false

0000075288

0000075288

2024-01-08

2024-01-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): January 8, 2024

Oxford Industries, Inc.

(Exact name of registrant as specified

in its charter)

| Georgia |

001-04365 |

58-0831862 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| 999 Peachtree Street, N.E., Suite 688, Atlanta, GA |

30309 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code (404) 659-2424

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

Stock, $1 par value |

OXM |

New

York Stock Exchange |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01 |

Regulation FD Disclosure. |

As announced by Oxford Industries, Inc. (the “Company”)

in its press release on December 27, 2023, the Company will be presenting at the ICR Conference 2024. The Company’s presentation

is scheduled to begin at 10:00 a.m., Eastern time, on January 9, 2024 and will be webcast on the Company’s website at www.oxfordinc.com.

In connection with the presentation and related meetings

with analysts and investors, the Company is announcing, among other things, that its performance during the Holiday selling season and

Resort selling season to date is on track to meet its previously issued guidance for the year, which was published by the Company in its

press release issued on December 6, 2023, and that the Company is expecting meaningful debt reduction during its fourth quarter, which

will end on February 3, 2024. A copy of the Company’s press releases can be found under the Investor Relations tab of its website

at www.oxfordinc.com.

In addition, the Company is furnishing as Exhibit

99.1 hereto a copy of the presentation materials that will be displayed during its presentation at the ICR Conference.

The information contained in this Form 8-K (including

Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be incorporated by reference in

any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing.

Cautionary Statements Regarding Forward-Looking

Statements

This Current Report on Form 8-K includes statements

that constitute forward-looking statements within the meaning of the federal securities laws. Generally, the words “believe,”

“expect,” “intend,” “estimate,” “anticipate,” “project,” “will”

and similar expressions identify forward-looking statements, which are not historical in nature. We intend for all forward-looking statements

contained herein or on our website, and all subsequent written and oral forward-looking statements attributable to us or persons acting

on our behalf, to be covered by the safe harbor provisions for forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934 (which Sections were adopted as part of the Private Securities Litigation Reform Act of 1995). Such statements are subject

to a number of risks, uncertainties and assumptions including, without limitation, demand for our products, which may be impacted by macroeconomic

factors that may impact consumer discretionary spending and pricing levels for apparel and related products, many of which may be impacted

by current inflationary pressures, rising interest rates, concerns about the stability of the banking industry or general economic uncertainty,

and the effectiveness of measures to mitigate the impact of these factors; competitive conditions and/or evolving consumer shopping patterns;

acquisition activities (such as the acquisition of Johnny Was), including our ability to integrate key functions, recognize anticipated

synergies and minimize related disruptions or distractions to our business as a result of these activities; supply chain disruptions;

costs and availability of labor and freight deliveries, including our ability to appropriately staff our retail stores and food and beverage

locations; costs of products as well as the raw materials used in those products, as well as our ability to pass along price increases

to consumers; energy costs; our ability to respond to rapidly changing consumer expectations; weather or natural disasters, including

the ultimate impact of the recent wildfires on the island of Maui; the ability of business partners, including suppliers, vendors, wholesale

customers, licensees, logistics providers and landlords, to meet their obligations to us and/or continue our business relationship to

the same degree as they have historically; retention of and disciplined execution by key management and other critical personnel; cybersecurity

breaches and ransomware attacks, as well as our and our third party vendors’ ability to properly collect, use, manage and secure

business, consumer and employee data and maintain continuity of our information technology systems; the effectiveness of our advertising

initiatives in defining, launching and communicating brand-relevant customer experiences; the level of our indebtedness, including the

risks associated with heightened interest rates on the debt and the potential impact on our ability to operate and expand our business;

changes in international, federal or state tax, trade and other laws and regulations, including the potential imposition of additional

duties; the timing of shipments requested by our wholesale customers; fluctuations and volatility in global financial and/or real estate

markets; the timing and cost of retail store and food and beverage location openings and remodels, technology implementations and other

capital expenditures, including the timing, cost and successful implementation of changes to our distribution network; pandemics or other

public health crises; expected outcomes of pending or potential litigation and regulatory actions; the increased consumer, employee and

regulatory focus on environmental, social and governance issues; the regulation or prohibition of goods sourced, or containing raw materials

or components, from certain regions and our ability to evidence compliance; access to capital and/or credit markets; factors that could

affect our consolidated effective tax rate; the risk of impairment to goodwill and other intangible assets; and geopolitical risks, including

those related to the ongoing war in Ukraine and the Israel-Hamas war. Forward-looking statements reflect our expectations at the time

such forward-looking statements are made, based on information available at such time, and are not guarantees of performance.

Although we believe that the expectations reflected

in such forward-looking statements are reasonable, these expectations could prove inaccurate as such statements involve risks and uncertainties,

many of which are beyond our ability to control or predict. Should one or more of these risks or uncertainties, or other risks or uncertainties

not currently known to us or that we currently deem to be immaterial, materialize, or should underlying assumptions prove incorrect, actual

results may vary materially from those anticipated, estimated or projected. Important factors relating to these risks and uncertainties

include, but are not limited to, those described in Part I. Item 1A. Risk Factors contained in our Fiscal 2022 Form 10-K, and those described

from time to time in our future reports filed with the SEC. We caution that one should not place undue reliance on forward-looking statements,

which speak only as of the date on which they are made. We disclaim any intention, obligation or duty to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise, except as required by law.

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

OXFORD INDUSTRIES, INC. |

| |

|

| |

|

| January 8, 2024 |

/s/ Suraj A. Palakshappa |

| |

Name: Suraj A. Palakshappa |

| |

Title: Senior Vice President |

| |

|

Exhibit 99.1

ICR Conference 2024

Introduction Tom Chubb Chairman, Chief Executive Officer and President

This presentation was prepared as o f January 8 , 2024 , and, except as otherwise provided herein, the information contained in this presentation is as of January 8 , 2024. Any subsequent distribution, dissemination or reproduction of this presentation or any of its content is not an affirmation or re sta tement of any forward - looking statements contained herein. Forward - Looking Statements This presentation includes statements that constitute forward - looking statements. Such statements are subject to a number of ris ks, uncertainties and assumptions which could cause actual results to differ materially from those anticipated or projected, including, without li mitation, those identified under Part I, Item 1A. contained in our Annual Report on Form 10 - K for the period ended January 28, 2023 under the heading “Risk Factors,” those descri bed from time to time in subsequent reports filed with the SEC and those identified in our press release dated December 6 , 2023 under the caption, “Safe Harbor”, all of which are available under the Investor Relations tab of our website at oxfordinc.com. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could impact the forward - looking statements contained in this presentation. You should not place undue reliance on forward - looking statements, w hich speak only as of the date they are made. We disclaim any intention, obligation or duty to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law. Non - GAAP Measures This infographic contains certain non - GAAP financial metrics, such as adjusted earnings per share, which are intended to supple ment our consolidated financial results presented in accordance with GAAP. We use these adjusted financial measures in making financial, operation al and planning decisions, to evaluate our ongoing performance and in discussions with investment and other financial institutions, our board of directors and others. Reconcili ati ons of these adjusted measures to the most directly comparable GAAP financial measures are presented in tables included at the end of our press releases dated December 6, 2023, Mar ch 23, 2023, March 23, 2022, March 28, 2019, March 23, 2017, and March 26, 2015. Cautionary Statement

OUR OBJECTIVE To maximize long - term shareholder value OUR STRATEGY To drive excellence across a portfolio of lifestyle brands that create sustained, profitable growth OUR PURPOSE To evoke happiness OUR FOCUS Generate cash to fund organic growth, acquisition opportunities and return of capital to shareholders

▪ Portfolio of happy, upbeat, high - margin lifestyle brands ▪ Founded in 1942 and headquartered in Atlanta, GA ▪ Significant opportunity for profitable growth o Digital capabilities driving customer reach and engagement o Omnichannel expertise o Compelling and growing bricks and mortar footprint o Brand - enhancing hospitality businesses ▪ Strong cash flow and a long history of returning capital to shareholders ▪ Publicly traded on the New York Stock Exchange since 1964 under the symbol OXM Tommy Bahama 57% Lilly Pulitzer 22% Johnny Was 13% Emerging Brands 8% Retail 39% eCommerce 34% Wholesale 20% Restaurant 7% TTM Revenue by Distribution Channel (1) TTM Revenue by Operating Group (1,2) $1.5B $1.5B (1) TTM as of 10/28/2023 (2) Emerging Brands consist of Southern Tide, The Beaufort Bonnet Company and Duck Head

‒ Highly profitable operating model ‒ Aspirational and inspiring messaging ‒ Full lifestyle brand covering a broad array of categories ‒ Unique, complementary food and beverage concept “Long live the island life” Tommy Bahama 57% TTM Revenue by Operating Group (1) (1) TTM as of 10/28/2023

Foundational changes to Tommy Bahama’s business drive sustainable margin uplift ▪ Aspirational brand messaging resonating with new and existing customers ▪ Efficient sales growth driven by significant increases in retail sales per square foot and eCommerce ▪ Focus on improved customer metrics enabled by: ▪ Enhanced digital marketing initiatives that provide a scalable avenue for targeting new customers ▪ Proven food and beverage concept that drives increased retail volume ▪ Improved gross margin driven by higher IMUs, bolstered by lower promotional activity ▪ Better inventory sell - through at full price driven by: ▪ New inventory order management system, including ship from store capabilities ▪ Development of strong core and key item programs ▪ Increase in women’s proportion of total business ▪ More focused merchandising, including additional performance products FY19 3Q23 TTM $676.7M $884.6M Revenue $413.2M $572.5M Gross Profit 61% 65% Gross Margin $53.2M $160.9M Operating Income 8% 18% Operating Margin 1,224 1,581 TTM Active Customers (in thousands) $324 $349 TTM Avg. Annual Spend 31% 36% Women's % of Full - Price Direct - to - consumer

‒ Highly profitable operating model ‒ Vibrant custom colors and prints ‒ Favorable product mix trends ‒ Advanced omnichannel capabilities “Create your sunshine, a resort state of mind” Lilly Pulitzer 22% TTM Revenue by Operating Group (1) (1) TTM as of 10/28/2023

‒ Culmination of a multi - year initiative of modernizing the brand, respecting heritage with an eye on the future ‒ Visual refresh of the brand across stores, marketing, packaging, and merchandising ‒ Exciting collaborations will immerse customers in the world of Lilly The brand’s 65 th anniversary in 2024 sets the stage for continued investment in brand enhancement

‒ Affordable luxury price point drives high consumer spend ‒ D iversifies OXM portfolio across fashion points of view, seasons and geographies ‒ Attractive store economics and substantial pipeline Johnny Was 13% TTM Revenue by Operating Group (1) (1) TTM as of 10/28/2023

‒ Allows for creative and brand autonomy while ensuring best - in - class execution ‒ Paves the way for potential future investments Emerging Brands 8% TTM Revenue by Operating Group (1) (1) TTM as of 10/28/2023 Emerging Brands Group

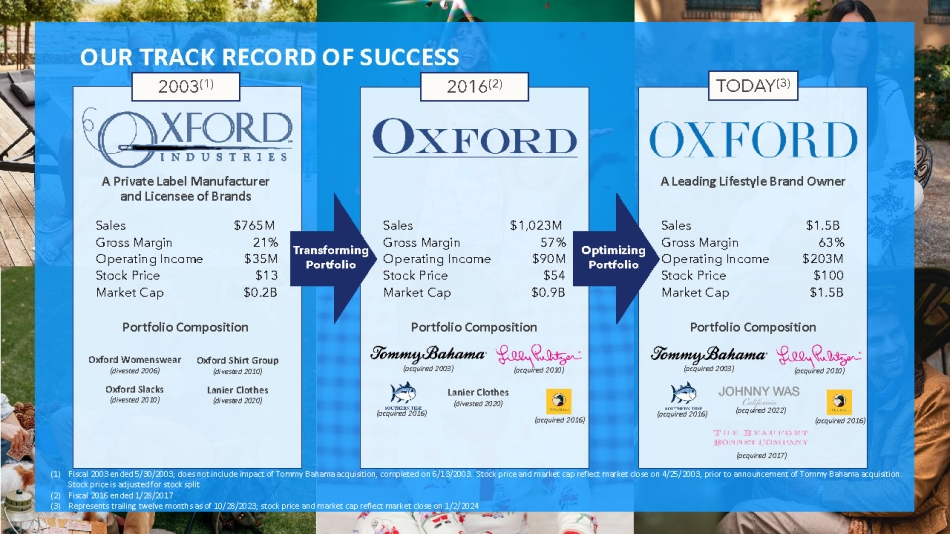

OUR TRACK RECORD OF SUCCESS A Leading Lifestyle Brand Owner Portfolio Composition Portfolio Composition Oxford Womenswear (divested 2006) Oxford Slacks (divested 2010) Oxford Shirt Group (divested 2010) Lanier Clothes (divested 2020) 2003 (1) TODAY (3) (1) Fiscal 2003 ended 5/30/2003; does not include impact of Tommy Bahama acquisition, completed on 6/13/2003. Stock price and ma rke t cap reflect market close on 4/25/2003, prior to announcement of Tommy Bahama acquisition. Stock price is adjusted for stock split (2) Fiscal 2016 ended 1/28/2017 (3) Represents trailing twelve months as of 10/28/2023; stock price and market cap reflect market close o n 1/2/2024 (acquired 2003) (acquired 2010) (acquired 2016) (acquired 2016) (acquired 2017) (acquired 2022) Portfolio Composition 2016 (2) Lanier Clothes (divested 2020) (acquired 2003) (acquired 2010) (acquired 2016) (acquired 2016) Optimizing Portfolio Transforming Portfolio A Private Label Manufacturer and Licensee of Brands Sales $1,023M Gross Margin 57% Operating Income $90M Stock Price $54 Market Cap $0.9B Sales $765M Gross Margin 21% Operating Income $35M Stock Price $13 Market Cap $0.2B

6% Customer Growth 80 % DTC Sales 2.7M TTM Known Unique Active Customers $380+ Average Annual Spend Passionate consumer base with strong emotional connection to our brands

Investing for the Future via Store Openings Tommy Bahama Johnny Was Southern Tide Lilly Pulitzer TBBC FY24 Pipeline 4Q23 Pipeline 3Q23 YTD Net Store Openings ~20 9 17

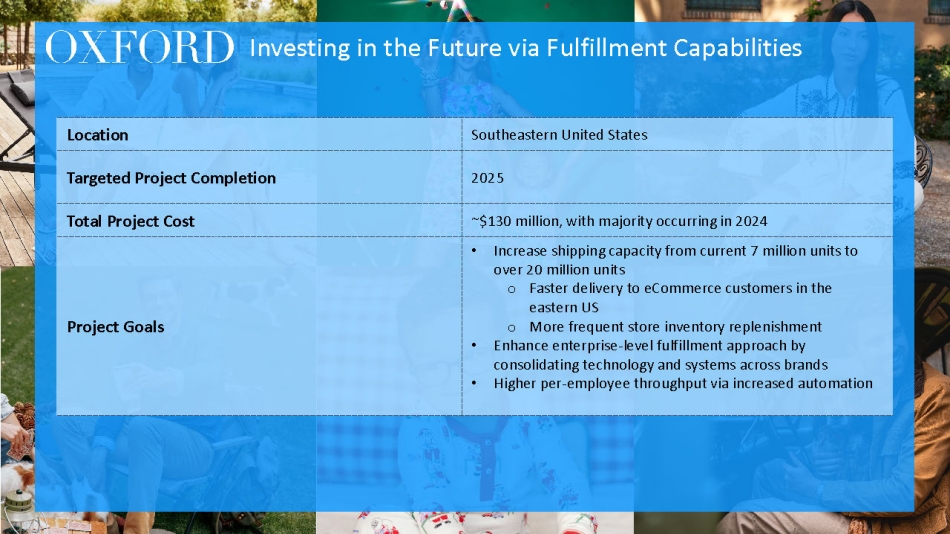

Southeastern United States Location 2025 Targeted Project Completion ~$130 million, with majority occurring in 2024 Total Project Cost • Increase shipping capacity from current 7 million units to over 20 million units o Faster delivery to eCommerce customers in the eastern US o More frequent store inventory replenishment • Enhance enterprise - level fulfillment approach by consolidating technology and systems across brands • Higher per - employee throughput via increased automation Project Goals Investing in the Future via Fulfillment Capabilities

$2.81 $2.98 $3.64 $3.30 $3.66 $4.32 $4.32 ($1.81) $7.99 $10.88 $2.75 $2.78 $3.54 $3.27 $3.87 $3.94 $4.05 $7.78 $10.19 $917 $998 $969 $1,023 $1,086 $1,107 $1,123 $749 $1,142 $1,412 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Adjusted EPS GAAP EPS Revenue ($M) 10 - Year Revenue and Adjusted EPS Trends 1 ($5.77) (1) See non - GAAP measures on slide 3 for additional information regarding historical operating results

(1) Free cash flow represents cash flow from operations of $209 million and capital expenditures of $69 million in the twelve mon ths ended October 28, 2023.

• Performance during the holiday and Resort selling season to date is on track to meet our previous guidance range • January is a very important full - price sales month for the Resort season • In December, we purchased three Southern Tide Signature Stores • Tommy Bahama’s Winter Park Marlin Bar is on schedule to open in January • We expect meaningful debt reduction in the fourth quarter Holiday and Resort Update

v3.23.4

Cover

|

Jan. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity File Number |

001-04365

|

| Entity Registrant Name |

Oxford Industries, Inc.

|

| Entity Central Index Key |

0000075288

|

| Entity Tax Identification Number |

58-0831862

|

| Entity Incorporation, State or Country Code |

GA

|

| Entity Address, Address Line One |

999 Peachtree Street

|

| Entity Address, Address Line Two |

N.E.

|

| Entity Address, Address Line Three |

Suite 688

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30309

|

| City Area Code |

(404)

|

| Local Phone Number |

659-2424

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $1 par value

|

| Trading Symbol |

OXM

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Grafico Azioni Oxford Industries (NYSE:OXM)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Oxford Industries (NYSE:OXM)

Storico

Da Nov 2023 a Nov 2024