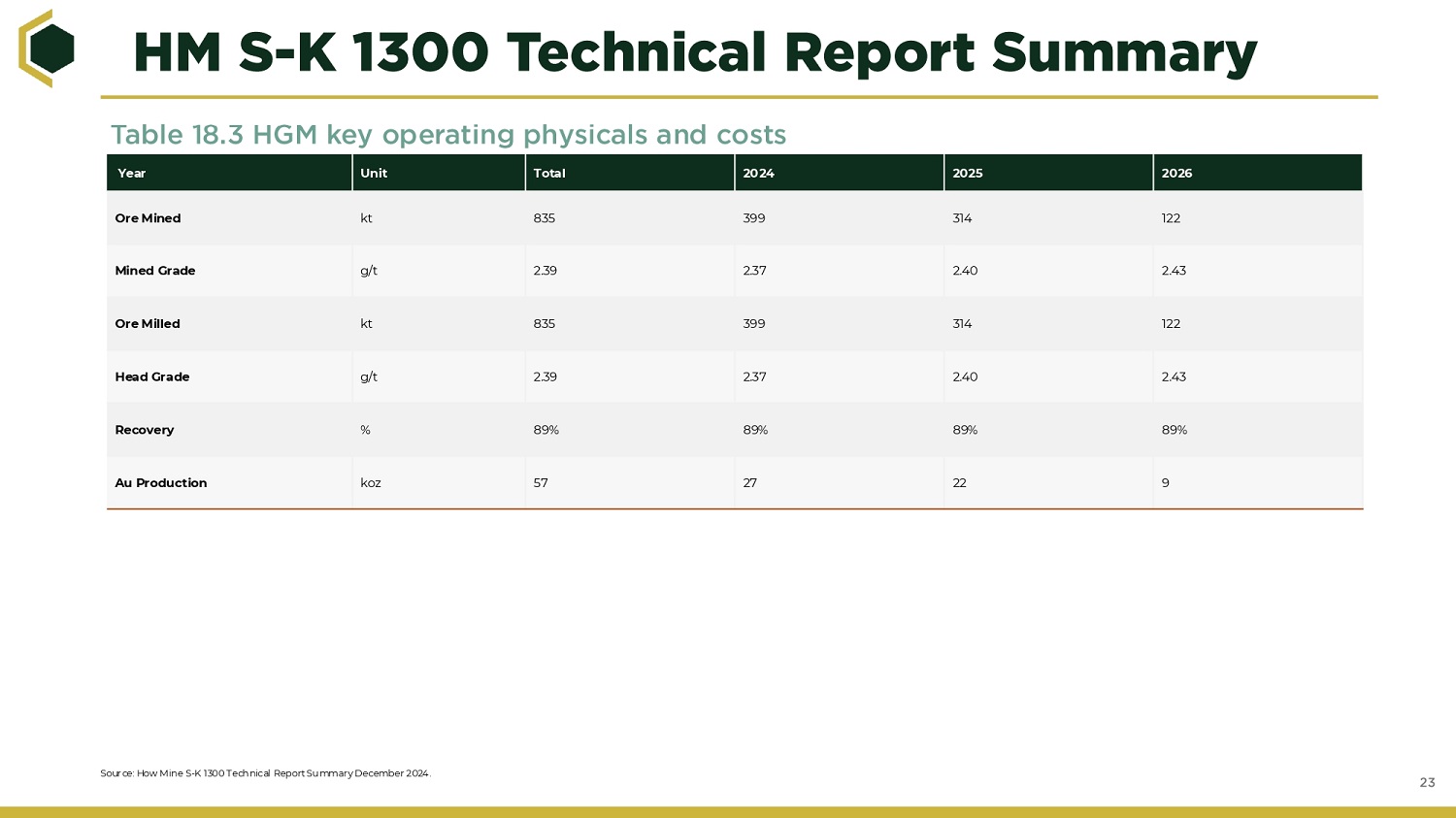

Target Production & Strategy Target Criteria DRC Expansion Target Criteria Target Criteria for 2024 (1) Existing Production Investment to support RM & MM restart Feasibility Studies Mine Development and Infrastructure Works Preparation to begin restart underway Target Au Production: 27kozpa Estimated Grade: 2.37 g/t HM’s strong cash flow profile to support new project development Producing at HM 33,714 ounces of gold produced in 2023 (1) Currently generating cash flow Reliant upon a successful financing to create a multi - asset gold company Full production ramp up to support DRC expansion Zimbabwe assets’ cash flow to fund further exploration & development of the DRC assets Unlocks battery metal potential and creates a multi - asset & jurisdiction portfolio MM & RM Restart Identify significant battery metals resource to create a multi - asset portfolio Multi - Asset, Jurisdiction & Metal Portfolio in Africa (1) Sour ce: How Mine S - K 1300 Technical Report Summary December 2024. Please refer to slide 23 for grade and target Au Production from Table 18 - 3 HGM Mineral Reserves only key operating physicals and costs.