ServisFirst Bancshares, Inc. (NYSE: SFBS), today announced

earnings and operating results for the quarter ended December 31,

2023.

Fourth Quarter 2023 Highlights:

- Entering the Memphis, Tennessee market with the hiring of

Joel Smith as President.

- Deposits grew 15% year-over-year and new deposit accounts

opened increased 12% year-over-year.

- Diluted earnings per share of $0.77 for the

quarter.

- Adjusted* diluted earnings per share of $0.91 for the

quarter.

- $2.1 billion in cash on hand with no FHLB advances or

brokered deposits.

- Book value per share of $26.45, up 10.7% from the fourth

quarter of 2022 and 10.8% annualized, from the third quarter of

2023.

- Cash dividend increased from $0.28 per share to $0.30 per

share, a 7% increase.

- Credit quality continues to be strong with non-performing

assets to total assets of 0.14%.

- Consolidated Common Equity Tier 1 capital to risk-weighted

assets increased from 9.95% to 10.91% year-over-year.

Tom Broughton, Chairman, President, and CEO, said, “We are

pleased to announce our entrance into the Memphis, Tennessee market

with the addition of Joel Smith, who is an outstanding banker with

a commercial and industrial banking background.”

Bud Foshee, CFO, said, “We are well-positioned for growth in

2024, with strong liquidity in what we believe to be the best

footprint in the United States.”

* This press release includes certain non-GAAP financial

measures: adjusted net income, adjusted net income available to

common stockholders, adjusted diluted earnings per share, adjusted

return on average assets, adjusted return on average common

stockholders’ equity, adjusted efficiency ratio, tangible common

stockholders' equity, total tangible assets, tangible book value

per share, and tangible common equity to total tangible assets.

Please see “GAAP Reconciliation and Management Explanation of

Non-GAAP Financial Measures.”

FINANCIAL SUMMARY (UNAUDITED)

(in Thousands except share and per share

amounts)

Period Ending December 31,

2023

Period Ending September 30,

2023

% Change From Period Ending

September 30, 2023 to Period Ending December 31, 2023

Period Ending December 31,

2022

% Change From Period Ending

December 31, 2022 to Period Ending December 31, 2023

QUARTERLY OPERATING RESULTS

Net Income

$

42,074

$

53,340

(21.1

)%

$

67,724

(37.9

)%

Net Income Available to Common

Stockholders

$

42,043

$

53,340

(21.2

)%

$

67,693

(37.9

)%

Diluted Earnings Per Share

$

0.77

$

0.98

(21.3

)%

$

1.24

(38.0

)%

Return on Average Assets

1.04

%

1.37

%

1.89

%

Return on Average Common Stockholders'

Equity

11.78

%

15.34

%

21.27

%

Average Diluted Shares Outstanding

54,548,719

54,530,635

54,537,685

Adjusted Net Income, net of tax*

$

49,891

$

53,340

(6.5

)%

$

67,724

(26.3

)%

Adjusted Net Income Available to

Common

Stockholders, net of tax*

$

49,860

$

53,340

(6.5

)%

$

67,693

(26.3

)%

Adjusted Diluted Earnings Per Share, net

of tax*

$

0.91

$

0.98

(6.6

)%

$

1.24

(26.4

)%

Adjusted Return on Average Assets, net of

tax*

1.23

%

1.37

%

1.89

%

Adjusted Return on Average Common

Stockholders' Equity, net of tax*

13.98

%

15.34

%

21.27

%

YEAR-TO-DATE OPERATING RESULTS

Net Income

$

206,853

$

251,504

(17.8

)%

Net Income Available to Common

Stockholders

$

206,791

$

251,442

(17.8

)%

Diluted Earnings Per Share

$

3.79

$

4.61

(17.8

)%

Return on Average Assets

1.37

%

1.71

%

Return on Average Common Stockholders'

Equity

15.13

%

20.73

%

Average Diluted Shares Outstanding

54,535,315

54,534,774

Adjusted Net Income, net of tax*

$

214,670

$

251,504

(14.6

)%

Adjusted Net Income Available to

Common

Stockholders, net of tax*

$

214,608

$

251,442

(14.6

)%

Adjusted Diluted Earnings Per Share, net

of tax*

$

3.94

$

4.61

Adjusted Return on Average Assets, net of

tax*

1.42

%

1.71

%

Adjusted Return on Average Common

Stockholders' Equity, net of tax*

15.71

%

20.73

%

BALANCE SHEET

Total Assets

$

16,129,668

$

16,044,332

0.5

%

$

14,595,753

10.5

%

Loans

11,658,829

11,641,130

0.2

%

11,687,968

(0.2

)%

Non-interest-bearing Demand Deposits

2,643,101

2,621,072

0.8

%

3,321,347

(20.4

)%

Total Deposits

13,273,511

13,142,376

1.0

%

11,546,805

15.0

%

Stockholders' Equity

1,440,405

1,401,384

2.8

%

1,297,896

11.0

%

DETAILED FINANCIALS

ServisFirst Bancshares, Inc. reported net income of $42.1

million and net income available to common stockholders of $42.0

million for the quarter ended December 31, 2023, compared to net

income and net income available to common stockholders of $53.3

million for the third quarter of 2023 and net income and net income

available to common stockholders of $67.7 million for the fourth

quarter of 2022. Basic and diluted earnings per common share were

both $0.77 in the fourth quarter of 2023, compared to $0.98 for

both in the third quarter of 2023 and $1.25 and $1.24,

respectively, in the fourth quarter of 2022.

Annualized return on average assets was 1.04% and annualized

return on average common stockholders’ equity was 11.78% for the

fourth quarter of 2023, compared to 1.89% and 21.27%, respectively,

for the fourth quarter of 2022.

Net interest income was $101.7 million for the fourth quarter of

2023, compared to $99.7 million for the third quarter of 2023 and

$122.4 million for the fourth quarter of 2022. The net interest

margin in the fourth quarter of 2023 was 2.57% compared to 2.64% in

the third quarter of 2023 and 3.52% in the fourth quarter of 2022.

The Company significantly increased deposits and liquidity in the

form of interest-bearing balances with banks after the stress in

the banking system in March. Average interest-bearing balances with

banks increased by $1.5 billion, or 333%, from the fourth quarter

of 2022 to the fourth quarter of 2023. While the increased

liquidity had a benign impact on net interest income, it has had an

impact on our net interest margin. Loan yields were 6.32% during

the fourth quarter of 2023 compared to 6.13% during the third

quarter of 2023 and 5.32% during the fourth quarter of 2022.

Investment yields were 3.08% during the fourth quarter of 2023

compared to 3.07% during the third quarter of 2023 and 2.49% during

the fourth quarter of 2022. Average interest-bearing deposit rates

were 4.06% during the fourth quarter of 2023, compared to 3.84%

during the third quarter of 2023 and 1.70% during the fourth

quarter of 2022. Average federal funds purchased rates were 5.49%

during the fourth quarter of 2023, compared to 5.43% during the

third quarter of 2023 and 3.75% during the fourth quarter of

2022.

Average loans for the fourth quarter of 2023 were $11.60

billion, an increase of $35.5 million, or 1.2% annualized, from

average loans of $11.56 billion for the third quarter of 2023, and

an increase of $113.4 million, or 1.0%, from average loans of

$11.49 billion for the fourth quarter of 2022.

Average total deposits for the fourth quarter of 2023 were

$13.23 billion, an increase of $549.1 million, or 17.2% annualized,

over average total deposits of $12.68 billion for the third quarter

of 2023, and an increase of $1.84 billion, or 16.2%, from average

total deposits of $11.39 billion for the fourth quarter of

2022.

Non-performing assets to total assets were 0.14% for the fourth

quarter of 2023, compared to 0.15% for the third quarter of 2023

and 0.12% for the fourth quarter of 2022. Annualized net

charge-offs to average loans were 0.09% for the fourth quarter of

2023, compared to 0.15% for the third quarter of 2023 and 0.06%

fourth quarter of 2022. The allowance for credit losses as a

percentage of total loans at December 31, 2023, September 30, 2023,

and December 31, 2022, was 1.32%, 1.31%, and 1.25%, respectively.

We recorded a $3.6 million provision for credit losses in the

fourth quarter of 2023 compared to $4.3 million in the third

quarter of 2023, and $7.1 million in the fourth quarter of

2022.

Non-interest income increased $413,000, or 5.9%, to $7.4 million

for the fourth quarter of 2023 from $7.0 million in the fourth

quarter of 2022, and decreased $756,000, or 9.3%, on a linked

quarter basis. Service charges on deposit accounts increased

$315,000, or 16.9%, to $2.2 million from the fourth quarter of 2022

to the fourth quarter of 2023, and increased $18,000, or 0.8%, on a

linked quarter basis. Mortgage banking revenue increased $278,000,

or 54.1%, to $792,000 from the fourth quarter of 2022 to the fourth

quarter of 2023, and decreased $33,000, or 4.0%, on a linked

quarter basis. Net credit card revenue decreased $257,000, or

11.4%, to $2.0 million during the fourth quarter of 2023, compared

to $2.3 million during the fourth quarter of 2022, and decreased

$528,000, or 20.9%, on a linked quarter basis. Bank-owned life

insurance (“BOLI”) income increased $39,000, or 2.4%, to $1.6

million during the fourth quarter of 2023, compared to $1.6 million

during the fourth quarter of 2022, and decreased $179,000, or 9.8%,

on a linked quarter basis. Other operating income for the fourth

quarter of 2023 increased $38,000, or 5.2%, to $763,000 from

$725,000 in the fourth quarter of 2022, and decreased $34,000, or

4.3%, on a linked quarter basis. We recognized $162,000 of income

on an interest rate cap during the fourth quarter of 2022. The

interest rate cap matured during the second quarter of 2023.

Merchant service revenue increased $95,000, or 19.5%, to $585,000

for the fourth quarter of 2023 from $490,000 in the fourth quarter

of 2022.

Non-interest expense for the fourth quarter of 2023 increased

$20.2 million, or 52.9%, to $58.3 million from $38.1 million in the

fourth quarter of 2022, and increased $16.6 million, or 39.8%, on a

linked quarter basis. Salary and benefit expense for the fourth

quarter of 2023 increased $3.8 million, or 19.7%, to $23.0 million

from $19.2 million in the fourth quarter of 2022, and increased

$2.9 million, or 14.7%, on a linked quarter basis. The number of

FTE employees increased by 20 to 591 at December 31, 2023 compared

to 571 at December 31, 2022, and increased by 23 from the end of

the third quarter of 2023. Equipment and occupancy expense

increased $597,000, or 18.3%, to $3.9 million in the fourth quarter

of 2023, from $3.3 million in the fourth quarter of 2022, and

increased $281,000, or 7.9% on a linked-quarter basis. The

year-over-year increase was primarily attributed to new leases that

began after the fourth quarter of 2022. Third party processing and

other services expense decreased $329,000, or 4.0%, to $7.8 million

in the fourth quarter of 2023, from $8.2 million in the fourth

quarter of 2022, and increased $1.3 million, or 19.7%, on a

linked-quarter basis. Professional services expense increased

$495,000, or 53.7%, to $1.4 million in the fourth quarter of 2023,

from $922,000 in the fourth quarter of 2022, and increased

$152,000, or 12.0%, on a linked quarter basis. FDIC and other

regulatory assessments increased $8.2 million to $9.5 million in

the fourth quarter of 2023, from $1.3 million in the fourth quarter

of 2022, and increased $7.2 million, or 305.3%, on a linked quarter

basis. The FDIC increased the assessment rate by two basis points

beginning in the first quarter of 2023. Other operating expenses

for the fourth quarter of 2023 increased $7.6 million, or 154.0%,

to $12.6 million from $5.0 million in the fourth quarter of 2022,

and increased $4.8 million, or 60.9%, on a linked-quarter basis.

During the fourth quarter of 2023, an incremental expense related

to tax credit investments of $3.3 million, associated with the tax

benefit discussed below, contributed to the increase in other

operating expenses. In addition, the following items, which

management views as unusual, infrequent, and not reflective of

future normal operating expenses, contributed to the increase in

non-interest expense: the FDIC implemented a special assessment to

recapitalize the Deposit Insurance Fund resulting in an expense of

$7.2 million, an EDP contract termination and related capitalized

cost write-offs of $1.1 million to other operating expenses, and an

adjustment to a privilege tax accrual resulting in a $2.2 million

expense to other operating expenses. The EDP contract termination

costs were related to a planned systems conversion that was

canceled. We determined the benefits to our clients were less than

expected and the disruption outweighed the benefits. We can

continue to provide best-in-class products with our current service

provider. The adjustment to the privilege tax accrual was due to an

under-accrual in previous years, and the correction resulted in

duplicate expense for 2023. See “GAAP Reconciliation and Management

Explanation of Non-GAAP Financial Measures” below for more

discussion of these expenses. The efficiency ratio was 55.23%

during the fourth quarter of 2023 compared to 29.45% during the

fourth quarter of 2022 and 38.64% during the third quarter of 2023.

The adjusted efficiency ratio was 42.22%.

Income tax expense decreased $11.2 million, or 68.6%, to $5.2

million in the fourth quarter of 2023, compared to $16.4 million in

the fourth quarter of 2022. Our effective tax rate was 10.91% for

the fourth quarter of 2023 compared to 19.49% for the fourth

quarter of 2022. We recognized an aggregate of $6.7 million in

credits during the fourth quarter of 2023 related to investments in

tax credit partnerships, compared to $3.1 million during the fourth

quarter of 2022. During the fourth quarter of 2023, $4.1 million of

the recognized credits were related to the incremental expense for

tax credit investments discussed above. We recognize a reduction in

provision for income taxes resulting from excess tax benefits from

the exercise and vesting of stock options and restricted stock

during the fourth quarters of 2023 and 2022 of $252,000 and

$10,000, respectively.

About ServisFirst Bancshares, Inc.

ServisFirst Bancshares, Inc. is a bank holding company based in

Birmingham, Alabama. Through its subsidiary ServisFirst Bank,

ServisFirst Bancshares, Inc. provides business and personal

financial services from locations in Alabama, Florida, Georgia,

North and South Carolina, Tennessee, and Virginia. We also operate

loan production offices in Florida. Through the bank, we originate

commercial, consumer and other loans and accept deposits, provide

electronic banking services, such as online and mobile banking,

including remote deposit capture, deliver treasury and cash

management services and provide correspondent banking services to

other financial institutions.

ServisFirst Bancshares, Inc. files periodic reports with the

U.S. Securities and Exchange Commission (SEC). Copies of its

filings may be obtained through the SEC’s website at www.sec.gov or

at www.servisfirstbancshares.com.

Statements in this press release that are not historical facts,

including, but not limited to, statements concerning future

operations, results or performance, are hereby identified as

"forward-looking statements" for the purpose of the safe harbor

provided by Section 21E of the Securities Exchange Act of 1934 and

Section 27A of the Securities Act of 1933. The words "believe,"

"expect," "anticipate," "project," “plan,” “intend,” “will,”

“could,” “would,” “might” and similar expressions often signify

forward-looking statements. Such statements involve inherent risks

and uncertainties. ServisFirst Bancshares, Inc. cautions that such

forward-looking statements, wherever they occur in this press

release or in other statements attributable to ServisFirst

Bancshares, Inc., are necessarily estimates reflecting the judgment

of ServisFirst Bancshares, Inc.’s senior management and involve a

number of risks and uncertainties that could cause actual results

to differ materially from those suggested by the forward-looking

statements. Such forward-looking statements should, therefore, be

considered in light of various factors that could affect the

accuracy of such forward-looking statements, including, but not

limited to: general economic conditions, especially in the credit

markets and in the Southeast; the performance of the capital

markets; changes in interest rates, yield curves and interest rate

spread relationships; changes in accounting and tax principles,

policies or guidelines; changes in legislation or regulatory

requirements; changes as a result of our reclassification as a

large financial institution by the FDIC; changes in our loan

portfolio and the deposit base; credit issues associated with the

efficacy of return to office policies; possible changes in laws and

regulations and governmental monetary and fiscal policies,

including, but not limited to, the Federal Reserve policies in

connection with continued inflationary pressures and the ability of

the U.S. Congress to increase the U.S. statutory debt limit as

needed; computer hacking or cyber-attacks resulting in unauthorized

access to confidential or proprietary information; substantial,

unexpected or prolonged changes in the level or cost of liquidity;

the cost and other effects of legal and administrative cases and

similar contingencies; possible changes in the creditworthiness of

customers and the possible impairment of the collectability of

loans and the value of collateral; the effect of natural disasters,

such as hurricanes and tornados, in our geographic markets; and

increased competition from both banks and non-bank financial

institutions. The foregoing list of factors is not exhaustive. For

discussion of these and other risks that may cause actual results

to differ from expectations, please refer to “Cautionary Note

Regarding Forward-looking Statements” and “Risk Factors” in our

most recent Annual Report on Form 10-K, in our Quarterly Reports on

Form 10-Q for fiscal year 2023, and our other SEC filings. If one

or more of the factors affecting our forward-looking information

and statements proves incorrect, then our actual results,

performance or achievements could differ materially from those

expressed in, or implied by, forward-looking information and

statements contained herein. Accordingly, you should not place

undue reliance on any forward-looking statements, which speak only

as of the date made. ServisFirst Bancshares, Inc. assumes no

obligation to update or revise any forward-looking statements that

are made from time to time.

More information about ServisFirst Bancshares, Inc. may be

obtained over the Internet at www.servisfirstbancshares.com or by

calling (205) 949-0302.

SELECTED FINANCIAL HIGHLIGHTS

(UNAUDITED)

(In thousands except share and per share

data)

4th Quarter 2023

3rd Quarter 2023

2nd Quarter 2023

1st Quarter 2023

4th Quarter 2022

CONSOLIDATED STATEMENT OF INCOME

Interest income

$

229,062

$

213,206

$

189,656

$

181,322

$

170,273

Interest expense

127,375

113,508

88,405

73,021

47,889

Net interest income

101,687

99,698

101,251

108,301

122,384

Provision for credit losses

3,582

4,282

6,654

4,197

7,135

Net interest income after provision for

credit losses

98,105

95,416

94,597

104,104

115,249

Non-interest income

7,379

8,135

8,582

6,321

6,966

Non-interest expense

58,258

41,663

38,466

39,664

38,092

Income before income tax

47,226

61,888

64,713

70,761

84,123

Provision for income tax

5,152

8,548

11,245

12,790

16,399

Net income

42,074

53,340

53,468

57,971

67,724

Preferred stock dividends

31

-

31

-

31

Net income available to common

stockholders

$

42,043

$

53,340

$

53,437

$

57,971

$

67,693

Earnings per share - basic

$

0.77

$

0.98

$

0.98

$

1.07

$

1.25

Earnings per share - diluted

$

0.77

$

0.98

$

0.98

$

1.06

$

1.24

Average diluted shares outstanding

54,548,719

54,530,635

54,527,317

54,534,482

54,537,685

CONSOLIDATED BALANCE SHEET DATA

Total assets

$

16,129,668

$

16,044,332

$

15,072,808

$

14,566,559

$

14,595,753

Loans

11,658,829

11,641,130

11,604,894

11,629,802

11,687,968

Debt securities

1,882,847

1,878,701

2,048,227

1,646,937

1,678,936

Non-interest-bearing demand deposits

2,643,101

2,621,072

2,855,102

2,898,736

3,321,347

Total deposits

13,273,511

13,142,376

12,288,219

11,615,317

11,546,805

Borrowings

64,735

64,751

64,737

65,417

64,726

Stockholders' equity

1,440,405

1,401,384

1,363,471

1,339,817

1,297,896

Shares outstanding

54,461,580

54,425,447

54,425,033

54,398,025

54,326,527

Book value per share

$

26.45

$

25.75

$

25.05

$

24.63

$

23.89

Tangible book value per share (1)

$

26.20

$

25.50

$

24.80

$

24.38

$

23.64

SELECTED FINANCIAL RATIOS (Annualized)

Net interest margin

2.57

%

2.64

%

2.93

%

3.15

%

3.52

%

Return on average assets

1.04

%

1.37

%

1.50

%

1.63

%

1.89

%

Return on average common stockholders'

equity

11.78

%

15.34

%

15.85

%

17.83

%

21.27

%

Efficiency ratio

55.23

%

38.64

%

35.02

%

34.60

%

29.45

%

Non-interest expense to average earning

assets

1.47

%

1.10

%

1.11

%

1.15

%

1.10

%

CAPITAL RATIOS (2)

Common equity tier 1 capital to

risk-weighted assets

10.91

%

10.69

%

10.37

%

10.01

%

9.55

%

Tier 1 capital to risk-weighted assets

10.92

%

10.69

%

10.38

%

10.02

%

9.55

%

Total capital to risk-weighted assets

12.45

%

12.25

%

11.94

%

11.54

%

11.03

%

Tier 1 capital to average assets

9.12

%

9.35

%

9.83

%

9.49

%

9.29

%

Tangible common equity to total tangible

assets (1)

8.85

%

8.66

%

8.96

%

9.11

%

8.81

%

(1) This press release contains certain

non-GAAP financial measures. Please see “GAAP Reconciliation and

Management Explanation of Non-GAAP Financial Measures.”

(2) Regulatory capital ratios for the most

recent period are preliminary.

GAAP Reconciliation and Management Explanation of Non-GAAP

Financial Measures

This press release contains certain non-GAAP financial measures,

including adjusted net income, adjusted net income available to

common stockholders, adjusted diluted earnings per share, adjusted

return on average assets, adjusted return on average common

stockholders’ equity, and adjusted efficiency ratio. During the

fourth quarter of 2023, we recorded a one-time expense of $7.2

million associated with the FDIC’s special assessment to

recapitalize the Deposit Insurance Fund following bank failures in

the spring of 2023. Additionally, we experienced expenses for the

termination of an EDP contract and related capitalized cost

write-offs resulting in $1.1 million in expenses, and an adjustment

to a privilege tax accrual resulting in a $2.2 million expense. The

EDP contract termination costs were related to a planned systems

conversion that was canceled. We determined the benefits to our

clients were less than expected and the disruption outweighed the

benefits. We can continue to provide best-in-class products with

our current service provider. The adjustment to the privilege tax

accrual was due to an under-accrual in previous years, and the

correction resulted in duplicate expenses for 2023. These expenses

are unusual, or infrequent, in nature and not part of the

noninterest expense run rate. Each of adjusted net income, adjusted

net income available to common stockholders, adjusted diluted

earnings per share, adjusted return on average assets, adjusted

return on average common stockholders’ equity, and adjusted

efficiency ratio excludes the impact of these items, net of tax,

and are all considered non-GAAP financial measures.

This press release also contains the non-GAAP financial measures

of tangible common stockholders’ equity, total tangible assets,

tangible book value per share, and tangible common equity to total

tangible assets, each of which excludes goodwill associated with

our acquisition of Metro Bancshares, Inc. in January 2015.

We believe these non-GAAP financial measures provide useful

information to management and investors that is supplementary to

our financial condition, results of operations, and cash flows

computed in accordance with GAAP; however, we acknowledge that

these non-GAAP financial measures have a number of limitations. As

such, you should not view these disclosures as a substitute for

results determined in accordance with GAAP, and they are not

necessarily comparable to non-GAAP financial measures that other

companies, including those in our industry, use. The following

reconciliation table provides a more detailed analysis of the

non-GAAP financial measures as of and for the comparative periods

presented in this press release. Dollars are in thousands, except

share and per share data.

Three Months Ended December 31,

2023

Year Ended December 31, 2023

Net income - GAAP

$

42,074

$

206,853

Adjustments:

FDIC special assessment

7,152

7,152

Privilege tax expense

2,150

2,150

EDP contract termination expense

1,134

1,134

Tax on adjustments

(2,619

)

(2,619

)

Adjusted net income - non-GAAP

$

49,891

$

214,670

Net income available to common

stockholders - GAAP

$

42,043

$

206,791

Adjustments:

FDIC special assessment

7,152

7,152

Privilege tax expense

2,150

2,150

EDP contract termination expense

1,134

1,134

Tax on adjustments

(2,619

)

(2,619

)

Adjusted net income available to common

stockholders -non-GAAP

$

49,860

$

214,608

Diluted earnings per share - GAAP

$

0.77

$

3.79

Adjustments:

FDIC special assessment

0.13

0.13

Privilege tax expense

0.04

0.04

EDP contract termination expense

0.02

0.02

Tax on adjustments

(0.05

)

(0.05

)

Adjusted diluted earnings per share -

non-GAAP

$

0.91

$

3.94

Return on average assets - GAAP

1.04

%

1.37

%

Net income - GAAP

$

42,074

$

206,853

Adjustments:

FDIC special assessment

7,152

7,152

Privilege tax expense

2,150

2,150

EDP contract termination expense

1,134

1,134

Tax on adjustments

(2,619

)

(2,619

)

Adjusted net income available to common

stockholders -non-GAAP

$

49,891

$

214,670

Average assets - GAAP

$

16,122,146

$

15,066,716

Adjusted return on average assets -

non-GAAP

1.23

%

1.42

%

Return on average common stockholders'

equity - GAAP

11.78

%

15.13

%

Net income available to common

stockholders - GAAP

$

42,074

$

206,853

Adjustments:

FDIC special assessment

7,152

7,152

Privilege tax expense

2,150

2,150

EDP contract termination expense

1,134

1,134

Tax on adjustments

(2,619

)

(2,619

)

Adjusted diluted earnings per share -

non-GAAP

$

49,891

$

214,670

Average common stockholders' equity -

GAAP

$

1,415,866

$

1,366,708

Adjusted return on average common

stockholders' equity non-GAAP

13.98

%

15.71

%

Efficiency ratio

55.23

%

40.67

%

Non-interest expense - GAAP

$

56,480

$

176,273

Adjustments:

FDIC special assessment

7,152

7,152

Privilege tax expense

2,150

2,150

EDP contract termination expense

1,134

1,134

Adjusted non-interest expense

$

46,044

$

165,837

Net interest income plus non-interest

income - GAAP

$

109,066

$

441,354

Adjusted efficiency ratio - non-GAAP

42.22

%

37.57

%

At December 31, 2023

At September 30, 2023

At June 30, 2023

At March 31, 2023

At December 31, 2022

Book value per share - GAAP

$

26.45

$

25.75

$

25.05

$

24.63

$

23.89

Total common stockholders' equity -

GAAP

1,440,405

1,401,384

1,363,471

1,339,817

1,297,896

Adjustment for Goodwill

(13,615

)

(13,615

)

(13,615

)

(13,615

)

(13,615

)

Tangible common stockholders' equity -

non-GAAP

$

1,426,790

$

1,387,769

$

1,349,856

$

1,326,202

$

1,284,281

Tangible book value per share -

non-GAAP

$

26.22

$

25.50

$

24.80

$

24.38

$

23.64

Stockholders' equity to total assets -

GAAP

8.93

%

8.73

%

9.05

%

9.20

%

8.89

%

Total assets - GAAP

$

16,129,668

$

16,044,332

$

15,072,808

$

14,566,559

$

14,595,753

Adjustment for Goodwill

(13,615

)

(13,615

)

(13,615

)

(13,615

)

(13,615

)

Total tangible assets - non-GAAP

$

16,116,053

$

16,030,717

$

15,059,193

$

14,552,944

$

14,582,138

Tangible common equity to total tangible

assets - non-GAAP

8.85

%

8.66

%

8.96

%

9.11

%

8.81

%

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(Dollars in thousands)

December 31, 2023

December 31, 2022

% Change

ASSETS

Cash and due from banks

$

123,430

$

106,317

16

%

Interest-bearing balances due from

depository institutions

1,907,083

708,221

169

%

Federal funds sold

100,575

1,515

6,539

%

Cash and cash equivalents

2,131,088

816,053

161

%

Available for sale debt securities, at

fair value

900,183

644,815

40

%

Held to maturity debt securities (fair

value of $907,191 and $935,953, respectively)

982,664

1,034,121

(5

)%

Restricted equity securities

10,226

7,734

32

%

Mortgage loans held for sale

5,074

1,607

216

%

Loans

11,658,829

11,687,968

-

%

Less allowance for credit losses

(153,317

)

(146,297

)

5

%

Loans, net

11,505,512

11,541,671

-

%

Premises and equipment, net

59,324

59,850

(1

)%

Goodwill

13,615

13,615

-

%

Other assets

521,982

476,287

10

%

Total assets

$

16,129,668

$

14,595,753

11

%

LIABILITIES AND STOCKHOLDERS' EQUITY

Liabilities:

Deposits:

Non-interest-bearing

$

2,643,101

$

3,321,347

(20

)%

Interest-bearing

10,630,410

8,225,458

29

%

Total deposits

13,273,511

11,546,805

15

%

Federal funds purchased

1,256,724

1,618,798

(22

)%

Other borrowings

64,735

64,726

-

%

Other liabilities

94,293

67,528

40

%

Total liabilities

14,689,263

13,297,857

10

%

Stockholders' equity:

Preferred stock, par value $0.001 per

share; 1,000,000 authorized and undesignated at

December 31, 2023 and December 31,

2022

-

-

-

%

Common stock, par value $0.001 per share;

200,000,000 shares authorized; 54,461,580 shares

issued and outstanding at December 31,

2023, and 54,326,527

shares issued and outstanding at December

31, 2022

54

54

-

%

Additional paid-in capital

232,605

229,693

1

%

Retained earnings

1,254,841

1,109,902

13

%

Accumulated other comprehensive loss

(47,595

)

(42,253

)

13

%

Total stockholders' equity attributable to

ServisFirst Bancshares, Inc.

1,439,905

1,297,396

11

%

Noncontrolling interest

500

500

-

%

Total stockholders' equity

1,440,405

1,297,896

11

%

Total liabilities and stockholders'

equity

$

16,129,668

$

14,595,753

11

%

CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

(In thousands except per share data)

Three Months Ended December

31,

Year Ended December 31,

2023

2022

2023

2022

Interest income:

Interest and fees on loans

$

184,897

$

153,924

$

699,101

$

499,691

Taxable securities

15,512

10,895

53,499

40,722

Nontaxable securities

12

27

65

137

Federal funds sold

1,018

818

2,844

1,556

Other interest and dividends

27,623

4,609

57,737

17,209

Total interest income

229,062

170,273

813,246

559,315

Interest expense:

Deposits

108,155

33,471

331,740

59,396

Borrowed funds

19,220

14,418

70,569

29,027

Total interest expense

127,375

47,889

402,309

88,423

Net interest income

101,687

122,384

410,937

470,892

Provision for credit losses

3,582

7,135

18,715

37,607

Net interest income after provision for

credit losses

98,105

115,249

392,222

433,285

Non-interest income:

Service charges on deposit accounts

2,181

1,866

8,420

8,033

Mortgage banking

792

514

2,755

2,438

Credit card income

2,004

2,261

8,631

9,917

Securities losses

-

-

-

(6,168

)

Bank-owned life insurance income

1,639

1,600

7,574

6,478

Other operating income

763

725

3,037

12,661

Total non-interest income

7,379

6,966

30,417

33,359

Non-interest expense:

Salaries and employee benefits

23,024

19,230

80,965

77,952

Equipment and occupancy expense

3,860

3,263

14,295

12,319

Third party processing and other

services

7,841

8,170

27,872

27,333

Professional services

1,417

922

5,916

4,277

FDIC and other regulatory assessments

9,509

1,311

15,614

4,565

Other real estate owned expense

17

239

47

295

Other operating expense

12,590

4,957

33,342

31,075

Total non-interest expense

58,258

38,092

178,051

157,816

Income before income tax

47,226

84,123

244,588

308,828

Provision for income tax

5,152

16,399

37,735

57,324

Net income

42,074

67,724

206,853

251,504

Dividends on preferred stock

31

-

62

62

Net income available to common

stockholders

$

42,043

$

67,693

$

206,791

$

251,442

Basic earnings per common share

$

0.77

$

1.25

$

3.80

$

4.63

Diluted earnings per common share

$

0.77

$

1.24

$

3.79

$

4.61

LOANS BY TYPE (UNAUDITED)

(In thousands)

4th Quarter 2023

3rd Quarter 2023

2nd Quarter 2023

1st Quarter 2023

4th Quarter 2022

Commercial, financial, and

agricultural

$

2,823,986

$

2,890,535

$

2,986,453

$

3,081,926

$

3,145,317

Real estate - construction

1,519,619

1,509,937

1,397,732

1,469,670

1,532,388

Real estate - mortgage:

Owner-occupied commercial

2,257,163

2,237,684

2,294,002

2,243,436

2,199,280

1-4 family mortgage

1,249,938

1,170,099

1,167,238

1,138,645

1,146,831

Other mortgage

3,744,346

3,766,124

3,686,434

3,624,071

3,597,750

Subtotal: Real estate - mortgage

7,251,447

7,173,907

7,147,674

7,006,152

6,943,861

Consumer

63,777

66,751

73,035

72,054

66,402

Total loans

$

11,658,829

$

11,641,130

$

11,604,894

$

11,629,802

$

11,687,968

SUMMARY OF CREDIT LOSS EXPERIENCE

(UNAUDITED)

(Dollars in thousands)

4th Quarter 2023

3rd Quarter 2023

2nd Quarter 2023

1st Quarter 2023

4th Quarter 2022

Allowance for credit losses:

Beginning balance

$

152,247

$

152,272

$

148,965

$

146,297

$

140,967

Loans charged off:

Commercial financial and agricultural

2,831

4,783

4,358

1,257

2,116

Real estate - construction

89

19

-

-

-

Real estate - mortgage

14

-

131

26

-

Consumer

231

341

111

390

200

Total charge offs

3,165

5,143

4,600

1,673

2,316

Recoveries:

Commercial financial and agricultural

614

825

1,233

128

393

Real estate - construction

-

-

-

3

-

Real estate - mortgage

-

-

-

1

-

Consumer

39

11

21

11

118

Total recoveries

653

836

1,254

143

511

Net charge-offs

2,512

4,307

3,346

1,530

1,805

Provision for credit losses

3,582

4,282

6,654

4,197

7,135

Ending balance

$

153,317

$

152,247

$

152,272

$

148,965

$

146,297

Allowance for credit losses to total

loans

1.32

%

1.31

%

1.31

%

1.28

%

1.25

%

Allowance for credit losses to total

average loans

1.32

%

1.31

%

1.31

%

1.28

%

1.27

%

Net charge-offs to total average loans

0.09

%

0.15

%

0.11

%

0.05

%

0.06

%

Provision for credit losses to total

average loans

0.12

%

0.15

%

0.23

%

0.14

%

0.25

%

Nonperforming assets:

Nonaccrual loans

$

19,349

$

20,912

$

16,897

$

13,157

$

12,450

Loans 90+ days past due and accruing

2,184

1,692

5,947

4,683

5,391

Other real estate owned and repossessed

assets

995

690

832

248

248

Total

$

22,528

$

23,294

$

23,676

$

18,088

$

18,089

Nonperforming loans to total loans

0.18

%

0.19

%

0.20

%

0.15

%

0.15

%

Nonperforming assets to total assets

0.14

%

0.15

%

0.16

%

0.12

%

0.12

%

Nonperforming assets to earning assets

0.14

%

0.16

%

0.16

%

0.13

%

0.13

%

Allowance for credit losses to nonaccrual

loans

795.17

%

731.74

%

901.18

%

1,132.24

%

1,175.08

%

CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

(In thousands except per share data)

4th Quarter 2023

3rd Quarter 2023

2nd Quarter 2023

1st Quarter 2023

4th Quarter 2022

Interest income:

Interest and fees on loans

$

184,897

$

178,754

$

171,718

$

163,732

$

153,924

Taxable securities

15,512

15,522

11,570

10,895

10,895

Nontaxable securities

12

15

17

21

27

Federal funds sold

1,018

985

227

614

818

Other interest and dividends

27,623

17,930

6,124

6,060

4,609

Total interest income

229,062

213,206

189,656

181,322

170,273

Interest expense:

Deposits

108,155

95,901

71,971

55,713

33,471

Borrowed funds

19,220

17,607

16,434

17,308

14,418

Total interest expense

127,375

113,508

88,405

73,021

47,889

Net interest income

101,687

99,698

101,251

108,301

122,384

Provision for credit losses

3,582

4,282

6,654

4,197

7,135

Net interest income after

provision for credit losses

98,105

95,416

94,597

104,104

115,249

Non-interest income:

Service charges on deposit accounts

2,181

2,163

2,142

1,934

1,866

Mortgage banking

792

825

696

442

514

Credit card income

2,004

2,532

2,406

1,689

2,261

Bank-owned life insurance income

1,639

1,818

2,496

1,621

1,600

Other operating income

763

797

842

635

725

Total non-interest income

7,379

8,135

8,582

6,321

6,966

Non-interest expense:

Salaries and employee benefits

23,024

20,080

18,795

19,066

19,230

Equipment and occupancy expense

3,860

3,579

3,421

3,435

3,263

Third party processing and other

services

7,841

6,549

6,198

7,284

8,170

Professional services

1,417

1,265

1,580

1,654

922

FDIC and other regulatory assessments

9,509

2,346

2,242

1,517

1,311

Other real estate owned expense

17

18

6

6

239

Other operating expense

12,590

7,826

6,224

6,702

4,957

Total non-interest expense

58,258

41,663

38,466

39,664

38,092

Income before income tax

47,226

61,888

64,713

70,761

84,123

Provision for income tax

5,152

8,548

11,245

12,790

16,399

Net income

42,074

53,340

53,468

57,971

67,724

Dividends on preferred stock

31

-

31

-

31

Net income available to common

stockholders

$

42,043

$

53,340

$

53,437

$

57,971

$

67,693

Basic earnings per common share

$

0.77

$

0.98

$

0.98

$

1.07

$

1.25

Diluted earnings per common share

$

0.77

$

0.98

$

0.98

$

1.06

$

1.24

AVERAGE BALANCE SHEETS AND NET INTEREST

ANALYSIS (UNAUDITED)

ON A FULLY TAXABLE-EQUIVALENT BASIS

(Dollars in thousands)

4th Quarter 2023

3rd Quarter 2023

2nd Quarter 2023

1st Quarter 2023

4th Quarter 2022

Average Balance

Yield / Rate

Average Balance

Yield / Rate

Average Balance

Yield / Rate

Average Balance

Yield / Rate

Average Balance

Yield / Rate

Assets:

Interest-earning assets:

Loans, net of unearned income (1)

Taxable

$

11,580,716

6.33

%

$

11,545,003

6.13

%

$

11,581,008

5.94

%

$

11,632,439

5.70

%

$

11,465,538

5.32

%

Tax-exempt (2)

17,787

4.71

18,023

4.71

18,312

4.82

18,978

3.36

19,526

6.60

Total loans, net of

unearned income

11,598,503

6.32

11,563,026

6.13

11,599,320

5.94

11,651,417

5.70

11,485,064

5.32

Mortgage loans held for sale

5,105

6.22

5,476

6.67

5,014

5.12

1,522

6.40

1,515

3.67

Debt securities:

Taxable

2,007,636

3.08

2,029,995

3.07

1,757,397

2.64

1,724,523

2.54

1,755,764

2.49

Tax-exempt (2)

1,739

2.30

2,408

2.49

2,960

2.43

3,781

2.43

4,863

2.39

Total securities (3)

2,009,375

3.08

2,032,403

3.07

1,760,357

2.64

1,728,304

2.54

1,760,627

2.49

Federal funds sold

72,178

5.60

74,424

5.25

15,908

5.72

50,526

4.93

82,656

3.93

Restricted equity securities

10,216

8.74

8,471

5.90

8,834

6.08

9,919

7.69

7,724

7.35

Interest-bearing balances with banks

1,981,411

5.49

1,293,243

5.45

460,893

5.21

510,021

4.67

458,115

3.83

Total interest-earning assets

$

15,676,788

5.80

$

14,977,043

5.65

$

13,850,326

5.49

$

13,951,709

5.27

$

13,795,701

4.90

Non-interest-earning assets:

Cash and due from banks

101,741

111,566

101,188

106,448

113,823

Net premises and equipment

60,110

60,121

60,499

60,617

60,323

Allowance for credit losses, accrued

interest and other assets

283,435

283,357

279,860

279,775

273,964

Total assets

$

16,122,074

$

15,432,087

$

14,291,873

$

14,398,549

$

14,243,811

Interest-bearing liabilities:

Interest-bearing deposits:

Checking

$

2,245,431

2.91

%

$

2,153,973

2.72

%

$

1,628,936

1.69

%

$

1,675,355

1.25

%

$

1,763,622

0.73

%

Savings

107,035

1.72

112,814

1.61

122,050

1.38

134,671

0.94

141,163

0.64

Money market

7,106,190

4.44

6,538,426

4.24

5,971,639

3.78

5,756,642

3.17

5,047,133

2.07

Time deposits

1,111,350

4.18

1,093,388

3.89

983,582

3.44

850,639

2.51

860,336

1.69

Total interest-bearing deposits

10,570,006

4.06

9,898,601

3.84

8,706,207

3.32

8,417,307

2.68

7,812,254

1.70

Federal funds purchased

1,338,110

5.49

1,237,721

5.43

1,191,582

5.14

1,389,217

4.67

1,453,445

3.75

Other borrowings

64,734

4.23

64,734

4.23

100,998

4.62

114,726

4.61

64,726

4.23

Total interest-bearing liabilities

$

11,972,850

4.22

%

$

11,201,056

4.02

%

$

9,998,787

3.55

%

$

9,921,250

2.98

%

$

9,330,425

2.04

%

Non-interest-bearing liabilities:

Non-interest-bearing

demand deposits

2,656,504

2,778,858

2,876,225

3,086,774

3,572,956

Other liabilities

76,651

72,924

64,917

72,121

77,544

Stockholders' equity

1,475,366

1,437,766

1,399,578

1,358,587

1,307,553

Accumulated other comprehensive

loss

(59,297

)

(58,517

)

(47,634

)

(40,183

)

(44,667

)

Total liabilities and

stockholders' equity

$

16,122,074

$

15,432,087

$

14,291,873

$

14,398,549

$

14,243,811

Net interest spread

1.58

%

1.63

%

1.94

%

2.29

%

2.86

%

Net interest margin

2.57

%

2.64

%

2.93

%

3.15

%

3.52

%

(1)

Average loans include nonaccrual loans in

all periods. Loan fees of $4,175, $2,996, $3,318 $3,263, and $3,630

are included in interest income in the fourth quarter of 2023,

third quarter of 2023, second quarter of 2023, first quarter of

2023, and fourth quarter of 2022, respectively.

(2)

Interest income and yields are presented

on a fully taxable equivalent basis using a tax rate of 21%.

(3)

Unrealized losses on debt securities of

$(84,647), $(83,815), $(69,498), $(59,738), and $(62,568) for the

fourth quarter of 2023, third quarter of 2023, second quarter of

2023, first quarter of 2023, and fourth quarter of 2022,

respectively, are excluded from the yield calculation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240129131808/en/

ServisFirst Bank Davis Mange (205) 949-3420

dmange@servisfirstbank.com

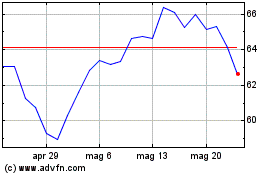

Grafico Azioni ServisFirst Bancshares (NYSE:SFBS)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni ServisFirst Bancshares (NYSE:SFBS)

Storico

Da Feb 2024 a Feb 2025