Goldshore

Announces

an Indicated

Mineral Resource Estimate of 1,535Koz Contained Gold at 1.23 g/t

Au and an

Inferred Mineral Resource Estimate of 5,198Koz Contained Gold at

1.11 g/t Au at the Moss Gold Project

VANCOUVER,

B.C., February 6, 2024: Goldshore Resources

Inc. (TSXV:

GSHR / OTCQB: GSHRF / FWB: 8X00)

("Goldshore" or the "Company") is

pleased to announce an updated mineral resource estimate (the

"MRE") for

the Moss deposit ("Moss" or the

"Moss

Deposit") and East Coldstream deposit

("East

Coldstream" or the "East Coldstream

Deposit"), both located at its 100%-owned Moss Gold

Project in Northwest Ontario, Canada (the "Moss Gold

Project" or the "Project").

Highlights

of the 2024 Mineral Resource Estimate Update:

-

Upgrading

of the MRE to include 23% Indicated Mineral Resources and an

increase in the average grade over the 2023 MRE.

-

Indicated Mineral Resource of 1,535 thousand

ounces grading 1.23 grams per tonne gold (g/t Au),

contained within 38.96 million tonnes.

-

Inferred Mineral Resource of 5,198 thousand

ounces grading 1.11 grams per tonne gold (g/t Au), contained within

146.24 million tonnes.

-

The total resource tonnage increase is just

under 1% overall over the 2023 MRE, however the overall grade

increase versus the 2023 MRE is approximately 11%.

-

The shears that host gold mineralization have

been extensively remodelled as constraining domains, greatly

enhancing the reliability of the current MRE.

-

With gold prices consistent with the 2023

MRE, 94% of the 2024 MRE's tonnes and gold ounces are contained

within these shear models.

-

This is a significant increase compared to

the 2023 MRE, where only 35% of the tonnes and 65% of the gold

ounces were contained in its shear model.

-

Implied stripping ratios based on diluted

block models and the Reasonable Potential for Eventual Economic

Extraction ("RPEEE")

constraining pit optimization are 3:1 for Moss and 6:1 for East

Coldstream.

-

The pit depth is constrained by the model (in

multiple locations), indicating the potential for a larger pit

should the model be extended at depth.

-

The 2024 Moss Project MRE update is set to be

the foundation for resource growth and development towards Tier One

status, and leading to a future Preliminary Economic Assessment

(PEA).

-

All identified zones within the Project are

still open to potential expansion.

-

The Moss Project encompasses 36 satellite

targets, including several mapped and sampled gold trends near the

Moss Gold Deposit, offering prospects for discoveries and

additional gold mineralization.

Table 1:

Moss Project Updated Mineral Resource Estimate

|

|

|

Indicated

|

Inferred

|

|

|

Cutoff

|

Tonnes

|

Grade

|

Metal

|

Tonnes

|

Grade

|

Metal

|

|

|

(g/t Au)

|

(Mt)

|

(g/t Au)

|

(Koz Au)

|

(Mt)

|

(g/t Au)

|

(Koz Au)

|

|

Moss

|

|

|

Core

Shears

|

0.35

|

19.95

|

1.39

|

893

|

56.32

|

1.39

|

2,525

|

|

Marginal

Shears

|

0.35

|

11.35

|

0.92

|

335

|

70.31

|

0.81

|

1,836

|

|

Low

Grade Halo

|

0.35

|

-

|

-

|

-

|

10.21

|

0.62

|

202

|

|

Open Pit

Subtotal

|

|

31.30

|

1.22

|

1,228

|

136.84

|

1.04

|

4,563

|

|

Underground

|

2.0

|

-

|

-

|

-

|

3.22

|

3.43

|

355

|

|

Moss Total

|

0.35/2.0

|

31.30

|

1.22

|

1,228

|

140.07

|

1.09

|

4,919

|

|

East

Coldstream

|

|

Open

Pit

|

0.35

|

7.67

|

1.25

|

307

|

5.36

|

1.15

|

198

|

|

Underground

|

2.0

|

-

|

-

|

-

|

0.82

|

3.10

|

82

|

|

E Coldstream

Total

|

0.35/2.0

|

7.67

|

1.25

|

307

|

6.18

|

1.41

|

280

|

|

Grand Total

|

0.35/2.0

|

38.96

|

1.23

|

1,535

|

146.24

|

1.11

|

5,198

|

Notes:

-

The 2024 Moss Mineral Resources were estimated and classified in

accordance with the Canadian Institute of Mining, Metallurgy and

Petroleum ("CIM") "Estimation of Mineral Resources and Mineral

Reserves Best Practice Guidelines" dated November 29, 2019, and the

CIM "Definition Standards for Mineral Resources and Mineral

Reserves" dated May 10, 2014.

-

Mr. Michael Dufresne, M.Sc., P.Geol., P.Geo. and Mr. Warren Black,

M.Sc., P.Geo. both of APEX Geoscience Ltd. ("APEX") qualified persons as defined by

NI 43-101, are responsible for completing the updated mineral

resource estimation, effective January 31, 2024.

-

Mineral resources that are not mineral reserves have no

demonstrated economic viability. No mineral reserves have been

calculated for Moss. There is no guarantee that any part of the

mineral resources discussed herein will be converted to a mineral

reserve in the future.

-

The estimate of mineral resources may be materially affected by

environmental, permitting, legal, title, market, or other relevant

factors.

-

The quantity and grade of reported Inferred Resources is uncertain,

and there has not been sufficient work to define the Inferred

Mineral Resource as an Indicated or Measured Mineral Resource. It

is reasonably expected that most of the Inferred Mineral Resources

could be upgraded to Indicated Mineral Resources with continued

exploration.

-

The historical underground voids from mining in any of the deposit

areas have been removed.

-

All figures are rounded to reflect the relative accuracy of the

estimates. Totals may not sum due to rounding. Resources are

presented as undiluted and in situ.

-

Tonnage estimates are based on individually measured and calculated

bulk densities for geological units ranging from 2.68 to 2.89

g/cm³. Overburden density is set at 1.8 g/cm³.

-

Metal prices are US$1,850/oz Au with a revenue factor of 1 and

recovery of 90% for Moss and 95% for East Coldstream.

-

Open-pit resource economic assumptions are mining costs of

US$2.25/waste tonne, $3.00/ore tonne, flotation-leaching processing

costs of US$9.50 per tonne, and mine-site administration costs of

US$2.10 per tonne processed.

-

Open-pit resources comprise blocks constrained by the pit shell

resulting from the pseudoflow optimization using the open-pit

economic assumptions and 50° pit slopes.

-

Underground resource economic assumptions are US$75/tonne for

mining mineralized and waste material and US$9.50/tonne for

processing. The underground resource mining assumptions are open

pit stope mining method with a minimum mining width of 1.5m and a

minimum stope volume equal to stope dimensions of 1.5m x 10m x

20m.

-

The Underground material below the open pit was manually

constrained to continuous material above the gold cutoff (2.0 g/t)

that met the minimum thickness and volume requirements. Resources

not meeting these size criteria are included if they maintain a

grade above the cutoff once diluted to the required size.

Table 2:

Moss Project Updated Open Pit Mineral Resource Estimate

Sensitivity

|

Cutoff (g/t Au)

|

Indicated

|

Inferred

|

|

Tonnes (Mt)

|

Grade

(g/t Au)

|

Metal

(Koz Au)

|

Tonnes (Mt)

|

Grade

(g/t Au)

|

Metal

(Koz Au)

|

|

Moss

|

|

0.2

|

33.55

|

1.16

|

1,249

|

185.72

|

0.83

|

4,985

|

|

0.3

|

32.36

|

1.19

|

1,239

|

150.61

|

0.97

|

4,707

|

|

0.35

|

31.30

|

1.22

|

1,228

|

136.84

|

1.04

|

4,563

|

|

0.4

|

30.15

|

1.25

|

1,214

|

125.85

|

1.10

|

4,431

|

|

0.5

|

27.31

|

1.34

|

1,173

|

104.78

|

1.22

|

4,126

|

|

0.6

|

24.05

|

1.44

|

1,115

|

86.6

|

1.37

|

3,807

|

|

0.8

|

17.88

|

1.70

|

977

|

60.33

|

1.66

|

3,221

|

|

1.0

|

13.00

|

2.00

|

836

|

42.89

|

1.97

|

2,721

|

|

East

Coldstream

|

|

0.2

|

8.70

|

1.13

|

316

|

6.54

|

0.99

|

208

|

|

0.3

|

8.01

|

1.21

|

311

|

5.73

|

1.09

|

201

|

|

0.35

|

7.66

|

1.25

|

307

|

5.35

|

1.15

|

198

|

|

0.4

|

7.33

|

1.29

|

303

|

4.99

|

1.20

|

193

|

|

0.5

|

6.59

|

1.38

|

292

|

4.36

|

1.31

|

184

|

|

0.6

|

5.92

|

1.47

|

280

|

3.77

|

1.43

|

174

|

|

0.8

|

4.58

|

1.70

|

250

|

2.94

|

1.64

|

155

|

|

1.0

|

3.49

|

1.95

|

219

|

2.31

|

1.84

|

137

|

-

See

footnotes for Table 1

Table 3:

Moss Project Updated Underground Mineral Resource Estimate

Sensitivity

|

Cutoff (g/t Au)

|

Inferred

|

|

Tonnes (Mt)

|

Grade

(g/t Au)

|

Metal

(Koz Au)

|

|

Moss

|

|

1.8

|

3.96

|

3.14

|

400

|

|

1.9

|

3.56

|

3.29

|

377

|

|

2.0

|

3.22

|

3.43

|

355

|

|

2.1

|

2.89

|

3.59

|

334

|

|

2.2

|

2.60

|

3.75

|

314

|

|

2.4

|

2.11

|

4.09

|

277

|

|

East

Coldstream

|

|

1.8

|

1.00

|

2.88

|

93

|

|

1.9

|

0.90

|

3.00

|

87

|

|

2.0

|

0.82

|

3.10

|

82

|

|

2.1

|

0.76

|

3.19

|

78

|

|

2.2

|

0.70

|

3.28

|

74

|

|

2.4

|

0.60

|

3.45

|

66

|

-

See

footnotes for Table 1

President

and CEO Brett Richards stated: "The MRE results above are

extremely encouraging, and validate the strategic exploration and

drilling campaign we embarked on almost 3 years

ago.

We have

consistently delivered exciting drilling results as they relate to

the Moss Gold Project, and this MRE illustrates a meaningful and

material increase in the quality, quantity, and grade of the

deposit.

Conducting

this update to the MRE was the logical next step in defining our

strategy going forward of understanding and defining the potential

of the Moss Gold Project; in an effort to maximize shareholder

value.

We

continue to believe that the Moss Gold Project will be a sector

anomaly of having top quartile grade and top quartile size and

scale within our comparable peers; as it moves closer to being a

Tier One asset."

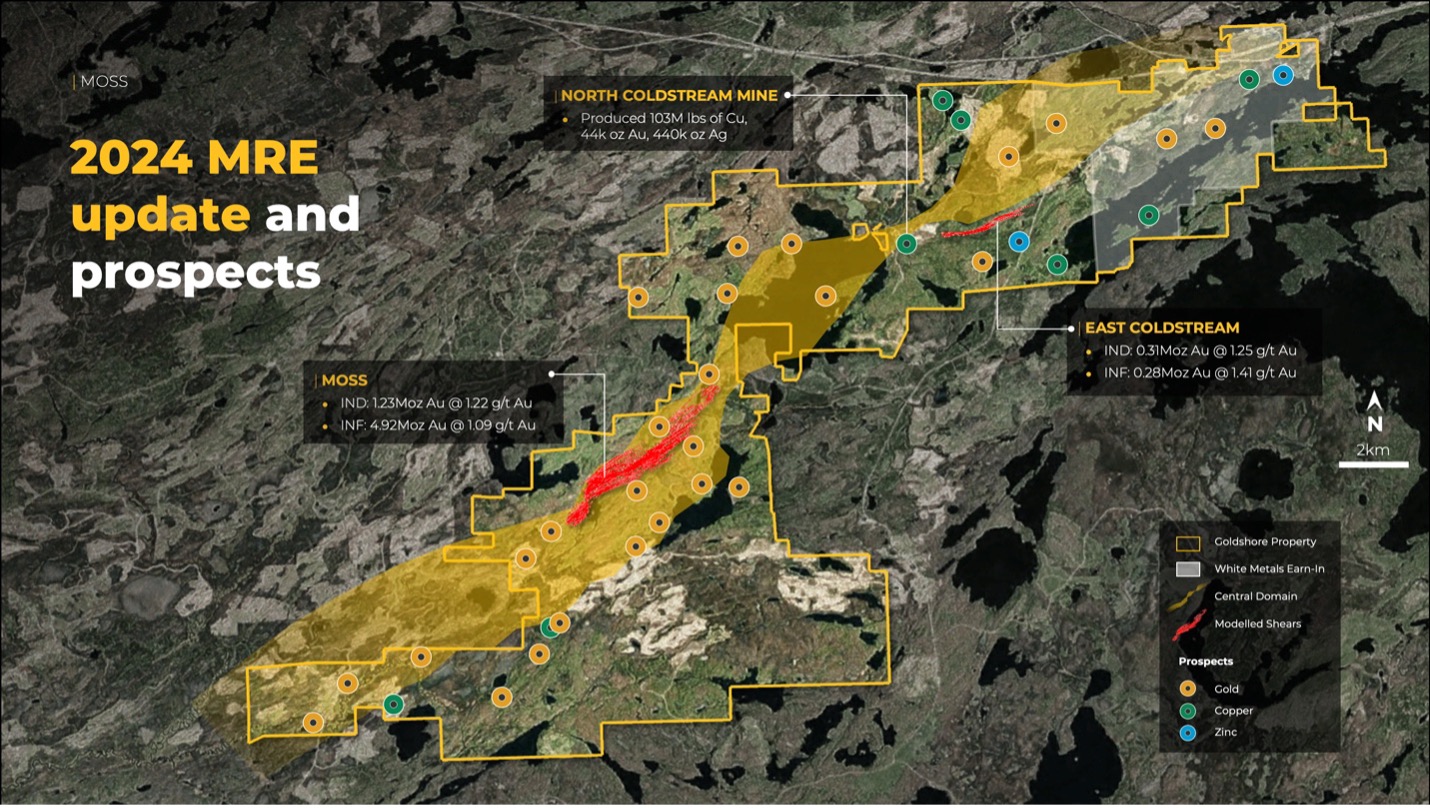

Figure 1:

Location of Moss Deposit and East Coldstream Deposit in the Moss

Gold Project

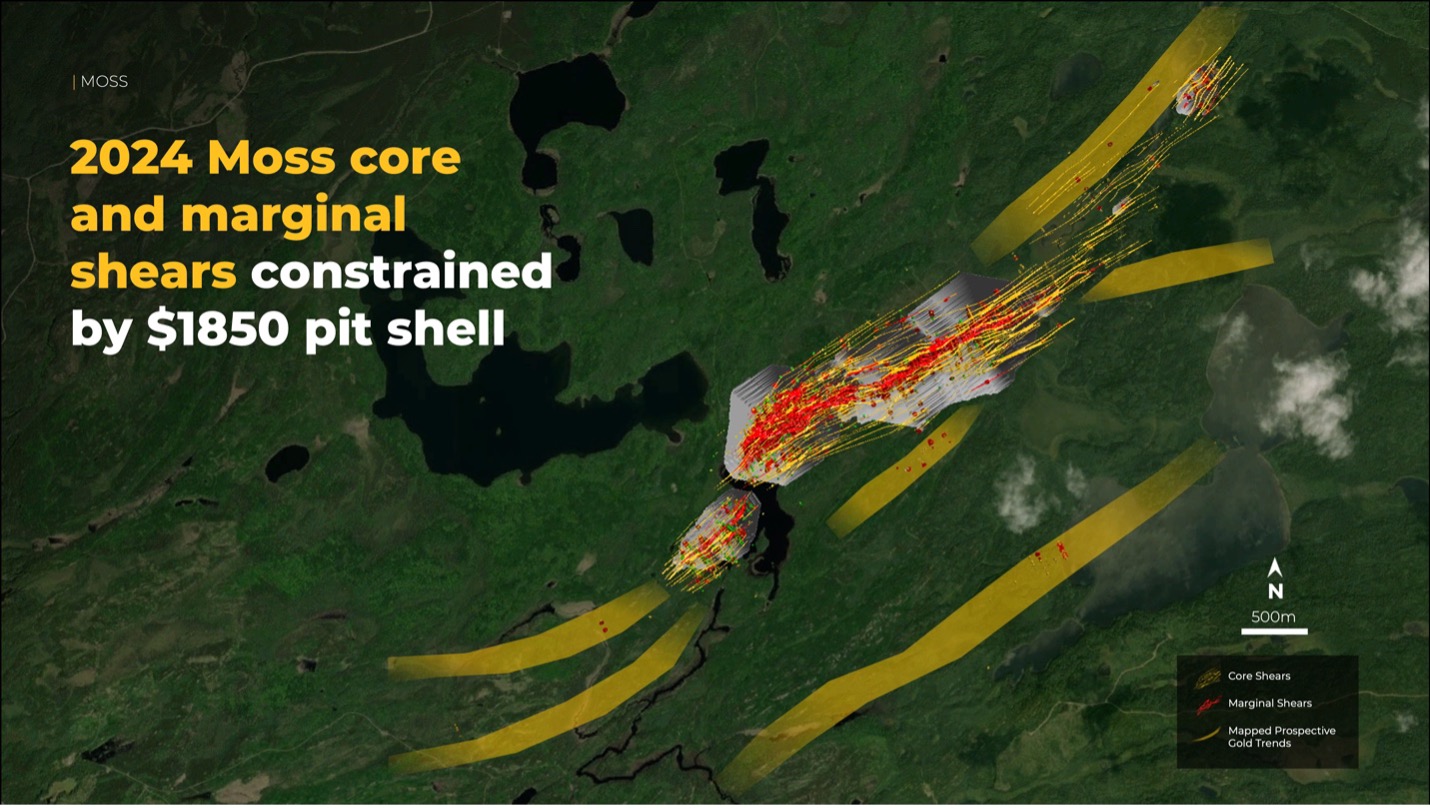

Figure 2:

Plan of Moss showing shears, $1850 pit shell and mapped mineralized

trends

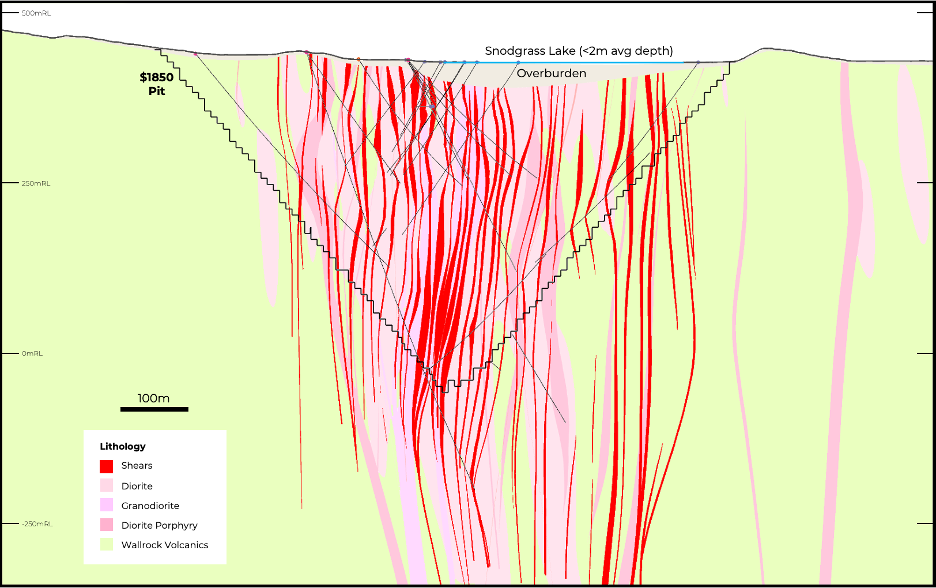

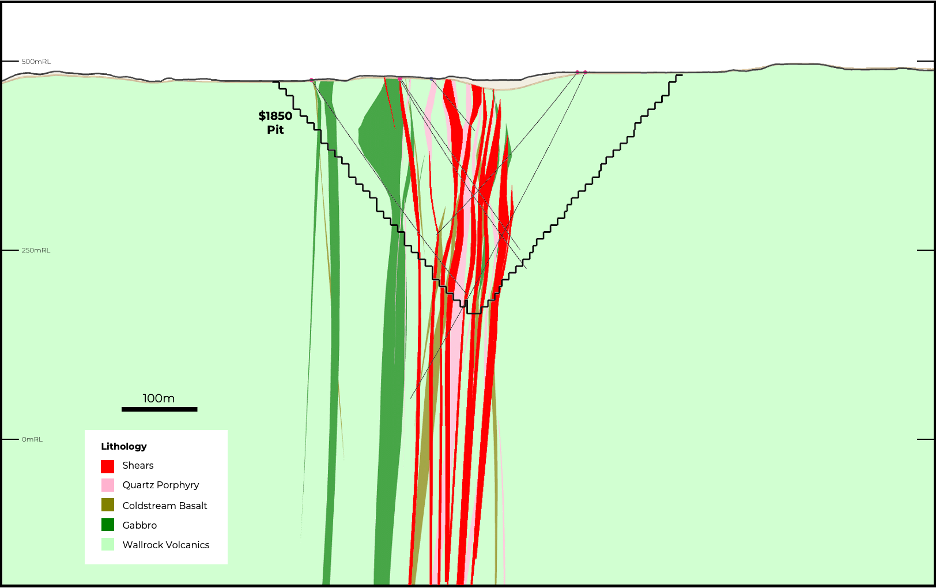

Figure

3: Cross

section through the Moss Main Zone showing geology

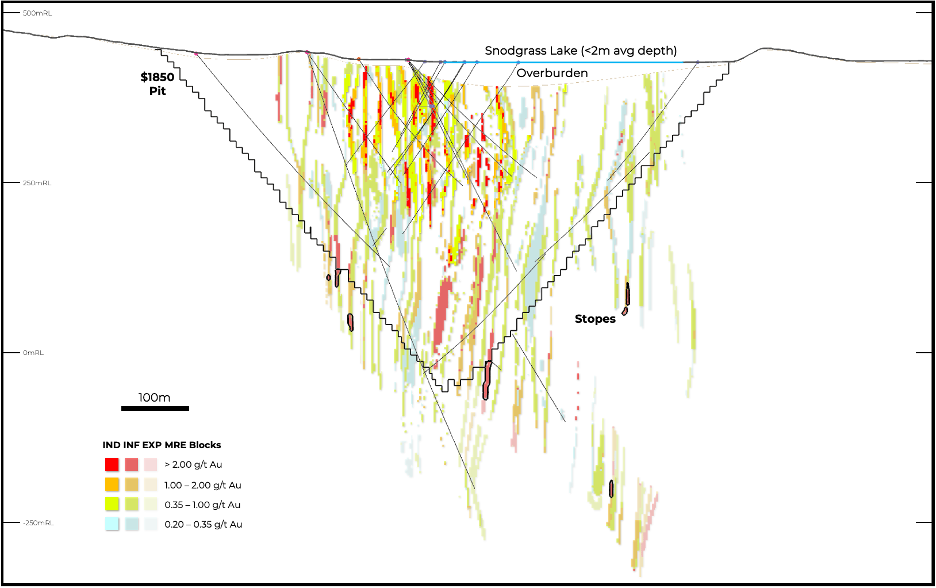

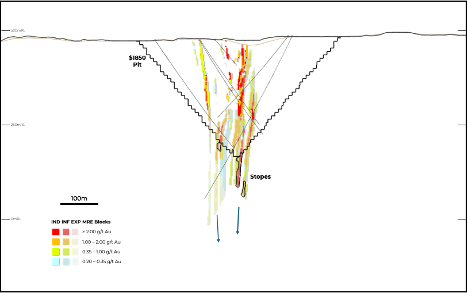

Figure

4: Cross

section through the Moss Main Zone showing grade model, $1850 open

pit shell and modelled stopes

Figure 5:

Plan of East Coldstream showing shears, cross-cutting diabase dike

and $1850 pit shell

Figure 6:

Cross section through East Coldstream showing geology

Figure 7:

Cross section through East Coldstream showing grade model, $1850

open pit shell and modelled stopes

Technical Overview

Historical Assay Review

APEX Geoscience Ltd. ("APEX")

completed an in-depth review and validation of assays collected

before 2010 at the Moss Deposit and East Coldstream Deposit to

establish whether the data is suitable for mineral resource

estimation. APEX reviewed previous studies' evaluation of twin

drilling and resampling programs and drew the following conclusions

regarding this data:

-

Five twin holes have been completed in the

Moss Zone. APEX regards this dataset as limited, insufficient for

definitive conclusions, but adequate for a preliminary assessment.

This view is due to the deposit's characteristics and challenges in

accurately positioning twin holes adjacent to historical holes. The

data indicate that the twin holes generally exhibit mineralization

that corresponds with the mineralization trends noted in the

historical drillholes they were designed to test and

confirm.

-

Six historical drillholes were resampled to

determine potential bias in the historical dataset.

-

Prior analyses of the resampling program

focused on comparing the difference between each interval's

historical and modern assays and noting variance discrepancies

between the two datasets.

-

APEX performed a quantile-to-quantile

comparison between resampled and historical assays and the results

show similar distributions, indicating no significant bias in

resampling assay values vs original values.

-

APEX considers the noted variance difference

to be within expected ranges, as the differences in sampling

volumes could explain any discrepancies.

-

These findings remain partially inconclusive

due to the limited number of holes resampled.

Due to the inconclusive results from the

twinning and resampling programs, APEX conducted a spatial pairing

analysis. This analysis compared the distribution of historical

assays with modern drilling data. The assay data was limited to

samples within the 2023 modelled shear domains, ensuring only

assays from similar geological settings were compared. In this

analysis, only assays from either dataset that are within 15 meters

of an assay from the other dataset could be considered.

The dataset included thousands of paired

samples to complete the analysis on. Below

are APEX's conclusions:

-

The assay distributions of historical paired

data and modern paired data were found to be similar after

accounting for comparable mineralization zones.

-

No evident bias in historical assays was

observed that could be attributed to assay methods or assay labs or

different generations (ages) of data.

-

Some historical data involved selective

assaying. Inserting nominal waste values for unsampled intervals

yields a conservative gold content estimate at the sample

location.

Based upon this analysis, the QP believes

that the historical assays can be used for a mineral resource

estimate even with limited historical QA/QC data. Details of the

Historical Assay Review and Analysis will be provided in a

technical report with an effective date of January 31, 2024,

prepared in accordance with National Instrument 43-101

("NI

43-101") standards.

Moss Deposit Geology

The Moss Deposit is a structurally controlled

gold deposit within the greenstone terrain of the Shebandowan Belt

in the Archean Superior Province. Mineralization is localized where

the major NE-trending Wawiag Fault Zone cuts a dioritic to

granodioritic intrusion complex. The

deposit comprises a network of centimetre- to meter-scale

northeast-trending shear zones hosting high-grade gold

mineralization. Surrounding the shear zones are areas of

lower-grade gold mineralization associated with less intense

shearing and more brittle deformation. This includes veining in

both the intrusion rock and adjacent wall rocks between the shear

zones. Mineralization is associated with pyrite, sericite and

chlorite alteration and millimetre- to centimetre-scale irregular

quartz-carbonate veinlets.

East Coldstream Deposit Geology

The East Coldstream Deposit is a structurally

controlled gold deposit located approximately 13 km northeast of

the Moss Deposit within the Moss Gold Project area. The East

Coldstream Deposit's mineralized zones are located on the south

margin of a shear zone that separates a gabbroic intrusion to the

north and a mafic-intermediate volcanic suite to the south.

Mineralization is found within sheared volcanic units, proximal to

sills of quartz and quartz-feldspar porphyries and distinctive,

brick-red syenites. The mineralized zones show silica, carbonate,

and hematite alteration. Mineralization consists of fine

disseminations of pyrite and lesser chalcopyrite throughout the

silica-hematite zones and within quartz-carbonate veinlets. Iron

carbonate is present in areas proximal to strong silicification. A

north-south-trending diabase dike has cut the two main mineralized

zones.

Mineral Resource Methodology, Assumptions,

and Cutoff Grades

Estimation Domains

APEX personnel comprehensively remodelled shear-hosted gold

estimation domains at Moss and East Coldstream deposits using

implicit modelling. The orientation of these domains is informed by

a structural trend model derived from oriented core structural

measurements. Additionally, APEX personnel developed an updated

geological model to guide estimation domain modelling and

facilitate density assignment by geological unit. The shear

estimation domains are delineated by connecting intervals of

mineralization that align with the structural trend and are

predominantly within a single geological unit. Discontinuous and

lower-grade gold mineralization associated with less intense

shearing and more brittle deformation are captured within a grade

shell with a nominal cutoff of 0.15 g/t Au.

The Granodiorite (IGD) unit at the Moss Lake

Deposit is associated with zones of higher-grade mineralization. In

the 2024 Moss Deposit MRE Update, modelled shear estimation domains

are categorized as "Core Shears" or "Marginal Shears." Core Shears,

continuous along strike, represent higher-grade material within or

adjacent to the IGD unit. Marginal Shears, in contrast, are shears

positioned further from the IGD unit or within shear domains where

lower-grade material is included to provide continuity along the

structural trend. Core shears are characterized by more intense

fracturing and extensive hydrothermal alteration than marginal

shears. The Core and Marginal Shears classification merges

short-range geological with longer-range structural continuity at

the Moss Deposit.

In this 2024 model, more than 94% of the in

pit block modelled gold mineralization tonnage above the cutoff

grade is contained within the wireframed Core Shear and Marginal

Shear domains. More than 96% of the block modelled gold

mineralization in terms of metal content above the cutoff grade is

also contained within the Core Shear and Marginal Shear

domains.

Mineral Resource Methodology

Modelling was conducted in the Universal

Transverse Mercator (UTM) coordinate space relative to the North

American Datum (NAD) 1983 and UTM zone 15N (EPSG: 26915). The

mineral resource block model utilized a block size of 3.0 m (X) x

3.0 m (Y) x 3.0 m (Z) to honour the mineralization wireframes. The

percentage of the volume of each block below the bare earth

surface, below the modelled waste overburden surface and within

each mineralization domain was calculated using the 3D geological

models and a 3D surface model. For the open pit resources, the

block model was block-averaged up to a 9 m (X) x 9 m (Y) x 9 m (Z)

SMU block size for pit optimization with the outer blocks on the

boundaries of the domains diluted. Resources are presented as

undiluted and in situ. The historical underground voids from

Noranda's 1980s exploration program have been removed from the MRE

at the Moss Deposit.

The MRE is based on the combination of

geological modelling, geostatistics and conventional block

modelling using the Ordinary Kriging method of grade interpolation

with locally varying anisotropy variogram models.

The Moss Project drillhole database consists

of 538 drill holes that intersected the interpreted mineralization

wireframes at the Moss Deposit and 156 drill holes that intersected

the interpreted mineralization wireframes at the East Coldstream

Deposit for a total of 738 Drill Holes used in the Mineral Resource

Estimate. Gold assays were composited to 2-meter composite lengths,

and the estimation utilized 31,149 composited samples. A total of

1.8% of the total drilled meters inside the interpreted

mineralization wireframes were not sampled, assumed to be waste,

and assigned a nominal waste value of half the detection limit of

modern assay methods (0.0025 g/t Au).

Gold estimation was completed using ordinary

kriging. The search ellipsoid size used to estimate the Au grades

was defined by the modelled variograms. Block grade estimation

employed locally varying anisotropy, which uses different rotation

angles to define the principal directions of the variogram model

and search ellipsoid on a per-block basis. Blocks within estimation

domains are assigned rotation angles using a modelled 3D

mineralization trend surface wireframe, which allows structural

complexities to be reproduced in the estimated block model. The

number of variogram structures, contributions of each structure,

and their ranges are set per estimation domain and do not vary

within the estimation domain.

A total of 2,812 bulk-density samples are

available from the Moss Project drillhole database. APEX personnel

performed exploratory data analysis of the bulk density samples

available, and the density was assigned for each geologic unit

modelled within the Moss Lake Deposit and East Coldstream Deposit

areas. The density of the deposits ranged from 2.68

g/cm3

to 2.89 g/cm3. The modelled overburden was

assigned a density of 1.8 g/cm3.

Mineral Resource Classification

The

Moss Gold Project MRE has been classified as an Indicated and

Inferred Mineral Resource. This resource classification reflects

that much of the drill hole data used for the resource estimate is

historical, and no QA/QC data or reports exist for most of these

drill holes. Statistical assessment of historical data spatially

near modern assay data support the use of the historical data in

the mineral resource estimate including the indicated category of

classification..

The

resource is classified according to the CIM "Estimation of Mineral

Resources and Mineral Reserves Best Practice Guidelines" dated

November 29, 2019, and CIM "Definition Standards for Mineral

Resources and Mineral Reserves" dated May 10, 2014.

Reasonable Prospects for Eventual Economic Extraction

The

CIM guidelines for mineral resources require that reported mineral

resources demonstrate reasonable prospects for eventual economic

extraction (RPEEE). Table 4 outlines the cost parameters and other

assumptions used to constrain the open-pit mineral resource

statement and reporting cutoff. The resource block model underwent

several pit optimization scenarios using Deswik's Pseudoflow pit

optimization. The resulting pit shell is used to constrain the

reported open-pit MRE that reaches a

maximum depth of approximately 510m and 340m in the

Moss Deposit and

East Coldstream Deposit, respectively.

Table 4:

Open Pit RPEEE Cost and Parameter Assumptions

|

Costs and

Geometry

|

|

Parameter

|

Unit

|

2024

MRE

|

|

Mining Waste

|

US$/ tonne waste

|

2.25

|

|

Mining Mineralized Material

|

US$/ tonne milled

|

3.00

|

|

Flotation Leach Processing

|

US$/ tonne milled

|

9.50

|

|

General and Administration

|

US$/ tonne milled

|

2.10

|

|

Slope

|

Degrees

|

50

|

|

Sale Price and

Recoveries

|

|

Gold Recovery (Moss Lake)

|

Percent

|

90

|

|

Gold Recovery (East Coldstream)

|

Percent

|

95

|

|

Gold Price

|

US$/ozt

|

1850

|

The reported underground MRE is constrained

within mining shapes assuming open-stope mining methods, a grade

cutoff of 2.0 g/t Au, and the assumptions detailed in Table

5. The mining shapes were manually constructed,

constraining continuous material above the gold cutoff that met the

minimum thickness and volume requirements.

Table 5:

Underground RPEEE Cost and Parameter Assumptions

|

Costs and

Geometry

|

|

Parameter

|

Unit

|

2024

MRE

|

|

Mining

|

US$/ tonne removed

|

75

|

|

Flotation Leach Processing

|

US$/ tonne milled

|

9.50

|

|

General and Administation

|

US$/ tonne milled

|

2.10

|

|

Assumed Open Stope Dimensions (W x H x

L)

|

Meters

|

1.5 x 10 x 20

|

|

Sale Price and

Recoveries

|

|

Gold Recovery (Moss Lake)

|

Percent

|

90

|

|

Gold Recovery (East Coldstream)

|

Percent

|

95

|

|

Gold Price

|

US$/ozt

|

1850

|

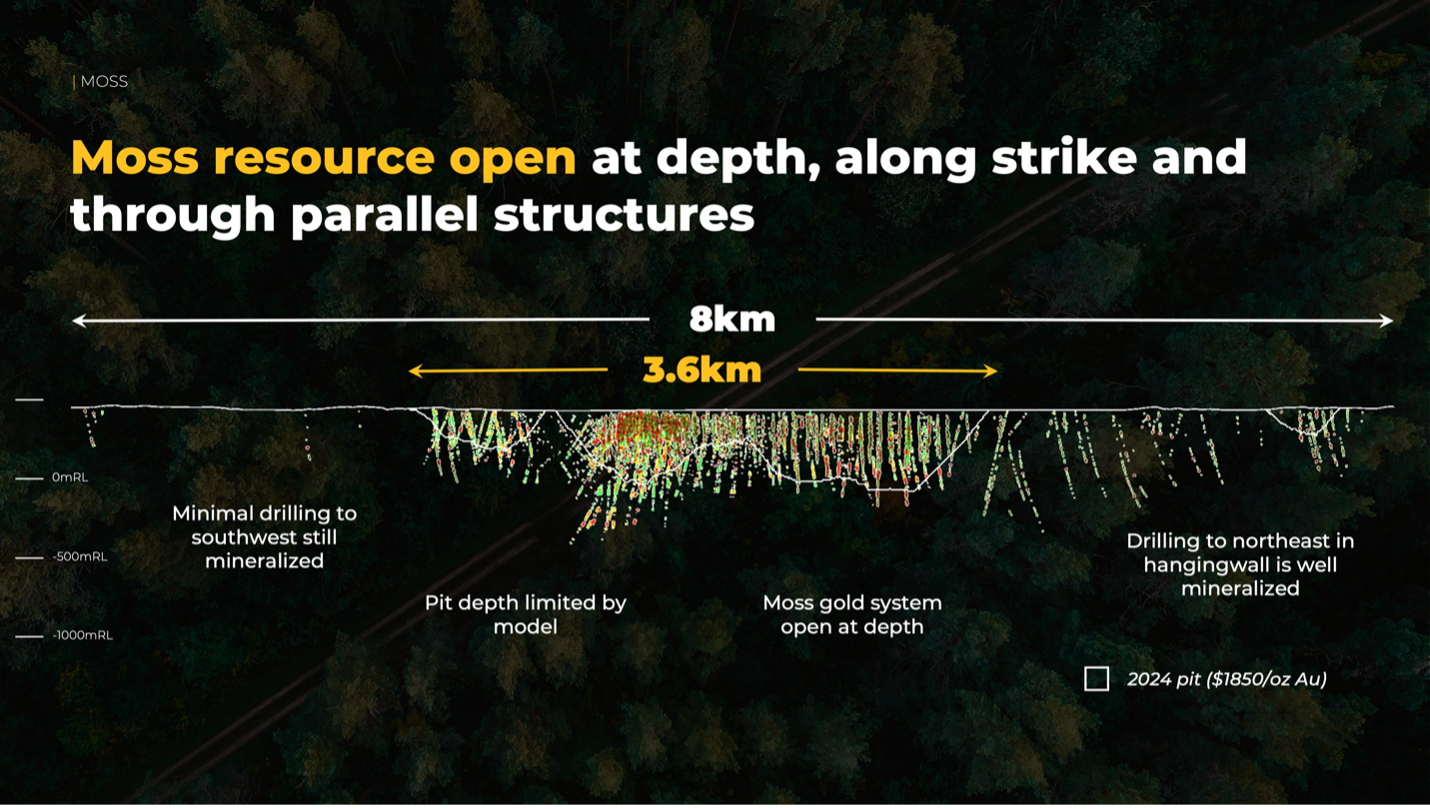

Additional Exploration Potential

The modelled shears extend to much greater

depth below the optimized open pit constraining the reported Moss

MRE. The shears are also open along strike, beyond the modelled

strike length of 5.7km. Historical drilling has intercepted gold

mineralization over a total strike length of 8 km, which has been a

focus of Goldshore's 2023 soil geochemistry and structural mapping

programs. This work suggests a series of en echelon

"master shears" with a second prospective

zone trending from just north of QES to the northeast beyond Span

(Figures 2 to 4 and 8).

Furthermore, there remains potential for

additional parallel shears with gold mineralization in historical

drill holes up to 2.5km to the southeast of the Moss

Deposit.

An additional 4 million tonnes of gold

mineralization has been identified and modelled inside the

conceptual open pit that is beyond the support distances required

for Inferred or Indicated classification. This tonnage represents a

target for future exploration drilling and resource

development.

Similar to the Moss deposit, the modelled

shears in East Coldstream extend to a greater depth below the

optimized open pit constraining the reported MRE. The

mineralization demonstrates a distinct shallow easterly plunge

which has been successfully tested at depth by Goldshore drilling

and represents potential for additional gold mineralization

discoveries beneath the current defined MRE open pit (Figures 5 to

7).

Figure 8:

Long section at the Moss Deposit showing gold mineralization in

drillholes along strike and at depth looking northwest

Next Steps

Goldshore will also continue an extensive

program of relogging and resampling of all historical drill holes

whose collars have been located and accurately surveyed. Where

possible, these drill holes are also being surveyed using modern

downhole surveying equipment. Resampling of historical drill core

will continue, although most core blocks are now illegible

rendering resampling impossible.

Pete

Flindell, VP Exploration for Goldshore, said:

"APEX have

completed a thorough and objective review of the geology of the

Moss and East Coldstream Gold Deposits, and the underlying drill

database. Their implicit modelling of core and marginal shears has

led to a more accurate model of the gold distribution. This has

resulted in a significant improvement in the Mineral Resource

Estimate, which can now form the basis for infill and step out

drill planning, and a definitive PEA. Their work also highlights

immediate potential to grow the MRE in and outside of the RPEEE

pits."

Qualified Person Statements

Mr. Michael Dufresne, M.Sc., P.Geol., P.Geo.

and Mr. Warren Black, M.Sc., P.Geo are both considered independent

"qualified persons" under NI 43-101 and are jointly responsible for

the 2024 Moss Gold Project MRE Update. Mr. Dufresne and Mr. Black

have prepared and approved the scientific and technical information

related to the MRE contained in this news release.

Peter Flindell, P.Geo., MAusIMM, MAIG, Vice

President - Exploration of the Company, and a "qualified person"

under NI 43-101 has also reviewed and approved the scientific and

technical information contained in this news release.

Updated Technical Report

Details of the Moss Gold Project MRE will be

provided in a technical report with an effective date of January

31, 2024, prepared in accordance with NI 43-101 standards, which

will be filed under the Company's SEDAR+ profile within 45 days of

this news release. The Moss Gold Project MRE was prepared by

independent mining consulting firm APEX Geoscience Ltd. in

accordance with the Canadian Institute of Mining, Metallurgy and

Petroleum ("CIM")

"Estimation of Mineral Resources and Mineral Reserves Best Practice

Guidelines" dated November 29, 2019, and the CIM "Definition

Standards for Mineral Resources and Mineral Reserves" dated May 10,

2014.

Results of the Company's Annual General

Meeting

The

Company also announces that all matters proposed at the Annual

General and Special Meeting (the "Meeting") held on January 23,

2024 were approved.

At the

Meeting, shareholders of the Company voted in favour of setting the

number of directors at six (6); as well as electing Galen McNamara,

Brett Richards, Brandon Macdonald, Shawn Khunkhun, Joanna Pearson

and Kyle Hickey as directors.

The

shareholders also approved the re-appointment of Davidson &

Company LLP as the Company's auditors, approved the adoption of a

new omnibus incentive plan (the "Incentive Plan") and provided

disinterested approval ratifying a previous grant of restricted

share units under the new Incentive Plan.

The new

Incentive Plan replaces the existing stock option plan previously

adopted by the Company, and allows for the grant of incentive stock

options, restricted share units and deferred share units to a

maximum of ten percent of the issued and outstanding share capital

from time-to-time.

For

further information regarding the matters presented at the Meeting,

or to review a copy of the new Incentive Plan, readers are

encouraged to review the Company's management proxy circular, a

copy of which is available under the Company's profile on

SEDAR+.

About Goldshore

Goldshore is an emerging junior gold

development company, and owns the

Moss Gold Project located in Ontario. The

Company is led and supported by an

industry-leading management group, board of

directors and advisory personnel. Goldshore is well-positioned and well

financed to advance

the Moss Gold Project through

the next stages of exploration and development.

Neither

the TSXV nor its Regulation Services Provider (as that term is

defined in the policies of the TSXV) accepts responsibility for the

adequacy or accuracy of this release.

For More

Information - Please Contact:

Brett A. Richards

President, Chief Executive Officer and

Director

Goldshore Resources Inc.

P. +1 604

288 4416 M. +1

905 449 1500

E. brichards@goldshoreresources.com

W. www.goldshoreresources.com

Facebook: GoldShoreRes |

Twitter: GoldShoreRes |

LinkedIn: goldshoreres

Cautionary

Note Regarding Forward-Looking Statements

This news release contains statements that

constitute "forward-looking statements." Such forward looking

statements involve known and unknown risks, uncertainties and other

factors that may cause the Company's actual results, performance or

achievements, or developments to differ materially from the

anticipated results, performance or achievements expressed or

implied by such forward-looking statements. Forward looking

statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects,"

"plans," "anticipates," "believes," "intends," "estimates,"

"projects," "potential" and similar expressions, or that events or

conditions "will," "would," "may," "could" or "should"

occur.

Forward-looking statements in this news

release include, among others, statements relating to expectations

regarding the exploration and development of the Project, the

filing of a technical report supporting the MRE, commencement of a

preliminary economic assessment and prefeasibility study, and other

statements that are not historical facts. By their nature,

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause our actual results,

performance or achievements, or other future events, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors and risks include, among others: the

Company may require additional financing from time to time in order

to continue its operations which may not be available when needed

or on acceptable terms and conditions acceptable; compliance with

extensive government regulation; domestic and foreign laws and

regulations could adversely affect the Company's business and

results of operations; the stock markets have experienced

volatility that often has been unrelated to the performance of

companies and these fluctuations may adversely affect the price of

the Company's securities, regardless of its operating performance;

the impact of COVID-19; the ongoing military conflict in Ukraine;

and other risk factors outlined in the Company's public disclosure

documents.

The forward-looking information contained in

this news release represents the expectations of the Company as of

the date of this news release and, accordingly, is subject to

change after such date. Readers should not place undue importance

on forward-looking information and should not rely upon this

information as of any other date. The Company undertakes no

obligation to update these forward-looking statements in the event

that management's beliefs, estimates or opinions, or other factors,

should change.