UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of March 2024

Commission File Number: 001-13464

Telecom

Argentina S.A.

(Translation of registrant’s name into English)

General Hornos, No. 690, 1272

Buenos Aires, Argentina

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x Form 40-F

¨

Contacts:

Luis Fernando

Rial Ubago - lfrialubago@teco.com.ar

Tomás Pellicori

- tlpellicori@teco.com.ar |

Market

Cap (NYSE: TEO): US$2,929.02 million* |

Telecom

Argentina S.A.

announces

consolidated annual results (“FY23”) and fourth

quarter of fiscal year 2023 (“4Q23”) **

Note:

For the figures included in the FFSS, the Company has accounted for the effects of inflation adjustment adopted by Resolution

777/18 of the Comisión Nacional de Valores (“CNV”), which establishes that the restatement will be applied to

annual financial statements, interim and special periods ending as of December 31, 2018 inclusive. Accordingly, the reported

figures corresponding to FY23 include the effects of the adoption of inflationary accounting in accordance with IAS 29. Finally,

comments related to variations of results of FY23 and vs. FY22 mentioned in this press release correspond to “figures restated

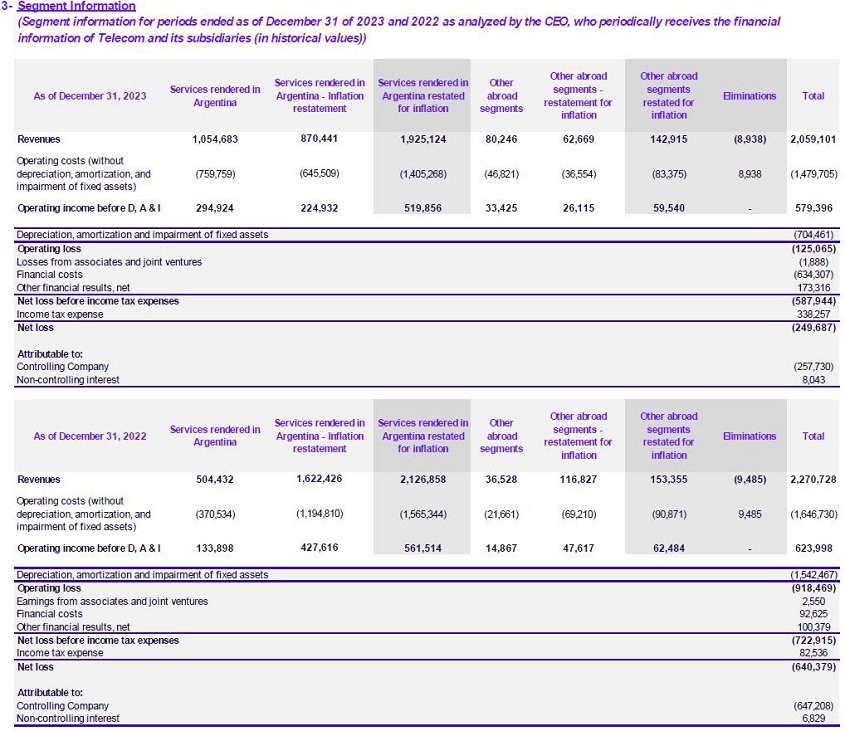

by inflation” or “constant”. Moreover, Table 3 contemplates information broken down by segment for periods

ended as of December 31 of 2023 and 2022, as analyzed by the Executive Committee and the CEO, who receive periodically the financial

information of Telecom and its subsidiaries (in historical values). For further details, please refer to the titles of the financial

tables beginning from page 11. |

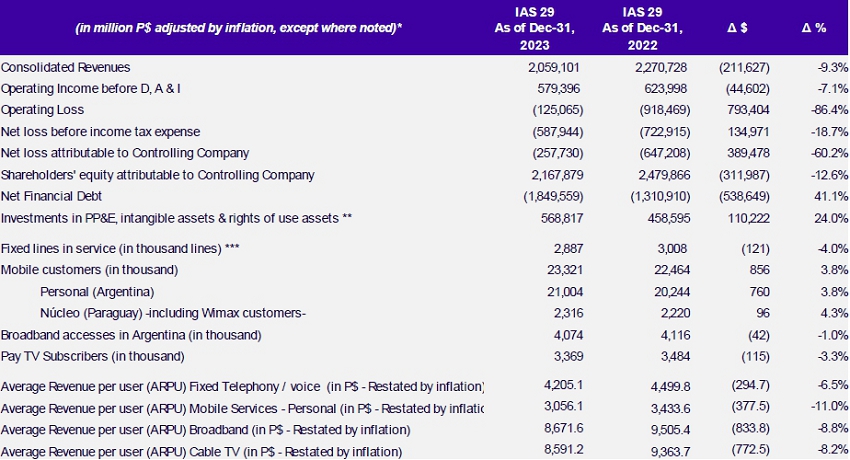

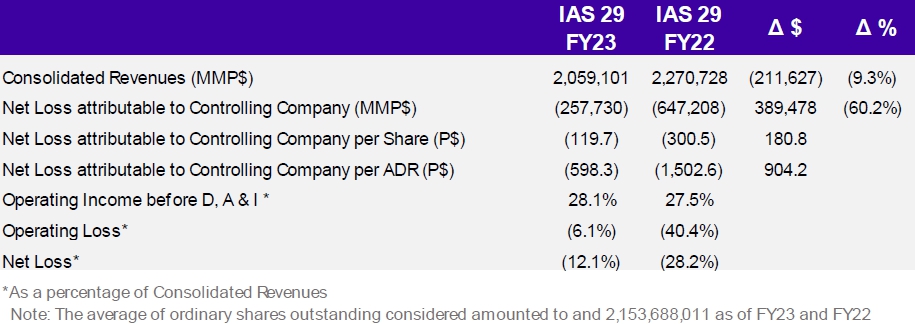

| · | It

should be noted that the results presented on a comparative basis (December 2022) include

the effect of the year-over-year inflation as of December 2023, which was 211.4%. |

| · | Even

with a scenario of strong inflationary acceleration, Service Revenues improved in real terms.

In FY22 was observed a variation of –11.7% vs. FY21, while in FY23 was observed a variation

of -10.1% compared to FY22, amounting $1,905,932. The Company's Consolidated Revenues amounted

to $2,059,101 million in FY23 (-9.3% in constant currency compared to FY22). |

| · | The

fixed segment customer base remained stable during the last quarters of 2023, reversing the

trend observed at the beginning of the year. Mobile subscribers in Argentina reached 21 million

in FY23 (+760 thousand vs. FY22), cable TV subscribers totaled 3.1 million in the same period

(-115 thousand vs. FY22), while broadband accesses amounted to 4.1 million (-42 thousand

vs. FY22). |

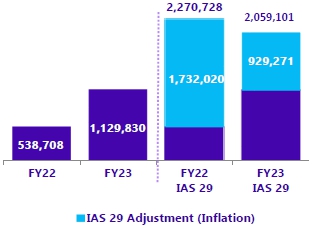

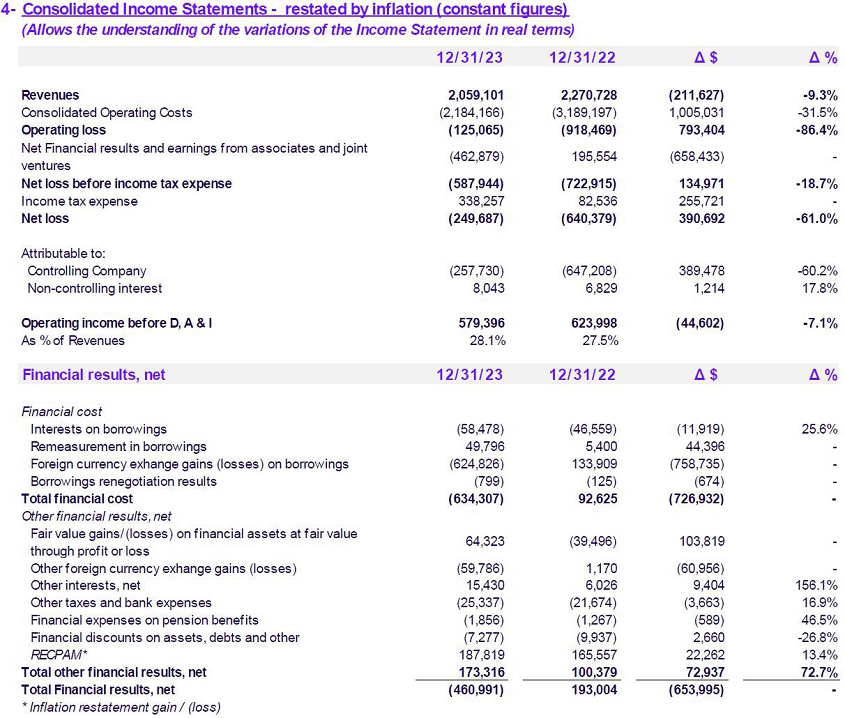

| · | The

margin over revenues has improved, even in the challenging context in Argentina, registering

28.1% in FY23 (compared to 27.5% in FY22). This variation is due to the effective management

of Operating Costs before Depreciation, Amortization, and Impairment of Fixed Assets, which

experienced a strong decline in real terms during EE23 (-10.1% vs EE22). In FY23, Operating

Income before Depreciation, Amortization and Impairment of Fixed Assets (“Operating

Income Before D, A & I”) amounted to P$579,396 million (-7.1% vs. FY22). |

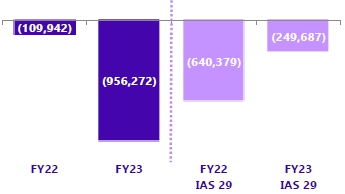

| · | As

a result of the strong devaluation of the Argentine peso against the US dollar in real terms,

during the FY23, the Company recorded a net loss of P$249,687 million (vs. a loss of P$640,379

million in FY22) mainly explained by exchange [rate?] differences losses included in Financial

Results. |

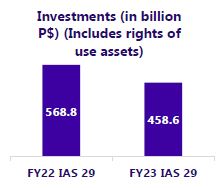

| · | Investments

in 2023 include the acquisition of the 100MHz block of 5G spectrum in the 3.5GHz band during

October. As a result, investments (including right-of-use assets) amounted to P$568,817 million

in FY23, which represents 27.6% of our Consolidated Revenues. CAPEX (excluding right-of-use

assets) during the FY23 represented 23.5% of Consolidated Revenues. |

| · | Net

Financial Debt increased due to the strong devaluation in real terms that occurred in December 2023

amounting to P$1,849,559 million in FY23 (+41.1% in constant currency vs. FY22). Additionally,

this increase is partially attributed to the acquisition of funds for 5G spectrum financing. |

*Market capitalization as of March 8, 2024

**Unaudited non-financial information

*(Figures

may not add up due to rounding)

**

(in constant currency - includes right-of-use assets as of December 31, 2023, for P$85,619 million and as of December 31, 2022,

for P$65,386 million)

***

(Includes IP telephony lines, which amounted to approximately 1.52 million and 1.10 million as of December 31, 2023, and December 31,

2022, respectively)

Consolidated Revenues

(in million P$)

| | Operating

Income before D, A & I (EBITDA)

(in million P$)

|

| | | |

| |  |

| | | |

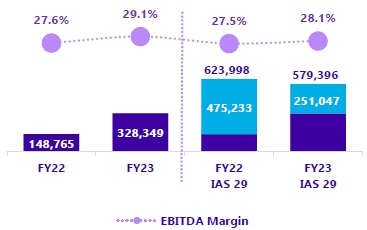

Operating Income (Loss) (EBIT)

(in million P$)

| | Net

Income (Loss)

(in million P$)

|

| | | |

| |  |

Buenos

Aires, March 11, 2024 - Telecom Argentina S.A.

(“Telecom Argentina”) - (NYSE: TEO; BYMA: TECO2), announced today a net loss of P$249,687 million for the period ended December 31,

2023. The net income attributable to the controlling company was P$257,730 million.

Comparative

figures for the previous fiscal year have been restated by inflation so that the resulting information is presented in terms of the current

measurement unit as of December 31, 2023.

The

following table shows the evolution of the national consumer price index (National CPI - according to INDEC’s official statistics)

for the last three fiscal years, used for the restatement of figures in constant currency.

| |

As

of December 31,

2021 |

As

of December 31,

2022 |

As

of December 31,

2023 |

| Annual |

50.9% |

94.8% |

211.4% |

3-month

cumulative

(Since

September) |

n/a |

n/a |

53.3% |

During

the FY23, Consolidated Revenues amounted to P$2,059,101 million, from which Service Revenues totaled P$1,905,932 million.

During

the FY23, Service Revenues decreased by 10.1% compared to FY22, mainly due to a decrease in real ARPUs in the main segments as a result

of not fully passing through the effects of the year-on-year inflation (which was 211.4%) to prices and offering higher discounts to

retain customers in the face of intense market competition.

Consolidated

Revenues

Mobile

Services

As

of December 31, 2023, total mobile subscribers in Argentina and Paraguay amounted to 23.3 million. In FY23, mobile services revenues

reached P$829,552 million (- P$83,221 million or -9.1% vs. FY22), obtaining the highest share in terms of service revenues (43.5%

and 43.1% of service revenues in FY23 and FY22, respectively). Mobile internet revenues in FY23 were equivalent to 92% of total sales

for these services, while in FY22 they were equivalent to 86% of total sales for these services.

Mobile

Services in Argentina

As

of December 31, 2023, total mobile subscribers amounted to approximately 21 million (+760 thousand vs. FY22). Throughout the period,

there has been a change in customer behavior, resulting in a 11.2% increase in the prepaid subscriber base and a 6.1% decrease in the

postpaid subscriber base. As of December 31, 2023, postpaid accesses represent 39% of our mobile subscriber base.

In

FY23, mobile service revenues in Argentina amounted to P$763,043 million (-$71,638 million or -8.6% vs FY22). The average monthly revenue

per user (“ARPU”) amounted to P$3,056.1 during the FY23 (vs. $3,433.6 in FY22). The effect generated by the restatement in

terms of the current measurement unit as of December 31, 2023, included in the ARPU amounted to P$1,383.1 and P$2,613.5 for FY23

and FY22, respectively. The average monthly churn rate was 1.8% in FY23 (compared to an average of 2.3% in FY22).

On

October 24, through a public auction, the Company acquired a 100MHz block of spectrum in the 3.5GHz band, marking an initial milestone

for the deployment of 5G technology in the country. As of the date of this report, the Company has over 100 sites operational with 5G

technology in the 3.5 GHz band.

During

the Mobile World Congress 2024, the Company was awarded for the fifth consecutive time by Ookla, a global leader in network usage testing,

for having the fastest mobile network in Argentina, as verified through its SpeedTest platform. Thus, it is the only operator in Latin

America to achieve this accomplishment.

Personal

in Paraguay (“Núcleo”)

As

of December 31, 2023, Núcleo’s subscriber base reached 2.3 million accesses. Of the total number of accesses, 76% correspond

to the prepaid modality and 24% to the postpaid modality, whereas as of December 31, 2022, prepaid accesses represented 79% and

postpaid accesses 21%.

During

FY23, Mobile service revenues in Paraguay reached $66,509 million (- $11,583 million or -14.8% vs. FY22), driven by a decline in ARPU

in guaraníes.

Internet

Services

Internet

services revenues totaled P$449,904 million during the FY23 (-P$53,767 million or -10.7% vs. FY22). Total broadband subscribers reached

approximately 4.1 million in FY23 (-42 thousand vs. FY22) remaining relatively steady since the second quarter of the year. The monthly

churn rate of Internet services was positioned at 1.8% and 1.6% as of December 31, 2023, and 2022, respectively.

Additionally,

broadband ARPU (restated in constant currency as of December 31, 2023) amounted to P$8,671.6 in FY23 (vs. P$9,505.4 in FY22). The

effect generated by the restatement in terms of the measuring unit as of December 31, 2023, included in the ARPU amounted to approximately

P$3,844.1 and P$7,251.3 for the FY23 and FY22, respectively.

As

of December 31, 2023, customers with a service of 100 Mb or higher represent 85% of the total customer base (vs. 79% as of December 31,

2022). In FY23, accesses with this speed or higher amounted to 3.5 million (+6.1% compared to FY22).

Cable

TV Services

| |

Cable

TV service revenues reached P$363,367 million in FY23 (-P$44,278 million or -10.9% vs. FY22). Cable TV subscribers, including Uruguay

and Paraguay, totaled approximately 3.4 million (-115 thousand vs. FY22). The monthly Cable TV ARPU (restated in constant currency as

of December 31, 2023) reached P$8,591.2 during the FY23 (vs. P$9,363.7 in FY22). The effect generated by the restatement in terms

of the measuring unit as of December 31, 2023, included in the ARPU amounts to P$3,974.7 and P$7,158.4, for FY23 and FY22, respectively.

The

subscriber base in Argentina amounted to 3.1 million accesses as of December 31, 2023, reflecting a 3.5% decrease compared to FY22.

This decline is primarily attributed to the country's economic situation and a shift in customer consumption trends. Despite this, the

number of Flow subscribers continued to grow (+10% vs. FY22), demonstrating the strength and market acceptance of the platform in the

market. Premium subscriptions as of FY23 amounted to 1.2 million. Monthly churn rate was 1.8% and 1.3% as of December 31, 2023,

and as of December 31, 2022, respectively.

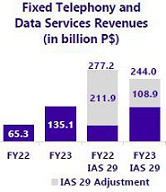

Fixed

Telephony and Data Services

Revenues

generated by fixed telephony and data services reached P$244,009 million in FY23 (-33,215 million or -12.0% vs. FY22).

The

monthly fixed voice ARPU (restated in constant currency as of December 31, 2023) reached P$4,205.1 in FY23 (vs. P$4,499.8 in FY22).

The effect generated by the restatement in terms of the measuring unit as of December 31, 2023, included in the ARPU amounted to

P$2,079.6 and P$3,496.2 for FY23 and FY22, respectively.

The

corporate segment continues to develop new solutions to support companies in boosting their business and advancing digital transformation

in this new context.

Revenues

from equipment sales

Equipment

revenues amounted to P$153,169 million (+P$1,760 million or +1.2% vs. FY22). This variation is mainly due to a 13% increase in the quantity

of handsets sold.

Personal

Pay

Our

virtual wallet service, Personal Pay, ended the year with more than 2 million customers (vs. 729 thousand in December 2022). Personal

Pay developed new features, including the addition of remunerated account balance services, prepaid cards for teenagers, Extra Pay and

B2B solutions, among others.

Consolidated

Operating Costs

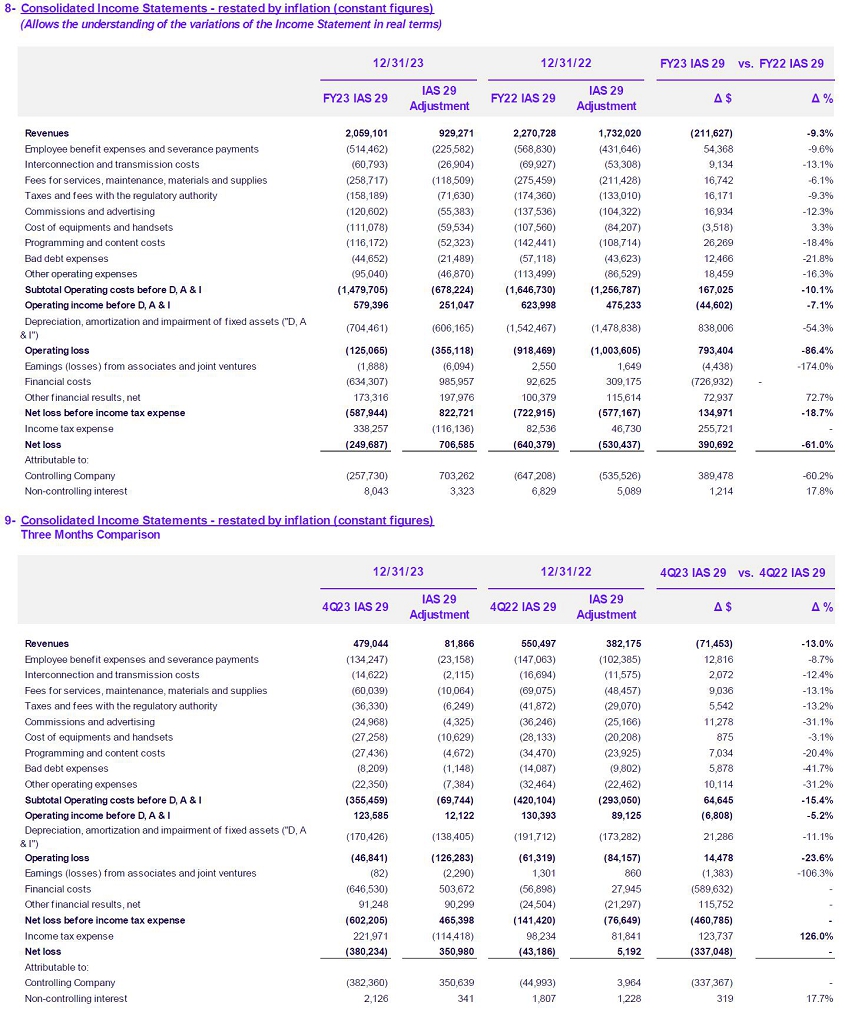

Consolidated

Operating Costs (including Depreciation, Amortization and Impairment of Fixed Assets) totaled P$2,184,166 million in FY23 (-P$1,005,031

million or -31.5% vs. FY22). Excluding Depreciation, Amortization and Impairment of Fixed Assets, operating costs experienced a reduction

of 10.1% in real terms during the same period.

The

cost breakdown was as follows:

| · | Employees

benefits and severance payments: P$514,462 million in FY23 (-9.6% vs. FY22). Total employees

amounted to 21,262 as of December 31, 2023. |

| · | Interconnection

and transmission costs (including roaming, international settlement charges and lease of

circuits): P$60,793 million (-13.1% vs. FY22). |

| · | Fees

for services, maintenance and materials: P$258,717 million in FY23 (-6.1% vs. FY22). |

| · | Taxes

and fees paid to regulatory authorities: P$158,189 million (-9.3% vs. FY22). |

| · | Commissions

and advertising (commissions paid to agents, collection fees and other commissions): These

costs totaled P$120,602 million in FY23 (-12.3% vs. FY22). |

| · | Cost

of handsets sold: P$111,078 million (+3.3% vs. FY22). The increase is mainly explained by

a higher volume of handsets sold compared to FY22. |

| · | Programming

and content costs: P$116,172 million (-18.4% vs. FY22). |

| · | Other

Costs totaled P$139,692 million (-18.1% vs. FY22), of which bad debt expenses totaled P$44,652

million (-21.8% vs. FY22). |

| · | Our

bad debt ratio was 2.2% of total revenues as of December 31, 2023 (vs 2.5% in FY22). |

| · | Other

operating costs, including charges for lawsuits and other contingencies, energy and other

public services, insurance, rents and internet capacity, among others, totaled P$95,040 million

(-16.3% vs. FY22). |

| · | Depreciation,

amortization and impairment of fixed assets amounted to P$704,461 million (-54.3% vs. FY22). |

| · | The

decrease is mainly because in FY22, the Company recognized an impairment of goodwill assigned

to the Argentine cash-generating unit (CGU), amounting to $759,523 million in the currency

of FY23. |

| · | This

charge also includes the impact of the amortization of assets incorporated after December 31,

2022, partially offset by the effect of the assets that were completely amortized after such

date. |

Net

Financial Results

Net

Financial Results (including Financial Expenses on Debt and Other Financial Results) showed a loss of P$460,991 million in FY23 (vs.

an income of P$193,004 million in FY22), mainly due to:

*Related

to Notes issued in UVA

Income

Tax

Telecom’s

income tax includes the following effects:

| i) | the

current income tax, determined based on the current tax legislation applicable to Telecom, |

| ii) | the

effect of applying the deferred tax method on temporary differences generated when comparing

our asset and liability valuation according to tax and financial accounting criteria which

includes the effect of the income tax inflation adjustment. |

Income

tax gain amounted to P$338,257 million in FY23 (vs. an income of P$82,536 million in FY22). The loss related to item (i) above amounted

to P$2,899 million in FY23 (vs. an income of P$54,562 million in FY22) and the income tax effect related to the application of the deferred

tax method described in item (ii) above is an income of P$341,156 million in FY23 (vs. an income of P$27,974 million in FY22).

Consolidated

Net Financial Debt

As

of December 31, 2023, our net financial debt (cash, cash equivalents – net of Client Funds - plus financial investments and

financial NDF* minus loans) is passive and amounted to P$1,849,559 million, which represents an increase of P$538,649 when compared to

the net financial debt as of December 31, 2022, restated by inflation. This increase is mainly due to the effect on foreign currency-denominated

debt of the devaluation of the Argentine peso against the US dollar in real terms.

*

Contemplates rate swaps and NDF (non-delivery forwards) agreements.

Investments

in PP&E, intangible assets and rights of use assets

During

the FY23, the Company invested (including rights of use assets) P$568,817 million (+24.0% vs. FY22). Said investments represented 27.6%

of consolidated revenues in FY23. As of December 31, 2023, investments without considering right of use of assets were affected

by import restrictions and totaled $483,198 million (-22.9% vs. FY22).

The

investments were focused on:

| · | Expansion

of cable TV and internet services to improve transmission and access speed offered to customers. |

| · | Deployment

and modernization of our 4G mobile access sites to improve coverage and increase mobile network

capacity. The deployment of 4G/LTE reached a coverage of 98% of the population in 2,032 locations

as of December 31, 2023. Our mobile subscribers with access to our 4G network, according

to Ookla's latest December 2023 benchmark, perceive an improved service experience,

reaching average speeds of 47.96Mbps, compared to 30Mbps during the same period in 2022. |

| · | Through

the government's public auction, we have acquired spectrum in the 3.5 MHz band, which will

accelerate the growth of our 5G service and will contribute to the expansion of mobile internet

and the improvement of service quality, and new Value Added Services. |

| · | Expanding

our transmission and transport networks to unify the different access technologies and to

consolidate the deployment of last-mile networks with FTTH architecture. |

Relevant

financial events of the period

Nulity

of Decree 690/2020

On

November 17, 2023, the Company was notified of the decision of Federal Administrative Court No. 8 in the case “Telecom

Argentina S.A. a/EN-Enacom and other re. on knowledge process” (Docket N° 4206/2021), which admitted the lawsuit initiated

by the Company and declared the nullity of Decree 690/2020 and ENACOM Resolutions N° 1466/2020 and 1467/2020.

Resignation

of Member and Alternate Member of the Board of Directors

On

December 1, 2023, the Company received resignation letters, as from December 7th 2023, of the Member of the Board of Directors

Eduardo Enrique de Pedro and of the Alternate Member of the Board of Directors Juan Santiago Fraschina, whose respective appointments

were proposed by FGS Anses.

Issuances

and financing during 2023

| (1) | For

the Series 15 notes, the subscription price was above par, thus, the Company received

funds equivalent to US$ 102.3 million. * |

| (2) | For

the Series 16 notes, the subscription price was above par, thus, the Company received

funds equivalent to US$ 213.2 million. * |

| (3) | For

the Series 18 notes, the subscription price was above par, thus, the Company received

funds equivalent to UVA 94.5 million. * |

| (4) | For

the Series 19 notes, the subscription price was above par, thus, the Company received

funds equivalent to US$ 48.3 million. * |

| (5) | For

the additional Series 19 notes, the subscription price was above par, thus, the Company

received funds equivalent to US$ 49.9 million. * |

*Excluding

issuance expenses

Relevant

events after December 31, 2023

Resignation

of Alternate Member of the Supervisory Committee

On

February 5, 2024, the Company received the resignation letter from the Alternate Member of the Supervisory Committee Luciano Nicolás

Giménez, effective as of that date, due to personal reasons.

Extension

of preliminary injunction

On

February 20, 2024, the Company informed of the decision rendered by the Federal Administrative Litigation Matters Court No. 8

in the proceedings “Telecom Argentina S.A. a/EN-Enacom and other re. preliminary injunction (Autonomous)” (Docket No. 12,881/2020)

whereby the Court decided to further extend for a period of six months the preliminary injunction previously granted to us according

to section 5 of Law No. 26,854.

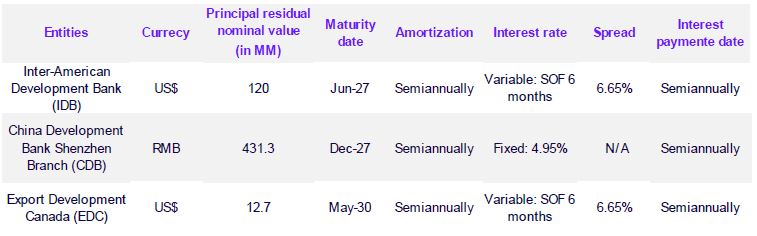

Compliance

with covenants

The Company holds certain

loans with IFC, IIC, IDB, Finnvera, EDC, and CDB, hereinafter collectively referred to as the "Lenders", whose balances as of

December 31, 2023, amounted to $769,919 million. These loans establish, among other provisions, the obligation to comply with certain

financial ratios, which are calculated based on contractual definitions: i) "Net Debt/EBITDA" and ii) "EBITDA/Interest

Net" on a quarterly basis, along with the presentation of the Company’s financial statements.

Considering the complexity

of Argentina's economic situation (for further reference, refer to note 29 of the Company's Consolidated Financial Statements as of December

31, 2023) which prevented the early and accurate estimation of the ratios, the Company requested and obtained from its lenders a waiver

with respect to its obligation to present the calculation of the Net Debt/EBITDA ratio until March 15, 2024. This waiver was conditioned

upon certain obligations during such period, which have been met to date.

During March 2024,

the Company requested and obtained from the lenders new waivers effective until March 31, 2025, which allowed to increase the Net Debt/EBITDA

maintenance ratio above the originally established level (raising it to 3.75), for the calculation period between December 31, 2023 and

December 31, 2024, inclusive, establishing a maximum Net Debt of US$2,700 billion on each calculation date, among other matters.

Additionally, during

the term of the waivers, the payment of dividends will be allowed during the period between October 1, 2024 and December 31, 2024, establishing

a maximum distribution amount of up to US$100 million, as long as a Net Debt/EBITDA maintenance ratio of less than 3 is met.

As of December 31, 2023, the Company is in compliance with the Net Debt/EBITDA maintenance ratio established in the waivers obtained in

March 2024, as well as with the rest of the commitments assumed and in force as of the date of submission of these earnings reports.

*******

Telecom

Argentina is a leading telecommunications company in Argentina, where it offers, either itself or through its controlled subsidiaries

local and long distance fixed-line telephone, cellular, data transmission, and pay TV and Internet services, among other services. Additionally,

Telecom Argentina offers mobile, broadband and satellite TV services in Paraguay and pay TV services in Uruguay. The Company commenced

operations on November 8, 1990, upon the Argentine government’s transfer of the telecommunications system in the northern

region of Argentina.

As

of December 31, 2023, Telecom Argentina owns 2,153,688,011 issued and outstanding shares.

|

*Trustees:

Hector Horacio Magnetto and David Manuel Martínez Guzmán |

For

more information, please contact Investor Relations:

Luis

Fernando Rial Ubago

lfrialubago@teco.com.ar

|

Tomás

Pellicori

tlpellicori@teco.com.ar |

Santiago

Gramegna

smgramegnavedani@teco.com.ar |

|

|

For

information about Telecom Argentina’s services, visit:

www.telecom.com.ar

www.personal.com.ar

www.personal.com.py

Disclaimer

This

document may contain statements that could constitute forward-looking statements, including, but not limited to (i) the Company’s

expectations for its future performance, revenues, income, earnings per share, capital expenditures, dividends, liquidity and capital

structure; (ii) the continued synergies expected from the merger between the Company and Cablevisión S.A. (or the Merger);

(iii) the implementation of the Company’s business strategy; (iv) the changing dynamics and growth in the telecommunications

and cable markets in Argentina, Paraguay, Uruguay and the United States; (v) the Company’s outlook for new and enhanced technologies;

(vi) the effects of operating in a competitive environment; (vii) the industry conditions; (viii) the outcome of certain

legal proceedings; and (ix) regulatory and legal developments. Forward-looking statements may be identified by words such as “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “plan,” “project,”

“will,” “may” and “should” or other similar expressions. Forward-looking statements are not guarantees

of future performance and involve certain risks and uncertainties that are difficult to predict. In addition, certain forward-looking

statements are based upon assumptions as to future events that may not prove to be accurate. Many factors could cause actual results,

performance or achievements of the Company to be materially different from any future results, performance or achievements that may be

expressed or implied by forward-looking statements. These factors include, among others: (i) the Company’s ability to successfully

implement our business strategy and to achieve synergies resulting from the Merger; (ii) the Company’s ability to introduce

new products and services that enable business growth; (iii) uncertainties relating to political and economic conditions in Argentina,

Paraguay, Uruguay and the United States, including the policies of the new government in Argentina; (iv) the impact of political

developments, including the policies of the new government in Argentina, on the demand for securities of Argentine companies; (v) inflation,

the devaluation of the peso, the Guaraní and the Uruguayan peso and exchange rate risks in Argentina, Paraguay and Uruguay; (vi) restrictions

on the ability to exchange Argentine or Uruguayan pesos or Paraguayan guaraníes into foreign currencies and transfer funds abroad;

(vii) the impact of currency and exchange measures or restrictions on our ability to access the international markets and our ability

to repay our dollar-denominated indebtedness; (viii) the creditworthiness of our actual or potential customers; (ix) the nationalization,

expropriation and/or increased government intervention in companies; (x) technological changes; (xi) the impact of legal or

regulatory matters, changes in the interpretation of current or future regulations or reform and changes in the legal or regulatory environment

in which the Company operates, including regulatory developments such as sanctions regimes in other jurisdictions (e.g., the United States)

which impact on the Company’s suppliers; (xii) the effects of increased competition; (xiii) reliance on content produced

by third parties; (xiv) increasing cost of the Company’s supplies; (xv) inability to finance on reasonable terms capital

expenditures required to remain competitive; (xvi) fluctuations, whether seasonal or in response to adverse macro-economic developments,

in the demand for advertising; (xvii) the Company’s ability to compete and develop our business in the future; (xviii) the

impact of increased national or international restrictions on the transfer or use of telecommunications technology; and (xix) the

impact of the outbreak of COVID-19 on the global economy and specifically on the economies of the countries in which we operate, as well

as on our operations and financial performance. Many of these factors are macroeconomic and regulatory in nature and therefore beyond

the control of the Company’s management. Should one or more of these risks or uncertainties materialize, or underlying assumptions

prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, expected, intended,

planned or projected. The Company does not intend and does not assume any obligation to update the forward-looking statements contained

in this document. These forward-looking statements are based upon a number of assumptions and other important factors that could cause

our actual results, performance or achievements to differ materially from our future results, performance or achievements expressed or

implied by such forward-looking statements. Readers are encouraged to consult the Company’s Annual Report on Form 20-F and

the periodic filings made on Form 6-K, which are periodically filed with or furnished to the United States Securities and Exchange

Commission, as well as the presentations periodically filed before the Argentine Securities and Exchange Commission (Comisión

Nacional de Valores) and the Buenos Aires Stock Exchange (Bolsas y Mercados Argentinos), for further information concerning risks and

uncertainties faced by the Company.

(Financial

tables follow)

*******

Telecom

Argentina S.A.

Consolidated

Information

Annual

period – Fiscal Year 2023

(in

million Argentine Pesos)

Telecom

Argentina S.A.

Consolidated

Information

Annual

period – Fiscal Year 2023

(in

million Argentine Pesos)

Telecom

Argentina S.A.

Consolidated

Information

Annual

period – Fiscal Year 2023

(in

million Argentine Pesos)

Telecom

Argentina S.A.

Consolidated

Information

Annual

period – Fiscal Year 2023

(in

million Argentine Pesos)

Telecom

Argentina S.A.

Consolidated

Information

Annual

period – Fiscal Year 2023

(in

million Argentine Pesos)

Telecom

Argentina S.A.

Consolidated

Information

Annual

period – Fiscal Year 2023

(in

million Argentine Pesos)

Telecom

Argentina S.A.

Consolidated

Information

Annual

period – Fiscal Year 2023

(in

million Argentine Pesos)

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Telecom Argentina S.A. |

| |

|

| |

|

| |

|

| Date: |

March

11, 2024 |

By: |

/s/

Luis Fernando Rial Ubago |

| |

|

|

Name: |

Luis

Fernando Rial Ubago |

| |

|

|

Title: |

Responsible

for Market Relations |

Grafico Azioni Telecom Argentina (NYSE:TEO)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Telecom Argentina (NYSE:TEO)

Storico

Da Gen 2024 a Gen 2025