Favorable tailwinds persist and drive third

consecutive raise to FY24 guidance

Maximus (NYSE: MMS), a leading provider of government services

worldwide, reported financial results for the three and nine months

ending June 30, 2024.

Highlights for the third quarter of fiscal year 2024

include:

- Revenue increased 10.6% to $1.31 billion, compared to $1.19

billion for the prior year period. All three segments contributed

to organic growth of 11.2%, with the U.S. Federal Services Segment

being the primary driver.

- Diluted earnings per share were $1.46 and adjusted diluted

earnings per share were $1.74, compared to $0.50 and $0.78,

respectively, for the prior year period.

- Guidance is increasing again for fiscal year 2024. At the

midpoints, revenue is increasing by $100 million, adjusted

operating income guidance is increasing by $30 million, adjusted

diluted earnings per share by $0.35, and free cash flow by $15

million.

- Net debt to EBITDA ratio improved to 1.5 times at June 30,

2024, compared to 1.7 times in the prior quarter.

- A quarterly cash dividend of $0.30 per share is payable on

August 31, 2024, to shareholders of record on August 15, 2024.

"Our third quarter demonstrates our ability to capitalize on

favorable tailwinds that have persisted across this year, where we

accomplished high quality and efficient delivery, at scale," said

Bruce Caswell, President and Chief Executive Officer. "I want to

acknowledge and thank all our teams for their respective roles in

delivering exceptional performance this quarter, enabling us to

solidly beat expectations and continue the momentum of the business

this year."

Third Quarter Results

Revenue for the third quarter of fiscal year 2024 increased

10.6% to $1.31 billion, compared to $1.19 billion for the prior

year period. All three segments contributed to consolidated organic

growth of 11.2%, with the primary driver being volume growth on

clinical programs in the U.S. Federal Services Segment.

For the third quarter of fiscal year 2024, operating margin was

10.8% and the adjusted operating margin was 12.6%. This compares to

margins of 4.9% and 6.9%, respectively, for the prior year period.

Diluted earnings per share were $1.46 and adjusted diluted earnings

per share were $1.74. This compares to $0.50 and $0.78,

respectively, for the prior year period which included a $0.26

impact from the previously disclosed cybersecurity incident.

Exceptional performance within environments of strong demand across

both domestic segments led to higher-than-anticipated earnings this

quarter.

U.S. Federal Services Segment

U.S. Federal Services Segment revenue for the third quarter of

fiscal year 2024 increased 17.0% to $683.3 million, compared to

$584.0 million reported for the prior year period. All growth was

organic and driven primarily by volume growth on clinical

programs.

The segment operating margin for the third quarter of fiscal

year 2024 was 15.5%, compared to 12.7% reported for the prior year

period. This quarter's margin reflects excellent operational

execution combined with high demand for services, particularly in

clinical services, and a temporarily favorable mix of lower

cost-plus revenue and higher performance-based revenue. The

full-year fiscal 2024 margin for the U.S. Federal Services Segment

is now expected to be approximately 12.5%.

U.S. Services Segment

U.S. Services Segment revenue for the third quarter of fiscal

year 2024 increased 5.2% to $472.3 million, compared to $449.1

million reported in the prior year period. All growth was organic

and enabled by strong performance across the Medicaid-related

portfolio, a portion of which were excess volumes from the

unwinding exercise which is now completed.

The segment operating margin for the third quarter of fiscal

year 2024 was 13.0%, compared to 10.5% reported for the prior year.

This quarter's margin benefited from the strong Medicaid-related

performance and the aforementioned excess volumes. The full-year

fiscal 2024 margin for the U.S. Services Segment is anticipated to

be approximately 13%.

Outside the U.S. Segment

Outside the U.S. Segment revenue for the third quarter of fiscal

year 2024 increased 2.3% to $159.3 million, compared to $155.7

million reported in the prior year period. Organic growth was 6.8%

and driven primarily by strong operations in the United Kingdom,

with the effect of divested businesses partially offsetting the

growth.

The segment realized an operating loss of $1.4 million for the

third quarter of fiscal year 2024, compared to a loss of $15.2

million in the prior year period. This quarter's loss was

contemplated in the full-year outlook for the segment, which

remains slightly above breakeven. A smaller footprint and improved

profitability are expected once segment-shaping efforts are

complete, which remain a priority for this fiscal year.

Sales and Pipeline

Year-to-date signed contract awards at June 30, 2024, totaled

$1.25 billion, and contracts pending (awarded but unsigned) totaled

$398 million. The book-to-bill ratio at June 30, 2024, was 0.6x

calculated on a trailing twelve-month basis.

The sales pipeline at June 30, 2024, totaled $44.1 billion,

comprised of approximately $2.93 billion in proposals pending,

$7.33 billion in proposals in preparation, and $33.8 billion in

opportunities tracking. This quarter's large increase to the

pipeline is attributable to capturing the Contact Center Operations

(CCO) early recompete and the Veterans Affairs Medical Disability

Examination contracts recompete stemming from higher volumes on the

program. New work opportunities represent approximately 55% of the

total sales pipeline.

Balance Sheet and Cash Flows

At June 30, 2024, cash and cash equivalents totaled $103

million, and gross debt was $1.16 billion. The ratio of debt, net

of allowed cash, to EBITDA for the quarter ended June 30, 2024, as

calculated in accordance with our credit agreement, was 1.5x. This

compares to 1.7x at March 31, 2024.

For the third quarter of fiscal year 2024, cash provided by

operating activities totaled $199 million, and free cash flow was

$165 million. DSO at June 30, 2024, were 59 days, compared with 62

days at March 31, 2024.

During the third quarter of fiscal year 2024, we purchased

approximately 611,000 shares, totaling $50.6 million, which is an

average price of $82.79 per share. Subsequent to June 30, 2024, we

purchased an additional 250,000 shares, totaling $21.2 million, at

an average price of $84.78 per share. In June 2024, the Board of

Directors authorized an expansion to the purchase program for

Maximus common stock of up to an aggregate of $200 million.

On July 5, 2024, our Board of Directors declared a quarterly

cash dividend of $0.30 for each share of our common stock

outstanding. The dividend is payable on August 31, 2024, to

shareholders of record on August 15, 2024.

Further Raise to FY24 Guidance

Maximus is further raising fiscal year 2024 guidance following

its third quarter results. Revenue is now expected to range between

$5.25 billion and $5.35 billion, representing an increase of $100

million from the midpoint of prior guidance.

Adjusted operating income is now expected to range between $570

million and $590 million, representing an increase of $30 million

from the midpoint of prior guidance. Adjusted operating income

excludes an estimated $90 million of expense for amortization of

intangible assets and $1 million of divestiture-related

charges.

Adjusted diluted earnings per share is now expected to range

between $6.00 and $6.20 per share, representing an increase of

$0.35 per share from the midpoint of prior guidance.

Free cash flow is now expected to range between $350 million and

$380 million as a result of the increased earnings guidance and

partially offset by higher capital expenditures for the remainder

of the year. Interest expense is estimated to be $80 million for

fiscal year 2024.

Conference Call and Webcast Information

Maximus will host a conference call tomorrow, August 8, 2024, at

9:00 a.m. ET. Shareholders are invited to submit questions for

management’s consideration by emailing IR@maximus.com up to one

hour prior to the call.

The call is open to the public and available by webcast or by

phone at:

877.407.8289 (Domestic) / +1.201.689.8341 (International)

For those unable to listen to the live call, a recording of the

webcast will be available on investor.maximus.com.

About Maximus

As a leading strategic partner to governments across the globe,

Maximus helps improve the delivery of public services amid complex

technology, health, economic, environmental, and social challenges.

With a deep understanding of program service delivery, acute

insights that achieve operational excellence, and an extensive

awareness of the needs of the people being served, our employees

advance the critical missions of our partners. Maximus delivers

innovative business process management, impactful consulting

services, and technology solutions that provide improved outcomes

for the public and higher levels of productivity and efficiency of

government-sponsored programs. For more information, visit

maximus.com.

Non-GAAP Measures and Forward-Looking Statements

This release contains non-GAAP measures and other indicators,

including organic growth, free cash flow, operating income and EPS

adjusted for amortization of intangible assets and

divestiture-related charges, adjusted EBITDA, and other non-GAAP

measures. A description of these non-GAAP measures and details as

to how they are calculated are included with our earnings

presentation and forthcoming Form 10-Q.

The presentation of these non-GAAP numbers is not meant to be

considered in isolation, nor as alternatives to cash flows from

operations, revenue growth, operating income, or net income as

measures of performance. These non-GAAP financial measures, as

determined and presented by us, may not be comparable to related or

similarly titled measures presented by other companies.

Statements that are not historical facts, including statements

about our confidence and strategies, and our expectations about

revenues, results of operations, profitability, future contracts,

market opportunities, market demand, or acceptance of our products

are forward-looking statements that involve risks and

uncertainties.

These risks could cause our actual results to differ materially

from those indicated by such forward-looking statements. A Special

Note Regarding Forward-Looking Statements is included within our

forthcoming Form 10-Q and a summary of risk factors can be found in

Item 1A, "Risk Factors" in our Annual Report on Form 10-K for the

year ended September 30, 2023, which was filed with the Securities

and Exchange Commission (SEC) on November 16, 2023. Our SEC reports

are accessible on maximus.com.

Maximus, Inc.

Consolidated Statements of

Operations

(Unaudited)

For the Three Months Ended

For the Nine Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

(in thousands, except per share

amounts)

Revenue

$

1,314,929

$

1,188,677

$

3,990,327

$

3,644,775

Cost of revenue

982,615

924,313

3,040,370

2,907,061

Gross profit

332,314

264,364

949,957

737,714

Selling, general, and administrative

expenses

167,033

182,545

504,682

471,445

Amortization of intangible assets

23,542

23,431

68,532

70,599

Operating income

141,739

58,388

376,743

195,670

Interest expense

20,555

21,026

62,428

63,631

Other expense/(income), net

809

1,005

475

(79

)

Income before income taxes

120,375

36,357

313,840

132,118

Provision for income taxes

30,623

5,494

79,430

29,472

Net income

$

89,752

$

30,863

$

234,410

$

102,646

Earnings per share:

Basic

$

1.47

$

0.50

$

3.83

$

1.68

Diluted

$

1.46

$

0.50

$

3.81

$

1.67

Weighted average shares outstanding:

Basic

61,079

61,141

61,233

61,125

Diluted

61,381

61,544

61,495

61,368

Dividends declared per share

$

0.30

$

0.28

$

0.90

$

0.84

Maximus, Inc.

Consolidated Balance

Sheets

June 30, 2024

September 30, 2023

(unaudited)

(in thousands)

Assets:

Cash and cash equivalents

$

102,794

$

65,405

Accounts receivable, net

850,462

826,873

Income taxes receivable

9,464

16,556

Prepaid expenses and other current

assets

115,571

146,632

Total current assets

1,078,291

1,055,466

Property and equipment, net

35,020

38,831

Capitalized software, net

169,449

107,811

Operating lease right-of-use assets

138,817

163,929

Goodwill

1,780,299

1,779,215

Intangible assets, net

653,386

703,648

Deferred contract costs, net

53,899

45,372

Deferred compensation plan assets

52,895

42,919

Deferred income taxes

5,911

2,459

Other assets

31,823

46,147

Total assets

$

3,999,790

$

3,985,797

Liabilities and Shareholders' Equity:

Liabilities:

Accounts payable and accrued

liabilities

$

280,836

$

282,081

Accrued compensation and benefits

162,318

194,251

Deferred revenue, current portion

82,065

60,477

Income taxes payable

11,146

451

Long-term debt, current portion

39,952

86,844

Operating lease liabilities, current

portion

47,992

49,852

Other current liabilities

55,734

49,058

Total current liabilities

680,043

723,014

Deferred revenue, non-current portion

35,269

38,849

Deferred income taxes

200,814

203,898

Long-term debt, non-current portion

1,100,701

1,163,149

Deferred compensation plan liabilities,

non-current portion

55,870

46,432

Operating lease liabilities, non-current

portion

101,911

129,367

Other liabilities

6,467

13,253

Total liabilities

2,181,075

2,317,962

Shareholders' equity:

Common stock, no par value; 100,000 shares

authorized; 60,427 and 60,998 shares issued and outstanding as of

June 30, 2024, and September 30, 2023, respectively

604,287

577,898

Accumulated other comprehensive loss

(30,934

)

(27,615

)

Retained earnings

1,245,362

1,117,552

Total shareholders' equity

1,818,715

1,667,835

Total liabilities and shareholders'

equity

$

3,999,790

$

3,985,797

Maximus, Inc.

Consolidated Statements of

Cash Flows

(Unaudited)

For the Three Months Ended

For the Nine Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

(in thousands)

Cash flows from operating activities:

Net income

$

89,752

$

30,863

$

234,410

$

102,646

Adjustments to reconcile net income to

cash flows from operations:

Depreciation and amortization of property,

equipment, and capitalized software

7,530

10,771

24,146

37,092

Amortization of intangible assets

23,542

23,431

68,532

70,599

Amortization of debt issuance costs and

debt discount

1,697

601

2,899

2,236

Deferred income taxes

4,545

3,743

(3,770

)

2,375

Stock compensation expense

9,481

8,296

27,605

22,239

Loss on sale of businesses

—

—

1,018

883

Change in assets and liabilities, net of

effects of business combinations:

Accounts receivable

65,857

(54,854

)

(26,528

)

7,675

Prepaid expenses and other current

assets

(616

)

7,689

19,316

21,101

Deferred contract costs

(4,777

)

1,662

(8,377

)

2,245

Accounts payable and accrued

liabilities

4,642

23,276

(1,659

)

16,915

Accrued compensation and benefits

(10,487

)

(17,390

)

(21,043

)

(31,612

)

Deferred revenue

7,374

(13,400

)

18,079

(31,747

)

Income taxes

(2,734

)

(26,608

)

10,576

(33,186

)

Operating lease right-of-use assets and

liabilities

(1,746

)

(1,670

)

(2,131

)

(3,742

)

Other assets and liabilities

5,268

(1,696

)

8,351

(15,968

)

Net cash provided by/(used in) operating

activities

199,328

(5,286

)

351,424

169,751

Cash flows from investing activities:

Purchases of property and equipment and

capitalized software

(34,690

)

(25,112

)

(82,237

)

(58,863

)

Asset acquisition

—

—

(18,006

)

—

Proceeds from divestitures

—

—

3,078

9,124

Net cash used in investing activities

(34,690

)

(25,112

)

(97,165

)

(49,739

)

Cash flows from financing activities:

Cash dividends paid to Maximus

shareholders

(18,239

)

(17,020

)

(54,847

)

(51,053

)

Purchases of Maximus common stock

(47,275

)

—

(47,275

)

—

Tax withholding related to RSU vesting

—

—

(13,455

)

(8,475

)

Payments for contingent consideration

(2,809

)

(2,621

)

(10,977

)

(6,662

)

Payments for debt financing costs

(9,724

)

—

(9,724

)

—

Proceeds from borrowings

426,757

220,000

850,166

682,398

Principal payments for debt

(488,038

)

(200,054

)

(952,825

)

(730,514

)

Cash-collateralized escrow liabilities

3,996

2,517

9,118

(54,543

)

Net cash provided by/(used in) financing

activities

(135,332

)

2,822

(229,819

)

(168,849

)

Effect of exchange rate changes on cash,

cash equivalents, and restricted cash

155

549

1,270

3,735

Net change in cash, cash equivalents, and

restricted cash

29,461

(27,027

)

25,710

(45,102

)

Cash, cash equivalents, and restricted

cash, beginning of period

118,340

118,720

122,091

136,795

Cash, cash equivalents, and restricted

cash, end of period

$

147,801

$

91,693

$

147,801

$

91,693

Maximus, Inc.

Consolidated Results of

Operations by Segment

(Unaudited)

For the Three Months Ended

For the Nine Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Amount

% (1)

Amount

% (1)

Amount

% (1)

Amount

% (1)

(dollars in thousands)

Revenue:

U.S. Federal Services

$

683,347

$

583,960

$

2,062,127

$

1,786,202

U.S. Services

472,298

449,061

1,448,258

1,338,242

Outside the U.S.

159,284

155,656

479,942

520,331

Revenue

$

1,314,929

$

1,188,677

$

3,990,327

$

3,644,775

Gross

profit:

U.S. Federal Services

$

186,075

27.2

%

$

156,945

26.9

%

$

506,074

24.5

%

$

402,513

22.5

%

U.S. Services

121,012

25.6

%

98,538

21.9

%

369,497

25.5

%

268,152

20.0

%

Outside the U.S.

25,227

15.8

%

8,881

5.7

%

74,386

15.5

%

67,049

12.9

%

Gross profit

$

332,314

25.3

%

$

264,364

22.2

%

$

949,957

23.8

%

$

737,714

20.2

%

Selling, general,

and administrative expenses:

U.S. Federal Services

$

79,949

11.7

%

$

82,892

14.2

%

$

247,671

12.0

%

$

229,591

12.9

%

U.S. Services

59,531

12.6

%

51,536

11.5

%

174,032

12.0

%

140,793

10.5

%

Outside the U.S.

26,647

16.7

%

24,122

15.5

%

75,249

15.7

%

75,936

14.6

%

Divestiture-related charges (2)

—

NM

—

NM

1,018

NM

883

NM

Other (3)

906

NM

23,995

NM

6,712

NM

24,242

NM

Selling, general, and administrative

expenses

$

167,033

12.7

%

$

182,545

15.4

%

$

504,682

12.6

%

$

471,445

12.9

%

Operating

income/(loss):

U.S. Federal Services

$

106,126

15.5

%

$

74,053

12.7

%

$

258,403

12.5

%

$

172,922

9.7

%

U.S. Services

61,481

13.0

%

47,002

10.5

%

195,465

13.5

%

127,359

9.5

%

Outside the U.S.

(1,420

)

(0.9

)%

(15,241

)

(9.8

)%

(863

)

(0.2

)%

(8,887

)

(1.7

)%

Amortization of intangible assets

(23,542

)

NM

(23,431

)

NM

(68,532

)

NM

(70,599

)

NM

Divestiture-related charges (2)

—

NM

—

NM

(1,018

)

NM

(883

)

NM

Other (3)

(906

)

NM

(23,995

)

NM

(6,712

)

NM

(24,242

)

NM

Operating income

$

141,739

10.8

%

$

58,388

4.9

%

$

376,743

9.4

%

$

195,670

5.4

%

(1)

Percentage of respective segment revenue.

Percentages not considered meaningful are marked "NM."

(2)

We have sold businesses in both fiscal

years 2023 and 2024.

(3)

Other expenses includes credits and costs

that are not allocated to a particular segment. In the three and

nine months ended June 30, 2024, these charges include $0.3 million

and $3.3 million related to the costs of a previously disclosed

cybersecurity incident, respectively, compared to $22.1 million for

the three and nine months ended June 30, 2023. Other charges

include expenses incurred as part of our acquisitions, as well as

potential acquisitions that have not been or may not be

completed.

Maximus, Inc.

Consolidated Free Cash Flows -

Non-GAAP

(Unaudited)

For the Three Months Ended

For the Nine Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

(in thousands)

Net cash provided by/(used in) operating

activities

$

199,328

$

(5,286

)

$

351,424

$

169,751

Purchases of property and equipment and

capitalized software

(34,690

)

(25,112

)

(82,237

)

(58,863

)

Free cash flow (Non-GAAP)

$

164,638

$

(30,398

)

$

269,187

$

110,888

Maximus, Inc.

Non-GAAP Adjusted Results

Excluding Amortization of Intangible Assets and Divestiture-Related

Charges

(Unaudited)

For the Three Months Ended

For the Nine Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

(dollars in thousands, except per

share data)

Operating income

$

141,739

$

58,388

$

376,743

$

195,670

Add back: Amortization of intangible

assets

23,542

23,431

68,532

70,599

Add back: Divestiture-related charges

—

—

1,018

883

Adjusted operating income excluding

amortization of intangible assets and divestiture-related charges

(Non-GAAP)

$

165,281

$

81,819

$

446,293

$

267,152

Adjusted operating income margin excluding

amortization of intangible assets and divestiture-related charges

(Non-GAAP)

12.6

%

6.9

%

11.2

%

7.3

%

Net income

$

89,752

$

30,863

$

234,410

$

102,646

Add back: Amortization of intangible

assets, net of tax

17,350

17,276

50,508

52,082

Add back: Divestiture-related charges

—

—

1,018

883

Adjusted net income excluding amortization

of intangible assets and divestiture-related charges (Non-GAAP)

$

107,102

$

48,139

$

285,936

$

155,611

Diluted earnings per share

$

1.46

$

0.50

$

3.81

$

1.67

Add back: Effect of amortization of

intangible assets on diluted earnings per share

0.28

0.28

0.82

0.86

Add back: Effect of divestiture-related

charges on diluted earnings per share

—

—

0.02

0.01

Adjusted diluted earnings per share

excluding amortization of intangible assets and divestiture-related

charges (Non-GAAP)

$

1.74

$

0.78

$

4.65

$

2.54

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807786571/en/

James Francis, VP - IR Jessica Batt, VP - IR & ESG

IR@maximus.com

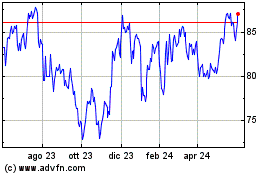

Grafico Azioni MAXIMUS (NYSE:MMS)

Storico

Da Nov 2024 a Dic 2024

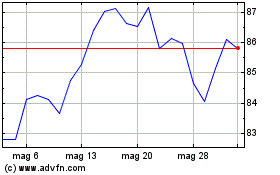

Grafico Azioni MAXIMUS (NYSE:MMS)

Storico

Da Dic 2023 a Dic 2024