New Poll Underscores Need for Financial Education in School

03 Aprile 2013 - 1:00PM

Business Wire

High school seniors who have taken a personal finance course are

more likely to engage in financially responsible behaviors, such as

saving, budgeting, and investing, according to a recent study

sponsored by Discover Financial Services as part of its Pathway to

Financial Success program (www.pathwaytofinancialsuccess.org). In

the face of economic uncertainty after high school and college,

students who discuss personal finances at home and at school are

more happy, confident, and knowledgeable about life after

graduation than those who do not.

The findings highlight the need for financial education

curriculum in schools to bolster the conversation around practical

money management and to build confidence among students preparing

to graduate high school. Pathway to Financial Success, a program

dedicated to getting financial education into the classroom, has

been providing grants to high schools to help pay for resources and

teacher training on financial education. Launched in February 2012,

the program has provided more than $2.6 million in financial

education grants to nearly 300 public high schools across the

country, reaching more than 65,000 students.

Students Rank Personal Finance as Most Important Subject in

School

Students who have taken a personal finance class at school are

twice as likely to be confident in their abilities to manage

finances and more likely to prepare a budget. Of students who have

taken a personal finance class, 60 percent have a budget, versus 46

percent of students who have not taken a class. The study also

found that 32 percent of those who have taken a class invest versus

17 percent who have not taken a class.

“By getting financial education in schools, we’re helping the

next generation gain confidence for life after graduation and

giving them the opportunity to achieve brighter financial futures,”

said David Nelms, chairman and chief executive officer of

Discover.

The 1,200 high school seniors who participated in the national

study ranked personal finance as the most important subject they

needed to learn in school for their future success – tied with math

and ahead of science and technology – but less than one third (29

percent) have taken a personal finance course in school.

Key Findings

The majority of high school seniors are earning their own

spending money, planning on contributing or paying entirely for

expenses when they graduate, and intending to work while going to

college.

- Only one-third claim to be “very

confident” in their ability to manage their personal finances.

- Female students are less confident

about their ability to manage money (28 percent) than male students

(40 percent), but females were twice as likely to rank personal

finance as most important to their personal success.

- Only half (52 percent) know the cost of

their tuition.

- Almost half (48 percent) still save

through a “piggy bank.”

- Nearly half (45 percent) do not use a

budget.

- About one-third (33 percent) say

they’ve already encountered issues with managing their own

finances.

Methodology

The survey titled, “High School Seniors’ Financial Knowledge and

Outlook: A Discover Pathway to Financial Success Survey,” was

conducted for Discover in March 2013 by the research firm Penn,

Schoen, Berland in collaboration with Burson-Marsteller. The survey

was conducted online among 1,200 randomly selected current high

school seniors, who plan to graduate in the spring of 2013. The

margin of error for the total sample is +/- 2.8%. The study was

commissioned by Discover to increase the understanding of issues

surrounding young people and money management, including

understanding students’ financial knowledge, behaviors, and

financial outlook of the future as they prepare to graduate.

About Pathway to Financial Success

Pathway to Financial Success is a five-year, $10 million

commitment to bring financial education curriculum into public high

schools across the country. Schools receiving grants must agree to

pre- and post-test students on the curriculum to measure success.

Discover began the program in February 2012 and has since given

more than $2.6 million to schools across the country. Lesson plans,

tips and information for how to talk to teens about money are

available on www.pathwaytofinancialsuccess.org.

Full Findings

For full findings, please visit

www.pathwaytofinancialsuccess.org/blog.

About Discover

Discover Financial Services (NYSE: DFS) is a direct banking and

payment services company with one of the most recognized brands in

U.S. financial services. Since its inception in 1986, the company

has become one of the largest card issuers in the United States.

The company operates the Discover card, America's cash rewards

pioneer, and offers home loans, private student loans, personal

loans, checking and savings accounts, certificates of deposit and

money market accounts through its direct banking business. Its

payment businesses consist of Discover Network, with millions of

merchant and cash access locations; PULSE, one of the nation's

leading ATM/debit networks; and Diners Club International, a global

payments network with acceptance in more than 185 countries and

territories. For more information, visit

www.discoverfinancial.com.

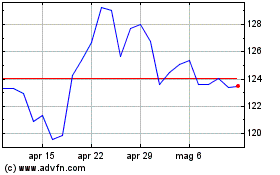

Grafico Azioni Discover Financial Servi... (NYSE:DFS)

Storico

Da Set 2024 a Ott 2024

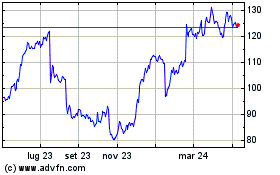

Grafico Azioni Discover Financial Servi... (NYSE:DFS)

Storico

Da Ott 2023 a Ott 2024