Annaly Capital Management, Inc. Expands Board with Election of Manon Laroche and Scott Wede

07 Settembre 2023 - 10:15PM

Business Wire

Annaly Capital Management, Inc. (NYSE: NLY) (“Annaly” or the

“Company”) announced today that the Board of Directors of the

Company (the “Board”) has elected Manon Laroche, former Head of

Global Spread Products Securitized Sales, North America at

Citigroup, and Scott Wede, former Global Head of Securitized

Products and Municipal Finance at Barclays Capital, as independent

members of the Board, effective October 1, 2023. Following their

appointment, Annaly’s Board will be comprised of twelve members,

ten of whom are independent and six of whom identify as women

and/or racially/ethnically diverse.

“We are excited to welcome both Manon and Scott to our Board of

Directors and look forward to benefiting from their deep experience

in financial markets and securitized products,” said Michael

Haylon, Chair of Annaly’s Board of Directors. “The expansion of our

Board reflects Annaly’s commitment to bringing a diverse range of

backgrounds and perspectives to strengthen our industry leading

corporate governance. The appointment of Scott and Manon as

Directors enhances Annaly’s ability to execute our strategic

initiatives as we continue to expand our housing finance

footprint.”

Ms. Laroche served as Managing Director, Head of Global Spread

Products Securitized Sales, North America at Citigroup, a global

financial services company, from 2018 to February 2023. Prior to

this, Ms. Laroche served as Head of Global Securitized Markets

Sales, New York beginning in 2012. From 2002 to 2012, Ms. Laroche

served as a Managing Director in Global Securitized Markets Sales

at Citigroup. Ms. Laroche received a B.S. in Applied Math and

Economics from Brown University.

Mr. Wede served as the Global Head of Securitized Products and

Municipal Finance at Barclays Capital from 2004 to 2015. More

recently, Mr. Wede served as the President and Chief Financial

Officer of Conventus Holdings Corp., a provider of business purpose

loans, from January 2022 to April 2022. Mr. Wede has served as a

member of the Board of Directors of Rapid Applications Group LLC

since 2016 and MPOWER Financing since 2021. He has served as an

Advisory Board member of INFLO since 2020. Mr. Wede received a B.S.

in Business Administration from Creighton University.

Ms. Laroche and Mr. Wede will stand for re-election to the Board

at the Company’s 2024 Annual Meeting of Stockholders for a term of

one year. Ms. Laroche has been appointed to the Board’s Corporate

Responsibility and Risk Committees. Mr. Wede has been appointed to

the Board’s Audit and Risk Committees.

About Annaly

Annaly is a leading diversified capital manager with investment

strategies across mortgage finance. Annaly’s principal business

objective is to generate net income for distribution to its

stockholders and to optimize its returns through prudent management

of its diversified investment strategies. Annaly is internally

managed and has elected to be taxed as a real estate investment

trust, or REIT, for federal income tax purposes. Additional

information on the company can be found at www.annaly.com.

Forward-Looking Statements

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as “may,” “will,” “should,” “estimate,”

“project,” “believe,” “expect,” “anticipate,” “continue,” or

similar terms or variations on those terms or the negative of those

terms. Actual results could differ materially from those set forth

in forward-looking statements due to a variety of factors,

including, but not limited to, changes in interest rates; changes

in the yield curve; changes in prepayment rates; the availability

of mortgage-backed securities and other securities for purchase;

the availability of financing and, if available, the terms of any

financing; changes in the market value of our assets; changes in

business conditions and the general economy; our ability to grow

our residential credit business; our ability to grow our mortgage

servicing rights business; credit risks related to our investments

in credit risk transfer securities and residential mortgage-backed

securities and related residential mortgage credit assets; risks

related to investments in mortgage servicing rights; the our

ability to consummate any contemplated investment opportunities;

changes in government regulations or policy affecting our business;

our ability to maintain our qualification as a REIT for U.S.

federal income tax purposes; our ability to maintain our exemption

from registration under the Investment Company Act of 1940;

operational risks or risk management failures by us or critical

third parties, including cybersecurity incidents; and risks and

uncertainties related to the COVID-19 pandemic, including as

related to adverse economic conditions on real estate-related

assets and financing conditions. For a discussion of the risks and

uncertainties which could cause actual results to differ from those

contained in the forward-looking statements, see “Risk Factors” in

our most recent Annual Report on Form 10-K and any subsequent

Quarterly Reports on Form 10-Q. The Company does not undertake, and

specifically disclaims any obligation, to publicly release the

result of any revisions which may be made to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230907168106/en/

Annaly Capital Management, Inc. Investor Relations 1-888-8Annaly

investor@annaly.com

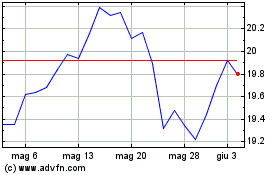

Grafico Azioni Annaly Capital Management (NYSE:NLY)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Annaly Capital Management (NYSE:NLY)

Storico

Da Feb 2024 a Feb 2025