TIDMSCE

RNS Number : 4226E

Surface Transforms PLC

28 February 2020

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

28 February 2020

Surface Transforms plc.

("Surface Transforms" or the "Company")

Unaudited interim results for the six months ended 30 November

2019

Surface Transforms (AIM: SCE) manufacturers of carbon fibre

reinforced ceramic materials, announces its unaudited interim

results for the six months ended 30 November 2019.

As previously reported, the Company has changed its accounting

year-end date to 31 December. To assist with the transition this

six-month statement also includes certain unaudited results for the

seven months to 31 December 2019. The full audited results and

report for the seven-month period to 31 December 2019 will be

issued on 30 March 2020.

Financial highlights (seven months ended 31 December 2019)

-- Revenue increased 183% to GBP1,451k (7 months to 31 December 2018: GBP512k).

-- Gross profit increased to GBP868k, representing a gross margin of 60%

-- Cash at 31 December 2019 was GBP770k (31 December 2018: GBP319k)

Financial highlights (six months ended 30 November 2019)

-- Revenue increased 102% to GBP1,029k (H1-2018: GBP509k)

-- Gross profit in the six month period increased 95% to GBP630k (H1-2018: GBP322k)

-- Loss before and after tax in the six month period decreased to GBP1,302k (H1-2018: GBP1,509k)

-- Capital expenditure on property, plant and equipment of

GBP582k (H1-2018: GBP144k) mainly related to the installation of

Production OEM Cell One

-- Inventory at 30 November 2019 was GBP1,120k (31 May 2019: GBP1,162k)

Sales and Operational highlights

-- Secured an EUR11.8m contract over seven years from major

German automotive OEM 5 with start of production ("SOP") in October

2021. Discussions continue regarding follow on business

-- Further SOP delays of contracts with British automotive customer OEM 6

-- Won and delivered a GBP400k contract with OEM 1, another

British automotive customer. Discussions continue regarding follow

on business

-- Continued progress on testing for OEM 3

-- Received full regulatory approval from the Environmental Agency for the Knowsley site

Financial Review

Revenue in the seven months to 31 December 2019 increased to

GBP1,451k (seven months to 31 December 2018: GBP512k) in part due

to the GBP400k order from OEM 1, whilst the Company is also pleased

to report increases in near OEM sales, which we believe to be

sustainable. Sales for the six months to November 2019 were

GBP1,029k (H1-2018: GBP509k). The high sales in December 2019

reflected the production catch up situation on near OEM and

aftermarket sales as the prior months of September and November had

been devoted to the OEM 1 order.

Gross profit in the seven months to 31 December 2019 increased

to GBP868k whilst for six months period to 30 November 2019,

increased to GBP630k (H1-2018: GBP322k). Gross profit margin was

61% (H1-2018: 63%) but is expected to improve in 2020 as OEM

Production Cell One cost reductions come on stream.

The Company has adopted IFRS 16 in the period, capitalising

operating leases. The major lease for the Company is the rent on

the Knowsley site; all other leases are minimal. The major impact

of IFRS 16 on the Company's financial statements, is on the Balance

Sheet creating right of use assets totalling GBP1.5m together with

corresponding liabilities. The impact on the Income Statement is to

exchange a reduction in the rent (hitherto treated as an expense)

for an increase in interest and depreciation. In the six months to

30 November 2019 this added a net GBP29k to the loss for the year

before and after tax. These IFRS 16 adjustments have no impact on

cash. To facilitate comparison, the 2018 comparatives have been

restated to reflect the impact of IFRS 16 had it been applied in

that period as well.

Administrative expenses rose by GBP134k to GBP864k (H1-2018:

GBP730k) largely driven by above budget plant repair costs of

GBP66k, certification and consultancy costs of GBP45k to achieve

environmental agency approval together with the introduction of

IFRS 16. The certification costs will not recur.

Research expenses increased to GBP1,294k (H1-2018: GBP1,068k) of

which the major elements were significant increases in the number

of prototypes being tested along with development of the furnace

process in support of cost reduction.

Cash at 31 December 2019 was GBP770k (December 2018: GBP319k),

to which can be added GBP425k customer payments received in the

first week of January; the corresponding cash balance at the end of

the half-year was GBP81k (31 May 2019: GBP1,925k). Both periods

were impacted by a combination of extended customer credit terms

and subsequent late payment. The significant cash inflow in

December and January reflected payment of these overdue sums and

December receipt of the R&D tax credit. Inventory reduction was

less than planned in 2019 but is expected to reduce further during

2020.

Loss per share was 0.96p (H1-2018: 1.24p).

Progress with potential OEM Customers

The Company continues to test products with customers as

described in previous announcements and still expects to make

further contract announcements during 2020:

OEM 5 : In the period the Company was notified of its selection

as a tier one supplier of a carbon ceramic disc to the major German

automotive Company OEM 5. The selection is to be the sole supplier

of the brake disc option on one axle of a new model. Lifetime

revenue on this car is estimated to be EUR11.8m commencing late

2021. Annual revenue is estimated to be EUR2.0m per year before

tapering off during 2026.

In addition, whilst this selection is the first with German OEM

5 the commercial understanding embraces the opportunity to be

selected for further multiple platforms in the customer's portfolio

over time - pricing has been agreed providing a link between

increasing volumes and decreasing unit prices. These potential

awards could generate revenues of many times the value of this

first contract.

The customer is now completing the system integration tasks

required to bring the car into production. This work is proceeding

to plan.

OEM 6 : Notwithstanding recent customer announcements on the SOP

of future models relevant to Surface Transforms, the Company is

maintaining guidance on overall timing of Company revenues. On the

first contract we won with them in 2017 the customer now expects to

enter production in the summer of 2020; however this delay had been

anticipated by the Company and is already reflected in the

Company's previously announced assumptions and revenue

guidance.

Similarly the customer has announced SOP delays on the second

car on which Surface Transforms is a nominated supplier from the

fourth quarter of 2021 to the second half of 2022. Again, the

Company had previously included a general overall delay contingency

to provide against any such risk.

OEM 1 : In the period the Company both received and delivered a

GBP400k order for carbon ceramic discs on a track car to a major

high performance British automotive Company.

The Company is in discussions with the customer on further

opportunities.

OEM 3 : Work continues on the product enhancements to meet the

customer's unique environmental test. Progress has been good with

particular focus on ensuring that a capable production process

matches the development activities. The Company is now in

discussions on whether this enhanced product is sufficiently

advanced for approval by OEM 3 for nomination on particular future

programmes, in parallel to continuing further process improvement

to widen the potential for nominations.

Other OEMs . The Company continues constructive discussions with

a number of other OEMs, some of whom are now testing our product

for the first time.

Knowsley Facility

OEM Production Cell One : All the new furnaces have now

demonstrated functional capability and, indeed, some are being used

to contribute to Small Volume Cell production output, thereby

taking advantage of superior technology and lower production costs.

The key task over the next few months is to demonstrate full

systems integration of all the machines in the cell.

Environmental permits : The Company has now received full

regulatory approval from the Environmental Agency for all

technologies, including furnaces, on the Knowsley site.

2019 production surge : The success in delivering the GBP400k

order for OEM 1 in a very limited period was a significant

achievement by the, relatively new, operations team. Apart from the

obvious customer relationship and financial benefits arising from

this order, the "production surge" was a very valuable learning

experience for us in respect to both the Company's internal

processes and supply chain. Where weaknesses were exposed, remedial

actions have either been addressed or are in advanced stages of

consideration.

Cost reductions : The Company continues to see continuous

reduction in manufacturing cost as a crucial key ingredient of

future success in the automotive industry. When OEM Production Cell

One goes live in 2020, the Company will have achieved its original

plan to halve production costs. The Company will not rest on this

milestone with further cost reduction initiatives under active

consideration.

Outlook

There are no changes to overall revenue guidance. Whilst OEM 6

has announced a number of changes to SOP on important cars for the

Company, these changes had been broadly anticipated in internal

forecasts.

The Board continues to expect gross margin percentages and

overheads to be in line with previous guidance. However, the

adoption of IFRS 16 will increase previously stated forecast losses

by approximately GBP48k in 2020, GBP44k in 2021, and GBP39k in

2022. These IFRS 16 adjustments have no impact on cash.

Summary

Surface Transforms continues its journey from a development

company to a mainstream volume automotive supplier with a site

capable of revenues of GBP50m per year in a market that could

ultimately reach GBP2 billion.

The Board maintains previous guidance that, with the recent

awards of multi year, multi million revenue contracts, the Company

will reach break-even EBITDA (including the tax credit) in H2 2020,

positive EBITDA (including the tax credit) in 2021 and profit

before tax in 2022.

In 2020 we expect to build on this foundation by winning further

contracts, completing the system integration of OEM Production Cell

One and begin delivering both production and development parts on

the new contracts.

Finally, may I conclude by recording the Board's appreciation of

the outstanding contribution by all members of staff. Thank

You!

David Bundred

Chairman

For enquiries, please contact:

Surface Transforms plc.

Kevin Johnson, CEO +44 151 356 2141

Michael Cunningham CFO

David Bundred, Chairman

Cantor Fitzgerald Europe (Nomad & Joint-Broker) +44 20 7894 7000

David Foreman / Michael Boot / Adam Dawes (Corporate

Finance)

Caspar Shand-Kydd / Maisie Atkinson (Sales)

finnCap Ltd (Joint-Broker) +44 20 7220 0500

Ed Frisby / Giles Rolls (Corporate Finance)

Richard Chambers (Corporate Broking)

For further Company details, visit www.surfacetransforms.com

Statement of Total Comprehensive Income

RESTATED RESTATED

Seven

Six Months Months Six Months Year

Ended Ended Ended Ended

30-Nov-19 31-Dec-19 30-Nov-18 31-May-19

GBP'000 GBP'000 GBP'000 GBP'000

Unaudited Unaudited Unaudited Unaudited

------------------------------------- ----------- ---------- ----------- ----------

Revenue 1,029 1,451 509 1,002

Cost of Sales (399) (583) (187) (385)

------------------------------------- ----------- ---------- ----------- ----------

Gross Profit 630 868 322 617

Administrative Expenses:

Before research and development

costs (864) (1,063) (730) (1,514)

Research and development costs (1,294) (1,502) (1,055) (2,039)

------------------------------------- ----------- ---------- ----------- ----------

Total administrative expenses (2,158) (2,566) (1,785) (3,553)

------------------------------------- ----------- ---------- ----------- ----------

Other operating income

------------------------------------- ----------- ---------- ----------- ----------

Operating loss before non recurring

items (1,528) (1,698) (1,463) (2,936)

Non-recurring items 0 0 (3) 0

Financial Income 1 1 1 2

Financial Expenses (49) (63) (44) (96)

------------------------------------- ----------- ---------- ----------- ----------

Loss before tax (1,576) (1,760) (1,509) (3,030)

Taxation 274 443 0 921

------------------------------------- ----------- ---------- ----------- ----------

Loss for the year after tax (1,302) (1,317) (1,509) (2,109)

Total comprehensive loss for the

year attributable to members (1,302) (1,317) (1,509) (2,109)

------------------------------------- ----------- ---------- ----------- ----------

Loss per ordinary share

Basic and diluted (0.96)p (0.97)p (1.24)p (1.68)p

------------------------------------- ----------- ---------- ----------- ----------

Statement of Financial Position

RESTATED RESTATED

Seven

Six Months Months Six Months Year

Ended Ended Ended Ended

30-Nov-19 31-Dec-19 30-Nov-18 31-May-19

GBP'000 GBP'000 GBP'000 GBP'000

Unaudited Unaudited Unaudited Unaudited

------------------------------------- ----------- ---------- ----------- ----------

Non-current Assets

Property, plant and equipment 4,356 4,336 4,069 3,921

Right of use assets 1,190 1,182 1,290 1,239

Intangibles 173 175 218 202

------------------------------------- ----------- ---------- ----------- ----------

5,719 5,694 5,577 5,362

Current assets

Inventories 1,120 1,006 1,062 1,162

Trade and other receivables 1,787 1,317 619 895

Cash and cash equivalents 81 770 745 1,925

------------------------------------- ----------- ---------- ----------- ----------

2,988 3,093 2,426 3,982

------------------------------------- ----------- ---------- ----------- ----------

Total assets 8,707 8,787 8,003 9,344

Current liabilities

Other interest bearing loans and

borrowings (68) (118) (65) (88)

Loans associated with right of

use assets (138) (138) (137) (137)

Trade and other payables (934) (1,028) (478) (584)

------------------------------------- ----------- ---------- ----------- ----------

(1,140) (1,284) (680) (809)

Non-current liabilities

Government Grants (200) (200) (200) (200)

Liabilities associated with right

of use assets (1,218) (1,207) (1,274) (1,244)

Other interest bearing loans and

borrowings (531) (476) (357) (270)

------------------------------------- ----------- ---------- ----------- ----------

Total liabilities (1,949) (1,883) (1,831) (1,714)

------------------------------------- ----------- ---------- ----------- ----------

Net assets 5,618 5,618 5,493 6,822

------------------------------------- ----------- ---------- ----------- ----------

Equity

Share capital 1,361 1,361 1,230 1,360

Share premium 20,712 20,712 18,972 20,704

Capital reserve 464 464 464 464

Retained loss (16,918) (16,917) (15,175) (15,706)

------------------------------------- ----------

Total equity attributable to equity

shareholders of the company 5,618 5,620 5,490 6,822

------------------------------------- ----------- ---------- ----------- ----------

Statement of Cash Flow

RESTATED RESTATED

Seven

Six Months Months Six Months Year

Ended Ended Ended Ended

30-Nov-19 31-Dec-19 30-Nov-18 31-May-19

GBP'000 GBP'000 GBP'000 GBP'000

Unaudited Unaudited Unaudited Unaudited

---------------------------------------- ----------- ---------- ----------- ----------

Cash flow from operating activities

Loss after tax for the year (1,302) (1,317) (1,509) (2,109)

Adjusted for:

Profit on disposal of property

plant and equipment 0 0 0 0

Depreciation and amortisation charge 239 290 209 442

Equity settled share-based payment

expenses 91 106 80 146

Financial expense 49 63 44 96

Financial income (1) (1) (1) (2)

Taxation 0 (443) 0 (921)

---------------------------------------- ----------- ---------- ----------- ----------

(924) (1,302) (1,178) (2,348)

Changes in working capital

Decrease/(increase) in inventories 42 157 (206) (307)

Decrease/(increase) in trade and

other receivables (892) (422) 157 281

Increase/(decrease) in trade and

other payables 350 444 (252) (206)

---------------------------------------- ----------- ---------- ----------- ----------

(1,424) (1,123) (1,479) (2,580)

Taxation received 0 443 0 521

---------------------------------------- ----------- ---------- ----------- ----------

Net cash used in operating activities (1,424) (681) (1,479) (2,059)

---------------------------------------- ----------- ---------- ----------- ----------

Cash flows from investing activities

Acquisition of tangible and intangible

assets (597) (622) (156) (175)

Proceeds from disposal of property,

plant and equipment 0 0 0 0

Net cash used in investing activities (597) (622) (156) (175)

---------------------------------------- ----------- ---------- ----------- ----------

Cash flows from financing activities

Proceeds from issue of share capital,

net of expenses 9 9 1,466 3,328

Payment of finance lease liabilities (63) (53) (33) 3

Proceeds from long term loans 279 253 66 0

Interest received 1 1 2 2

Interest paid (49) (63) (44) (96)

---------------------------------------- ----------- ---------- ----------- ----------

Net cash generated from financing

activities 177 147 1,457 3,236

---------------------------------------- ----------- ---------- ----------- ----------

Net (decrease)/increase in cash

and cash equivalents (1,844) (1,155) (178) 1,002

Cash and cash equivalents at the

beginning of the period 1,925 1,925 923 923

---------------------------------------- ----------- ---------- ----------- ----------

Cash and cash equivalents at the

end of the period 81 770 745 1,925

---------------------------------------- ----------- ---------- ----------- ----------

Statement of Changes in Equity

Share

Share premium Capital Retained

capital account reserve loss Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------------------- --------------------- --------------------- --------- --------

Balance as at 31 May 2019 1,360 20,704 464 (15,707) 6,821

Comprehensive income for

the year

Loss for the year (1,302) (1,302)

---------------------------- --------------------- --------------------- --------------------- ---------

Total comprehensive income

for the year - - - (1,302) (1,302)

---------------------------- --------------------- --------------------- --------------------- --------- --------

Transactions with owners,

recorded directly to equity

Shares issued in the year 1 8 9

Equity settled share based

payment transactions 91 91

---------------------------- --------------------- --------------------- --------------------- ---------

Total contributions by and

distributions to the

owners 1 8 - 91 100

---------------------------- --------------------- --------------------- --------------------- ---------

Balance at 30 November 2019 1,361 20,712 464 (16,918) 5,618

---------------------------- --------------------- --------------------- --------------------- --------- --------

Restated

Share Retained Retained

Share premium Capital loss IFRS16 loss

capital account reserve (Unaudited) Impact (Unaudited) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------------------- --------------------- --------------------- ------------ --------------------- ------------ --------

Balance as at

31 May

2018 1,140 17,596 464 (13,652) (91) (13,743) 5,457

Comprehensive

income

for the year

Loss for the

year (1,482) (27) (1,509) (1,509)

--------------- --------------------- --------------------- --------------------- ------------ ------------ --------

Total

comprehensive

income for

the year - - - (1,482) (27) (1,509) (1,509)

--------------- --------------------- --------------------- --------------------- ------------ --------------------- ------------ --------

Transactions

with owners,

recorded

directly to

equity

Shares issued

in the

year 90 1,445 1,535

Cost of issue

off to

share premium (69) (69)

Equity settled

share

based payment

transactions 76 76 76

--------------- --------------------- --------------------- --------------------- ------------ --------------------- ------------ --------

Total

contributions

by and

distributions

to the owners 90 1,376 - 76 - 76 1,542

--------------- --------------------- --------------------- --------------------- ------------ --------------------- ------------ --------

Balance as at

30 November

2018 1,230 18,972 464 (15,058) (118) (15,176) 5,490

--------------- --------------------- --------------------- --------------------- ------------ --------------------- ------------ --------

Restated

Share Retained Retained

Share premium Capital loss IFRS16 loss

capital account reserve (Audited) Impact (Unaudited) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------------------- --------------------- --------------------- ---------- --------------------- ------------ --------

Balance as at

31 May

2018 1,140 17,596 464 (13,652) (91) (13,743) 5,457

Comprehensive

income

for the year

Loss for the

year (2,059) (50) (2,109) (2,109)

--------------- --------------------- --------------------- --------------------- ---------- --------------------- ------------ --------

Total

comprehensive

income for

the year - - - (2,059) (50) (2,109) (2,109)

--------------- --------------------- --------------------- --------------------- ---------- --------------------- ------------ --------

Transactions

with owners,

recorded

directly to

equity

Shares issued

in the

year 213 3,228 3,441

Share options

exercised 7 63 70

Cost of issue

off to

share premium (183) (183)

Equity settled

share

based payment

transactions 145 145 145

--------------- --------------------- --------------------- --------------------- ---------- --------------------- ------------ --------

Total

contributions

by and

distributions

to the owners 220 3,108 - 145 - 145 3,473

--------------- --------------------- --------------------- --------------------- ---------- --------------------- ------------ --------

Balance as at

31 May

2019 1,360 20,704 464 (15,566) (141) (15,707) 6,821

--------------- --------------------- --------------------- --------------------- ---------- --------------------- ------------ --------

SURFACE TRANSFORMS PLC

NOTES

1. Accounting policies

The interim financial statements are the responsibility of the

Directors and were authorised and approved by the Board of

Directors for issuance on 28 February 2020.

Basis of preparation

The Company is a public limited liability Group incorporated and

domiciled in England & Wales. The financial information is

presented in Pounds Sterling (GBP) which is also the functional

currency. The Company's accounting reference date is 31

December.

These interim condensed financial statements are for the six

months to 30 November 2019. They have not been prepared in

accordance with IAS 34, Interim Financial Reporting that is not

mandatory for UK AIM listed companies, in the preparation of this

half-yearly financial report. While the financial information

included has been prepared in accordance with the recognition and

measurement criteria of International Financial Reporting Standards

(IFRS), as adopted by the European Union (EU), these interim

results do not contain sufficient information to comply with

IFRS.

These interim results for the period ended 30 November 2019,

which are not audited; do not comprise statutory accounts within

the meaning of section 435 of the Companies Act 2006.

Full audited accounts of the Company in respect of the year

ended 31 May 2019, which received an unqualified audit opinion and

did not contain a statement under section 498(2) or (3) (accounting

record or returns inadequate, accounts not agreeing with records

and returns or failure to obtain necessary information and

explanations) of the Companies Act 2006 and have been delivered to

the Registrar of Companies.

The accounting policies used in the preparation of the financial

information for the six months ended 30 November 2019 are in

accordance with the recognition and measurement criteria of IFRS as

adopted by the EU and are consistent with those which will be

adopted in the annual statutory financial statements for the year

ending 31 December 2019.

Accounting for Right of Use Assets

IFRS 16 requires the company to capitalise assets to which it

has the right of use. Assets are then depreciated and implicit

interest charged to the P&L. The company has followed accepted

guidance in the preparation of these charges. The impact of the

standard is to accelerate the charge to the P&L of the lease

liability and to reduce expenses and increase interest and

depreciation charges. The only significant right of use asset

applicable to the company is the rent payable on the Knowsley

facility. The actual rent payable remains as previously

expected.

Segmental reporting

IFRS 8 "Operating Segments" requires that the segments should be

reported on the same basis as the internal reporting information

that is provided to, and regularly reviewed by, the chief operating

decision-maker, whom the Group has identified as the CEO.

The Board has reviewed the requirements of IFRS 8, including

consideration of what results and information the CEO reviews

regularly to assess performance and allocate resources, and

concluded that all revenue falls under a single business

segment.

The Directors consider that the Group does not have separate

divisional segments as defined under IFRS 8. The CEO assesses the

commercial performance of the business based upon consolidated

revenues; margins and operating costs and assets are reviewed at a

consolidated level.

Estimates

The preparation of half-yearly financial statements requires

management to make judgments, estimates and assumptions that affect

the application of accounting policies and the reported amounts of

assets and liabilities, income and expense. Actual results may

differ from these estimates. In preparing these condensed

consolidated half-yearly financial statements, the significant

judgments made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty which will

be adopted in the annual statutory financial statements for the

year ending 31 December 2019

Going concern

The financial statements have been prepared on a going concern

basis that the Directors believe to be appropriate. Whilst the

Group incurred a net loss of GBP1,298k during the period, the

Directors are satisfied that sufficient cash is available to meet

the Company's liabilities as and when they fall due for at least 12

months from the date of signing the half yearly report.

2. Taxation

Analysis of credit in the period

Six months Seven months Six months Year ended

ended ended ended

ended

30-Nov 31-Dec 30-Nov 31-May

2019 2019 2018 2019

GBP'000 GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (unaudited) (audited)

UK Corporation tax

Current tax on income - - - -

for the period

Research and development

tax in respect of prior

years - 123 - 521

Research and development

tax allowances for current

year 274 320 - 400

274 443 - 921

------------ ------------- ------------ -----------

The effective rate of tax for the period/year is lower than the

standard rate of corporation tax in the UK of 20 per cent,

principally due to losses incurred by the Company.

The potential deferred tax asset relating to losses has not been

recognised in the financial statements because it is not possible

to assess whether there will be suitable taxable profits from which

the future reversal of the underlying timing differences can be

deducted.

3. Loss per share

Six months Seven months Restated Six Restated Year

ended ended months ended

ended

30-Nov 31-Dec 30-Nov 31-May

2019 2019 2018 2019

(unaudited) (unaudited) (unaudited) (unaudited)

Pence Pence Pence Pence

Loss per

share:

Basic

and diluted (0.96) (0.96) (1.24) (1.68)

------------ ------------- -------------- --------------

Loss per ordinary share is based on the Company's loss for the

financial period of GBP1,302k (30 November 2018: GBP1,505k loss; 31

May 2019: GBP2,100 loss). The weighted average number of shares

used in the basic calculation is 136,025,765 (31 May 2019:

125,184,218; 30 November 2018: 121,756,727).

The calculation of diluted loss per ordinary share is identical

to that used for the basic loss per ordinary share. This is because

the exercise of share options would have the effect of reducing the

loss per ordinary share and is therefore not dilutive under the

terms of International Accounting Standard 33 "Earnings per

share".

4. Segment reporting

Due to the startup nature of the business the Company is

currently focused on building revenue streams from a variety of

different markets. As there is only one manufacturing facility, and

as this has capacity above and beyond the current levels of trade,

there is no requirement to allocate resources to or discriminate

between specific markets or products. As a result, the Company's

chief operating decision maker, the Chief Executive, reviews

performance information for the Company as a whole and does not

allocate resources based on products or markets. In addition, all

products manufactured by the Company are produced using similar

processes. Having considered this information in conjunction with

the requirements of IFRS 8, as at the reporting date the Board of

Directors has concluded that the Company has only one reportable

segment that being the manufacture and sale of carbon fibre

materials and the development of technologies associated with

this.

The Company considers it offers product technology namely carbon

fibre re-enforced ceramic material which is machined into different

shapes depending on the intended purpose of the end user.

Revenue by geographical destination is analysed as follows:

Six Months Seven Months Restated Restated

Ended Ended Six Months Year Ended

Ended

30-Nov-19 31-Dec-19 30-Nov-18 31-May-19

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000

United Kingdom 745 963 112 220

Rest of Europe 90 165 168 492

United States

of America 163 251 216 269

Rest of World 30 72 12 21

----------------

1,029 1,451 509 1,002

---------------- ------------- ------------- ------------- ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR DZGZZMNVGGZZ

(END) Dow Jones Newswires

February 28, 2020 02:00 ET (07:00 GMT)

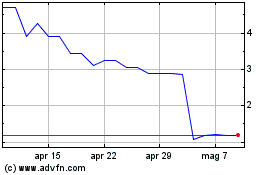

Grafico Azioni Surface Transforms (LSE:SCE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Surface Transforms (LSE:SCE)

Storico

Da Apr 2023 a Apr 2024