Mettler-Toledo International Inc. (NYSE: MTD) today announced

second quarter results for 2023. Provided below are the

highlights:

- Reported sales were flat compared with the prior-year. In local

currency, sales increased 2% in the quarter as currency reduced

sales growth by 2%.

- Net earnings per diluted share as reported (EPS) were $9.69,

compared with $9.29 in the prior-year period. Adjusted EPS was

$10.19, an increase of 9% over the prior-year amount of $9.39.

Adjusted EPS is a non-GAAP measure, and a reconciliation to EPS is

included on the last page of the attached schedules.

Second Quarter Results

Patrick Kaltenbach, President and Chief Executive Officer,

stated, “Sales growth in the second quarter included strong growth

in our Service business, as well as solid performance across our

Industrial product categories, which was offset in part by softer

market conditions in Laboratory and China following very strong

growth over the last couple of years. Focused execution of our

margin expansion and disciplined cost control initiatives resulted

in good growth in Adjusted EPS despite a very significant adverse

foreign exchange impact.”

GAAP Results

EPS in the quarter was $9.69, compared with the prior-year

amount of $9.29.

Compared with the prior-year, total reported sales were flat at

$982.1 million. By region, reported sales increased 1% in both the

Americas and Europe, and decreased 1% in Asia/Rest of World.

Earnings before taxes amounted to $263.4 million, compared with

$256.7 million in the prior-year.

Non-GAAP Results

Adjusted EPS was $10.19, an increase of 9% over the prior-year

amount of $9.39.

Compared with the prior-year, total sales in local currency

increased 2% as currency reduced sales growth by 2%. By region,

local currency sales increased 4% in Asia/Rest of World, 1% in the

Americas, and were flat in Europe. Adjusted Operating Profit

amounted to $307.7 million, an 8% increase from the prior-year

amount of $285.4 million.

Adjusted EPS and Adjusted Operating Profit are non-GAAP

measures. Reconciliations to the most comparable GAAP measures are

provided in the attached schedules.

Six Month Results

GAAP Results

EPS was $18.15, compared with the prior-year amount of

$16.84.

Compared with the prior-year, total reported sales increased 2%

to $1,910.9 million. By region, reported sales increased 3% in the

Americas, 2% in Europe, and 1% in Asia/Rest of World. Earnings

before taxes amounted to $490.0 million, compared with $469.7

million in the prior-year.

Non-GAAP Results

Adjusted EPS was $18.82, an increase of 9% over the prior-year

amount of $17.25.

Compared with the prior-year, total sales in local currency

increased 4% as currency reduced sales growth by 2%. By region,

local currency sales increased 3% in both the Americas and in

Europe, and 6% in Asia/Rest of World. Adjusted Operating Profit

amounted to $574.2 million, a 9% increase from the prior-year

amount of $526.7 million.

Outlook

The Company stated that forecasting remains challenging.

Management cautions that market conditions are dynamic and changes

to the business environment can occur quickly. There is increased

uncertainty in the economic environment today, including the risk

of recession in many countries, and management acknowledges that

market conditions are subject to change.

Based on today's assessment of market conditions, management

anticipates local currency sales for the third quarter of 2023 will

decline approximately 3% to 4%, and Adjusted EPS is forecast to be

$9.55 to $9.85, a decline of 3% to 6%. Included in the third

quarter guidance is an estimated 3% headwind to Adjusted EPS growth

due to adverse currency.

For the full year, management anticipates local currency sales

growth in 2023 will be approximately 0% to 1%, and Adjusted EPS is

forecast to be in the range of $40.30 to $41.20, representing

growth of approximately 2% to 4%. This compares with previous local

currency sales growth guidance of approximately 5% and Adjusted EPS

guidance of $43.65 to $43.95. Included in the 2023 guidance is an

estimated 3% to 4% headwind to Adjusted EPS growth due to adverse

currency.

While the Company has provided an outlook for local currency

sales growth and Adjusted EPS, it has not provided an outlook for

reported sales growth or EPS as it would require an estimate of

currency exchange fluctuations and non-recurring items, which are

not yet known.

Conclusion

Kaltenbach concluded, “As we look to the remainder of 2023,

there is increased uncertainty in the global economy and our end

markets, and we continue to face challenging sales growth

comparisons. Market demand in China has deteriorated sharply, and

we expect reduced sales during the remainder of 2023. We remain

confident in the factors we can control, including executing on our

best-in-class sales and marketing programs and our margin expansion

and proactive cost savings initiatives. Our team remains very agile

in adapting to changing market conditions, and I am confident that

our efforts will deliver good financial results this year in a more

challenging business environment.”

Other Matters

The Company will host a conference call to discuss its quarterly

results today (Thursday, July 27) at 4:30 p.m. Eastern Time. To

hear a live webcast or replay of the call, visit the investor

relations page on the Company’s website at www.mt.com/investors.

The presentation referenced in the conference call will be located

on the website prior to the call.

METTLER TOLEDO (NYSE: MTD) is a leading global supplier of

precision instruments and services. We have strong leadership

positions in all of our businesses and believe we hold global

number-one market positions in most of them. We are recognized as

an innovation leader and our solutions are critical in key R&D,

quality control and manufacturing processes for customers in a wide

range of industries including life sciences, food and chemicals.

Our sales and service network is one of the most extensive in the

industry. Our products are sold in more than 140 countries and we

have a direct presence in approximately 40 countries. With proven

growth strategies and a focus on execution, we have achieved a

long-term track record of strong financial performance. For more

information, please visit www.mt.com.

Forward-Looking Statements Disclaimer

You should not rely on forward-looking statements to predict our

actual results. Our actual results or performance may be materially

different than reflected in forward-looking statements because of

various risks and uncertainties, including statements about

expected revenue growth, inflation and ongoing developments related

to Ukraine. You can identify forward-looking statements by

terminology such as “may,” “will,” “could,” “would,” “should,”

“expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,”

“predict,” “potential,” or “continue.”

We make forward-looking statements about future events or our

future financial performance, including earnings and sales growth,

earnings per share, strategic plans and contingency plans, growth

opportunities or economic downturns, our ability to respond to

changes in market conditions, planned research and development

efforts and product introductions, adequacy of facilities, access

to and the costs of raw materials, shipping and supplier costs,

gross margins, customer demand, our competitive position, pricing,

capital expenditures, cash flow, tax-related matters, the impact of

foreign currencies, compliance with laws, effects of acquisitions,

and the impact of inflation and ongoing developments related to

Ukraine on our business.

Our forward-looking statements may not be accurate or complete,

and we do not intend to update or revise them in light of actual

results. New risks also periodically arise. Please consider the

risks and factors that could cause our results to differ materially

from what is described in our forward-looking statements, including

inflation, and the ongoing developments related to Ukraine. See in

particular “Factors Affecting Our Future Operating Results” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in our Annual Report on Form 10-K for the

year ended December 31, 2022 and other reports filed with the SEC

from time to time.

METTLER-TOLEDO INTERNATIONAL INC. CONSOLIDATED STATEMENTS

OF OPERATIONS (amounts in thousands except share data)

(unaudited)

Three months ended

Three months ended

June 30, 2023 % of sales June 30, 2022 % of sales Net sales

$

982,117

(a)

100.0

$

978,387

100.0

Cost of sales

398,574

40.6

406,726

41.6

Gross profit

583,543

59.4

571,661

58.4

Research and development

47,245

4.8

44,023

4.5

Selling, general and administrative

228,594

23.3

242,206

24.8

Amortization

18,042

1.8

16,365

1.6

Interest expense

19,249

2.0

12,765

1.3

Restructuring charges

8,021

0.8

1,770

0.2

Other charges (income), net

(1,011

)

(0.1

)

(2,160

)

(0.2

)

Earnings before taxes

263,403

26.8

256,692

26.2

Provision for taxes

49,476

5.0

44,622

4.5

Net earnings

$

213,927

21.8

$

212,070

21.7

Basic earnings per common share: Net earnings

$

9.75

$

9.39

Weighted average number of common shares

21,944,645

22,593,375

Diluted earnings per common share: Net earnings

$

9.69

$

9.29

Weighted average number of common

22,080,602

22,821,666

and common equivalent shares Note:

(a) Local currency sales

increased 2% as compared to the same period in 2022.

RECONCILIATION OF EARNINGS BEFORE TAXES TO ADJUSTED

OPERATING PROFIT

Three months ended

Three months ended

June 30, 2023 % of sales June 30, 2022 % of sales Earnings

before taxes

$

263,403

$

256,692

Amortization

18,042

16,365

Interest expense

19,249

12,765

Restructuring charges

8,021

1,770

Other charges (income), net

(1,011

)

(2,160

)

Adjusted operating profit

$

307,704

(b)

31.3

$

285,432

29.2

Note:

(b) Adjusted operating profit

increased 8% as compared to the same period in 2022.

METTLER-TOLEDO INTERNATIONAL INC. CONSOLIDATED STATEMENTS

OF OPERATIONS (amounts in thousands except share data)

(unaudited)

Six months ended

Six months ended

June 30, 2023

% of sales

June 30, 2022

% of sales

Net sales

$

1,910,855

(a)

100.0

$

1,876,178

100.0

Cost of sales

780,746

40.9

784,932

41.8

Gross profit

1,130,109

59.1

1,091,246

58.2

Research and development

92,722

4.9

87,051

4.6

Selling, general and administrative

463,232

24.2

477,518

25.5

Amortization

35,821

1.9

32,969

1.8

Interest expense

37,433

2.0

24,103

1.3

Restructuring charges

12,295

0.6

5,781

0.3

Other charges (income), net

(1,407

)

(0.1

)

(5,869

)

(0.3

)

Earnings before taxes

490,013

25.6

469,693

25.0

Provision for taxes

87,660

4.5

83,622

4.4

Net earnings

$

402,353

21.1

$

386,071

20.6

Basic earnings per common share: Net earnings

$

18.28

$

17.02

Weighted average number of common shares

22,013,662

22,680,353

Diluted earnings per common share: Net earnings

$

18.15

$

16.84

Weighted average number of common

22,164,394

22,928,933

and common equivalent shares Note:

(a) Local currency sales

increased 4% as compared to the same period in 2022.

RECONCILIATION OF EARNINGS BEFORE TAXES TO ADJUSTED

OPERATING PROFIT

Six months ended

Six months ended

June 30, 2023

% of sales

June 30, 2022

% of sales

Earnings before taxes

$

490,013

$

469,693

Amortization

35,821

32,969

Interest expense

37,433

24,103

Restructuring charges

12,295

5,781

Other charges (income), net

(1,407

)

(5,869

)

Adjusted operating profit

$

574,155

(b)

30.0

$

526,677

(b)

28.1

Note:

(b) Adjusted operating profit

increased 9% as compared to the same period in 2022.

METTLER-TOLEDO INTERNATIONAL

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(amounts in thousands)

(unaudited)

June 30, 2023 December 31, 2022 Cash and cash

equivalents

$

83,574

$

95,966

Accounts receivable, net

648,002

709,321

Inventories

394,959

441,694

Other current assets and prepaid expenses

119,971

128,108

Total current assets

1,246,506

1,375,089

Property, plant and equipment, net

780,723

778,600

Goodwill and other intangibles assets, net

959,694

966,224

Other non-current assets

383,472

372,482

Total assets

$

3,370,395

$

3,492,395

Short-term borrowings and maturities of long-term debt

$

107,365

$

106,054

Trade accounts payable

170,230

252,538

Accrued and other current liabilities

730,408

789,139

Total current liabilities

1,008,003

1,147,731

Long-term debt

2,045,462

1,908,480

Other non-current liabilities

406,635

411,391

Total liabilities

3,460,100

3,467,602

Shareholders’ equity

(89,705

)

24,793

Total liabilities and shareholders’ equity

$

3,370,395

$

3,492,395

METTLER-TOLEDO INTERNATIONAL INC. CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (amounts in thousands)

(unaudited) Three months ended Six months ended June

30, June 30,

2023

2022

2023

2022

Cash flow from operating activities: Net earnings

$

213,927

$

212,070

$

402,353

$

386,071

Adjustments to reconcile net earnings to net cash provided by

operating activities: Depreciation

12,194

11,447

24,217

23,327

Amortization

18,042

16,365

35,821

32,969

Deferred tax benefit

(2,368

)

(2,141

)

(1,766

)

(3,237

)

Other

4,195

4,691

8,222

9,200

Increase (decrease) in cash resulting from changes in operating

assets and liabilities

20,821

(23,276

)

(48,774

)

(138,337

)

Net cash provided by operating activities

266,811

219,156

420,073

309,993

Cash flows from investing activities: Proceeds from sale of

property, plant and equipment

412

118

412

118

Purchase of property, plant and equipment

(28,751

)

(43,240

)

(51,947

)

(62,391

)

Proceeds from government funding (a)

1,264

7,013

1,264

25,013

Acquisitions

-

(1,061

)

(613

)

(10,765

)

Other investing activities

(15,837

)

3,629

(14,414

)

7,372

Net cash used in investing activities

(42,912

)

(33,541

)

(65,298

)

(40,653

)

Cash flows from financing activities: Proceeds from borrowings

475,903

555,776

1,080,921

1,239,813

Repayments of borrowings

(455,215

)

(474,080

)

(958,731

)

(952,559

)

Proceeds from exercise of stock options

7,614

12,421

19,087

17,710

Repurchases of common stock

(250,000

)

(274,999

)

(499,999

)

(549,999

)

Acquisition contingent consideration payment

(5,626

)

(7,912

)

(5,626

)

(7,912

)

Other financing activities

(103

)

(50

)

(714

)

(382

)

Net cash used in financing activities

(227,427

)

(188,844

)

(365,062

)

(253,329

)

Effect of exchange rate changes on cash and cash equivalents

(1,983

)

(4,271

)

(2,105

)

(5,126

)

Net increase (decrease) in cash and cash equivalents

(5,511

)

(7,500

)

(12,392

)

10,885

Cash and cash equivalents: Beginning of period

89,085

116,949

95,966

98,564

End of period

$

83,574

$

109,449

$

83,574

$

109,449

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES

TO ADJUSTED FREE CASH FLOW Net cash provided by operating

activities

$

266,811

$

219,156

$

420,073

$

309,993

Payments in respect of restructuring activities

5,415

2,331

7,398

4,245

Transition tax payment

8,042

4,289

8,042

4,289

Proceeds from sale of property, plant and equipment

412

118

412

118

Purchase of property, plant and equipment, net (a)

(24,907

)

(20,054

)

(44,815

)

(37,526

)

Acquisition payments (b)

4,775

2,405

4,775

2,579

Adjusted free cash flow

$

260,548

$

208,245

$

395,885

$

283,698

Notes:

(a)

In September 2021, the Company entered into an agreement with the

U.S. Department of Defense to increase the domestic production

capacity of pipette tips and enhance manufacturing automation and

logistics. The Company will receive funding of $35.8 million, which

will offset future capital expenditures. Funding proceeds of $1.3

million and $7.0 million during the three months ended June 30,

2023 and 2022, respectively and the related purchase of property,

plant and equipment of $3.8 million and $23.2 million for the three

months ended June 30, 2023 and 2022, respectively, are excluded

from Adjusted free cash flow. Funding proceeds of $1.3 million and

$25.0 million during the six months ended June 30, 2023 and 2022,

respectively and the related purchase of property, plant and

equipment of $7.1 million and $24.9 million for the six months

ended June 30, 2023 and 2022, respectively, are excluded from

Adjusted free cash flow.

(b)

Includes $4.4 million and $2.4 million of the PendoTECH contingent

consideration payment that was reported in net cash provided by

operating activities as required by U.S. GAAP for the three and six

months ended June 30, 2023 and 2022, respectively.

METTLER-TOLEDO INTERNATIONAL INC. OTHER OPERATING

STATISTICS SALES GROWTH BY DESTINATION

(unaudited) Europe Americas

Asia/RoW

Total U.S. Dollar Sales Growth Three Months Ended June 30,

2023

1

%

1

%

(1

%)

0

%

Six Months Ended June 30, 2023

2

%

3

%

1

%

2

%

Local Currency Sales Growth Three Months Ended June 30, 2023

0

%

1

%

4

%

2

%

Six Months Ended June 30, 2023

3

%

3

%

6

%

4

%

RECONCILIATION OF DILUTED EPS AS REPORTED TO

ADJUSTED DILUTED EPS (unaudited) Three months

ended Six months ended June 30, June 30,

2023

2022

% Growth

2023

2022

% Growth EPS as reported, diluted

$

9.69

$

9.29

4

%

$

18.15

$

16.84

8

%

Purchased intangible amortization, net of tax

0.23

(a)

0.22

(a)

0.46

(a)

0.44

(a) Restructuring charges, net of tax

0.29

(b)

0.06

(b)

0.45

(b)

0.20

(b) Income tax expense

(0.02

)

(c)

(0.18

)

(c)

(0.24

)

(c)

(0.25

)

(c) Acquisition costs, net of tax

-

-

-

(d)

0.02

(d) Adjusted EPS, diluted

$

10.19

$

9.39

9

%

$

18.82

$

17.25

9

%

Notes:

(a)

Represents the EPS impact of purchased intangibles amortization of

$6.7 million ($5.2 million net of tax) and $6.4 million ($4.9

million net of tax) for the three months ended June 30, 2023 and

2022, and of $13.3 million ($10.3 million net of tax) and $13.0

million ($10.1 million net of tax) for the six months ended June

30, 2023 and 2022, respectively.

(b)

Represents the EPS impact of restructuring charges of $8.0 million

($6.5 million after tax) and $1.8 million ($1.4 million after tax)

for the three months ended June 30, 2023 and 2022, and $12.3

million ($10.0 million after tax) and $5.8 million ($4.7 million

after tax) for the six months ended June 30, 2023 and 2022,

respectively, which primarily include employee related costs.

(c)

Represents the EPS impact of the difference between our quarterly

and estimated annual tax rate before non-recurring discrete items

during the three and six months ended June 30, 2023 and 2022 due to

the timing of excess tax benefits associated with stock option

exercises. Also includes a $0.05 EPS charge for the three months

ended June 30, 2023 for the increase of our annualized effective

tax rate to 19.0% for the first quarter of 2023.

(d)

Represents the EPS impact of acquisition costs of $0.5 million

($0.4 million after tax) for the six months ended June 30, 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230727429663/en/

Adam Uhlman Head of Investor Relations METTLER TOLEDO Direct:

614-438-4794 adam.uhlman@mt.com

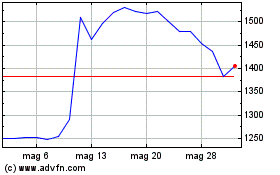

Grafico Azioni Mettler Toledo (NYSE:MTD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Mettler Toledo (NYSE:MTD)

Storico

Da Nov 2023 a Nov 2024