Altria Announces Intent to Sell a Portion of its Investment in Anheuser-Busch InBev

13 Marzo 2024 - 9:15PM

Business Wire

Altria Group, Inc. (Altria) (NYSE: MO) today announced its

intent to sell a portion of its investment in Anheuser-Busch InBev

SA/NA (ABI) (NYSE: BUD) (Euronext: ABI) (MEXBOL: ANB) (JSE: ANH)

through a global secondary offering (offering) comprised of a

public offering of ABI ordinary shares represented by American

depositary shares (ADS) in the United States, a public offering of

ABI ordinary shares in the United States, a concurrent private

placement of ABI ordinary shares in the European Economic Area and

the United Kingdom and an offering of ABI ordinary shares,

including ABI ordinary shares represented by ADSs, in other

countries outside the United States. In addition, ABI has agreed to

repurchase $200 million of ordinary shares directly from Altria,

concurrently with, and conditional on, completion of the

offering.

Altria currently holds approximately 197 million shares of ABI,

representing approximately 10% ownership. Altria, as the selling

shareholder, is offering 35 million of ABI’s ordinary shares. In

connection with the offering, Altria expects to grant the

underwriters an option to purchase up to 5.25 million additional

ABI shares owned by Altria, exercisable within 30 days following

the pricing of the offering. In addition, we have agreed to a

180-day lockup with the lead underwriter for our remaining ABI

shares.

We expect to use the proceeds for additional share repurchases

of our common stock. Future share repurchases remain subject to the

discretion of our Board of Directors (Board).

“As good stewards of shareholder capital, we consistently review

options to unlock the value of our ABI investment, and we believe

this is an opportunistic transaction that realizes a portion of the

substantial return on our long-term investment,” said Billy

Gifford, Altria’s Chief Executive Officer. “Over the decades of our

ownership, the beer investment has provided significant income and

cash returns and supported our strong balance sheet. Our continued

investment reflects ongoing confidence in ABI’s long-term

strategies, premium global brands and experienced management

team.”

The offering and the partial sale of our investment in ABI have

been approved by our Board.

ABI has filed a registration statement (including a prospectus)

with the U.S. Securities and Exchange Commission (SEC) for the

offering to which this release relates. Before you invest, you

should read the prospectus in that registration statement and other

documents ABI has filed with the SEC, including the preliminary

prospectus supplement dated March 13, 2024, for more complete

information about ABI and this offering. You may get these

documents for free by visiting EDGAR on the SEC website at

www.sec.gov. Alternatively, any underwriter or any dealer

participating in the offering will arrange to send you the

prospectus and the prospectus supplement, when available, if you

request them by contacting: Morgan Stanley & Co. LLC, 180

Varick Street, 2nd Floor, New York, NY 10014, Attn: Prospectus

Department; or J.P. Morgan Securities LLC, c/o Broadridge Financial

Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by

telephone at 866-803-9204 or by email at

prospectus-eq_fi@jpmchase.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the securities described herein,

nor shall there be any offer or sale of these securities in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

Morgan Stanley is acting as the lead underwriter for the

proposed offering. J.P. Morgan is also acting as an active

underwriter for the proposed offering.

Forward-Looking and Cautionary Statements

This release contains certain forward-looking statements with

respect to the offering, which are subject to various risks and

uncertainties. These forward-looking statements relate to, among

other things, the anticipated completion of the offering and our

intended use of proceeds. Factors that may cause actual results to

differ include prevailing economic, market or business conditions

or changes in such conditions. Other risk factors are detailed from

time to time in our publicly filed reports, including our Annual

Report on Form 10-K for the year ended December 31, 2023. These

forward-looking statements speak only as of the date of this

release. We assume no obligations to provide any revisions to, or

update, any forward-looking statements contained in or implied by

this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240313927448/en/

Altria Client Services Investor Relations 804-484-8222

Altria Client Services Media Relations 804-484-8897

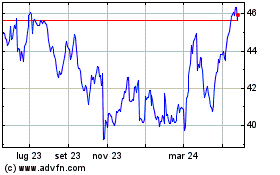

Grafico Azioni Altria (NYSE:MO)

Storico

Da Dic 2024 a Gen 2025

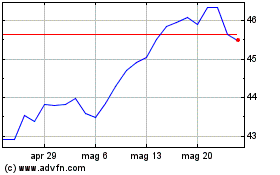

Grafico Azioni Altria (NYSE:MO)

Storico

Da Gen 2024 a Gen 2025