Discover® Small Business WatchSM: Small Business Economic Confidence Drops Sharply after 3-Month Climb

26 Maggio 2009 - 11:05AM

Business Wire

After reaching its highest level in 14 months, the economic

confidence among small business owners fell in May as owners

reported cash flow concerns and expect to cut back on business

development spending, according to the latest Discover� Small

Business WatchSM. The monthly

index dropped more than 10 points to 78.1, down from 88.5 in

April.

The Watch also recorded significant drops in the numbers of

small business owners who think the overall economy is getting

better, and number of owners who thought economic conditions were

improving for their own businesses.

�We saw cash flow problems jump this month to their highest

level in 2� years, which is certainly not going to boost the

optimism of a small business owner, especially in this economic

climate,� said Ryan Scully, director of Discover's business credit

card. �However, for the past three months we�ve been recording our

highest confidence levels since summer of 2008, so all is not

lost.�

May Highlights:

- 49 percent of small business

owners say they have experienced temporary cash flow issues in the

past 90 days, up 10 percentage points from April. That�s the

highest percentage in that category since the Watch started in

August 2006.

- Nearly half of small business

owners, or 48 percent, see economic conditions for their businesses

getting worse, up from 40 percent in April; 24 percent see

conditions improving, down from 32 percent last month; and 23

percent say conditions are the same; 4 percent were not sure.

- 60 percent of small business

operators rate the economy as poor, up from 54 percent in April.

Only 7 percent rate the economy as excellent or good, and 32

percent called it fair.

- 57 percent believe the economy

is getting worse, up from 51 percent in April, while 23 percent

believe it�s getting better, down from 31 percent in April; 16

percent say it�s staying the same; and 4 percent weren�t sure.

- 53 percent of small business

owners say they plan to decrease spending on business development

over the next six months, an increase over the 46 percent in April

who said the same. Twenty-two percent plan to increase spending,

which is largely unchanged from 21 percent in April; while the

number of owners who were not planning any changes in spending

dropped from 30 percent in April to 23 percent in May.

POLL: Small Business Owners Continue to Toil Harder Than Most

Americans, Even More During Tough Economic Times

As documented in previous Watch surveys, American small business

owners report working more hours, more days and more holidays than

their general public counterparts, and during the past year, that

gap has widened.

While the amount of days and hours on the job for the average

American have been relatively flat since 2007, the number of small

business owners who work more than 10 hours a day jumped from 30

percent in 2008 to 39 percent in 2009. In comparison, only 20

percent of average workers make the same claim.

When it comes to days worked per week, 61 percent of small

business owners said they work six or more, up from 45 percent in

2008 and 43 percent in 2007. Comparatively, only 22 percent of

workers in the general population say they work more than five days

a week.

�The economy has obviously been a factor for small business

owners caught in the slowdown; they�re grinding out more hours

serving existing customers and likely putting in more time looking

for new business,� Scully said.

More Work Survey Results:

- Given their heavy work

schedules, small business owners are finding less time for vacation

than in years past. Today, only 29 percent say they have taken a

vacation in the past year that lasted a week, down from 40 percent

in May 2008 and 41 percent in May 2007. Thirty percent say it�s

been four years or more since they had a vacation that lasted a

week, up from 23 percent in both 2008 and 2007.

- 56 percent of small business

owners say that the economy has caused them to postpone or cancel

vacation time this summer, compared to 45 percent of the general

population who said the same.

- 27 percent of small business

owners define a day off as not working at all, followed by 37

percent who say a day off means not actively working, but available

for calls and e-mails; 25 percent define it as working an hour here

and there; 7 percent said it�s working all day, but from a remote

location; and 3 percent weren�t sure how they would define a day

off. In the general population, 54 percent of people define a day

off as not working at all.

- 57 percent of small business

owners say they always or most of the time work on holidays, up

from 47 percent in 2008.

- 31 percent of the general public

says they always or most of the time work on holidays, up from 29

percent in 2008.

- The spouses of small business

owners haven�t changed their opinions much since 2007 on whether

they approve of checking work e-mail when away: 56 percent approve,

19 percent disapprove and 24 percent aren�t sure.

- Spouses in the general public

seem to be getting much more used to the idea of checking work

e-mail when off: In 2007, only 21 percent of spouses approved of

the practice, while 74 percent disapproved and 5 percent weren�t

sure. This year, 39 percent of spouses approve, 22 percent

disapprove and 39 percent aren�t sure.

The views and opinions expressed by small business owners and

consumers who participate in the Small Business Watch survey are

their own and do not necessarily reflect those of Discover

Financial Services or its affiliates.

About the Small Business Watch

The Discover Small Business Watch is a monthly index measuring

the relative economic confidence of U.S. small business owners who

have less than five employees, a segment that consists of 22

million businesses producing more than a trillion dollars in annual

receipts. The Watch is based on a national random survey of 750

small business owners. It is commissioned by the Discover Business

Card, which strives to offer the best business credit card for

American small businesses, and is conducted by Rasmussen Reports,

LLC (www.rasmussenreports.com), an independent survey research

firm. The numeric index is calculated by assigning values to

responses to a set of six consistent questions. The base value of

the Watch was established at 100.0 based on surveys conducted in

August 2006. In addition to generating the index, the Small

Business Watch surveys small business owners every month on key

issues, and polls 3,000 consumers four times per year to gauge

purchasing behavior and attitudes towards small businesses. For

past results and survey data, visit

www.discovercard.com/business/watch. For information on Discover

Business Card, visit www.discovercard.com/business.

About Discover Financial Services

Discover Financial Services (NYSE: DFS) is a leading credit card

issuer and electronic payment services company with one of the most

recognized brands in U.S. financial services. Since its inception

in 1986, the company has become one of the largest card issuers in

the United States. The company operates the Discover Card,

America's cash rewards pioneer, and offers student and personal

loans, as well as savings products such as certificates of deposit

and money market accounts. Its payments businesses consist of the

Discover Network, with millions of merchant and cash access

locations; PULSE, one of the nation's leading ATM/debit networks;

and Diners Club International, a global payments network with

acceptance in 185 countries and territories. For more information,

visit www.discoverfinancial.com.

Photos/Multimedia�Gallery Available:

http://www.businesswire.com/cgi-bin/mmg.cgi?eid=5971936&lang=en

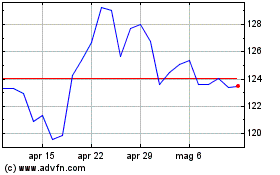

Grafico Azioni Discover Financial Servi... (NYSE:DFS)

Storico

Da Set 2024 a Ott 2024

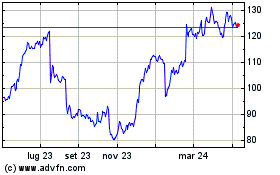

Grafico Azioni Discover Financial Servi... (NYSE:DFS)

Storico

Da Ott 2023 a Ott 2024