TIDMHTG

RNS Number : 9150I

Hunting PLC

17 December 2020

For Immediate Release 17 December 2020

Hunting PLC

("Hunting" or "the Company" or "the Group")

2020 Year End Trading Update

Hunting PLC (LSE : HTG), the international energy services

group, today issues a year-end trading update. The Group will be

reporting its 2020 Full Year Results on Thursday 4 March 2021.

Jim Johnson, Chief Executive of Hunting, commented:

"As the Group approaches the year-end, market indicators

including the WTI oil price, the onshore rig count and the number

of active frac crews in the US, have all shown modest increases

throughout the quarter which will support activity levels going

into the New Year. With this market backdrop, coupled with a

significantly lower cost base, where c.$81m in annualised savings

have been achieved in the year to date, management anticipates an

improving performance for the year ahead.

"The Group's actions to restructure our global businesses during

2020 will also lead to further efficiencies being recognised as

activity levels ramp up. With the closure of our Canada

manufacturing operation and partial divestment of our Drilling

Tools business, coupled with further consolidation in Singapore and

USA, our business footprint is leaner and better positioned for the

forecast return to growth. Our year end headcount will be below

2,000 employees, or a reduction of 34% since the start of 2020.

"Hunting continues to develop and launch new products and

technology to clients. In the year, 39 new patents were

successfully issued globally, supporting the Group's strong

intellectual property portfolio. As highlighted previously, efforts

to develop non-oil and gas related sales continue throughout the

Group.

"Our efforts to reduce working capital in the year have been

successful which has led to a cash and bank position of $94m as at

30 November 2020. Inventory levels continue to decline, and will

likely result in a closing position at the year end of below

$300m."

Trading Update

As anticipated, the performance of the Group during the final

quarter of the year has reflected slightly lower revenue compared

to the previous two quarters, as an improving US onshore market is

offset by lower international activity, primarily in our North Sea

market, while other offshore projects have been delayed due to

COVID-19 related issues. In the year to 30 November 2020, Group

EBITDA has been c.$26m, with Q4 2020 likely to report a small

EBITDA loss, given the caution exhibited by clients in respect to

capital spending due to market uncertainties and low commodity

prices, coupled with the usual seasonal slowdown.

The Group continues to report a strong cash and bank of c.$94m

as at 30 November 2020, as working capital improvements continue to

generate cash. Given this positive cash position the Board has

agreed a programme to purchase up to 4.0m Ordinary shares for

transferring to our employee share trust. These shares will be used

to satisfy future vestings under the Hunting Performance Share

Plan.

Inventory levels at 30 November 2020 were c.$304m, reflecting a

continued focus to reduce stock. Capital investment for the full

year is projected to be c.$17m.

Hunting Titan's trading results have improved since the half

year point, with the business reporting increasing revenue and a

broadly break-even result in November, supported by an improving

product mix and lower cost base. New order intake in November for

Hunting Titan was the highest since the start of the pandemic,

demonstrating a slowly strengthening order book.

Hunting's US businesses reported relatively stable revenue in

October and November as the segment continues to record modest

activity levels. As announced on 15 December 2020 the segment has

divested its Drilling Tools business and assets to Rival Downhole

Tools in exchange for a 23.5% equity position in the enlarged Rival

business, which allows the Group to retain a presence in the

onshore drilling tools rental market, but with a reduced capital

requirement.

The Group's EMEA segment reports a continuing decline in

activity within the North Sea, leading to losses in the period. The

business has completed a headcount reduction during the quarter to

reduce its cost base, however, all current market indicators

suggest that clients in the region will be recommencing drilling

programmes in 2021 which will support a recovery in this

segment.

In Asia Pacific, the segment has reported lower revenues in

November 2020, compared to the prior month, as international

markets continued to slow. However, the segment has remained

profitable in the quarter.

For further information please contact:

Hunting PLC Tel: +44 (0) 20 7321 0123

Jim Johnson, Chief Executive

Bruce Ferguson, Finance Director

Tarryn Riley, Investor Relations

Buchanan Tel: +44 (0) 20 7466 5000

Ben Romney

Chris Judd

Notes to Editors:

About Hunting PLC

Hunting PLC is an international energy services provider to the

world's leading upstream oil and gas companies. Established in

1874, it is a premium listed public company traded on the London

Stock Exchange. The Company maintains a corporate office in Houston

and is headquartered in London. As well as the United Kingdom, the

Company has operations in Canada, China, Indonesia, Mexico,

Netherlands, Norway, Saudi Arabia, Singapore, United Arab Emirates

and the United States of America.

The Group reports in US dollars across five segments: Hunting

Titan, US, Canada, Europe, Middle East and Africa ("EMEA") and Asia

Pacific. From 1 January 2021, the Group's Canada business will be

incorporated into the US operating segment.

Hunting PLC's Legal Entity Identifier is

2138008S5FL78ITZRN66.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAXAKFFNEFFA

(END) Dow Jones Newswires

December 17, 2020 02:00 ET (07:00 GMT)

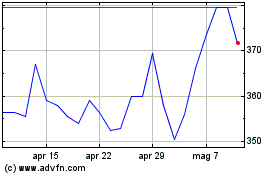

Grafico Azioni Hunting (LSE:HTG)

Storico

Da Mar 2024 a Apr 2024

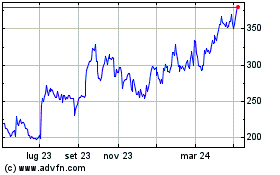

Grafico Azioni Hunting (LSE:HTG)

Storico

Da Apr 2023 a Apr 2024