Safe Bulkers, Inc. Declares Quarterly Dividend on its 8.00% Series C Cumulative Redeemable Perpetual Preferred Shares; 8.00% Series D Cumulative Redeemable Perpetual Preferred Shares

04 Gennaio 2024 - 10:05PM

Safe Bulkers, Inc. (the “Company”) (NYSE: SB), an international

provider of marine drybulk transportation services, announced today

that the Company's Board of Directors has declared:

- a cash dividend of $0.50 per share

on its 8.00% Series C Cumulative Redeemable Perpetual Preferred

Shares (the “Series C Preferred Shares”) (NYSE: SB.PR.C) for the

period from October 30, 2023 to January 29, 2024;

- a cash dividend of $0.50 per share

on its 8.00% Series D Cumulative Redeemable Perpetual Preferred

Shares (the “Series D Preferred Shares”) (NYSE: SB.PR.D) for the

period from October 30, 2023 to January 29, 2024.

Each dividend will be paid on January 30, 2024

to all shareholders of record as of January 19, 2024 of the Series

C Preferred Shares and of the Series D Preferred Shares,

respectively. Dividends on the Series C and D Preferred Shares are

payable quarterly in arrears on the 30th day (unless the 30th falls

on a weekend or public holiday, in which case the payment date is

moved to the next business day) of January, April, July and October

of each year.

The declaration and payment of dividends, if

any, will always be subject to the discretion of the Board of

Directors of the Company, and will depend on, among other things,

the Company’s earnings, financial condition and cash requirements

and availability, the Company’s ability to obtain debt and equity

financing on acceptable terms as contemplated by the Company’s

growth and leverage strategies, the restrictive covenants in the

Company’s existing and future debt instruments and global economic

conditions.

About Safe Bulkers, Inc.

The Company is an international provider of

marine drybulk transportation services, transporting bulk cargoes,

particularly coal, grain and iron ore, along worldwide shipping

routes for some of the world’s largest users of marine drybulk

transportation services. The Company has a fleet of 46 vessels,

consisting of 11 Panamax, 9 Kamsarmax, 18 Post-Panamax and 8

Capesize vessels, with an aggregate carrying capacity of 4.6

million dwt and an average age of 10.5 years. Twelve vessels in the

Company’s fleet are eco-ships built after 2014, and seven are IMO

GHG-EEDI Phase 3 – Nox-Tier III vessels built 2022 onwards. The

Company has an outstanding orderbook of eight Phase 3 newbuild

vessels, two of which are methanol dual fuel, with scheduled

deliveries three in 2024, two in 2025, two in 2026, and one in

2027. The Company’s common stock, series C preferred stock and

series D preferred stock are listed on the NYSE, and trade under

the symbols “SB”, “SB.PR.C”, and “SB.PR.D”, respectively.

Forward-Looking Statements

This press release contains forward-looking

statements (as defined in Section 27A of the Securities Exchange

Act of 1933, as amended, and in Section 21E of the Securities Act

of 1934, as amended) concerning future events, the Company’s growth

strategy and measures to implement such strategy, including

expected vessel acquisitions and entering into further time

charters. Words such as “expects,” “intends,” “plans,” “believes,”

“anticipates,” “hopes,” “estimates” and variations of such words

and similar expressions are intended to identify forward-looking

statements. Although the Company believes that the expectations

reflected in such forward-looking statements are reasonable, no

assurance can be given that such expectations will prove to have

been correct. These statements involve known and unknown risks and

are based upon a number of assumptions and estimates that are

inherently subject to significant uncertainties and contingencies,

many of which are beyond the control of the Company. Actual results

may differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause actual results

to differ materially include, but are not limited to, changes in

the demand for drybulk vessels, competitive factors in the market

in which the Company operates, risks associated with operations

outside the United States and other factors listed from time to

time in the Company’s filings with the Securities and Exchange

Commission. The Company expressly disclaims any obligations or

undertaking to release any updates or revisions to any

forward-looking statements contained herein to reflect any change

in the Company’s expectations with respect thereto or any change in

events, conditions or circumstances on which any statement is

based.

For further information please

contact:

Company Contact: Dr. Loukas

Barmparis President Safe Bulkers, Inc. Tel.: +30 2 111 888 400

+357 25 887 200

E-Mail: directors@safebulkers.com

Investor Relations / Media

Contact: Paul Lampoutis Capital Link, Inc. 230 Park

Avenue, Suite 1536 New York, N.Y. 10169 Tel.: (212) 661-7566 Fax:

(212) 661-7526 E-Mail: safebulkers@capitallink.com

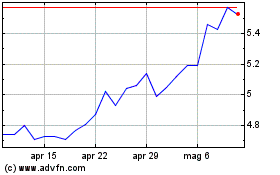

Grafico Azioni Safe Bulkers (NYSE:SB)

Storico

Da Dic 2024 a Gen 2025

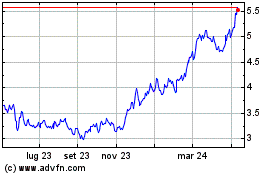

Grafico Azioni Safe Bulkers (NYSE:SB)

Storico

Da Gen 2024 a Gen 2025