Brookfield Strikes Deal to Buy Rest of GGP Mall Owner

27 Marzo 2018 - 3:28AM

Dow Jones News

By Maria Armental and Miriam Gottfried

Brookfield Property Partners LP and GGP Inc. have reached an

agreement for Brookfield to buy the remaining shares of the mall

owner it doesn't already own, a deal that would create one of the

world's largest retail real-estate companies.

The deal is a sweetened version of the offer that Brookfield

made for the roughly 66% stake in November.

Brookfield currently owns about 34% in the company, formerly

known as General Growth Properties.

Under the agreement announced Monday, and unanimously endorsed

by a special committee of GGP's board, GGP investors could choose

either $23.50 a share in cash or stock in either Brookfield

Property or a new real-estate investment trust being formed. The

offer is subject to proration based on aggregate cash consideration

of $9.25 billion.

Earlier, Brookfield had offered $23 a share in cash for an

aggregate cash consideration of $7.4 billion.

"We raised the cash price," said Brian Kingston, Brookfield

chief executive, in an interview Monday evening. The offer went

from about 50% cash and 50% shares to about 61% cash and 39%

shares.

The previous offer valued one share of GGP with 0.9656 of

Brookfield. The new offer values the two shares equally.

The deal values GGP at $15.3 billion based on the value of

Brookfield Property when the company first announced its offer to

buy the company in November. Mr. Kingston predicted GGP would vote

on the deal "sometime in the third quarter."

The Brookfield deal marks the latest chapter in the saga of GGP

which went through a high-profile bankruptcy reorganization after

the 2008 financial crash. It comes as the retail real-estate world

is being rocked by investor unease caused by the growth of online

shopping.

Matt Kopsky, an analyst at Edward Jones, said Brookfield's price

reflects a weak appetite for portfolios of malls in the current

environment. He called the price "a disappointment" given that GGP

owns top quality malls that have relatively high occupancy and

rents compared with the rest of the sector.

"The market has sniffed this out given the weakness in mall

REITs," Mr. Jones said in an email. "I think this deal is

confirmation that a new reality/pricing has set in, even to

high-quality centers."

Mr. Jones added: "I would expect some downward pressure on mall

REITs" in the stock market on Tuesday "given the low price."

Mr. Kingston said that Brookfield has been in "pretty regular

dialogue" with the GGP special committee since November. For the

past four months, Brookfield "has been firming up our offer," he

said.

GGP shareholders will have the option of either exchanging GGP

shares for Brookfield shares or shares in the new REIT because "a

large number of the GGP shareholders are U.S. shareholders who

don't want to own partnership units," Mr. Kingston said. "This

allows them to own shares in a U.S.-listed REIT. Certain investors

may want the partnership."

He added: GGP shareholders "get an ability to participate in our

global business."

--Esther Fung contributed to this article.

(END) Dow Jones Newswires

March 26, 2018 21:13 ET (01:13 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

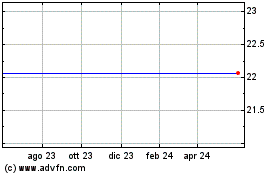

Grafico Azioni GGP Inc. (NYSE:GGP)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni GGP Inc. (NYSE:GGP)

Storico

Da Dic 2023 a Dic 2024