Macquarie Capital Strengthens Leveraged Finance Effort with Senior Appointment

17 Aprile 2018 - 1:30PM

Business Wire

Macquarie Capital, the corporate advisory, capital markets and

principal investment arm of Macquarie Group, today announced the

appointment of Adam Hoffman as a Managing Director in its leveraged

finance business. Based in New York, Mr. Hoffman will report to

Andy Stock, Co-Head of Sales and Trading, Americas at Macquarie

Capital.

Mr. Hoffman joins from HSBC Securities, where he served as Head

of Loan Trading, North America establishing the firm's loan trading

business in the region. He brings more than 14 years of trading

experience, primarily as a market maker across all loan sectors.

Prior to HSBC, Mr. Hoffman was a loan trader at Morgan Stanley.

Throughout his career, he has built and expanded loan trading

platforms in order to deliver institutional investing clients a

wider array of solutions.

"Adam is well respected by institutional investors for his deep

technical understanding of the syndicated loan market, his

understanding of investor needs and his ability to provide

liquidity to market participants.” Mr. Stock said. “As client

demand for leveraged products continues to grow, it is important

that we broaden our capabilities and distribution platform, and

Adam brings significant expertise and leadership to help us

accomplish this.”

Macquarie Capital’s leveraged finance business experienced

significant growth since its inception, recently marking a record

level of activity. Macquarie Capital has held leading positions in

Bloomberg’s 2016 and 2017 rankings for US syndicated LBO

bookrunners in the technology sector.

Notable recent transactions include: lead bookrunner on a senior

secured credit facilities backing the acquisition of Vistage by

Providence Equity Partners, sole bookrunner on an incremental first

lien term loan for Corsair Components backing a shareholder

dividend, joint bookrunner on a First Lien Term Loan extension and

Incremental Term Loan raise for The Stars Group backing two

acquisitions and the refinancing of a second lien term loan and

joint bookrunner on a first lien term loan backing the acquisition

of Weld North Education by Silver Lake Partners.

About Macquarie Group

Macquarie Group (Macquarie) is a global provider of banking,

financial, advisory, investment and funds management services.

Founded in 1969, Macquarie employs more than 13,900 people in over

27 countries. At 30 September 2017, Macquarie had assets under

management of $US371.3 billion. For more information, visit

www.macquarie.com.

About Macquarie Capital

Macquarie Capital combines grounded thinking with innovative

approaches to develop transformative ideas and realize greater

possibilities for our clients - our partners. We look beyond

convention to connect our clients with ideas and opportunities

others don’t see, while our global platform, specialized expertise

and comprehensive services allow us to deliver what others

can’t.

Our capabilities encompass corporate advisory and a full

spectrum of capital solutions, including capital raising services

from equity, debt and private capital markets and principal

investments from Macquarie’s own balance sheet. These offerings are

reinforced through our deep sector expertise in aerospace, defense

and government services, consumer, gaming and leisure, financial

institutions, infrastructure and energy, real estate, resources,

services, telecommunications, media and technology sectors across

the US.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180417005181/en/

Macquarie Media InquiriesDavid Franecki,

212-231-1310Macquarie Group Corporate

Communicationsdavid.franecki@macquarie.com

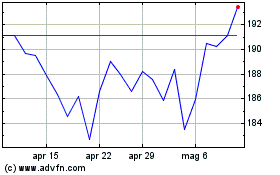

Grafico Azioni Macquarie (ASX:MQG)

Storico

Da Mar 2024 a Apr 2024

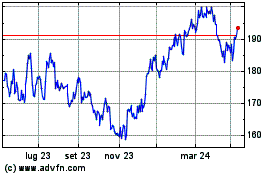

Grafico Azioni Macquarie (ASX:MQG)

Storico

Da Apr 2023 a Apr 2024