0000773141false00007731412024-03-052024-03-050000773141us-gaap:CommonStockMember2024-03-052024-03-050000773141mdc:SeniorNotesSixPercentDueJanuary2043Member2024-03-052024-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

_________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): March 5, 2024

M.D.C. Holdings, Inc. | | | | | | | | |

| (Exact name of registrant as specified in its charter) | |

| | | | | | | | |

| Delaware | 1-8951 | 84-0622967 |

(State or other

jurisdiction of

incorporation) | (Commission file number) | (I.R.S. employer

identification no.) |

4350 South Monaco Street, Suite 500, Denver, Colorado 80237 | | | | | | | | |

| (Address of principal executive offices) (Zip code) | |

Registrant’s telephone number, including area code: (303) 773-1100

Not Applicable | | | | | | | | |

| (Former name or former address, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $.01 par value | | MDC | | New York Stock Exchange |

| 6% Senior Notes due January 2043 | | MDC 43 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Effective March 5, 2024, HomeAmerican Mortgage Corporation ("HomeAmerican"), a wholly-owned subsidiary of M.D.C. Holdings, Inc. ("MDC"), entered into a Waiver and Consent with U.S. Bank National Association, as Agent under HomeAmerican’s Amended and Restated Master Repurchase Agreement dated as of September 16, 2016, as amended (the "Repurchase Agreement"). Under the terms of Waiver and Consent, the Agent waived any events of default under the Repurchase Agreement arising with respect to the change of control occurring as a result of Sekisui House, Ltd. entering into a contract or arrangement which upon consummation will result in its acquisition of or control over equity interests of MDC representing 20% or more of the combined voting power of all MDC equity interests (the "Transaction"). The Agent also consented and agreed to the consummation of the Transaction as well as any reconstitution of MDC's board of directors that might result from the Transaction.

A copy of the Waiver and Consent is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 10.1 | | Waiver and Consent, dated as of March 5, 2024, between HomeAmerican Mortgage Corporation, as Seller, and U.S. Bank National Association, as Agent and Buyer, under the Amended and Restated Master Repurchase Agreement, dated as of September 16, 2016, as amended. |

| | |

| 104 | | Cover Page Interactive Data file (formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

_________________________________

| | | | | | | | | | | | | | |

| | M.D.C. HOLDINGS, INC. | |

| | | | |

| Dated: | March 8, 2024 | By: | /s/ Joseph H. Fretz | |

| | | Joseph H. Fretz | |

| | | Vice President, Secretary and Corporate Counsel | |

WAIVER AND CONSENT

THIS WAIVER AND CONSENT (this “Waiver and Consent”), dated as of March 5, 2024, is made and entered into by and between HomeAmerican Mortgage Corporation, a Colorado corporation (the “Seller”), U.S. Bank National Association, as Agent and representative of itself as a Buyer and the other Buyers (the “Agent” and sometimes “U.S. Bank”), and the other Buyers.

RECITALS:

A.The Seller and the Agent are parties to an Amended and Restated Master Repurchase Agreement dated as of September 16, 2016 (as further amended, restated or otherwise modified from time to time, the “Repurchase Agreement”).

B.The Seller and the Agent now desire to waive an event of default and consent to certain related events under the Repurchase Agreement as set forth herein.

WAIVER:

In consideration of the promises herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

Section 1.Waiver.

1.1.Existing Events of Default. A Change of Control (as defined in the Repurchase Agreement) occurred as a result of Sekisui House, Ltd. entering into a contract or arrangement which upon consummation will result in its acquisition of or control over equity interests of Parent representing 20% or more of the combined voting power of all equity interests of Parent entitled to vote in the election of directors (the “Transaction”). Such a Change of Control constitutes an Event of Default under Section 18.1(g) of the Repurchase Agreement (the “Existing Events of Default”).

1.2.Waiver of Existing Events of Default. Upon the effectiveness of this Waiver pursuant to the terms hereof, the Agent hereby waives the Existing Events of Default and any rights of the Agent and the Buyers arising with respect to such Event of Default (the “Waiver”). The Waiver is limited to the express terms hereof, and nothing herein shall be deemed a consent or waiver by the Agent with respect to any other term, condition, representation, or covenant applicable to the Seller under the Repurchase Agreement or any of the other Repurchase Documents executed and delivered in connection therewith, or of the covenants described therein. The waiver set forth herein shall not be deemed to be a course of action upon which the Seller may rely in the future.

1.3.Effect of Waiver. The waiver set forth in Section 1.2 hereof is limited to the express terms thereof, and nothing herein shall be deemed a waiver by the Agent with respect to any other term, condition, representation, or covenant applicable to the Seller or their Subsidiaries under the Repurchase Agreement or any of the other agreements, documents, or instruments executed and delivered in connection therewith, or of the covenants described therein. The waiver set forth herein shall not be deemed to be a course of action upon which the Seller or any of their Subsidiaries may rely in the future, and the Agent hereby expressly waives any claim to such effect. The Agent reserves the right to exercise any rights and remedies available to it in connection with any present or future Events of Default with respect to the Repurchase Agreement or any other provision of any Loan Document that do not relate to or result from the Existing Events of Default.

Section 2.Consent.

2.1.Consent to the Consummation of the Transaction and the Reconstitution of Board of Directors. Notwithstanding anything to the contrary in the Repurchase Agreement, upon the effectiveness of this Waiver and Consent pursuant to Section 3 hereof, the Agent hereby (a) consents and agrees to the consummation of the Transaction and the acquisition of or control over equity interests of Parent representing 20% or more of the combined voting power of all equity interests of Parent entitled to vote in the election of directors as well as any reconstitution of the Parent’s Board of Directors that may result from the Transaction and (b) acknowledges that such events shall not constitute an Event of Default under the Repurchase Documents.

2.2.Scope of Consent. The consent set forth in Section 2.1 hereof is limited to the express terms thereof, and nothing herein shall be deemed a consent or waiver by the Agent with respect to any other term, condition, representation, or covenant applicable to the Seller under the Repurchase Agreement or any of the other agreements, documents, or instruments executed and delivered in connection therewith, or of the covenants described therein. The consent set forth herein shall not be deemed to be a course of action upon which the Seller or any of its Subsidiaries may rely in the future, and the Seller hereby expressly waives any claim to such effect.

Section 3.Conditions Precedent and Effectiveness. This Waiver and Consent shall be effective as of the date first above written, upon the delivery to the Agent of this Waiver and Consent duly executed by the Seller in a quantity sufficient that the Agent and the Seller may each have a fully executed original of each such document.

Section 4.Miscellaneous.

4.1.Delivery of Documents. The Seller hereby agrees to deliver to Agent, any documents, certificates or information related to the Transaction as the Agent may, from time to time, reasonably request, including without limitation a Beneficial Ownership Certification, such other information and documentation reasonably requested by the Agent for purposes of compliance with applicable “know your customer” requirements under the PATRIOT Act or other applicable anti-money laundering laws.

4.2.Ratifications. The terms and provisions of this Waiver and Consent shall modify and supersede all inconsistent terms and provisions of the Repurchase Agreement and the other Repurchase Documents, and, except as expressly modified and superseded by this Waiver and Consent, the terms and provisions of the Repurchase Agreement and each other Repurchase Document are ratified and confirmed and shall continue in full force and effect.

4.3.Seller Representations and Warranties. The Seller hereby represents and warrants that (a) the representations and warranties made by the Seller in Article 15 of the Repurchase Agreement and in the other Repurchase Documents are true and correct in all material respects with the same force and effect on and as of the date hereof as though made as of the date hereof, (b) after giving effect to this Waiver and Consent, no Default or Event of Default has occurred and is continuing, and (c) the Seller is not aware of any action or causes of action, suits, claims, demands, judgments, damages, levies, and executions with respect to the Repurchase Documents, the administration of the Repurchase Documents, the negotiations relating to this Agreement and the other Repurchase Documents executed in connection with this Agreement and any other instruments and agreements executed by the Seller in connection with the Repurchase Documents or this Agreement, in each case, which exist as of the date hereof .

4.4.Survival. The representations and warranties made by the Seller in this Waiver and Consent shall survive the execution and delivery of this Waiver and Consent.

4.5.Reference to Repurchase Agreement. Each of the Repurchase Documents, including the Repurchase Agreement and any and all other agreements, documents, or instruments now or hereafter executed and delivered pursuant to the terms hereof or pursuant to the terms of the Repurchase Agreement as amended hereby, is hereby amended so that any reference in such Repurchase Document to the Repurchase Agreement refers to the Repurchase Agreement as amended and modified hereby.

4.6.Applicable Law. This Waiver and Consent shall be governed by and construed in accordance with the laws of the State of Minnesota.

4.7.Successors and Assigns. This Waiver and Consent is binding upon and shall inure to the benefit of the Agent, the Seller, and their respective successors and assigns, except that the Seller may not assign or transfer any of its rights or obligations hereunder without the prior written consent of the Agent.

4.8.Counterparts. This Waiver and Consent may be executed in one or more counterparts, each of which when so executed shall be deemed to be an original, but all of which when taken together shall constitute one and the same instrument.

4.9.Headings. The headings, captions, and arrangements used in this Waiver and Consent are for convenience only and shall not affect the interpretation of this Waiver and Consent.

4.10.ENTIRE AGREEMENT. THIS WAIVER AND CONSENT AND THE OTHER REPURCHASE DOCUMENTS REPRESENT THE FINAL AGREEMENT AMONG THE PARTIES HERETO AND THERETO WITH RESPECT TO THE SUBJECT MATTER HEREOF AND THEREOF AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES HERETO OR THERETO.

[REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF the parties have caused this Waiver and Consent to be executed as of the date first written above.

SELLER:

HOMEAMERICAN MORTGAGE CORPORATION,

as Seller

By: /s/ Clare Wilson

Name: Clare Wilson

Title: Vice President, Treasurer

AGENT:

U.S. BANK NATIONAL ASSOCIATION,

as Agent

By: /s/ Rodney S. Davis

Name: Rodney S. Davis

Title: Senior Vice President

[Signature Page to Waiver and Consent to Master Repurchase Agreement]

Cover

|

Mar. 05, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 05, 2024

|

| Entity Registrant Name |

M.D.C. Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-8951

|

| Entity Tax Identification Number |

84-0622967

|

| Entity Address, Address Line One |

4350 South Monaco Street

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80237

|

| City Area Code |

303

|

| Local Phone Number |

773-1100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000773141

|

| Amendment Flag |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

MDC

|

| Security Exchange Name |

NYSE

|

| Senior Notes, 6%, Due January 2043 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6% Senior Notes due January 2043

|

| Trading Symbol |

MDC 43

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdc_SeniorNotesSixPercentDueJanuary2043Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

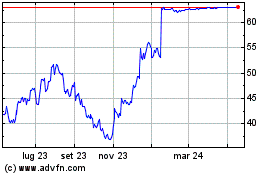

Grafico Azioni M D C (NYSE:MDC)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni M D C (NYSE:MDC)

Storico

Da Dic 2023 a Dic 2024