Goldshore Intersects

Additional High-Grade Shears in the QES Zone at the Moss Lake Gold

Project

VANCOUVER, B.C.,

November 28, 2022: Goldshore Resources

Inc. (TSXV: GSHR / OTCQB: GSHRF / FWB: 8X00)

("Goldshore" or the "Company"), is pleased

to announce

assay results from

its ongoing

100,000-meter drill

program at

the Moss

Lake Project

in Northwest

Ontario, Canada (the

"Moss Lake Gold

Project").

Highlights:

-

Results for seven holes, drilled to expand the

coverage of the high-grade shears in the QES Zone, have

confirmed higher-grade

shear-hosted gold mineralization within a large volume of well

mineralized diorites. These results are all within the $1500

Whittle pit that constrains the current resource and identifies new

high-grade shears. Best intercepts

include:

-

1.51 g/t Au over 6.0m from 502.0m depth in

MQD-22-075 and

-

1.47 g/t Au over 30.1m

from 530.0m

-

8.45 g/t Au over 5.0m

from 576m depth in MQD-22-076 including

-

36.9 g/t Au over 1.0m

from 577m

-

1.87 g/t Au over 6.75m from 602.25m

-

1.31 g/t Au over 14.15m from 544.0m depth in

MQD-22-080

-

2.07 g/t Au over 6.0m from 422.0m depth in

MQD-22-085 and

-

1.07 g/t Au over 15.0m from 457.0m

-

1.26 g/t Au over 7.15m from 573.85m

-

1.07 g/t Au over 24.7m

from 369.0m depth in MQD-22-087 and

-

2.15 g/t Au over 5.0m from 489.0m

-

1.75 g/t Au over 8.05m from 513.95m

-

2.11 g/t Au over 30.75m

from 536.9m including

-

11.5 g/t Au over 3.1m

from 555.2m

-

1.31 g/t Au over 63.6m

from 427.0m depth in MQD-22-090A

-

2.07 g/t Au over 32.0m

from 439.0m

-

A new parallel mineralized

shear structure has been discovered 150m south of the main QES

system containing high grade mineralization within a sheared

intermediate volcanic package with best

intercepts of:

-

3.44 g/t Au over 5.8m

from 246.4m depth in MQD-22-080

-

1.22 g/t Au over 4.0m from 206.0m depth in

MQD-22-087

-

1.15 g/t Au over 7.3m from 75.0m

depth in MQD-22-090A

President and CEO Brett Richards stated:

"The results from these drill

holes in the QES Zone are part of a 52-hole data set that was not

included in the recent mineral resource estimate. They confirm our

belief that there are additional high-grade shear zones within the

deposit that will potentially add to the shear domain component of

the mineral resource that we anticipate will be prioritized in the

mining schedule when we move towards conducting a preliminary

economic analysis next year."

Technical

Overview

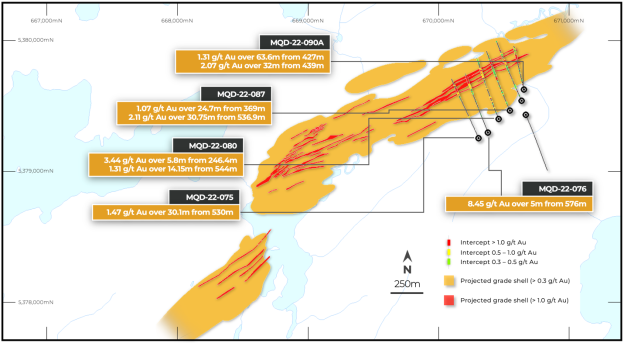

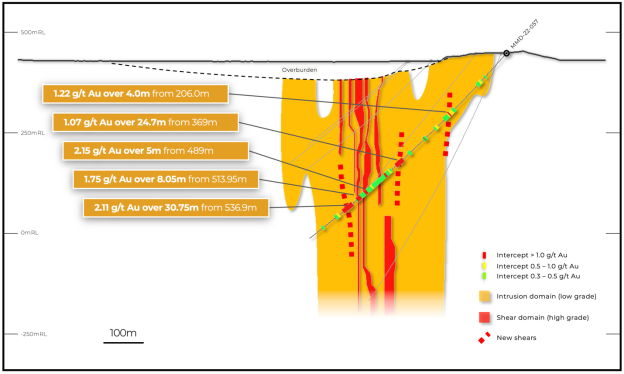

Figure 1 shows the

better intercepts in plain view and Figure 2 is a typical section

through hole MQD-22-087. Table 1 shows the significant intercepts.

Table 2 shows the drill hole locations.

Figure 1: Drill plan showing best of several +1 g/t Au intercepts

relative to shear and intrusion domains

Figure 2: Drill section through MQD-22-0087 relative to shear and

intrusion domains

Results have been received for six holes that

have infilled areas of the QES Zone that are between sections

drilled by historic holes with collar survey problems. As a result,

they will replace the low-confidence historic holes in the upcoming

resource model update.

A seventh hole was drilled to the southeast of

the QES Zone to investigate two historical showing along a parallel

structure of the QES Zone but did not intersect significant

mineralization.

As with the historic holes, these holes

intersected several broad zones of low-grade mineralization within

the altered diorite intrusion host. Examples include

0.77 g/t Au over 83m

from 493m depth in MQD-22-075; 0.41 g/t Au over

32.45m from 437.55m and 0.71 g/t Au over 131.1m from

493m in MQD-22-076;

0.54 g/t Au over 102m

from 476m and 0.39 g/t Au over 27.95m from 643m in

MQD-22-080; 0.78 g/t Au over 70m from

419m and 0.50 g/t Au over 28.75m from 521.25m in

MQD-22-085; 0.50 g/t Au over 115.9m from

408.1m in MQD-22-087; and 0.48 g/t Au over 27.45m from

552.05m in MQD-22-090A.

All these low-grade zones occur as envelopes to

higher-grade structures that form a three-dimensional, anastomosing

shear network that has developed in response to strain on the

altered diorite intrusion. Results include the broad zones of +1

g/t Au mineralization shown in the highlights (e.g.,

1.31 g/t Au over 63.6m

from 427m depth in MQD-22-090A) and several narrow

high-grade intervals, including 10.1 g/t Au over 0.7m from 545.8m

and 36.9 g/t Au over 1m from

577m in MQD-22-076; 10.0 g/t Au over 1m from 427m in

MQD-22-085; 20.6 g/t Au over 0.9m from

370.65m, 28.3 g/t Au over 0.3m from 540.3m and

11.5 g/t Au over 3.1m

from 555.2m in MQD-22-087; and

19.4 g/t Au over 1.15m

from 455.85m in MQD-22-090A.

An additional parallel shear was discovered

within the intermediate volcanic package approximately 150m south

of the main QES system which contains broad intercepts of low-grade

mineralization including 0.91 g/t over 24.8m from

246.4m in MQD-22-080; 0.33 g/t over 45.7m from 150.0m

in MQD-22-085; 0.42 g/t over 39.0m from 189.0m in MQD-22-087

containing internal higher grade intercepts including

3.44 g/t Au over 5.8m

from 246.4m depth in MQD-22-080; 1.22 g/t Au over

4.0m from 206.0m depth in MQD-22-087; 1.15 g/t Au over 7.3m from

75.0m depth in MQD-22-090A.

Importantly, these intercepts have identified

additional high-grade shears not modelled in the recent Mineral

Resource.

Pete Flindell, VP Exploration for Goldshore,

said "These drill results confirm

high-grade shears that we have modelled at the QES Zone and

confirmed additional shears that we expect to include in the next

mineral resource update early next year."

Table 1: Significant downhole gold intercepts

|

HOLE ID

|

FROM

|

TO

|

LENGTH (m)

|

TRUE WIDTH

(m)

|

CUT GRADE

(g/t Au)

|

UNCUT

GRADE

(g/t Au)

|

|

MQD-22-075

|

243.00

|

264.00

|

21.00

|

15.4

|

0.47

|

0.47

|

|

including

|

254.00

|

256.40

|

2.40

|

1.8

|

1.54

|

1.54

|

|

|

468.00

|

476.90

|

8.90

|

6.8

|

0.45

|

0.45

|

|

|

493.00

|

576.00

|

83.00

|

64.6

|

0.77

|

0.77

|

|

including

|

502.00

|

508.00

|

6.00

|

4.6

|

1.51

|

1.51

|

|

and

|

530.00

|

560.10

|

30.10

|

23.5

|

1.47

|

1.47

|

|

|

595.25

|

610.00

|

14.75

|

11.7

|

0.54

|

0.54

|

|

including

|

596.00

|

599.00

|

3.00

|

2.4

|

1.13

|

1.13

|

|

|

|

|

|

|

|

|

|

MQD-22-076

|

192.00

|

196.00

|

4.00

|

2.8

|

0.46

|

0.46

|

|

|

214.00

|

216.00

|

2.00

|

1.4

|

0.39

|

0.39

|

|

|

355.00

|

358.15

|

3.15

|

2.4

|

0.38

|

0.38

|

|

|

437.55

|

470.00

|

32.45

|

25.0

|

0.41

|

0.41

|

|

including

|

453.00

|

456.70

|

3.70

|

2.9

|

1.52

|

1.52

|

|

|

483.50

|

489.40

|

5.90

|

4.6

|

0.35

|

0.35

|

|

|

493.00

|

624.10

|

131.10

|

103.8

|

0.71

|

0.77

|

|

including

|

545.80

|

546.50

|

0.70

|

0.6

|

10.1

|

10.1

|

|

and

|

576.00

|

581.00

|

5.00

|

4.0

|

7.07

|

8.45

|

|

including

|

577.00

|

578.00

|

1.00

|

0.8

|

30.0

|

36.9

|

|

and

|

602.25

|

609.00

|

6.75

|

5.4

|

1.87

|

1.87

|

|

|

641.00

|

644.00

|

3.00

|

2.4

|

0.46

|

0.46

|

|

|

|

|

|

|

|

|

|

MQD-22-080

|

82.75

|

86.60

|

3.85

|

2.6

|

0.35

|

0.35

|

|

|

131.40

|

143.75

|

12.35

|

8.5

|

0.63

|

0.63

|

|

|

181.30

|

187.80

|

6.50

|

4.6

|

0.40

|

0.40

|

|

|

209.90

|

220.85

|

10.95

|

7.7

|

0.57

|

0.57

|

|

|

246.40

|

271.20

|

24.80

|

17.7

|

0.91

|

0.91

|

|

including

|

246.40

|

252.20

|

5.80

|

4.1

|

3.44

|

3.44

|

|

|

355.00

|

369.00

|

14.00

|

10.2

|

0.57

|

0.57

|

|

including

|

361.70

|

363.70

|

2.00

|

1.5

|

1.67

|

1.67

|

|

|

382.00

|

385.45

|

3.45

|

2.5

|

0.63

|

0.63

|

|

|

398.50

|

401.30

|

2.80

|

2.1

|

0.58

|

0.58

|

|

|

418.00

|

421.00

|

3.00

|

2.2

|

0.54

|

0.54

|

|

|

429.20

|

434.00

|

4.80

|

3.6

|

0.35

|

0.35

|

|

|

458.00

|

460.70

|

2.70

|

2.0

|

0.59

|

0.59

|

|

|

476.00

|

578.00

|

102.00

|

79.7

|

0.54

|

0.54

|

|

including

|

524.00

|

528.00

|

4.00

|

3.1

|

1.32

|

1.32

|

|

and

|

544.00

|

558.15

|

14.15

|

11.2

|

1.31

|

1.31

|

|

|

613.00

|

616.00

|

3.00

|

2.4

|

0.37

|

0.37

|

|

|

624.10

|

633.00

|

8.90

|

7.3

|

0.30

|

0.30

|

|

|

643.00

|

670.95

|

27.95

|

23.1

|

0.39

|

0.39

|

|

|

|

|

|

|

|

|

|

MQD-22-085

|

63.60

|

74.10

|

10.50

|

7.1

|

0.38

|

0.38

|

|

|

116.15

|

118.35

|

2.20

|

1.5

|

1.57

|

1.57

|

|

|

150.00

|

195.70

|

45.70

|

32.2

|

0.33

|

0.33

|

|

|

248.00

|

250.00

|

2.00

|

1.4

|

0.39

|

0.39

|

|

|

256.00

|

258.00

|

2.00

|

1.4

|

0.41

|

0.41

|

|

|

284.80

|

288.05

|

3.25

|

2.4

|

0.91

|

0.91

|

|

including

|

286.00

|

288.05

|

2.05

|

1.5

|

1.30

|

1.30

|

|

|

337.00

|

342.00

|

5.00

|

3.7

|

0.30

|

0.30

|

|

|

362.00

|

371.65

|

9.65

|

7.2

|

0.31

|

0.31

|

|

|

382.45

|

388.00

|

5.55

|

4.1

|

0.30

|

0.30

|

|

|

390.80

|

410.90

|

20.10

|

15.0

|

0.31

|

0.31

|

|

|

419.00

|

489.00

|

70.00

|

53.1

|

0.78

|

0.78

|

|

including

|

422.00

|

428.00

|

6.00

|

4.5

|

2.07

|

2.07

|

|

including

|

427.00

|

428.00

|

1.00

|

0.8

|

10.0

|

10.0

|

|

and

|

443.00

|

446.00

|

3.00

|

2.3

|

1.09

|

1.09

|

|

and

|

457.00

|

472.00

|

15.00

|

11.4

|

1.07

|

1.07

|

|

and

|

481.00

|

485.00

|

4.00

|

3.1

|

2.10

|

2.10

|

|

|

506.00

|

508.00

|

2.00

|

1.5

|

0.67

|

0.67

|

|

|

521.25

|

550.00

|

28.75

|

22.4

|

0.50

|

0.50

|

|

|

573.85

|

581.00

|

7.15

|

5.7

|

1.26

|

1.26

|

|

|

665.20

|

671.55

|

6.35

|

5.1

|

0.35

|

0.35

|

|

|

|

|

|

|

|

|

|

MQD-22-087

|

78.00

|

81.55

|

3.55

|

2.4

|

0.43

|

0.43

|

|

|

92.00

|

109.00

|

17.00

|

11.6

|

0.33

|

0.33

|

|

|

189.00

|

228.00

|

39.00

|

27.3

|

0.42

|

0.42

|

|

including

|

206.00

|

210.00

|

4.00

|

2.8

|

1.22

|

1.22

|

|

|

249.75

|

261.00

|

11.25

|

8.0

|

0.49

|

0.49

|

|

|

289.50

|

298.70

|

9.20

|

6.6

|

0.42

|

0.42

|

|

including

|

294.50

|

296.65

|

2.15

|

1.6

|

1.07

|

1.07

|

|

|

342.00

|

349.65

|

7.65

|

5.6

|

0.40

|

0.40

|

|

|

369.00

|

393.70

|

24.70

|

18.2

|

1.07

|

1.09

|

|

including

|

370.65

|

371.55

|

0.90

|

0.7

|

20.6

|

20.6

|

|

|

408.10

|

524.00

|

115.90

|

87.3

|

0.50

|

0.50

|

|

including

|

425.30

|

429.50

|

4.20

|

3.1

|

1.28

|

1.28

|

|

and

|

489.00

|

494.00

|

5.00

|

3.8

|

2.15

|

2.15

|

|

and

|

513.95

|

522.00

|

8.05

|

6.1

|

1.75

|

1.75

|

|

|

536.90

|

567.65

|

30.75

|

23.6

|

2.11

|

2.11

|

|

including

|

539.55

|

567.65

|

28.10

|

21.6

|

2.23

|

2.23

|

|

including

|

540.30

|

540.60

|

0.30

|

0.2

|

28.3

|

28.3

|

|

and

|

555.20

|

558.30

|

3.10

|

2.4

|

11.5

|

11.5

|

|

|

579.00

|

592.00

|

13.00

|

10.1

|

0.37

|

0.37

|

|

|

628.65

|

634.00

|

5.35

|

4.2

|

0.48

|

0.48

|

|

|

|

|

|

|

|

|

|

MQD-22-090A

|

75.00

|

82.30

|

7.30

|

3.8

|

1.15

|

1.15

|

|

including

|

78.00

|

81.55

|

3.55

|

1.8

|

2.05

|

2.05

|

|

|

94.00

|

98.00

|

4.00

|

2.1

|

0.54

|

0.54

|

|

|

133.00

|

146.00

|

13.00

|

7.0

|

0.35

|

0.35

|

|

|

193.00

|

196.00

|

3.00

|

1.6

|

0.39

|

0.39

|

|

|

227.70

|

230.60

|

2.90

|

1.6

|

0.53

|

0.53

|

|

|

238.55

|

240.85

|

2.30

|

1.3

|

0.42

|

0.42

|

|

|

245.00

|

252.25

|

7.25

|

4.0

|

0.35

|

0.35

|

|

|

287.35

|

292.75

|

5.40

|

3.0

|

0.44

|

0.44

|

|

|

427.00

|

490.60

|

63.60

|

37.7

|

1.31

|

1.31

|

|

including

|

427.00

|

429.00

|

2.00

|

1.2

|

1.10

|

1.10

|

|

and

|

439.00

|

471.00

|

32.00

|

19.0

|

2.07

|

2.07

|

|

including

|

455.85

|

457.00

|

1.15

|

0.7

|

19.4

|

19.4

|

|

|

503.85

|

508.00

|

4.15

|

2.5

|

0.73

|

0.73

|

|

|

519.00

|

541.00

|

22.00

|

13.3

|

0.35

|

0.35

|

|

including

|

525.00

|

527.00

|

2.00

|

1.2

|

1.47

|

1.47

|

|

|

552.05

|

579.50

|

27.45

|

16.8

|

0.48

|

0.48

|

|

including

|

574.00

|

576.00

|

2.00

|

1.2

|

1.14

|

1.14

|

|

Intersections calculated

above at 0.3 g/t Au cut off with a top cut of 30 g/t Au and a

maximum internal waste interval of 10 metres. Shaded intervals are

intersections calculated above a 1.0 g/t Au cut off. Intervals in

bold are those with a grade thickness factor exceeding 20 gram x

metres / tonne gold. True widths are approximate and assume a

subvertical body.

|

Table 2: Location of drill holes in this press release

|

HOLE

|

EAST

|

NORTH

|

RL

|

AZIMUTH

|

DIP

|

EOH

|

|

MQD-22-075

|

670,308

|

5,379,250

|

443

|

336°

|

-47°

|

675.1

|

|

MQD-22-076

|

670,379

|

5,379,296

|

442

|

338°

|

-47°

|

651.0

|

|

MQD-22-080

|

670,462

|

5,379,398

|

450

|

335°

|

-50°

|

675.05

|

|

MQD-22-083

|

670,667

|

5,379,431

|

433

|

156°

|

-50°

|

630.1

|

|

MQD-22-085

|

670,636

|

5,379,537

|

441

|

336°

|

-49°

|

675.0

|

|

MQD-22-087

|

670,546

|

5,379,463

|

449

|

336°

|

-49°

|

675.0

|

|

MQD-22-090A

|

670,654

|

5,379,625

|

429

|

346°

|

-60°

|

606.0

|

|

Approximate collar

coordinates in NAD 83, Zone 15N

|

Analytical

and QA/QC Procedures

All samples were sent to ALS Geochemistry in

Thunder Bay for preparation and analysis was performed in the ALS

Vancouver analytical facility. ALS is accredited by the Standards

Council of Canada (SCC) for the Accreditation of Mineral Analysis

Testing Laboratories and CAN-P-4E ISO/IEC 17025. Samples were

analyzed for gold via fire assay with an AA finish ("Au-AA23") and

48 pathfinder elements via ICP-MS after four-acid digestion

("ME-MS61"). Samples that assayed over 10 ppm Au were re-run via

fire assay with a gravimetric finish

("Au-GRA21").

In addition to ALS quality assurance / quality

control ("QA/QC") protocols, Goldshore has implemented a quality

control program for all samples collected through the drilling

program. The quality control

program was designed by a qualified and independent third party,

with a focus on the quality of analytical results for gold.

Analytical results are received, imported to our secure on-line

database and evaluated to meet our established guidelines to ensure

that all sample batches pass industry best practice for analytical

quality control. Certified reference materials are considered

acceptable if values returned are within three standard deviations

of the certified value reported by the manufacture of the material.

In addition to the certified reference material, certified blank

material is included in the sample stream to monitor contamination

during sample preparation. Blank material results are assessed

based on the returned gold result being less than ten times the

quoted lower detection limit of the analytical method. The results

of the on-going analytical quality control program are evaluated

and reported to Goldshore by Orix Geoscience Inc.

About

Goldshore

Goldshore is an emerging junior gold

development company, and owns the Moss Lake

Gold Project located in Ontario. Wesdome Gold Mines Ltd. is

currently a large shareholder of Goldshore with an

approximate 27% equity position in the

Company. Well-financed and

supported by an industry-leading management group,

board of directors and advisory board,

Goldshore is positioned to advance the Moss

Lake Gold Project

through the next stages of exploration and

development.

About

the Moss Lake Gold Project

The Moss Lake Gold Project is located

approximately 100 km west of the city of Thunder Bay, Ontario. It

is accessed via Highway 11 which passes within 1 km of the property

boundary to the north. The Moss Lake Gold

Project covers 14,292 hectares and consists of 282 unpatented and

patented mining claims.

The Moss Lake Gold Project hosts a number of

gold and base metal rich deposits including the Moss Lake Deposit

(Table 3), the East Coldstream Deposit (Table 4), the historically

producing North Coldstream Mine (Table 5), and the Hamlin Zone, all

of which occur over a mineralized trend exceeding 20 km in

length.

The Moss Lake Deposit hosts an estimated

inferred mineral resource of 4.17Moz Au (see Goldshore's news

release dated November 15, 2022). A technical report is being

prepared in accordance with National Instrument 43-101

("NI

43-101") and will be available on the Company's

website and SEDAR within 45 days of November 15, 2022.

A historical mineral resource estimate (the

"East Coldstream Historical

Estimate") was completed on the East Coldstream Deposit

in 2011 by Foundation Resources Inc.2,3

The East Coldstream Deposit is a shear-hosted

disseminated-style gold deposit which locally outcrops at surface.

It has been drilled over a 1.3 km length and to depths of 200 m

with 138 holes completed between 1988 and 2017. The deposit remains

largely open at depth and may have the potential for expansion

along strike. Historic drill hole

highlights from the East Coldstream Deposit include 4.86 g/t Au

over 27.3 m in C-10-15.

The historically producing North Coldstream

Mine is reported to have produced significant amounts of copper,

gold and silver4

from mineralization with potential

iron-oxide-copper-gold deposit style affinity. The exploration

potential immediately surrounding the historic mining area is not

currently well understood and historic data compilation is

required.

The Hamlin Zone is a significant occurrence of

copper and gold mineralization, and also of potential

iron-oxide-copper-gold deposit style affinity. Between 2008 and

2011, Glencore tested Hamlin with 24 drill holes which successfully

outlined a broad and intermittently mineralized zone over a strike

length of 900 m. Historic drill hole

highlights from the Hamlin Zone include 0.9 g/t Au and 0.35% Cu

over 150.7 m in HAM-11-75.

The Moss Lake, East Coldstream and North

Coldstream deposits sit on a mineral trend marked by a regionally

significant deformation zone locally referred to as the Wawiag

Fault Zone in the area of the Moss Lake Deposit. This deformation

zone occurs over a length of approximately 20 km on the Moss Lake

Gold Project and there is an area spanning approximately 7 km

between the Moss Lake and East Coldstream deposits that is

significantly underexplored.

Table 3:

Mineral Resource Estimate (Moss Lake Deposit)

1

|

Inferred Resources

(Domains)

|

Tonnes

(Mt)

|

Grade

(g/t Au)

|

Contained Metal (Moz

AU)

|

|

Shear

|

34.7

|

2.0

|

2.20

|

|

Intrusion

|

87

|

0.7

|

1.97

|

|

TOTAL

|

121.7

|

1.1

|

4.17

|

Notes:

(1) The Moss Lake Deposit hosts an estimated

inferred mineral resource of 4.17Moz Au (see Goldshore's news

release dated November 15, 2022). A technical report is being

prepared in accordance with NI 43-101 and will be available on the

Company's website and SEDAR within 45 days of November 15,

2022.

Table 4:

Historical Mineral Resources (East Coldstream Deposit)

2,3

|

|

INDICATED

|

INFERRED

|

|

|

Tonnes

|

Grade (g/t

Au)

|

Oz Au

|

Tonnes

|

Grade (g/t

Au)

|

Oz Au

|

|

East Coldstream

Total

|

3,516,700

|

0.85

|

96,400

|

30,533,000

|

0.78

|

763,276

|

Notes:

(2) Source: McCracken, T. "Technical Report

and Resource Estimate on the Osmani Gold Deposit, Coldstream

Property, Northwestern Ontario", prepared for Foundation Resources

Inc. and Alto Ventures Ltd. The East Coldstream

Historical Estimate is based on a 0.4 g/t Au cut-off grade. The

qualified persons for the East Coldstream Historical Estimate are

Todd McCracken, P.Geo. (Tetratech Wardrop), and Jeff Wilson, Ph.D.,

P.Geo. (Tetratech Wardrop), and the effective date of the East

Coldstream Historical Estimate is December 12, 2011. Resources are

presented unconstrained, undiluted and in situ. The East Coldstream

Historical Estimate includes 2 gold-bearing zones. A cut-off grade

of 0.4 g/t Au was selected as the official resource cut-off grade.

The East Coldstream Historical Estimate is based on 116 diamond

drill holes drilled from 1986 to 2011. A fixed density of 2.78

g/cm3 was used. Capping was established at 5.89 g/t Au and 5.70 g/t

Au for domains EC-1 and EC-2, respectively. This is supported by

statistical analysis and the high grade distribution within the

deposit. Compositing was done on drill hole sections falling within

the mineralized zone solids (composite = 1 m). Resources were

evaluated from drill hole samples using the ID2 interpolation

method in a multi-folder percent block model using Datamine Studio

3 version 3.20.5321.0. Resource categorization is based on spatial

continuity based from the variography of the assays within the

drillholes. Ounce (troy) = metric tons x grade / 31.10348.

Calculations used metric units (metres, tonnes and g/t). The number

of metric tonnes was rounded to the nearest thousand. Any

discrepancies in the totals are due to rounding effects; rounding

followed the recommendations in NI 43-101.

(3) The reader is cautioned that the East

Coldstream Historical Estimate is considered historical in nature

and as such is based on prior data and reports prepared by previous

property owners. The reader is cautioned not to treat it, or any

part of it, as current mineral resources or reserves. The Company

has determined this historical resource is reliable, and relevant

to be included here in that it demonstrates simply the mineral

potential of the Moss Lake Gold Project. A qualified person has not

done sufficient work to classify the East Coldstream Historical

Estimate as a current resource and Goldshore is not treating the

East Coldstream Historical Estimate as a current resource.

Significant data compilation, re-drilling, re-sampling and data

verification may be required by a qualified person before the East

Coldstream Historical Estimate can be classified as a current

resource. There can be no assurance that any of the historical

mineral resources, in whole or in part, will ever become

economically viable. In addition, mineral resources are not mineral

reserves and do not have demonstrated economic viability. Even if

classified as a current resource, there is no certainty as to

whether further exploration will result in any inferred mineral

resources being upgraded to an indicated or measured mineral

resource category. The East Coldstream Historical Estimate relating

to inferred mineral resources was calculated using prior mining

industry standard definitions and practices for estimating mineral

resource and mineral reserves. Such prior definitions and practices

were utilized prior to the implementation of the current standards

of the Canadian Institute of Mining for mineral resource

estimation, and have a lower level of confidence.

Table 5:

Reported Historical Production (North Coldstream Deposit)

4

|

Deposit

|

Tonnes

|

Cu %

|

Au g/t

|

Ag

|

Cu lbs

|

Au oz

|

Ag oz

|

|

Historical Production

|

2,700,0000

|

1.89

|

0.56

|

5.59

|

102,000,000

|

44,000

|

440,000

|

Note:

(4) Source: Schlanka, R., 1969. Copper,

Nickel, Lead and Zinc Deposits of Ontario, Mineral Resources

Circular No. 12, Ontario Geological Survey, pp. 314-316.

Peter Flindell, P.Geo., MAusIMM, MAIG, Vice

President – Exploration of the Company, a qualified person under NI

43-101 has approved the scientific and technical information

contained in this news release.

Neither the TSXV nor its

Regulation Services Provider (as that term is defined in the

policies of the TSXV) accepts responsibility for the adequacy or

accuracy of this release.

For More Information –

Please Contact:

Brett A. Richards

President, Chief Executive Officer and

Director

Goldshore Resources Inc.

P. +1 604 288 4416

M. +1 905 449 1500

E. brichards@goldshoreresources.com

W. www.goldshoreresources.com

Facebook: GoldShoreRes

|

Twitter: GoldShoreRes |

LinkedIn: goldshoreres

Cautionary Note

Regarding Forward-Looking Statements

This news release contains statements that

constitute "forward-looking statements." Such forward looking

statements involve known and unknown risks, uncertainties and other

factors that may cause the Company's actual results, performance or

achievements, or developments to differ materially from the

anticipated results, performance or achievements expressed or

implied by such forward-looking statements. Forward looking

statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects,"

"plans," "anticipates," "believes," "intends," "estimates,"

"projects," "potential" and similar expressions, or that events or

conditions "will," "would," "may," "could" or "should"

occur.

Forward-looking statements in this news release

include, among others, statements relating to expectations

regarding the exploration and development of the Moss Lake Gold

Project, plans to conduct a preliminary economic assessment and

timing thereof, updating the mineral resource estimates, the filing

of a technical report to support the mineral resource estimate at

the Moss Lake Deposit, and other statements that are not historical

facts. By their nature, forward-looking statements involve known

and unknown risks, uncertainties and other factors which may cause

our actual results, performance or achievements, or other future

events, to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Such factors and risks include, among

others: the Company may require additional financing from time to

time in order to continue its operations which may not be available

when needed or on acceptable terms and conditions acceptable;

compliance with extensive government regulation; domestic and

foreign laws and regulations could adversely affect the Company's

business and results of operations; the stock markets have

experienced volatility that often has been unrelated to the

performance of companies and these fluctuations may adversely

affect the price of the Company's securities, regardless of its

operating performance; the ongoing military conflict in Ukraine;

and other risk factors outlined in the Company's public disclosure

documents.

The forward-looking information contained in

this news release represents the expectations of the Company as of

the date of this news release and, accordingly, is subject to

change after such date. Readers should not place undue importance

on forward-looking information and should not rely upon this

information as of any other date. The Company undertakes no

obligation to update these forward-looking statements in the event

that management's beliefs, estimates or opinions, or other factors,

should change.