As previously announced, on March 26, 2018, GGP Inc.

(“GGP”) (NYSE: GGP) and Brookfield Property Partners L.P. (“BPY”)

entered into a definitive agreement pursuant to which BPY will

acquire all of the shares of GGP common stock, par value $0.01 per

share, that BPY and its affiliates do not already own, through a

series of transactions (collectively, the “Transactions”),

including the declaration of a special dividend. As more fully

described in the Merger Agreement (as defined below), the special

dividend is payable to the holders of record of shares of GGP

common stock (not including restricted shares of GGP common stock)

as of the end of trading on the New York Stock Exchange (the

“NYSE”) on the first business day following receipt of the

requisite stockholder approval of the Transactions and following

the exchange of all shares of GGP common stock held by certain

affiliates of BPY for series B preferred stock to be authorized and

issued by GGP pursuant to the terms of the Merger Agreement (the

“Pre-Closing Dividend”). GGP today announced that its board of

directors (the “Board”), upon the recommendation of the special

committee of the Board, comprised entirely of non-management

independent directors who are not affiliated with BPY (the “Special

Committee”), fixed the end of trading on the NYSE on July 27, 2018

as the record date for, and declared, the Pre-Closing Dividend. The

payment of the Pre-Closing Dividend is conditioned upon, among

other things, the Transactions having been approved by the holders

of GGP common stock at the Special Meeting (as defined below) and

the satisfaction of other customary closing conditions.

In aggregate, the Pre-Closing Dividend consists of the Aggregate

Cash Dividend Amount (as such term is defined in the Merger

Agreement) and a number of shares of class A stock, par value $0.01

per share, to be authorized and issued by Brookfield Property REIT

Inc. (“BPR”) (the surviving corporation following the consummation

of the Transactions) upon the amendment and restatement of GGP’s

certificate of incorporation on the Charter Closing Date (as such

term is defined in the Merger Agreement) equal to the Aggregate

Stock Dividend Amount (as such term is defined in the Merger

Agreement), as appropriately adjusted pursuant to the terms of the

Merger Agreement (to the extent applicable), with a payment date of

the Charter Closing Date.

As more fully described in the Merger Agreement, holders of GGP

common stock who are entitled to receive the Pre-Closing Dividend

will have the right to elect to receive either cash and/or class A

stock of BPR or limited partnership units of BPY, subject to

proration. The election forms setting forth detailed instructions

on how to make an election to receive cash and/or class A stock of

BPR or BPY units will be mailed to such holders on or after the

record date for the Pre-Closing Dividend. Any shares of GGP common

stock that are entitled to make an election for which an effective,

properly completed election form has not been received by the

deadline specified in the election forms will be deemed to have

made a cash election and will be deemed to have made an election to

receive BPY units to the extent any equity is received or entitled

to be received due to proration. Thus, any holder of GGP common

stock that wishes to receive a portion of their consideration in

class A stock of BPR must submit a properly completed election form

prior to the deadline.

It is anticipated that from trading on July 26, 2018, the

business day immediately prior to the record date for the

Pre-Closing Dividend, through (and including) the payment date for

the Pre-Closing Dividend, GGP common stock will trade with “due

bills” attached, pursuant to which, during such period, the

transferor of any GGP common stock will relinquish its entitlement

to the Pre-Closing Dividend to the transferee and the transferee of

any GGP common stock will be deemed to have made an election to

receive the default cash in the Pre-Closing Dividend and to receive

BPY units to the extent any equity is received or entitled to be

received due to proration. It is currently expected that the NYSE

will not issue an ex-dividend date with respect to the Pre-Closing

Dividend. More detailed information about the Pre-Closing Dividend

will be included in the election forms and materials which will be

mailed to holders of GGP common stock who are entitled to receive

the Pre-Closing Dividend on or after the record date for the

Pre-Closing Dividend.

In connection with the Transactions, GGP has filed a definitive

proxy statement with the U.S. Securities and Exchange Commission

(the “SEC”) on June 27, 2018, which contains a notice of

a special meeting of holders of GGP common stock to be held on

July 26, 2018 for the purpose of obtaining the requisite

stockholder approval of the Transactions (the “Special

Meeting”).

GGP expects that the Transactions will be completed in the third

quarter of 2018, subject to, among other things, receipt of the

requisite stockholder approval of the Transactions and the

satisfaction of other customary closing conditions.

About GGP Inc.

GGP Inc. is an S&P 500 company focused exclusively on

owning, managing, leasing and redeveloping high-quality retail

properties throughout the United States. GGP is headquartered in

Chicago, Illinois, and publicly traded on the NYSE under the symbol

GGP.

About Brookfield Property Partners L.P.

Brookfield Property Partners is one of the world’s largest

commercial real estate companies, with approximately $69 billion in

total assets. We are leading owners, operators and investors in

commercial real estate, with a diversified portfolio of premier

office and retail assets, as well as interests in multifamily,

triple net lease, industrial, hospitality, self-storage, student

housing and manufactured housing assets. Brookfield Property

Partners is listed on the NASDAQ and Toronto stock exchanges.

Further information is available at bpy.brookfield.com.

Brookfield Property Partners is the flagship listed real estate

company of Brookfield Asset Management, a leading global

alternative asset manager with over $285 billion in assets under

management.

Additional Information and Where to Find It

This communication is being made in respect of the proposed

transaction contemplated by the Agreement and Plan of Merger, dated

as of March 26, 2018 and as amended on

June 25, 2018, among BPY, Goldfinch Merger Sub Corp. and

GGP (as may be further amended or otherwise modified from time to

time in accordance with its terms, the “Merger Agreement”). This

communication may be deemed to be solicitation material in respect

of the proposed transaction involving BPY and GGP. In connection

with the proposed transaction, BPY filed with the SEC a

registration statement on Form F-4 (File No.: 333-224594) that

includes a prospectus of BPY (the “BPY prospectus”), and GGP filed

with the SEC a registration statement on Form S-4 (File No.:

333-224593) that includes a proxy statement/prospectus of GGP (the

“GGP proxy statement/prospectus”). The parties also filed a

Rule 13E-3 transaction statement on Schedule 13E-3. The

registration statements filed by BPY and GGP were declared

effective by the SEC on June 26, 2018 and GGP has mailed

the GGP proxy statement/prospectus in definitive form to its

stockholders of record as of the close of business on

June 22, 2018. Each of BPY and GGP may also file other

documents with the SEC regarding the proposed transaction. This

communication is not a substitute for the BPY prospectus, the GGP

proxy statement/prospectus, the registration statements or any

other document which BPY or GGP may file with the SEC. INVESTORS

AND SECURITY HOLDERS ARE URGED TO READ THE ABOVE-REFERENCED AND

OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC, AS WELL

AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND

IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN

OR WILL CONTAIN IMPORTANT INFORMATION ABOUT BPY, GGP, THE PROPOSED

TRANSACTION AND RELATED MATTERS. Investors and stockholders may

obtain free copies of the above-referenced and other documents

filed with the SEC by BPY and GGP, when available, through the

SEC’s website at http://www.sec.gov. In addition, investors may

obtain free copies of the above-referenced and other documents

filed with the SEC by BPY, when available, by contacting BPY

Investor Relations at bpy.enquiries@brookfield.com or +1 (855)

212-8243 or at BPY’s website at http://bpy.brookfield.com, and may

obtain free copies of the above-referenced and other documents

filed with the SEC by GGP, when available, by contacting GGP

Investor Relations at (312) 960-5000 or at GGP’s website at

http://www.ggp.com.

Non-solicitation

This communication shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the U.S.

Securities Act of 1933, as amended.

Participants in Solicitation

BPY, GGP and their respective directors and executive officers

and other persons may be deemed to be participants in the

solicitation of proxies from GGP stockholders in respect of the

proposed transaction that is described in the BPY prospectus and

the GGP proxy statement/prospectus. Information regarding the

persons who may, under the rules of the SEC, be deemed participants

in the solicitation of proxies from GGP stockholders in connection

with the proposed transaction, including a description of their

direct or indirect interests, by security holdings or otherwise, is

set forth in the BPY prospectus and the GGP proxy

statement/prospectus. You may also obtain the documents that BPY

and GGP file electronically free of charge from the SEC’s website

at http://www.sec.gov. Information regarding BPY’s directors and

executive officers is contained in BPY’s 2017 Annual Report on

Form 20-F filed with the SEC on March 9, 2018.

Information regarding GGP’s directors and executive officers is

contained in GGP’s 2017 Annual Report on Form 10-K filed with

the SEC on February 22, 2018 and its 2018 Annual Proxy

Statement on Schedule 14A filed with the SEC on

April 27, 2018.

Forward-Looking Statements

This communication contains “forward-looking information” within

the meaning of Canadian provincial securities laws and applicable

regulations and “forward-looking statements” within the meaning of

“safe harbor” provisions of applicable U.S. securities laws,

including the United States Private Securities Litigation Reform

Act of 1995. Forward-looking statements include statements that are

predictive in nature or depend upon or refer to future events or

conditions, include statements regarding the expected timing,

completion and effects of the proposed transaction, our operations,

business, financial condition, expected financial results,

performance, prospects, opportunities, priorities, targets, goals,

ongoing objectives, strategies and outlook, as well as the outlook

for North American and international economies for the current

fiscal year and subsequent periods, and include words such as

“expects,” “anticipates,” “plans,” “believes,” “estimates,”

“seeks,” “intends,” “targets,” “projects,” “forecasts,” “likely,”

or negative versions thereof and other similar expressions, or

future or conditional verbs such as “may,” “will,” “should,”

“would” and “could.”

Although we believe that our anticipated future results,

performance or achievements expressed or implied by the

forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on forward-looking statements and information

because they involve known and unknown risks, uncertainties and

other factors, many of which are beyond our control, which may

cause our actual results, performance or achievements to differ

materially from anticipated future results, performance or

achievement expressed or implied by such forward-looking statements

and information.

Factors that could cause actual results to differ materially

from those contemplated or implied by forward-looking statements

include, but are not limited to: the occurrence of any event,

change or other circumstance that could affect the proposed

transaction on the anticipated terms and timing, including the risk

that the proposed transaction may not be consummated; risks related

to BPY’s ability to integrate GGP’s business into its own and the

ability of the combined company to attain expected benefits

therefrom; risks incidental to the ownership and operation of real

estate properties including local real estate conditions; the

impact or unanticipated impact of general economic, political and

market factors in the countries in which we do business; the

ability to enter into new leases or renew leases on favorable

terms; business competition; dependence on tenants’ financial

condition; the use of debt to finance our business; the behavior of

financial markets, including fluctuations in interest and foreign

exchange rates; uncertainties of real estate development or

redevelopment; global equity and capital markets and the

availability of equity and debt financing and refinancing within

these markets; risks relating to our insurance coverage; the

possible impact of international conflicts and other developments

including terrorist acts; potential environmental liabilities;

changes in tax laws and other tax related risks; dependence on

management personnel; illiquidity of investments; the ability to

complete and effectively integrate other acquisitions into existing

operations and the ability to attain expected benefits therefrom;

operational and reputational risks; catastrophic events, such as

earthquakes and hurricanes; and other risks and factors detailed

from time to time in our documents filed with the securities

regulators in Canada and the United States.

We caution that the foregoing list of important factors that may

affect future results is not exhaustive. When relying on our

forward-looking statements or information, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Except as required by law, we

undertake no obligation to publicly update or revise any

forward-looking statements or information, whether written or oral,

that may be as a result of new information, future events or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180717005456/en/

GGP Inc. Contact:Kevin Berry, 312-960-5529 (O)EVP Human

Resources & CommunicationsM: (708)

308-5999kevin.berry@ggp.comorBrookfield Contact:Matthew

Cherry, 212-417-7488 (O)SVP, Investor Relations &

CommunicationsM: (917) 209-7343matthew.cherry@brookfield.com

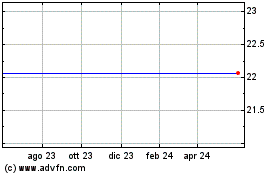

Grafico Azioni GGP Inc. (NYSE:GGP)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni GGP Inc. (NYSE:GGP)

Storico

Da Dic 2023 a Dic 2024