Brookfield's Underwhelming Bid For GGP Pushes Down Retail REITs

28 Marzo 2018 - 12:48AM

Dow Jones News

By Esther Fung

Shares of retail real estate companies plunged Tuesday, as

investors raised concerns that the weak acquisition price for GGP

Inc. meant that the malaise in the retail world was beginning to

drag down values of top-tier malls.

In 4 p.m. trading, shares of Chicago-based GGP were down 5.3%,

Macerich Co. 4.1%, Taubman Centers Inc. 2.5% and Simon Property

Group 1.9%. The S&P 500 index fell 1.7% Tuesday.

Brookfield Property Partners LP said Monday evening that a

special committee of the board of directors at GGP agreed to its

offer to buy the 66% stake in the company it doesn't already own.

The price -- $23.50 per share in cash or stock -- was a sweetened

version of the offer that Brookfield made in November.

But it was below the $24 price tag many investors and analysts

felt the company would fetch. Some predicted that GGP shareholders

would reject it when the special committee's recommendation is put

up for a vote later this year.

In a research report Tuesday, analysts at BTIG pointed out that

Brookfield's "wholly inadequate" offer values GGP at a 21.9%

discount to what the company would be worth if its properties were

sold separately. "Why should the shareholders gift that arbitrage

to Brookfield and award a very valuable management fee stream to

Brookfield Asset Management shareholders in the process?" the

report said.

But others noted that at this juncture, the shareholders of the

REIT have little choice since there are no other bids.

"There are people who are upset and want to vote no," said

Alexander Goldfarb, managing director at Sandler O'Neill +

Partners. "While the transaction price undervalues GGP, we believe

GGP shareholders are left with the unpleasant situation of either

declining in hopes of a higher price or just accepting reality and

moving on."

The low bid comes at a time that competition from online

shopping is clobbering bricks-and-mortar retail. In recent weeks

alone, Toys "R" Us Inc. said it is starting to wind down its U.S.

business and liquidate inventory in all 735 of its U.S. stores. The

Wayne, N. J. -- based company filed for bankruptcy protection in

September.

Last week, teen-accessories chain Claire's Stores Inc. had also

filed for chapter 11 protection from its creditors.

The low bid for GGP gave the market the jitters because its

portfolio of 125 properties includes some of the top malls in the

country, such as Ala Moana Center in Honolulu. Top-quality malls

located in wealthier areas have high rents and occupancy rates and

are believed to be more immune to the turmoil in the retail

world.

Another sign of Brookfield's low bid is by looking at its

so-called capitalization, or "cap" rate, a common measurement in

the real-estate industry of annual income from a property compared

with its original cost. Lower cap rates mean higher prices.

Analysts say that Brookfield's price amounts to a 6.0% cap rate.

In 2016, GGP sold a 50% stake in Fashion Show Mall in Las Vegas to

TIAA Global Asset Management at a price that valued the mall at a

cap rate of 3.9%.

In December, European shopping center giant Unibail-Rodamco SE

made a $15.7 billion takeover offer for Westfield Corp., which has

a smaller portfolio of high-end malls in the U.S. compared with

GGP. Analysts said the offer placed Westfield at a cap rate of

around 4% to 5%. Since then, mergers and acquisitions activity in

the upscale mall world has been slow.

GGP was forced into bankruptcy protection in 2009 but recovered

after emerging from chapter 11 in 2010. Its portfolio includes more

second-tier malls than some of its peers.

Write to Esther Fung at esther.fung@wsj.com

(END) Dow Jones Newswires

March 27, 2018 18:33 ET (22:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

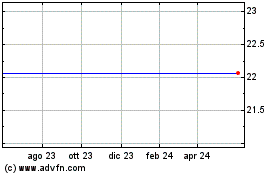

Grafico Azioni GGP Inc. (NYSE:GGP)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni GGP Inc. (NYSE:GGP)

Storico

Da Dic 2023 a Dic 2024