TIDMHIK

RNS Number : 7089Q

Hikma Pharmaceuticals Plc

22 June 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN THE UNITED

STATES, CANADA, JAPAN, AUSTRALIA OR ANY OTHER STATE OR JURISDICTION

IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE

UNLAWFUL

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

22 June 2020

Hikma Pharmaceuticals PLC ("Hikma" or the "Company")

Buy back of up to approximately GBP295 million of shares from

Boehringer Ingelheim

Boehringer Ingelheim Invest GmbH ("Boehringer Ingelheim") has

today announced its intention to exit in full its investment in

Hikma. As of today, Boehringer Ingelheim holds 40 million ordinary

shares in Hikma, which represents approximately 16.4 per cent. of

the issued ordinary share capital and voting rights in the

Company.

Boehringer Ingelheim has commenced an accelerated bookbuild

offering (the "Bookbuild") to sell up to approximately 28 million

shares in Hikma (the "Placing Shares") to institutional investors

only (the "Placing"). Concurrently with the Placing, Hikma has

committed to buy back from Boehringer Ingelheim such number of

ordinary shares ("the Buy Back Shares") as does not exceed an

aggregate value of GBP295 million (being an amount approximately

equal to 4.99% of the aggregate market value of all the Shares of

the Company at the close of business on 22(nd) June 2020, less the

value of the commitment fee described below) (the "Buy Back"). The

purchase price for each of the Buy Back Shares will be equal to the

sale price for each of the Placing Shares (the "Buy Back Price").

The Buy Back Price is subject to the price limit set out below.

Hikma has separately today entered into an agreement with

Boehringer Ingelheim pursuant to which Hikma will receive a

commitment fee of 2 per cent. of the aggregate value of the Buy

Back Shares acquired at the Buy Back Price (the "Commitment Fee").

Citigroup Global Markets Limited ("Citi") will act as riskless

principal for the purpose of the Buy Back.

The Buy Back is subject to the satisfaction of a number of

conditions, including the successful pricing of the Placing and

provided that the price payable by Hikma for the Buy Back Shares

does not exceed a per share amount equal to GBP24.71, which, net of

the 2% commitment fee, is equal to approximately GBP24.22, being

the average closing price of the five business days preceding to

today's date. If the Placing Price is within the pricing limits

that apply to the Buy Back Price, the Placing cannot proceed unless

the Buy Back proceeds.

Hikma will fund the Buy Back from cash and available facilities.

Hikma intends to hold the Buy Back Shares in treasury and Hikma

will not receive any proceeds from the Placing. Following the

successful completion of the Placing and the Buy Back, Boehringer

Ingelheim would no longer hold any shares in Hikma.

The shares being sold by Boehringer Ingelheim were issued by

Hikma as part of the consideration for the acquisition of Roxane

Laboratories in February 2016. The Buy Back demonstrates the

Board's confidence in Hikma's future prospects. Since its initial

public offering ("IPO") in 2005, Hikma has delivered a total

shareholder return of approximately 926%, exceeding the FTSE 100

total shareholder return of approximately 105%.

As at 31 December 2019, Hikma's net debt to core EBITDA ratio

was 0.4x.

Boehringer Ingelheim is a related party of Hikma for the

purposes of the Listing Rules by virtue of its approximately 16.4

per cent. shareholding in Hikma. The Buy Back by Hikma and the

associated payment of the Commitment Fee by Boehringer Ingelheim

constitute a smaller related party transaction falling within LR

11.1.10R(1) and this announcement is therefore made in accordance

with LR11.1.10R(2)(c). The aggregate amount of the Buy Back and the

commitment fee cannot be higher than approximately GBP301

million.

Citi and Goldman Sachs International ("Goldman Sachs") are

acting as joint financial advisers to Hikma on the Buy Back.

Commenting, Said Darwazah, Executive Chairman of Hikma,

said:

"I would like to thank Boehringer Ingelheim for their support as

a major shareholder in Hikma since our acquisition of Roxane in

2016. We are delighted to have the opportunity to welcome new

investors into Hikma and at the same time have this unique

opportunity to acquire a significant proportion of our share

capital. The Buy Back reflects our confidence in the future

prospects of the business and we will retain significant financial

flexibility to continue to execute our strategy. We remain focused

on delivering future growth and value creation for our

shareholders."

The person responsible for the release of this announcement on

behalf of Hikma is Peter Speirs (Company Secretary).

Enquiries:

Hikma

Susan Ringdal +44 (0)20 7399 2760/+44

EVP, Strategic Planning and Global Affairs (0)7776 477050

Guy Featherstone +44 (0)20 3892 4389/+44

Senior Investor Relations Manager (0)7795 896738

Citi (Financial Adviser and Corporate

Broker to Hikma) +44 (0)20 7986 4000

Andrew Seaton

Robert Way

Suneel Hargunani

Goldman Sachs (Financial Adviser to Hikma) +44 (0)20 7774 1000

Robert King

John Wilkinson

Christoph Stanger

Teneo (Public Relations Adviser to Hikma)

Charles Armitstead +44 (0)7703 330 269

Camilla Cunningham +44 (0)7464 982 426

About Hikma

Hikma Pharmaceuticals PLC (LSE: HIK) (NASDAQ Dubai: HIK) (OTC:

HKMPY) (LEI:549300BNS685UXH4JI75) (rated Ba1/stable Moody's and

BB+/positive S&P)

Hikma helps put better health within reach every day for

millions of people in more than 50 countries around the world. For

more than 40 years, we've been creating high-quality medicines and

making them accessible to the people who need them. Headquartered

in the UK, we are a global company with a local presence across the

United States (US), the Middle East and North Africa (MENA) and

Europe, and we use our unique insight and expertise to transform

cutting-edge science into innovative solutions that transform

people's lives. We're committed to our customers, and the people

they care for, and by thinking creatively and acting practically,

we provide them with a broad range of branded and non-branded

generic medicines. Together, our 8,600 colleagues are helping to

shape a healthier world that enriches all our communities. We are a

leading licensing partner, and through our venture capital arm, are

helping bring innovative health technologies to people around the

world. For more information, please visit: www.hikma.com

(c)2020 Hikma Pharmaceuticals PLC. All rights reserved.

Disclaimer

Citi, which is authorised by the Prudential Regulation Authority

and regulated in the UK by the Financial Conduct Authority and the

Prudential Regulation Authority is acting as financial adviser and

corporate broker to Hikma and for no one else in connection with

the Buy Back and other matters described in this announcement, and

will not be responsible to anyone other than Hikma for providing

the protections afforded to its clients nor for providing advice in

relation to the Buy Back or any other matters referred to in this

announcement. Neither Citi nor any of its affiliates, directors or

employees owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, consequential, whether in

contract, tort, in delict, under statute or otherwise) to any

person who is not a client of Citi in connection with this

announcement, any statement contained herein, the Buy Back or

otherwise.

Goldman Sachs, which is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority in the United Kingdom, is acting as

financial adviser to Hikma and no one else in connection with the

Buy Back and will not be responsible to anyone other than Hikma for

providing the protections afforded to clients of Goldman Sachs

International or for providing advice in connection with the Buy

Back or in this Announcement or any transaction or arrangement

referred to herein.

Further Information

This communication is not intended to and does not constitute an

offer to buy or the solicitation of an offer to subscribe for or

sell or an invitation to purchase or subscribe for any securities

or the solicitation of any vote in any jurisdiction. The release,

publication or distribution of this communication in whole or in

part, directly or indirectly, in, into or from certain

jurisdictions may be restricted by law and therefore persons in

such jurisdictions should inform themselves about and observe such

restrictions.

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about, and observe, such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law of any such jurisdictions.

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014. Upon the publication of

this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

POSQLLFLBQLFBBF

(END) Dow Jones Newswires

June 22, 2020 12:13 ET (16:13 GMT)

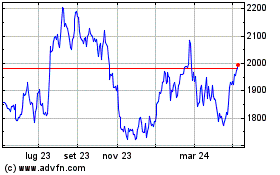

Grafico Azioni Hikma Pharmaceuticals (LSE:HIK)

Storico

Da Mar 2024 a Apr 2024

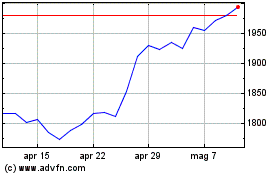

Grafico Azioni Hikma Pharmaceuticals (LSE:HIK)

Storico

Da Apr 2023 a Apr 2024