Martin Marietta Completes Acquisition of Albert Frei & Sons, Inc.

16 Gennaio 2024 - 12:57PM

Martin Marietta Materials, Inc. (NYSE: MLM) (“Martin Marietta” or

the “Company”) today announced that it completed the acquisition of

Albert Frei & Sons, Inc. (“AFS”), a leading aggregates producer

in Colorado. The transaction, which closed on January 12, 2024,

provides more than 60 years of high-quality, hard rock reserves to

better serve new and existing customers.

Ward Nye, Chairman, President and CEO of Martin Marietta stated,

“We are delighted to announce the acquisition of AFS and welcome

such a talented team to our company. The acquisition, wholly

consistent with our strategic plan, enhances our aggregates

platform in the high-growth, Denver metropolitan area and

strengthens our ability to deliver significant value for

shareholders and customers. We expect this transaction to be

immediately accretive to earnings, margins and cash flow as we

redeploy proceeds from prior divestitures.”

About Martin Marietta

Martin Marietta, a member of the S&P 500 Index, is an

American-based company and a leading supplier of building

materials, including aggregates, cement, ready mixed concrete and

asphalt. Through a network of operations spanning 28 states, Canada

and The Bahamas, dedicated Martin Marietta teams supply the

resources for building the solid foundations on which our

communities thrive. Martin Marietta’s Magnesia Specialties business

produces high-purity magnesia and dolomitic lime products used

worldwide in environmental, industrial, agricultural and specialty

applications. For more information, visit www.martinmarietta.com or

www.magnesiaspecialties.com.

Investor Contact: Jacklyn

RookerDirector, Investor Relations (919)

510-4736Jacklyn.Rooker@martinmarietta.com

MLM-G

This release contains statements which

constitute forward-looking statements within the meaning of federal

securities law. Statements and assumptions on future revenues,

income and cash flows, performance, economic trends, the outcome of

litigation, regulatory compliance and environmental remediation

cost estimates are examples of forward-looking statements. Numerous

factors could affect the Company’s forward-looking statements and

actual performance.

Investors are cautioned that all forward-looking

statements involve risks and uncertainties, and are based on

assumptions that the Company believes in good faith are reasonable

at the time the statements are made, but which may be materially

different from actual results. Investors can identify these

statements by the fact that they do not relate only to historic or

current facts. The words “may”, “will”, “could”, “should”,

“anticipate”, “believe”, “estimate”, “expect”, “forecast”,

“intend”, “outlook”, “plan”, “project”, “scheduled” and other words

of similar meaning in connection with future events or future

operating or financial performance are intended to identify

forward-looking statements. Any or all of Martin Marietta’s

forward-looking statements in this release and in other

publications may turn out to be wrong.

You should consider these forward-looking

statements in light of risk factors discussed in Martin Marietta’s

Annual Report on Form 10-K for the year ended December 31, 2022,

Martin Marietta’s Quarterly Reports on Form 10-Q for the quarters

ended March 31, 2023, June 30, 2023, and September 30, 2023, and

other periodic filings made with the SEC. All of the Company’s

forward-looking statements should be considered in light of these

factors. In addition, other risks and uncertainties not presently

known to the Company or that it considers immaterial could affect

the accuracy of its forward-looking statements, or adversely affect

or be material to the Company. Except as required by law, the

Company undertakes no obligation to update any forward-looking

statements in order to reflect any event or circumstance that may

arise after the date of this release.

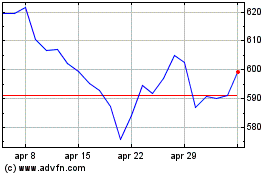

Grafico Azioni Martin Marietta Materials (NYSE:MLM)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Martin Marietta Materials (NYSE:MLM)

Storico

Da Dic 2023 a Dic 2024