TIDMTLY

RNS Number : 1882S

Totally PLC

07 July 2020

7 July 2020

Totally plc

("Totally", "the Company" or "the Group")

Preliminary results for the 12-month period ended 31 March

2020

Totally plc (AIM: TLY), the provider of a range of healthcare

services across the UK and Ireland, is pleased to announce its

results for the 12-month period ended 31 March 2020.

Operational highlights

-- Successfully completed acquisition of Greenbrook Healthcare in June 2019 via reverse takeover

-- Greenbrook Healthcare secured new Urgent Treatment Centre

contract in Watford for the Company's Urgent Care division

-- Secured largest dermatology contract to date for About Health in Manchester

-- Launched new Insourcing start-up business, Totally

Healthcare, in October 2019 delivering Insourcing services across

the UK and Ireland

-- Continued to provide frontline healthcare services supporting

the NHS to manage the COVID-19 pandemic

-- 97% of registered services rated as 'Good' by the Care Quality Commission (CQC)

Financial highlights

-- Revenue up 35.8% to GBP105.9m (2019: GBP78.0m)

-- Gross margin improved to 18.1% (2019: 15.5%)

-- Underlying EBITDA* up 265% to GBP4.0m** (2019: GBP1.1m)

-- Loss before tax of GBP3.4m (2019: GBP1.8m)

-- Cash up 19% to GBP8.9m as at 31 March 2020 (31 March 2019: GBP7.5m)

-- Paid a maiden interim dividend to shareholders in February 2020 of 0.25p per share

*Earnings before interest, tax, depreciation and amortisation,

before exceptional items outlined in the notes to the financial

statements

**Includes GBP1.6m impact relating to implementation of IFRS

16

Post period end highlights

-- Significant contract extensions awarded to Vocare worth a total of GBP19.5m

-- Mobilisation and restart of Planned Care and Insourcing care divisions

-- Continued support to NHS across all operating divisions in response to COVID-19

-- Maiden final dividend of 0.25 pence per share proposed

bringing total dividend for the year to 0.50 pence per share

CHAIRMAN'S STATEMENT

The year ended 31 March 2020 was a good year for Totally

delivering profit before depreciation and amortisation during times

of unrivalled political instability which included BREXIT and a

General Election followed by the worldwide pandemic of COVID-19

which has impacted on every person and every business.

Totally's strategy has always been to support the NHS to manage

the pressures and demands placed upon healthcare services. The

COVID-19 pandemic is no exception, and everyone at Totally has

stood shoulder to shoulder with the NHS and delivered

patient-facing services throughout this period and continues to do

so. At the time of writing, we are still very much in a period of

uncertainty as everyone works together to ensure services are

robust and ready for any second wave of demand. What is very clear

to the Board of Totally is that our strategy has been, and

continues to be, correctly focused during these unprecedented

times.

Whilst we expect the business to grow in 2021 and beyond, due to

current run rates and new contract wins, the timing of new tenders,

which is a key part of our growth plans, remains uncertain due to

the COVID-19 pandemic and its impact on the NHS. We are therefore

unable to give firm guidance at this stage on our growth

expectations for the current financial year and the Board has

considered it appropriate for market forecasts to be withdrawn at

this time. The medium to long term outlook and trajectory of the

business however remains unchanged. Shareholders should also be

pleased that we expect continued growth in operating cash flow and

the Board therefore remain committed not only to the payment of

dividends but also in continuing with our progressive dividend

policy. Accordingly, the Board is pleased to propose a maiden final

dividend of 0.25 pence per share taking the total dividends for the

year to 0.50 pence per share. Subject to shareholder approval at

the upcoming AGM the final dividend will be paid in October

2020.

With the expertise of our leadership teams, we will continue to

ensure our services respond to any changes in demand we receive and

that we support our staff to deliver exceptional services in

partnership with the NHS and other public sector bodies across the

UK and Ireland. Whilst the way we secure new business has changed,

the demand for our services is not expected to diminish.

During the year, we completed the acquisition of Greenbrook

Healthcare, which increased our presence across London in Urgent

Care. You will read throughout this report the progress that's been

made with integrating Greenbrook Healthcare into our Urgent Care

Division and harnessing technology will continue to build to our

market-leading position.

The Group also launched its Insourcing business, Totally

Healthcare, which during its first few months of operations secured

contracts across the UK and Ireland delivering services to provide

bespoke services to reduce hospital waiting lists. Already its

reputation is for delivering services quickly, efficiently and of

high quality to every patient treated. Of course, these services

were put on hold during the pandemic as all elective healthcare

services were suspended to focus on managing COVID-19. Totally

Healthcare is now back working and supporting hospitals plan for

how they reduce the waiting times and waiting lists which have

increased during the first half of 2020.

We all know that cash is a seen as a barometer of the success of

any business and we reported GBP8.9m cash at the bank at year end,

an accurate reflection of the efforts of all our support teams to

ensure we operationally deliver across the business.

All of this has been achieved during the most testing times

which reflects the outstanding commitment and expertise of everyone

across the Group for which I commend them. We must also thank our

investors for their continued support which enables us to continue

to deliver our strategic intentions of becoming a partner of choice

for the delivery of healthcare services across the UK.

Bob Holt OBE

Chairman

7 July 2020

CHIEF EXECUTIVE OFFICER'S REVIEW

Building strong partnerships with a reputation for delivering

high --quality care even during the most difficult times

I am pleased to report excellent progress across the Group with

a strong set of results during a year when we saw many external

challenges including the Covid-19 pandemic which impacted all of

our businesses towards the end of the reporting period.

Our management team has seized every opportunity presented to

them to strengthen our market position and support the delivery of

healthcare services across our three divisions.

Demand for our services continues to be strong, on the back of

our reputation for delivery of high-quality services. 26 out of 27

of our registered services with the Care Quality Commission are

rated as good, an excellent position to grow from and it has been

pleasing to see continuing improvement in our CQC ratings

reflecting the high-quality care we provide.

Our three distinct business divisions - Urgent Care, Planned

Care and Insourcing - provide a portfolio of healthcare services

across the UK and Ireland built on the expertise and commitment of

our people, ensuring the patients we treat receive the highest

quality of care quickly and efficiently. We partner with healthcare

organisations across the UK supporting them to manage demand for

services.

We continue to support the NHS by working on the frontline

delivering services to manage the demand from the Covid-19 pandemic

but also respond to the need to reduce waiting times and waiting

lists due to the suspension of elective healthcare services.

Whilst we expect the business to grow during 2020/21 and the

medium to long term outlook for the business remains unchanged, we

are unable to give clear guidance at this stage of the impact of

COVID-19 on the current financial year and as such the Board has

resolved to withdraw market forecasts at this time. Each of our

divisions has been affected in different ways by the COVID-19

pandemic and demand for many of our services remains strong.

COVID-19 has though inevitably resulted in delays being encountered

with the NHS awarding tenders and there has been an impact on the

near-term visibility for growth, particularly in Planned Care.

Of course, our results demonstrate the significant progress we

have made, regardless of external forces. New contracts were

secured across the three divisions, including the largest to date

within our Planned care division to deliver Dermatology outpatient

services across Manchester. In addition, we have continued to

secure a number of vital contract extensions in both Urgent Care

and Planned Care which underpin our foundations for continued

growth -in excess of GBP20m of contract extensions were secured in

the period under review.

Building on our Strategy

During the year, we have focused on delivering services across

the Group that are sustainable and reactive to changes in

demand.

-- High-quality: has to be at the centre of everything we do.

Our reputation is built upon this core requirement.

-- Geography: during the year, we have successfully expanded our

footprint across the UK and Ireland and are now delivering services

across England, Scotland, Wales, Northern Ireland and the Republic

of Ireland.

-- Diversification: across our divisions ensuring we deliver

models of care across all areas of high demand in the healthcare

sector and that our divisions support each other by "cross-selling"

services to both existing and potential new customers.

-- Learning: from everything we do, both positive and negative,

and ensuring we stay ahead of our competition with our approach to

disrupting care models and delivering real tangible benefits.

-- Supporting: our people and investing in them as they are at the core of what we do.

The Future

I would like to re-emphasise my confidence in the team of people

we have and their ability to grow the business organically and via

acquisitions, as well as continually review and develop the range

of services we offer.

We are well positioned to further build on our market-leading

positions in all of our divisions. Building on our strong

relationships with our commissioners and supporting government

bodies to proactively manage the demands placed on healthcare

services during unprecedented events such as the recent Covid-19

pandemic when we experienced major increases in demand for our

services, specifically in NHS 111. We were able, with the

dedication of our people, to stand shoulder to shoulder with other

healthcare professionals, and deliver services 24/7 across England

supporting everyone by providing the high-quality services we are

known to deliver.

I look forward to updating you further as we continue to expand

our services across the UK

Wendy Lawrence

Chief Executive Officer

7 July 2020

STRATEGIC REVIEW

Operational changes during the period

Since acquiring Greenbrook Healthcare in June 2019, we have

taken the opportunity to review our care delivery models in our

Urgent Treatment Centres across the country to ensure we retain our

competitive advantage to remain the largest independent provider of

UTCs across England.

This has involved a critical review of all aspects of the care

pathways across both Vocare and Greenbrook Healthcare taking the

best from both and delivering excellence to the patients we see.

Our staff take pride in what they do and deliver services with a

passion and experience that sets us apart.

Despite the difficult political backdrop, which resulted in the

number of tendering opportunities being significantly reduced

(Brexit, General Election, COVID-19), we have secured new business,

and opened our new Urgent Treatment Centre in Watford in July 2019

(delayed opening due to COVID-19). We have retained contracts to

continue the delivery of services in our UTCs, 111 and numerous

other services across England.

During the summer of 2019, we embedded our new delivery

structure with the creation of our three delivery divisions.

-- Urgent Care

-- Planned Care

-- Insourcing

Early in 2020, it became clear that the UK was about to be

impacted by the worldwide pandemic, COVID-19. Healthcare providers

braced themselves as demand to access services escalated. Our

delivery divisions were all impacted differently.

Urgent Care saw demand increase in excess of 200% above normal

levels for access to its NHS 111 services across the country.

Vocare who is our specialist provider of 111 systems responded

accordingly and worked tirelessly, shoulder to shoulder, with NHS

England to coordinate the delivery of core 111 services alongside

new services targeted for the management of COVID-19 and onboarding

additional staff to help meet the unprecedented demand.

Vocare quickly mobilised its Emergency Preparedness, Resilience

and Response processes to ensure every part of the business and

every member of staff were supported during the ever-changing

landscape. This was supported by our Business Continuity Plan

activation across the Totally Group to ensure government guidance

was quickly adopted and implemented.

Our Urgent Treatment Centres and GP Out of Hours services saw a

decline in demand which meant that staff could be redeployed to

where demand was increasing while still enabling all of our

business to support its people by observing social distancing and

isolation requirements and applying them across all staff

groups.

Our internal mandatory systems for Staff Absence Management

(SAMS) was reviewed and adapted to ensure every member of staff who

needed to be absent from the workplace was supported by a clinician

to ensure national guidance and advice was followed. This involved

many changes including:

-- Increased working from home with the provision of equipment to enable this change.

-- Increased use of video meetings and clinical consultations.

-- Decrease in working from offices where home working is

possible and for those services where office working is essential

changes made to the workplace to meet the latest advice. This

included:

o Increased spaces for work for social distancing.

o Provision of PPE.

o Increased workplace cleaning regimes.

o Provision of more space for essential call centre

capacity.

All of the above resulted in a minimum number of staff being

furloughed or made redundant while working through the

pandemic.

Our Planned Care and Insourcing divisions saw contracts paused

whilst all elective healthcare services were stopped across the UK.

During that period waiting lists and referrals for healthcare

services increased with estimates from the NHS of over 10million

people now waiting for treatment. Whilst our planned care division

prepares for services to restart, our insourcing business, Totally

Healthcare resumed some of its services in early June.

Whilst no tenders have been issued by the NHS in recent months,

the Group has put in place extensions to a number of existing

contracts across its operating subsidiaries and we anticipate this

continuing. New business is currently being secured as a result of

the Group's national coverage, existing relationships and

partnering arrangements.

All of the above ensured that Totally as a group of businesses

were able to not only support the NHS during the COVID-19 pandemic,

but also demonstrated how to approach service delivery during such

times. Our strategy remains as being regarded as a partner of

choice for the NHS and other healthcare bodies to respond to

increases in demand for services whatever the cause may be.

The Board and the management team could not be prouder of the

way our people responded during this time and we must ensure they

know how valued they are by Totally plc and the businesses within

it.

FINANCIAL REVIEW

The results reflect a successful year for the Group; well

positioned for further scale and delivering diversification through

the creation of three distinct divisions.

The acquisition of a quality urgent care provider, Greenbrook

Healthcare and the creation of a new business in Insourcing have

strengthened the financial performance of the Group. Growth in

revenue was 35.8% year on year at GBP105.9m, and the Group

generated a loss before tax of GBP3.4m (2019: GBP1.8m loss).

Underlying EBITDA increased by 265% to GBP4.0m. This includes a

GBP1.6m positive impact relating to IFRS 16.

The Group is cash generative and responded with the distribution

of our maiden dividend in February 2020. The Board is also

proposing the payment of a full year dividend of 0.25 pence per

share, payable in October 2020. The intention is to consider future

dividend payments based upon the trading performance of the

Group.

Growth in revenues was 35.8% primarily driven by the in-year

acquisition, bringing revenues to GBP105.9m. New contract wins were

adversely impacted by the uncertainty created by Brexit and the

general election. NHS commissioning understandably paused during

this time; nonetheless, the Group was able to secure extensions of

several existing contracts across the Group, plus a significant new

contract for Planned Care, in Manchester. The new Insourcing

division delivered over GBP1m in revenues in its first period of

trading.

Gross margin improved to 18.1% from 15.5%, largely as a result

of improved performance in the underlying Urgent Care division.

This improved performance has resulted in a reduction in provisions

relating to performance related incentives of GBP1m. Underlying

margin is therefore 17.2%.

All of our businesses continually review service delivery models

and this approach has supported us through our response to the

global pandemic. By utilising additional technology, reducing face

to face contact, delivering 111 24/7 and flexing our services we

have continued to deliver sustainable support to our partners, the

NHS.

The Group posted an EBITDA, excluding exceptional costs relating

to the acquisition and impairment of goodwill, of GBP4.0m. The loss

before tax of GBP3.4m is stated after an amortisation charge of

GBP2.8m relating to the intangible value of contracts acquired.

31 March 31 March

2020 2019

------------------- --------- ---------

Revenue 105.9 78.0

Gross profit 19.2 12.1

EBITDA 4.0 1.1

Exceptional items (2.0) 0.1

Depreciation (2.0) (0.6)

Amortisation (3.1) (2.2)

Operating loss (3.1) (1.6)

Loss before tax (3.4) (1.8)

Net assets 34.4 25.9

Cash 8.9 7.5

------------------- --------- ---------

A prudent view of growth in Planned Care revenues has been

considered in light of the impact of the COVID-19 pandemic. As a

consequence, we recognised an impairment of goodwill relating to

this cash generating unit (CGU). The carrying value of goodwill in

relation to this CGU after impairment is GBP7.8m.

12 months 12 months

to to

31 March 31 March

2020 2019

GBP000 GBP000

----------------------------------------- ---------- ----------

Acquisition-related costs 528 465

Impairment of goodwill 1,500 2,000

Revaluation of contingent consideration 0 (2,668)

Other exceptional costs 0 77

----------------------------------------- ---------- ----------

Total exceptional items 2,028 (126)

Tax credit attributable to exceptional

items (100) 404

----------------------------------------- ---------- ----------

Total exceptional items after tax 1,928 278

----------------------------------------- ---------- ----------

Acquisition costs

The acquisition costs comprised legal, professional and other

related expenditure and amounted to GBP0.5m (2019: GBP0.5m).

Cash flow statement

Cash generated from operating activities is positive in the year

reflecting improved underlying profitability of the Group. Cash

outflow relating to the acquisition of Greenbrook, net of cash

acquired was GBP8.0m. The acquisition was funded by the issue of

share capital, net of expenses of GBP9.3m.

In June 2019, the Company issued 97,390,939 new ordinary shares

of 10 pence each. The Company also issued 25,000,000 new ordinary

shares of 10 pence each as part of the consideration for the

acquisition of Greenbrook Healthcare (Hounslow) Limited and

Greenbrook Healthcare (Earl's Court) Limited on the same date.

31 March 31 March

2020 2019

------------------------------------------ --------- ---------

Net cash flows from operating activities 2.9 (1.8)

Net cash flows from investing activities (8.6) (0.9)

Net cash flows from financing activities 7.1 0

------------------------------------------ --------- ---------

Net increase/(decrease) in cash and

cash equivalents 1.4 (2.7)

Cash and cash equivalents at the

beginning of the year 7.5 10.2

------------------------------------------ --------- ---------

Cash and cash equivalents at the

end of the year 8.9 7.5

------------------------------------------ --------- ---------

Maiden final dividend

We remain committed to the payment of dividends as we believe

this reflects our confidence in the Company's future prospects. The

Board is therefore pleased to be recommending to shareholders a

maiden final dividend of 0.25 pence per share. This, together with

the interim dividend of 0.25 pence per share paid in February 2020,

makes a total dividend for the year of 0.50 pence per share.

Subject to approval by shareholders at the Annual General Meeting

to be held on 7 September 2020, the final dividend will be paid on

16 October 2020 to shareholders on the register as at the close of

business on 18 September 2020. The shares will be marked

ex-dividend on 17 September 2020.

Acquisition of Greenbrook Healthcare

On 20 June 2019, the Company completed the acquisition of the

entire share capital of Greenbrook Healthcare (Hounslow) Limited

and the convertible loan note in Greenbrook Healthcare (Earl's

Court) Limited for a maximum consideration of GBP11.5m on a

cash-free and debt-free basis with a normalised level of working

capital. The table below sets out the adjustments to the purchase

price to reflect a normalised level of working capital which has

resulted in additional consideration payable of GBP4.7m.

Greenbrook is one of the leading providers of Urgent Care

Centres in London. The company was acquired as part of the Group's

stated "buy and build" strategy and to bring new and complementary

routes to the existing healthcare services offered by the Group.

Greenbrook's Urgent Care services provide synergies with Totally's

existing subsidiary businesses, in particular Vocare, and

complements its business model of providing preventative and

responsive healthcare in out-of-hospital settings to improve

people's health, reduce NHS healthcare reliance, re-admissions and

emergency admissions to hospital.

The assets and liabilities as at 20 June 2019 arising from the

acquisition were as follows:

Carrying Fair value Fair

amount adjustment value

GBP000 GBP000 GBP000

--------------------------------------- --------- ----------- --------

Property, plant and equipment 308 0 308

Intangible assets: customer contracts 0 9,354 9,354

Right-of-use assets 1,425 0 1,425

Trade receivables and other debtors 4,712 0 4,712

Cash in hand 5,781 0 5,781

Trade and other payables (6,955) (763) (7,718)

Lease liabilities (1,425) 0 (1,425)

Onerous contracts 0 (529) (529)

Deferred tax (34) (1,438) (1,472)

Convertible loan notes (50) 0 (50)

--------------------------------------- --------- ----------- --------

Net assets acquired 3,762 6,624 10,386

Goodwill 5,850

--------------------------------------- --------- ----------- --------

Total consideration 16,236

--------------------------------------- --------- ----------- --------

Satisfied by:

Cash 13,736

Ordinary shares issued 2,500

16,236

--------------------------------------- --------- ----------- --------

The goodwill is attributable to the knowledge and expertise of

the workforce, the expectation of future contracts and the

operating synergies that arise from the Group's strengthened market

position. Any impairment charges will not be deductible for tax

purposes.

Included in the fair value of Greenbrook are provisions for

additional costs or potential costs that existed at the time of

acquisition.

Changes in accounting policies

The Group adopted IFRS 16 with a transition date of 1 April

2019. The Group has chosen not to restate comparatives on adoption

and, therefore, the revised requirements are not reflected in the

prior year financial statements. Rather, these changes have been

processed at the date of initial application and recognised in the

opening equity balances. Details of the impact this standard has

had are given below.

IFRS 16 provides a single lessee accounting model, requiring the

recognition of assets and liabilities for all leases, together with

options to exclude leases where the lease term is twelve months or

less, or where the underlying asset is of low value. IFRS 16

substantially carries forward the lessor accounting in IAS 17, with

the distinction between operating leases and finance leases being

retained. The Group does not have significant leasing activities

acting as a lessor.

As a lessee, the Group previously classified leases as operating

or finance leases based on its assessment of whether the lease

transferred substantially all of the risks and rewards of

ownership. Under IFRS 16, the Group recognises right-of-use assets

and lease liabilities for most leases. However, the Group has

elected not to recognise right-of-use assets and lease liabilities

for some leases of low value assets based on the value of the

underlying asset when new or for short-term leases with a lease

term of twelve months or less.

On adoption the Group recognised right-of-use assets at an

amount equal to the lease liability, adjusted by the amount of any

prepaid or accrued lease payments. Lease liabilities are measured

at the present value of the remaining lease payments, discounted

using the Group's incremental borrowing rate as at 1 April 2019.

The Group's incremental borrowing rate is the rate at which a

similar borrowing could be obtained from an independent creditor

under comparable terms and conditions.

The impact of adopting IFRS 16 on the Consolidated Statement of

Profit or Loss is to increase profit before exceptional items by

GBP1,636,000, increase depreciation by GBP1,509,000 and increase

finance costs by GBP235,000.

The impact of adopting IFRS 16 on the Consolidated Statement of

Financial Position can be seen below:

31 March 1 April

2019 IFRS 16 2019

GBP000 GBP000 GBP000

--------------------- -------------------------------- ---------------------------- ----------------------------

Assets

Right-of-use assets - 4,083 4,083

Prepaid rent - (57) (57)

Liabilities

Lease liabilities - 4,026 4,026

The impact of adopting IFRS 16 on the Consolidated Cash Flow

Statement is to increase operating cash flows and decrease

financing cash flows by GBP1,744,000 respectively. The following

table reconciles the minimum lease commitments disclosed in the

Group's 31 March 2019 financial statements to the amount of lease

liabilities recognised on 1 April 2019.

GBP000

--------------------------------------------------- ---------------

Minimum operating lease commitment at 31 March

2019 5,295

Inclusion of previously unrecognised commitments 151

Less: short-term leases not recognised under

IFRS 16 (71)

Less: low value leases not recognised under

IFRS 16 (17)

Less: licences not considered leases under

IFRS 16 (434)

---------------------------------------------------- ---------------

Undiscounted lease payments 4,924

Less: effect of discounting using the incremental

borrowing rate (898)

---------------------------------------------------- ---------------

Lease liability as at 1 April 2019 4,026

---------------------------------------------------- ---------------

Lisa Barter

Finance Director

7 July 2020

For further information please contact:

Totally plc 020 3866 3335

Wendy Lawrence, Chief Executive

Bob Holt, Chairman

Allenby Capital Limited (Nominated Adviser

& Joint Corporate Broker) 020 3328 5656

Nick Athanas

Liz Kirchner

Canaccord Genuity Limited (Joint Corporate

Broker) 020 7523 8000

Bobbie Hilliam

Alex Aylen

Yellow Jersey PR 020 3004 9512

Georgia Colkin

Joe Burgess

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE YEARED 31 MARCH 2020

12 months 12 months

to 31 March to 31 March

2020 2019

Continuing operations GBP000 GBP000

Revenue 105,948 78,007

Cost of sales (86,772) (65,939)

------------------------------------------------- --------------------------- ---------------------------

Gross profit 19,176 12,068

Administrative expenses (15,140) (10,962)

---------------------------------------------- --------------------------- ---------------------------

Profit before exceptional items 4,036 1,106

Exceptional items (2,028) 126

---------------------------------------------- --------------------------- ---------------------------

Profit before interest, tax and depreciation 2,008 1,232

Depreciation and amortisation (5,122) (2,822)

----------------------------------------------- --------------------------- ---------------------------

Operating loss (3,114) (1,590)

Finance income 6 3

Finance costs (302) (228)

------------------------------------------------- --------------------------- ---------------------------

Loss before taxation (3,410) (1,815)

Income tax credit 577 313

Loss for the year attributable to the

equity

shareholders of the parent company (2,833) (1,502)

------------------------------------------------ --------------------------- ---------------------------

Other comprehensive income - -

---------------------------------------------- --------------------------- ---------------------------

Total comprehensive loss for the year

net of tax

attributable to the equity shareholders

of the parent company (2,833) (1,502)

------------------------------------------------ --------------------------- ---------------------------

12 months 12 months

to 31 March to 31 March

2020 2019

Loss per share Pence Pence

From continuing operations:

Basic (1.82) (2.51)

Diluted (1.82) (2.51)

------------------------------------------------- --------------------------- ---------------------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 MARCH 2020

Equity

Retained shareholders'

Share capital Share premium earnings funds

GBP000 GBP000 GBP000 GBP000

--------------- ------------------------- ------------------------- ------------------------- -------------------------

At 1 April 2018 5,979 16,408 4,951 27,338

Total

comprehensive

loss

for the year - - (1,502) (1,502)

Credit on issue

of warrants

and options - - 43 43

At 31 March

2019 5,979 16,408 3,492 25,879

Total

comprehensive

loss

for the year - - (2,833) (2,833)

Cancellation of

share

premium account - (16,408) 16,408 -

Issue of shares 12,240 - - 12,240

Expenses

attached to

equity

issue - - (450) (450)

Dividend

payment - - (455) (455)

Credit on issue

of warrants

and options - - 64 64

At 31 March

2020 18,219 - 16,226 34,445

---------------- ------------------------- ------------------------- ------------------------- -------------------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 MARCH 2020

31 March 31 March

2020 2019

GBP000 GBP000

------------------------------ ----------------------- -----------------------

Non-current assets

Intangible assets 39,631 28,824

Property, plant and equipment 789 599

Right-of-use assets 4,129 -

Investments in subsidiaries - -

Deferred tax 408 158

--------------------------------- -----------------------

44,957 29,581

------------------------------ ----------------------- -----------------------

Current assets

Inventories 77 68

Trade and other receivables 11,185 8,606

Cash and cash equivalents 8,923 7,520

20,185 16,194

------------------------------ ----------------------- -----------------------

Total assets 65,142 45,775

--------------------------------- ----------------------- -----------------------

Current liabilities

Trade and other payables (24,182) (18,784)

Contingent consideration (271) (322)

Lease liabilities (1,449) (5)

(25,902) (19,111)

------------------------------ ----------------------- -----------------------

Non-current liabilities

Trade and other payables (786) (768)

Lease liabilities (2,729) (3)

Deferred tax (1,280) (14)

(4,795) (785)

------------------------------ ----------------------- -----------------------

Total liabilities (30,697) (19,896)

------------------------------- ----------------------- -----------------------

Net current liabilities (5,717) (2,917)

------------------------------- ----------------------- -----------------------

Net assets 34,445 25,879

--------------------------------- ----------------------- -----------------------

Shareholders' equity

Called up share capital 18,219 5,979

Share premium - 16,408

Retained earnings 16,226 3,492

Equity shareholders' funds 34,445 25,879

-------------------------------- ----------------------- -----------------------

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEARED 31 MARCH 2020

31 March

2020 31 March 2019

GBP000 GBP000

------------------------------------------- ------------------------- -------------------------

Cash flows from operating

activities

Loss for the year (2,833) (1,502)

Adjustments for:

- options and warrants charge 64 43

- depreciation and amortisation 5,122 2,822

- impairment of goodwill 1,500 2,000

- tax (income)/expense recognised in

profit or loss (577) (313)

- finance income (6) -

- finance costs 302 112

- revaluation of contingent

consideration - (2,668)

Movements in working capital:

- inventories (8) 10

- movement in trade and other receivables 2,076 1,100

- movement in trade and other

payables (2,637) (3,457)

Cash used for operations 3,003 (1,853)

Income tax received/(paid) (104) 39

Net cash flows from operating

activities 2,899 (1,814)

--------------------------------------------- ------------------------- -------------------------

Cash flows from investing

activities

Purchase of property, plant and equipment (397) (265)

Additions of intangible assets (192) (491)

Acquisition of subsidiaries, net of

cash acquired (7,955) -

Contingent consideration paid (51) (130)

Net cash flows from investing

activities (8,595) (886)

--------------------------------------------- ------------------------- -------------------------

Cash flows from financing

activities

Issued share capital, net

of expenses 9,289 -

Dividends paid to the holders of the

parent (455) -

Interest

paid (97) -

Principle paid on lease liabilities (1,638) (4)

Net cash flows from financing

activities 7,099 (4)

--------------------------------------------- ------------------------- -------------------------

Net increase / (decrease) in cash and

cash equivalents 1,403 (2,704)

Cash and cash equivalents at the beginning

of year 7,520 10,224

Cash and cash equivalents at the end

of the year 8,923 7,520

---------------------------------------------- ------------------------- -------------------------

NOTES TO THE FINANCIAL INFORMATION

FOR THE YEARED 31 MARCH 2020

1. GENERAL INFORMATION

Totally plc is a public limited company ("the Company")

incorporated in the United Kingdom under the Companies Act 2006

(registration number 3870101). The Company is domiciled in the

United Kingdom and its registered address is Cardinal Square West,

10 Nottingham Road, Derby DE1 3QT. The Company's ordinary shares

are traded on the AIM market of the London Stock Exchange

("AIM").

The Group's principal activities are the provision of innovative

and consolidatory solutions to the healthcare sector, which are

provided by the Group's wholly owned subsidiaries.

The Company's principal activity is to provide management

services to its subsidiaries.

2. BASIS OF PREPARATION

The financial information set out in this announcement does not

constitute statutory accounts as defined by section 435 of the

Companies Act 2006. It has been prepared in accordance with the

recognition and measurement principles of International Financial

Reporting Standards (IFRS) adopted for use in the European Union,

including IFRIC interpretations issued by the International

Accounting Standards Board, and in accordance with the AIM rules

and is not therefore in full compliance with IFRS. The principal

accounting policies applied in the preparation of the financial

information are detailed in note 3.

The financial statements for the year ended 31 March 2020 are

not authorised for issue however it is anticipated that audit

reports will not be modified and will not draw attention to any

matters by way of emphasis or contain a statement under 498(2) or

498(3) of the Companies Act 2006.

The financial information has been prepared on the historical

cost basis and are presented in Sterling and all values are rounded

to the nearest thousand pounds (GBP000) except when otherwise

indicated.

The Directors have produced forecasts that have been sensitised

to reflect plausible downside scenarios as a result of the COVID-19

pandemic and its impact on the group's operations given the nature

of its contracts with customers and the customer base. These

demonstrate the Group is forecast to generate profits and cash in

the year ending 31 March 2021 and beyond and that the Group has

sufficient cash reserves to enable the Group to meet its

obligations as they fall due for a period of at least 12 months

from the date of signing of these financial statements.

As such, the Directors are satisfied that the Group has adequate

resources to continue to operate for the foreseeable future. For

this reason, they continue to adopt the going concern basis for

preparing these financial statements.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of consolidation

The Group's financial statements include the results of the

Company and its subsidiaries, all of which are prepared up to the

same date as the parent company.

Subsidiaries

Subsidiaries are all entities over which the Company has the

ability to exercise control and are accounted for as subsidiaries.

The trading results of subsidiaries acquired or disposed of during

the period end are included in the income statement from the

effective date of acquisition or up to the effective date of

disposal, as appropriate.

All intra-group transactions, balances, income and expenditure

are eliminated on consolidation.

The purchase method of accounting is used to account for the

acquisition of subsidiaries by the Company. The cost of an

acquisition is measured as the fair value of the assets given,

equity instruments issued, and liabilities incurred or assumed at

the date of exchange. Identifiable assets acquired and liabilities

and contingent liabilities assumed in a business combination are

initially measured at fair value at the acquisition date

irrespective of the extent of any non-controlling interest. The

excess of cost of acquisition over the fair values of the Group's

share of identifiable net assets acquired is recognised as

goodwill. Any deficiency of the cost of acquisition below the fair

value of identifiable net assets acquired (i.e. discount on

acquisition) is recognised directly in the income statement. All

acquisition expenses have been reported within the income statement

immediately.

Any contingent consideration to be transferred by the Group is

recognised at fair value at the acquisition date. Subsequent

changes to the fair value of the contingent consideration that is

deemed to be an asset or liability is recognised in accordance with

IAS 39 either in profit or loss or as a change to other

comprehensive income.

Where necessary, adjustments are made to the financial

information of subsidiaries to bring the accounting policies used

in line with those used by other members of the Group.

Revenue recognition

Revenue is generated by providing clinical health coaching,

supporting shared decision-making services and software solutions

to the healthcare sector, physiotherapy, dermatology and urgent

care services. Services are provided through short-term and

long-term contracts.

Revenue is recognised to the extent that it is probable that the

economic benefits will flow to the Group and the revenue can be

reliably measured. Revenue is measured as the fair value of the

consideration received or receivable, excluding discounts, rebates,

value added tax and other sales taxes.

Clinical health coaching, supporting shared decision-making

services and software solutions to the healthcare sector

Revenue is recognised as services are provided. Revenue is

recognised in the month when the service is provided, as this is

the point when revenue activity can be reliably measured.

Physiotherapy and dermatology services

Revenue represents invoiced sales of services to regional Care

Commissioning Groups of the National Health Service. Revenue is

recognised in the month when the service is provided, as this is

the point when revenue activity can be reliably measured. Revenue

can be subject to clawback adjustments based on performance against

criteria as detailed in the individual contracts.

Insourcing services

Revenue is recognised as services are provided. Revenue is

recognised in the month when the service is provided, as this is

the point when revenue activity can be reliably measured.

Urgent Care services

Revenue is recognised as services are provided. Revenue is

recognised in the month when the service is provided, as this is

the point when revenue activity can be reliably measured. Revenue

can be subject to clawback adjustments based on performance against

criteria as detailed in the individual contracts.

All revenue originates in the United Kingdom.

Finance income

Finance income comprises bank interest received, recognised on

an accruals basis.

Finance costs

Finance costs comprise bank charges and interest on leases

recognised under IFRS 16. The prior year also included the

unwinding of the fair value adjustment of the contingent

consideration.

Property, plant and equipment

Property, plant and equipment is carried at cost less

accumulated depreciation and any recognised impairment in value.

Cost comprises the aggregate amount paid to acquire assets and

includes costs directly attributable to making the asset capable of

operating as intended.

Depreciation is calculated to write down the cost of the assets

to their residual values by equal instalments over the estimated

useful economic lives as follows:

Motor vehicles - 3 and 5

years

Computer equipment - 2 and 5

years

Plant and machinery and Office equipment - 2 to 5 years

Freehold property improvements and Short - 3 to 10

leasehold property years

The assets' residual values, useful lives and methods of

depreciation are reviewed, and adjusted if appropriate on an annual

basis. An asset is de-recognised upon disposal or when no future

economic benefits are expected from its use or disposal. Any gain

or loss arising on de-recognition of the asset (calculated as the

difference between the net disposal proceeds and the carrying

amount of the asset) is included in the income statement in the

period that the asset is de-recognised.

Inventories

Inventories are valued at the lower of cost and net realisable

value. In general, costs are determined on a first in first out

basis and includes all direct expenditure based on a normal level

of activity. Net realisable value is the price at which the stocks

can be sold in the normal course of business after allowing for the

costs of realisation and where appropriate for the costs of

conversion from its existing state to a finished condition.

Intangible assets other than goodwill

Intangible assets other than goodwill comprise computer software

and customer contracts and relationships.

Computer software is recognised at cost and subsequently

amortised over its expected useful economic life of three

years.

Customer contracts and the related customer relationships were

acquired in business combinations and recognised separately from

goodwill. They are initially recognised at their fair value at the

acquisition date (which is regarded as their cost). Subsequent to

initial recognition, these assets are amortised over the expected

life of contracts and reported at cost less accumulated

amortisation and accumulated impairment losses. Assets are reviewed

for impairment on at least an annual basis.

Goodwill

Goodwill represents the excess of the fair value of the

consideration of an acquisition over the fair value of the Group's

share of the net identifiable assets of the acquired subsidiary at

the date of acquisition. Goodwill is considered to have an

indefinite useful life. Goodwill is tested for impairment annually

and again whenever indicators of impairment are detected and is

carried at cost less any provision for impairment.

Impairment of non-current assets

For the purposes of impairment testing, goodwill is allocated to

each of the Group's cash-generating units ("CGUs") or groups of

CGUs that is expected to benefit from the synergies of the

combination. These comprise Urgent Care and Planned Care segments

and at 31 March 2020 the goodwill allocated to each amounted to

GBP22,674,000 and GBP7,836,000 respectively.

A cash-generating unit to which goodwill has been allocated is

tested for impairment annually, or more frequently when there is an

indication that the unit may be impaired. If the recoverable amount

of the cash-generating unit is less than its carrying amount, the

impairment loss is allocated first to reduce the carrying amount of

any goodwill allocated to the unit and then to the other assets of

the unit pro-rata based on the carrying amount of each asset in the

unit. Any impairment loss for goodwill is recognised directly in

profit or loss. An impairment loss recognised for goodwill is not

reversed in subsequent periods.

The value of the goodwill was tested for impairment during the

current financial year by means of comparing the recoverable amount

of each CGU or group of CGUs with the carrying value of its

goodwill.

The calculation of the CGUs' value in use is calculated on the

cash flows expected to be generated using the latest budget and

forecast data. Estimates of revenue and costs are based on past

experience and expectations of future changes in the market.

Board approved cash flow projections for five years are used and

then extrapolated out assuming flat cash flows and discounted at a

pre-tax rate of 10% (2019: 10%) over five years and then into

perpetuity.

Based on the operating performance of the CGUs, an impairment of

goodwill of GBP1.5m was identified in the current financial year

(2019: GBP2.0m).

On disposal of the relevant cash-generating unit, the

attributable amount of goodwill is included in the determination of

the profit or loss on disposal.

Trade and other receivables

Trade receivables, which are generally received by the end of

month following terms, are recognised and carried at the lower of

their original invoiced value less provision for expected credit

losses.

Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and short-term

deposits with an original maturity of three months or less.

Trade and other payables

Trade payables are obligations to pay for goods and services

that have been acquired in the ordinary course of business from

suppliers. Trade and other payables are recognised at original

cost.

Borrowings

Borrowings are initially recognised at fair value, being

proceeds received less directly attributable transaction costs

incurred. Borrowings are subsequently measured at amortised cost

with any transaction costs amortised to the income statement over

the period of the borrowings using the effective interest

method.

Foreign currencies transactions

Transactions denominated in foreign currencies are translated at

the exchange rate at the date of the transaction. Monetary assets

and liabilities denominated in foreign currencies at the period end

are translated at the exchange rate ruling at that date. Foreign

exchange differences arising on translation are recognised in the

income statement.

Leased assets

Until 31 March 2019, leases of property, plant and equipment

were classified as either finance leases or operating leases. From

1 April 2019, leases are recognised as a right-of-use asset and a

corresponding liability at the date at which the leased asset is

available for use by the Company.

Assets and liabilities arising from a lease are initially

measured on a present value basis. Lease liabilities include the

net present value of fixed lease payments. The lease payments are

discounted using the interest rate implicit in the lease. If that

rate cannot be readily determined, the lessee's incremental

borrowing rate is used, being the rate that the lessee would have

to borrow the funds necessary to obtain an asset of similar value

to the right-of-use asset with similar terms, security and

conditions.

Lease payments are allocated between principle and finance

costs. The finance cost is charged to profit or loss over the lease

period so as to produce a constant periodic rate of interest on the

remaining balance of the liability for each period.

Right-of-use assets are measured at cost comprising the initial

measurement of lease liability, any lease payments made at or

before the commencement date less any lease incentives received,

and any initial direct costs.

Right-of-use assets are depreciated over the shorter of the

asset's useful life and the lease term on a straight-line

basis.

Payments associated with short-term leases of equipment and

vehicles and all leases of assets considered low value are

recognised as an expense in profit or loss on a straight-line

basis. Short-term leases are leases with a lease term of twelve

months or less.

Exceptional items

Exceptional items are those items that, in the Directors' view,

are required to be separately disclosed by virtue of their size or

incidence to enable a full understanding of the Group's financial

performance.

Income taxes

Current income tax assets and liabilities are measured at the

amount expected to be recovered or paid to the taxation authorities

based on tax rates and laws that are enacted or substantively

enacted by the period end date. Deferred income tax is recognised

using the balance sheet liability method, providing for temporary

differences between the tax bases and the accounting bases of

assets and liabilities. Deferred income tax is calculated on an

undiscounted basis at the tax rates that are expected to apply in

the period when the liability is settled and the asset is realised,

based on tax rates and laws enacted or substantively enacted at the

period end date.

Deferred income tax liabilities are recognised for all temporary

differences, except for an asset or liability in a transaction that

is not a business combination, and at the time of the transaction

affects neither the accounting profit nor taxable profit or

loss.

Deferred income tax is charged or credited to the income

statement, except when it relates to items charged or credited to

equity, in which case the deferred tax is also dealt with in

equity. Deferred income tax assets and liabilities are offset

against each other only when the Company has a legally enforceable

right to do so.

Deferred income tax assets are recognised to the extent that it

is probable that future taxable profits will be available against

which the deductible temporary differences can be utilised.

Retirement benefits

The Group operates a defined contribution plan. A defined

contribution plan is a pension plan under which the employer pays

fixed contribution into a separate entity. Contributions payable to

the plan are charged to the income statement in the period to which

they relate. The Group has no legal or constructive obligations to

pay further contributions if the fund does not hold sufficient

assets to pay all employees the benefits relating to employee

service in the current and prior periods.

Company only accounting policies

The following principal accounting policies have been

applied:

Investments

Fixed asset investments are stated at cost less provisions for

diminution in value.

Deferred tax

Deferred tax assets and liabilities are recognised where the

carrying amount of an asset or liability in the Company Statement

of financial position differs from its tax base, except for

differences arising on:

-- the initial recognition of goodwill;

-- the initial recognition of an asset or liability in a

transaction which is not a business combination and at the time of

the transaction affects neither accounting or taxable profit;

and

-- investments in subsidiaries where the Company is able to

control the timing of the reversal of the difference and it is

probable that the difference will not reverse in the foreseeable

future.

Recognition of deferred tax assets is restricted to those

instances where it is probable that taxable profit will be

available against which the difference can be utilised.

The amount of the asset or liability is determined using tax

rates that have been enacted or substantively enacted by the

reporting date and are expected to apply when the deferred tax

liabilities or assets are settled or recovered. Deferred tax

balances are not discounted.

Share-based payments

The Group provides benefits to employees (including Directors)

of the Group in the form of share-based payment transactions,

whereby employees render services in exchange for shares or rights

over shares. The fair value of the employee services rendered is

determined by reference to the fair value of the shares awarded or

options granted. Share options are valued using the Black Scholes

pricing model, or the Monte Carlo model where performance-based

market vesting conditions apply. This fair value is charged to the

income statement over the vesting period of the share-based payment

scheme, with the corresponding increase in equity.

The value of the charge is adjusted in the income statement over

the remainder of the vesting period to reflect expected and actual

levels of options vesting, with the corresponding adjustment made

in equity.

Standards adopted in the year

During the year the Group adopted IFRS 16 with a transition date

of 1 April 2019.

There have been no other standards adopted that have had a

material impact on the financial statements and no standards

adopted in advance of their implementation dates.

Standards, interpretations and amendments not yet effective

There are a number of standards, amendments to standards, and

interpretations which have been issued by the International

Accounting Standards Board ("IASB") that are effective in future

accounting periods that the Group has decided not to adopt early.

The following amendments are effective for the period beginning 1

April 2020:

-- IAS 1 Presentation of Financial Statements;

-- IAS 8 Accounting Policies, Changes in Accounting Estimates

and Errors (Amendment - Definition of Material); and

-- IFRS 3 Business Combinations (Amendment - Definition of Business).

In January 2020, the IASB issued amendments to IAS 1, which

clarify the criteria used to determine whether liabilities are

classified as current or non-current. These amendments clarify that

current or non-current classification is based on whether an entity

has a right at the end of the reporting period to defer settlement

of the liability for at least twelve months after the reporting

period.

The Group does not believe that the amendments to IAS 1 will

have a significant impact on the classification of its

liabilities.

4. (LOSS)/EARNINGS PER SHARE

12 months to 31 March

2020 12 months to 31 March 2019

--------------------------------------- ---------------------------------------------------------------------------

Basic Diluted

loss loss Diluted

per per Basic loss loss per

Earnings share share Earnings per share share

GBP'000 GBP'000

-------------- --------------------- ------- ------- --------------------- ------------------------- -------------------------

Loss before

exceptional

items (905) (0.58)p (0.58)p (1,224) (2.05)p (2.05)p

Effect of

exceptional

items (1,928) (1.24)p (1.24)p (278) (0.46)p (0.46)p

(Loss)/profit

attributable

to owners of

the

parent (2,833) (1.82)p (1.82)p (1,502) (2.51)p (2.51)p

---------------- --------------------- ------- ------- --------------------- ------------------------- -------------------------

2020 2019

GBP'000 GBP'000

-------------- --------------------- ------- ------- --------------------- ------------------------- -------------------------

Weighted average

number of

ordinary

shares 155,696 59,795

Dilutive effect - -

of shares from

share options

----------------

Fully diluted

weighted

average number

of ordinary

shares 155,696 59,795

---------------- --------------------- ------- ------- --------------------- ------------------------- -------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR RFMTTMTTMTIM

(END) Dow Jones Newswires

July 07, 2020 02:00 ET (06:00 GMT)

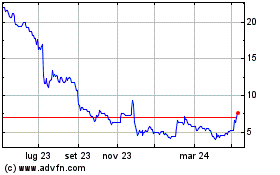

Grafico Azioni Totally (LSE:TLY)

Storico

Da Mar 2024 a Apr 2024

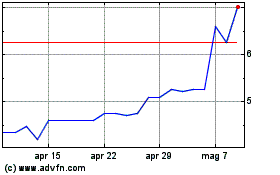

Grafico Azioni Totally (LSE:TLY)

Storico

Da Apr 2023 a Apr 2024