As filed with the Securities and Exchange Commission on June 11, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GREAT AJAX CORP.

(Exact name of registrant as specified in its charter)

| |

Maryland

(State or other jurisdiction of

incorporation or organization)

|

|

|

46-5211870

(I.R.S. Employer

Identification No.)

|

|

| |

799 Broadway

New York, New York

(212) 850-7770

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

|

|

Michael Nierenberg

Chairman and Chief Executive Officer

799 Broadway

New York, New York

(212) 850-7770

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

Anna T. Pinedo, Esq.

Brian D. Hirshberg, Esq.

Mayer Brown LLP

1221 Avenue of the Americas

New York, NY 10020

Telephone: (212) 506-2500

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box: ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☐

|

|

|

Accelerated filer ☒

|

|

|

Non-accelerated filer ☐

|

|

|

Smaller reporting company

☐

|

|

| |

|

|

|

|

|

|

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 11, 2024

PROSPECTUS

3,174,645 Shares of Common Stock

This prospectus relates to the offer and resale, from time to time, by Thetis Asset Management LLC, or its transferees, assignees or successors-in-interest (the “selling stockholder”), of up to an aggregate of 3,174,645 shares of our common stock, par value $0.01 per share (“common stock”).

The selling stockholder received the shares of common stock from us pursuant to a private placement transaction. See “Summary Information” for additional information.

The shares of common stock described in this prospectus or in any supplement to this prospectus may be sold from time to time pursuant to this prospectus or any such supplement thereto by the selling stockholder, to or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions therefrom, in ordinary brokerage transactions, in transactions in which brokers solicit purchases, in negotiated transactions, or in a combination of any such methods of sale, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at fixed prices or prices subject to change, or at negotiated prices. See “Selling Stockholder” and “Plan of Distribution.” The registration of the shares of our common stock described in this prospectus does not necessarily mean that any of such shares will be offered or sold by the selling stockholder and we cannot predict when, if or in what amounts the selling stockholder may sell any of the shares offered by this prospectus.

We are not selling any of the shares of our common stock described in this prospectus, and we will not receive any of the proceeds from the sale of such shares by the selling stockholder. The selling stockholder will pay all brokerage fees and commissions and similar sale-related expenses. We will bear fees and expenses relating to the registration of the offer and sale of the shares of our common stock described in this prospectus with the U.S. Securities and Exchange Commission (the “SEC”).

A supplement to this prospectus may add, update or change information contained in this prospectus. You should read this prospectus and any prospectus supplement, together with the documents we incorporate by reference, carefully before you invest.

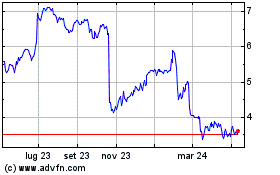

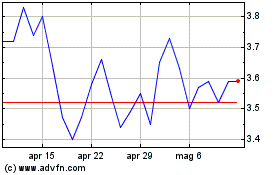

Our common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “AJX.” On June 10, 2024, the last reported sale price of our common stock on the NYSE was $3.28 per share.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

ii |

|

|

|

|

|

|

|

|

ii |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

|

35

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC, using a “shelf” registration process for the delayed offering and sale of securities pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”). Under this shelf registration process, the selling stockholder named in this prospectus or any supplement to this prospectus may sell the securities described in this prospectus in one or more offerings. The selling stockholder is required to provide you with this prospectus and, in certain cases, a prospectus supplement containing specific information about the selling stockholder and the terms upon which the securities are being offered.

We may also add, update or change information contained in this prospectus by means of a prospectus supplement or by incorporating by reference information that we file or furnish to the SEC. The registration statement that we filed with the SEC includes exhibits that provide more detail on the matters discussed in this prospectus. If the information in this prospectus is inconsistent with a prospectus supplement, you should rely on the information in that prospectus supplement. Please carefully read this prospectus and any prospectus supplement, together with the additional information described under the headings “Information Incorporated by Reference” and “Where You Can Find More Information” before purchasing any securities.

You should rely only on the information contained or incorporated by reference in this prospectus, any prospectus supplement and any issuer free writing prospectus. “Incorporated by reference” means that we can disclose important information to you by referring you to another document filed separately with the SEC. Neither we, nor any selling stockholder, has authorized any other person to provide you with different information. If anyone provides you with different information, you should not rely on it. We are not making an offer of these securities in any state or jurisdiction where the offer is not permitted. You should only assume that the information in this prospectus or in any prospectus supplement or issuer free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

In this prospectus, the “Company,” “we,” “us” and “our” refer to Great Ajax Corp. and its consolidated subsidiaries, except where the context otherwise requires.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus and any accompanying prospectus supplement, including the documents incorporated by reference into this prospectus and any accompanying prospectus supplement, contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negatives of these terms or other comparable terminology.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors including but not limited to:

•

our ability to recognize the anticipated benefits of the strategic transaction (the “Transaction”) with Rithm Capital Corp. and its affiliates (“Rithm”);

•

changes to our business strategy as a result of the Transaction;

•

the significant losses we have incurred to date from our holdings of non-performing loans (“NPLs”) and re-performing loans (“RPLs”);

•

the expectation that we will continue to incur increasing and significant consolidated net losses from our mortgage holdings;

•

difficulties in consummating sales of our NPLs and RPLs at attractive prices and on a prompt timeline or at all and adverse market developments negatively impacting the value of, and the returns expected from, such assets;

•

the impact of changes in interest rates and the market value of the collateral underlying our RPL and NPL portfolios or of our other real estate assets;

•

the impact of adverse real estate, mortgage or housing markets and changes in the general economy;

•

Rithm’s ability to manage and address potential conflicts of interest relating to our investment objectives, which may overlap with the investment objectives of Rithm or one of its operating companies;

•

our share price has been and may continue to be volatile;

•

the broader impacts of increasing interest rates, inflation, and potential for a global economic recession;

•

general volatility of the capital markets;

•

the impact of adverse legislative or regulatory tax changes;

•

our ability to control our costs;

•

our failure to qualify or maintain qualification as a real estate investment trust (“REIT”); and

•

our failure to maintain our exemption from registration under the Investment Company Act of 1940, as amended.

The preceding list is not intended to be an exhaustive list of all forward-looking statements in this prospectus and any accompanying prospectus supplement. You should read this prospectus and any accompanying prospectus supplement with the understanding that actual future results, levels of activity, performance and achievements may be materially different from what is currently expected. We qualify all of the forward-looking statements by these cautionary statements. Additional factors that could cause results to differ materially from those described above can be found in the reports and information that we file with the SEC from time to time.

SUMMARY INFORMATION

This summary does not contain all the information that you should consider before investing in our Company. You should carefully read the entire prospectus and any accompanying prospectus supplement, including all documents incorporated by reference herein and therein.

Overview

We are a Maryland corporation that is organized and operated in a manner intended to allow us to qualify as a REIT. As previously announced on February 26, 2024, we entered into a series of agreements with Rithm, a global asset manager focused on real estate, credit and financial services, which are described below (see “— The Transaction”). On May 20, 2024, we received stockholder approval for the Transaction and the stockholders elected to reconstitute our board of directors as follows: a five-member board, two members of which are existing directors, one member nominated by Rithm, and one member of which is a new independent director (with one vacant board seat).

In connection with the closing of the Transaction, on June 11, 2024, we entered into a management agreement with an affiliate of Rithm to serve as our external manager. Under Rithm’s management, we expect to shift our strategic direction and invest in commercial mortgage loans. Our target assets will include preferred equity or debt instruments secured by mortgages on commercial real estate, small balance commercial loans, mezzanine loans secured by pledges of equity interests in entities that own commercial real estate or other forms of subordinated debt in connection with commercial real estate, as well as commercial mortgage servicing rights and operating businesses in the commercial real estate sector. We do not anticipate investing in residential mortgage loans, RPLs or NPLs. Given the change in focus of our business, we intend to, over time, reposition much of our existing portfolio. We believe commercial real estate offers an attractive investment opportunity given market dynamics that are creating significant refinancing challenges and funding gaps.

Great Ajax Operating Partnership L.P., our operating partnership (the “Operating Partnership”), through interests in certain entities, as of March 31, 2024, owns 99.9% of Great Ajax II REIT Inc., which owns Great Ajax II Depositor LLC which then acts as the depositor of mortgage loans into securitization trusts and holds subordinated securities issued by such trusts. Similarly, as of March 31, 2024, the Operating Partnership wholly-owned Great Ajax III Depositor LLC, which was formed to act as the depositor into Ajax Mortgage Loan Trust 2021-E, which is a real estate mortgage investment conduit. We have securitized mortgage loans through these securitization trusts and retained subordinated securities from the secured borrowings. These trusts are considered to be variable interest entities (“VIEs”), and we have determined that we are the primary beneficiary of the VIEs.

In 2018, we formed Gaea Real Estate Corp. (“Gaea”), as a wholly-owned subsidiary of the Operating Partnership that invests in multifamily properties with a focus on property appreciation and triple net lease veterinary clinics. We elected to treat Gaea as a taxable REIT subsidiary (“TRS”) under the Internal Revenue Code of 1986, as amended (the “Code”) for 2018 and elected to treat Gaea as a REIT under the Code in 2019 and thereafter. Also during 2018, we formed Gaea Real Estate Operating Partnership LP, a wholly-owned subsidiary of Gaea, to hold investments in commercial real estate assets, and Gaea Real Estate Operating LLC, to act as its general partner. We also formed Gaea Veterinary Holdings LLC, BFLD Holdings LLC, Gaea Commercial Properties LLC, Gaea Commercial Finance LLC and Gaea RE Holdings LLC as subsidiaries of Gaea Real Estate Operating Partnership. In 2019, we formed DG Brooklyn Holdings LLC, also a subsidiary of Gaea Real Estate Operating Partnership LP, to hold investments in multi-family properties. At March 31, 2024, we owned approximately 22.2% of Gaea. We account for our investment in Gaea under the equity method.

We elected to be taxed as a REIT for U.S. federal income tax purposes beginning with our taxable year ended December 31, 2014. Our qualification as a REIT depends upon our ability to meet, on a continuing basis, various complex requirements under the Code relating to, among other things, the sources of our gross income, the composition and values of our assets, our distribution levels and the diversity of ownership of our capital stock. We believe that we are organized in conformity with the requirements for qualification as a REIT under the Code, and that our current intended manner of operation enables us to meet the requirements for taxation as a REIT for U.S. federal income tax purposes.

The Transaction

Termination and Release Agreement

In connection with the closing of the Transaction, we entered into a termination and release agreement (“Termination and Release Agreement”) with Thetis Asset Management LLC, our former external manager, pursuant to which we paid the termination fee due thereunder in shares of common stock (the “Manager Shares”), which shares are being registered for resale hereunder. See the sections entitled “The Transaction — Management Agreement” and “The Transaction — Registration Rights Agreements” in the Proxy Statement, which are incorporated by reference herein. The Termination and Release Agreement is filed as an exhibit to the registration statement of which this prospectus forms a part, and the foregoing description of the Termination and Release Agreement is qualified by reference thereto.

Securities Purchase Agreement

In connection with the Transaction, on February 26, 2024, we, the Operating Partnership, and Thetis Asset Management LLC entered into a securities purchase agreement (the “Purchase Agreement”) with Rithm. See the section entitled “The Transaction — Securities Purchase Agreement” in the Proxy Statement, which is incorporated by reference herein. Pursuant to the Purchase Agreement, we issued 2,874,744 shares of common stock to Rithm at a purchase price of $4.87 per share, for aggregate proceeds of approximately $14.0 million, and warrants to purchase an aggregate of 3,264,926 shares of common stock for an exercise price of $5.36 per share. The Purchase Agreement is filed as an exhibit to the registration statement of which this prospectus forms a part, and the foregoing description of the Purchase Agreement is qualified by reference thereto.

Corporate Information

Our principal offices are located at 13190 SW 68th Parkway, Suite 110, Tigard, OR 97223. Our telephone number is 503-505-5670. Our web address is www.greatajax.com. The information on our website does not constitute a part of this prospectus.

THE OFFERING

This prospectus relates to the offer and resale, from time to time, by the selling stockholder of up to an aggregate of 3,174,645 shares of common stock. We will not receive any proceeds from the sale of any shares of common stock by the selling stockholder. Shares of our common stock that may be offered under this prospectus will be fully paid and non-assessable.

Great Ajax Corp.

Common Stock Offered by the Selling Stockholder

Up to 3,174,645 shares

Common Stock Currently Outstanding(1)

45,613,049 shares

We are not selling any of the shares of our common stock described in this prospectus, and we will not receive any of the proceeds from the sale of such shares by the selling stockholder. See “Use of Proceeds.”

AJX

See “Risk Factors” on page 4 for a discussion of factors you should carefully consider before deciding to invest in our common stock.

(1)

Total shares currently outstanding is based on 39,563,660 shares of common stock issued and outstanding as of May 21, 2024, and includes the following which were issued in connection with the closing of the Transaction: (i) 2,874,744 shares issued to Rithm pursuant to the Purchase Agreement and (ii) 3,174,645 Manager Shares.

RISK FACTORS

An investment in our securities offered pursuant to this prospectus involves substantial risks. Before acquiring any of our securities from the selling stockholder, you should carefully consider the risk factors incorporated by reference from our Annual Report on Form 10-K for the year ended December 31 2023, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, and the other information contained in this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in any prospectus supplement or other documents that are incorporated by reference into this prospectus. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities. Please also refer to the section entitled “Cautionary Note Concerning Forward-Looking Statements.”

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of any shares of common stock offered by the selling stockholder pursuant to this prospectus. Any proceeds from the sale of shares of common stock under this prospectus will be received by the selling stockholder. See “Selling Stockholder.”

SELLING STOCKHOLDER

This prospectus relates to the offer and sale from time to time by the selling stockholder of up to an aggregate 3,174,645 shares of our common stock. The selling stockholder received the shares of common stock from us pursuant to a private placement transaction.

We do not know how long the selling stockholder will hold the shares of common stock before selling them or how many shares of common stock the selling stockholder will sell, if any.

The following table sets forth the maximum number of shares of common stock that may be sold by the selling stockholder, the name of the selling stockholder, the nature of any position, office, or other material relationship the selling stockholder has had, within the past three years, with us or with any of our predecessors or affiliates, and the number of securities to be owned by the selling stockholder after completion of the offering.

We prepared the following table based on information provided to us by the selling stockholder. We have not sought to verify such information. Additionally, the selling stockholder may have sold or transferred some or all of their shares of common stock in transactions exempt from the registration requirements of the Securities Act since the date on which the information in the table was provided to us. Other information about the selling stockholder may also change over time and, if necessary, we will amend or supplement this prospectus accordingly and as required.

Except as otherwise indicated, the selling stockholder has sole voting and dispositive power with respect to such securities.

| |

|

|

Shares of Common Stock

Beneficially Owned Prior to the

Offering(1)

|

|

|

Shares of

Common Stock

Offered

Hereby(3)

|

|

|

Shares of Common Stock

Beneficially Owned After

Completion of the Offering(4)

|

|

|

Name of Selling Stockholder

|

|

|

Number

|

|

|

Percent(2)

|

|

|

Number

|

|

|

Number

|

|

|

Percent(2)

|

|

|

Thetis Asset Management LLC

|

|

|

|

|

3,174,645(5) |

|

|

|

|

|

7.0% |

|

|

|

|

|

3,174,645 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

(1)

Beneficial ownership is determined in accordance with Rule 13d-3 under the Exchange Act. In computing the number of securities beneficially owned and the percentage ownership of each selling stockholder, securities that are currently exercisable into shares of our common stock, or exercisable into shares of our common stock within 60 days of the date hereof, are deemed outstanding.

(2)

Calculated based on 45,613,049 shares of common stock outstanding, which consists of (i) 39,563,660 shares of our common stock issued and outstanding on May 21, 2024, (ii) 2,874,744 shares of common stock issued to Rithm pursuant to the Purchase Agreement and (iii) 3,174,645 Manager Shares.

(3)

Pursuant to Rule 416 under the Securities Act, the shares of common stock being registered hereunder include such indeterminate number of shares of common stock as may be issuable with respect to the shares of common stock being registered hereunder as a result of stock splits, stock dividends or similar transactions.

(4)

Because the selling stockholder is not obligated to sell all or any portion of the shares of our common stock shown as offered by it, we cannot estimate the actual number or percentage of shares of our common stock that will be held by the selling stockholder upon completion of this offering. However, for purposes of this table, we have assumed that all shares of common stock being registered under the registration statement of which this prospectus is a part are sold in this offering, and that the selling stockholder does not acquire additional shares of our common stock after the date of this prospectus and prior to completion of this offering.

(5)

Consists of 3,174,645 Manager Shares. The business address of Thetis Asset Management LLC is 13190 SW 68th Parkway, Suite 110, Tigard, OR 97223.

Relationship with the Selling Stockholder

In connection with the Transaction, we entered into a series of agreements with Thetis Asset Management LLC. See the section entitled “The Transaction” in the Proxy Statement, which is incorporated by reference herein.

For a description of the material relationships and transactions between us and Thetis Asset Management LLC, see the section entitled “Certain Relationships and Related Party Transactions” in the Proxy Statement, which is incorporated by reference herein.

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES

This section summarizes the material U.S. federal income tax considerations a prospective stockholder of our common stock (“Shares”) may consider relevant. Because this section is a summary, it does not address all aspects of taxation that may be relevant to particular stockholders in light of their personal investment or tax circumstances, or to certain types of stockholders that are subject to special treatment under the U.S. federal income tax laws, such as:

•

insurance companies;

•

tax-exempt organizations, tax-deferred and tax-advantaged accounts;

•

financial institutions or broker-dealers;

•

dealers in securities or currencies;

•

non-U.S. individuals and non-U.S. corporations (except to the extent discussed in “— Taxation of Non-U.S. Holders” or “— Foreign Account Tax Compliance Act” below);

•

U.S. expatriates;

•

persons who mark-to-market our Shares;

•

subchapter S corporations;

•

U.S. stockholders (as defined below) whose functional currency is not the U.S. dollar;

•

regulated investment companies and REITs, and their investors;

•

trusts and estates (except to the extent discussed herein);

•

persons who receive our Shares through the exercise of employee stock options or otherwise as compensation; persons holding our Shares as part of a “straddle,” “hedge,” “conversion transaction,” “synthetic security” or other integrated investment;

•

persons subject to special rules under Section 451(b) of the Code;

•

persons subject to the alternative minimum tax provisions of the Code;

•

persons holding our Shares through a partnership or similar pass-through entity; and

•

persons holding a 10% or more (by vote or value) beneficial interest in our Shares.

This summary assumes that stockholders hold our Shares as capital assets for U.S. federal income tax purposes, which generally means as property held for investment.

The statements in this section are not intended to be, and should not be construed as, tax advice. The statements in this section are based on the Code, current, temporary and proposed U.S. Department of Treasury regulations promulgated under the Code (the “Treasury Regulations”), the legislative history of the Code, current administrative interpretations and practices of the U.S. Internal Revenue Service (“IRS”), and court decisions. The reference to IRS interpretations and practices includes the IRS practices and policies endorsed in private letter rulings, which are not binding on the IRS except with respect to the taxpayer that receives the ruling. In each case, these sources are relied upon as they exist on the date of this discussion. Future legislation, Treasury Regulations, administrative interpretations and court decisions could change current law or adversely affect existing interpretations of current law on which the information in this section is based. Any such change could apply retroactively. We have not received any rulings from the IRS concerning our intention to qualify as a REIT, but we have received a private letter ruling from the IRS that allows us to exclude our proportionate share of gross income from the Manager if we held our interest in the Manager through our Operating Partnership. Although we have received such a ruling, we continue to hold our interest in the Manager through Thetis TRS instead of through our Operating Partnership. Accordingly, even if there is no change in the applicable law, no assurance can be provided that the statements made in the following discussion, which do not bind the IRS or the courts, will not be challenged by the IRS or will be sustained by a court if so challenged.

WE URGE YOU TO CONSULT YOUR OWN TAX ADVISER REGARDING THE SPECIFIC TAX CONSEQUENCES TO YOU OF THE PURCHASE, OWNERSHIP AND SALE OF OUR SHARES AND

OF OUR ELECTION TO BE TAXED AS A REIT. SPECIFICALLY, YOU SHOULD CONSULT YOUR OWN TAX ADVISER REGARDING THE U.S. FEDERAL, STATE, LOCAL, FOREIGN, AND OTHER TAX CONSEQUENCES OF SUCH PURCHASE, OWNERSHIP, SALE AND ELECTION, AND REGARDING POTENTIAL CHANGES IN APPLICABLE TAX LAWS.

Taxation of Our Company

We elected to be taxed as a REIT under Sections 856 through 860 of the Code commencing with our short taxable year ended December 31, 2014. We believe that, commencing with our short taxable year ended December 31, 2014, we have been organized and have operated in such a manner as to qualify for taxation as a REIT under the U.S. federal income tax laws, and we intend to continue to operate in such a manner, but no assurances can be given that we will operate in a manner so as to qualify or remain qualified as a REIT. This section discusses the laws governing the U.S. federal income tax treatment of a REIT and its stockholders. These laws are highly technical and complex.

In connection with this filing, Mayer Brown LLP will render an opinion that, commencing with our taxable year ended December 31, 2014, we were organized and operated in conformity with the requirements for qualification and taxation as a REIT under the Code, and our current and proposed method of operation will enable us to continue to meet the requirements for qualification and taxation as a REIT for our taxable year ending December 31, 2020 and subsequent taxable years. Investors should be aware that Mayer Brown LLP’s opinion is based upon customary assumptions, will be conditioned upon certain representations made by us as to factual matters, including representations regarding the nature of our assets and the conduct of our business, is not binding upon the IRS, or any court and speaks as of the date issued. In addition, Mayer Brown LLP’s opinion will be based on existing U.S. federal income tax law governing qualification as a REIT, which is subject to change either prospectively or retroactively. Moreover, our qualification and taxation as a REIT depends upon our ability to meet on a continuing basis, through actual results, certain qualification tests set forth in the U.S. federal income tax laws. Those qualification tests involve the percentage of income that we earn from specified sources, the percentage of our assets that falls within specified categories, the diversity of our capital stock ownership, and the percentage of our earnings that we distribute. Mayer Brown LLP will not review our compliance with those tests on a continuing basis. Accordingly, no assurance can be given that our actual results of operations for any particular taxable year will satisfy such requirements. Our ability to satisfy the REIT qualification tests will depend upon our analysis of the characterization and fair market values of our assets, some of which will not be susceptible to a precise determination, and for which we will not obtain independent appraisals. Our compliance with the REIT income and quarterly asset requirements also depends upon our ability to successfully manage the composition of our income and assets on an ongoing basis (which, based on the types of assets we will own, could fluctuate rapidly, significantly and unpredictably). In addition, we will be required to make estimates of or otherwise determine the value of real property that is collateral for our mortgage loan assets. There can be no assurance that the IRS would not challenge our valuations or valuation estimates of this collateral.

If we qualify as a REIT, we generally will not be subject to U.S. federal income tax on our REIT taxable income that we currently distribute to our stockholders, but taxable income generated by any domestic TRS, such as Thetis TRS, will be subject to regular corporate income tax. However, we will be subject to U.S. federal tax in the following circumstances:

•

We will pay U.S. federal income tax on our taxable income, including net capital gain, that we do not distribute to stockholders during, or within a specified time period after, the calendar year in which the income is earned.

•

We will pay income tax at the highest corporate rate on:

•

net income from the sale or other disposition of property acquired through foreclosure, or foreclosure property, that we hold primarily for sale to customers in the ordinary course of business, and

•

other non-qualifying income from foreclosure property.

•

We will pay a 100% tax on net income earned from sales or other dispositions of property, other than foreclosure property, that we hold primarily for sale to customers in the ordinary course of business.

•

If we fail to satisfy the 75% gross income test or the 95% gross income test, as described below under “— Gross Income Tests,” but nonetheless continue to qualify as a REIT because we meet other requirements, we will be subject to a 100% tax on:

•

the greater of the amount by which we fail the 75% gross income test or the 95% gross income test, multiplied, in either case, by

•

a fraction intended to reflect our profitability.

•

If we fail to satisfy the asset tests (other than a de minimis failure of the 5% asset test, the 10% vote test or the 10% value test, as described below under “— Asset Tests”), as long as the failure was due to reasonable cause and not to willful neglect, we dispose of the assets or otherwise comply with such asset tests within six months after the last day of the quarter in which we identify such failure and we file a schedule with the IRS describing the assets that caused such failure, we will pay a tax equal to the greater of $50,000 or the product of the highest U.S. federal corporate tax rate and the net income from the non-qualifying assets during the period in which we failed to satisfy such asset tests.

•

If we fail to satisfy one or more requirements for REIT qualification, other than the gross income tests and the asset tests, and the failure was due to reasonable cause and not to willful neglect, we will be required to pay a penalty of $50,000 for each such failure.

•

We may be required to pay monetary penalties to the IRS in certain circumstances, including if we fail to meet recordkeeping requirements intended to monitor our compliance with rules relating to the composition of a REIT’s stockholders, as described below in “— Requirements for Qualification.”

•

If we fail to distribute during a calendar year at least the sum of: (i) 85% of our REIT ordinary income for the year, (ii) 95% of our REIT capital gain net income for the year and (iii) any undistributed taxable income from earlier periods, we will pay a 4% nondeductible excise tax on the excess of the required distribution over the amount we actually distributed, plus any retained amounts on which income tax has been paid at the corporate level.

•

We may elect to retain and pay income tax on our net long-term capital gain. In that case, a U.S. stockholder would be taxed on its proportionate share of our undistributed long-term capital gain (to the extent that we make a timely designation of such gain to the stockholder) and would receive a credit or refund for its proportionate share of the tax we paid.

•

We will be subject to a 100% excise tax on transactions between us and a TRS that are not conducted on an arm’s-length basis including “redetermined TRS service income.” Redetermined TRS service income generally represents gross income of a TRS that is understated and attributable to services provided to us or on our behalf.

•

The earnings of our TRSs and any other TRS that we may form will be subject to U.S. federal corporate income tax.

•

If we acquire any asset from a C corporation, or a corporation that generally is subject to full corporate — level tax, in a merger or other transaction in which we acquire a basis in the asset that is determined by reference either to the C corporation’s basis in the asset or to another asset, we will pay tax at the highest regular corporate rate applicable if we recognize gain on the sale or disposition of the asset during the 5-year period after we acquire the asset. The amount of gain on which we will pay tax is the lesser of:

•

the amount of gain that we recognize at the time of the sale or disposition, and

•

the amount of gain that we would have recognized if we had sold the asset at the time we acquired it, assuming that the C corporation will not elect, in lieu of this treatment, to be subject to an immediate tax when the asset is acquired.

•

If we derive “excess inclusion income” from an interest in certain mortgage loan securitization structures (i.e., from a taxable mortgage pool (“TMP”), or a residual interest in a real estate mortgage investment conduit (“REMIC”)), we could be subject to corporate level U.S. federal income tax to the extent that such income is allocable to specified types of tax-exempt stockholders known as “disqualified organizations” that are not subject to unrelated business income tax. To the extent that

we own a REMIC residual interest or a TMP through a TRS, we will not be subject to this tax directly, but all of the income from the investment will be subject to U.S. federal income tax at the TRS level. See “— Taxable Mortgage Pools and Excess Inclusion Income” below.

In addition, notwithstanding our qualification as a REIT, we may also have to pay certain state and local income taxes, because not all states and localities treat REITs in the same manner that they are treated for U.S. federal income tax purposes. Moreover, as further described below, any domestic TRS in which we may own an interest will be subject to U.S. federal, state and local corporate income tax on its taxable income. In addition, we may be subject to a variety of taxes other than U.S. federal income tax, including state and local franchise, property and other taxes and foreign taxes. We could also be subject to tax in situations and on transactions not presently contemplated.

Requirements for Qualification

A REIT is a corporation, trust, or association that meets each of the following requirements:

1.

It is managed by one or more trustees or directors.

2.

Its beneficial ownership is evidenced by transferable shares or by transferable certificates of beneficial interest.

3.

It would be taxable as a domestic corporation, but for the REIT provisions of the U.S. federal income tax laws.

4.

It is neither a financial institution nor an insurance company subject to special provisions of the U.S. federal income tax laws.

5.

At least 100 persons are beneficial owners (determined without reference to any rules of attribution) of its shares or ownership certificates.

6.

Not more than 50% in value of its outstanding shares or ownership certificates is owned, directly or indirectly, by five or fewer individuals, which the U.S. federal income tax laws define to include certain entities, during the last half of any taxable year.

7.

It elects to be taxed as a REIT, or has made such election for a previous taxable year, and satisfies all relevant filing and other administrative requirements that must be met to elect and maintain REIT qualification.

8.

It meets certain other qualification tests, described below, regarding the nature of its income and assets and the distribution of its income.

9.

It uses the calendar year as its taxable year.

10.

It has no earnings and profits from any non-REIT taxable year at the close of any taxable year.

We must meet requirements 1 through 4 and 9 during our entire taxable year and must meet requirement 5 during at least 335 days of a taxable year of twelve months, or during a proportionate part of a taxable year of less than twelve months. Requirements 5 and 6 apply to us beginning with our 2015 taxable year. If we comply with all the requirements for ascertaining the ownership of our outstanding shares in a taxable year and have no reason to know that we violated requirement 6, we will be deemed to have satisfied requirement 6 for that taxable year. For purposes of determining share ownership under requirement 6, an “individual” generally includes a supplemental unemployment compensation benefits plan, a private foundation, or a portion of a trust permanently set aside or used exclusively for charitable purposes. An “individual” generally does not include a trust that is a qualified employee pension or profit sharing trust under the U.S. federal income tax laws, however, and beneficiaries of such a trust will be treated as holding our shares in proportion to their actuarial interests in the trust for purposes of requirement 6.

We believe that we have issued shares with sufficient diversity of ownership to satisfy requirements 5 and 6. In addition, our charter restricts the ownership and transfer of our shares so that we should continue to satisfy these requirements. These restrictions, however, may not ensure that we will, in all cases, be able to satisfy these share ownership requirements. If we fail to satisfy these share ownership requirements,

our qualification as a REIT may terminate. The provisions of our charter restricting the ownership and transfer of the shares are described in “Restrictions on Ownership and Transfer.”

To monitor compliance with the share ownership requirements, we generally will be required to maintain records regarding the actual ownership of our shares. To do so, we must demand written statements each year from the record holders of significant percentages of our shares pursuant to which the record holders must disclose the actual owners of the shares (i.e., the persons required to include our dividends in their gross income). We must maintain a list of those persons failing or refusing to comply with this demand as part of our records. We could be subject to monetary penalties if we fail to comply with these record-keeping requirements. If you fail or refuse to comply with the demands, you will be required by Treasury Regulations to submit a statement with your tax return disclosing your actual ownership of our shares and other information. In addition, we must satisfy all relevant filing and other administrative requirements that must be met to elect and maintain REIT status. We intend to comply with these requirements.

Qualified REIT Subsidiaries

A corporation that is a “qualified REIT subsidiary” is not treated as a corporation separate from its parent REIT. All assets, liabilities, and items of income, deduction, and credit of a qualified REIT subsidiary are treated as assets, liabilities, and items of income, deduction, and credit of the REIT. A qualified REIT subsidiary is a corporation, other than a TRS, all of the shares of which is owned, directly or through one or more qualified REIT subsidiaries or disregarded entities, by the REIT. Thus, in applying the requirements described herein, any qualified REIT subsidiary that we own will be ignored, and all assets, liabilities, and items of income, deduction, and credit of such subsidiary will be treated as our assets, liabilities, and items of income, deduction, and credit.

Other Disregarded Entities and Partnerships

An unincorporated domestic entity, such as a limited liability company, that has a single owner generally is not treated as an entity separate from its parent for U.S. federal income tax purposes. An unincorporated domestic entity with two or more owners generally is treated as a partnership for U.S. federal income tax purposes. In the case of a REIT that is a partner in a partnership that has other partners, the REIT is treated as owning its proportionate share of the assets of the partnership and as earning its allocable share of the gross income of the partnership for purposes of the applicable REIT qualification tests. For purposes of the 10% value test (see “— Asset Tests”), our proportionate share is based on our proportionate interest in the equity interests and certain debt securities issued by the partnership. For all of the other asset and income tests, our proportionate share is based on our proportionate interest in the capital interests in the partnership. Our proportionate share of the assets, liabilities, and items of income of any partnership, joint venture, or limited liability company that is treated as a partnership for U.S. federal income tax purposes in which we acquire an interest, directly or indirectly, will be treated as our assets and gross income for purposes of applying the various REIT qualification requirements. In the event that a disregarded subsidiary of ours ceases to be wholly-owned — for example, if any equity interest in the subsidiary is acquired by a person other than us or another disregarded subsidiary of ours — the subsidiary’s separate existence would no longer be disregarded for U.S. federal income tax purposes. Instead, the subsidiary would have multiple owners and would be treated as either a partnership or a taxable corporation. Such an event could, depending on the circumstances, adversely affect our ability to satisfy the various asset and gross income requirements applicable to REITs, including the requirement that REITs generally may not own, directly or indirectly, more than 10% of the total value or total voting power of the outstanding securities of another corporation. See “— Asset Tests” and “— Gross Income Tests.”

Ownership of Subsidiary REITs

Our Operating Partnership currently owns an indirect majority interest in Great Ajax II REIT, Inc. and may own 100% of the common stock in one or more of our subsidiaries that will elect to be taxed as REITs, which we refer to as “Subsidiary REITs.” We may use the Subsidiary REITs for various purposes, including to execute non-REMIC securitization transactions that are treated as TMPs, as described in “— Taxable Mortgage Pools and Excess Inclusion Income.”

Any Subsidiary REIT will be subject to the various REIT qualification requirements and other limitations described that apply to us. We believe that Great Ajax II REIT, Inc. and any other Subsidiary REIT that we may own an interest in will be organized and will operate in a manner to permit it to qualify for taxation as a REIT for U.S. federal income tax purposes from and after the effective date of its REIT election. However, if any Subsidiary REIT were to fail to qualify as a REIT, then (i) the Subsidiary REIT would become subject to regular corporate income tax as described in “— Failure to Qualify,” and (ii) our ownership of shares of common stock in the Subsidiary REIT would not be a qualifying real estate asset for purposes of the 75% asset test and would become subject to the 5% asset test, the 10% vote test, and the 10% value test generally applicable to our ownership in corporations other than REITs, qualified REIT subsidiaries and TRSs. See “— Asset Tests.” If a Subsidiary REIT were to fail to qualify as a REIT, it is possible that we would not meet the 10% vote test, 10% value test and the 5% asset test with respect to our indirect interest in such entity, in which event we would fail to qualify as a REIT unless we could avail ourselves of certain relief provisions, as described in “— Asset Tests.”

Taxable REIT Subsidiaries

A REIT is permitted to own up to 100% of the stock of one or more TRSs. A TRS is a fully taxable corporation that may earn income that would not be qualifying income if earned directly by the parent REIT. The subsidiary and the REIT must jointly elect to treat the subsidiary as a TRS. A corporation with respect to which a TRS directly or indirectly owns more than 35% of the voting power or value of the outstanding securities will automatically be treated as a TRS. However, an entity will not qualify as a TRS if it directly or indirectly operates or manages a lodging or health care facility or, generally, provides to another person, under a franchise, license or otherwise, rights to any brand name under which any lodging facility or health care facility is operated. We generally may not own more than 10%, as measured by voting power or value, of the securities of a corporation that is not a qualified REIT subsidiary or a REIT unless we and such corporation elect to treat such corporation as a TRS. Overall, no more than 20% of the value of a REIT’s assets may consist of stock or securities of one or more TRSs.

The separate existence of a TRS or other taxable corporation, unlike a disregarded subsidiary as discussed above, is not ignored for U.S. federal income tax purposes. Accordingly, a domestic TRS would generally be subject to corporate income tax on its earnings, which may reduce the cash flow generated by us and our subsidiaries in the aggregate and our ability to make distributions to our stockholders.

A REIT is not treated as holding the assets of a TRS or other taxable subsidiary corporation or as receiving any income that the subsidiary earns. Rather, the stock issued by the subsidiary is an asset in the hands of the REIT, and the REIT generally recognizes as income the dividends, if any, that it receives from the subsidiary. This treatment can affect the gross income and asset test calculations that apply to the REIT, as described below.

Because a parent REIT does not include the assets and income of such subsidiary corporations in determining the parent REIT’s compliance with the REIT requirements, such entities may be used by the parent REIT to undertake indirectly activities that the REIT rules might otherwise preclude it from doing directly or through pass-through subsidiaries or render commercially unfeasible (for example, activities that give rise to certain categories of income such as non-qualifying hedging income or inventory sales).

Certain restrictions imposed on TRSs are intended to ensure that such entities will be subject to appropriate levels of U.S. federal income taxation. If amounts are paid to a REIT or deducted by a TRS due to transactions between a REIT, its tenants and/or a TRS, that exceed the amount that would be paid to or deducted by a party in an arm’s-length transaction, the REIT generally will be subject to an excise tax equal to 100% of such excess. Similarly, if amounts are paid to a TRS for services provided to or on behalf of its parent REIT and such amounts are less than the amount that would be paid to a party in an arm’s-length transaction, the REIT generally will be subject to an excise tax equal to 100% of such deficiency. We intend that all of our transactions with Thetis TRS, GAJX Real Estate Corp. and any other TRS that we may form will be conducted on an arm’s-length basis, but there can be no assurance that we will be successful in this regard.

We have elected to treat certain of our subsidiaries, including Thetis TRS and GAJX Real Estate Corp as TRSs and we may form or invest in additional domestic or foreign TRSs in the future. We have received a

private letter ruling from the IRS that allows us to exclude our proportionate share of gross income from the Manager if we held our interest in the Manager through our Operating Partnership. Although we received such a ruling, we continue to hold our interest in the Manager through Thetis TRS instead of through our Operating Partnership. Thetis TRS owns a 19.8% equity interest in Thetis Asset Management LLC. We may also use a TRS, including GAJX Real Estate Corp., to market and sell distressed mortgage loans and property acquired upon foreclosure of those loans, and may modify loans through a TRS. We intend to market and sell mortgage loans and the related foreclosed property through a TRS when the sale of those assets directly by us or our Operating Partnership may be subject to the 100% prohibited transactions tax. See “— Gross Income Tests — Prohibited Transactions.” We anticipate that our marketing and sales of loans and the related foreclosed property will generally be conducted through a TRS.

It is possible that such TRS will be treated as a dealer for U.S. federal income tax purposes. In that case, such TRS will generally mark all the loans it holds on the last day of each taxable year, if any, to their market value, and will recognize ordinary income or loss on such loans with respect to such taxable year as if they had been sold for that value on that day. If we significantly modify mortgage loans in a TRS and determine that such TRS qualifies as a trader, but not a dealer, for tax purposes, such TRS may elect to be subject to similar “mark-to-market” rules that apply to electing traders.

A TRS may also provide services with respect to our properties to the extent we determine that having a TRS provide those services will assist us in complying with the gross income tests applicable to REITs. See “— Gross Income Tests — Rents From Real Property.”

Under legislation commonly known as the “Tax Cuts and Jobs Act,” for taxable years beginning after December 31, 2017, the deduction of net interest expense is limited for all businesses; provided that certain businesses, including real estate businesses, may elect not to be subject to such limitations and instead to depreciate their real property related assets over longer depreciable lives. To the extent that our TRSs or any other TRS we form has interest expense that exceeds its interest income, the net interest expense limitation could potentially apply to such TRS.

To the extent that our TRSs or any other TRS that we may form pays any taxes, they will have less cash available for distribution to us. If dividends are paid by domestic TRSs to us, then the dividends we designate and pay to our stockholders who are taxed at individual rates, up to the amount of dividends that we receive from such entities, generally will be eligible to be taxed at the reduced 20% maximum U.S. federal rate applicable to qualified dividend income. See “— Taxation of U.S. Holders — Taxation of Taxable U.S. Holders on Distributions on Shares.”

Gross Income Tests

We must satisfy two gross income tests annually to qualify and maintain our qualification as a REIT. First, at least 75% of our gross income for each taxable year must consist of defined types of income that we derive, directly or indirectly, from investments relating to real property or mortgage loans on real property or qualified temporary investment income. Qualifying income for purposes of the 75% gross income test generally includes:

•

rents from real property;

•

interest on debt secured by a mortgage on real property or on interests in real property, and interest on debt secured by mortgages on both real and personal property if the fair market value of such personal property does not exceed 15% of the total fair market value of all such property;

•

dividends or other distributions on, and gain from the sale of, shares in other REITs;

•

gain from the sale of real property or mortgage loans;

•

income and gain derived from foreclosure property (as described below);

•

income derived from a REMIC in proportion to the real estate assets held by the REMIC, unless at least 95% of the REMIC’s assets are real estate assets, in which case all of the income derived from the REMIC; and

•

income derived from the temporary investment of new capital that is attributable to the issuance of our shares or a public offering of our debt with a maturity date of at least five years and that we receive during the one-year period beginning on the date on which we received such new capital.

Second, in general, at least 95% of our gross income for each taxable year must consist of income that is qualifying income for purposes of the 75% gross income test (except for income derived from the temporary investment of new capital), other types of interest and dividends, gain from the sale or disposition of stock or securities or any combination of these.

Certain income items do not qualify for either gross income test. Other types of income are excluded from both the numerator and the denominator in one or both of the gross income tests. For example, gross income from the sale of property that we hold primarily for sale to customers in the ordinary course of business, income and gain from “hedging transactions,” as defined in “— Hedging Transactions,” and gross income attributable to cancellation of indebtedness, or “COD,” income will be excluded from both the numerator and the denominator for purposes of both the 75% and 95% gross income tests. In addition, certain foreign currency gains will be excluded from gross income for purposes of one or both of the gross income tests. See “— Foreign Currency Gain.” For purposes of the 75% and 95% gross income tests, we are treated as receiving our proportionate share of our Operating Partnership’s gross income. We will monitor the amount of our non-qualifying income and will seek to manage our investment portfolio to comply at all times with the gross income tests. The following paragraphs discuss the specific application of the gross income tests to us.

Dividends

Our share of any dividends received from any corporation (including dividends from our TRSs and any other TRS that we may form, but excluding any REIT) in which we own an equity interest will qualify for purposes of the 95% gross income test but not for purposes of the 75% gross income test. Our share of any dividends received from any other REIT in which we own an equity interest, if any, will be qualifying income for purposes of both gross income tests.

Interest

The term “interest,” as defined for purposes of both gross income tests, generally excludes any amount that is based in whole or in part on the income or profits of any person. However, interest generally includes the following:

•

an amount that is based on a fixed percentage or percentages of receipts or sales; and

•

an amount that is based on the income or profits of a debtor, as long as the debtor derives substantially all of its income from the real property securing the debt from leasing substantially all of its interest in the property, and only to the extent that the amounts received by the debtor would be qualifying “rents from real property” if received directly by a REIT.

If a loan contains a provision that entitles a REIT to a percentage of the borrower’s gain upon the sale of the real property securing the loan or a percentage of the appreciation in the property’s value as of a specific date, income attributable to that loan provision will be treated as gain from the sale of the property securing the loan, which generally is qualifying income for purposes of both gross income tests, provided that the property is not inventory or dealer property in the hands of the borrower or the REIT.

Interest on debt secured by a mortgage on real property or on interests in real property, including, for this purpose, market discount, original issue discount, discount points, prepayment penalties, loan assumption fees, and late payment charges that are not compensation for services, generally is qualifying income for purposes of the 75% gross income test. However, if the loan is secured by real property and other property and the highest principal amount of a loan outstanding during a taxable year exceeds the fair market value of the real property securing the loan as of (i) the date the REIT agreed to originate or acquire the loan or (ii) as discussed below, in the event of a “significant modification,” the date we modified the loan, a portion of the interest income from such loan will not be qualifying income for purposes of the 75% gross income test, but will be qualifying income for purposes of the 95% gross income test. The portion of the interest income that will not be qualifying income for purposes of the 75% gross income test will be equal to the

portion of the principal amount of the loan that is not secured by real property — that is, the amount by which the loan balance exceeds the applicable value of the real estate that secures the loan.

We generally acquire re-performing and non-performing mortgage loans. Our mortgage loans are secured by a first lien on real property. Interest on debt secured by mortgages on real property or on interests in real property, including, for this purpose, prepayment penalties, loan assumption fees and late payment charges that are not compensation for services, generally is qualifying income for purposes of the 75% gross income test.

Under the applicable Treasury Regulation (referred to as the “interest apportionment regulation”), if we receive interest income with respect to a mortgage loan that is secured by both real property and other property, and the highest principal amount of the loan outstanding during a taxable year exceeds the fair market value of the real property on the date that we acquired the mortgage loan, the interest income will be apportioned between the real property and the other collateral, and our income from the arrangement will qualify for purposes of the 75% gross income test only to the extent that the interest is allocable to the real property. Even if a mortgage loan is not secured by real property, or is undersecured, the income that it generates may nonetheless qualify for purposes of the 95% gross income test. In Revenue Procedure 2014-51, the IRS interpreted the “principal amount” of the loan for purposes of that test to be the face amount of the loan, despite the Code’s requirement that taxpayers treat any market discount (discussed below) as interest rather than principal. In the case of mortgage loans secured by both real and personal property, if the fair market value of such personal property does not exceed 15% of the total fair market value of all property securing the loan, then the personal property securing the loan will be treated as real property for purposes of determining whether the mortgage interest income is qualifying for purposes of the 75% gross income test.

We generally acquire re-performing and non-performing mortgage loans for substantially less than their face amount. However, we believe that all of the mortgage loans that we acquire are secured only by real property and no other property value is taken into account in our underwriting and pricing. Accordingly, we believe that the interest apportionment rules and Revenue Procedure 2014-51 (to the extent it addresses interest apportionment) will not apply to our mortgage loans. Nevertheless, if the IRS were to assert successfully that our mortgage loans were secured by other property, then depending upon the value of the real property securing our mortgage loans and their face amount, and the sources of our gross income generally, we might not be able to satisfy the 75% income test.

Under the Code, if the terms of a loan are modified in a manner constituting a “significant modification,” such modification triggers a deemed exchange of the original loan for the modified loan. IRS Revenue Procedure 2014-51 provides a safe harbor pursuant to which we will not be required to redetermine the fair market value of the real property securing a loan for purposes of the gross income and asset tests in connection with a loan modification that is: (i) occasioned by a borrower default; or (ii) made at a time when we reasonably believe that the modification to the loan will substantially reduce a significant risk of default on the original loan. If we modify our mortgage loans in the future, no assurance can be provided that all of our loan modifications will qualify for the safe harbor in Revenue Procedure 2014-51. To the extent we significantly modify a mortgage loan in a manner that does not qualify for that safe harbor, we will be required to redetermine the value of the real property securing the loan at the time it was significantly modified. If the fair market value of the real property securing a loan has decreased, a portion of the interest income from the loan would not be qualifying income for the 75% gross income test and a portion of the value of the loan would not be a qualifying asset for purposes of the 75% asset test.

Hedging Transactions

From time to time, we may enter into hedging transactions with respect to one or more of our assets or liabilities. Our hedging activities may include entering into interest rate swaps, caps, and floors, options to purchase these items, and futures and forward contracts. Except to the extent provided by Treasury Regulations, income and gain from “hedging transactions” will be excluded from gross income for purposes of both the 75% and 95% gross income tests. A “hedging transaction” includes any transaction entered into in the normal course of our trade or business primarily to manage the risk of interest rate changes, price changes, or currency fluctuations with respect to borrowings made or to be made, or ordinary obligations incurred or to be incurred, to acquire or carry real estate assets, or liability hedge. A “hedging transaction” also includes any transaction entered into primarily to manage risk of currency fluctuations with respect to

any item of income or gain that is qualifying income for purposes of the 75% or 95% gross income test (or any property which generates such income or gain). To the extent we enter into transactions to mitigate the risk of hedging transactions where the hedged asset has been extinguished or disposed of, such transaction may also constitute a “hedging transaction.” We are required to clearly identify any such hedging transaction before the close of the day on which it was acquired, originated, or entered into and satisfy other identification requirements. To the extent that we hedge for other purposes, or to the extent that a portion of the hedged assets are not treated as “real estate assets” (as described below under “— Asset Tests”) or we enter into derivative transactions that are not liability hedges or we fail to satisfy the identification requirements with respect to a hedging transaction, the income from those transactions will likely be treated as non-qualifying income for purposes of both gross income tests. We intend to structure any hedging transactions in a manner that does not jeopardize our qualification as a REIT, but we cannot assure you that we will be able to do so. We may conduct some or all of our hedging activities through a TRS or other corporate entity, the income from which may be subject to U.S. federal income tax, rather than by participating in the arrangements directly or through pass — through subsidiaries.

Fee Income

We may earn income from fees in certain circumstances. Fee income generally will be qualifying income for purposes of both the 75% and 95% gross income tests if it is received in consideration for entering into an agreement to make a loan secured by real property and the fees are not determined by income and profits. Other fees, including certain amounts received in connection with mortgage servicing rights (which we do not currently intend to acquire on a standalone basis), generally are not qualifying income for purposes of either gross income test. Any fees earned by a TRS, like other income earned by a TRS, will not be included in the REIT’s gross income for purposes of the gross income tests.

Foreign Currency Gain

Certain foreign currency gains will be excluded from gross income for purposes of one or both of the gross income tests. “Real estate foreign exchange gain” will be excluded from gross income for purposes of the 75% and 95% gross income tests. Real estate foreign exchange gain generally includes foreign currency gain attributable to any item of income or gain that is qualifying income for purposes of the 75% gross income test, foreign currency gain attributable to the acquisition or ownership of (or becoming or being the obligor under) obligations secured by mortgages on real property or on interest in real property and certain foreign currency gain attributable to certain “qualified business units” of a REIT. “Passive foreign exchange gain” will be excluded from gross income for purposes of the 95% gross income test. Passive foreign exchange gain generally includes real estate foreign exchange gain as described above, and also includes foreign currency gain attributable to any item of income or gain that is qualifying income for purposes of the 95% gross income test and foreign currency gain attributable to the acquisition or ownership of (or becoming or being the obligor under) obligations. These exclusions for real estate foreign exchange gain and passive foreign exchange gain do not apply to foreign currency gain derived from dealing, or engaging in substantial and regular trading, in securities. Such gain is treated as non-qualifying income for purposes of both the 75% and 95% gross income tests.

Rents from Real Property

We acquired interests in real property as part of our initial portfolio and may acquire additional real property or an interest therein in the future. Rents we receive from our interests in real property will qualify as “rents from real property” in satisfying the gross income requirements for a REIT described above only if the following conditions are met:

•

First, the amount of rent must not be based in whole or in part on the income or profits of any person. An amount received or accrued generally will not be excluded, however, from rents from real property solely by reason of being based on fixed percentages of receipts or sales.

•

Second, rents we receive from a “related party tenant” will not qualify as rents from real property in satisfying the gross income tests unless the tenant is a TRS, at least 90% of the property is leased to unrelated tenants, the rent paid by the TRS is substantially comparable to the rent paid by the unrelated tenants for comparable space and the rent is not attributable to an increase in rent due to a

modification of a lease with a “controlled TRS” (i.e., a TRS in which we own directly or indirectly more than 50% of the voting power or value of the stock). A tenant is a related party tenant if the REIT, or an actual or constructive owner of 10% or more of the REIT, actually or constructively owns 10% or more of the tenant.

•

Third, if rent attributable to personal property, leased in connection with a lease of real property, is greater than 15% of the total rent received under the lease, then the portion of rent attributable to the personal property will not qualify as rents from real property.

•

Fourth, we generally must not operate or manage our real property or furnish or render services to our tenants, other than through an “independent contractor” who is adequately compensated and from whom we do not derive revenue. We may, however, provide services directly to tenants if the services are “usually or customarily rendered” in connection with the rental of space for occupancy only and are not considered to be provided for the tenants’ convenience. In addition, we may provide a minimal amount of “non-customary” services to the tenants of a property, other than through an independent contractor, as long as our income from the services does not exceed 1% of our income from the related property. Furthermore, we may own up to 100% of the stock of a TRS, which may provide customary and non-customary services to tenants without tainting our rental income from the related properties.

If a portion of the rent that we receive from a property does not qualify as “rents from real property” because the rent attributable to personal property exceeds 15% of the total rent for a taxable year, the portion of the rent that is attributable to personal property will not be qualifying income for purposes of either the 75% or 95% gross income test. Thus, if such rent attributable to personal property, plus any other income that is non-qualifying income for purposes of the 95% gross income test, during a taxable year exceeds 5% of our gross income during the year, we would lose our REIT qualification. Further, the rent from a particular property does not qualify as “rents from real property” if (i) the rent is considered based on the income or profits of the tenant, (ii) the tenant either is a related party tenant or fails to qualify for the exceptions to the related party tenant rule for qualifying TRS or (iii) we furnish non-customary services to the tenants of the property, or manage or operate the property, other than through a qualifying independent contractor or a TRS.

Our Operating Partnership and/or its subsidiaries will generally lease our real estate owned (“REO”) properties to tenants that are individuals. Our REO property leases will typically have a term of at least one year and require the tenant to pay fixed rent. We may also lease portions of our mixed-use properties, if any, to tenants that are entities. We intend to structure any such leases so that the rent will qualify as “rents from real property,” and do not intend to own more than 10% of any tenant of a mixed-use property. We do not anticipate leasing significant amounts of personal property pursuant to any of our leases. Moreover, we do not intend to perform any services other than customary ones for our tenants, unless such services are provided through independent contractors or a TRS. Accordingly, we believe that our leases generally produce rent that qualifies as “rents from real property” for purposes of the 75% and 95% gross income tests.