TIDMIMB

RNS Number : 3706D

Imperial Brands PLC

18 February 2020

Directors and Persons Discharging Managerial Responsibility

("PDMRs") Interests

Imperial Brands PLC (the "Company") Long Term Incentive Plan

On 17 February 2020, the Company made the following grant of

awards under the Imperial Brands Long Term Incentive Plan (the

"LTIP") to PDMRs:

PDMR No. of LTIP awards granted

Oliver Tant 102,739

---------------------------

Walter Prinz 53,253

---------------------------

Dominic Brisby 55,890

---------------------------

Joerg Biebernick 53,150

---------------------------

David Newns 24,657

---------------------------

The Remuneration Committee is cognisant of the current share

price and the impact this has on the number of shares awarded if

the same percentage of salary was maintained as in previous years.

On this occasion the Remuneration Committee has decided that

shareholder interests are best served by making awards linked to a

percentage of base salary in line with previous years.

Further to the commitment in its Annual Report and Accounts

2019, the Company confirms that the performance measures in respect

of the Annual Imperial Brands LTIP grant made on 17 February 2020

will be:

Earnings per Share Element

This criterion is used for 40 per cent of the award with the

following vesting schedule:

Compound annual adjusted EPS growth(*) Shares vesting (as

a percentage of element)

Less than 2% per annum nil

--------------------------

2% per annum 25%

--------------------------

2% to 6% per annum Between 25% and 100%

(pro rata)

--------------------------

6% per annum or higher 100%

--------------------------

*As per the Remuneration Committee's decision in 2014, and all

awards since 2015, EPS growth and net revenue growth are measured

at constant currency.

Total Net Revenue Growth Element

The net revenue growth criterion is used for 40 per cent of the

award with the following vesting schedule:

Compound annual growth in net revenue(**) Shares vesting (as

a percentage of element)

Less than 1% per annum nil

--------------------------

1% per annum 25%

--------------------------

1% to 4% per annum Between 25% and 100%

(pro rata)

--------------------------

4% per annum or higher 100%

--------------------------

**As per the Remuneration Committee's decision in 2014, and all

awards since 2015, EPS growth and net revenue growth are measured

at constant currency.

Total Shareholder Return Element

The relative total shareholder return ("TSR") criterion is used

for 20 per cent of the award. The peer group used for the

assessment of relative TSR now reflects a more relevant group of

companies in the consumer goods sector. The companies in the

revised peer group are:

Altria Group Anheuser-Busch Beiersdorf British American Brown-Forman

InBev Tobacco

Carlsberg Clorox Constellation Diageo Heineken

Brands

--------------- --------------- ----------------- -----------------

Henkel Japan Tobacco Kimberly-Clark Kirin Holdings L'Oreal

--------------- --------------- ----------------- -----------------

Monster Beverage Pernod Ricard Pepsico Philip Morris Procter & Gamble

International

--------------- --------------- ----------------- -----------------

Reckitt Benckiser Swedish Match Uni Charm Unilever PLC

Group

--------------- --------------- ----------------- -----------------

Vesting of awards on this element would occur as per the vesting

schedule below:

Relative TSR performance Shares vesting (as

percentage of element)

Below median of peer group nil

------------------------

At median of peer group 25%

------------------------

Between median and upper quartile Between 25% and 100%

(pro rata)

------------------------

At or above upper quartile 100%

------------------------

Each element operates independently and is capable of vesting

regardless of the Company's performance in respect of the other

elements.

The Remuneration Committee retains the discretion under the

rules of the plan to reduce the level of vesting determined by an

assessment of the performance conditions, if it is considered to be

appropriate having regard to such factors as the Committee

considers relevant

There is no opportunity to retest if any of the performance

criteria are not achieved.

Details of individual awards are provided below:

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name OLIVER REGINALD TANT

--------------------------- --------------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status EXECUTIVE DIRECTOR - CHIEF FINANCIAL

OFFICER

--------------------------- --------------------------------------

b) Initial notification

/Amendment INITIAL NOTIFICATION

--------------------------- --------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name IMPERIAL BRANDS PLC

--------------------------- --------------------------------------

b) LEI 549300DFVPOB67JL3A42

--------------------------- --------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description of the

financial instrument, ORDINARY SHARES

type of instrument

Identification code GB0004544929

--------------------------- --------------------------------------

b) Nature of the transaction LAPSING OF AWARD UNDER LONG TERM

INCENTIVE PLAN

--------------------------- --------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

Not Applicable LAPSED 47,049

---------------

--------------------------- --------------------------------------

d) Aggregated information

- Aggregated volume LAPSED 47,049

- Price NOT APPLICABLE

--------------------------- --------------------------------------

e) Date of the transaction 17 FEBRUARY 2020

--------------------------- --------------------------------------

f) Place of the transaction OUTSIDE A TRADING VENUE

--------------------------- --------------------------------------

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name OLIVER REGINALD TANT

--------------------------- --------------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status EXECUTIVE DIRECTOR - CHIEF FINANCIAL

OFFICER

--------------------------- --------------------------------------

b) Initial notification INITIAL NOTIFICATION

/Amendment

--------------------------- --------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name IMPERIAL BRANDS PLC

--------------------------- --------------------------------------

b) LEI 549300DFVPOB67JL3A42

--------------------------- --------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description of the

financial instrument,

type of instrument ORDINARY SHARES

Identification code GB0004544929

--------------------------- --------------------------------------

b) Nature of the transaction CONDITIONAL AWARD GRANTED UNDER LONG

TERM INCENTIVE PLAN

--------------------------- --------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

NOT APPLICABLE 102,739

----------

--------------------------- --------------------------------------

d) Aggregated information

- Aggregated volume 102,739

- Price NOT APPLICABLE

--------------------------- --------------------------------------

e) Date of the transaction 17 FEBRUARY 2020

--------------------------- --------------------------------------

f) Place of the transaction OUTSIDE A TRADING VENUE

--------------------------- --------------------------------------

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name WALTER NORBERT PRINZ

--------------------------- --------------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status PDMR - GROUP MANUFACTURING AND SUPPLY

CHAIN DIRECTOR

--------------------------- --------------------------------------

b) Initial notification

/Amendment INITIAL NOTIFICATION

--------------------------- --------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name IMPERIAL BRANDS PLC

--------------------------- --------------------------------------

b) LEI 549300DFVPOB67JL3A42

--------------------------- --------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description of the

financial instrument,

type of instrument ORDINARY SHARES

Identification code GB0004544929

--------------------------- --------------------------------------

b) Nature of the transaction LAPSING OF AWARD UNDER LONG TERM

INCENTIVE PLAN

--------------------------- --------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

Not Applicable LAPSED 17,947

---------------

--------------------------- --------------------------------------

d) Aggregated information

- Aggregated volume LAPSED 17,947

- Price NOT APPLICABLE

--------------------------- --------------------------------------

e) Date of the transaction 17 February 2020

--------------------------- --------------------------------------

f) Place of the transaction OUTSIDE A TRADING VENUE

--------------------------- --------------------------------------

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name WALTER NORBERT PRINZ

--------------------------- --------------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status PDMR - GROUP MANUFACTURING AND SUPPLY

CHAIN DIRECTOR

--------------------------- --------------------------------------

b) Initial notification INITIAL NOTIFICATION

/Amendment

--------------------------- --------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name IMPERIAL BRANDS PLC

--------------------------- --------------------------------------

b) LEI 549300DFVPOB67JL3A42

--------------------------- --------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description of the

financial instrument,

type of instrument ORDINARY SHARES

Identification code GB0004544929

--------------------------- --------------------------------------

b) Nature of the transaction CONDITIONAL AWARD GRANTED UNDER LONG

TERM INCENTIVE PLAN

--------------------------- --------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

NOT APPLICABLE 53,253

----------

--------------------------- --------------------------------------

d) Aggregated information

- Aggregated volume 53,253

- Price NOT APPLICABLE

--------------------------- --------------------------------------

e) Date of the transaction 17 FEBRUARY 2020

--------------------------- --------------------------------------

f) Place of the transaction OUTSIDE A TRADING VENUE

--------------------------- --------------------------------------

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name DOMINIC JAMES BRISBY

-------------------------- ------------------------------------------

2 Reason for the notification

----------------------------------------------------------------------

a) Position/status PDMR - JOINT INTERIM CHIEF EXECUTIVE

OFFICER AND DIVISION DIRECTOR, AMERICAS,

AFRICA, ASIA & AUSTRALASIA

-------------------------- ------------------------------------------

b) Initial notification

/Amendment INITIAL NOTIFICATION

-------------------------- ------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------

a) Name IMPERIAL BRANDS PLC

-------------------------- ------------------------------------------

b) LEI 549300DFVPOB67JL3A42

-------------------------- ------------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

----------------------------------------------------------------------

a) Description of the

financial instrument,

type of instrument ORDINARY SHARES

Identification code GB0004544929

-------------------------- ------------------------------------------

b) Nature of the transaction LAPSING OF AWARD UNDER LONG TERM

INCENTIVE PLAN

-------------------------- ------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

Not Applicable LAPSED 16,061

---------------

-------------------------- ------------------------------------------

d) Aggregated information

- Aggregated volume LAPSED 16,061

- Price NOT APPLICABLE

-------------------------- ------------------------------------------

e) Date of the transaction 17 FEBRUARY 2020

-------------------------- ------------------------------------------

f) Place of the transaction OUTSIDE A TRADING VENUE

-------------------------- ------------------------------------------

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name DOMINIC JAMES BRISBY

-------------------------- ------------------------------------------

2 Reason for the notification

----------------------------------------------------------------------

a) Position/status PDMR - JOINT INTERIM CHIEF EXECUTIVE

OFFICER AND DIVISION DIRECTOR, AMERICAS,

AFRICA, ASIA & AUSTRALASIA

-------------------------- ------------------------------------------

b) Initial notification INITIAL NOTIFICATION

/Amendment

-------------------------- ------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------

a) Name IMPERIAL BRANDS PLC

-------------------------- ------------------------------------------

b) LEI 549300DFVPOB67JL3A42

-------------------------- ------------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

----------------------------------------------------------------------

a) Description of the

financial instrument, ORDINARY SHARES

type of instrument

Identification code GB0004544929

-------------------------- ------------------------------------------

b) Nature of the transaction CONDITIONAL AWARD GRANTED UNDER LONG

TERM INCENTIVE PLAN

-------------------------- ------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

NOT APPLICABLE 55,890

----------

-------------------------- ------------------------------------------

d) Aggregated information

- Aggregated volume 55,890

- Price NOT APPLICABLE

-------------------------- ------------------------------------------

e) Date of the transaction 17 FEBRUARY 2020

-------------------------- ------------------------------------------

f) Place of the transaction OUTSIDE A TRADING VENUE

-------------------------- ------------------------------------------

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name JOERG BIEBERNICK

-------------------------- ---------------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status PDMR - JOINT INTERIM CHIEF EXECUTIVE

OFFICER AND DIVISION DIRECTOR, EUROPE

-------------------------- ---------------------------------------

b) Initial notification INITIAL NOTIFICATION

/Amendment

-------------------------- ---------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name IMPERIAL BRANDS PLC

-------------------------- ---------------------------------------

b) LEI 549300DFVPOB67JL3A42

-------------------------- ---------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description of the

financial instrument, ORDINARY SHARES

type of instrument

Identification code GB0004544929

-------------------------- ---------------------------------------

b) Nature of the transaction CONDITIONAL AWARD GRANTED UNDER LONG

TERM INCENTIVE PLAN

-------------------------- ---------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

NOT APPLICABLE 53,150

----------

-------------------------- ---------------------------------------

d) Aggregated information

- Aggregated volume 53,150

- Price NOT APPLICABLE

-------------------------- ---------------------------------------

e) Date of the transaction 17 FEBRUARY 2020

-------------------------- ---------------------------------------

f) Place of the transaction OUTSIDE A TRADING VENUE

-------------------------- ---------------------------------------

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name DAVID THOMAS NEWNS

--------------------------- --------------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status PDMR - GROUP INNOVATION AND SCIENCE

DIRECTOR

--------------------------- --------------------------------------

b) Initial notification INITIAL NOTIFICATION

/Amendment

--------------------------- --------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name IMPERIAL BRANDS PLC

--------------------------- --------------------------------------

b) LEI 549300DFVPOB67JL3A42

--------------------------- --------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description of the

financial instrument, ORDINARY SHARES

type of instrument

Identification code GB0004544929

--------------------------- --------------------------------------

b) Nature of the transaction CONDITIONAL AWARD GRANTED UNDER LONG

TERM INCENTIVE PLAN

--------------------------- --------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

NOT APPLICABLE 24,657

----------

--------------------------- --------------------------------------

d) Aggregated information

- Aggregated volume 24,657

- Price NOT APPLICABLE

--------------------------- --------------------------------------

e) Date of the transaction 17 FEBRUARY 2020

--------------------------- --------------------------------------

f) Place of the transaction OUTSIDE A TRADING VENUE

--------------------------- --------------------------------------

Trevor Williams

Deputy Company Secretary

Copies of our announcements are available on our website:

www.imperialbrandsplc.com/Investors/Stock-Exchange-announcements

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DSHXVLFFBLLBBBV

(END) Dow Jones Newswires

February 18, 2020 08:10 ET (13:10 GMT)

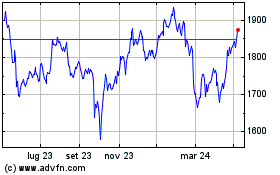

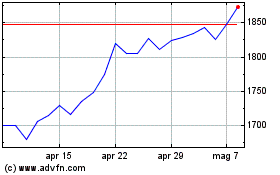

Grafico Azioni Imperial Brands (LSE:IMB)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Imperial Brands (LSE:IMB)

Storico

Da Apr 2023 a Apr 2024