Shoe Carnival, Inc. (Nasdaq: SCVL) (the “Company”), a leading

retailer of footwear and accessories for the family, today reported

results for the fourth quarter and fiscal year ended February 3,

2024 (“Fiscal 2023”) and provided annual guidance for its fiscal

year ending on February 1, 2025 (“Fiscal 2024”).

- Net sales achieved at the high end of the Company’s

expectation, totaling $280.2 million in fourth quarter 2023 and

$1.176 billion in Fiscal 2023.

- EPS achieved at the mid-range of the Company’s expectation with

fourth quarter 2023 GAAP EPS of $0.57 and Adjusted EPS of $0.59;

Fiscal 2023 GAAP EPS of $2.68 and Adjusted EPS of $2.70.

- Initiating Fiscal 2024 outlook with net sales expected to grow

approximately 5.0 percent at the mid-point of guidance.

- Increasing Rogan’s synergy expectation to approximately $2.5

million annually and accelerating integration to fully capture in

Fiscal 2025.

- Dividend increase of 12.5 percent, representing an increased

annualized dividend rate to $0.54, approved in March 2024.

“I would like to thank our dedicated team members and vendor

partners for their support in driving growth during the key holiday

period and setting us up for continued growth in 2024. With the

acquisition of Rogan’s, we are now at an all-time high of 429

stores. Rogan’s will be immediately accretive to our results in

2024 and the level of accretion is expected to meaningfully

increase in 2025. The integration progress to date has been

encouraging and we are raising the full synergy expectation to $2.5

million and accelerating the integration schedule, with the

expectation of now realizing full synergies in 2025. We are well

positioned to advance our strategy to be the nation’s leading

family footwear retailer by accelerating growth, as well as

pursuing additional growth initiatives and M&A opportunities in

the future,” said Mark Worden, President and Chief Executive

Officer.

Fourth Quarter Operating Results

The Company’s financial results for fourth quarter 2023 were

consistent with the preliminary results previously announced.

Net sales in fourth quarter 2023 were $280.2 million, down 3.6

percent compared to fourth quarter 2022. The net sales performance

was at the high end of the Company’s expectation, driven by strong

sales growth during the key December holiday period.

Comparable store sales, in line with the Company’s expectation,

declined 9.4 percent in the quarter primarily due to soft trends

prior to the December holiday period and weather disruptions in

January.

Fourth quarter 2023 marked the 12th consecutive quarter the

Company’s gross profit margin exceeded 35 percent. Gross profit

margin decreased to 35.6 percent in fourth quarter 2023 on lower

merchandise margins and buying, distribution and occupancy

deleveraging on lower sales.

Fourth quarter 2023 SG&A included approximately $0.8 million

in expenses related to the acquisition of Rogan Shoes, Incorporated

(“Rogan’s”) and otherwise declined in the quarter on lower selling

expenses.

Fourth quarter 2023 net income was $15.5 million, or $0.57 per

diluted share, compared to fourth quarter 2022 net income of $21.6

million, or $0.79 per diluted share.

EPS results in fourth quarter 2023 were in line with the

Company’s expectation, primarily driven by net sales performance in

the quarter that was at the high end of the Company’s expectation

and sustained gross profit margin performance. On an adjusted

basis, excluding the approximately $0.8 million in transaction

costs in the fourth quarter related to the acquisition of Rogan’s,

fourth quarter Adjusted EPS was $0.59 and Adjusted EPS for Fiscal

2023 was $2.70.

Merchandise Inventory

The Company’s inventory optimization improvement plan delivered

ahead of expectation in Fiscal 2023, with inventory $43.9 million,

or 11.3 percent lower than prior year. As part of the on-going

inventory optimization improvement plan, the Company expects

further inventory efficiencies in Fiscal 2024, and year end

inventory dollars are expected to be lower by approximately $20

million, or 5 percent, versus Fiscal 2023 year end, excluding the

impacts of the Rogan’s acquisition.

Acquisition of Rogan’s, Planned Store Growth and Store

Modernization

On February 13, 2024, the Company announced the acquisition of

Rogan’s, a 53-year-old work and family footwear company with 28

store locations in Wisconsin, Minnesota, and Illinois, for a

purchase price of $45 million, subject to further adjustments, and

funded entirely with cash generated in Fiscal 2023. The acquisition

of Rogan’s is expected to be immediately accretive to the Company’s

Fiscal 2024 earnings and it positions the Company as the market

leader in Wisconsin, and establishes a store base in Minnesota, the

Company’s 36th state, creating additional expansion

opportunities.

As previously announced, the Company has an 18-month integration

plan in place. Based on progress to date, the Company is increasing

its full synergy expectation to approximately $2.5 million annually

and is accelerating the integration plan to fully capture those

synergies in Fiscal 2025.

As of February 3, 2024, the Company had 400 stores, including

372 Shoe Carnival stores and 28 Shoe Station stores. Today, the

Company operates 429 stores following the acquisition of Rogan’s.

By the end of Fiscal 2024, the Company expects to operate 430 to

432 stores, representing net growth of 30 to 32 stores. The Company

has a strategic growth roadmap in place to surpass 500 stores in

2028, inclusive of organic growth and strategic M&A

activity.

The Company continued to modernize its fleet. As of February 3,

2024, approximately 60 percent of the Shoe Carnival store

modernization was complete, and the Company expects to modernize

additional stores in Fiscal 2024. Total capital expenditures are

expected to be in a range of $25 million to $35 million in Fiscal

2024 and lower than Fiscal 2023 and Fiscal 2022 as the store

modernization program nears completion.

Dividend and Share Repurchase Program

In March 2024, the Company’s Board of Directors approved a

dividend increase of 12.5 percent from 12 cents per share to 13.5

cents per share. The quarterly cash dividend will be paid on April

22, 2024, to shareholders of record as of the close of business on

April 8, 2024. With the increase in the quarter, the Company has

paid 48 consecutive quarterly dividends.

As of March 21, 2024, the Company has $50 million available for

future repurchases under its share repurchase program. During the

fourth quarter 2023, the Company did not repurchase any shares.

Capital Management

The 2023 fiscal year end marked the 19th consecutive year the

Company ended a year with no debt, fully funding its operations and

investments from operating cash flow. At the end of Fiscal 2023,

the Company had approximately $111 million of cash, cash

equivalents and marketable securities. Compared to year end Fiscal

2022, cash and cash equivalents increased over $47 million in

Fiscal 2023 and cash flow from operations increased over $72

million compared to prior year.

Long-Term Profit Transformation

As part of its long-term growth strategy, the Company has

invested significantly in CRM capabilities, e-commerce

infrastructure, modernization of its store fleet, and acquisitions

as key drivers of profitable growth. Since 2019, EPS has increased

84 percent, gross profit margin expanded 570 basis points, and net

sales grew 13 percent.

The Fiscal 2024 outlook builds on this sales growth and profit

transformation led by the Company’s acquisition strategy, sustained

gross profit margin, and increased omnichannel sales.

Fiscal 2024 Outlook

The Company is initiating its financial outlook for Fiscal 2024

and notes that its Fiscal 2024 is a 52-week year and compares to a

53-week year in Fiscal 2023.

The Company expects to grow net sales in Fiscal 2024 led by the

recent Rogan’s acquisition, continued strength of the Shoe Station

banner and growth in e-commerce sales, combined with the

expectation of improving trends in the Shoe Carnival banner.

Below is additional information regarding the Company’s Fiscal

2024 outlook.

Net Sales: Expected to be in a range of $1.21 billion to

$1.25 billion, representing growth of 4.0 percent to 6.0 percent

versus Fiscal 2023.

Comparable Store Sales: Expected to be in a range of down

3.0 percent to up 1.0 percent versus Fiscal 2023.

Gross Profit Margin: Expected to be approximately even

with Fiscal 2023.

Selling, General and Administrative Expenses

(“SG&A”): As a percent of net sales, SG&A is expected

to be approximately 40 basis points higher than Fiscal 2023.

Approximately 20 basis points of the increase is due to expected

purchase accounting, transaction and integration costs related to

the Rogan’s acquisition and the balance of the increase is

primarily driven by approximately $2.5 million of Rogan’s current

operating expenses that are expected to be synergized in Fiscal

2025.

Income Tax Rate: Expected to be approximately 26 percent

in Fiscal 2024, representing an increase of 230 basis points versus

Fiscal 2023 and a negative impact of approximately of $0.08 to

EPS.

GAAP EPS: Fiscal 2024 EPS on a GAAP basis is expected to

be in a range of $2.50 to $2.70.

Non-GAAP EPS (“Adjusted EPS”): Excluding the expected

purchase accounting, transaction and integration costs related to

the Rogan’s acquisition, Adjusted EPS is expected to be in a range

of $2.55 to $2.75.

Record Date and Date of Annual Shareholder Meeting

The Company announced that April 24, 2024, has been set as the

shareholder of record date and the Annual Meeting of Shareholders

will be held on June 25, 2024.

Conference Call

Today, at 8:30 a.m. Eastern Time, the Company will host a

conference call to discuss its fourth quarter and Fiscal 2023

results and Fiscal 2024 outlook. Participants can listen to the

live webcast of the call by visiting Shoe Carnival's Investors

webpage at www.shoecarnival.com. While the question-and-answer

session will be available to all listeners, questions from the

audience will be limited to institutional analysts and investors. A

replay of the webcast will be available on the Company’s website

beginning approximately two hours after the conclusion of the

conference call and will be archived for one year.

Non-GAAP Financial Measures

The non-GAAP adjusted results for fourth quarter 2023, Fiscal

2023 and in the Fiscal 2024 outlook discussed herein exclude

transaction expenses included in SG&A associated with the

Rogan’s acquisition related to deal formation and legal and

accounting advice and purchase accounting and integration expenses.

These adjusted results are provided to enhance the user's overall

understanding of the Company's historical operations and financial

performance and future projections. Specifically, the Company

believes the adjusted results provide investors with relevant

comparisons of the Company’s core operations. Unaudited adjusted

results are provided in addition to, and not as alternatives for,

the Company’s reported results and guidance determined in

accordance with generally accepted accounting principles. A

reconciliation of these non-GAAP measures to the Company's GAAP

results and guidance appears below in the tables entitled

"Reconciliation of GAAP to Non-GAAP Financial Measures" with

respect to adjusted net income and adjusted EPS results in fourth

quarter 2023 and Fiscal 2023 and entitled “Reconciliation of GAAP

to Non-GAAP Financial Measures for Fiscal 2024 Outlook” with

respect to adjusted EPS in the Fiscal 2024 outlook.

About Shoe Carnival

Shoe Carnival, Inc. is one of the nation’s largest family

footwear retailers, offering a broad assortment of dress, casual

and athletic footwear for men, women and children with emphasis on

national name brands. As of March 21, 2024, the Company operates

429 stores in 36 states and Puerto Rico under its Shoe Carnival and

Shoe Station banners and offers shopping at www.shoecarnival.com

and www.shoestation.com. Headquartered in Evansville, IN, Shoe

Carnival, Inc. trades on The Nasdaq Stock Market LLC under the

symbol SCVL. Press releases and annual reports are available on the

Company's website at www.shoecarnival.com.

Cautionary Statement Regarding Forward-Looking

Information

As used herein, “we”, “our” and “us” refer to Shoe Carnival,

Inc. This press release contains forward-looking statements, within

the meaning of the Private Securities Litigation Reform Act of

1995, that involve a number of risks and uncertainties, such as

statements about our future growth, operations, cash flows and

shareholder returns, as well as our growth strategy and profit

transformation.

A number of factors could cause our actual results, performance,

achievements or industry results to be materially different from

any future results, performance or achievements expressed or

implied by these forward-looking statements. These factors include,

but are not limited to: our ability to control costs and meet our

labor needs in a rising wage, inflationary, and/or supply chain

constrained environment; the impact of competition and pricing,

including our ability to maintain current promotional intensity

levels; the effects and duration of economic downturns and

unemployment rates; our ability to achieve expected operating

results from, and planned growth of, our Shoe Station banner, which

includes the recently acquired stores and operations of Rogan’s,

within expected time frames, or at all; the potential impact of

national and international security concerns, including those

caused by war and terrorism, on the retail environment; general

economic conditions in the areas of the continental United States

and Puerto Rico where our stores are located; changes in the

overall retail environment and more specifically in the apparel and

footwear retail sectors; our ability to successfully utilize the

e-commerce sales channel and its impact on traffic and transactions

in our physical stores; the success of the open-air shopping

centers where many of our stores are located and the impact on our

ability to attract customers to our stores; our ability to attract

customers to our e-commerce platform and to successfully grow our

omnichannel sales; the effectiveness of our inventory management,

including our ability to manage key merchandise vendor

relationships and direct-to-consumer initiatives; changes in our

relationships with other key suppliers; changes in the political

and economic environments in, the status of trade relations with,

and the impact of changes in trade policies and tariffs impacting,

China and other countries which are the major manufacturers of

footwear; our ability to successfully manage and execute our

marketing initiatives and maintain positive brand perception and

recognition; our ability to successfully manage our current real

estate portfolio and leasing obligations; changes in weather,

including patterns impacted by climate change; changes in consumer

buying trends and our ability to identify and respond to emerging

fashion trends; the impact of disruptions in our distribution or

information technology operations including at our distribution

center located in Evansville, IN; the impact of natural disasters,

public health and political crises, civil unrest, and other

catastrophic events on our operations and the operations of our

suppliers, as well as on consumer confidence and purchasing in

general; the duration and spread of a public health crisis and the

mitigating efforts deployed, including the effects of government

stimulus on consumer spending; risks associated with the

seasonality of the retail industry; the impact of unauthorized

disclosure or misuse of personal and confidential information about

our customers, vendors and employees, including as a result of a

cybersecurity breach; our ability to effectively integrate Rogan’s,

retain Rogan’s employees, and achieve the expected operating

results, synergies, efficiencies and other benefits from the

Rogan’s acquisition within the expected time frames, or at all;

risks that the Rogan’s acquisition may disrupt our current plans

and operations or negatively impact our relationship with our

vendors and other suppliers; our ability to successfully execute

our business strategy, including the availability of desirable

store locations at acceptable lease terms, our ability to identify,

consummate or effectively integrate future acquisitions, our

ability to implement and adapt to new technology and systems, our

ability to open new stores in a timely and profitable manner,

including our entry into major new markets, and the availability of

sufficient funds to implement our business plans; higher than

anticipated costs associated with the closing of underperforming

stores; the inability of manufacturers to deliver products in a

timely manner; an increase in the cost, or a disruption in the

flow, of imported goods; the impact of regulatory changes in the

United States, including minimum wage laws and regulations, and the

countries where our manufacturers are located; the resolution of

litigation or regulatory proceedings in which we are or may become

involved; continued volatility and disruption in the capital and

credit markets; future stock repurchases under our stock repurchase

program and future dividend payments.; and other factors described

in the Company’s SEC filings, including the Company’s latest Annual

Report on Form 10-K. In addition, these forward-looking statements

necessarily depend upon assumptions, estimates and dates that may

be incorrect or imprecise and involve known and unknown risks,

uncertainties and other factors. Accordingly, any forward-looking

statements included in this press release do not purport to be

predictions of future events or circumstances and may not be

realized. Forward-looking statements can be identified by, among

other things, the use of forward-looking terms such as “believes,”

“expects,” “aims,” “on track,” “may,” “will,” “should,” “seeks,”

“pro forma,” “anticipates,” “intends” or the negative of any of

these terms, or comparable terminology, or by discussions of

strategy or intentions. Given these uncertainties, we caution

investors not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. We disclaim any

obligation to update any of these factors or to publicly announce

any revisions to the forward-looking statements contained in this

press release to reflect future events or developments.

Financial Tables Follow

SHOE CARNIVAL, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(In thousands, except per share

data)

(Unaudited)

Fourteen

Thirteen

Fifty-Three

Fifty-Two

Weeks Ended

Weeks Ended

Weeks Ended

Weeks Ended

February 3, 2024

January 28, 2023

February 3, 2024

January 28, 2023

Net sales

$

280,169

$

290,779

$

1,175,882

$

1,262,235

Cost of sales (including buying,

distribution and occupancy costs)

180,462

179,457

754,492

794,071

Gross profit

99,707

111,322

421,390

468,164

Selling, general and administrative

expenses

79,738

82,628

327,885

321,720

Operating income

19,969

28,694

93,505

146,444

Interest income

(1,173

)

(407

)

(2,917

)

(972

)

Interest expense

74

70

282

294

Income before income taxes

21,068

29,031

96,140

147,122

Income tax expense

5,548

7,421

22,792

37,054

Net income

$

15,520

$

21,610

$

73,348

$

110,068

Net income per share:

Basic

$

0.57

$

0.80

$

2.69

$

4.00

Diluted

$

0.57

$

0.79

$

2.68

$

3.96

Weighted average shares:

Basic

27,117

27,152

27,231

27,543

Diluted

27,328

27,456

27,407

27,812

Cash dividends declared per share

$

0.12

$

0.09

$

0.44

$

0.36

SHOE CARNIVAL, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

February 3, 2024

January 28, 2023

ASSETS

Current Assets:

Cash and cash equivalents

$

99,000

$

51,372

Marketable securities

12,247

11,601

Accounts receivable

2,593

3,052

Merchandise inventories

346,442

390,390

Other

21,056

13,308

Total Current Assets

481,338

469,723

Property and equipment – net

168,613

141,435

Operating lease right-of-use assets

333,851

318,612

Intangible assets

32,600

32,600

Goodwill

12,023

12,023

Other noncurrent assets

13,600

15,388

Total Assets

$

1,042,025

$

989,781

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current Liabilities:

Accounts payable

$

58,274

$

78,850

Accrued and other liabilities

16,620

20,281

Current portion of operating lease

liabilities

52,981

58,154

Total Current Liabilities

127,875

157,285

Long-term portion of operating lease

liabilities

301,355

285,074

Deferred income taxes

17,341

11,844

Deferred compensation

11,639

9,840

Other

426

170

Total Liabilities

458,636

464,213

Total Shareholders’ Equity

583,389

525,568

Total Liabilities and Shareholders’

Equity

$

1,042,025

$

989,781

SHOE CARNIVAL, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Fifty-Three

Fifty-Two

Weeks Ended

Weeks Ended

February 3, 2024

January 28, 2023

Cash Flows From Operating Activities

Net income

$

73,348

$

110,068

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

28,794

23,196

Stock-based compensation

4,887

5,434

Loss (Gain) on retirement and impairment

of assets, net

130

(501

)

Deferred income taxes

5,497

14,543

Non-cash operating lease expense

54,998

47,766

Other

728

962

Changes in operating assets and

liabilities:

Accounts receivable

459

11,410

Merchandise inventories

43,948

(106,192

)

Operating lease liabilities

(59,129

)

(48,992

)

Accounts payable and accrued

liabilities

(22,214

)

925

Other

(8,690

)

(8,181

)

Net cash provided by operating

activities

122,756

50,438

Cash Flows From Investing Activities

Purchases of property and equipment

(56,281

)

(77,293

)

Investments in marketable securities

(403

)

(976

)

Sales of marketable securities

598

3,040

Other

1,447

1,195

Net cash used in investing activities

(54,639

)

(74,034

)

Cash Flow From Financing Activities

Proceeds from issuance of stock

183

187

Dividends paid

(12,190

)

(9,972

)

Purchase of common stock for treasury

(5,445

)

(30,515

)

Shares surrendered by employees to pay

taxes on stock-based compensation awards

(3,037

)

(2,175

)

Net cash used in financing activities

(20,489

)

(42,475

)

Net increase (decrease) in cash and cash

equivalents

47,628

(66,071

)

Cash and cash equivalents at beginning of

year

51,372

117,443

Cash and cash equivalents at end of

year

$

99,000

$

51,372

SHOE CARNIVAL, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(In thousands, except per share

data)

(Unaudited)

Fourteen Weeks Ended February 3,

2024

% of Net Sales

Fifty-three Weeks Ended February

3, 2024

% of Net Sales

Reported net income

$

15,520

5.5%

$

73,348

6.2%

Acquisition-related fees and expenses

806

0.3%

806

0.1%

Tax effect of acquisition-related fees and

expenses

(196

)

0.0%

(196

)

0.0%

Adjusted net income

$

16,130

5.8%

$

73,958

6.3%

Reported net income per diluted share

$

0.57

$

2.68

Acquisition-related fees and expenses

0.03

0.03

Tax effect of acquisition-related fees and

expenses

(0.01

)

(0.01

)

Adjusted diluted net income per share

$

0.59

$

2.70

SHOE CARNIVAL, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

FOR FISCAL 2024

OUTLOOK

(Unaudited)

Low End of Fiscal 2024

Outlook

High End of Fiscal 2024

Outlook

Net income per diluted share (GAAP)

$

2.50

$

2.70

Acquisition-related purchase accounting

and transaction and integration expenses

0.07

0.07

Tax effect of acquisition-related purchase

accounting and transaction and integration expenses

(0.02

)

(0.02

)

Adjusted diluted net income per share

$

2.55

$

2.75

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240321031626/en/

Steve R. Alexander Shoe Carnival – Vice President Investor

Relations (812) 306-6176

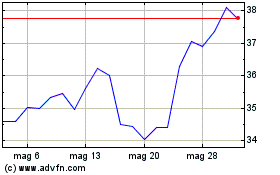

Grafico Azioni Shoe Carnival (NASDAQ:SCVL)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Shoe Carnival (NASDAQ:SCVL)

Storico

Da Nov 2023 a Nov 2024