UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material under §240.14a‑12

| | |

| WESTERN ASSET MORTGAGE CAPITAL CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(l) and 0-11

| | |

On October 19, 2023, Western Asset Mortgage Capital Corporation (“WMC”) mailed to its stockholders the following materials relating to WMC's special meeting of stockholders: |

October 19, 2023

Dear Fellow Stockholder,

On October 3, 2023, we mailed proxy materials to you regarding our proposed merger with AG Mortgage Investment Trust, Inc. (“MITT”) (the “Merger”) and the Special Meeting of Stockholders (the “Special Meeting”) of Western Asset Mortgage Capital Corporation (the “Company” or “WMC”) to be held on November 7, 2023. The proxy materials are also available at http://proxy.westernassetmcc.com.

The Board of Directors (the “Board”) of the Company unanimously recommends that stockholders vote “FOR” all proposals set forth in the proxy materials as it has determined that the Merger Agreement and the transactions contemplated thereby, including the Merger, are advisable, fair to and in the best interests of WMC and its stockholders, as outlined below and in the proxy materials.

WMC and MITT have complementary investment strategies, as both focus on residential mortgage credit investments. Based on valuations of WMC and MITT as of the quarter ended June 30, 2023, the combined company will have an investment portfolio valued at $5.7 billion, consisting of approximately 86% of Non-Agency residential mortgage loans, 5% Agency RMBS, and 6% other residential investments. WMC’s legacy commercial investments will represent approximately 3% of the total investment portfolio on a pro forma basis.

Due to the expected synergies between the two companies, we believe that the combined company will realize significant operating efficiencies, which should result in a reduced general and administrative expense ratio and a more optimized capital structure. As a result, we expect the combination of our businesses to be accretive to earnings within one year of closing and to support an attractive growth profile for the combined company.

Furthermore, given the increased scale of the combined company, we expect the investor base to expand, which should lead to enhanced trading liquidity and volume.

Finally, the combined company will be backed by strong commitments and resources from Angelo Gordon, the parent company of MITT’s external manager, which is a leading global alternative asset manager with extensive expertise in residential credit and a proprietary, best-in-class securitization platform that will support future growth of the residential mortgage portfolio. As an illustration of its support, MITT’s external manager has agreed to waive $2.4 million of management fees during the first year after closing.

Your vote is crucial.

Even if you plan to virtually attend the WMC special meeting, we urge you to authorize a proxy as promptly as possible by (1) accessing the Internet website specified on your proxy card, (2) calling

the toll-free number 1-800-776-9437 in the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone and following the instructions or (3) completing, signing, dating and returning the proxy card you received in the mail. If you hold your shares of WMC common stock in “street name,” which means through a broker, bank or other nominee, please follow the instructions on the voting instruction card furnished to you by such record holder.

Because adoption and approval of the proposed merger requires the affirmative vote of a majority of the Company’s issued and outstanding common stock, abstentions and broker non-votes with respect to the proposal will have the same effect as a vote “Against” the proposal.

For these reasons, your vote is extremely important.

If you have any questions regarding voting, you may call our proxy solicitor, Morrow Sodali, LLC, toll free at 1-800-662-5200.

Sincerely,

Bonnie M. Wongtrakool

Chief Executive Officer and Director

Important Additional Information and Where to Find It

In connection with the proposed Merger, MITT has filed with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (File No. 333-274319) (the “Registration Statement”), which was declared effective by the SEC on September 29, 2023. The Registration Statement includes a prospectus of MITT and a joint proxy statement of MITT and WMC (the “joint proxy statement/prospectus”). The joint proxy statement/prospectus contains important information about MITT, WMC, the proposed Merger and related matters. MITT and WMC may file with the SEC other documents regarding the Merger. The definitive joint proxy statement/prospectus has been sent to the stockholders of MITT and WMC, and contains important information about MITT, WMC, the proposed Merger and related matters. This communication is not a substitute for any proxy statement, registration statement, tender or exchange offer statement, prospectus or other document MITT or WMC has filed or may file with the SEC in connection with the proposed Merger and related matters. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE RELATED JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS THAT ARE FILED OR MAY BE FILED BY MITT AND WMC WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT MITT, WMC AND THE PROPOSED MERGER. Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by MITT with the SEC are also available free of charge on MITT’s website at www.agmit.com. Copies of the documents filed by WMC with the SEC are also available free of charge on WMC’s website at www.westernassetmcc.com.

Participants in the Solicitation Relating to the Merger

MITT, WMC and certain of their respective directors and executive officers and certain other affiliates of MITT and WMC may be deemed to be participants in the solicitation of proxies from the common stockholders of WMC and MITT in respect of the proposed Merger. Information regarding WMC and its directors and executive officers and their ownership of common stock of WMC can be found in WMC’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed

with the SEC on March 13, 2023, and in its definitive proxy statement relating to its 2023 annual meeting of stockholders, filed with the SEC on May 2, 2023. Information regarding MITT and its directors and executive officers and their ownership of common stock of MITT can be found in MITT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on February 27, 2023, and in its definitive proxy statement relating to its 2023 annual meeting of stockholders, filed with the SEC on March 22, 2023. Additional information regarding the interests of such participants in the Merger is included in the joint proxy statement/prospectus and other relevant documents relating to the proposed Merger filed with the SEC. These documents are available free of charge on the SEC’s website and from MITT or WMC, as applicable, using the sources indicated above.

No Offer or Solicitation

This communication and the information contained herein shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, as amended (the “Securities Act”). This communication may be deemed to be solicitation material in respect of the proposed Merger.

Forward-Looking Statements

This document contains certain “forward-looking” statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, as amended. MITT and WMC intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with the safe harbor provisions. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” “should,” “may,” “projects,” “could,” “estimates” or variations of such words and other similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature, but not all forward-looking statements include such identifying words. Forward-looking statements regarding MITT and WMC include, but are not limited to, statements related to the proposed Merger, including the anticipated timing, benefits and financial and operational impact thereof; other statements of management’s belief, intentions or goals; and other statements that are not historical facts. These forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties associated with: MITT’s and WMC’s ability to complete the proposed Merger on the proposed terms or on the anticipated timeline, or at all, including risks and uncertainties related to securing the necessary stockholder approval from WMC’s and MITT’s respective stockholders and satisfaction of other closing conditions to consummate the proposed Merger; the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement; risks related to diverting the attention of MITT and WMC management from ongoing business operations; failure to realize the expected benefits of the proposed Merger; significant transaction costs and/or unknown or inestimable liabilities; the risk of stockholder litigation in connection with the proposed Merger, including resulting expense or delay; the risk that MITT’s and WMC’s respective businesses will not be integrated successfully or that such integration may be more difficult, time-consuming or costly than expected; and effects relating to the announcement of the proposed Merger or any further announcements or the consummation of the proposed Merger on the market price of MITT’s or WMC’s common stock. Additional risks and uncertainties related to MITT’s and WMC’s business are included under the headings “Forward-Looking Statements” and “Risk Factors” in the joint proxy statement/prospectus and MITT’s and

WMC’s Annual Report on Form 10-K for the year ended December 31, 2022, and in other reports and documents filed by either company with the SEC from time to time. Moreover, other risks and uncertainties of which MITT or WMC are not currently aware may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated in the forward-looking statements, even if they are subsequently made available by MITT or WMC on their respective websites or otherwise. Neither MITT nor WMC undertakes any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made, except as required by law.

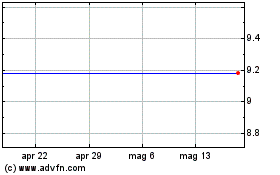

Grafico Azioni Western Asset Mortgage C... (NYSE:WMC)

Storico

Da Mar 2024 a Apr 2024

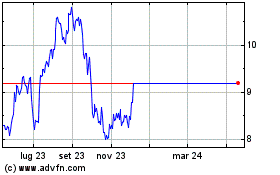

Grafico Azioni Western Asset Mortgage C... (NYSE:WMC)

Storico

Da Apr 2023 a Apr 2024