Filed by Exxon Mobil

Corporation

(Commission File No.:

001-02256)

Pursuant to Rule 425

of the Securities Act of 1933

and deemed filed pursuant

to Rule 14a-12

of the Securities

Exchange Act of 1934

Subject Company: Pioneer

Natural Resources Company

(Commission File No.:

001-13245)

| Pioneer

Merger Key Messages |

Key messages:

| · | This

deal strengthens America’s energy security by bringing the best technologies, operational

excellence and financial capability to an important source of domestic supply. This will

enable ExxonMobil to increase the production from these existing assets more efficiently

and with a lower environmental impact. |

| · | The

proposed merger advances the energy transition. By combining both companies’ operational

best practices and infrastructure, ExxonMobil will lower its collective environmental footprint

and accelerate Pioneer Natural Resources net-zero plan from 2050 to 2035. |

| o | ExxonMobil will work to leverage its

Permian GHG reduction plans to accelerate Pioneer Natural Resources net zero target by 15

years. |

| o | Our goal is lower both companies’

methane emissions in the Permian by using the same aggressive strategy and applying our industry-leading

new technologies for monitoring, measuring, and addressing fugitive methane. |

| o | Using combined operating capabilities

and infrastructure, we expect to increase the amount of recycled water used in our Permian

operations to more than 90% by 2030. |

| · | Pioneer’s

contiguous acreage creates greater opportunities to deploy our technologies, delivering operating

and capital efficiency as well as significantly increasing production. |

| o | Adding Pioneer to our existing land in

the Midland basin will allow us to do what we do best – drill and complete very long,

successful wells in the most efficient manner. |

| o | We expect to enhance field digitalization

and automation that will optimize production throughput and cost. |

| · | Transaction

summary: We plan to purchase Pioneer in an all-stock deal valued at approximately $60 billion

and expect the deal to close in the first half of 2024 pending Pioneer shareholder approval

and regulatory approvals. |

| · | While

the deal is “big” in terms of dollar value it is small in terms of the combined

companies’ aggregate volume of oil and gas production globally, domestically and in

the Permian, which is ~15% in the Permian, ~5% in the US and ~3% worldwide. |

Deal details: The approximately

$60 billion merger creates industry-leading, high-quality, high-return undeveloped U.S. unconventional inventory by adding Pioneer Natural

Resources’ more than 850,000 net acres in the Midland Basin to ExxonMobil’s 570,000 net acres in the Delaware and Midland

basins for a combined, estimated resource of 16 billion barrels of oil equivalent.

| o | ExxonMobil’s Permian production

volume would more than double to 1.3 million barrels of oil equivalent (MOEBD), based on

2023 volumes at the close of the deal, which is expected in the first half of 2024 subject

to Pioneer shareholder approval and regulatory approvals. |

Questions and Answers:

Q1. Does this transaction mean

ExxonMobil is doubling down on fossil fuels?

| A1. | We are investing in both sides of the “and

equation.” This deal is an opportunity to provide energy security and use our technology

and expertise to lower costs of oil and gas extraction – not raise them. For ExxonMobil,

this is also a unique chance to take a very large U.S. energy producer and bend their carbon

emissions curve in the same direction in which ExxonMobil’s carbon intensity is heading,

downward. |

Q2. Will this merger impact jobs?

| A2. | Reducing overhead and the workforce is not

driving this deal. Significant benefits will come from the combined capabilities of the two

organizations, our advanced technology and Pioneer Natural Resources advantaged acreage. |

| Q3. | Will ExxonMobil close Pioneer’s

Irving office and moving its employees to Houston? If so, when? |

| A3. | Pioneer’s Irving office will remain

open for at least two years. Updates will be provided as the companies move through the integration

process. |

| Q4. | Will consumers see an impact to

gas prices as a result of the planned merger? |

| A4. | We expect to generate incremental returns

by recovering more resources, more efficiently with lower environmental impact – a

win for consumers and the companies’ shareholders. |

| Q5. | Does the deal harm competition? |

| A5. | The deal is small in terms of combined share

of global, U.S. and Permian production – it’s less than 3% of global, 6% of US

domestic, and 15% of total Permian basin production combined. |

Also, there is no meaningful

horizontal overlap between Pioneer and Exxon’s nonproduction related assets.

| · | Pioneer

does not own or operate any refinery, terminal, or retail related assets. |

| · | Pioneer

does not operate any pipelines, gathering systems or gas processing facilities. |

| · | Exxon

does not operate any pipelines, gathering systems or gas processing facilities in the Midland

Basin. |

Important Information about the Transaction

and Where to Find It

In connection with the proposed transaction

between Exxon Mobil Corporation (“ExxonMobil”) and Pioneer Natural Resources Company (“Pioneer”), ExxonMobil

and Pioneer will file relevant materials with the Securities and Exchange Commission (the “SEC”), including a registration

statement on Form S-4 filed by ExxonMobil that will include a proxy statement of Pioneer that also constitutes a prospectus of ExxonMobil.

A definitive proxy statement/prospectus will be mailed to stockholders of Pioneer. This communication is not a substitute for the registration

statement, proxy statement or prospectus or any other document that ExxonMobil or Pioneer (as applicable) may file with the SEC in connection

with the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF EXXONMOBIL AND PIONEER

ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL

BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME

AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and

security holders may obtain free copies of the registration statement and the proxy statement/prospectus (when they become available),

as well as other filings containing important information about ExxonMobil or Pioneer, without charge at the SEC’s Internet website

(http://www.sec.gov). Copies of the documents filed with the SEC by ExxonMobil will be available free of charge on ExxonMobil’s

internet website at www.exxonmobil.com under the tab “investors” and then under the tab “SEC Filings” or by contacting

ExxonMobil’s Investor Relations Department at investor.relations@exxonmobil.com. Copies of the documents filed with the SEC by

Pioneer will be available free of charge on Pioneer’s internet website at https://investors.pxd.com/investors/financials/sec-filings/.

The information included on, or accessible through, ExxonMobil’s or Pioneer’s website is not incorporated by reference into

this communication.

Participants in the Solicitation

ExxonMobil, Pioneer, their respective

directors and certain of their respective executive officers may be deemed to be participants in the solicitation of proxies in respect

of the proposed transaction. Information about the directors and executive officers of Pioneer is set forth in its proxy statement for

its 2023 annual meeting of stockholders, which was filed with the SEC on April 13, 2023, in its Form 10-K for the year ended December

31, 2022, which was filed with the SEC on February 23, 2023, in its Form 8-K filed on May 30, 2023, in its Form 8-K filed on April 26,

2023 and in its Form 8-K filed on February 13, 2023. Information about the directors and executive officers of ExxonMobil is set forth

in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 13, 2023, in its Form 10-K

for the year ended December 31, 2022, which was filed with the SEC on February 22, 2023, in its Form 8-K filed on June 6, 2023 and in

its Form 8-K filed on February 24, 2023. Additional information regarding the participants in the proxy solicitations and a description

of their direct or indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other

relevant materials filed with the SEC when they become available.

No Offer or Solicitation

This communication is for informational

purposes and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to buy any securities or

a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities

Act of 1933, as amended.

Forward-Looking Statements

This communication contains “forward-looking

statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address future

business and financial events, conditions, expectations, plans or ambitions, and often contain words such as “expect,” “anticipate,”

“intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,”

“target,” similar expressions, and variations or negatives of these words, but not all forward-looking statements include

such words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements

about the consummation of the proposed transaction and the anticipated benefits thereof. All such forward-looking statements are based

upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are

beyond the control of ExxonMobil and Pioneer, that could cause actual results to differ materially from those expressed in such forward-looking

statements. Important risk factors that may cause such a difference include, but are not limited to: the completion of the proposed transaction

on anticipated terms and timing, or at all, including obtaining regulatory approvals that may be required on anticipated terms and Pioneer

stockholder approval; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies,

economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management,

expansion and growth of the combined company’s operations and other conditions to the completion of the proposed transaction, including

the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within

the expected time period; the ability of ExxonMobil and Pioneer to integrate the business successfully and to achieve anticipated synergies

and value creation; potential litigation relating to the proposed transaction that could be instituted against ExxonMobil, Pioneer or

their respective directors; the risk that disruptions from the proposed transaction will harm ExxonMobil’s or Pioneer’s business,

including current plans and operations and that management’s time and attention will be diverted on transaction-related issues;

potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction;

rating agency actions and ExxonMobil and Pioneer’s ability to access short- and long-term debt markets on a timely and affordable

basis; legislative, regulatory and economic developments, including regulatory implementation of the Inflation Reduction Act, timely

and attractive permitting for carbon capture and storage by applicable federal and state regulators, and other regulatory actions targeting

public companies in the oil and gas industry and changes in local, national, or international laws, regulations, and policies affecting

ExxonMobil and Pioneer including with respect to the environment; potential business uncertainty, including the outcome of commercial

negotiations and changes to existing business relationships during the pendency of the proposed transaction that could affect ExxonMobil’s

and/or Pioneer’s financial performance and operating results; certain restrictions during the pendency of the proposed transaction

that may impact Pioneer’s ability to pursue certain business opportunities or strategic transactions or otherwise operate its business;

acts of terrorism or outbreak of war, hostilities, civil unrest, attacks against ExxonMobil or Pioneer, and other political or security

disturbances; dilution caused by ExxonMobil’s issuance of additional shares of its common stock in connection with the proposed

transaction; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected

factors or events; changes in policy and consumer support for emission-reduction products and technology; the impacts of pandemics or

other public health crises, including the effects of government responses on people and economies; global or regional changes in the

supply and demand for oil, natural gas, petrochemicals, and feedstocks and other market or economic conditions that impact demand, prices

and differentials, including reservoir performance; changes in technical or operating conditions, including unforeseen technical difficulties;

those risks described in Item 1A of ExxonMobil’s Annual Report on Form 10-K, filed with the SEC on February 22, 2023, and subsequent

reports on Forms 10-Q and 8-K, as well as under the heading “Factors Affecting Future Results” on the Investors page of ExxonMobil’s

website at www.exxonmobil.com (information included on or accessible through ExxonMobil’s website is not incorporated by reference

into this communication); those risks described in Item 1A of Pioneer’s Annual Report on Form 10-K, filed with the SEC on February

23, 2023, and subsequent reports on Forms 10-Q and 8-K; and those risks that will be described in the registration statement on Form

S-4 and accompanying prospectus available from the sources indicated above. References to resources or other quantities of oil or natural

gas may include amounts that ExxonMobil or Pioneer believe will ultimately be produced, but that are not yet classified as “proved

reserves” under SEC definitions.

These risks, as well as other risks associated

with the proposed transaction, will be more fully discussed in the proxy statement/prospectus that will be included in the registration

statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented

here is, and the list of factors to be presented in the registration statement on Form S-4 will be, considered representative, no such

list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant

additional obstacles to the realization of forward-looking statements. We caution you not to place undue reliance on any of these forward-looking

statements as they are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without

limitation, our actual results of operations, financial condition and liquidity, and the development of new markets or market segments

in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this communication.

Neither ExxonMobil nor Pioneer assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether

as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities

and other applicable laws. Neither future distribution of this communication nor the continued availability of this communication in

archive form on ExxonMobil’s or Pioneer’s website should be deemed to constitute an update or re-affirmation of these statements

as of any future date.

Actions needed to advance ExxonMobil’s

2030 and 2035 greenhouse gas emission-reductions plans are incorporated into its medium-term business plans, which are updated annually.

The reference case for planning beyond 2030 is based on the Company’s Energy Outlook research and publication. The Outlook is reflective

of the existing global policy environment, the Energy Outlook does not attempt to project the degree of required future policy and technology

advancement and deployment for the world, or ExxonMobil, to meet net zero by 2050. As future policies and technology advancements emerge,

they will be incorporated into the Outlook, and the Company’s business plans will be updated accordingly. Actual future results,

including the achievement of net zero in Upstream Permian Basin unconventional operated assets by 2030/2035 and plans to lower methane

emissions from operated assets, to increase water recycling in our combined Permian operations, and to feed hydrogen, ammonia, and carbon

capture projects could vary depending on the ability to execute operational objectives on a timely and successful basis; policy support

for emission-reduction products and technologies; changes in laws, regulations and international treaties regarding lower emission technologies

and projects; government incentives; unforeseen technical or operational difficulties; the outcome of research efforts and future technology

developments, including the ability to scale projects, technologies, and markets on a commercially competitive basis; changes in supply

and demand and other market factors affecting future prices of oil, gas, and petrochemical products; the actions of competitors; and

other factors discussed in this communication and in the additional Forward Looking Statement disclaimer included above.

All references to production rates, project

capacity, resource size, and acreage are on a gross basis, unless otherwise noted.

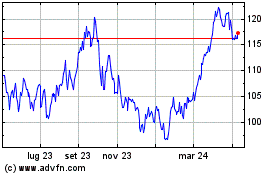

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Giu 2024 a Lug 2024

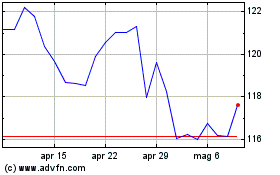

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Lug 2023 a Lug 2024