Filed Pursuant to Rule 424(b)(5)

Registration No. 333-269340

PROSPECTUS SUPPLEMENT

(To Prospectus dated January 30, 2023)

110,000 Shares of Common Stock

Pre-Funded Warrants to Purchase up to 780,208 Shares of Common Stock

Up to 780,208 Shares of Common Stock Underlying the Pre-Funded Warrants

We are offering 110,000 shares (the “Shares”) of our common stock, par value $0.001 (the “Common Stock”), and pre-funded warrants (the “Pre-Funded Warrants”) to purchase 780,208 shares of our Common Stock (and the shares of Common Stock underlying such Pre-Funded Warrants) directly to institutional investors pursuant to this prospectus supplement and the accompanying prospectus. The offering price per Share and per Pre-Funded Warrant is $3.37 and $3.369, respectively. The Pre-Funded Warrants will have an exercise price of $0.001 per share and will be exercisable upon issuance until exercised in full.

In a concurrent private placement, we are also issuing to the purchasers of the Shares, warrants to purchase up to 890,208 shares of Common Stock (the “Purchase Warrants”) at an exercise price of $3.25 per share (and the shares of Common Stock issuable upon the exercise of the Purchase Warrants). The Purchase Warrants and the shares of Common Stock issuable upon the exercise of such warrants are not being registered under the Securities Act of 1933, as amended (the “Securities Act”), are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act.

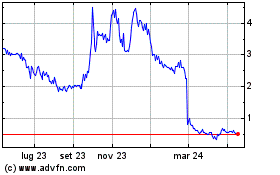

Our Common Stock is currently traded on The Nasdaq Capital Market under the symbol “KA”. On October 3, 2023, the last reported sale price of our Common Stock on The Nasdaq Capital Market was $3.95 per share.

As of October 2, 2023, the aggregate market value of our outstanding Common Stock held by non-affiliates, or public float, was approximately $37.2 million, based on 10,214,945 shares of outstanding Common Stock, of which approximately 1,920,530 shares were held by affiliates, and a price of $4.49 per share, which was the price at which our Common Stock was last sold on The Nasdaq Capital Market on such date. We have not offered or sold any securities pursuant to General Instruction I.B.6 of Form S-3 during the prior 12-calendar-month period that ends on and includes the date of this prospectus supplement other than (i) 126,503 shares of Common Stock sold under the Open Market Sale AgreementSM dated February 10, 2023 with Jefferies LLC during the six months ended June 30, 2023 for aggregate net proceeds to the Company of approximately $0.8 million and (ii) 1,425,179 shares of Common Stock and pre-funded warrants issued in connection with the Securities Purchase Agreement dated April 20, 2023 with an institutional investor during the six months ended June 30, 2023 for aggregate net proceeds to the Company of approximately $5.5 million. Accordingly, based on the foregoing, we are currently eligible under General Instruction I.B.6 of Form S-3 to offer and sell shares of our Common Stock having an aggregate offering price of up to $6.6 million. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public primary offering with a value exceeding one-third of our public float in any 12-month period so long as our public float remains below $75.0 million.

We have engaged H.C. Wainwright & Co., LLC (the “placement agent”) as our exclusive placement agent in connection with this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay the placement agent the placement agent fees set forth in the table below. See “Plan of Distribution” beginning on page S-22 of this prospectus supplement for more information regarding these arrangements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share |

|

|

Per Pre-Funded Warrant |

|

|

Total |

|

Public offering price |

|

$ |

3.37 |

|

|

$ |

3.369 |

|

|

$ |

3,000,001 |

|

Placement agent fees (1) |

|

$ |

0.2359 |

|

|

$ |

0.2358 |

|

|

$ |

210,000 |

|

Proceeds, before expenses, to us |

|

$ |

3.1341 |

|

|

$ |

3.1332 |

|

|

$ |

2,790,001 |

|

_____________

(1) We have agreed to reimburse the placement agent for certain expenses. See “Plan of Distribution” for a description of compensation payable to the placement agent.

Delivery of our shares of Common Stock and Pre-Funded Warrants is expected to be made on or about October 5, 2023, subject to satisfaction of customary closing conditions.

An investment in our securities involves a high degree of risk. Please read “Risk Factors” on page S‑10 of this prospectus supplement and in the documents incorporated by reference into this prospectus supplement before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

H.C. Wainwright & Co.

The date of this prospectus supplement is October 3, 2023

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration process. Under the shelf registration process, we may offer securities, including shares of our Common Stock, having an aggregate offering price of up to $200,000,000 under the accompanying prospectus. This prospectus supplement may add to, update or change information in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement or the accompanying prospectus.

We are providing information to you about this offering of shares of our Common Stock and Pre-Funded Warrants in two separate documents that are bound together: (1) this prospectus supplement, which describes the specific details regarding this offering of shares of our Common Stock and the Pre-Funded Warrants; and (2) the accompanying prospectus, which provides general information, some of which may not apply to this offering. Generally, when we refer to this “prospectus,” we are referring to both documents combined.

If information in this prospectus supplement is inconsistent with the accompanying prospectus or with any document incorporated by reference that was filed with the SEC before the date of this prospectus supplement, you should rely on this prospectus supplement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date–for example, a document incorporated by reference in this prospectus supplement–the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates.

This prospectus supplement, the accompanying prospectus and the documents incorporated into each by reference herein and therein include important information about us, the securities being offered and other information you should know before investing in our securities. You should also read and consider information in the documents we have referred you to in the section of this prospectus supplement and the accompanying prospectus entitled “Where You Can Find Additional Information” and “Incorporation by Reference.”

You should rely only on the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus and any free writing prospectus we may provide to you in connection with this offering and the information incorporated or deemed to be incorporated by reference therein. We have not, and the placement agent has not, authorized anyone to provide you with information that is in addition to or different from that contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the placement agent is not, offering to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus is accurate as of any date other than as of the date of this prospectus supplement or the accompanying prospectus, as the case may be, or in the case of the documents incorporated by reference, the date of such documents regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or any sale of our securities. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus supplement were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We are offering to sell, and are seeking offers to buy, the shares of our Common Stock and the Pre-Funded Warrants only in jurisdictions where such offers and sales are permitted. No action has been or will be taken in any jurisdiction by us or the placement agent that would permit a public offering of the shares of our Common Stock and the Pre-Funded Warrants or the possession or distribution of this prospectus supplement and the accompanying

S-1

prospectus in any jurisdiction, other than in the United States. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our Common Stock and the Pre-Funded Warrants and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

On December 16, 2022, we effected a reverse merger, pursuant to which a wholly-owned subsidiary of ours merged with and into Kineta Operating, Inc. (formerly known as Kineta, Inc.) (“Private Kineta”), with Private Kineta surviving as a wholly-owned subsidiary of ours. Private Kineta subsequently merged with and into Kineta Operating, LLC, with Kineta Operating, LLC being the surviving corporation. On December 16, 2022, we changed our name from Yumanity Therapeutics, Inc. to Kineta, Inc. As used in this prospectus supplement, unless the context otherwise requires, (i) references to “Kineta,” the “Company,” “we,” “our,” or “us” refer to (x) prior to the date of the reverse merger, Private Kineta, and its wholly-owned, consolidated subsidiaries, or either or all of them as the context may require, and (y) following the date of the reverse merger, Kineta, Inc. and its wholly-owned, consolidated subsidiaries, or either or all of them as the context may require, and (ii) references to “Common Stock” refer to the common stock, par value $0.001 per share, of the Company.

S-2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the information incorporated herein or therein by reference contain certain statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify these forward-looking statements by the use of terms such as “expect,” “will,” “continue,” “believe,” “estimate,” “aim,” “project,” “intend,” “should,” “is to be,” or similar expressions, and variations or negatives of these words, but the absence of these words does not mean that a statement is not forward-looking. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from results expressed or implied in this prospectus supplement or the accompanying prospectus. The following factors, among others, could cause actual results to differ materially from those described in these forward-looking statements:

•the timing, progress and results of preclinical studies and clinical trials for our programs and product candidates, including statements regarding the timing of initiation and completion of studies or trials and related preparatory work, the period during which the results of the trials will become available and our research and development programs;

•our ability to recruit and enroll suitable patients in our clinical trials;

•the potential attributes and benefits of our product candidates;

•our ability to develop and advance product candidates into, and successfully complete, clinical studies;

•the timing, scope or likelihood of regulatory filings and approvals;

•our ability to obtain and maintain regulatory approval for our product candidates, and any related restrictions, limitations or warnings in the label of an approved product candidate;

•the implementation of our business model and our strategic plans for our business, product candidates, technology and our discovery engine;

•our commercialization, marketing and manufacturing capabilities and strategy;

•the pricing and reimbursement of our product candidates, if approved;

•the rate and degree of market acceptance of our product candidates, if approved;

•our ability to establish or maintain collaborations or strategic relationships or obtain additional funding;

•our ability to contract with and rely on third parties to assist in conducting our clinical trials and manufacturing our product candidates;

•the size and growth potential of the markets for our product candidates, and our ability to serve those markets, either alone or in partnership with others;

•our ability to obtain funding for our operations, including funding necessary to complete further development, approval and, if approved, commercialization of our product candidates;

S-3

•the period over which we anticipate our existing cash and cash equivalents will be sufficient to fund our operating expenses and capital expenditure requirements;

•the potential for our business development efforts to maximize the potential value of our portfolio;

•our ability to compete with other companies currently marketing or engaged in the development of treatments for the indications that we are pursuing for our product candidates;

•our expectations regarding our ability to obtain and maintain intellectual property protection for our product candidates;

•our financial performance;

•our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals;

•any statements of the plans, strategies and objectives of management for future operations, including the execution of integration plans and the anticipated timing of filings;

•our expectations related to the use of our cash reserves;

•our estimates regarding expenses, future revenue, capital requirements and needs for additional financing;

•our ability to remediate the material weaknesses in our internal control over financial reporting;

•the impact of laws and regulations, including without limitation recently enacted tax reform legislation;

•the impact of global economic and political developments on our business, including rising inflation and capital market disruptions, the current conflict in Ukraine, economic sanctions and economic slowdowns or recessions that may result from such developments, which could harm our research and development efforts as well as the value of our Common Stock and our ability to access capital markets;

•the effect of COVID-19 on the foregoing; and

•other risks and uncertainties, including those listed under the caption “Risk Factors” beginning on page S-10 of this prospectus supplement, page 3 of the accompanying prospectus and under similar headings in the other documents that are incorporated by reference into this prospectus supplement.

The forward-looking statements contained in this prospectus supplement, the accompanying prospectus and the other information and documents incorporated herein or therein by reference are based on our current expectations and beliefs concerning future developments and their potential effects on our business. There can be no assurance that future developments affecting our business will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” beginning on page S-10 of this prospectus supplement, page 3 of the accompanying prospectus and under similar headings in the other documents that are incorporated by reference into this prospectus supplement. Moreover, we operate in a very competitive and rapidly changing environment.

New risks and uncertainties emerge from time to time and it is not possible for us to predict all such risk factors, nor can we assess the effect of all such risk factors on our business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking

S-4

statements. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

The forward-looking statements made by us in this prospectus supplement, the accompanying prospectus and the other information and documents incorporated herein or therein by reference speak only as of the date of such statement. Except to the extent required under the federal securities laws and rules and regulations of the SEC, we disclaim any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. In light of these risks and uncertainties, there is no assurance that the events or results suggested by the forward-looking statements will in fact occur, and you should not place undue reliance on these forward-looking statements.

Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law, you are advised to consult any additional disclosures we make in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC. For information about where you can find these reports, see “Where You Can Find Additional Information” and “Incorporation by Reference.”

S-5

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights selected information about us, this offering and information appearing elsewhere in this prospectus supplement, in the accompanying prospectus and in the documents incorporated by reference. This summary is not complete and does not contain all the information you should consider before investing in our Common Stock pursuant to this prospectus supplement and the accompanying prospectus. Before making an investment decision, to fully understand this offering and its consequences to you, you should carefully read this entire prospectus supplement and the accompanying prospectus, including “Risk Factors” beginning on page S-11 of this prospectus supplement, the financial statements and related notes, and the other information incorporated by reference herein, including our most recent Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our other filings with the SEC that we file from time to time.

Overview

We are a clinical-stage biotechnology company with a mission to develop next-generation immunotherapies that transform patients’ lives. We have leveraged our expertise in innate immunity and are focused on discovering and developing potentially differentiated immunotherapies that address the major challenges with current cancer therapy.

We have established our Innate Immunity Development Platform aimed at developing fully human monoclonal antibodies to address the major mechanisms of cancer immune resistance:

•Poor tumor immunogenicity.

Utilization of the Innate Immunity Development Platform is designed to result in novel, well-characterized immuno-oncology lead antibody therapeutics that can be efficiently advanced into investigational new drug-enabling preclinical studies and clinical trials.

Our pipeline of assets and research interests includes (i) KVA12123, a monoclonal antibody (“mAb”) immunotherapy targeting VISTA (V-domain Ig suppressor of T cell activation) and (ii) an anti-CD27 agonist mAb immunotherapy. These immunotherapies have the potential to address disease areas with unmet medical needs and significant commercial potential.

We dosed the first patient in a Phase 1/2 clinical trial of KVA12123 in the United States in April 2023. The ongoing Phase 1/2 clinical study is designed to evaluate KVA12123 alone and in combination with the immune checkpoint inhibitor pembrolizumab in patients with advanced solid tumors. KVA12123 is engineered to be a differentiated VISTA blocking immunotherapy to address the problem of immunosuppression in the tumor microenvironment. It is a fully human engineered IgG1 monoclonal antibody that was designed to bind to VISTA through a unique epitope and across neutral and acidic pHs. KVA12123 may be an effective immunotherapy for many types of cancer including non-small cell lung cancer (“NSCLC”), colorectal cancer (“CRC”), ovarian cancer (“OC”), renal cell carcinoma (“RCC”) and head and neck squamous cell carcinoma (“HNSCC”). These indications represent a significant unmet medical need with a large worldwide commercial opportunity for KVA12123.

We are also conducting preclinical studies on our lead anti-CD27 agonist mAb immunotherapy that was discovered utilizing our Innate Immunity Development Platform. This lead candidate is a fully human mAb that demonstrates low nanomolar (“nM”) binding affinity to CD27 in humans. In preclinical studies, our lead anti-CD27 agonist mAb was observed to induce T cell proliferation and secretion of cytokines involved in T cell priming and recruitment, as well as NK cell activation, suggesting the ability to potentiate new anti-tumor responses. CD27 is a clinically validated target that may be an effective immunotherapy for advanced solid tumors including RCC, CRC and OC. We continue to conduct preclinical studies to optimize our lead anti-CD27 agonist mAb clinical candidate and to evaluate it in combination with other check-point inhibitors.

Corporate Information

We were incorporated in Delaware on December 13, 2006 under the name Proteoguard, Inc. and subsequently changed our name to Proteostasis Therapeutics, Inc. on September 17, 2007. On December 22, 2020, we effected a reverse merger, pursuant to which a wholly-owned subsidiary of ours merged with and into Yumanity, Inc. (formerly Yumanity Therapeutics, Inc.) (“Yumanity”) with Yumanity surviving as a wholly-owned subsidiary of ours. On December 22, 2020, we changed our name from Proteostasis Therapeutics, Inc. to Yumanity Therapeutics, Inc. On December 16, 2022, we effected a reverse merger, pursuant to which a wholly-owned subsidiary of ours merged with and into Kineta with Kineta surviving as a wholly-owned subsidiary of ours. Kineta subsequently merged with and into Kineta Operating, LLC, with Kineta Operating, LLC being the surviving corporation. On December 16, 2022, we changed our name from Yumanity Therapeutics, Inc. to Kineta, Inc. Our principal executive offices are located at 219 Terry Ave. N., Suite 300, Seattle, Washington 98109. Our telephone number is (206) 378-0400. Our website address is https://kinetabio.com. Information contained on our website or connected thereto does not constitute part of, and is not incorporated by reference into, this prospectus supplement.

Kineta, the Kineta logo and our other registered or common law trademarks, service marks or trade names appearing in this prospectus supplement are the property of Kineta. Other trademarks, service marks and trade names used in this prospectus supplement are the property of their respective owners.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act since the market value of our shares held by non-affiliates is less than $700 million and our annual revenue was less than $100 million during the most recently completed fiscal year. We may continue to be a smaller reporting company after this offering if either (i) the market value of our shares held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our shares held by non-affiliates is less than $700 million. As a “smaller reporting company,” we have elected to take advantage of certain of the scaled disclosure available for smaller reporting companies in this prospectus supplement as well as our filings under the Exchange Act, including that we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and have reduced disclosure obligations regarding executive compensation, and, if we are a smaller reporting company with less than $100 million in annual revenue, we would not be required to obtain an attestation report on internal control over financial reporting issued by our independent registered public accounting firm.

Recent Developments

Private Placement of Purchase Warrants

In a concurrent private placement, we are also issuing to the purchasers of the Shares and Pre-Funded Warrants, warrants to purchase up to 890,208 shares of Common Stock. The Purchase Warrants have an exercise price of $3.25 per share, are exercisable immediately following issuance and will have a term of five and one-half years from the initial exercise date.

Nasdaq Compliance

As previously disclosed, on June 27, 2023, we received written notice from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) stating that the Company is not in compliance with Nasdaq Listing Rule 5550(b)(2) because the Company had not maintained a minimum Market Value of Listed Securities of at least $35 million for the last 30 consecutive business days.

On August 15, 2023, we received written notice from the Listing Qualifications Department of Nasdaq notifying the Company that, based on its Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, the Company has regained compliance with the alternative standard under Nasdaq Listing Rule 5550(b)(1). Nasdaq considers the matter closed.

THE OFFERING

|

|

Issuer |

Kineta, Inc. |

Securities offered by us |

110,000 shares of our Common Stock Pre-Funded Warrants to purchase up to 780,208 shares of Common Stock at an exercise price of $0.001 per share. Each Pre-Funded Warrant will be exercisable immediately upon issuance and will not expire until exercised in full. This prospectus supplement also relates to the offering of the shares of Common Stock issuable upon exercise of such Pre-Funded Warrants. See “Description of Securities That We Are Offering—Pre-Funded Warrants” for a discussion on the terms of the Pre-Funded Warrants. |

Offering price per Share or Pre-Funded Warrant |

$3.37 per Share and $3.369 per Pre-Funded Warrant |

Common stock to be outstanding after this offering |

10,622,671 shares (1) |

Use of proceeds |

We estimate the net proceeds to us from this offering will be approximately $2.6 million after deducting estimated offering expenses payable by us. We currently intend to use the net proceeds from this offering for general corporate purposes. General corporate purposes may include funding research, clinical development, including for KVA12123, working capital, capital expenditures and other purposes. See “Use of Proceeds.” |

Concurrent Private Placement |

In a concurrent private placement, we are selling to the investors purchasing the Shares and Pre-Funded Warrants in this offering Purchase Warrants to purchase up to 890,208 shares of Common Stock at an exercise price of $3.25 per share. The Purchase Warrants are exercisable immediately following issuance and will have a term of five and one-half years from the initial exercise date. We will receive gross proceeds from exercise of the Purchase Warrants in such concurrent private placement transaction solely to the extent such Purchase Warrants are exercised for cash. The Purchase Warrants and the shares of Common Stock issuable upon the exercise of the Purchase Warrants are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act. There is no established public trading market for the Purchase Warrants, and we do not expect a market to develop. In addition, we do not intend to list the Purchase Warrants on The Nasdaq Capital Market, any other national securities exchange or any other nationally recognized trading system. See “Private Placement Transaction.” |

|

|

Risk factors |

You should read the “Risk Factors” section of this prospectus supplement and in the documents incorporated by reference in this prospectus supplement for a discussion of factors to consider before deciding to purchase shares of our Common Stock. |

Nasdaq Capital Market symbol |

“KA” |

____________________

(1) Includes the shares underlying the Pre-Funded Warrants but excludes the shares underlying the Purchase Warrants and Placement Agent Warrants (as defined below).

The number of shares of our Common Stock that will be outstanding immediately after this offering as shown above is based on 9,732,463 shares of Common Stock issued and outstanding as of June 30, 2023 and, unless otherwise indicated, excludes:

•1,959,262 shares of Common Stock issuable upon the exercise of stock options outstanding as of June 30, 2023, at a weighted-average exercise price of $10.10 per share;

•9,809 shares of Common Stock issuable upon the settlement of restricted stock units outstanding as of June 30, 2023;

•2,294,982 shares of Common Stock issuable upon the exercise of warrants outstanding as of June 30, 2023, at a weighted-average exercise price of $4.83 per share;

•1,047,339 shares of Common Stock reserved for future issuance under the 2022 Equity Incentive Plan as of June 30, 2023;

•890,208 shares of Common Stock issuable upon the exercise of the Purchase Warrants offered in the concurrent private placement with an exercise price of $3.25 per share as described under “Private Placement Transaction”; and

•44,510 shares of Common Stock issuable upon the exercise of warrants issued to the placement agent as described in “Plan of Distribution” (the “Placement Agent Warrants”).

RISK FACTORS

Investing in our securities involves significant risks and uncertainties. Before making an investment decision, you should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus supplement, the accompanying prospectus and any subsequent updates described in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as the risks, uncertainties and additional information set forth in the other reports and documents incorporated by reference in this prospectus supplement and the accompanying prospectus. For a description of these reports and documents, and information about where you can find them, see “Where You Can Find Additional Information” and “Incorporation by Reference.”

We could be materially and adversely affected by any or all of these risks or by additional risks and uncertainties not presently known to us or that we currently deem immaterial that may adversely affect us or a particular offering in the future.

Risks Related to this Offering

We have broad discretion in the use of our available cash and other sources of funding, including the net proceeds from this offering, and may not use them effectively.

Our management has broad discretion in the use of our available cash and other sources of funding, including the net proceeds we receive in this offering and could spend those resources for purposes other than those described in the “Use of Proceeds” portion of this prospectus supplement, and in ways that do not improve our results of operations or enhance the value of our Common Stock. The failure by our management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the price of our Common Stock to decline and delay the development of our product candidates. Pending use in our operations, we may invest our available cash, including the net proceeds we receive in this offering, in a manner that does not produce income or that loses value.

If you purchase shares of our Common Stock and Pre-Funded Warrants sold in this offering, you may experience immediate and substantial dilution in the net tangible book value of your shares. In addition, we may issue additional equity or convertible debt securities in the future, which may result in additional dilution to investors.

The price per share of our Common Stock being offered may be higher than the net tangible book value per share of our outstanding Common Stock prior to this offering. Based on an aggregate of 110,000 shares of our Common Stock sold at a price of $3.37 per share and Pre-Funded Warrants to purchase 780,208 shares of Common Stock sold at a price of $3.369 per Pre-Funded Warrant, for aggregate gross proceeds of approximately $3.0 million, and after deducting commissions and estimated offering expenses payable by us, new investors in this offering will incur immediate dilution of $2.82 per share. For a more detailed discussion of the foregoing, see the section entitled “Dilution” below.

In addition, to raise additional capital in the future, we believe that we may offer and issue additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock in the future. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock in future transactions may be higher or lower than the price per share in this offering. We also have a significant number of stock options and warrants outstanding. To the extent that outstanding stock options or warrants have been or may be exercised or other shares issued, you may experience additional dilution.

Further, as we grow our business, we may seek to rely more heavily on capital raising transactions to fund our operations, raise capital to retire any debt we may hereafter incur, for other corporate purposes, or due to market

conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans.

There is no public market for the Pre-Funded Warrants to purchase shares of our Common Stock being offered in this offering.

There is no established public trading market for the Pre-Funded Warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the Pre-Funded Warrants on any national securities exchange or other nationally recognized trading system, including The Nasdaq Capital Market. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited.

The Pre-Funded Warrants purchased in this offering do not entitle the holder to any rights as common stockholders until the holder exercises the warrant for shares of our Common Stock, except as set forth in the Pre-Funded Warrants.

Until you acquire shares of our Common Stock upon exercise of your Pre-Funded Warrants purchased in this offering, such warrants will not provide you any rights as a common stockholder, except as set forth therein. Upon exercise of your Pre-Funded Warrants purchased in this offering, you will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs on or after the exercise date.

The Pre-Funded Warrants are speculative in nature.

The Pre-Funded Warrants offered hereby do not confer any rights of Common Stock ownership on their holders, such as voting rights, but rather merely represent the right to acquire shares of Common Stock at a fixed price. Specifically, commencing on the date of issuance, holders of the Pre-Funded Warrants may acquire the shares of Common Stock issuable upon exercise of such warrants at an exercise price of $0.001 per share of Common Stock. Moreover, following this offering, the market value of the Pre-Funded Warrants is uncertain and there can be no assurance that the market value of the Pre-Funded Warrants will equal or exceed their public offering price.

Provisions of the Pre-Funded Warrants offered by this prospectus could discourage an acquisition of us by a third party.

Certain provisions of the Pre-Funded Warrants offered by this prospectus could make it more difficult or expensive for a third party to acquire us. The Pre-Funded Warrants prohibit us from engaging in certain transactions constituting “fundamental transactions” unless, among other things, the surviving entity assumes our obligations under the Pre-Funded Warrants. These and other provisions of the Pre-Funded Warrants offered by this prospectus could prevent or deter a third party from acquiring us even where the acquisition could be beneficial to stockholders.

Our stock price is volatile, and your investment may suffer a decline in value.

The closing market price for our Common Stock has varied between a high of $15.05 on December 6, 2022, and a low of $1.84 on August 10, 2023, in the twelve-month period ended October 2, 2023 (in each case, after giving effect to our 1-for-7 reverse stock split effected on December 16, 2022). As a result of fluctuations in the price of our Common Stock, you may be unable to sell your shares at or above the price you paid for them. The market price of our Common Stock is likely to continue to be volatile and subject to significant price and volume fluctuations in response to market, industry and other factors, including the risk factors described under the caption “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2022 and any subsequent updates described in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as the risks, uncertainties and additional information set forth in the other reports and documents incorporated by reference in this prospectus supplement. The market price of our Common Stock may also be dependent upon the valuations and recommendations of the analysts who cover our business. If the results of our business do not meet these analysts’ forecasts, the expectations of investors or the financial guidance we provide to investors in any period, the market price of our Common Stock could decline.

In addition, the stock markets in general, and the markets for biotechnology stocks in particular, have experienced significant volatility that has often been unrelated to the financial condition or results of operations of particular companies. These broad market fluctuations may adversely affect the trading price of our Common Stock and, consequently, adversely affect the price at which you could sell the shares of Common Stock that you purchase in this offering. In the past, following periods of volatility in the market or significant price declines, securities class-action litigation has often been instituted against companies. Such litigation, if instituted against us, could result in substantial costs and diversion of management’s attention and resources, which could materially and adversely affect our business, financial condition, results of operations and growth prospects.

Future sales of our Common Stock in the public market or other financings could cause our stock price to fall, and a substantial number of shares of Common Stock may be sold in the market following this offering, which may depress the market price for our Common Stock.

Sales of a substantial number of shares of our Common Stock in the public market, the perception that these sales might occur, or other financings could depress the market price of our Common Stock and could impair our ability to raise capital through the sale of additional equity securities. A substantial portion of the outstanding shares of our Common Stock are freely tradable without restriction or further registration under the Securities Act unless these shares are owned or purchased by “affiliates” as that term is defined in Rule 144, promulgated under the Securities Act (“Rule 144”). In addition, shares of Common Stock issuable upon exercise of outstanding warrants and options, as well as shares reserved for future issuance under our incentive stock plan, will be eligible for sale in the public market to the extent permitted by applicable vesting requirements, if any, and, in some cases, subject to compliance with the requirements of Rule 144. As a result, these shares will be eligible to be freely sold in the public market upon issuance, subject to restrictions under the securities laws.

Because we do not currently intend to declare cash dividends on our shares of Common Stock in the foreseeable future, stockholders must rely on appreciation of the value of our Common Stock for any return on their investment.

We do not currently anticipate declaring or paying any cash dividends in the foreseeable future. In addition, the terms of any existing or future debt agreements may preclude us from paying dividends. As a result, we expect that only appreciation of the price of our Common Stock, if any, will provide a return to existing stockholders for the foreseeable future.

Resales of our Common Stock in the public market during this offering by our stockholders may cause the market price of our Common Stock to fall.

We may issue Common Stock from time to time. This issuance from time to time of these new shares of our Common Stock, or our ability to issue these shares of Common Stock in this offering, could result in resales of our Common Stock by our current stockholders concerned about the potential dilution of their holdings. In turn, these resales could have the effect of depressing the market price for our Common Stock.

The market price of our Common Stock may be adversely affected by market conditions affecting the stock markets in general, including price and trading fluctuations on Nasdaq.

Market conditions may result in volatility in the level of, and fluctuations in, market prices of stocks generally and, in turn, our Common Stock and sales of substantial amounts of our Common Stock in the market, in each case being unrelated or disproportionate to changes in our operating performance. A weak global economy or other circumstances, such as changes in tariffs and trade, could also contribute to extreme volatility of the markets, which may have an effect on the market price of our Common Stock.

Risks Related to Our Existing Private Placement

The second closing of the June 2022 Private Placement may not close as anticipated.

As previously disclosed, on June 5, 2022, we entered into a financing agreement, as amended on October 24, 2022, December 5, 2022, March 29, 2023, May 1, 2023 and July 21, 2023, with certain investors to sell shares of our common stock to such investors in a private placement (the “June 2022 Private Placement”). The first closing of the June 2022 Private Placement occurred on December 16, 2022 and we issued 649,346 shares of our common stock and received net proceeds of $7.4 million. The second closing of the June 2022 Private Placement (the “Second Closing”) for an aggregate purchase price of $22.5 million is scheduled to occur on October 31, 2023. We may further amend the June 2022 Private Placement to close at a later date based on our funding needs. No assurance can be provided that the Second Closing will occur as anticipated or at all. If we do not consummate the Second Closing, it may have a material adverse effect on our business, financial condition and results of operations.

USE OF PROCEEDS

We estimate that the net proceeds from the sale of the 110,000 shares of Common Stock and the Pre-Funded Warrants to purchase 780,208 shares of Common Stock that we are offering will be approximately $2.6 million, after deducting the estimated placement agent fees and estimated offering expenses payable by us.

We will only receive additional proceeds from the exercise of the Purchase Warrants issuable in connection with the private placement if the Purchase Warrants are exercised and the holders of such Purchase Warrants pay the exercise price in cash upon such exercise and do not utilize the cashless exercise provision of the Purchase Warrants.

We currently intend to use the net proceeds from this offering for general corporate purposes. General corporate purposes may include funding research, clinical development, including for KVA12123, working capital, capital expenditures and other general corporate purposes.

The amounts and timing of our use of the net proceeds from this offering will depend on a number of factors, such as the timing and progress of our research and development efforts for KVA12123, the timing and progress of any clinical trial activities, partnering, or future commercialization efforts, technological advances and the competitive environment for KVA12123, among other things. Accordingly, our management will have broad discretion in the timing and application of these proceeds. We may find it necessary or advisable to use the net proceeds from this offering for other purposes, and we will have broad discretion in the application of net proceeds.

We do not expect that the net proceeds from this offering, together with our existing cash, cash equivalents and investments, will be sufficient to enable us to fund the completion of development of any of our product candidates.

Pending the use of the net proceeds from this offering, we may invest the net proceeds in short-term, investment-grade, interest-bearing securities, or certificates of deposit.

DIVIDEND POLICY

We do not currently intend to pay cash dividends on our Common Stock in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements and other factors our board of directors deems relevant.

DILUTION

If you invest in our Common Stock in this offering, your interest will be diluted immediately to the extent of the difference between the offering price and the as adjusted net tangible book value per share of our Common Stock after this offering.

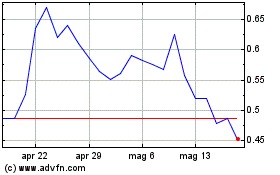

Our net tangible book value on June 30, 2023 was approximately $3,286,000, or $0.34 per share of our Common Stock. Our net tangible book value is the amount of our total tangible assets less our total liabilities. Net tangible book value per share represents net tangible book value divided by the total number of shares of our Common Stock outstanding as of June 30, 2023. Dilution with respect to net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of Common Stock in this offering and the as adjusted net tangible book value per share of our Common Stock immediately after this offering.

After giving effect to the sale of 110,000 shares of our Common Stock in this offering at an offering price of $3.37 per share and the sale of Pre-Funded Warrants to purchase 780,208 shares of Common Stock at an offering price of $3.369 per Pre-Funded Warrant and the issuance of the shares of Common Stock underlying the Pre-Funded Warrants upon the exercise thereof and after deducting estimated offering commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2023 would have been approximately $5.9 million, or $0.55 per share. This represents an immediate increase in as adjusted net tangible book value of $0.21 per share to existing stockholders and an immediate dilution of $2.82 per share to new investors purchasing securities in this offering. The following table illustrates this per share dilution:

|

|

|

|

|

|

|

|

|

Offering price per share of Common Stock |

|

|

|

|

$ |

3.37 |

|

Net tangible book value per share as of June 30, 2023 |

|

$ |

0.34 |

|

|

|

|

Increase in net tangible book value per share attributable to new investors purchasing our Common Stock in this offering |

|

|

0.21 |

|

|

|

|

As adjusted net tangible book value per share as of June 30, 2023, after giving effect to this offering |

|

|

|

|

|

0.55 |

|

Dilution per share to investors purchasing our Common Stock in this offering |

|

|

|

|

$ |

2.82 |

|

The table and discussion above are based on 9,732,463 shares of Common Stock issued and outstanding as of June 30, 2023 and excludes as of that date:

•1,959,262 shares of Common Stock issuable upon the exercise of stock options outstanding as of June 30, 2023, at a weighted-average exercise price of $10.10 per share;

•9,809 shares of Common Stock issuable upon the settlement of restricted stock units outstanding as of June 30, 2023;

•2,294,982 shares of Common Stock issuable upon the exercise of warrants outstanding as of June 30, 2023, at a weighted-average exercise price of $4.83 per share;

•1,047,339 shares of Common Stock reserved for future issuance under the 2022 Equity Incentive Plan as of June 30, 2023;

•890,208 shares of Common Stock issuable upon the exercise of the Purchase Warrants offered in the concurrent private placement with an exercise price of $3.25 per share as described under “Private Placement Transaction”; and

•44,510 shares of Common Stock issuable upon the exercise of the Placement Agent Warrants.

To the extent that options or restricted stock units outstanding as of June 30, 2023 have been or may be exercised or settle, as applicable, or other shares are issued, investors purchasing our Common Stock in this offering may experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

DESCRIPTION OF SECURITIES THAT WE ARE OFFERING

Common Stock

See “Description of Capital Stock—Common Stock” on page 11 of the accompanying prospectus for a description of the material terms of our Common Stock.

Pre-Funded Warrants

The following summary of certain terms and provisions of the Pre-Funded Warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by the provisions of, the Pre-Funded Warrants. You should carefully review the terms and provisions of the form of the Pre-Funded Warrant for a complete description of the terms and conditions of the Pre-Funded Warrants.

Duration and Exercise Price. The Pre-Funded Warrants offered hereby will entitle the holder thereof to purchase up to an aggregate of 780,208 shares of our Common Stock at an exercise price of $0.001 per share, commencing immediately on the date of issuance. The Pre-Funded Warrants will be issued separately from the Common Stock and may be transferred separately immediately thereafter.

Exercisability. The Pre-Funded Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of Common Stock purchased upon such exercise (except in the case of a cashless exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s warrants to the extent that the holder would own more than 4.99% (or, at the election of the holder, 9.99%) of our outstanding shares of Common Stock immediately after exercise, except that upon notice from the holder to us, the holder may increase or decrease the amount of ownership of outstanding shares of Common Stock after exercising the holder’s Pre-Funded Warrants up to 9.99% of the number of shares of Common Stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrants, provided that any increase in this limitation shall not be effective until 61 days after notice to us.

Cashless Exercise. In lieu of making the cash payment otherwise contemplated to be made to us upon the exercise of a Pre-Funded Warrant in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of Common Stock determined according to a formula set forth in the Pre-Funded Warrant.

Exercise Price Adjustment. The exercise price of the Pre-Funded Warrants is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our Common Stock.

Fundamental Transaction. In the event of any fundamental transaction, as described in the Pre-Funded Warrants and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our shares of Common Stock, then upon any subsequent exercise of a Pre-Funded Warrant, the holder will have the right to receive as alternative consideration, for each share of Common Stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of Common Stock of the successor or acquiring corporation or of our Company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of shares of Common Stock for which the Pre-Funded Warrant is exercisable immediately prior to such event.

Transferability. In accordance with its terms and subject to applicable laws, a Pre-Funded Warrant may be transferred at the option of the holder upon surrender of the Pre-Funded Warrant to us together with the appropriate instruments of transfer and payment of funds sufficient to pay any transfer taxes (if applicable).

Fractional Shares. No fractional shares of Common Stock will be issued upon the exercise of the Pre-Funded Warrants. Rather, the number of shares of Common Stock to be issued will, at our election, either be

rounded up to the nearest whole number or we will pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the exercise price.

Exchange Listing. There is no established trading market for the Pre-Funded Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Pre-Funded Warrants on any national securities exchange or other trading market. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited.

Rights as a Stockholder. Except as otherwise provided in the Pre-Funded Warrants or by virtue of such holder’s ownership of shares of our Common Stock, the holder of a Pre-Funded Warrants does not have the rights or privileges of a holder of our Common Stock, including any voting rights, until the holder exercises the Pre-Funded Warrant.

PRIVATE PLACEMENT TRANSACTION

In a concurrent private placement, we plan to issue and sell to the investors the Purchase Warrants to purchase up to an aggregate of 890,208 shares of Common Stock at an exercise price equal to $3.25 per share.

The Purchase Warrants and the shares of Common Stock issuable upon the exercise of such warrants are not being registered under the Securities Act, are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act. Accordingly, investors may only sell shares of Common Stock issued upon exercise of the Purchase Warrants pursuant to an effective registration statement under the Securities Act covering the resale of those shares, an exemption under Rule 144 under the Securities Act or another applicable exemption under the Securities Act.

Exercisability. The Purchase Warrants are exercisable immediately following issuance and will have a term of five and one-half (5.5) years from the initial exercise date. The Purchase Warrants will be exercisable, at the option of the holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement registering the issuance of shares of Common Stock underlying the Purchase Warrants under the Securities Act is effective and available for the issuance of such shares, or an exemption from registration under the Securities Act is available for the issuance of such shares, by payment in full in immediately available funds for the number of Shares of Common Stock purchased upon such exercise. If at the time of exercise there is no effective registration statement registering, or the prospectus contained therein is not available for the issuance of the shares of Common Stock underlying the Purchase Warrants, then the Purchase Warrants may also be exercised, in whole or in part, at such time by means of a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of Common Stock determined according to the formula set forth in the warrant.

Exercise Limitation. A holder will not have the right to exercise any portion of the Purchase Warrants if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or, upon election of the holder, 9.99%) of the number of our shares of Common Stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Purchase Warrants. However, any holder may increase or decrease such percentage, but in no event may such percentage be increased to more than 9.99%, provided that any increase will not be effective until the 61st day after such election.

Exercise Price Adjustment. The exercise price of the Purchase Warrants is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our shares of Common Stock.

Transferability. Subject to applicable laws, the Purchase Warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange Listing. There is no established trading market for the Purchase Warrants, and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Purchase Warrants on any national securities exchange or other trading market.

Fundamental Transactions. In the event of any fundamental transaction, as described in the Purchase Warrants and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our shares of Common Stock, then upon any subsequent exercise of a Purchase Warrant, the holder will have the right to receive as alternative consideration, for each share of Common Stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of shares of Common Stock of the successor or acquiring corporation of our company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of shares of Common Stock for which the Purchase Warrant is exercisable immediately prior to such event.

Notwithstanding the foregoing, in the event of a fundamental transaction, we or a successor entity shall, at the holder’s option, exercisable at any time concurrently or within thirty (30) days following the consummation of a fundamental transaction, purchase the Purchase Warrant by paying to the holder an amount equal to the Black

Scholes Value (as defined in each Purchase Warrant) of the remaining unexercised portion of the Purchase Warrant on the date of the fundamental transaction. If the fundamental transaction is not within our control, the holders of the Purchase Warrants will only be entitled to receive from us or a successor entity the same type or form of consideration (and in the same proportion), at the Black Scholes Value of the unexercised portion of the Purchase Warrant, that is being offered and paid to the holders of our Common Stock in connection with the fundamental transaction, whether that consideration is in the form of cash, stock or any combination thereof, or whether the holders of our Common Stock are given the choice to receive alternative forms of consideration in connection with the fundamental transaction.

Rights as a Stockholder. Except as otherwise provided in the Purchase Warrants or by virtue of such holder’s ownership of our Common Stock, the holder of a Purchase Warrant will not have the rights or privileges of a holder of our Common Stock, including any voting rights, until the holder exercises the warrant.

Resale Registration Rights. We have entered into a securities purchase agreement directly with certain institutional investors that have agreed to purchase our securities in this offering. We are required within 45 days of the date of the securities purchase agreement to file a registration statement providing for the resale of the shares of Common Stock issued and issuable upon the exercise of the Purchase Warrants. We are required to use commercially reasonable efforts to cause such registration to become effective within 181 days of the closing of the offering and to keep such registration statement effective at all times until no investor owns any Purchase Warrants or shares issuable upon exercise thereof.

You should review a copy of the securities purchase agreement and a copy of the form of the Purchase Warrant to be issued to the investors under the securities purchase agreement, which are executed or issued in connection with this offering and will be filed as exhibits to a Current Report on Form 8-K that we file with the SEC, for a complete description of the terms and conditions of the Purchase Warrants and the related transaction agreements.

PLAN OF DISTRIBUTION

Pursuant to an engagement letter agreement dated September 27, 2023, we have engaged H.C. Wainwright & Co., LLC, referred to herein as Wainwright or the placement agent, to act as our exclusive placement agent in connection with this offering. Under the terms of the engagement letter, Wainwright is not purchasing the securities offered by us in this offering, and is not required to sell any specific number or dollar amount of securities, but will assist us in this offering on a reasonable best efforts basis. The terms of this offering were subject to market conditions and negotiations between us, Wainwright and prospective investors. Wainwright will have no authority to bind us by virtue of the engagement letter. Wainwright may engage sub-agents or selected dealers to assist with this offering. We may not sell the entire amount of our shares of Common Stock offered pursuant to this prospectus supplement.

The placement agent proposes to arrange for the sale of the securities we are offering pursuant to this prospectus supplement and accompanying prospectus to one or more institutional or accredited investors through securities purchase agreements directly between the purchaser and us. We will only sell to such investors who have entered into the securities purchase agreement with us.

Delivery of the securities offered hereby is expected to take place on or about October 5, 2023, subject to satisfaction of customary closing conditions.

Fees and Expenses

We have agreed to pay the placement agent a cash fee of 7.0% of the aggregate gross proceeds raised in the offering. The following table shows the per share and total cash fees we will pay to the placement agent in connection with the sale of our securities offered pursuant to this prospectus supplement and the accompanying prospectus, assuming the purchase of all of the securities offered hereby.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share |

|

|

Per Pre-Funded Warrant |

|

|

Total |

|

Public offering price |

|

$ |

3.37 |

|

|

$ |

3.369 |

|

|

$ |

3,000,001 |

|

Placement agent fees (1) |

|

$ |

0.2359 |

|

|

$ |

0.2358 |

|

|

$ |

210,000 |

|

Proceeds, before expenses, to us |

|

$ |

3.1341 |

|

|

$ |

3.1332 |

|

|

$ |

2,790,001 |

|

_____________

(1) As described in the engagement letter, the placement agent fee may be reduced to 3.5% of the aggregate gross proceeds raised from the sale of securities to certain individuals or entities.

We have also agreed to pay the placement agent up to $50,000 for fees and expenses of legal counsel and other out-of-pocket expenses, up to $35,000 for non-accountable expenses and a $15,950 clearing fee. We estimate the total offering expenses of this offering that will be payable by us, excluding the placement agent’s fees and expenses, will be approximately $96,000.

In addition, we will issue to the placement agent, or its designees, warrants to purchase up to 44,510 shares of Common Stock. The Placement Agent Warrants will have an exercise price equal to $4.2125 and will be exercisable for five years from the commencement of sales in this offering.

The securities purchase agreement that we entered into with certain investors prohibits us: (i) for sixty (60) days following the closing date from issuing any shares of Common Stock or Common Stock Equivalents (as defined in the securities purchase agreement) or filing any registration statement (other than pursuant to the securities purchase agreement or on a Form S-8), subject to certain exceptions, and (ii) for six (6) months following the closing date from issuing any shares of Common Stock or Common Stock Equivalents in a Variable Rate Transaction (as defined in the securities purchase agreement).

We have granted Wainwright, subject to certain conditions and exceptions, a right of first refusal for a period of twelve (12) months following the consummation of this offering to act as our sole book-runner, manager, placement agent, or agent on any debt financing or refinancing or public or private offering for any further capital raising transactions undertaken by us or any of our subsidiaries.

In the event that any investor whom the placement agent had contacted during the term of its engagement or introduced to the Company during the term of our engagement of the placement agent provides any capital to us, in a public or private offering or other financing or capital-raising transaction of any kind, within the twelve (12) months following the expiration of termination of the engagement of the placement agent, we shall pay the placement agent the cash and warrant compensation provided above, calculated in the same manner.

We have agreed to indemnify the placement agent and specified other persons against certain liabilities relating to or arising out of the placement agent’s activities under its engagement letter, including liabilities under the Securities Act, and to contribute to payments that the placement agent may be required to make in respect of such liabilities.

The placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the sale of our securities offered hereby by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. The placement agent will be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of our securities by the placement agent. Under these rules and regulations, the placement agent may not (i) engage in any stabilization activity in connection with our securities; and (ii) bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until they have completed their participation in the distribution.

From time to time, the placement agent or its affiliates may provide in the future various advisory, investment and commercial banking and other services to us in the ordinary course of business, for which they have received and may continue to receive customary fees and commissions. However, except as disclosed in this prospectus supplement, we have no present arrangements with the placement agent for any further services.

Transfer Agent

The Transfer Agent and Registrar for our Common Stock is Equiniti Trust Company, LLC (formerly American Stock Transfer & Trust Company, LLC).

Listing

Our shares of Common Stock trade on The Nasdaq Capital Market under the ticker symbol “KA.” We do not intend to apply for listing of the Pre-Funded Warrants or the Purchase Warrants on any securities exchange or other nationally recognized trading system.

LEGAL MATTERS

The validity of the securities offered hereby will be passed upon for us by Orrick, Herrington & Sutcliffe LLP, Boston, Massachusetts. Ellenoff Grossman & Schole LLP, New York, New York is counsel to the placement agent in connection with this offering.

EXPERTS

The consolidated financial statements of Kineta, Inc. as of December 31, 2022 and 2021 and for each of the two years then ended, incorporated in this prospectus supplement by reference to the Annual Report on Form 10-K for the year ended December 31, 2022, have been audited by Marcum LLP, an independent registered public accounting firm, as stated in their report thereon, included therein, and incorporated by reference in the prospectus and registration statement in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an internet website at http://www.sec.gov that contains periodic and current reports, proxy and information statements, and other information regarding registrants that file electronically with the SEC. Copies of certain information filed by us with the SEC are also available on our website at https://kinetabio.com/. Our website is not a part of this prospectus supplement and is not incorporated by reference in this prospectus supplement.

This prospectus supplement and the accompanying prospectus are part of a registration statement we filed with the SEC. This prospectus supplement and the accompanying prospectus omit some information contained in the registration statement in accordance with SEC rules and regulations. You should review the information and exhibits in the registration statement for further information on us and our consolidated subsidiaries and the securities we are offering. Statements in this prospectus supplement and the accompanying prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate these statements.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus supplement certain information we file with it, which means that we can disclose important information by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus supplement, and information that we file later with the SEC will automatically update and supersede information contained in this prospectus supplement and the accompanying prospectus. We incorporate by reference the documents listed below and all documents filed after the date of this prospectus supplement with the SEC pursuant to Section 13(a), 13(c), 14, or 15(d) of the Exchange Act, prior to the termination of the offering covered by this prospectus supplement (provided, however, that we are not incorporating, in each case, any documents or information deemed to have been “furnished” and not filed in accordance with SEC rules):

•Our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on March 31, 2023;

•Our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2023 and June 30, 2023 filed with the SEC on May 11, 2023 and August 11, 2023, respectively;

•Our Current Reports on Form 8-K filed with the SEC on February 10, 2023, February 24, 2023, March 1, 2023, April 14, 2023, April 21, 2023, May 2, 2023 as amended by Form 8-K/A filed on June 2, 2023, May 30, 2023, June 9, 2023, June 28, 2023, July 3, 2023, July 21, 2023, August 16, 2023 and October 3, 2023, respectively; and

•The description of our Common Stock contained in our Registration Statement on Form 8-A, filed with the SEC on February 10, 2016, as updated by the description of our Common Stock included in Exhibit 4.2 to our Annual Report on Form 10-K for the year ended December 31, 2021, filed on March 24, 2022 and as supplemented by the description of our Common Stock set forth in our Registration Statement on Form S-4, filed with the SEC on August 29, 2022, together with any subsequent amendment or report filed for the purpose of updating such description.

Any statement contained in a document incorporated by reference in this prospectus supplement or the accompanying prospectus shall be deemed to be modified or superseded to the extent that a statement contained herein, therein or in any other subsequently filed document that also is incorporated by reference herein or therein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement or the accompanying prospectus.

We will provide to each person, including any beneficial owner, to whom this prospectus supplement is delivered, upon written or oral request, at no cost to the requester, a copy of any and all of the information that has been incorporated by reference in this prospectus supplement but not delivered with the prospectus supplement.

Requests for such information should be directed to our Corporate Secretary at the address below:

Kineta, Inc.

219 Terry Ave. N., Suite 300

Seattle, WA 98109

Attention: Secretary

Telephone: (206) 378-0400

Please include your contact information with the request.