false0001445283KINETA, INC./DENASDAQ00014452832023-11-032023-11-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 3, 2023

KINETA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

001-37695 |

20-8436652 |

(State or other jurisdiction |

(Commission |

(IRS Employer |

of incorporation) |

File Number) |

Identification No.) |

219 Terry Ave. N., Suite 300 |

|

|

Seattle, WA |

|

98109 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (206) 378-0400

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class |

Trading |

Name of each exchange |

|

|

Symbol(s) |

on which registered |

|

Common Stock, par value $0.001 per share |

|

KA |

|

The Nasdaq Capital Market |

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 3, 2023, Kineta, Inc. (the “Company”) issued a press release containing information about the Company’s results of operations for the three and nine months ended September 30, 2023. A copy of this press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

No. Document

99.1 Press release issued by Kineta, Inc., dated November 3, 2023

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 3, 2023

Kineta, Inc.

|

|

By: |

/s/ Shawn Iadonato |

Name: |

Shawn Iadonato |

Title: |

Chief Executive Officer and Director |

Exhibit 99.1

Kineta Reports Third Quarter 2023 Financial Results and Provides Corporate Update

Announced positive KVA12123 monotherapy safety data from its ongoing phase 1/2 VISTA-101 clinical trial

Enrolled the first patient of KVA12123 in combination with pembrolizumab in patients with advanced solid tumors

Initial KVA12123 monotherapy clinical safety, pharmacokinetic, receptor occupancy and biomarker data to be presented at SITC 2023

Expected Cash Runway into early 2025

SEATTLE — (November 3, 2023) Kineta, Inc. (Nasdaq: KA), a clinical-stage biotechnology company focused on the development of novel immunotherapies in oncology that address cancer immune resistance, today reported financial results for the third quarter ended September 30, 2023 and provided a corporate update.

“We are thrilled to share the significant progress made during the third quarter of 2023, highlighted by announcing, in September, initial monotherapy data from our VISTA-101 clinical trial evaluating KVA12123 in patients with advanced solid tumors. Additionally, we initiated Part B of the study enrolling the first patient in combination with pembrolizumab” said Shawn Iadonato, Ph.D., Chief Executive Officer of Kineta. “We continue to execute the VISTA-101 trial on time and on budget as we remain laser focused on advancing this promising new immunotherapy for cancer patients.”

RECENT CORPORATE HIGHLIGHTS

KVA12123

•Announced positive KVA12123 monotherapy safety data from its ongoing Phase 1/2 VISTA-101 clinical trial in patients with advanced solid tumors

•Enrolled the first patient in Part B of its VISTA-101 Phase 1/2 clinical trial evaluating the safety and tolerability of KVA12123 in combination with Merck’s anti-PD-1 therapy KEYTRUDA® (pembrolizumab) in patients with advanced solid tumors

•Continued recruitment of new patients in monotherapy and combination cohorts in its ongoing VISTA-101 phase 1/2 clinical study evaluating KVA12123 as a monotherapy and in combination with pembrolizumab in patients with advanced solid tumors

•Announced new research agreement with Fred Hutchinson Cancer Center to evaluate VISTA expression as a potential biomarker in cancer patients from Kineta’s ongoing VISTA-101 Phase 1/2 clinical trial

•Abstract accepted for KVA12123 poster presentation of monotherapy clinical data from VISTA-101 Phase 1/2 clinical trial at Society for Immunotherapy of Cancer 38th annual meeting in November 2023 ("SITC 2023")

•Thierry Guillaudeux PhD, Chief Scientific Officer of Kineta, co-authored a publication titled “Clinical and research updates on the VISTA immune checkpoint: immuno-oncology themes and highlights” in Frontiers in Oncology

•Presented preclinical data on VISTA blocking KVA12123 at Immuno US 2023

CD27 monoclonal antibody (mAb) Program

•Abstract accepted for poster presentation of preclinical data on lead anti-CD27 agonist mAb at SITC 2023

•Presented new preclinical data on lead anti-CD27 agonist antibody at AACR special conference on tumor immunology and immunotherapy

Business

•Closed $3 million registered direct offering priced at-the-market under Nasdaq rules in October 2023

ANTICIPATED FUTURE MILESTONES

•Initial KVA12123 monotherapy clinical safety, pharmacokinetic, receptor occupancy and biomarker data to be presented at SITC 2023

oAdditional KVA12123 monotherapy safety and efficacy data

oInitial KVA12123 and pembrolizumab combination therapy data

THIRD QUARTER AND YEAR-TO-DATE 2023 FINANCIAL HIGHLIGHTS

•Cash position: As of September 30, 2023, cash was $7.6 million, compared to $13.1 million as of December 31, 2022. The decrease was primarily due to cash used for clinical trial development of KVA12123 as well as general corporate purposes, partially offset by $5.5 million net proceeds received from the registered direct offering in April 2023 and $5.0 million in cash received from the Merck milestone payment in July 2023. We believe our cash position as of September 30, 2023, together with the $2.7 million in cash received in October 2023 from the registered direct offering plus the committed proceeds of $22.5 million pursuant to the second closing of the private placement expected in April 2024, will be sufficient to fund operating expenses and capital expenditure requirements into early 2025.

•Revenues: Total revenues were zero for the three months ended September 30, 2023 compared to $0.2 million for the three months ended September 30, 2022 and were $5.4 million for the nine months ended September 30, 2023 compared to $1.5 million for the nine months ended September 30, 2022. Revenues in 2023 were primarily due to our achievement of a development milestone under the Merck Exclusive License and Research Collaboration Agreement in the second quarter, which triggered a $5.0 million milestone payment. Revenues

in 2022 were primarily due to research and development services from the Genentech Option and License Agreement, which was terminated in December 2022.

•Research and development (R&D) expense: R&D expenses were $1.9 million for the three months ended September 30, 2023 compared to $2.6 million for the three months ended September 30, 2022 and were $7.5 million for the nine months ended September 30, 2023 compared to $10.5 million for the nine months ended September 30, 2022. The decreases in R&D expenses were primarily due to lower activities for KVA12123 manufacturing and clinical study start up as the company began enrolling the first patient in the study, which occurred in April 2023. The company expects R&D expenses to increase over time this year as additional patients are enrolled and dosed.

•General and administrative expense: General and administrative expenses were $2.1 million for the three months ended September 30, 2023 compared to $2.0 million for the three months ended September 30, 2022 and were $9.4 million for the nine months ended September 30, 2023 compared to $5.5 million for the nine months ended September 30, 2022. The increases were primarily due to higher personnel-related costs from non-cash stock-based compensation for stock options issued during 2023 and increased public company expenses such as professional services fees and insurance.

•Net loss: Net loss was $5.3 million, or $0.46 per basic and diluted share, for the three months ended September 30, 2023, compared to a net loss of $5.7 million, or $1.14 per basic and diluted share, for the three months ended September 30, 2022. Net loss was $11.4 million, or $1.09 per basic and diluted share, for the nine months ended September 30, 2023, compared to a net loss of $16.5 million, or $3.42 per basic and diluted share, for the nine months ended September 30, 2022.

About Kineta

Kineta (Nasdaq: KA) is a clinical-stage biotechnology company with a mission to develop next-generation immunotherapies that transform patients’ lives. Kineta has leveraged its expertise in innate immunity and is focused on discovering and developing potentially differentiated immunotherapies that address the major challenges with current cancer therapy. For more information on Kineta, please visit www.kinetabio.com, and follow Kineta on Twitter, LinkedIn and Facebook.

Cautionary Statements Regarding Forward-Looking Statements:

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The use of words such as, but not limited to, “believe,” “expect,” “estimate,” “project,” “intend,” “future,” “potential,” “continue,” “may,” “might,” “plan,” “will,” “should,” “seek,” “anticipate,” or “could” and other similar words or expressions are intended to identify forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on Kineta’s current beliefs, expectations and assumptions regarding the future of Kineta’s business, future plans and strategies, clinical results and other future conditions. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements.

Such forward-looking statements are subject to a number of material risks and uncertainties including, but not limited to: the adequacy of Kineta’s capital to support its future operations (including its ability to complete the second tranche of the previously disclosed contemplated private placement in the second quarter of 2024) and its ability to successfully initiate and complete clinical trials; the difficulty in predicting the time and cost of development of Kineta’s product candidates; Kineta’s plans to research, develop and commercialize its current and future product candidates, including, but not limited to, KVA12123; the

timing and anticipated results of Kineta’s planned pre-clinical studies and clinical trials and the risk that the results of Kineta’s pre-clinical studies and clinical trials may not be predictive of future results in connection with future studies or clinical trials; the timing of the availability of data from Kineta’s clinical trials; the timing of any planned investigational new drug application or new drug application; the risk of cessation or delay of any ongoing or planned clinical trials of Kineta or its collaborators; the clinical utility, potential benefits and market acceptance of Kineta’s product candidates; Kineta’s commercialization, marketing and manufacturing capabilities and strategy; developments and projections relating to Kineta’s competitors and its industry; the impact of government laws and regulations; the timing and outcome of Kineta’s planned interactions with regulatory authorities; Kineta’s ability to protect its intellectual property position; Kineta’s estimates regarding future revenue, expenses, capital requirements and need for additional financing; the intended use of proceeds from the registered direct offering completed in April 2023 and October 2023; and those risks set forth under the caption “Risk Factors” in the company’s most recent Annual Report on Form 10-K filed with the SEC on March 31, 2023, and Quarterly Reports on Form 10-Q filed with the SEC on May 11, 2023 and August 11, 2023, as well as discussions of potential risks, uncertainties and other important factors in Kineta’s subsequent filings with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Except as required by law, Kineta undertakes no obligation to publicly update or revise any forward-looking statement, whether as result of new information, future events or otherwise.

KINETA, INC.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration revenues |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

442 |

|

|

$ |

— |

|

Licensing revenues |

|

|

— |

|

|

|

— |

|

|

|

5,000 |

|

|

|

965 |

|

Grant revenues |

|

|

— |

|

|

|

200 |

|

|

|

— |

|

|

|

501 |

|

Total revenues |

|

|

— |

|

|

|

200 |

|

|

|

5,442 |

|

|

|

1,466 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

1,909 |

|

|

|

2,605 |

|

|

|

7,462 |

|

|

|

10,507 |

|

General and administrative |

|

|

2,077 |

|

|

|

2,046 |

|

|

|

9,432 |

|

|

|

5,480 |

|

Total operating expenses |

|

|

3,986 |

|

|

|

4,651 |

|

|

|

16,894 |

|

|

|

15,987 |

|

Loss from operations |

|

|

(3,986 |

) |

|

|

(4,451 |

) |

|

|

(11,452 |

) |

|

|

(14,521 |

) |

Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense (with related parties $0 for the three and nine months ended September 30, 2023 and $465 and $1,366 for the three and nine months ended September 30, 2022, respectively) |

|

|

(21 |

) |

|

|

(559 |

) |

|

|

(65 |

) |

|

|

(1,699 |

) |

Change in fair value of rights from Private Placement |

|

|

(1,401 |

) |

|

|

— |

|

|

|

(180 |

) |

|

|

— |

|

Change in fair value measurement of notes payable |

|

|

(4 |

) |

|

|

(418 |

) |

|

|

(17 |

) |

|

|

(542 |

) |

(Loss) gain on extinguishments of debt, net |

|

|

— |

|

|

|

(236 |

) |

|

|

— |

|

|

|

259 |

|

Other (expense) income, net |

|

|

101 |

|

|

|

(3 |

) |

|

|

298 |

|

|

|

(17 |

) |

Total other (expense) income, net |

|

|

(1,325 |

) |

|

|

(1,216 |

) |

|

|

36 |

|

|

|

(1,999 |

) |

Net loss |

|

$ |

(5,311 |

) |

|

$ |

(5,667 |

) |

|

$ |

(11,416 |

) |

|

$ |

(16,520 |

) |

Net (loss) income attributable to noncontrolling interest |

|

|

69 |

|

|

|

(82 |

) |

|

|

29 |

|

|

|

(81 |

) |

Net loss attributable to Kineta, Inc. |

|

$ |

(5,380 |

) |

|

$ |

(5,585 |

) |

|

$ |

(11,445 |

) |

|

$ |

(16,439 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.46 |

) |

|

$ |

(1.14 |

) |

|

$ |

(1.09 |

) |

|

$ |

(3.42 |

) |

Weighted-average shares outstanding, basic and diluted |

|

|

11,738 |

|

|

|

4,891 |

|

|

|

10,505 |

|

|

|

4,808 |

|

SELECTED CONSOLIDATED BALANCE SHEET DATA

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

|

|

(in thousands) |

|

Cash |

|

$ |

7,562 |

|

|

$ |

13,143 |

|

Total current assets |

|

|

7,843 |

|

|

|

13,600 |

|

Working capital |

|

|

228 |

|

|

|

2,113 |

|

Total assets |

|

|

10,705 |

|

|

|

17,435 |

|

Total debt |

|

|

765 |

|

|

|

748 |

|

Total stockholders' equity |

|

|

2,889 |

|

|

|

4,570 |

|

FOR FURTHER INFORMATION, PLEASE CONTACT:

Kineta, Inc. :

Jacques Bouchy

EVP Investor Relations & Business Development

+1 206-378-0400

jbouchy@kineta.us

Investor Relations:

John Mullaly

LifeSci Advisors, LLC

jmullaly@lifesciadvisors.com

Source: Kineta, Inc.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

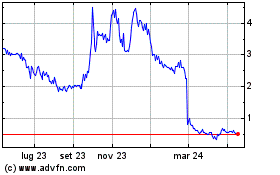

Grafico Azioni Kineta (NASDAQ:KA)

Storico

Da Mar 2024 a Apr 2024

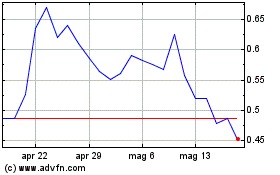

Grafico Azioni Kineta (NASDAQ:KA)

Storico

Da Apr 2023 a Apr 2024