false

FY

0001864055

0001864055

2023-01-01

2023-12-31

0001864055

dei:BusinessContactMember

2023-01-01

2023-12-31

0001864055

2023-12-31

0001864055

2022-12-31

0001864055

2022-01-01

2022-12-31

0001864055

us-gaap:PreferredStockMember

2021-12-31

0001864055

us-gaap:CommonStockMember

2021-12-31

0001864055

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001864055

us-gaap:RetainedEarningsMember

2021-12-31

0001864055

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001864055

2021-12-31

0001864055

us-gaap:PreferredStockMember

2022-12-31

0001864055

us-gaap:CommonStockMember

2022-12-31

0001864055

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001864055

us-gaap:RetainedEarningsMember

2022-12-31

0001864055

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001864055

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001864055

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001864055

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001864055

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001864055

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0001864055

us-gaap:PreferredStockMember

2023-01-01

2023-12-31

0001864055

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001864055

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001864055

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001864055

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-12-31

0001864055

us-gaap:PreferredStockMember

2023-12-31

0001864055

us-gaap:CommonStockMember

2023-12-31

0001864055

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001864055

us-gaap:RetainedEarningsMember

2023-12-31

0001864055

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001864055

2021-12-28

2021-12-28

0001864055

2021-12-28

0001864055

us-gaap:PrivatePlacementMember

2022-02-11

2022-02-11

0001864055

MOXC:AbitHongKongLimitedMember

2023-01-01

2023-12-31

0001864055

MOXC:AbitHongKongLimitedMember

2023-12-31

0001864055

MOXC:AbitUSAIncMember

2023-01-01

2023-12-31

0001864055

MOXC:AbitUSAIncMember

2023-12-31

0001864055

MOXC:BeijingBitmatrixTechnologyCoLtdMember

2023-01-01

2023-12-31

0001864055

MOXC:BeijingBitmatrixTechnologyCoLtdMember

2023-12-31

0001864055

MOXC:ElectronicEquipmentMember

srt:MinimumMember

2023-12-31

0001864055

MOXC:ElectronicEquipmentMember

srt:MaximumMember

2023-12-31

0001864055

us-gaap:FurnitureAndFixturesMember

srt:MinimumMember

2023-12-31

0001864055

us-gaap:FurnitureAndFixturesMember

srt:MaximumMember

2023-12-31

0001864055

us-gaap:VehiclesMember

2023-12-31

0001864055

srt:MinimumMember

2023-12-31

0001864055

srt:MaximumMember

2023-12-31

0001864055

MOXC:RenminbiAndUnitedStatesDollarMember

2023-12-31

0001864055

MOXC:RenminbiAndUnitedStatesDollarMember

2022-12-31

0001864055

MOXC:HongKongDollarAndUnitedStatesDollarMember

2023-12-31

0001864055

MOXC:HongKongDollarAndUnitedStatesDollarMember

2022-12-31

0001864055

MOXC:UnitedStatesDollarCoinMember

2023-01-01

2023-12-31

0001864055

MOXC:UnitedStatesDollarCoinMember

2022-01-01

2022-12-31

0001864055

MOXC:UnitedStatesDollarCoinMember

2023-12-31

0001864055

MOXC:UnitedStatesDollarCoinMember

2022-12-31

0001864055

MOXC:UnitedStatesDollarTetherMember

2023-01-01

2023-12-31

0001864055

MOXC:UnitedStatesDollarTetherMember

2022-01-01

2022-12-31

0001864055

MOXC:UnitedStatesDollarTetherMember

2023-12-31

0001864055

MOXC:UnitedStatesDollarTetherMember

2022-12-31

0001864055

us-gaap:LandMember

2022-12-31

0001864055

MOXC:PlantMember

2022-12-31

0001864055

us-gaap:EquipmentMember

2022-12-31

0001864055

us-gaap:VehiclesMember

2022-12-31

0001864055

us-gaap:LandMember

2023-01-01

2023-12-31

0001864055

MOXC:PlantMember

2023-01-01

2023-12-31

0001864055

us-gaap:EquipmentMember

2023-01-01

2023-12-31

0001864055

us-gaap:VehiclesMember

2023-01-01

2023-12-31

0001864055

us-gaap:LandMember

2023-12-31

0001864055

MOXC:PlantMember

2023-12-31

0001864055

us-gaap:EquipmentMember

2023-12-31

0001864055

MOXC:BitmainTechnologiesLimitedMember

2023-12-31

0001864055

MOXC:BitmainTechnologiesLimitedMember

2023-01-01

2023-12-31

0001864055

MOXC:MoxianHongKongLimitedMember

2022-07-01

2022-07-31

0001864055

2022-07-01

2022-07-31

0001864055

2017-12-21

2017-12-22

0001864055

country:HK

2023-01-01

2023-12-31

0001864055

country:CN

2023-01-01

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

iso4217:HKD

xbrli:pure

MOXC:Integer

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

20-F

☐

REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES

EXCHANGE ACT OF 1934

OR

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the year ended December

31, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE

ACT OF 1934

OR

☐

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date

of event requiring this shell company report_________________

For

the transition period from to

Commission

file number 333-256665

ABITS

GROUP INC

(Exact

name of Registrant as specified in its charter)

British

Virgin Islands

(Jurisdiction

of incorporation or organization)

Level

24 Lee Garden One 33 Hysan

Avenue

Causeway Bay Hong Kong SAR

(Address

of principal executive offices)

Wanhong

Tan, Chief Financial Officer

+852

9855 6575– telephone

yf@abitgrp.com

(Name,

Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities

registered or to be registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Symbol |

|

Name

of each exchange on which registered |

| Ordinary

shares, par value $0.001 per share |

|

ABTS |

|

Nasdaq

Capital Market |

Securities

registered or to be registered pursuant to Section 12(g) of the Act: None

Securities

for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate

the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered

by the transition report: 35,554,677 ordinary shares, par value $0.001 per share, as of December 31, 2023.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐

Yes ☒ No

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934.

☐

Yes ☒ No

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

☒

Yes ☐ No

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

☒

Yes ☐ No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company”

in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated filer ☒ |

Emerging

growth company ☐ |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act:

☐

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If securities are

registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in

the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check

mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received

by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ |

|

International

Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

|

Other

☐ |

If

“Other” has been checked in response to the previous question, indicate by check mark which financial statement item the

registrant has elected to follow.

☐

Item 17 ☐ Item 18

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities

Exchange Act of 1934).

☐

Yes ☒ No

(APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities

Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐

Yes ☐ No

ABITS

GROUP INC

FORM

20-F ANNUAL REPORT

TABLE

OF CONTENTS

PART

I

CERTAIN

INFORMATION

In

this annual report on Form 20-F, unless otherwise indicated, “we,” “us,” “our,” the “Company,”

“Moxian BVI” and “Moxian” refer to Abits Group Inc, a company incorporated in the British Virgin Islands, its

predecessor entity and its subsidiaries.

References

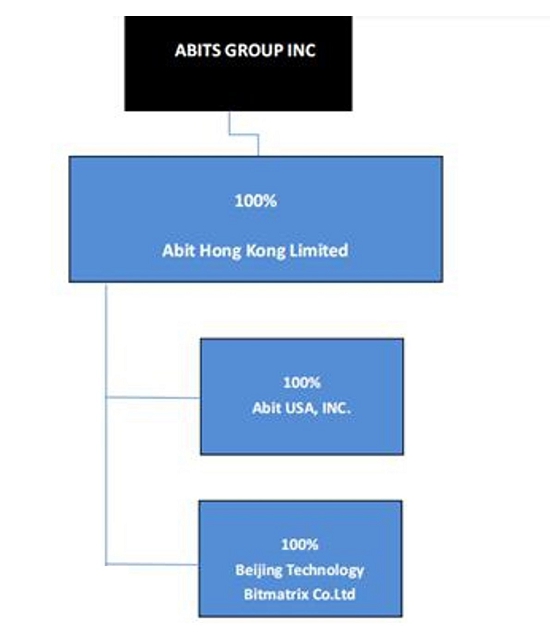

to “subsidiaries” are to:

| ● |

Abit Hong Kong Limited

(“Abit Hong Kong”), a company established under the laws of Hong Kong SAR and a wholly-owned subsidiary of Abits Group

Inc; |

| |

|

| ● |

Abit USA Inc (“Abit

USA”), a company incorporated in the state of Delaware, United States and a wholly-owned subsidiary of Abit Hong Kong Limited; |

| |

|

| ● |

Beijing

Bitmatrix Technology Co. Ltd. (“Bitmatrix”), a company incorporated under the laws of the People’s Republic

of China and a wholly-owned subsidiary of Abit Hong Kong Limited

|

Unless

the context indicates otherwise, all references to “China” and the “PRC” refer to the People’s Republic

of China, all references to “Renminbi” or “RMB” are to the legal currency of the People’s Republic of China,

all references to “U.S. dollars,” “dollars” and “$” are to the legal currency of the United States.

This annual report contains translations of Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader.

We make no representation that the Renminbi or U.S. dollar amounts referred to in this report could have been or could be converted into

U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

FORWARD-LOOKING

STATEMENTS

This

report contains “forward-looking statements” for purposes of the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995 that represent our beliefs, projections and predictions about future events. All statements other than statements

of historical fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items,

any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects

or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs,

goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may”,

“will”, “should”, “could”, “would”, “predicts”, “potential”,

“continue”, “expects”, “anticipates”, “future”, “intends”, “plans”,

“believes”, “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking

statements.

These

statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause

our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements

described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking

statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their

likely impact, and the accuracy and completeness of the publicly available information with respect to the factors upon which our business

strategy is based or the success of our business.

Forward-looking

statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether,

or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the

time those statements are made and management’s belief as of that time with respect to future events and are subject to risks and

uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking

statements. Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings

“Risk Factors”, “Operating and Financial Review and Prospects,” and elsewhere in this report.

ITEM

1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not

Applicable for annual reports on Form 20-F.

ITEM

2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not

Applicable for annual reports on Form 20-F.

ITEM

3. KEY INFORMATION

Our

Corporate Structure

Abits

Group Inc, or Abits Group, is not a PRC operating company but a British Virgin Islands holding company (“the Company”)

resulting from a merger with its U.S. domiciled parent holding company in August 2021. In July 2022, the Company divested its entire

interest in Moxian (Hong Kong) Limited, or Moxian HK, with the result that it no longer has any substantial business operations in

the PRC, other than certain administrative functions conducted by a wholly owned indirect subsidiary located in Beijing. To reflect that change, the Company changed its name to Abits Group Inc as it now solely operates in the bitcoin mining

industry, with principal operations in the United States through its wholly-owned subsidiary, Abit USA Inc.

Because

of the Company’s past history in operating in China, it could be subject to investigative action by the Chinese authorities but

as of the date of this report, the Company has not received any formal notification of such action. Whilst the Company acknowledges that

such risks exist at any time, it also believes that repeating them in great depth serves no purpose and can preclude a proper reading

of this report.

The

Holding Foreign Companies Accountable Act

Our ordinary shares may be prohibited from trading on a national exchange or “over-the-counter” markets

under the HFCAA if the PCAOB is unable to inspect our auditors for two consecutive years. Pursuant to the HFCAA enacted in December 2020

and related legislation, if the SEC determines that a company has filed an audit report issued by a registered public accounting firm

that has not been subject to inspection by the PCAOB for two consecutive years, the SEC is required to prohibit such company’s securities

from being traded on a national securities exchange or in the over the counter trading market in the U.S.

Pursuant

to the HFCAA, the PCAOB issued a Determination Report on December 16, 2021, which found that the PCAOB was unable to inspect or

investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. In addition, the

PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. In June

2022, we were conclusively identified by the SEC as a Commission-Identified Issuer under the HFCAA following the filing of our

annual report on Form 20-F for the fiscal year ended December 31, 2021, which contained the audit report issued by Centurion ZD CPA

& Co. (“Centurion”), a registered public accounting firm headquartered in Hong Kong that the PCAOB had determined it

was previously unable to inspect or investigate completely because of a position taken by an authority in such jurisdiction.

Effective June 30, 2022, we appointed Audit Alliance LLP (“Audit Alliance”) as our independent registered public

accounting firm for the fiscal year ending December 31, 2022 and accepted the resignation of Centurion, effective on the same date.

On August 26, 2022, the PCAOB signed a Statement of Protocol (SOP) Agreement with the CSRC and the MOF of the PRC regarding

cooperation in the oversight of PCAOB-registered public accounting firms in the PRC and Hong Kong to establish a method for the

PCAOB to conduct inspections of PCAOB-registered public accounting firms in the PRC and Hong Kong, as contemplated by the

Sarbanes-Oxley Act. On December 15, 2022, the PCAOB determined that the PCAOB was able to secure complete access to inspect and

investigate registered public accounting firms headquartered in mainland China and Hong Kong and vacated its previous 2021 adverse

determinations. However, should the PCAOB fails to have complete access in the future, the PCAOB will consider the need to issue a

new determination.

Our

current auditor, Audit Alliance LLP, is based in the Republic of Singapore and has been inspected by the PCAOB on a regular basis. Our

auditor is not among the PCAOB-registered public accounting firms headquartered in the PRC or Hong Kong that are subject to PCAOB’s

determination. Notwithstanding the foregoing, in the future, if it is later determined that the PCAOB is unable to inspect or investigate

our auditor completely, or if there is any regulatory change or step taken by PRC regulators that does not permit our auditor to provide

audit documentations to the PCAOB for inspection or investigation, our investors may be deprived of the benefits of such inspection.

Any audit reports not issued by auditors that are completely inspected or investigated by the PCAOB, or a lack of PCAOB inspections of

audit work undertaken in China that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control

procedures, could result in a lack of assurance that our financial statements and disclosures are adequate and accurate, which could

result in limitation or restriction to our access to the U.S. capital markets and trading of our securities, including trading on the

national exchange or “over-the-counter” markets, may be prohibited under the HFCAA.

Foreign

Private Issuer

As

an offshore holding company incorporated in the British Virgin Islands, we are qualified as a “foreign private issuer” within

the meaning of the rules under the Exchange Act. As such, we are exempt from certain rules under the Exchange Act that are applicable

to U.S. domestic issuers. Moreover, we are not required to provide as many Exchange Act reports, or as frequently or as promptly, as

U.S. domestic issuers. We are also not required to provide the same level of disclosure on certain issues. In addition, as a company

incorporated in the British Virgin Islands, we are permitted to adopt certain home country practices in relation to corporate governance

matters that differ significantly from that applied to the U.S. domestic issuers under the Nasdaq listing rules. These exemptions and

practices may afford less protection to our shareholders than they would enjoy if we were a U.S. domestic issuer.

Selected

Financial Data

The

following table presents the selected consolidated financial information of our Company as of December 31, 2023, December 31, 2022

and December 31, 2021. The selected consolidated statements of operations data and the selected consolidated balance sheets data

have been derived from our audited consolidated financial statements, of which that for the year ended December 31, 2023 and

December 31. 2022 are included in this annual report. These audited consolidated financial statements begin on F-1 and are prepared

and presented in accordance with accounting principles generally accepted in the United States, or U.S. GAAP. Our historical results

do not necessarily indicate results expected for any future period. You should read the following selected financial data in

conjunction with the consolidated financial statements and related notes and “Item 5. Operating and Financial Review and

Prospects” included elsewhere in this report.

Summary

Consolidated Statements of Operations:

| | |

Year ended December 31 | |

| | |

2023 | | |

2022 | | |

2021 | |

| | |

| | |

| | |

| |

| Revenue | |

| 1,681,533 | | |

| 161,428 | | |

| 219,330 | |

| | |

| | | |

| | | |

| | |

| Loss from operations | |

| (11,013,871 | ) | |

| (19,260,227 | ) | |

| 2,866,140 | |

| | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| 126,290 | |

| Loss before taxation | |

| 12,585,250 | | |

| 21,520,114 | | |

| 2,739,850 | |

Summary

Consolidated Balance Sheet Data:

The

following table presents our summary consolidated balance sheet data as of December 31, 2023 and December 31, 2022.

| | |

December 31 | | |

December 31 | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 884,199 | | |

| 2,505,286 | |

| Digital assets | |

| 1,194,157 | | |

| 7,087,747 | |

| Property, equipment and vehicles | |

| 9,465,567 | | |

| 12,553,408 | |

| Other assets | |

| 774,345 | | |

| 2,384,976 | |

| Total assets | |

| 12,318,268 | | |

| 24,531,417 | |

| Total liabilities | |

| (1,005,608 | ) | |

| (613,455 | ) |

| Stockholders’ equity | |

| 11,312,660 | | |

| 23,917,962 | |

3B.

Capitalization and Indebtedness

Not

Applicable for annual reports on Form 20-F.

3C.

Reasons for The Offer and Use of Proceeds

Not

Applicable for annual reports on Form 20-F.

3D.

Risk Factors

An

investment in our ordinary shares involves a high degree of risk. You should carefully consider the risks and uncertainties described

below together with all other information contained in this annual report, including the matters discussed under the headings “Forward-Looking

Statements” and “Operating and Financial Review and Prospects” before you decide to invest in our ordinary shares.

If any of the following risks, or any other risks and uncertainties that are not presently foreseeable to us, actually occur, our business,

financial condition, results of operations, liquidity and our future growth prospects could be materially and adversely affected.

Summary

Of Risk Factors

Our

business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely

affect our business, financial condition, results of operations, cash flows, and prospects. These risks are discussed more fully below

and include, but are not limited to, risks related to:

General

Risks

| |

●

|

Failure

to manage our liquidity and cash flows may materially and adversely affect our financial conditions and results of operations. As

a result, we may need additional capital, and financing may not be available on terms acceptable to us, or at all. |

| |

●

|

We

have a history of operating losses, and we may not be able to achieve or sustain profitability; we have recently shifted our bitcoin

mining business, and we may not be successful in this business. |

| |

●

|

Our

results of operation may fluctuate significantly and may not fully reflect the underlying performance of our business. |

| |

●

|

We

may acquire other businesses, form joint ventures or acquire other companies or businesses that could negatively affect our operating

results, dilute our stockholders’ ownership, increase our debt or cause us to incur significant expense; notwithstanding the

foregoing, our growth may depend on our success in uncovering and completing such transactions. |

| |

●

|

From

time to time, we may evaluate and potentially consummate strategic investments or acquisitions, which could require significant management

attention, disrupt our business and adversely affect our financial results. |

Risks

Related to Bitcoin Mining

| |

● |

Our

results of operations are expected to vary with Bitcoin price volatility. |

| |

●

|

Our

mining operating costs outpace our mining revenues, which could seriously harm our business or increase our losses. |

| |

●

|

We

have an evolving business model which is subject to various uncertainties. |

| |

●

|

Regulatory

changes or actions may alter the nature of an investment in us or restrict the use of cryptocurrencies in a manner that adversely

affects our business, prospects or operations. |

| |

●

|

The

development and acceptance of cryptographic and algorithmic protocols governing the issuance of and transactions in cryptocurrencies

is subject to a variety of factors that are difficult to evaluate. |

| |

●

|

Banks

and financial institutions may not provide banking services, or may cut off services, to businesses that engage in bitcoin-related

activities or that accept cryptocurrencies as payment, including financial institutions of investors in our securities. |

| |

●

|

We

may face risks of Internet disruptions, which could have an adverse effect on the price of cryptocurrencies. |

| |

●

|

Acceptance

and/or widespread use of bitcoin is uncertain. |

| |

●

|

The

decentralized nature of bitcoin systems may lead to slow or inadequate responses to crises, which may negatively affect our business. |

| |

●

|

Our

bitcoins may be subject to loss, theft or restriction on access. |

| |

●

|

There

is a lack of liquid markets, and possible manipulation of blockchain/bitcoin-based assets. |

| |

●

|

Incorrect

or fraudulent bitcoin transactions may be irreversible. |

| |

●

|

Our

reliance primarily on a single model of miner may subject our operations to increased risk of mine failure. |

| |

●

|

Our

future success will depend in large part upon the value of bitcoin; the value of bitcoin may be subject to pricing risk and has historically

been subject to wide swings. |

| |

●

|

Cryptocurrencies,

including those maintained by or for us, may be exposed to cybersecurity threats and hacks. |

| |

●

|

We

are subject to risks associated with our need for significant electrical power. Government regulators may potentially restrict the

ability of electricity suppliers to provide electricity to mining operations, such as ours. |

| |

●

|

We

may not adequately respond to price fluctuations and rapidly changing technology, which may negatively affect our business. |

Risks

Involving Intellectual Property

| |

● |

Bitcoin

and bitcoin mining operations rely on software and specialized technology. |

| |

● |

We

may not be able to prevent others from unauthorized use of our intellectual property, which could harm our business and competitive

position. |

| |

● |

We

may be subject to intellectual property infringement claims, which may be expensive to defend and may disrupt our business and operations |

| |

● |

Our

platform and internal systems rely on software that is highly technical, and if it contains undetected errors, our business could

be adversely affected. |

Risks

Related to Our Ordinary Shares

| |

●

|

Our

ordinary shares may be thinly traded and you may be unable to sell at or near ask prices or at all if you need to sell your shares

to raise money or otherwise desire to liquidate your shares. |

| |

●

|

We

are not likely to pay cash dividends in the foreseeable future. |

| |

●

|

You

may face difficulties in protecting your interests as a shareholder, as the laws of British Virgin Islands provides substantially

less protection when compared to the laws of the United States and it may be difficult for a shareholder of ours to effect service

of process or to enforce judgements obtained in the United States courts. |

| |

●

|

Volatility

in our ordinary shares price may subject us to securities litigation. |

| |

●

|

We

may be unable to comply with the applicable continued listing requirements of the Nasdaq Capital Market, which may adversely impact

our access to capital markets and may cause us to default certain of our agreements |

General

Risks

If

we are unable to successfully execute our bitcoin mining, it would adversely affect our financial and business condition and results

of operations.

As

of the date of this Report, the Company operates in one self-owned mining site in Duff, Tennessee. New mining sites are always being

explored but none has yet to be developed. This dependence on one site has its risks on local factors such as a power failure or

adverse weather conditions. If we cannot execute the bitcoin mining, it would seriously affect our financial and business condition

and deepen the losses of the Company.

Failure

to manage our liquidity and cash flows may materially and adversely affect our financial conditions and results of operations. As a result,

we may need additional capital, and financing may not be available on terms acceptable to us, or at all.

The

Company is new to bitcoin mining and is operating in the United States for the first time. If we fail to manage our liquidity and cash

flows, it will seriously affect our financial condition and results of operations. We may need additional financing and such access may

be limited or at unacceptable terms.

We

have a history of operating losses, and we may not be able to achieve or sustain profitability; we have recently begun to conduct our bitcoin

mining operations, and we may not be successful in this business.

We

are not profitable and have incurred losses since our inception. We expect to continue to incur losses for the foreseeable future,

and these losses could increase as we continue to work to develop our business. We were previously engaged in the business of mobile

payments which we ceased operation in June 2018. Whilst we had continued with the digital advertising business, it later proved to

be increasingly difficult because of restrictions on online gaming by the PRC government, which was a key business of our then

clients. Starting in March 2022, we diversified into the bitcoin mining business and subsequently divested all of the equity in Moxian HK and the digital advertising business conducted by Moxian

HK’s subsidiaries. Our current operations and business strategy are new, are in

an industry that is relatively itself new and evolving and are subject to the risks discussed below. Even if we achieve profitability

in the future, we may not be able to sustain profitability in subsequent periods.

Our

results of operation may fluctuate significantly and may not fully reflect the underlying performance of our business.

Our

results of operations, including the levels of our net revenues, expenses, net loss and other key metrics, may vary significantly in

the future due to a variety of factors, some of which are outside of our control, and period-to-period comparisons of our operating results

may not be meaningful, especially given our limited operating history. Accordingly, the results for any one quarter are not necessarily

an indication of future performance. Fluctuations in quarterly results may adversely affect the market price of our ordinary shares.

Factors that may cause fluctuations in our quarterly financial results include:

| |

● |

the

amount and timing of operating expenses related to our new business operations and infrastructure; |

| |

|

|

| |

● |

fluctuations

in the price of bitcoin; and |

| |

|

|

| |

● |

general

economic, industry and market conditions. |

We

may acquire other businesses, form joint ventures or acquire other companies or businesses that could negatively affect our operating

results, dilute our stockholders’ ownership, increase our debt or cause us to incur significant expense; notwithstanding the foregoing,

our growth may depend on our success in uncovering and completing such transactions.

We

are actively seeking other business opportunities, however, we cannot offer any assurance that acquisitions of businesses, assets and/or

entering into strategic alliances or joint ventures will be successful. We may not be able to find suitable partners or acquisition candidates

and may not be able to complete such transactions on favorable terms, if at all. If we make any acquisitions, we may not be able to integrate

these acquisitions successfully into our existing infrastructure. In addition, in the event we acquire any existing businesses we could

assume unknown or contingent liabilities.

Any

future acquisitions also could result in the issuance of stock, incurrence of debt, contingent liabilities or future write-offs of intangible

assets or goodwill, any of which could have a negative impact on our cash flows, financial condition and results of operations. Integration

of an acquired company may also disrupt ongoing operations and require management resources that otherwise would be focused on developing

and expanding our existing business. We may experience losses related to potential investments in other companies, which could harm our

financial condition and results of operations. Further, we may not realize the anticipated benefits of any acquisition, strategic alliance

or joint venture if such investments do not materialize.

To

finance any acquisitions or joint ventures, we may choose to issue ordinary shares, preferred stock or a combination of debt and equity

as consideration, which could significantly dilute the ownership of our existing stockholders or provide rights to such preferred stock

holders in priority over our common stock holders. Additional funds may not be available on terms that are favorable to us, or at all.

If the price of our common stock is low or volatile, we may not be able to acquire other companies or fund a joint venture project using

stock as consideration.

From

time to time we may evaluate and potentially consummate strategic investments or acquisitions, which could require significant management

attention, disrupt our business and adversely affect our financial results.

We

may evaluate and consider strategic investments, combinations, acquisitions or alliances in both the bitcoin mining business. These transactions

could be material to our financial condition and results of operations if consummated. If we are able to identify an appropriate business

opportunity, we may not be able to successfully consummate the transaction and, even if we do consummate such a transaction, we may be

unable to obtain the benefits or avoid the difficulties and risks of such transaction.

Strategic

investments or acquisitions will involve risks commonly encountered in business relationships, including:

| |

● |

difficulties

in assimilating and integrating the operations, personnel, systems, data, technologies, products and services of the acquired business; |

| |

|

|

| |

● |

inability

of the acquired technologies, products or businesses to achieve expected levels of revenue, profitability, productivity or other

benefits; |

| |

|

|

| |

● |

difficulties

in retaining, training, motivating and integrating key personnel; |

| |

|

|

| |

● |

diversion

of management’s time and resources from our normal daily operations; |

| |

|

|

| |

● |

difficulties

in successfully incorporating licensed or acquired technology and rights into our businesses; |

| |

|

|

| |

● |

difficulties

in maintaining uniform standards, controls, procedures and policies within the combined organizations; |

| |

|

|

| |

● |

difficulties

in retaining relationships with customers, employees and suppliers of the acquired business; |

| |

|

|

| |

● |

risks

of entering markets, including the U.S., in which we have limited or no prior experience; |

We

may not make any investments or acquisitions, or any future investments or acquisitions may not be successful, may not benefit our business

strategy, may not generate sufficient revenues to offset the associated acquisition costs or may not otherwise result in the intended

benefits. In addition, we cannot assure you that any future investment in or acquisition of new businesses or technology will lead to

the successful development of new or enhanced loan products and services or that any new or enhanced loan products and services, if developed,

will achieve market acceptance or prove to be profitable.

Our

loss of any of our management team, our inability to execute an effective succession plan, or our inability to attract and retain qualified

personnel, could adversely affect our business.

Our

success and future growth will depend to a significant degree on the skills and services of our management, including our Chief Executive

Officer and Chief Financial Officer. We will need to continue to grow our management in order to alleviate pressure on our existing team

and in order to continue to develop our business. If our management, including any new hires that we may make, fails to work together

effectively and to execute our plans and strategies on a timely basis, our business could be harmed. Furthermore, if we fail to execute

an effective contingency or succession plan with the loss of any member of management, the loss of such management personnel may significantly

disrupt our business.

The

loss of key members of management could inhibit our growth prospects. Our future success also depends in large part on our ability to

attract, retain and motivate key management and operating personnel. As we continue to develop and expand our operations, we may require

personnel with different skills and experiences, and who have a sound understanding of our business and the bitcoin industry. The market

for highly qualified personnel in this industry is very competitive and we may be unable to attract such personnel. If we are unable

to attract such personnel, our business could be harmed.

We

incur significant costs and demands upon management and accounting and finance resources as a result of complying with the laws and regulations

affecting public companies; if we fail to maintain proper and effective internal controls, our ability to produce accurate and timely

financial statements could be impaired, which could harm our operating results, our ability to operate our business and our reputation.

As

a public reporting company, we are required to, among other things, maintain a system of effective internal control over financial reporting.

Ensuring that we have adequate internal financial and accounting controls and procedures in place so that we can produce accurate financial

statements on a timely basis is a costly and time-consuming effort that needs to be re-evaluated frequently. Substantial work will continue

to be required to further implement, document, assess, test and remediate our system of internal controls.

If

our internal control over financial reporting is not effective, we may be unable to issue our financial statements in a timely manner,

we may be unable to obtain the required audit or review of our financial statements by our independent registered public accounting firm

in a timely manner or we may be otherwise unable to comply with the periodic reporting requirements of the SEC, our common stock listing

on Nasdaq could be suspended or terminated and our stock price could materially suffer. In addition, we or members of our management

could be subject to investigation and sanction by the SEC and other regulatory authorities and to stockholder lawsuits, which could impose

significant additional costs on us and divert management attention.

Because

cryptocurrencies may be determined to be investment securities, we may inadvertently violate the Investment Company Act and incur large

losses as a result and potentially be required to register as an investment company or terminate operations and we may incur third party

liabilities.

We

are engaged in the mining of bitcoins which the SEC said is currency and not securities. We therefore believe that we are not engaged

in the business of investing, reinvesting, or trading in securities, and we do not hold ourselves out as being engaged in those activities.

However, under the Investment Company Act a company may be deemed an investment company under section 3(a)(1)(C) thereof if the value

of its investment securities is more than 40% of its total assets (exclusive of government securities and cash items) on an unconsolidated

basis.

If,

as a result of our investments and our mining activities, including investments in which we do not have a controlling interest, the investment

securities we hold could exceed 40% of our total assets, exclusive of cash items and, accordingly, we could determine that we have become

an inadvertent investment company. The bitcoins we own, acquire or mine may be deemed an investment security by the SEC, although we

do not believe any of the cryptocurrencies we own, acquire or mine are securities. An inadvertent investment company can avoid being

classified as an investment company if it can rely on one of the exclusions under the Investment Company Act. One such exclusion, Rule

3a-2 under the Investment Company Act, allows an inadvertent investment company a grace period of one year from the earlier of (a) the

date on which an issuer owns securities and/or cash having a value exceeding 50% of the issuer’s total assets on either a consolidated

or unconsolidated basis and (b) the date on which an issuer owns or proposes to acquire investment securities having a value exceeding

40% of the value of such issuer’s total assets (exclusive of government securities and cash items) on an unconsolidated basis.

We may take actions to cause the investment securities held by us to be less than 40% of our total assets, which may include acquiring

assets with our cash and bitcoin on hand or liquidating our investment securities or bitcoin or seeking a no-action letter from the SEC

if we are unable to acquire sufficient assets or liquidate sufficient investment securities in a timely manner.

As

the Rule 3a-2 exception is available to a company no more than once every three years, and assuming no other exclusion were available

to us, we would have to keep within the 40% limit for at least three years after we cease being an inadvertent investment company. This

may limit our ability to make certain investments or enter into joint ventures that could otherwise have a positive impact on our earnings.

In any event, we do not intend to become an investment company engaged in the business of investing and trading securities.

Classification

as an investment company under the Investment Company Act requires registration with the SEC. If an investment company fails to register,

it would have to stop doing almost all business, and its contracts would become voidable. Registration is time consuming and restrictive

and would require a restructuring of our operations, and we would be very constrained in the kind of business we could do as a registered

investment company. Further, we would become subject to substantial regulation concerning management, operations, transactions with affiliated

persons and portfolio composition, and would need to file reports under the Investment Company Act regime. The cost of such compliance

would result in the Company incurring substantial additional expenses, and the failure to register if required would have a materially

adverse impact to conduct our operations.

We

face risks similar to that of the novel Coronavirus (COVID-19) outbreak, which could significantly disrupt our operations and financial

results.

Although

the outbreak of the novel Coronavirus (COVID-19) appears to be over, we believe that our results of operations, business and financial

condition could be adversely impacted by the effects of any outbreak of any severe virus affecting public health.

The

continued spread of the novel Coronavirus (COVID-19) or the occurrence of other epidemics and the imposition of public health measures

and travel and business restrictions will adversely affect impact our business, financial condition, operating results and cash flows.

In addition, we have experienced and will experience disruptions to our business operations resulting from quarantines, self-isolations,

or other movement and restrictions on the ability of our employees to perform their jobs. If we are unable to effectively service our

miners, our ability to mine bitcoin will be adversely affected as miners go offline, which would have an adverse effect on our business

and the results of our operations.

If

we cannot maintain our corporate culture as we grow, we could lose the innovation, collaboration and focus that contribute to our business.

We

believe that a critical component of our success is our corporate culture, which we believe fosters innovation, encourages teamwork and

cultivates creativity. As we develop the infrastructure of a public company and continue to grow, we may find it difficult to maintain

these valuable aspects of our corporate culture. Any failure to preserve our culture could negatively impact our future success, including

our ability to attract and retain employees, encourage innovation and teamwork and effectively focus on and pursue our corporate objectives.

If

the PRC government determines that the historical contractual arrangements with the former PRC subsidiaries structure did not comply

with PRC regulation, or if these regulations change or are interpreted differently in the future, our shares may decline in value or

become worthless if we are deemed to be unable to assert our contractual control rights over the assets of the former subsidiaries.

In

order to streamline our corporate structure and considering the changing regulatory environment, we had completed the divestment of

Moxian HK and its PRC subsidiaries to Jiantao Liu, a resident of China for

a cash consideration of HKD 1,000. Accordingly, all contractual arrangements involving the PRC subsidiaries were effectively terminated.

Although

we completed the divestment in July 2022, the PRC government could find any one of our previous agreements non-compliant with relevant

PRC laws, regulations, and rules, or if these laws, regulations, and rules or the interpretation thereof change in the future, and such

changes may be retroactively applied to our historical contractual arrangements, we could be subject to severe penalties and require

a potential restatement of our financial statements included elsewhere in this annual report. As a result, our shares may decline in

value or become worthless.

There

remain substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations, and rules

which may be relevant to our former PRC subsidiaries’ and our former operations in China, including potential future actions by

the PRC government which may retroactively affect the enforceability and legality of our historical operations involving the former PRC

subsidiaries.

Although

we divested all of the equity in Moxian HK and its PRC subsidiaries in July 2022 and we no longer have substantial operations in

China, we may be subject to potential future actions by the PRC government which may retroactively affect the enforceability and

legality of our historical operations involving the former PRC subsidiaries. If the PRC government finds such agreements

non-compliant with relevant PRC laws, regulations, and rules, or if these laws, regulations, and rules or the interpretation thereof

change in the future, and such changes may be retroactively applied to our historical contractual arrangements, we could be subject

to severe penalties. As such, the following former risk factors of doing business in China may still apply:

| |

● |

Changes in China’s

economic, political or social conditions or government policies could have a material adverse effect on our business and results

of operations. |

| |

● |

Uncertainties in the interpretation

and enforcement of Chinese laws and regulations could limit the legal protections available to us. |

| |

● |

The PRC government may

intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment

in China-based issuers, which could result in a material change in our operations and/or cause the value of our securities to significantly

decline or be worthless. |

| |

● |

PRC regulations establish

complex procedures for some acquisitions conducted by foreign investors, which could make it more difficult for us to pursue growth

through acquisitions in China. |

| |

● |

The PCAOB is currently

unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB

to conduct inspections or investigation completely over our auditor deprives our investors with the benefits of such inspections. |

| |

● |

Our ordinary shares will

be prohibited from trading in the United States under the HFCAA in 2024 if the PCAOB is unable to inspect or fully investigate auditors

located in China, or as early as 2023 if proposed changes to the law are enacted. The delisting of our ordinary shares, or the threat

of their being delisted, may materially and adversely affect the value of your investment. |

| |

● |

PRC regulations relating

to the establishment of offshore special purpose companies by PRC residents may limit our ability to inject capital into our PRC

subsidiaries, limit our subsidiaries’ ability to increase their registered capital or distribute profits to us, or may otherwise

adversely affect us |

| |

● |

PRC regulation of loans

to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay

or prevent us from using offshore funds to make loans to our PRC subsidiaries, or to make additional capital contributions to our

PRC subsidiaries. |

| |

● |

Regulatory bodies of the

United States may be limited in their ability to conduct investigations or inspections of our operations in China. |

| |

● |

Enhanced scrutiny over

acquisition transactions by the PRC tax authorities may have a negative impact on potential acquisitions we may pursue in the future. |

| |

● |

Fluctuations in exchange

rates could have a material adverse effect on our results of operations and the value of your investment. |

Risks

related to Bitcoin Mining

Our

results of operations are expected to vary with Bitcoin price volatility

The

price of Bitcoin has experienced significant fluctuations over its relatively short existence and may continue to fluctuate significantly

in the future.

We

expect our results of operations to continue to be affected by the Bitcoin price as most of the revenue is from bitcoin mining production

as of the filing date. Any future significant reductions in the price of Bitcoin will likely have a material and adverse effect on our

results of operations and financial condition. We cannot assure you that the Bitcoin price will remain high enough to sustain our operation

or that the Bitcoin price will not decline significantly in the future.

Various

factors, mostly beyond our control, could impact the Bitcoin price. For example, the usage of Bitcoins in the retail and commercial marketplace

is relatively low in comparison with the usage for speculation, which contributes to Bitcoin price volatility. Additionally, the reward

for Bitcoin mining will decline over time, with the most recent halving event occurred in May 2020 and next one four years later, which

may further contribute to Bitcoin price volatility.

Our

mining operating costs outpace our mining revenues, which could seriously harm our business or increase our losses.

Our

mining operations are costly and our expenses may increase in the future. We intend to use funds on hand from our private placement to

continue to purchase bitcoin mining machines. This expense increase may not be offset by a corresponding increase in revenue. Our expenses

may be greater than we anticipate, and our investments to make our business more efficient may not succeed and may outpace monetization

efforts. Increases in our costs without a corresponding increase in our revenue would increase our losses and could seriously harm our

business and financial perform

We

have an evolving business model which is subject to various uncertainties.

As

bitcoin assets may become more widely available, we expect the services and products associated with them to evolve. In order to stay

current with the industry, our business model may need to evolve as well. From time to time, we may modify aspects of our business model

relating to our strategy. We cannot offer any assurance that these or any other modifications will be successful or will not result in

harm to our business. We may not be able to manage growth effectively, which could damage our reputation, limit our growth and negatively

affect our operating results. Further, we cannot provide any assurance that we will successfully identify all emerging trends and growth

opportunities in this business sector and we may lose out on those opportunities. Such circumstances could have a material adverse effect

on our business, prospects or operations.

Regulatory

changes or actions may alter the nature of an investment in us or restrict the use of cryptocurrencies in a manner that adversely affects

our business, prospects or operations.

As

cryptocurrencies have grown in both popularity and market size, governments around the world have reacted differently to cryptocurrencies;

certain governments have deemed them illegal, and others have allowed their use and trade without restriction, while in some jurisdictions,

such as in the U.S., subject to extensive, and in some cases overlapping, unclear and evolving regulatory requirements. Ongoing and future

regulatory actions may impact our ability to continue to operate, and such actions could affect our ability to continue as a going concern

or to pursue our new strategy at all, which could have a material adverse effect on our business, prospects or operations.

The

development and acceptance of cryptographic and algorithmic protocols governing the issuance of and transactions in cryptocurrencies

is subject to a variety of factors that are difficult to evaluate.

The

use of cryptocurrencies to, among other things, buy and sell goods and services and complete transactions, is part of a new and rapidly

evolving industry that employs bitcoin assets based upon a computer-generated mathematical and/or cryptographic protocol. Large-scale

acceptance of cryptocurrencies as a means of payment has not, and may never, occur. The growth of this industry in general, and the use

of bitcoin, in particular, is subject to a high degree of uncertainty, and the slowing or stopping of the development or acceptance of

developing protocols may occur unpredictably. The factors include, but are not limited to:

| |

● |

continued

worldwide growth in the adoption and use of cryptocurrencies as a medium to exchange; |

| |

|

|

| |

● |

governmental

and quasi-governmental regulation of cryptocurrencies and their use, or restrictions on or regulation of access to and operation

of the network or similar bitcoin systems; |

| |

|

|

| |

● |

changes

in consumer demographics and public tastes and preferences; |

| |

|

|

| |

● |

the

maintenance and development of the open-source software protocol of the network; |

| |

● |

the

increased consolidation of contributors to the bitcoin blockchain through mining pools; |

| |

|

|

| |

● |

the

availability and popularity of other forms or methods of buying and selling goods and services, including new means of using fiat

currencies; |

| |

|

|

| |

● |

the

use of the networks supporting cryptocurrencies for developing smart contracts and distributed applications; |

| |

|

|

| |

● |

general

economic conditions and the regulatory environment relating to cryptocurrencies; and |

| |

|

|

| |

● |

negative

consumer sentiment and perception of bitcoin specifically and cryptocurrencies generally. |

The

outcome of these factors could have negative effects on our ability to continue as a going concern or to pursue our business strategy

at all, which could have a material adverse effect on our business, prospects or operations as well as potentially negative effect on

the value of any bitcoin or other cryptocurrencies we mine or otherwise acquire or hold for our own account, which would harm investors

in our securities.

Banks

and financial institutions may not provide banking services, or may cut off services, to businesses that engage in bitcoin-related activities

or that accept cryptocurrencies as payment, including financial institutions of investors in our securities.

A

number of companies that engage in bitcoin and/or other bitcoin-related activities have been unable to find banks or financial institutions

that are willing to provide them with bank accounts and other services. Similarly, a number of companies and individuals or businesses

associated with cryptocurrencies may have had and may continue to have their existing bank accounts closed or services discontinued with

financial institutions in response to government action, particularly in China, where regulatory response to cryptocurrencies has been

to exclude their use for ordinary consumer transactions within China. We also may be unable to obtain or maintain these services for

our business. The difficulty that many businesses that provide bitcoin and/or derivatives on other bitcoin-related activities have and

may continue to have in finding banks and financial institutions willing to provide them services may be decreasing the usefulness of

cryptocurrencies as a payment system and harming public perception of cryptocurrencies, and could decrease their usefulness and harm

their public perception in the future.

The

usefulness of cryptocurrencies as a payment system and the public perception of cryptocurrencies could be damaged if banks or financial

institutions were to close the accounts of businesses engaging in bitcoin and/or other bitcoin-related activities. This could occur as

a result of compliance risk, cost, government regulation or public pressure. The risk applies to securities firms, clearance and settlement

firms, national stock and derivatives on commodities exchanges, the over-the-counter market, and the Depository Trust Company, which,

if any of such entities adopts or implements similar policies, rules or regulations, could negatively affect our relationships with financial

institutions and impede our ability to convert cryptocurrencies to fiat currencies. Such factors could have a material adverse effect

on our ability to continue as a going concern or to pursue our new strategy at all, which could have a material adverse effect on our

business, prospects or operations and harm investors.

We

may face risks of Internet disruptions, which could have an adverse effect on the price of cryptocurrencies.

A

disruption of the Internet may affect the use of cryptocurrencies and subsequently the value of our securities. Generally, cryptocurrencies

and our business of mining cryptocurrencies is dependent upon the Internet. A significant disruption in Internet connectivity could disrupt

a currency’s network operations until the disruption is resolved and have an adverse effect on the price of cryptocurrencies and

our ability to mine cryptocurrencies.

The

impact of geopolitical and economic events on the supply and demand for cryptocurrencies is uncertain.

Geopolitical

crises may motivate large-scale purchases of bitcoin and other cryptocurrencies, which could increase the price of bitcoin and other

cryptocurrencies rapidly. This may increase the likelihood of a subsequent price decrease as crisis-driven purchasing behavior dissipates,

adversely affecting the value of our inventory following such downward adjustment. Such risks are similar to the risks of purchasing

commodities in general uncertain times, such as the risk of purchasing, holding or selling gold. Alternatively, as an emerging asset

class with limited acceptance as a payment system or commodity, global crises and general economic downturn may discourage investment

in cryptocurrencies as investors focus their investment on less volatile asset classes as a means of hedging their investment risk.

As

an alternative to fiat currencies that are backed by central governments, cryptocurrencies, which are relatively new, are subject to

supply and demand forces. How such supply and demand will be impacted by geopolitical events is largely uncertain but could be harmful

to us and investors in our common stock. Political or economic crises may motivate large-scale acquisitions or sales of cryptocurrencies

either globally or locally. Such events could have a material adverse effect on our ability to continue as a going concern or to pursue

our new strategy at all, which could have a material adverse effect on our business, prospects or operations and potentially the value

of any bitcoin or any other cryptocurrencies we mine or otherwise acquire or hold for our own account.

Acceptance

and/or widespread use of bitcoin is uncertain.

Currently,

there is a relatively limited use of any bitcoin in the retail and commercial marketplace, thus contributing to price volatility that

could adversely affect an investment in our securities. Banks and other established financial institutions may refuse to process funds

for bitcoin transactions, process wire transfers to or from bitcoin exchanges, bitcoin-related companies or service providers, or maintain

accounts for persons or entities transacting in bitcoin. Conversely, a significant portion of bitcoin demand is generated by investors

seeking a long-term store of value or speculators seeking to profit from the short- or long-term holding of the asset. Price volatility

undermines any bitcoin’s role as a medium of exchange, as retailers are much less likely to accept it as a form of payment. Market

capitalization for a bitcoin as a medium of exchange and payment method may always be low.

The

relative lack of acceptance of bitcoins in the retail and commercial marketplace, or a reduction of such use, limits the ability of end

users to use them to pay for goods and services. Such lack of acceptance or decline in acceptances could have a material adverse effect

on our ability to continue as a going concern or to pursue our new strategy at all, which could have a material adverse effect on our

business, prospects or operations and potentially the value of bitcoins we mine or otherwise acquire or hold for our own account.

Transactional

fees may decrease demand for bitcoin and prevent expansion.

As

the number of bitcoins currency rewards awarded for solving a block in a blockchain decreases, the incentive for miners to continue to

contribute to the bitcoin network may transition from a set reward to transaction fees. In order to incentivize miners to continue to

contribute to the bitcoin network, the bitcoin network may either formally or informally transition from a set reward to transaction

fees earned upon solving a block. This transition could be accomplished by miners independently electing to record in the blocks they

solve only those transactions that include payment of a transaction fee. If transaction fees paid for bitcoin transactions become too

high, the marketplace may be reluctant to accept bitcoin as a means of payment and existing users may be motivated to switch from bitcoin

to another bitcoin or to fiat currency. Either the requirement from miners of higher transaction fees in exchange for recording transactions

in a blockchain or a software upgrade that automatically charges fees for all transactions may decrease demand for bitcoin and prevent

the expansion of the bitcoin network to retail merchants and commercial businesses, resulting in a reduction in the price of bitcoin

that could adversely impact an investment in our securities. Decreased use and demand for bitcoin may adversely affect its value and

result in a reduction in the price of bitcoin and the value of our common stock.

The

decentralized nature of bitcoin systems may lead to slow or inadequate responses to crises, which may negatively affect our business.

The

decentralized nature of the governance of bitcoin systems may lead to ineffective decision making that slows development or prevents

a network from overcoming emergent obstacles. Governance of many bitcoin systems is by voluntary consensus and open competition with

no clear leadership structure or authority. To the extent lack of clarity in corporate governance of bitcoin systems leads to ineffective

decision making that slows development and growth of such cryptocurrencies, the value of our common stock may be adversely affected.

It

may be illegal now, or in the future, to acquire, own, hold, sell or use bitcoin, ether, or other cryptocurrencies, participate in blockchains

or utilize similar bitcoin assets in one or more countries, the ruling of which would adversely affect us.

Although

currently cryptocurrencies generally are not regulated or are lightly regulated in most countries, one or more countries such as China

and Russia, which have taken harsh regulatory action, may take regulatory actions in the future that could severely restrict the right

to acquire, own, hold, sell or use these bitcoin assets or to exchange for fiat currency. In many nations, particularly in China and

Russia, it is illegal to accept payment in bitcoin and other cryptocurrencies for consumer transactions and banking institutions are

barred from accepting deposits of cryptocurrencies. Such restrictions may adversely affect us as the large-scale use of cryptocurrencies

as a means of exchange is presently confined to certain regions globally. Such circumstances could have a material adverse effect on

our ability to continue as a going concern or to pursue our new strategy at all, which could have a material adverse effect on our business,

prospects or operations and potentially the value of any bitcoin or other cryptocurrencies we mine or otherwise acquire or hold for our

own account, and harm investors.

There

is a lack of liquid markets, and possible manipulation of blockchain/bitcoin-based assets.

Cryptocurrencies

that are represented and trade on a ledger-based platform may not necessarily benefit from viable trading markets. Stock exchanges have

listing requirements and vet issuers; requiring them to be subjected to rigorous listing standards and rules, and monitor investors transacting

on such platform for fraud and other improprieties. These conditions may not necessarily be replicated on a distributed ledger platform,

depending on the platform’s controls and other policies. The laxer a distributed ledger platform is about vetting issuers of bitcoin

assets or users that transact on the platform, the higher the potential risk for fraud or the manipulation of the ledger due to a control

event. These factors may decrease liquidity or volume or may otherwise increase volatility of investment securities or other assets trading

on a ledger-based system, which may adversely affect us. Such circumstances could have a material adverse effect on our ability to continue

as a going concern or to pursue our new strategy at all, which could have a material adverse effect on our business, prospects or operations

and potentially the value of any bitcoin or other cryptocurrencies we mine or otherwise acquire or hold for our own account, and harm

investors.

Our

operations, investment strategies and profitability may be adversely affected by competition from other methods of investing in cryptocurrencies.

We

compete with other users and/or companies that are mining cryptocurrencies and other potential financial vehicles, including securities

backed by or linked to cryptocurrencies through entities similar to us. Market and financial conditions, and other conditions beyond

our control, may make it more attractive to invest in other financial vehicles, or to invest in cryptocurrencies directly, which could

limit the market for our shares and reduce their liquidity. The emergence of other financial vehicles and exchange-traded funds have

been scrutinized by regulators and such scrutiny and the negative impressions or conclusions resulting from such scrutiny could be applicable

to us and impact our ability to successfully pursue our new strategy or operate at all, or to establish or maintain a public market for

our securities. Such circumstances could have a material adverse effect on our ability to continue as a going concern or to pursue our

new strategy at all, which could have a material adverse effect on our business, prospects or operations and potentially the value of

any bitcoin or other cryptocurrencies we mine or otherwise acquire or hold for our own account, and harm investors.

The

development and acceptance of competing blockchain platforms or technologies may cause consumers to use alternative distributed ledgers

or other alternatives.

The

development and acceptance of competing blockchain platforms or technologies may cause consumers to use alternative distributed ledgers

or an alternative to distributed ledgers altogether. Our business utilizes presently existent digital ledgers and blockchains and we

could face difficulty adapting to emergent digital ledgers, blockchains, or alternatives thereto. This may adversely affect us and our

exposure to various blockchain technologies and prevent us from realizing the anticipated profits from our investments. Such circumstances

could have a material adverse effect on our ability to continue as a going concern or to pursue our new strategy at all, which could

have a material adverse effect on our business, prospects or operations and potentially the value of any bitcoin or other cryptocurrencies

we mine or otherwise acquire or hold for our own account, and harm investors.

Our

bitcoins may be subject to loss, theft or restriction on access.

There

is a risk that some or all of our bitcoins could be lost or stolen. Cryptocurrencies are stored in bitcoin sites commonly referred to

as “wallets” by holders of bitcoins which may be accessed to exchange a holder’s bitcoin assets. Access to our bitcoin

assets could also be restricted by cybercrime (such as a denial of service attack) against a service at which we maintain a hosted hot

wallet. A hot wallet refers to any bitcoin wallet that is connected to the Internet. Generally, hot wallets are easier to set up and