Altria Group, Inc. (Altria) (NYSE: MO) today announced that it

has agreed to sell 35 million shares of Anheuser-Busch InBev SA/NV

(ABI) (NYSE: BUD) (Euronext: ABI) (MEXBOL: ANB) (JSE: ANH) through

a global secondary offering (offering) comprised of a public

offering of ABI ordinary shares represented by American depositary

shares (ADS) in the United States, a public offering of ABI

ordinary shares in the United States, a concurrent private

placement of ABI ordinary shares in the European Economic Area and

the United Kingdom and an offering of ABI ordinary shares,

including ABI ordinary shares represented by ADSs, in other

countries outside the United States, at a price of $61.50 per ADS,

corresponding to €56.17 per ABI ordinary share. In addition, ABI

will repurchase $200 million of ordinary shares directly from

Altria, concurrently with, and conditional on, completion of the

offering. The aggregate amount of the offering and repurchase by

ABI is approximately $2.4 billion. Altria has also granted the

underwriters an option to purchase up to 5.25 million additional

ABI shares owned by Altria at the price per ADS paid by the

underwriters in the offering, exercisable within the next 30

days.

In connection with the pricing of the offering, we announce a

$2.4 billion increase to our existing $1 billion share repurchase

program. Our Board of Directors (Board) has authorized the expanded

program, which we expect to complete by December 31, 2024. Share

repurchases depend on marketplace conditions and other factors, and

the program remains subject to the discretion of our Board. As part

of the expanded share repurchase program, we expect to enter into

an estimated $2.4 billion accelerated share repurchase (ASR)

program. We expect cash savings from the elimination of future

dividend payments on the repurchased shares.

“These opportunistic capital allocation decisions reflect our

ongoing confidence in Altria’s future and the significant value

offered in our shares today,” said Billy Gifford, Altria’s Chief

Executive Officer. “We have a longstanding history of returning

cash to our shareholders, and today’s announcement reflects our

continued desire to create long-term shareholder value.”

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the securities described herein,

nor shall there be any offer or sale of these securities in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

Partial Sale of Our Investment in ABI

- Our remaining ownership of ABI after the offering and the share

repurchase by ABI will be approximately 8.1% (or approximately 7.8%

assuming full exercise of the underwriters’ option to purchase

additional shares). We estimate that we will own approximately 159

million shares of ABI (or approximately 154 million shares of ABI

assuming full exercise of the underwriters’ option to purchase

additional shares) following the offering and the share repurchase

by ABI.

- In conjunction with the offering, we have agreed to a 180-day

lockup with the lead underwriter for our remaining ABI shares.

- We expect to maintain two seats on ABI’s board of directors

through ABI’s 2025 annual general meeting. Following such meeting,

we expect to have one seat on ABI’s board of directors, in

accordance with our rights as a holder of restricted shares.

- Following the offering, we expect to continue to use the equity

method of accounting for our investment in ABI.

Financial Flexibility and Cash Returns to

Shareholders

- We expect cash savings from the elimination of future dividend

payments on the repurchased shares of our common stock. These cash

savings may be used for general corporate purposes including

investments in our Vision, debt repayment or further cash returns

to shareholders.

- We remain committed to our progressive dividend goal that

targets mid-single digits dividend per share growth annually

through 2028. Future dividend payments remain subject to the

discretion of our Board.

2024 Full-Year Guidance

We expect the combined transactions will be accretive to our

2024 full-year adjusted diluted earnings per share (EPS).

Therefore, we raise our guidance for 2024 full-year adjusted

diluted EPS to be in a range of $5.05 to $5.17, representing a

growth rate of 2% to 4.5% from a base of $4.95 in 2023, to reflect

our estimate for lower 2024 weighted-average shares outstanding,

partially offset by lower equity earnings related to the reduced

ownership of our investment in ABI. We expect 2024 adjusted diluted

EPS growth to be weighted to the second half of the year. Our

guidance includes the impact of two additional shipping days in

2024 and assumes limited impact from enforcement efforts in the

illicit e-vapor market on combustible and e-vapor volumes.

While the 2024 full-year adjusted diluted EPS guidance accounts

for a range of scenarios, the external environment remains dynamic.

We will continue to monitor conditions related to (i) the economy,

including the cumulative impact of inflation, (ii) adult tobacco

consumer dynamics, including purchasing patterns and adoption of

smoke-free products, (iii) illicit e-vapor enforcement and (iv)

regulatory, litigation and legislative developments.

Our 2024 full-year adjusted diluted EPS guidance range includes

planned investments in support of our Vision, such as (i)

marketplace activities in support of our smoke-free products and

(ii) continued smoke-free product research, development and

regulatory preparation expenses.

The 2024 full-year adjusted diluted EPS guidance range excludes

estimated net income of approximately $0.2 billion (or $0.12 per

share) that we expect to record in the first quarter of 2024 for

the partial sale of our investment in ABI. This estimated net

income is subject to certain adjustments, including any exercise of

the underwriters’ option to purchase additional shares, adjustments

related to the conversion from international financial reporting

standards to U.S. generally accepted accounting principles (GAAP)

and adjustments required under the equity method of accounting.

Additionally, the guidance excludes an estimated per share gain of

$1.17 related to the sale of the IQOS Tobacco Heating System

commercialization rights that we expect to record in the second

quarter of 2024.

Our full-year adjusted diluted EPS guidance range excludes the

impact of certain income and expense items that our management

believes are not part of underlying operations. These items may

include, for example, loss on early extinguishment of debt,

restructuring charges, asset impairment charges, acquisition,

disposition and integration-related items, equity

investment-related special items, certain income tax items, charges

associated with tobacco and health and certain other litigation

items, and resolutions of certain non-participating manufacturer

(NPM) adjustment disputes under the MSA (NPM Adjustment Items).

Our management cannot estimate on a forward-looking basis the

impact of certain income and expense items, including those items

noted in the preceding paragraph, on our reported diluted EPS

because these items, which could be significant, may be unusual or

infrequent, are difficult to predict and may be highly variable. As

a result, we do not provide a corresponding GAAP measure for, or

reconciliation to, our adjusted diluted EPS guidance.

Forward-Looking and Cautionary Statements

This release contains certain forward-looking statements that

are subject to various risks and uncertainties and are made

pursuant to the Safe Harbor Provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements

relate to, among other things, the anticipated completion of the

offering, our intended use of proceeds, our expected entry into an

ASR program, expected cash savings on future dividend payments,

future adjusted diluted EPS, the expected timing of completion of

the share repurchase program and estimated net income related to

the partial sale of our investment in ABI. Factors that may cause

actual results with respect to the offering to differ include

prevailing economic, market or business conditions or changes in

such conditions.

Important factors that may cause actual results to differ

materially from those contained in, or implied by, the

forward-looking statements included in this release are described

in our publicly filed reports, including our Annual Report on Form

10-K for the year ended December 31, 2023. These factors include

the following:

- our inability to anticipate and respond to changes in adult

tobacco consumer preferences and purchase behavior;

- our inability to compete effectively;

- the growth of the e-vapor category, including illegal flavored

disposable e-vapor products, and other innovative tobacco products,

including oral nicotine pouches, contributing to reductions in

cigarette and moist smokeless tobacco consumption levels and

shipment volume;

- our failure to commercialize innovative products, including

tobacco products that may reduce health risks relative to other

tobacco products and appeal to adult tobacco consumers;

- changes, including in macroeconomic and geopolitical conditions

(including inflation), that result in shifts in adult tobacco

consumer disposable income and purchasing behavior, including

choosing lower-priced and discount brands or products, and

reductions in shipment volumes;

- unfavorable outcomes with respect to litigation proceedings or

any governmental investigations;

- the risks associated with significant federal, state and local

government actions, including U.S. Food and Drug Administration

regulatory actions, and various private sector actions;

- increases in tobacco product-related taxes;

- our failure to complete or manage successfully strategic

transactions, including acquisitions, dispositions, joint ventures

and investments in third parties, or realize the anticipated

benefits of such transactions;

- significant changes in price, availability or quality of

tobacco, other raw materials or component parts, including as a

result of changes in macroeconomic, climate and geopolitical

conditions;

- our reliance on a few significant facilities and a small number

of key suppliers, distributors and distribution chain service

providers and the risks associated with an extended disruption at a

facility or in service by a supplier, distributor or distribution

chain service provider;

- the risk that we may be required to write down intangible

assets, including trademarks and goodwill, due to impairment;

- the risk that we could decide, or be required to, recall

products;

- the various risks related to health epidemics and pandemics,

and the measures that international, federal, state and local

governments, agencies, law enforcement and health authorities

implement to address them;

- our inability to attract and retain a highly skilled and

diverse workforce due to the decreasing social acceptance of

tobacco usage, tobacco control actions and other factors;

- the risks associated with the various U.S. and foreign laws and

regulations to which we are subject due to our international

business operations;

- the risks concerning a challenge to our tax positions, an

increase in the income tax rate or other changes to federal or

state tax laws;

- the risks associated with legal and regulatory requirements

related to climate change and other environmental sustainability

matters;

- disruption and uncertainty in the credit and capital markets,

including risk of losing access to these markets;

- a downgrade or potential downgrade of our credit ratings;

- our inability to attract investors due to increasing investor

expectations of our performance relating to corporate

responsibility factors;

- the failure of our, or our key service providers’ or key

suppliers’, information systems to function as intended, or

cyber-attacks or security breaches;

- our failure, or the failure of our key service providers or key

suppliers, to comply with personal data protection, privacy,

artificial intelligence and information security laws;

- the risk that the expected benefits of our investment in ABI

may not materialize in the expected manner or timeframe or at all,

including due to macroeconomic and geopolitical conditions; foreign

currency exchange rates; ABI’s business results; ABI’s share price;

impairment losses on the value of our investment; our incurrence of

additional tax liabilities related to our investment in ABI; and

potential reductions in the number of directors that we can have

appointed to the ABI board of directors; and

- the risks associated with our investment in Cronos, including

legal, regulatory and reputational risks and the risk that the

expected benefits of the transaction may not materialize in the

expected timeframe or at all.

You should understand that it is not possible to predict or

identify all factors and risks. Consequently, you should not

consider the foregoing list complete. We do not undertake to update

any forward-looking statement that we may make from time to time

except as required by applicable law. All subsequent written and

oral forward-looking statements attributable to Altria or any

person acting on our behalf are expressly qualified in their

entirety by the cautionary statements referenced above.

Schedule 1

ALTRIA GROUP, INC.

and Subsidiaries

Reconciliation of GAAP and

non-GAAP Measures

(dollars in millions, except per

share data)

(Unaudited)

Earnings before Income

Taxes

Provision for Income

Taxes

Net Earnings

Diluted EPS

2023 Reported

$

10,928

$

2,798

$

8,130

$

4.57

NPM Adjustment Items

(50

)

(12

)

(38

)

(0.02

)

Acquisition, disposition and

integration-related items

35

9

26

0.01

Tobacco and health and certain other

litigation items

430

107

323

0.18

Loss on disposition of JUUL equity

securities

250

—

250

0.14

ABI-related special items

89

19

70

0.03

Cronos-related special items

29

—

29

0.02

Income tax items

—

(32

)

32

0.02

2023 Adjusted for Special Items

$

11,711

$

2,889

$

8,822

$

4.95

While we report our financial results in accordance with GAAP,

our management reviews certain financial results, including diluted

EPS, on an adjusted basis, which excludes certain income and

expense items, including those items noted under “2024 Full-Year

Guidance” in the release. Our management does not view any of these

special items to be part of our underlying results as they may be

highly variable, may be unusual or infrequent, are difficult to

predict and can distort underlying business trends and results. Our

management believes that adjusted financial measures provide useful

additional insight into underlying business trends and results and

provide a more meaningful comparison of year-over-year results. Our

management uses adjusted financial measures for planning,

forecasting and evaluating business and financial performance,

including allocating capital and other resources and evaluating

results relative to employee compensation targets. These adjusted

financial measures are not required by, or calculated in accordance

with GAAP and may not be calculated the same as similarly titled

measures used by other companies. These adjusted financial measures

should thus be considered as supplemental in nature and not

considered in isolation or as a substitute for the related

financial information prepared in accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240313960468/en/

Altria Client Services Investor Relations 804-484-8222

Altria Client Services Media Relations 804-484-8897

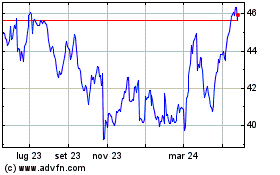

Grafico Azioni Altria (NYSE:MO)

Storico

Da Dic 2024 a Gen 2025

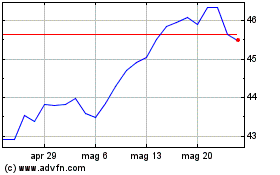

Grafico Azioni Altria (NYSE:MO)

Storico

Da Gen 2024 a Gen 2025