TIDMJLEN

RNS Number : 6408H

Jlen Environmental Assets Grp

04 December 2020

4 December 2020

JLEN Environmental Assets Group Limited

("JLEN" or the "Company")

Acquisition of a portfolio of biomethane refuelling stations for

Compressed Natural Gas vehicles

JLEN, the listed environmental infrastructure fund, is pleased

to announce that it has acquired a minority stake in a portfolio of

five Compressed Natural Gas ("CNG") refuelling stations for heavy

goods vehicles ("HGVs"), located in the UK. The investment has been

made alongside other Foresight funds and the developer and operator

of the stations, CNG Fuels Limited ("CNG Fuels"). JLEN will also

contribute to a funding line to fund the construction of a further

pipeline of CNG refuelling stations as part of a national network.

JLEN's total investment, including the initial acquisition, is

expected to be up to approximately GBP20m over the next two to five

years.

The transport sector is the largest source of carbon dioxide

emissions in the UK, accounting for 34 per cent in 2019[1]. Within

the transport sector HGVs produce 17% of road transport emissions

and 4.5% of total UK greenhouse gases ("GHGs").

Therefore, HGVs fuelled by biomethane (as generated by anaerobic

digestion plants) are the only commercially available, at-scale

solution to substantially reduce these emissions. HGVs fuelled with

100% biomethane offer a saving in GHG emissions of over 80% on a

"well-to-wheel" basis when compared to a similar diesel vehicle.

They also offer further environmental benefits such as lower noise

and lower particulate emissions[2].

The take-up of CNG HGVs fuelled by biomethane, therefore offers

fleet operators the opportunity to lower their emissions

substantially. CNG HGVs are also cheaper to run over a typical 5-7

year duty cycle, due in part to a favourable fuel duty position

compared to comparable diesel vehicles. The government has

committed to maintaining a clear advantage for gas powered vehicles

until 2032, as part of measures supporting the UK's target of net

zero emissions by 2050.

Revenues are earned from sales of biomethane fuel to customers

under contract, which include several of the largest fleet

operators in the UK. The commodity price of gas is passed through

to the customer, meaning that JLEN has no exposure to underlying

merchant gas prices.

The initial acquisition was funded by a draw-down under the

Company's revolving credit facility.

Richard Morse, Chairman of JLEN, said:

"We are pleased to make this investment into biomethane

refuelling infrastructure, helping to decarbonise one of the most

emission-intensive parts of the transport sector. We consider that

this investment combines the two pillars of delivering better

environmental performance and lower cost operations for customers,

thereby supporting our investment case and we look forward to

supporting the growth of a national biomethane refuelling

network."

This announcement is released by JLEN Environmental Assets Group

Limited and contains inside information for the purposes of Article

7 of the Market Abuse Regulation (EU) 596/2014 (MAR), and is

disclosed in accordance with the Company's obligations under

Article 17 of MAR.

For f urth er d etails contact:

Foresight Group +44 (0)20 3667 8100

Chris Tanner

Chris Holmes

Winterflood Investment Trusts +44 (0)20 3100 0000

Neil Langford

Chris Mills

Newgate Communications +44 (0)20 3757 6880

Elisabeth Cowell

Ian Silvera

Praxis Fund Services +44 (0)14 8175 5530

Matt Falla

For the purposes of MAR and Article 2 of Commission Implementing

Regulation (EU) 2016/1055, the person responsible for releasing

this announcement is Matt Falla, Company Secretary.

About JLEN

JLEN's investment policy is to invest in environmental

infrastructure projects that have the benefit of long-term,

predictable, wholly or partially inflation-linked cash flows

supported by long-term contracts or stable regulatory

frameworks.

Environmental Infrastructure is defined by the Company as

infrastructure projects that utilise natural or waste resources or

support more environmentally-friendly approaches to economic

activity. This could involve the generation of renewable energy

(including solar, wind, hydropower and biomass technologies), the

supply and treatment of water, the treatment and processing of

waste, and projects that promote energy efficiency.

JLEN's aim is to provide investors with a sustainable,

progressive dividend per share, paid quarterly and to preserve the

capital value of the portfolio over the long term on a real basis.

The target dividend for the year to 31 March 2021 is 6.76 pence per

share.

Further details of the Company can be found on its website

www.jlen.com

[1] BEIS "2019 UK greenhouse gas emissions, provisional figures"

(26 March 2020)

[2] Source: CNG Fuels, Element Energy

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFLFLVFELSIII

(END) Dow Jones Newswires

December 04, 2020 08:17 ET (13:17 GMT)

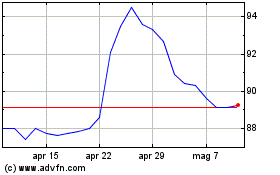

Grafico Azioni Jlen Environmental Assets (LSE:JLEN)

Storico

Da Mar 2024 a Apr 2024

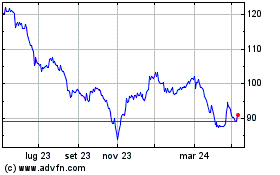

Grafico Azioni Jlen Environmental Assets (LSE:JLEN)

Storico

Da Apr 2023 a Apr 2024