Filed

pursuant to Rule 424(b)(5)

Registration

No. 333-272516

Prospectus

Supplement

(To

Prospectus dated June 14, 2023)

Up

to $4,000,000

Ordinary

Shares

We

have entered into an At Market Issuance Sales Agreement (the “Sales Agreement”) with B. Riley Securities, Inc. (the “Agent”

or “B. Riley”), relating to our ordinary shares, no par value per share, offered by this prospectus supplement and the accompanying

prospectus. In accordance with the terms of the Sales Agreement, we may offer and sell our ordinary shares having an aggregate offering

price of up to $4.0 million from time to time through or to B. Riley, acting as sales agent or principal.

Our ordinary shares are listed

on The Nasdaq Capital Market under the symbol “OKYO”. On December 19, 2023, the last reported price of our ordinary shares

on The Nasdaq Capital Market was $2.01 per share.

Sales of our ordinary shares,

if any, under this prospectus supplement may be made in sales deemed to be “at the market offerings” as defined in Rule 415(a)(4)

promulgated under the Securities Act of 1933, as amended (the “Securities Act”). B. Riley is not required to sell any specific

number or dollar amount of securities, but will act as a sales agent using commercially reasonable efforts consistent with its normal

trading and sales practices, on mutually agreed terms between B. Riley and us. There is no arrangement for funds to be received in any

escrow, trust or similar arrangement.

B. Riley will be entitled to compensation

at a fixed commission rate of up to 3.0% of the gross sales price per ordinary share sold under the Sales Agreement. In connection with

the sale of our ordinary shares on our behalf, B. Riley will be deemed to be an “underwriter” within the meaning of the Securities

Act and the compensation of B. Riley will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification

and contribution to B. Riley with respect to certain liabilities, including liabilities under the Securities Act or the Securities Exchange

Act of 1934, as amended (the “Exchange Act”).

As of the date of this

prospectus supplement, the aggregate market value of our outstanding ordinary shares held by non-affiliates, or our public float,

was $43,941,615 based on 21,861,500 outstanding ordinary shares held by non-affiliates and a per share price of $2.01, the closing

price of our ordinary shares on December 19, 2023, which is the highest closing price of our ordinary shares on The Nasdaq Capital

Market within the prior 60 days. During the 12 calendar month period that ends on, and

includes, the date of this prospectus supplement (excluding this offering), we have offered and sold our ordinary shares at an

aggregate sales price of $10,606,101 pursuant to General Instruction I.B.6. of Form F-3 and, accordingly, may offer and sell

additional ordinary shares having an aggregate offering price of up to $4 million from time to time through B. Riley in accordance

with the terms of the Sales Agreement.

We are an “emerging growth

company,” as defined by the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and as such, have elected to comply with certain

reduced public company reporting requirements for this prospectus supplement and future filings.

Investing in our securities

involves a high degree of risk. Please carefully consider the risks discussed in this prospectus supplement under “Risk Factors”

on page S-6 in this prospectus supplement, page 7 in the accompanying prospectus and in the documents incorporated by reference in this

prospectus supplement for a discussion of the factors you should carefully consider before deciding to purchase our securities.

Neither the U.S. Securities

and Exchange Commission, any U.S. state securities commission, nor any other foreign securities commission has approved or disapproved

of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

B. Riley Securities

The

date of this prospectus supplement is December 20, 2023.

Table

of Contents

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus are part of a “shelf” registration statement on Form F-3 (File No. 333-272516) that

we originally filed with the U.S. Securities and Exchange Commission (the “SEC”), on June 8, 2023 and which became effective

on June 14, 2023.

This

document is in two parts. The first part is the prospectus supplement, including the documents incorporated by reference, which describes

the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference,

provides more general information. Generally, when we refer to this prospectus supplement, we are referring to both parts of this document

combined. We urge you to carefully read this prospectus supplement and the accompanying prospectus, and the documents incorporated by

reference herein and therein, before buying any of the securities being offered under this prospectus supplement. This prospectus supplement

may add, update or change information contained in the accompanying prospectus. To the extent that any statement that we make in this

prospectus supplement is inconsistent with statements made in the accompanying prospectus or any documents incorporated by reference

therein filed prior to the date of this prospectus supplement, the statements made in this prospectus supplement will be deemed to modify

or supersede those made in the accompanying prospectus and such documents incorporated by reference therein.

You

should rely only on the information contained or incorporated herein by reference in this prospectus supplement and contained or incorporated

therein by reference in the accompanying prospectus. We have not authorized anyone to provide you with different or additional information.

If anyone provides you with different, additional or inconsistent information, you should not rely on it.

We

are offering to sell the securities only in jurisdictions where such offers and sales are permitted. The distribution of this prospectus

supplement and the accompanying prospectus and the offering of the securities in certain jurisdictions or to certain persons within such

jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and

the accompanying prospectus must inform themselves about and observe any restrictions relating to the offering of the securities and

the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement

and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an

offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction

in which it is unlawful for such person to make such an offer or solicitation.

You

should assume that the information in this prospectus supplement and the accompanying prospectus is accurate only as of the date on the

front of the applicable document and that any information we have incorporated by reference is accurate only as of the date of the document

incorporated by reference, regardless of the time of delivery of this prospectus supplement or the accompanying prospectus, or any sale

of a security. Our business, financial condition, results of operations and prospects may have changed since those dates. You should

read this prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement

and the accompanying prospectus when making your investment decision. You should also read and consider the information in the documents

we have referred you to in the sections of this prospectus supplement and the accompanying prospectus titled “Where You Can Find

More Information” and “Incorporation of Documents by Reference.”

The

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference herein or in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in

some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This

prospectus supplement, the accompanying prospectus, and the information incorporated herein and therein by reference includes trademarks,

service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated

by reference into this prospectus supplement or the accompanying prospectus are the property of their respective owners.

Unless

otherwise indicated or the context otherwise requires, all references in this registration statement to the terms “OKYO,”

“OKYO Pharma Limited,” the “Company,” “we,” “us” and “our” refer to OKYO

Pharma Limited and our wholly owned subsidiary OKYO Pharma US Inc.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information about us and this offering and does not contain all of the information that you should consider

in making your investment decision. You should carefully read this entire prospectus supplement and the accompanying prospectus, including

the information set forth under the sections of this prospectus supplement entitled “Risk Factors,” “Cautionary Statement

Regarding Forward-Looking Statements,” and similar headings in the other documents that are incorporated by reference into this

prospectus supplement and the accompanying prospectus. If you invest in our securities, you are assuming a high degree of risk.

Overview

We

are a clinical-stage biopharmaceutical company developing next-generation therapeutics to improve the lives of patients suffering from

inflammatory eye diseases and ocular pain. Our research program is focused on a novel G Protein-Coupled Receptor, or GPCR, which we believe

plays a key role in the pathology of these inflammatory eye diseases of high unmet medical need. Our therapeutic approach is focused

on targeting inflammatory and pain modulation pathways that drive these conditions. We are presently developing OK-101, our lead clinical

product candidate, for the treatment of dry eye disease (“DED”). We also plan to evaluate its potential in benefiting patients

with ocular neuropathic pain, uveitis and allergic conjunctivitis. We have also been evaluating OK-201, a bovine adrenal medulla, or

BAM, lipidated-peptide preclinical analogue candidate that is currently in developmental stage.

OK-101

OK-101,

our lead clinical-stage product candidate, is focused on keratoconjunctivitis sicca, commonly referred to as DED, which is a multifactorial

disease caused by an underlying inflammation resulting in the lack of lubrication and moisture in the surface of the eye. DED is one

of the most common ophthalmic conditions encountered in clinical practice. Symptoms of DED include constant discomfort and irritation

accompanied by inflammation of the ocular surface, visual impairment and potential damage to the ocular surface. There are presently

approximately 20 million people suffering from DED in the U.S. alone (Farrand et al. AJO 2017; 182:90), with the disease affecting approximately

up to 34% of the population aged 50+ (Dana et al. AJO 2019; 202:47), and with women representing approximately two-thirds of those affected

(Matossian et al. J Womens Health (Larchmt) 2019; 28:502–514). Prevalence of DED is anticipated to increase substantially in the

next 10-20 years due to aging populations in the U.S., Europe, Japan and China and use of contact lenses in the younger population. We

believe this increase in prevalence of DED represents a major expanding economic burden to public healthcare. According to Market Research

Report, Dry Eye Disease, December 2020, the global DED market in 2019 was approximately $5.22 billion, with the market size expected

to reach $6.54 billion by 2027. In addition, DED causes approximately $3.8 billion annually in healthcare costs and represents a major

economic burden to public healthcare, accounting for more than $50 billion to the U.S. economy annually.

At

present, there are 5 prescription drugs available to treat DED: 1) Restasis (0.05% cyclosporine), 2) Cequa (0.09% cyclosporine), 3) Xiidra

(5% lifitegrast), 4) Tyrvaya (0.03 mg varenicline), and 5) Eysuvis (0.25% loteprednol – a corticosteroid for short term use only).

However, DED continues to be a major unmet medical need due to the large number of patients not well served by the treatments available

to them through the medical community.

The

development of new drugs to treat DED has been particularly challenging due to the heterogeneous nature of the patient population suffering

from DED, and due to the difficulties in demonstrating an improvement in both signs and symptoms of the disease in well-controlled clinical

trials. The evidence from over 40 years of scientific literature, however, suggests inflammation as the most common underlying element

of DED. Consequently, development of new therapeutic agents that target inflammatory pathways is looking to be an attractive approach

in improving symptoms in DED patients. Moreover, large number of dry eye patients suffer from ocular neuropathic pain, making their condition

more resistant to topical anti-inflammatory therapy, and a drug capable of targeting both of these aspects of DED would be a significant

addition to the ocular-care practitioner’s arsenal for the treatment of DED.

The

chemerin receptor (CMKLR1 or ChemR23) is a chemokine like GCPR expressed on select populations of cells including inflammatory mediators,

epithelial and endothelial cells as well as neurons and glial cells in the dorsal root ganglion, spinal cord, and retina. Activation

of CMKLR1 by chemerin has been shown to resolve the inflammation and pain in animal models of asthma and pain, respectively. We have

been pioneering the development of OK-101, a lipidated-chemerin analogue, which is an agonist of CMKLR1, in treating DED and other ocular

inflammatory conditions. OK-101 was first identified in a program developed by OTT using membrane-tethered ligand technology.

To

expand our understanding of the structure-activity relationships of the lipidated-chemerin analogues, such as OK-101, as agonists of

the chemerin receptor, we synthesized a small library of analogues of OK-101. We screened these analogues in a cell-line based receptor

binding assay to characterize the agonist potency of these lipidated-chemerin analogues. This work has also been coupled to an evaluation

of a subset of these analogues’ potential in treating DED by using a variety of preclinical studies and dry eye animal model studies.

After evaluating a number of our analogues in a mouse model of acute DED by looking at their ability to reduce corneal permeability,

a measure of dry-eye effectiveness, as well as the analogues’ impact on immune response, we determined that OK-101 was in fact

the most potent analogue in reducing corneal permeability and down-regulating immune response. In addition, in a separate set of animal

model experiments, OK-101 was shown to exhibit potent ocular pain-reducing activity in a ciliary nerve ligation mouse model of corneal

neuropathic pain. Following these studies, we evaluated the ocular tolerance of OK-101 via repeated ocular instillation in rabbits

followed by clinical ophthalmic observations. Rabbit ocular tolerance tests on OK-101 showed no adverse signs such as inflammation, chemosis

or hyperemia and no signs of local irritation. With potential anti-inflammatory and neuropathic pain reducing characteristics, we are

developing OK-101 for the treatment of DED.

Based

on the results from the DED animal model, the neuropathic corneal pain model as well as the rabbit ocular tolerance studies, we moved

forward over the past 18 months with plans to file an IND on OK-101 to treat DED to enable us to begin clinical trials soon thereafter.

During the fourth quarter of 2021 we successfully manufactured a 200-gram batch of OK-101 drug substance needed for initiating the IND-enabling

studies that were begun during the first quarter of 2022. In support of this work, we also had previously signed an agreement on April

13, 2021, with Ora, Inc., or Ora, a major clinical research organization, or CRO, specializing in ophthalmic drug development.

On

February 15, 2022, we announced the successful completion of the pre-IND meeting facilitated by Ora with the FDA regarding development

plans for OK-101 to treat DED. Both nonclinical and clinical development milestones were covered in the pre-IND meeting, with the FDA

agreeing that our first human trial would be a Phase 2 safety and efficacy trial in DED patients. The FDA also provided guidance on the

planned protocol for this trial in DED patients, concurring with one particular option OKYO has considered for the protocol which is

to designate co-primary efficacy endpoints covering both a sign and a symptom of DED in the clinical trial. Notably, the final decision

we recently took to, in fact, designate these two primary efficacy endpoints in the clinical protocol of the ongoing phase 2 trial is

significant as should this phase 2 trial then meet these prespecified endpoints, the trial should considerably affect the timeline to

an NDA filing with the FDA for OK-101 to treat DED.

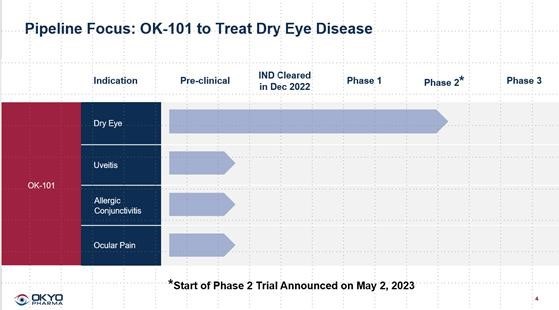

On

May 2, 2023, we announced that the first patient had been screened for our Phase 2, multi-center, randomized, double-blinded, placebo-controlled

trial of OK-101. Because the drug is designed to be administered topically, we were able to skip the standard Phase 1 studies typically

expected with orally delivered or injectable drug candidates in non-life-threatening conditions and we opened the first trial with OK-101

as a Phase 2 clinical trial in DED patients (See OKYO Pipeline below). This trial is planned to be conducted in approximately 200 to

240 DED patients. The study is being designed in conjunction with and is being managed and monitored by Ora, well known for its leadership

of ophthalmic clinical trial activities. The Phase 2 trial is expected to be completed in 6-8 months from enrollment of the first patient.

OK-201

MAS-Related

G Protein-Coupled Receptors, or MRGPRs, mainly expressed in the sensory neurons, are involved in the perception of pain, thus making

them a promising analgesic target. Activation of MRGPR by Bovine Adrenal Medulla, or BAM, peptide inhibits pain perception by modulating

Ca2+ influx. OK-201, a BAM peptide analogue, licensed from TMC on May 1, 2018, is a potent agonist of human MRGPR and a promising candidate

for the treatment of neuropathic and inflammatory pain.

On

August 6, 2019, we signed a collaborative agreement with TMC and Pedram Hamrah, MD, Professor of Ophthalmology at Tufts University School

of Medicine, Boston, MA as Principal Investigator to evaluate OK-201 and other proprietary lead compounds to suppress corneal neuropathic

pain using a mouse ocular pain model recently developed in Dr. Hamrah’s laboratory. Our goal was to further develop this lipidated

peptide, as well as explore additional analogues, for their potential use in treating ocular pain, and for potentially treating long-term

chronic pain.

On

April 28, 2021, we announced positive results of OK-201, a non-opioid analgesic drug candidate delivered topically in Dr. Hamrah’s

mouse neuropathic corneal pain model, as a potential drug to treat acute and chronic ocular pain. Importantly, OK-201 demonstrated a

reduced corneal pain response equivalent to that of gabapentin, a commonly used oral drug for neuropathic pain. These observations demonstrated

preclinical ‘proof-of-concept’ for the topical administration of OK-201 as a potential non-opioid analgesic for ocular pain.

Current treatments for corneal pain are limited to short term non-steroidal anti-inflammatory drugs, or NSAIDs, steroids, and oral gabapentin

and opioids in severe cases.

Although

the results with OK-201 were encouraging, due to subsequent success obtained with OK-101 (see section above on OK-101) in follow-on animal

model studies utilizing the same mouse corneal neuropathic pain model as for OK-201, we have decided to maintain this drug candidate

at the exploratory level while we focus our primary energy on the OK-101 program to treat DED, based on OK-101’s combination of

anti-inflammatory and corneal pain-reducing activities in animal models of these conditions.

Corporate

Information

We

were originally incorporated in the British Virgin Islands as a British Virgin Islands Business Company on July 4, 2007 under the BVI

Business Companies Act 2004 with company number 1415559 under the name Jellon Enterprises, Inc. Our legal and commercial name was changed

to Minor Metals & Mining, Inc. on October 24, 2007, to Emerging Metals Limited on November 28, 2007, to West African Minerals Corporation

on December 9, 2011, and to OKYO Pharma Corporation on January 10, 2018. On March 9, 2018, shareholders approved the cancellation of

our AIM listing and migration to Guernsey. On July 3, 2018, following the approval of the Guernsey Companies Registry, we were registered

under the Guernsey Companies Law under the name OKYO Pharma Limited, as a Guernsey company with limited liability, an indefinite life

and company number 65220. We are domiciled in Guernsey. On July 17, 2018, our Ordinary Shares were admitted to listing on the standard

segment of the Official List of the FCA and admitted to trading on the Main Market of the London Stock Exchange. On May 22, 2023, we

delisted our ordinary shares from the standard segment of Official List of the FCA, and trading ceased on the Main Market of the London

Stock Exchange. We are no longer subject to the Takeover Code.

Our

registered office is located at Martello Court, Admiral Park, St. Peter Port, Guernsey GY1 3HB and our telephone number is +44 (0) 20

7495 2379. Our website address is www.okyopharma.com. The reference to our website is an inactive textual reference only and the information

contained in, or that can be accessed through, our website is not a part of this prospectus supplement or the accompanying prospectus.

Our agent for service of process in the United States is OKYO Pharma US, Inc.

THE

OFFERING

| Ordinary

shares offered by us in this offering |

|

Ordinary

shares having an aggregate offering price of up to $4.0 million. |

| |

|

|

| Ordinary

shares outstanding immediately after this offering (1) |

|

Up

to 35,226,100 ordinary shares, assuming the sale of up to 1,990,050 ordinary shares hereunder at a price of $2.01 per share,

the closing price per share on The Nasdaq Capital Market on December 19, 2023. The actual number of shares issued may vary depending

on the price at which shares may be sold from time to time during this offering. |

| |

|

| Use

of proceeds |

|

We

currently expect to use the net proceeds, if any, for clinical development of our product candidates, general corporate purposes

and working capital. See “Use of Proceeds” on page S-8.

|

| Form

of offering |

|

“At

the market offering” that may be made from time to time through or to B. Riley as sales

agent or principal. See “Plan of Distribution” on page S-10 of this prospectus

supplement.

|

| |

|

| Risk

factors |

|

See

“Risk Factors” beginning on page S-6 of this prospectus supplement, page 7 of the accompanying prospectus and

all other information included in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus

for a discussion of certain factors you should carefully consider before deciding to invest in our securities. |

| |

|

| Nasdaq

Capital Market symbol for Ordinary shares |

|

Our

ordinary shares are listed on the Nasdaq Capital Market under the symbol “OKYO.” |

(1)

The number of ordinary shares to be outstanding after this offering is based on 33,236,050 ordinary shares outstanding as of December

14, 2023, and excludes as of such date:

| |

● |

2,146,451 ordinary shares issuable upon the exercise of share options at

a weighted average exercise price of $3.44 per ordinary share of which 618,354 ordinary shares are currently exercisable and 1,528,097

are exercisable between July 27, 2023 and November 23, 2033; and |

| |

● |

538,461

ordinary shares that currently may be issued upon the exercise of warrants to purchase ordinary shares at a weighted average exercise

price of $3.68 per ordinary share. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider

carefully the risks described below and discussed under the section captioned “Risk Factors” contained in our Annual Report

on Form 20-F for the year ended March 31, 2023, as amended, which is incorporated by reference in this prospectus supplement

and the accompanying prospectus in its entirety, and any amendment or update thereto reflected in subsequent filings with the SEC, together

with other information in this prospectus supplement, the accompanying prospectus, the information and documents incorporated herein

and therein by reference, as updated by our subsequent filings under the Exchange Act and in any free writing prospectus that we have

authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results

of operations or cash flow could be seriously harmed. This could cause the trading price of our ordinary shares to decline, resulting

in a loss of all or part of your investment.

Risks

Related to this Offering and our Nasdaq Listing

Management

will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Our

management will have broad discretion in the application of the net proceeds we receive in this offering, including for any of the purposes

described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision

to assess whether our management is using the net proceeds appropriately. Because of the number and variability of factors that will

determine our use of our net proceeds from this offering their ultimate use may vary substantially from their currently intended use.

You

may experience immediate and substantial dilution as a result of this offering.

The

offering price per share in this offering may exceed the net tangible book value per share of our ordinary shares outstanding prior to

this offering. Assuming that an aggregate of 1,990,050 ordinary shares are sold during the term of the Sales Agreement at an assumed

public offering price of $2.01 per share, the last reported sale price of our ordinary shares on The Nasdaq Capital Market on December

19, 2023, for aggregate gross proceeds of $4,000,000, after deducting commissions and estimated aggregate offering expenses payable by

us, you will experience immediate dilution of $1.16 per share, representing the difference between our pro forma as adjusted net tangible

book value per share as of March 31, 2023 after giving effect to this offering and the assumed offering price. The exercise of outstanding

stock options and warrants may result in further dilution of your investment. See the section entitled “Dilution” below for

a more detailed illustration of the dilution you would incur if you participate in this offering.

If

we raise additional capital in the future, your ownership in us could be diluted.

In

order to raise additional capital, we may at any time, including during this offering, offer additional ordinary shares or other securities

convertible into or exchangeable for our ordinary shares at prices that may not be the same as the price per share in this offering.

We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors

in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders,

including investors who purchase ordinary shares in this offering. The price per share at which we sell additional ordinary shares or

securities convertible into ordinary shares in future transactions may be higher or lower than the price per share in this offering.

Until

such time, if ever, as we can generate substantial revenue from our operations, we anticipate financing our cash needs through a combination

of equity offerings, debt financings and license agreements. To the extent that we raise additional capital through the further sale

of equity securities or convertible debt securities, your ownership interest will be diluted.

We

have never declared or paid any cash dividends on our ordinary shares and, accordingly, shareholders must rely on stock appreciation

for any return on their investment.

We

have never declared or paid any cash dividends on our ordinary shares, and we do not intend to pay any cash dividends on our ordinary

shares. Rather, we currently intend to retain all available funds and any future earnings, if any, to fund the development and expansion

of our business and for general corporate purposes, and we do not anticipate paying any cash dividends in the foreseeable future. Consequently,

investors must rely on sales of their ordinary shares after price appreciation, which may never occur, as the primary way to realize

any gains on their investment.

The

actual number of ordinary shares we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject

to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice

to B. Riley at any time throughout the term of the Sales Agreement. The number of shares that are sold by B. Riley after delivering a

placement notice will fluctuate based on the market price of our ordinary shares during the sales period and limits we set with B. Riley.

Because the price per share of each share sold will fluctuate based on the market price of our ordinary shares during the sales period,

it is not possible at this stage to predict the number of shares that will be ultimately issued.

The

ordinary shares offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times

will likely pay different prices.

Investors

who purchase shares in this offering at different times will likely pay different prices, and so may experience different outcomes in

their investment results. We will have discretion, subject to market demand, to vary the timing, prices and numbers of shares sold, and

there is no minimum or maximum sales price. Investors may experience a decline in the value of their shares as a result of share sales

made at prices lower than the prices they paid.

Our

ordinary shares could be delisted from The Nasdaq Capital Market.

We

may be unable to maintain the listing of our ordinary shares on The Nasdaq Capital Market. In the event that our ordinary shares were

to be delisted from The Nasdaq Capital Market, we expect that they would be traded on the OTCQB or OTCQX, which are unorganized, inter-dealer, over-the-counter markets

which provide significantly less liquidity than the Nasdaq or other national securities exchanges. In the event that our ordinary shares

were to be delisted from The Nasdaq Capital Market, it may have a material adverse effect on the trading and price of our ordinary shares.

If,

for any reason, Nasdaq should delist our ordinary shares from trading on its exchange and we are unable to obtain listing on another

national securities exchange or take action to restore our compliance with the Nasdaq continued listing requirements, a material adverse

effect on our shareholders may occur due to a reduction in some or all of the following: the market price of our ordinary shares; the

liquidity of our ordinary shares; our ability to obtain financing for the continuation of our operations; the number of market makers

in our ordinary shares; and the number of institutional and general investors that will consider investing in our ordinary shares.

In

the event that our ordinary shares were to be delisted from The Nasdaq Capital Market, they may be considered a “penny stock.”

Securities broker-dealers participating in sales of our ordinary shares would then be subject to the “penny stock” regulations

set forth in Rules 15g-2 through 15g-9 promulgated under the Exchange Act. Generally, brokers may be less willing

to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to

dispose of our ordinary shares and cause a decline in the market value of our stock.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein and therein, and any free writing

prospectus that we have authorized for use in connection with this offering, contain forward-looking statements that involve substantial

risks and uncertainties. The forward-looking statements are contained principally in the sections of this prospectus supplement titled

“About this Prospectus Supplement,” “Risk Factors,” and “Prospectus Supplement Summary.” All statements,

other than statements of historical facts, contained in this prospectus supplement, including statements regarding our future results

of operations and financial position, business strategy, prospective products, product approvals, research and development costs, timing

and likelihood of success, plans and objectives of management for future operations, and future results of current and anticipated products,

are forward-looking statements. These statements relate to future events or to our future financial performance and involve known and

unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different

from any future results, performance or achievements expressed or implied by the forward-looking statements. The words “anticipate,”

“assume,” “believe,” “contemplate,” “continue,” “could,” “estimate,”

“expect,” “goal,” “intend,” “may,” “might,” “objective,” “plan,”

“potential,” “predict,” “project,” “positioned,” “seek,” “should,”

“target,” “will,” “would,” or the negative of these terms or other similar expressions are intended

to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking

statements are based on current expectations, estimates, forecasts and projections about our business and the industry in which we operate

and management’s beliefs and assumptions, are not guarantees of future performance or development and involve known and unknown

risks, uncertainties and other factors.

Actual

results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we

make. As a result, any or all of our forward-looking statements in this prospectus supplement may turn out to be inaccurate. We have

included important factors in the cautionary statements included in this prospectus supplement, particularly in the section of this prospectus

supplement titled “Risk Factors,” that we believe could cause actual results or events to differ materially from the forward-looking

statements that we make. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements,

and you should not place undue reliance on our forward-looking statements. Moreover, we operate in a highly competitive and rapidly changing

environment in which new risks often emerge. It is not possible for our management to predict all risks, nor can we assess the impact

of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially

from those contained in any forward-looking statements we may make. Our forward-looking statements do not reflect the potential impact

of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You

should read this prospectus supplement, the accompanying prospectus, and the documents that we reference in this prospectus supplement

and have filed as exhibits to the registration statement of which this prospectus supplement is a part completely and with the understanding

that our actual future results may be materially different from what we expect. The forward-looking statements contained in this prospectus

supplement are made as of the date of this prospectus supplement, and we do not assume any obligation to update any forward-looking statements

except as required by applicable law and regulation.

USE

OF PROCEEDS

We

may issue and sell our ordinary shares having aggregate gross sales proceeds of up to $4.0 million from time to time. The amount of proceeds

from this offering will depend upon the number of ordinary shares sold and the market price at which they are sold. There can be no assurance

that we will be able to sell any shares under or fully utilize the Sales Agreement with B. Riley as a source of financing.

We

currently intend to use the net proceeds to us from this offering for clinical development of our product candidates, general corporate

purposes and working capital. This expected use of our net proceeds from this offering represents our intentions based upon our current

plans and business conditions, which could change in the future as our plans and business conditions evolve. The amounts and timing of

our actual expenditures may vary significantly depending on numerous factors, including any unforeseen cash needs. Accordingly, we will

have broad discretion over the uses of the net proceeds from this offering and investors will be relying on the judgment of our management

regarding the application of the net proceeds from this offering. The timing and amount of our actual expenditures will be based on many

factors, including cash flows from operations and the anticipated growth of our business.

Investors

are further cautioned that the proceeds from this offering are expected to be sufficient to enable us to continue operations for only

a short period of time. We expect that we will have to raise such additional funds through the sale of additional equity or equity backed

securities. Any future equity or equity linked financing that we may need may not be able available on terms favorable to us or at all.

Pending

any use, as described above, we plan to deposit the net proceeds in money market accounts with our primary bank or otherwise invest the

net proceeds in high-quality, short-term, interest-bearing securities.

DILUTION

If

you invest in our securities in this offering, your ownership interest will be diluted to the extent of the difference between the offering

price per ordinary share in this offering and the as adjusted net tangible book value per ordinary share immediately after this offering.

The net tangible book value of our ordinary shares as of March 31, 2023 was approximately $(2,053,237), or approximately $(0.08) per

ordinary share based upon 25,519,882 ordinary shares outstanding at that time. Net tangible book value per share is equal to our total

tangible assets, less our total liabilities, divided by the total number of ordinary shares outstanding as of March 31, 2023.

Net

tangible book value dilution per ordinary share to investors participating in this offering represents the difference between the effective

offering price per ordinary share paid by purchasers of securities in this offering and the pro forma as adjusted net tangible book value

per ordinary share immediately after this offering. After giving effect to the issuance of (i) the issuance of 2,666,670 ordinary shares

in September 2023 at an offering price of $1.50 per share, (ii) the issuance of 1,092,600 ordinary shares in October 2023 at an offering

price of $1.50 per share, (iii) the issuance of 2,766,667 ordinary shares to certain creditors in October 2023, (iv) the issuance of

400,000 ordinary shares in December 2023 at an offering price of $1.50 per share and (v) the issuance of 144,800 ordinary shares in December

2023 to certain creditors in December 2023, our pro forma net tangible book value as of March 31, 2023 would have been approximately

$8.5 million, or $0.26 per ordinary share. After giving effect to the sale of our ordinary shares in the aggregate amount of $4.0 million

in this offering at an assumed public offering price of $2.01 per share (which was the last reported sale price of our ordinary shares

on the Nasdaq Capital Market on December 19, 2023), and after deducting estimated offering expenses and after deducting estimated sales

agent commissions payable by us, our pro forma as adjusted net tangible book value as of March 31, 2023 would have been approximately

$12.5 million, or $0.35 per ordinary share. This represents an immediate increase in net tangible book value of $0.09 per ordinary share

to existing stockholders and immediate dilution of $1.16 per ordinary share to investors purchasing our securities in this offering at

the offering price. The following table illustrates this dilution on a per ordinary share basis:

| Assumed public offering price per

share | |

| | | |

$ | 2.01 | |

| Pro forma net tangible book

value per share as of March 31, 2023 | |

$ | 0.26 | | |

| | |

| Increase

in net tangible per share attributable to this offering | |

| 0.09 | | |

| | |

| Pro forma as adjusted

net tangible book value per share as of March 31, 2023 | |

| | | |

| 0.35 | |

| Dilution

in net tangible book value per share to investors participating in this offering | |

| | | |

$ | 1.16 | |

The discussion of

dilution, and the table quantifying it, assumes no exercise of any outstanding options or warrants or other potentially dilutive securities.

The exercise of potentially dilutive securities having an exercise price less than the offering price would increase the dilutive effect

to new investors.

In particular, the table

above excludes the following securities as of March 31, 2023:

| |

● |

1,956,451

ordinary shares issuable upon the exercise of share options at a weighted average exercise price of $3.63 per ordinary share of which

618,354 ordinary shares are currently exercisable and 1,338,097 are exercisable between July 27, 2023 and July 26, 2033; and |

| |

|

|

| |

● |

538,461

ordinary shares that currently may be issued upon the exercise of warrants to purchase ordinary shares at a weighted average exercise

price of $3.68 per ordinary share. |

To

the extent that any outstanding stock options or warrants are exercised, new options are issued under our equity incentive plans and

subsequently exercised or we issue additional ordinary shares in the future, there will be further dilution to new investors participating

in this offering.

PLAN

OF DISTRIBUTION

We

have entered into an At Market Issuance Sales Agreement (the “Sales Agreement”) with B. Riley (the “Agent”).

Pursuant to this prospectus supplement, we may offer and sell our ordinary shares having an aggregate gross sales price of up to $4.0

million from time to time through or to the Agent acting as sales agent or principal.

The

Agent may sell the ordinary share by any method permitted by law deemed to be an “at the market offering” as defined in Rule

415(a)(4) under the Securities Act.

Each

time that we wish to sell ordinary shares under the Sales Agreement, we will provide the Agent with a placement notice describing the

number of ordinary shares to be sold, the time period during which sales are requested to be made, any limitation on the number of ordinary

shares that may be sold in any one day and any minimum price below which sales may not be made.

Upon

receipt of a placement notice from us, and subject to the terms and conditions of the Sales Agreement, the Agent has agreed to use its

commercially reasonable efforts consistent with its normal trading and sales practices to sell such ordinary shares up to the amount

specified on such terms. Unless otherwise specified, the settlement between us and the Agent will occur on the second trading day following

the date on which the sale was made. The obligation of the Agent under the Sales Agreement to sell ordinary shares pursuant to a placement

notice is subject to a number of conditions. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We

will pay the Agent a commission of up to 3% of the gross proceeds of the sales price of all ordinary shares sold through the Agent as

sales agent under the Sales Agreement. Because there is no minimum offering amount required as a condition to closing this offering,

the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time.

We

estimate that the total expenses for the offering, excluding compensation payable to the Agent under the terms of the Sales Agreement,

will be approximately US$50,000. We have also agreed to reimburse B. Riley for its reasonable out-of-pocket expenses, including

attorney’s fees, in an amount not to exceed an aggregate of $75,000 incurred in connection with entering into the transactions

contemplated by the Sales Agreement and up to $5,000 per calendar quarter, for ongoing diligence arising from the transactions contemplated

by the Sales Agreement.

In

connection with the sale of ordinary shares contemplated in this prospectus supplement, the Agent will be deemed to be an “underwriter”

within the meaning of the Securities Act, and the compensation paid to the Agent will be deemed to be underwriting commissions or discounts.

We have agreed to provide indemnification and contribution to B. Riley against certain civil liabilities, including liabilities under

the Securities Act.

The

offering of ordinary shares pursuant to the Sales Agreement will terminate on the earlier of (1) the sale of all of the ordinary shares

subject to the Sales Agreement or (2) termination of the Sales Agreement by us or the Agent.

This

summary of the material provisions of the Sales Agreement does not purport to be a complete statement of its terms and conditions. A

copy of the Sales Agreement has been or will be filed with the SEC as an exhibit to registration statement of which this prospectus supplement

is a part.

The

Agent does not have any relationship with us other than its role as a sales agent for our current “at the market offerings”

of ordinary shares. The Agent and its affiliates may in the future provide various investment banking and other financial services for

us, for which services they may in the future receive customary fees.

LEGAL

MATTERS

Certain

legal matters with respect to English law and Guernsey law in connection with the validity of our ordinary shares registered hereby

will be passed upon for us by Orrick, Herrington & Sutcliffe (UK) LLP, United Kingdom and Carey Olsen (Guernsey) LLP, Bailiwick

of Guernsey, respectively. Certain matters of U.S. federal law will be passed upon for us by Sheppard, Mullin, Richter & Hampton

LLP, New York, New York. B. Riley Securities, Inc. is being represented in this offering by Duane Morris LLP, New York, New

York.

EXPERTS

The

consolidated financial statements of OKYO Pharma Limited as of March 31, 2023 and for the year then ended, included in our Form 20-F

annual report for the year ended March 31, 2023, as amended, and incorporated by reference in this prospectus supplement have

been audited by PKF Littlejohn LLP, an independent registered public accounting firm, given on the authority of said firm as experts

in auditing and accounting. The audit report contains an explanatory paragraph regarding our ability to continue as a going concern.

The

consolidated financial statements of OKYO Pharma Limited as of March 31, 2022, and 2021 and for each of the years then ended, included

in our Form 20-F annual report for the year ended March 31, 2023 and incorporated by reference in this prospectus

supplement have been audited by Mazars LLP, an independent registered public accounting firm, given on the authority of said firm

as experts in auditing and accounting. The audit report contains an explanatory paragraph regarding our ability to continue as a going

concern. The registered business address of Mazars LLP is 30 Old Bailey, London EC4M 7AU, United Kingdom.

INCORPORATION

OF DOCUMENTS BY REFERENCE

This

prospectus supplement is part of the registration statement, but the registration statement includes and incorporates by reference additional

information and exhibits. The SEC permits us to “incorporate by reference” the information contained in documents we file

with the SEC, which means that we can disclose important information to you by referring you to those documents rather than by including

them in this prospectus supplement and the accompanying base prospectus. Information that is incorporated by reference is considered

to be part of this prospectus supplement and the accompanying base prospectus and you should read it with the same care that you read

this prospectus supplement and the accompanying base prospectus. Information that we file later with the SEC will automatically update

and supersede the information that is either contained, or incorporated by reference, in this prospectus supplement and the accompanying

base prospectus, and will be considered to be a part of this prospectus supplement and the accompanying base prospectus from the date

those documents are filed.

We

incorporate by reference the documents listed below, all filings filed by us pursuant to the Exchange Act after the date of the registration

statement of which this prospectus supplement and the and the accompanying base prospectus form a part, and any future filings we make

with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the time that all securities covered by this prospectus

supplement have been sold; provided, however, that we are not incorporating any information furnished under either Item 2.02 or Item

7.01 of any Current Report on Form 6-K and exhibits furnished on such form that relate to such items:

| ● |

|

Our Annual Report on Form 20-F for the fiscal year ended March 31, 2023 filed with the SEC on August 15, 2023, as amended on August 25, 2023; |

| |

|

|

| ● |

|

our Reports on Form 6-K

furnished to the SEC on May

18, 2022, May

19, 2022, May

20, 2022, June

9, 2022, August

16, 2022, August

19, 2022, August

30, 2022, September

7, 2022, September

8, 2022, October

20, 2022, October

24, 2022, November

10, 2022, November

21, 2022, November

25, 2022, December

1, 2022, December

6, 2022, December

21, 2022, December

22, 2022, December

30, 2022,

January 3, 2023, January

4, 2023, February

14, 2023, February

21, 2023, February

23, 2023, February

28, 2023, March

13, 2023, March

14, 2023, March

15, 2023 (2), March

16, 2023, March

24, 2023, March

29, 2023, March

30, 2023, April

4, 2023, April

5, 2023, April

25, 2023, May

2, 2023, May

3, 2023 (3), May

11, 2023 (2), May

15, 2023, May

19, 2023, May

22, 2023, June

6, 2023, July

27, 2023, July

28, 2023, July

31, 2023, August

15, 2023, August

29, 2023, August

30, 2023, September

8, 2023, September

13, 2023, September

14, 2023, September

15, 2023, October

5, 2023, October

10, 2023, October

31, 2023, November

1 2023, November

29, 2023, December

4, 2023 and December

18, 2023; and |

| |

|

|

| ● |

|

the description of our

ordinary shares contained in our Registration Statement on Form 8-A filed with the SEC on May 10, 2022, as amended by Form 8-A/A filed with the SEC on June 2, 2023, including any amendments or reports filed for the purpose of updating such description. |

We

are also incorporating by reference all subsequent Annual Reports on Form 20-F that we file with the SEC and certain reports on Form

6-K that we furnish to the SEC after the date of this prospectus supplement (if they state that they are incorporated by reference into

this prospectus supplement) prior to the termination of this offering. In all cases, you should rely on the later information over different

information included in this prospectus supplement.

Unless

expressly incorporated by reference, nothing in this prospectus supplement shall be deemed to incorporate by reference information

furnished to, but not filed with, the SEC. Copies of all documents incorporated by reference in this prospectus supplement, other than

exhibits to those documents unless such exhibits are specifically incorporated by reference in this prospectus supplement, will

be provided at no cost to each person, including any beneficial owner, who receives a copy of this prospectus supplement on the

written or oral request of that person made to:

OKYO

Pharma Limited

Martello

Court

Admiral

Park

St.

Peter Port

Guernsey

GY1 3HB

+44

(0)20 7495 2379

You

may also access these documents on our website, www.okyopharma.com. The information contained on, or that can be accessed through,

our website is not a part of this prospectus supplement. We have included our website address in this prospectus supplement solely as

an inactive textual reference.

You

should rely only on information contained in, or incorporated by reference into, this prospectus supplement. We have not authorized anyone

to provide you with information different from that contained in this prospectus supplement or incorporated by reference in this prospectus

supplement. We are not making offers to sell the securities in any jurisdiction in which such an offer or solicitation is not authorized

or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer

or solicitation.

WHERE YOU CAN FIND MORE INFORMATION

This

prospectus supplement constitutes a part of the registration statement on Form F-3 that we have filed with the SEC under the Securities

Act. As permitted by the SEC’s rules, this prospectus supplement and any accompanying prospectus, which forms a part of the registration

statement, do not contain all of the information that is included in the registration statement. You will find additional information

about us in the registration statement. Any statement made in this prospectus supplement or any accompanying prospectus concerning legal

documents are not necessarily complete and you should read the documents that are filed as exhibits to the registration statement or

otherwise filed with the SEC for a more complete understanding of the document or matter.

We

are subject to the informational requirements of the Exchange Act. Our Annual Report on Form 20-F for the year ending March 31, 2023

has been filed with the SEC. The company has also filed periodic reports with the SEC on Form 6-K. You may inspect and copy reports and

other information filed with the SEC at the Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation

of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet website

that contains reports and other information about issuers, like us, that file electronically with the SEC. The address of that website

is www.sec.gov.

As

a foreign private issuer, we are exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and

content of proxy statements, and our executive officers, directors and principal shareholders are exempt from the reporting and

short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we will not be required under the

Exchange Act to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose

securities are registered under the Exchange Act.

PROSPECTUS

$100,000,000

Ordinary

Shares

Warrants

Units

We

may offer, issue and sell from time to time up to $100,000,000, or its equivalent in any other currency, currency units, or composite

currency or currencies, of our ordinary shares, warrants to purchase ordinary shares, and a combination of such securities, separately

or as units, in one or more offerings. This prospectus provides a general description of offerings of these securities that we may undertake.

We

refer to our ordinary shares, warrants, and units collectively as “securities” in this prospectus.

Each

time we sell our securities pursuant to this prospectus, we will provide the specific terms of such offering in a supplement to this

prospectus. The prospectus supplement may also add, update, or change information contained in this prospectus. You should read this

prospectus, the accompanying prospectus supplement, together with the additional information described under the heading “Where

You Can Find More Information,” before you make your investment decision.

We

may, from time to time, offer to sell the securities, through public or private transactions, directly or through underwriters, agents

or dealers, on or off The Nasdaq Capital Market, at prevailing market prices or at privately negotiated prices. If any underwriters,

agents or dealers are involved in the sale of any of these securities, the applicable prospectus supplement will set forth the names

of the underwriter, agent or dealer and any applicable fees, commissions or discounts.

Our

ordinary shares are listed on The Nasdaq Capital Market under the symbol “OKYO”. On June 7, 2023, the last reported price

of our ordinary shares on The Nasdaq Capital Market was $1.45 per share.

We

are an “emerging growth company,” as defined by the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and as such,

have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing

in our securities involves a high degree of risk. Please carefully consider the risks discussed in this prospectus under “Risk

Factors” in this prospectus, in any accompanying prospectus supplement and in the documents incorporated by reference in this prospectus

for a discussion of the factors you should carefully consider before deciding to purchase our securities.

Neither

the U.S. Securities and Exchange Commission, any U.S. state securities commission, nor any other foreign securities commission has approved

or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a

criminal offense.

The

date of this prospectus is June 14, 2023.

Table

of Contents

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or SEC, using a “shelf”

registration process. Under this shelf registration process, we may sell our securities described in this prospectus in one or more offerings

up to a total dollar amount of $100,000,000. Each time we offer our securities, we will provide you with a supplement to this prospectus

that will describe the specific amounts, prices and terms of the securities we offer. The prospectus supplement may also add, update

or change information contained in this prospectus. This prospectus, together with applicable prospectus supplements and the documents

incorporated by reference in this prospectus and any prospectus supplements, includes all material information relating to an offering

of our securities. Please read carefully both this prospectus and any prospectus supplement together with additional information described

below under “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

You

should rely only on the information contained in or incorporated by reference in this prospectus and any applicable prospectus supplement.

We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or inconsistent

information, you should not rely on it. The information contained in this prospectus is accurate only as of the date of this prospectus,

regardless of the time of delivery of this prospectus or any sale of securities described in this prospectus. This prospectus is not

an offer to sell our securities and it is not soliciting an offer to buy our securities in any jurisdiction where the offer or sale is

not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information

we have previously filed with the SEC and incorporated by reference, is accurate as of the date on the front of those documents only.

Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus may not be

used to consummate a sale of our securities unless it is accompanied by a prospectus supplement.

Throughout

this prospectus, unless otherwise designated, the terms “OKYO,” “OKYO Pharma Limited,” “the company,”

“we,” “us” and “our” refer to OKYO Pharma Limited and its wholly-owned subsidiary, OKYO Pharma US,

Inc. References to “ordinary shares”, “warrants” and “share capital” refer to the ordinary shares,

warrants and share capital, respectively, of OKYO Pharma Limited.

Certain

figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables

may not be an arithmetic aggregation of the figures that precede them.

We

have not authorized anyone to provide you with information that is different from that contained in this prospectus, any amendment or

supplement to this prospectus, or in any free writing prospectus we may authorize to be delivered or made available to you. We take no

responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus

is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale

is not permitted. The information contained in this prospectus is accurate only as of the date on the front of this prospectus, regardless

of the time of delivery of this prospectus or any sale of the securities. For investors outside of the United States: We have not taken

any action to permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose

is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to

this offering and the distribution of this prospectus.

The

industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described

in the section titled “Risk Factors.” These and other factors could cause results to differ materially from those expressed

in the estimates made by the independent parties and by us.

We

qualify as an “emerging growth company,” as defined in the JOBS Act. An emerging growth company may take advantage of specified

reduced reporting and regulatory requirements in contrast to those otherwise applicable generally to public companies. These provisions

include, but are not limited to, an exemption from the auditor attestation requirement in the assessment of our internal control over

financial reporting pursuant to Section 404 the Sarbanes-Oxley Act of 2002, as amended.

We

may take advantage of these reduced reporting and other regulatory requirements until such time that we are no longer an emerging growth

company. We will remain an “emerging growth company” until the earliest of (i) the last day of the fiscal year in which we

have total annual gross revenues of $1.07 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the

date of our initial public offering; (iii) the date on which we have issued more than $1 billion in non-convertible debt during the previous

three years; or (iv) the date on which we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 of the Securities

Exchange Act of 1934, as amended, or the Exchange Act. In addition, the JOBS Act provides that an emerging growth company may delay adopting

new or revised accounting standards until those standards apply to private companies.

We

are a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act. As a result, our proxy solicitations are not

subject to the disclosure and procedural requirements of Regulation 14A under the Exchange Act and transactions in our equity securities

by our officers and directors are exempt from Section 16 of the Exchange Act. In addition, we are not required under the Exchange Act

to file periodic reports and financial statements as frequently or as promptly as U.S. companies whose securities are registered under

the Exchange Act.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements that involve substantial risks and uncertainties. The forward-looking statements are contained

principally in the sections of this prospectus titled “About this Prospectus,” “Risk Factors,” and “Prospectus

Summary.” All statements, other than statements of historical facts, contained in this prospectus, including statements regarding

our future results of operations and financial position, business strategy, prospective products, product approvals, research and development

costs, timing and likelihood of success, plans and objectives of management for future operations, and future results of current and

anticipated products, are forward-looking statements. These statements relate to future events or to our future financial performance

and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

The words “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “goal,” “intend,” “may,” “might,” “objective,”

“plan,” “potential,” “predict,” “project,” “positioned,” “seek,”

“should,” “target,” “will,” “would,” or the negative of these terms or other similar

expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying

words. These forward-looking statements are based on current expectations, estimates, forecasts and projections about our business and

the industry in which we operate and management’s beliefs and assumptions, are not guarantees of future performance or development

and involve known and unknown risks, uncertainties and other factors.

Actual

results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we

make. As a result, any or all of our forward-looking statements in this prospectus may turn out to be inaccurate. We have included important

factors in the cautionary statements included in this prospectus, particularly in the section of this prospectus titled “Risk Factors,”

that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. We may not

actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance

on our forward-looking statements. Moreover, we operate in a highly competitive and rapidly changing environment in which new risks often

emerge. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements we may make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions,

joint ventures or investments we may make.

You

should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement

of which this prospectus is a part completely and with the understanding that our actual future results may be materially different from

what we expect. The forward-looking statements contained in this prospectus are made as of the date of this prospectus, and we do not

assume any obligation to update any forward-looking statements except as required by applicable law and regulation.

PROSPECTUS

SUMMARY

You

should read the following summary together with the more detailed information about us, the securities that may be sold from time to

time, and our financial statements and the notes thereto, all of which appear elsewhere in this prospectus or in the documents incorporated

by reference in this prospectus.

Overview

We

are a clinical-stage biopharmaceutical company developing next-generation therapeutics to improve the lives of patients suffering from

inflammatory eye diseases and ocular pain. Our research program is focused on a novel G Protein-Coupled Receptor, or GPCR, which we believe

plays a key role in the pathology of these inflammatory eye diseases of high unmet medical need. Our therapeutic approach is focused

on targeting inflammatory and pain modulation pathways that drive these conditions. We are presently developing OK-101, our lead preclinical

product candidate, for the treatment of dry eye disease (“DED”). We also plan to evaluate its potential in benefiting patients

with ocular neuropathic pain, uveitis and allergic conjunctivitis. We have also been evaluating OK-201, a bovine adrenal medulla, or

BAM, lipidated-peptide preclinical analogue candidate that is currently in developmental stage.

On

February 21, 2018, we announced that we successfully obtained (via assignment from Panetta Partners Ltd., a related party) a license

from On Target Therapeutics LLC, or OTT, to patents owned or controlled by OTT and a sub-license from OTT to certain patents licensed

by OTT from Tufts Medical Center Inc., or TMC, to support our ophthalmic disease drug programs. These licenses gave us the right to exploit

the intellectual property, or IP estate which is directed to compositions-of-matter and methodologies for treating ocular inflammation,

DED, with chemerin or lipid-linked chemerin analogues. We also have a license from TMC to a separate IP estate for treating symptoms

of ocular neuropathic pain and uveitis associated pain. On August 6, 2019, we signed a collaborative agreement with TMC on a research

program focused on ocular neuropathic pain.

On

January 7, 2021, we announced the appointment of Mr. Gabriele Cerrone as Non-Executive Chairman and Director, and Gary S. Jacob, Ph.D.

as Chief Executive Officer and Director. The addition of these two individuals was a significant step for us, highlighting a careful

realignment of the strategic focus of our research and development program, with the aim of facilitating advancement of both of our preclinical

programs. We believed this realignment would allow us to file investigational new drug, or IND, applications on our drug candidates with

the U.S. Food and Drug Administration, or FDA, in the shortest time possible.

OK-101

OK-101,

our lead clinical-stage product candidate, is focused on keratoconjunctivitis sicca, commonly referred to as DED, which is a multifactorial

disease caused by an underlying inflammation resulting in the lack of lubrication and moisture in the surface of the eye. DED is one

of the most common ophthalmic conditions encountered in clinical practice. Symptoms of DED include constant discomfort and irritation

accompanied by inflammation of the ocular surface, visual impairment and potential damage to the ocular surface. There are presently

approximately 20 million people suffering from DED in the U.S. alone (Farrand et al. AJO 2017; 182:90), with the disease affecting approximately

up to 34% of the population aged 50+ (Dana et al. AJO 2019; 202:47), and with women representing approximately two-thirds of those affected

(Matossian et al. J Womens Health (Larchmt) 2019; 28:502–514). Prevalence of DED is anticipated to increase substantially in the

next 10-20 years due to aging populations in the U.S., Europe, Japan and China and use of contact lenses in the younger population. We

believe this increase in prevalence of DED represents a major expanding economic burden to public healthcare. According to Market Research

Report, Dry Eye Disease, December 2020, the global DED market in 2019 was approximately $5.22 billion, with the market size expected

to reach $6.54 billion by 2027. In addition, DED causes approximately $3.8 billion annually in healthcare costs and represents a major

economic burden to public healthcare, accounting for more than $50 billion to the U.S. economy annually.

At

present, there are 5 prescription drugs available to treat DED: 1) Restasis (0.05% cyclosporine), 2) Cequa (0.09% cyclosporine), 3) Xiidra

(5% lifitegrast), 4) Tyrvaya (0.03 mg varenicline), and 5) Eysuvis (0.25% loteprednol – a corticosteroid for short term use only).

However, DED continues to be a major unmet medical need due to the large number of patients not well served by the treatments available

to them through the medical community.

The

development of new drugs to treat DED has been particularly challenging due to the heterogeneous nature of the patient population suffering

from DED, and due to the difficulties in demonstrating an improvement in both signs and symptoms of the disease in well-controlled clinical

trials. The evidence from over 40 years of scientific literature, however, suggests inflammation as the most common underlying element

of DED. Consequently, development of new therapeutic agents that target inflammatory pathways is looking to be an attractive approach