Corner Store Owner Couche-Tard in Merger Talks With Europe's Carrefour -- Update

13 Gennaio 2021 - 5:22PM

Dow Jones News

By Noemie Bisserbe, Saabira Chaudhuri and Ben Dummett

PARIS -- Canada's Alimentation Couche-Tard Inc. said it has made

a 16.1-billion-euro offer, equivalent to $19.66 billion, to buy

French hypermarket chain Carrefour SA, as large retailers come

under pressure to transform their bricks-and-mortar footprint amid

pandemic restrictions on shopping and disruption from tech

giants.

A merger would combine two companies with very different formats

and geographical footprints into a $53 billion giant, making it the

world's third largest grocery retailer, behind Walmart Inc. and

Lidl owner Schwarz Group. Retailers are in a rush to find new ways

to get food to customers ordering online as the spread of Covid-19

has massively accelerated online grocery shopping, including

click-and-collect.

Carrefour -- which opened its first store in 1960 -- is one of

Europe's largest grocery retailers. It also operates hypermarkets

and supermarkets in Asia and Latin America. The 31-year-old

Couche-Tard is the largest independent convenience store operator

in North America, operating under brands such as the Corner Store,

Circle K and Holiday. It also operates a network of gas stations in

Europe and has stores there and elsewhere in the world.

Carrefour shares were up 15.5% in Paris on Wednesday.

Couche-Tard shares were down 10.05% in Toronto.

Jefferies analyst James Grzinic said he was a little blindsided

by the talks, saying it was hard to map out synergies because

overlap between the retailers is virtually nonexistent. He

described the talks as a major departure from Couche-Tard's stated

strategy of maintaining return on capital employed at above

15%.

Carrefour announced the talks in the early hours of Wednesday,

saying Couche-Tard approached the company. Couche-Tard said there

was "no certainty at this stage that these exploratory discussions

will result in any agreement."

If the companies merge, Couche-Tard would have the controlling

hand, analysts say.

The grocery store landscape has seen a string of large deals

over the past few years as companies look to compete with

Amazon.com Inc. and traditional rivals that have increased online

investments.

Many grocers have also struggled with being squeezed in the

middle as discounters such as Aldi, Lidl and Walmart Inc. and

upscale chains such as Amazon's Whole Foods chain have done well.

Throughout the Covid-19 pandemic, most grocers have benefited as

consumers hunker down to cook and eat at home.

The sector's latest deal involves Walmart, which is currently

awaiting regulatory approval to sell a majority stake in British

grocery chain Asda Group Ltd. for $8.8 billion to a private

investment group that also owns a business running thousands of

convenience stores in gas stations. That deal isn't looking to

merge the two businesses, but is expected to see Asda open

convenience stores in gas stations.

A similar path could be followed in the event of a deal between

Couche-Tard and Carrefour, according to one person familiar with

the matter.

The lack of overlap between the companies is, however, a

positive in terms of gaining regulatory approval for any deal.

Walmart initially tried to sell its Asda stake to another U.K.

grocer, but the deal collapsed in 2019 after Britain's regulator

blocked it saying it could lead to higher prices for consumers.

Analysts raised concerns the French government -- which has a

history of blocking foreign takeovers of French firms -- could be

hostile to an acquisition of Carrefour. Carrefour is one of the

nation's largest employers with about 105,000 employees in France.

The group employs more than 321,000 people world-wide and owns

12,225 stores in more than 30 countries.

It has been working to cut costs and invest in building up its

e-commerce offerings in recent years, under the leadership of

Alexandre Bompard, who became chief executive in 2017. The strategy

has held it in good stead through the pandemic. Carrefour posted

its best performance in at least two decades in the third quarter

of 2020.

Couche-Tard's approach showed that "at the current share price,

Carrefour is cheap and that the turnaround story is moving in the

right direction," analysts at French bank Société Générale

said.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com, Saabira

Chaudhuri at saabira.chaudhuri@wsj.com and Ben Dummett at

ben.dummett@wsj.com

(END) Dow Jones Newswires

January 13, 2021 11:07 ET (16:07 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

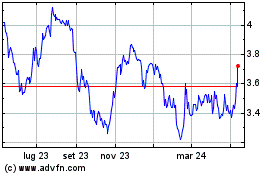

Grafico Azioni Carrefour (PK) (USOTC:CRRFY)

Storico

Da Nov 2024 a Dic 2024

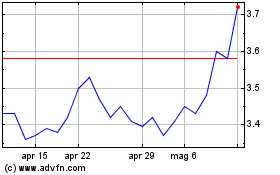

Grafico Azioni Carrefour (PK) (USOTC:CRRFY)

Storico

Da Dic 2023 a Dic 2024