TransAlta Corporation (“TransAlta” or the

“Company”) (TSX: TA) (NYSE: TAC) today reported its financial

results for the three and nine months ended Sept. 30, 2024,

demonstrating another quarter of strong financial performance.

"Our third quarter results illustrate the value

of our proactive hedging strategy together with the active

management of our Alberta merchant portfolio. Our asset

optimization strategies have achieved exceptional results and we

are tracking toward the upper end of our 2024 guidance given our

portfolio position and performance during the first nine months of

the year," said John Kousinioris, President and Chief Executive

Officer of TransAlta.

"As we look forward, given the ample supply

conditions for Alberta throughout 2025, we have taken the decision

to temporarily mothball Sundance 6, holding it in reserve as we

continue to explore future economic opportunities relating to new

demand for electricity entering the province and the enhancement of

grid reliability. We will maintain flexibility to returning

Sundance 6 to service as market fundamentals improve or

opportunities to contract are secured."

"Finally, we remain actively engaged in

commercial discussions with Energy Capital Partners in respect of

the acquisition of Heartland Generation and are making progress

with the Competition Bureau in our effort to obtain regulatory

approval. We are optimistic that we have a pathway to completing

the transaction and adding Heartland's complementary assets to our

portfolio. We are also pursuing multiple opportunities to support

the energy transition in our core jurisdictions, while at the same

time actively pursuing redevelopment and recontracting

opportunities at our increasingly valuable legacy thermal fleet,"

added Mr. Kousinioris.

Third Quarter 2024 Financial Highlights

TransAlta's third quarter results exceeded

expectations delivering strong free cash flow and exceptional

operating performance. The Company delivered Free Cash Flow ("FCF")

per share(1) of $0.47, due to its proactive hedging and asset

management strategies given the anticipated decline in Alberta spot

power prices in 2024, milder than anticipated weather, low natural

gas prices and incremental generation from new supply in the

market. Highlights for the quarter include:

- Adjusted

EBITDA(1) of $325 million, compared to $453 million for the same

period in 2023

- Operational

adjusted availability of 94.5 per cent, compared to 91.9 per cent

for the same period in 2023

- FCF(1) of $140

million or $0.47 per share, compared to $228 million or $0.87 per

share for the same period in 2023

- The return of

$114 million of capital to shareholders during the nine months

ended Sept. 30, 2024, through the buyback of 11.8 million common

shares constituting 76 per cent of the Company's 2024 enhanced

share repurchase program of up to $150 million

- Tracking towards

the upper end of guidance for 2024 of

- Adjusted EBITDA

of $1,150 million to $1,300 million

- FCF of $450

million to $600 million

Other Business Highlights and Updates

- Advancing the

acquisition of Heartland Generation.

- Temporarily

mothballing Sundance Unit 6 effective April 1, 2025 for a period of

up to two years.

Key Business Developments

Advancing Acquisition of Heartland

Generation

The Company continues to remain actively engaged

with the federal Competition Bureau in an effort to obtain

Competition Act approval for the Heartland Generation acquisition.

We also remain engaged with Energy Capital Partners regarding

commercial terms to advance the completion of the transaction. The

Company remains optimistic that it has a pathway to completing the

transaction in a timely manner and to adding Heartland Generation

complementary assets to our portfolio.

Mothballing of Sundance Unit 6

On Nov. 4, 2024, the Company provided notice to

the Alberta Electric System Operator that Sundance Unit 6 will be

temporarily mothballed effective April 1, 2025, for a period of up

to two years depending on market conditions. TransAlta maintains

the flexibility to return the mothballed unit to service when

market fundamentals or opportunities to contract are secured. The

unit remains available and fully operational for the upcoming

winter season.

Appointment of New Chief Financial Officer

("CFO")

Joel Hunter was appointed Executive Vice

President, Finance and Chief Financial Officer of the Company

effective July 1, 2024.

Share Repurchase Program

TransAlta is committed to enhancing shareholder

returns through appropriate capital allocation such as share

buybacks and its quarterly dividend. In the first quarter of 2024,

the Company announced an enhanced common share repurchase program

for 2024 allocating up to $150 million, and targeting up to 42 per

cent of 2024 FCF guidance to be returned to shareholders in the

form of share repurchases and dividends.

On May 27, 2024, the Company announced that it

had received approval from the Toronto Stock Exchange to purchase

up to a maximum of 14 million common shares during the 12-month

period that commenced May 31, 2024, and terminates May 31, 2025.

Any common shares purchased under the NCIB will be cancelled.

During the nine months ended Sept. 30, 2024, the

Company purchased and cancelled a total of 11,814,700 common

shares, at an average price of $9.65 per common share, for a total

cost of $114 million, including taxes.

Third Quarter 2024 Highlights

|

$ millions, unless otherwise

stated |

Three months ended |

Nine months ended |

|

Sept. 30, 2024 |

Sept. 30, 2023 |

Sept. 30, 2024 |

Sept. 30, 2023 |

|

Operational information |

|

|

|

|

|

Adjusted availability (%) |

94.5 |

|

91.9 |

92.5 |

89.4 |

|

Production (GWh) |

5,712 |

|

5,678 |

16,612 |

16,246 |

| Select financial

information |

|

|

|

|

|

Revenues |

638 |

|

1,017 |

2,167 |

2,731 |

|

Adjusted EBITDA(1) |

325 |

|

453 |

968 |

1,343 |

|

Earnings before income taxes |

9 |

|

453 |

370 |

915 |

|

Net earnings (loss) attributable to common shareholders |

(36 |

) |

372 |

242 |

728 |

| Cash

flows |

|

|

|

|

|

Cash flow from operating activities |

229 |

|

681 |

581 |

1,154 |

|

Funds from operations(1) |

200 |

|

357 |

673 |

1,122 |

|

Free cash flow(1) |

140 |

|

228 |

521 |

769 |

| Per

share |

|

|

|

|

|

Net earnings (loss) per share attributable to common shareholders,

basic and diluted |

(0.12 |

) |

1.41 |

0.80 |

2.75 |

|

Funds from operations per share(1),(2) |

0.68 |

|

1.36 |

2.22 |

4.23 |

|

FCF per share(1),(2) |

0.47 |

|

0.87 |

1.72 |

2.90 |

|

Weighted average number of common shares outstanding |

296 |

|

263 |

303 |

265 |

Segmented Financial Performance

|

$ millions |

Three months ended |

Nine months ended |

|

Sept. 30, 2024 |

Sept. 30, 2023 |

Sept. 30, 2024 |

Sept. 30, 2023 |

|

Hydro |

89 |

|

150 |

|

259 |

|

403 |

|

| Wind and Solar |

44 |

|

37 |

|

221 |

|

175 |

|

| Gas |

139 |

|

254 |

|

419 |

|

660 |

|

| Energy Transition |

34 |

|

29 |

|

63 |

|

96 |

|

| Energy Marketing |

54 |

|

13 |

|

104 |

|

95 |

|

|

Corporate |

(35 |

) |

(30 |

) |

(98 |

) |

(86 |

) |

|

Total adjusted EBITDA |

325 |

|

453 |

|

968 |

|

1,343 |

|

|

Earnings before income taxes |

9 |

|

453 |

|

370 |

|

915 |

|

Third Quarter 2024 Financial Results

Summary

Production for the three months

ended Sept. 30, 2024, was 5,712 GWh compared to 5,678 GWh, an

increase of one per cent, compared to the same period in 2023,

primarily due to:

- Higher

production from the Wind and Solar segment, driven primarily by new

asset additions, including White Rock, Horizon Hill and Northern

Goldfields, together with the return to service of the Kent Hills;

partially offset by

- Lower production

from the Gas segment, primarily due to higher dispatch optimization

and lower market prices in Alberta;

- Lower production

from the Energy Transition segment, which was impacted by increased

economic dispatch at the Centralia facility due to lower market

prices; and

- Lower production

from the Hydro segment due to lower water resources and increased

planned outages.

Adjusted availability for the

three months ended Sept. 30, 2024, was 94.5 per cent, an increase

of 2.6 percentage points, compared to the same period in 2023,

primarily due to:

- The addition of

the newly commissioned Oklahoma wind and Western Australia solar

assets; and

- The return to

service of the Kent Hills wind facilities; partially offset

by

- Higher planned

major maintenance outages and unplanned outages in the Hydro

segment.

Adjusted EBITDA for the three months ended

Sept. 30, 2024, was $325 million, a decrease of $128 million, or 28

per cent, compared to the same period in 2023. The major factors

impacting adjusted EBITDA are summarized below:

- Hydro adjusted

EBITDA for the three months ended Sept. 30, 2024, decreased by $61

million, or 41 per cent, compared to the same period in 2023,

although broadly in line with expectations, primarily due to:

- Lower power

prices in the Alberta market; and

- Lower energy

production due to lower water resources in the North Saskatchewan

River region and increased planned outages across our fleet

compared to the same periods in 2023; partially offset by

- Higher ancillary

services volumes due to increased demand by the AESO;

- Realized

premiums over spot prices stemming from asset optimization

activities; and

- Higher

environmental and tax attributes revenues due to the increased

sales of emission credits to third parties and intercompany sales

to the Gas segment.

- Wind and Solar

adjusted EBITDA for the three months ended Sept. 30, 2024,

increased by $7 million, or 19 per cent, compared to the same

period in 2023, primarily due to:

- The addition of

the Oklahoma wind assets, including tax attribute revenue from the

transfer of production tax credits (PTC) to taxable US

counterparties; and

- Higher

production from the return to service of the Kent Hills wind

facilities; partially offset by

- Lower realized

power prices at our merchant assets in the Alberta market.

- Gas adjusted

EBITDA for the three months ended Sept. 30, 2024, decreased by $115

million, or 45 per cent, compared to the same period in 2023,

although results were broadly in line with expectations. The

decrease was primarily due to:

- Lower production

from the Alberta gas fleet where excess supply conditions in the

market drove higher dispatch optimization and lower realized

prices, which were partially mitigated by our higher volume of

hedges which had favourable premiums to spot merchant prices;

and

- Lower capacity

payments at Southern Cross Energy in Australia due to the scheduled

conclusion on Dec. 31, 2023, of the demand capacity charge under

the customer contract, partially offset by the commencement in

March 2024 of capacity payments for the Mount Keith 132kV

expansion.

- Energy

Transition adjusted EBITDA for the three months ended Sept. 30,

2024, increased by $5 million, or 17 per cent, compared to the same

period in 2023, primarily due to:

- Lower purchased

power costs driven by lower Mid-C prices on repurchases of power

and lower production; partially offset by

- Increased

economic dispatch due to lower market prices driving lower

production.

- Energy Marketing

adjusted EBITDA for the three months ended Sept. 30, 2024,

increased by $41 million, or 315 per cent, compared to the same

period in 2023, primarily due to favourable market volatility

across North American power and natural gas markets and higher

realized settled trades in the third quarter of 2024 in comparison

to the prior period.

- Corporate

adjusted EBITDA for the three months ended Sept. 30, 2024,

decreased by $5 million or 17 per cent, compared to the same period

in 2023, primarily due to increased spending for the planning and

design of the enterprise resource planning ("ERP") upgrade program,

and to support strategic and growth initiatives.

Net loss attributable to common

shareholders for the three months ended Sept. 30, 2024,

totalled $36 million, compared to net earnings attributable to

common shareholders of $372 million for the same period in 2023,

primarily due to:

- Lower adjusted

EBITDA due to the items discussed above;

- Lower unrealized

mark-to-market gains in the Gas segment was due to the prior period

having significant volume of favourable hedging positions relating

to the Alberta portfolio which largely have settled;

- Higher

unrealized mark-to-market losses in the Wind and Solar segment was

mainly due to the long-term wind energy sales related to the

Oklahoma projects in the Central US. The unrealized losses were due

to the strengthening forecasted wind capture prices reflected in

the period;

- Lower unrealized

mark-to-market gains in the Energy Marketing segment is mainly

driven by market volatility across North American power and natural

gas markets; and

- Higher asset

impairment charges resulting from changes in decommissioning and

restoration provisions related to discount rates and revision in

estimated costs to decommission retired assets; partially offset

by

- Lower

depreciation and amortization primarily due to revisions to useful

lives on certain facilities in prior periods.

Excluding unrealized mark-to-market losses and

gains, net earnings attributable to common shareholders for the

three months ended Sept. 30, 2024, was $23 million, or $0.08 per

share4 compared to $202 million, or $0.68 per share4, for the same

period in 2023.

FCF for the three months ended

Sept. 30, 2024, totalled $140 million, a decrease of $88 million,

or 39 per cent, compared to the same period in 2023, primarily due

to:

- Lower adjusted

EBITDA items as noted above;

- Higher current

income tax expense due to the full utilization of Canadian

non-capital loss carryforwards in 2023, partially offset by lower

earnings before income taxes for the period; and

- Higher net

interest expense3 due to lower capitalized interest driven by

completion of the construction program previously underway and

lower interest income resulting from lower cash balances; partially

offset by

- Lower

distributions paid to subsidiaries' non-controlling interests

relating to lower TransAlta Cogeneration, LP net earnings resulting

from lower merchant pricing in the Alberta market and the cessation

of distributions to TransAlta Renewables Inc. non-controlling

interest. On Oct. 5, 2023, the Company acquired all of the

outstanding common shares of TransAlta Renewables not already

owned, directly or indirectly.

Cash from operating activities

for the three months ended Sept. 30, 2024, of $229 million

decreased by $452 million, or 66 per cent, compared to the same

period in 2023, primarily due to:

- Lower revenues

net of unrealized losses from risk management activities; and

- Higher trade and

other receivables resulting in an unfavourable change in non-cash

operating working capital balances; partially offset by

- Lower fuel and

purchased power.

Alberta Electricity Portfolio

The average spot power price per MWh for the

three months ended Sept. 30, 2024, decreased to $55 per MWh from

$152 per MWh in the same period in 2023, primarily due to:

- Higher

generation from the addition of new wind, solar and gas supply in

the Alberta merchant market compared to the prior period;

- Lower natural

gas prices; and

- Lower volatility

due to milder weather compared to the same period in 2023.

The realized merchant power price per MWh of

production for the three months ended Sept. 30, 2024, decreased to

$90 MWh from $140 MWh, compared to the same period in 2023,

although was significantly higher than average spot power prices

during the quarter, primarily due to:

-

Lower average spot power prices as explained above; and

- Lower hedge

prices compared to the same period in 2023.

Carbon compliance cost per MWh of production for

the three months ended Sept. 30, 2024, increased to $19 per MWh

from $13 per MWh, compared to the same period in 2023, primarily

due to an increase in carbon pricing from $65 per tonne to $80 per

tonne.

Hedged volumes for the three months ended Sept.

30, 2024, were 2,365 GWh at an average price of $85 per MWh.

Volumes increased over the same period in 2023 by 246 GWh, with

realized gains and losses on financial hedges included in

Revenues.

Liquidity and Financial Position

We expect to maintain adequate available

liquidity under our committed credit facilities. As at Sept. 30,

2024, we had access to $1.8 billion in liquidity, including $401

million in cash.

2024 Financial Guidance

The following table outlines our expectations on

key financial targets and related assumptions for 2024:

|

Measure |

2024 Target |

|

Adjusted EBITDA |

$1,150 million - $1,300 million |

|

FCF |

$450 million - $600 million |

|

FCF per share |

$1.47 - $1.96 |

|

Dividend per share (annualized) |

$0.24 |

The Company's outlook for 2024 may be impacted

by a number of factors as detailed further below.

|

Market |

Updated 2024 Assumptions |

2024 Assumptions |

|

Alberta spot ($/MWh) |

$60 to $75 |

$75 to $95 |

|

Mid-C spot (US$/MWh) |

US$60 to US$70 |

US$75 to US$85 |

|

AECO gas price ($/GJ) |

$1.25 to $1.75 |

$2.50 to $3.00 |

Alberta spot price sensitivity: a +/- $1 per MWh

change in spot price is expected to have a +/-$1 million impact on

adjusted EBITDA for balance of year 2024.

Other assumptions relevant to the 2024

outlook

|

|

Updated 2024 Expectations |

2024 Expectations |

|

Energy Marketing gross margin |

$150 million to $170 million |

$110 million to $130 million |

|

Sustaining capital |

no change |

$130 million to $150 million |

|

Corporate cash taxes |

$140 million to $160 million |

$95 million to $130 million |

|

Cash interest |

no change |

$240 million to $260 million |

|

Hedging assumptions |

|

Q4 2024 |

Full year 2025 |

Full year 2026 |

|

Hedged production (GWh) |

|

2,415 |

5,541 |

3,640 |

| Hedge price ($/MWh) |

|

$82 |

$75 |

$78 |

| Hedged gas volumes (GJ) |

|

15 million |

28 million |

18 million |

| Hedge

gas prices ($/GJ) |

|

$2.55 |

$3.51 |

$3.67 |

Conference call

TransAlta will hold a conference call and

webcast at 9:00 a.m. MST (11:00 a.m. EST) today, November 5, 2024,

to discuss our third quarter 2024 results. The call will begin with

an address by John Kousinioris, President and Chief Executive

Officer, and Joel Hunter, Executive Vice President, Finance and

Chief Financial Officer, followed by a question and answer period

for investment analysts and investors. A question and answer period

for the media will immediately follow.

|

Third Quarter 2024 Conference Call |

|

|

|

Webcast link:

https://edge.media-server.com/mmc/p/22yb3pn9 |

| |

A link to the live webcast will be available on

the Investor Centre section of TransAlta’s website at

https://transalta.com/investors/presentations-and-events/. To

access the conference call via telephone, please register ahead of

time using the call link here:

https://register.vevent.com/register/BI863e6b314dbc4284ae19fafc47eca7ac.

Once registered, participants will have the option of 1) dialing

into the call from their phone (via a personalized PIN); or 2)

clicking the “Call Me” option to receive an automated call directly

to their phone.

Related materials will be available on the

Investor Centre section of TransAlta’s website at

https://transalta.com/investors/presentations-and-events/. If you

are unable to participate in the call, the replay will be

accessible at https://edge.media-server.com/mmc/p/22yb3pn9. A

transcript of the broadcast will be posted on TransAlta’s website

once it becomes available.

Notes

(1) These items are not defined and have no

standardized meaning under IFRS. Presenting these items from period

to period provides management and investors with the ability to

evaluate earnings (loss) trends more readily in comparison with

prior periods’ results. Please refer to the Non-IFRS Measures

section of this earnings release for further discussion of these

items, including, where applicable, reconciliations to measures

calculated in accordance with IFRS.(2) Funds from operations

("FFO") per share and free cash flow ("FCF") per share are

calculated using the weighted-average number of common

shares outstanding during the period. Refer to the Additional

IFRS Measures and Non-IFRS Measures section of the MD&A for the

purpose of these non-IFRS ratios.(3) Net interest expense includes

interest expense for the period less interest income.(4) Calculated

using the weighted average number of common shares outstanding for

the three months ended Sept. 30, 2024.

Non-IFRS financial measures and other specified

financial measures

We use a number of financial measures to

evaluate our performance and the performance of our business

segments, including measures and ratios that are presented on a

non-IFRS basis, as described below. Unless otherwise indicated, all

amounts are in Canadian dollars and have been derived from our

unaudited interim condensed consolidated financial statements

prepared in accordance with IFRS. We believe that these non-IFRS

amounts, measures and ratios, read together with our IFRS amounts,

provide readers with a better understanding of how management

assesses results.

Non-IFRS amounts, measures and ratios do not

have standardized meanings under IFRS. They are unlikely to be

comparable to similar measures presented by other companies and

should not be viewed in isolation from, as an alternative to, or

more meaningful than, our IFRS results.

Adjusted EBITDA

Each business segment assumes responsibility for

its operating results measured by adjusted EBITDA. Adjusted EBITDA

is an important metric for management that represents our core

operational results. In the second quarter of 2024, our reported

EBITDA composition was adjusted to include the impact of

acquisition transaction and integration costs as the Company does

not have frequent business acquisitions and the acquisition

transaction and integration costs are not reflective of Company’s

ongoing business performance. Accordingly, the Company has applied

this composition to all previously reported periods. Interest,

taxes, depreciation and amortization are not included, as

differences in accounting treatments may distort our core business

results. In addition, certain reclassifications and adjustments are

made to better assess results, excluding those items that may not

be reflective of ongoing business performance. This presentation

may facilitate the readers' analysis of trends.

Funds From Operations ("FFO")

FFO is an important metric as it provides a

proxy for cash generated from operating activities before changes

in working capital and provides the ability to evaluate cash flow

trends in comparison with results from prior periods. FFO is a

non-IFRS measure.

Free Cash Flow ("FCF")

FCF is an important metric as it represents the

amount of cash that is available to invest in growth initiatives,

make scheduled principal repayments on debt, repay maturing debt,

pay common share dividends or repurchase common shares. Changes in

working capital are excluded so FFO and FCF are not distorted by

changes that we consider temporary in nature, reflecting, among

other things, the impact of seasonal factors and timing of receipts

and payments. FCF is a non-IFRS measure.

Non-IFRS Ratios

FFO per share, FCF per share and adjusted net

debt to adjusted EBITDA are non-IFRS ratios that are presented in

the MD&A. Refer to the Reconciliation of Cash Flow from

Operations to FFO and FCF and Key Non-IFRS Financial Ratios

sections of the MD&A for additional information.

FFO per share and FCF per share

FFO per share and FCF per share are calculated

using the weighted average number of common shares outstanding

during the period. FFO per share and FCF per share are non-IFRS

ratios.

Reconciliation of these non-IFRS financial

measures to the most comparable IFRS measure are provided

below.

Reconciliation of Non-IFRS Measures on a Consolidated

Basis

The following table reflects adjusted EBITDA by

segment and provides reconciliation to earnings before income taxes

for the three months ended Sept. 30, 2024:

|

Three months ended Sept. 30, 2024 millions |

Hydro |

Wind & Solar(1) |

Gas |

Energy Transition |

EnergyMarketing |

Corporate |

Total |

Equity- accounted

investments(1) |

Reclass adjustments |

IFRS financials |

|

Revenues |

105 |

2 |

|

314 |

|

165 |

|

55 |

|

— |

|

641 |

|

(3 |

) |

— |

|

638 |

|

| Reclassifications

and adjustments: |

|

|

|

|

|

|

|

|

|

|

Unrealized mark-to-market (gain) loss |

1 |

74 |

|

(5 |

) |

(8 |

) |

(3 |

) |

— |

|

59 |

|

— |

|

(59 |

) |

— |

|

|

Realized gain (loss) on closed exchange positions |

— |

— |

|

(3 |

) |

— |

|

12 |

|

— |

|

9 |

|

— |

|

(9 |

) |

— |

|

|

Decrease in finance lease receivable |

— |

— |

|

5 |

|

— |

|

— |

|

— |

|

5 |

|

— |

|

(5 |

) |

— |

|

|

Finance lease income |

— |

1 |

|

2 |

|

— |

|

— |

|

— |

|

3 |

|

— |

|

(3 |

) |

— |

|

|

Unrealized foreign exchange loss on commodity |

— |

— |

|

1 |

|

— |

|

— |

|

— |

|

1 |

|

— |

|

(1 |

) |

— |

|

|

Adjusted revenues |

106 |

77 |

|

314 |

|

157 |

|

64 |

|

— |

|

718 |

|

(3 |

) |

(77 |

) |

638 |

|

| Fuel and purchased power |

4 |

5 |

|

100 |

|

104 |

|

— |

|

— |

|

213 |

|

— |

|

— |

|

213 |

|

| Reclassifications

and adjustments: |

|

|

|

|

|

|

|

|

|

|

Australian interest income |

— |

— |

|

(1 |

) |

— |

|

— |

|

— |

|

(1 |

) |

— |

|

1 |

|

— |

|

|

Adjusted fuel and purchased power |

4 |

5 |

|

99 |

|

104 |

|

— |

|

— |

|

212 |

|

— |

|

1 |

|

213 |

|

| Carbon

compliance |

— |

— |

|

40 |

|

1 |

|

— |

|

— |

|

41 |

|

— |

|

— |

|

41 |

|

|

Gross margin |

102 |

72 |

|

175 |

|

52 |

|

64 |

|

— |

|

465 |

|

(3 |

) |

(78 |

) |

384 |

|

|

OM&A |

13 |

26 |

|

43 |

|

17 |

|

10 |

|

35 |

|

144 |

|

(1 |

) |

— |

|

143 |

|

| Reclassifications and

adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Acquisition and integration costs |

— |

— |

|

— |

|

— |

|

— |

|

(1 |

) |

(1 |

) |

— |

|

1 |

|

— |

|

|

Adjusted OM&A |

13 |

26 |

|

43 |

|

17 |

|

10 |

|

34 |

|

143 |

|

(1 |

) |

1 |

|

143 |

|

| Taxes, other than

income taxes |

— |

5 |

|

3 |

|

1 |

|

— |

|

1 |

|

10 |

|

— |

|

— |

|

10 |

|

| Net other operating

income |

— |

(3 |

) |

(10 |

) |

— |

|

— |

|

— |

|

(13 |

) |

— |

|

— |

|

(13 |

) |

|

Adjusted EBITDA(2) |

89 |

44 |

|

139 |

|

34 |

|

54 |

|

(35 |

) |

325 |

|

|

|

|

|

Equity loss |

|

|

|

|

|

|

|

|

|

(1 |

) |

| Finance lease income |

|

|

|

|

|

|

|

|

|

3 |

|

| Depreciation and

amortization |

|

|

|

|

|

|

|

|

|

(133 |

) |

| Asset impairment charges |

|

|

|

|

|

|

|

|

|

(20 |

) |

| Interest income |

|

|

|

|

|

|

|

|

|

4 |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

(83 |

) |

| Foreign exchange loss |

|

|

|

|

|

|

|

|

|

(6 |

) |

| Gain on

sale of assets and other |

|

|

|

|

|

|

|

|

|

1 |

|

|

Earnings before income taxes |

|

|

|

|

|

|

|

|

|

9 |

|

(1) The Skookumchuck wind facility has been

included on a proportionate basis in the Wind and Solar segment.(2)

Adjusted EBITDA is not defined and has no standardized meaning

under IFRS. Refer to the non-IFRS financial measures and other

specified financial measures section in this earnings release.

The following table reflects adjusted EBITDA by

segment and provides reconciliation to earnings before income taxes

for the three months ended Sept. 30, 2023:

|

Three months ended Sept. 30, 2023 millions |

Hydro |

Wind & Solar(1) |

Gas |

Energy Transition |

EnergyMarketing |

Corporate |

Total |

Equity- accounted

investments(1) |

Reclass adjustments |

IFRS financials |

|

Revenues |

163 |

62 |

|

522 |

|

188 |

86 |

|

— |

|

1,021 |

|

(4 |

) |

— |

|

1,017 |

|

| Reclassifications

and adjustments: |

|

|

|

|

|

|

|

|

|

|

Unrealized mark-to-market (gain) loss |

— |

4 |

|

(112 |

) |

5 |

(67 |

) |

— |

|

(170 |

) |

— |

|

170 |

|

— |

|

|

Realized gain on closed exchange positions |

— |

— |

|

4 |

|

— |

8 |

|

— |

|

12 |

|

— |

|

(12 |

) |

— |

|

|

Decrease in finance lease receivable |

— |

— |

|

14 |

|

— |

— |

|

— |

|

14 |

|

— |

|

(14 |

) |

— |

|

|

Finance lease income |

— |

— |

|

2 |

|

— |

— |

|

— |

|

2 |

|

— |

|

(2 |

) |

— |

|

|

Unrealized foreign exchange gain on commodity |

— |

— |

|

— |

|

— |

(1 |

) |

— |

|

(1 |

) |

— |

|

1 |

|

— |

|

|

Adjusted revenues |

163 |

66 |

|

430 |

|

193 |

26 |

|

— |

|

878 |

|

(4 |

) |

143 |

|

1,017 |

|

|

Fuel and purchased power |

4 |

6 |

|

111 |

|

148 |

— |

|

— |

|

269 |

|

— |

|

— |

|

269 |

|

| Reclassifications

and adjustments: |

|

|

|

|

|

|

|

|

|

|

Australian interest income |

— |

— |

|

(1 |

) |

— |

— |

|

— |

|

(1 |

) |

— |

|

1 |

|

— |

|

|

Adjusted fuel and purchased power |

4 |

6 |

|

110 |

|

148 |

— |

|

— |

|

268 |

|

— |

|

1 |

|

269 |

|

| Carbon

compliance |

— |

— |

|

28 |

|

— |

— |

|

— |

|

28 |

|

— |

|

— |

|

28 |

|

|

Gross margin |

159 |

60 |

|

292 |

|

45 |

26 |

|

— |

|

582 |

|

(4 |

) |

142 |

|

720 |

|

|

OM&A |

9 |

20 |

|

45 |

|

15 |

13 |

|

30 |

|

132 |

|

(1 |

) |

— |

|

131 |

|

| Taxes, other than

income taxes |

— |

4 |

|

3 |

|

1 |

— |

|

— |

|

8 |

|

— |

|

— |

|

8 |

|

| Net other operating

income |

— |

(1 |

) |

(10 |

) |

— |

— |

|

— |

|

(11 |

) |

— |

|

— |

|

(11 |

) |

|

Adjusted EBITDA(2) |

150 |

37 |

|

254 |

|

29 |

13 |

|

(30 |

) |

453 |

|

|

|

|

|

Finance lease income |

|

|

|

|

|

|

|

|

|

2 |

|

| Depreciation and

amortization |

|

|

|

|

|

|

|

|

|

(140 |

) |

| Asset impairment

reversals |

|

|

|

|

|

|

|

|

|

58 |

|

| Interest income |

|

|

|

|

|

|

|

|

|

16 |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

(69 |

) |

| Foreign exchange loss |

|

|

|

|

|

|

|

|

|

(5 |

) |

| Loss on

sale of assets and other |

|

|

|

|

|

|

|

|

|

(1 |

) |

|

Earnings before income taxes |

|

|

|

|

|

|

|

|

|

453 |

|

(1) The Skookumchuck wind facility has been

included on a proportionate basis in the Wind and Solar segment.(2)

Adjusted EBITDA is not defined and has no standardized meaning

under IFRS. Refer to the non-IFRS financial measures and other

specified financial measures section in this earnings release.

The following table reflects adjusted EBITDA by

segment and provides reconciliation to earnings before income taxes

for the nine months ended Sept. 30, 2024:

|

Nine months ended Sept. 30,

2024millions |

Hydro |

Wind & Solar(1) |

Gas |

Energy Transition |

EnergyMarketing |

Corporate |

Total |

Equity- accounted

investments(1) |

Reclass adjustments |

IFRS financials |

|

Revenues |

316 |

|

253 |

|

1,031 |

|

461 |

|

154 |

|

(34 |

) |

2,181 |

|

(14 |

) |

— |

|

2,167 |

|

| Reclassifications

and adjustments: |

|

|

|

|

|

|

|

|

|

|

Unrealized mark-to-market (gain) loss |

(3 |

) |

61 |

|

(86 |

) |

(28 |

) |

(5 |

) |

— |

|

(61 |

) |

— |

|

61 |

|

— |

|

|

Realized gain (loss) on closed exchange positions |

— |

|

— |

|

8 |

|

— |

|

(16 |

) |

— |

|

(8 |

) |

— |

|

8 |

|

— |

|

|

Decrease in finance lease receivable |

— |

|

1 |

|

14 |

|

— |

|

— |

|

— |

|

15 |

|

— |

|

(15 |

) |

— |

|

|

Finance lease income |

— |

|

4 |

|

5 |

|

— |

|

— |

|

— |

|

9 |

|

— |

|

(9 |

) |

— |

|

|

Unrealized foreign exchange gain on commodity |

— |

|

— |

|

(1 |

) |

— |

|

— |

|

— |

|

(1 |

) |

— |

|

1 |

|

— |

|

|

Adjusted revenues |

313 |

|

319 |

|

971 |

|

433 |

|

133 |

|

(34 |

) |

2,135 |

|

(14 |

) |

46 |

|

2,167 |

|

|

Fuel and purchased power |

13 |

|

22 |

|

339 |

|

316 |

|

— |

|

— |

|

690 |

|

— |

|

— |

|

690 |

|

| Reclassifications

and adjustments: |

|

|

|

|

|

|

|

|

|

|

Australian interest income |

— |

|

— |

|

(3 |

) |

— |

|

— |

|

— |

|

(3 |

) |

— |

|

3 |

|

— |

|

|

Adjusted fuel and purchased power |

13 |

|

22 |

|

336 |

|

316 |

|

— |

|

— |

|

687 |

|

— |

|

3 |

|

690 |

|

| Carbon

compliance |

— |

|

— |

|

106 |

|

1 |

|

— |

|

(34 |

) |

73 |

|

— |

|

— |

|

73 |

|

|

Gross margin |

300 |

|

297 |

|

529 |

|

116 |

|

133 |

|

— |

|

1,375 |

|

(14 |

) |

43 |

|

1,404 |

|

|

OM&A |

39 |

|

70 |

|

131 |

|

50 |

|

29 |

|

105 |

|

424 |

|

(3 |

) |

— |

|

421 |

|

| Reclassifications and

adjustments: |

|

|

|

|

|

|

|

|

|

|

| Acquisition and integration

costs |

— |

|

— |

|

— |

|

— |

|

— |

|

(8 |

) |

(8 |

) |

— |

|

8 |

|

— |

|

|

Adjusted OM&A |

39 |

|

70 |

|

131 |

|

50 |

|

29 |

|

97 |

|

416 |

|

(3 |

) |

8 |

|

421 |

|

| Taxes, other than income

taxes |

2 |

|

13 |

|

9 |

|

3 |

|

— |

|

1 |

|

28 |

|

(1 |

) |

— |

|

27 |

|

| Net

other operating income |

— |

|

(7 |

) |

(30 |

) |

— |

|

— |

|

— |

|

(37 |

) |

— |

|

— |

|

(37 |

) |

|

Adjusted EBITDA(2) |

259 |

|

221 |

|

419 |

|

63 |

|

104 |

|

(98 |

) |

968 |

|

|

|

|

|

Equity income |

|

|

|

|

|

|

|

|

|

3 |

|

| Finance lease income |

|

|

|

|

|

|

|

|

|

9 |

|

| Depreciation and

amortization |

|

|

|

|

|

|

|

|

|

(388 |

) |

| Asset impairment charges |

|

|

|

|

|

|

|

|

|

(26 |

) |

| Interest income |

|

|

|

|

|

|

|

|

|

19 |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

(232 |

) |

| Foreign exchange loss |

|

|

|

|

|

|

|

|

|

(12 |

) |

| Gain on

sale of assets and other |

|

|

|

|

|

|

|

|

|

4 |

|

|

Earnings before income taxes |

|

|

|

|

|

|

|

|

|

370 |

|

(1) The Skookumchuck wind facility has been

included on a proportionate basis in the Wind and Solar segment.(2)

Adjusted EBITDA is not defined and has no standardized meaning

under IFRS. Refer to the non-IFRS financial measures and other

specified financial measures section in this earnings release.

The following table reflects adjusted EBITDA by

segment and provides reconciliation to earnings before income taxes

for the nine months ended Sept. 30, 2023:

|

Nine months ended Sept. 30, 2023

millions |

Hydro |

Wind & Solar(1) |

Gas |

Energy Transition |

EnergyMarketing |

Corporate |

Total |

Equity- accounted

investments(1) |

Reclass adjustments |

IFRS financials |

|

Revenues |

456 |

|

263 |

|

1,268 |

|

576 |

|

181 |

|

1 |

|

2,745 |

|

(14 |

) |

— |

|

2,731 |

|

| Reclassifications

and adjustments: |

|

|

|

|

|

|

|

|

|

|

Unrealized mark-to-market (gain) loss |

(2 |

) |

(4 |

) |

(120 |

) |

(12 |

) |

42 |

|

— |

|

(96 |

) |

— |

|

96 |

|

— |

|

|

Realized loss on closed exchange positions |

— |

|

— |

|

(13 |

) |

— |

|

(95 |

) |

— |

|

(108 |

) |

— |

|

108 |

|

— |

|

|

Decrease in finance lease receivable |

— |

|

— |

|

40 |

|

— |

|

— |

|

— |

|

40 |

|

— |

|

(40 |

) |

— |

|

|

Finance lease income |

— |

|

— |

|

10 |

|

— |

|

— |

|

— |

|

10 |

|

— |

|

(10 |

) |

— |

|

|

Adjusted revenues |

454 |

|

259 |

|

1,185 |

|

564 |

|

128 |

|

1 |

|

2,591 |

|

(14 |

) |

154 |

|

2,731 |

|

|

Fuel and purchased power |

14 |

|

22 |

|

326 |

|

419 |

|

— |

|

1 |

|

782 |

|

— |

|

— |

|

782 |

|

| Reclassifications

and adjustments: |

|

|

|

|

|

|

|

|

|

|

Australian interest income |

— |

|

— |

|

(3 |

) |

— |

|

— |

|

— |

|

(3 |

) |

— |

|

3 |

|

— |

|

|

Adjusted fuel and purchased power |

14 |

|

22 |

|

323 |

|

419 |

|

— |

|

1 |

|

779 |

|

— |

|

3 |

|

782 |

|

| Carbon

compliance |

— |

|

— |

|

85 |

|

— |

|

— |

|

— |

|

85 |

|

— |

|

— |

|

85 |

|

|

Gross margin |

440 |

|

237 |

|

777 |

|

145 |

|

128 |

|

— |

|

1,727 |

|

(14 |

) |

151 |

|

1,864 |

|

|

OM&A |

35 |

|

55 |

|

136 |

|

46 |

|

33 |

|

86 |

|

391 |

|

(2 |

) |

|

389 |

|

| Taxes, other than

income taxes |

2 |

|

11 |

|

11 |

|

3 |

|

— |

|

— |

|

27 |

|

(1 |

) |

|

26 |

|

| Net other operating

income |

— |

|

(4 |

) |

(30 |

) |

— |

|

— |

|

— |

|

(34 |

) |

— |

|

|

(34 |

) |

|

Adjusted EBITDA(2) |

403 |

|

175 |

|

660 |

|

96 |

|

95 |

|

(86 |

) |

1,343 |

|

|

|

|

|

Equity income |

|

|

|

|

|

|

|

|

|

1 |

|

| Finance lease income |

|

|

|

|

|

|

|

|

|

10 |

|

| Depreciation and

amortization |

|

|

|

|

|

|

|

|

|

(489 |

) |

| Asset impairment

reversals |

|

|

|

|

|

|

|

|

|

74 |

|

| Interest income |

|

|

|

|

|

|

|

|

|

47 |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

(215 |

) |

| Gain on

sale of assets and other |

|

|

|

|

|

|

|

|

|

4 |

|

|

Earnings before income taxes |

|

|

|

|

|

|

|

|

|

915 |

|

(1) The Skookumchuck wind facility has been

included on a proportionate basis in the Wind and Solar segment.(2)

Adjusted EBITDA is not defined and has no standardized meaning

under IFRS. Refer to the non-IFRS financial measures and other

specified financial measures section in this earnings release.

Reconciliation of cash flow from operations to FFO and

FCF

The table below reconciles cash flow from

operating activities to FFO and FCF:

| |

Three months ended Sept. 30 |

Nine months ended Sept. 30 |

|

$ millions, unless otherwise stated |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Cash flow from operating activities(1) |

229 |

|

681 |

|

581 |

|

1,154 |

|

| Change

in non-cash operating working capital balances |

(48 |

) |

(355 |

) |

59 |

|

11 |

|

|

Cash flow from operations before changes in working

capital |

181 |

|

326 |

|

640 |

|

1,165 |

|

|

Adjustments |

|

|

|

|

|

Share of adjusted FFO from joint venture(1) |

— |

|

2 |

|

4 |

|

10 |

|

|

Decrease in finance lease receivable |

5 |

|

14 |

|

15 |

|

40 |

|

|

Clean energy transition provisions and adjustments(2) |

— |

|

— |

|

— |

|

7 |

|

|

Realized gain (loss) on closed exchanged positions |

9 |

|

12 |

|

(8 |

) |

(108 |

) |

|

Acquisition and integration costs |

1 |

|

— |

|

8 |

|

— |

|

|

Other(3) |

4 |

|

3 |

|

14 |

|

8 |

|

|

FFO(4) |

200 |

|

357 |

|

673 |

|

1,122 |

|

|

Deduct: |

|

|

|

|

|

Sustaining capital(1) |

(35 |

) |

(36 |

) |

(75 |

) |

(100 |

) |

|

Productivity capital |

— |

|

(1 |

) |

— |

|

(2 |

) |

|

Dividends paid on preferred shares |

(13 |

) |

(14 |

) |

(39 |

) |

(39 |

) |

|

Distributions paid to subsidiaries’ non-controlling interests |

(10 |

) |

(75 |

) |

(34 |

) |

(204 |

) |

|

Principal payments on lease liabilities |

(1 |

) |

(3 |

) |

(3 |

) |

(8 |

) |

|

Other |

(1 |

) |

— |

|

(1 |

) |

— |

|

|

FCF(4) |

140 |

|

228 |

|

521 |

|

769 |

|

|

Weighted average number of common shares outstanding in the

period |

296 |

|

263 |

|

303 |

|

265 |

|

|

FFO per share(4) |

0.68 |

|

1.36 |

|

2.22 |

|

4.23 |

|

|

FCF per share(4) |

0.47 |

|

0.87 |

|

1.72 |

|

2.90 |

|

(1) Includes our share of amounts for

Skookumchuck, an equity-accounted joint venture.(2)

2023 includes amounts related to onerous contracts recognized in

2021.(3) Other consists of production tax credits, which

is a reduction to tax equity debt, less distributions from the

equity-accounted joint venture. (4) These items are

not defined and have no standardized meaning under IFRS. Refer to

the non-IFRS Measures section in this earnings release.The table

below provides a reconciliation of adjusted EBITDA to FFO and

FCF:

| |

Three months ended Sept. 30 |

Nine months ended Sept. 30 |

|

$ millions, unless otherwise stated |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Adjusted EBITDA(1)(4) |

325 |

|

453 |

|

968 |

|

1,343 |

|

| Provisions |

2 |

|

(4 |

) |

8 |

|

— |

|

| Net interest expense(2) |

(62 |

) |

(40 |

) |

(167 |

) |

(123 |

) |

| Current income tax

expense |

(63 |

) |

(37 |

) |

(123 |

) |

(55 |

) |

| Realized foreign exchange gain

(loss) |

1 |

|

(7 |

) |

(7 |

) |

(13 |

) |

| Decommissioning and

restoration costs settled |

(10 |

) |

(6 |

) |

(29 |

) |

(22 |

) |

|

Other non-cash items |

7 |

|

(2 |

) |

23 |

|

(8 |

) |

|

FFO(3)(4) |

200 |

|

357 |

|

673 |

|

1,122 |

|

|

Deduct: |

|

|

|

|

|

Sustaining capital(4) |

(35 |

) |

(36 |

) |

(75 |

) |

(100 |

) |

|

Productivity capital |

— |

|

(1 |

) |

— |

|

(2 |

) |

|

Dividends paid on preferred shares |

(13 |

) |

(14 |

) |

(39 |

) |

(39 |

) |

|

Distributions paid to subsidiaries’ non-controlling interests |

(10 |

) |

(75 |

) |

(34 |

) |

(204 |

) |

|

Principal payments on lease liabilities |

(1 |

) |

(3 |

) |

(3 |

) |

(8 |

) |

|

Other |

(1 |

) |

— |

|

(1 |

) |

— |

|

|

FCF(3)(4) |

140 |

|

228 |

|

521 |

|

769 |

|

(1) Adjusted EBITDA is defined in the Additional

IFRS Measures and non-IFRS Measures of this earnings release and

reconciled to earnings (loss) before income taxes above.(2) Net

interest expense includes interest expense for the period less

interest income.(3) These items are not defined and have no

standardized meaning under IFRS. FFO and FCF are defined in the

Non-IFRS financial measures and other specified financial measures

section of in this earnings release and reconciled to cash flow

from operating activities above.(4) Includes our share of amounts

for Skookumchuck wind facility, an equity-accounted joint venture.

Refer to the Capital Expenditures section of our Third Quarter 2024

MD&A for details of sustaining capital expenditures.

TransAlta is in the process of filing its

unaudited interim Consolidated Financial Statements and

accompanying notes, as well as the associated Management’s

Discussion & Analysis (“MD&A”). These documents will be

available today on the Investors section of TransAlta’s website at

www.transalta.com or through SEDAR at www.sedarplus.ca.

About TransAlta Corporation

TransAlta owns, operates and develops a diverse

fleet of electrical power generation assets in Canada, the United

States and Australia with a focus on long-term shareholder value.

TransAlta provides municipalities, medium and large industries,

businesses and utility customers with affordable, energy efficient

and reliable power. Today, TransAlta is one of Canada’s largest

producers of wind power and Alberta’s largest producer of

hydroelectric power. For over 113 years, TransAlta has been a

responsible operator and a proud member of the communities where we

operate and where our employees work and live. TransAlta aligns its

corporate goals with the UN Sustainable Development Goals and the

Future-Fit Business Benchmark, which also define sustainable goals

for businesses. Our reporting on climate change management has been

guided by the International Financial Reporting Standards (IFRS) S2

Climate-related Disclosures Standard and the Task Force on

Climate-related Financial Disclosures (TCFD) recommendations.

TransAlta has achieved a 66 per cent reduction in GHG emissions or

21.3 million tonnes CO2e since 2015 and received an upgraded MSCI

ESG rating of AA.

For more information about TransAlta, visit our

web site at transalta.com.

Cautionary Statement Regarding Forward-Looking

Information

This news release contains "forward-looking

information", within the meaning of applicable Canadian securities

laws, and "forward-looking statements", within the meaning of

applicable United States securities laws, including the United

States Private Securities Litigation Reform Act of 1995

(collectively referred to herein as "forward-looking statements).

In some cases, forward-looking statements can be identified by

terminology such as "plans", "expects", "proposed", "would",

"will", "anticipates", "develop", "continue", "estimate", and

similar expressions suggesting future events or future performance.

In particular, this news release contains, without limitation,

statements pertaining to: the temporary mothballing of Sundance 6

and its return to service; TransAlta’s commitment to enhancing

shareholder returns through share buybacks and dividends; our

acquisition of Heartland; our liquidity and financial position;

that opportunities will arise to support the energy transition in

our core jurisdictions, including the redevelopment and

recontracting our legacy thermal sites; and our expectations on key

financial targets and related assumptions for 2024 and our ability

to meet such targets, including adjusted EBITDA, free cash flow,

and dividend per share.

The forward-looking statements contained in this

news release are based on many assumptions including, but not

limited to, the following material assumptions: no significant

changes to applicable laws and regulations beyond those that have

already been announced; those assumptions contained in the

Company’s 2024 Outlook, including as it pertains to power and gas

prices and expected hedge levels; no material adverse impacts to

long-term investment and credit markets; no significant changes to

the decommissioning and restoration costs; no significant changes

to the integrity and reliability of our assets; and no significant

changes to the Company's debt and credit ratings. Forward-looking

statements are subject to a number of significant risks, and

uncertainties that could cause actual plans, performance, results

or outcomes to differ materially from current expectations. Factors

that may adversely impact what is expressed or implied by

forward-looking statements contained in this news release include,

risks relating to: fluctuations in power prices, including merchant

pricing in Alberta, Ontario and Mid-Columbia; supply chain

disruptions impacting major maintenance and growth projects;

reductions in production; restricted access to capital and

increased borrowing costs, including any difficulty raising debt,

equity or tax equity, as applicable, on reasonable terms or at all;

labour relations matters, reduced labour availability and the

ability to continue to staff our operations and facilities;

reliance on key personnel; disruptions to our supply chains,

including our ability to secure necessary equipment; force majeure

claims; our ability to obtain regulatory and any other third-party

approvals on the expected timelines or at all in respect of our

growth projects; long term commitments on gas transportation

capacity that may not be fully utilized over time; adverse

financial impacts arising from the Company's hedged positions;

risks associated with development and construction projects,

including as it pertains to real property, disputes with

contractors and potential delays in the construction or

commissioning of such projects; significant fluctuations in the

Canadian dollar against the US dollar and Australian dollar;

changes in short-term and long-term electricity supply and demand;

counterparty risk, including credit risk and risks of realizing a

higher rate of losses on our accounts receivables; impairments

and/or write-downs of assets; adverse impacts on our information

technology systems and our internal control systems, including

cybersecurity threats; commodity risk management and energy trading

risks, including the effectiveness of the Company’s risk management

tools associated with hedging and trading procedures to protect

against significant losses; an inability to contract our generation

for prices that will provide expected returns and to replace

contracts as they expire; changes to the legislative, regulatory

and political environments in the jurisdictions in which we

operate; environmental requirements and changes in, or liabilities

under, these requirements; disruptions in the transmission and

distribution of electricity; the effects of weather, including

man-made or natural disasters, and climate-change related risks;

increases in costs; reductions to our generating units’ relative

efficiency or capacity factors; disruptions in the source of fuels,

including natural gas, coal, water, solar, or wind resources

required to operate our facilities; any inability to receive all

required regulatory approvals for the acquisition of Heartland

Generation Ltd. and the risk that the closing of such transaction

could be delayed or not occur; failure to meet financial

expectations, including any failure to meet our 2024 Outlook;

general domestic and international economic and political

developments, including armed hostilities, the threat of terrorism,

adverse diplomatic developments or other similar events; equipment

failure and our ability to carry out or have completed the repairs

in a cost-effective and timely manner or at all; industry risk and

competition in the business in which we operate; structural

subordination of securities; inadequacy or unavailability of

insurance coverage; our provision for income taxes and any risk of

reassessment; and legal, regulatory and contractual disputes and

proceedings involving the Company; and other risks and

uncertainties discussed in the Company's materials filed with the

securities regulatory authorities from time to time and as also set

forth in the Company's Management Discussion and Analysis and

Annual Information Form for the year ended Dec. 31, 2023. Readers

are urged to consider these factors carefully in evaluating the

forward-looking statements, which reflect the Company's

expectations only as of the date hereof and are cautioned not to

place undue reliance on them. The purpose of the financial outlooks

contained herein is to give the reader information about

management's current expectations and plans and readers are

cautioned that such information may not be appropriate for other

purposes. The forward-looking statements included in this document

are made only as of the date hereof and we do not undertake to

publicly update these forward-looking statements to reflect new

information, future events or otherwise, except as required by

applicable laws.

Note: All financial figures are in Canadian

dollars unless otherwise indicated.

For more information:

| Investor

Inquiries: |

Media

Inquiries: |

| Phone: 1-800-387-3598 in

Canada and US |

Phone: 1-855-255-9184 |

| Email:

investor_relations@transalta.com |

Email:

ta_media_relations@transalta.com |

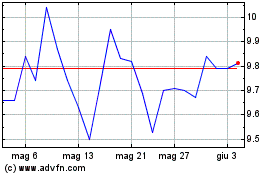

Grafico Azioni TransAlta (TSX:TA)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni TransAlta (TSX:TA)

Storico

Da Gen 2024 a Gen 2025