Harbour Energy Working With ENN, Hony on Bid for Santos

15 Maggio 2018 - 10:12AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Private-equity backed oil and gas investor

Harbour Energy Ltd. continues to edge toward a takeover deal for

Santos Ltd. (STO.AU), negotiating for the support of Chinese

investors that collectively hold the single biggest stake in the

Australian company.

In a statement to the Australian Securities Exchange on Tuesday,

Harbour said it was working in concert with Chinese natural-gas

distributor ENN Group Co. and private-equity firm Hony Capital and

is seeking to agree on terms with the pair in order to put forward

a final proposal to acquire Santos.

Last year, ENN and Hony Capital raised their collective stake in

Santos to 15.1% and agreed to act together as investors.

Santos, which has a market value of almost US$9.8 billion, is

one of the largest independent oil and gas producers in the

Asia-Pacific region, supplying homes and businesses. It owns vast

oil and gas acreage in Australia and is a partner in two liquefied

natural gas ventures in Australia and another in Papua New

Guinea.

In early April, Santos agreed to open its books after Harbour

approached it with a fresh US$10.37 billion takeover bid.

However, analysts have speculated the offer would have to be

raised to reflect the rise in oil prices since the conditional

offer of US$4.98 a share was made. Santos has also continued to

sell assets, including a portfolio of investments in Asia, as it

chips away at debt that stood at US$2.5 billion at the end of

March. Its shares ended Tuesday at 6.23 Australian dollars

(US$4.69).

Harbour, which was set up by EIG Global Energy Partners in 2014

to hunt for oil and gas assets outside the U.S., last year paid

US$3 billion to buy energy assets offshore from the U.K. from Royal

Dutch Shell PLC.

In April, Harbour said it had lined up equity for a Santos

takeover bid from investors including commodities trader Mercuria

and $7.75 billion in debt through J.P. Morgan and Morgan Stanley.

The tentative offer comprised cash and a special dividend, though

it said it would also offer an option for Santos shareholders to

accept unlisted shares in a new private company.

Harbour has plans to use Santos's core assets to grow in

Australia and throughout Asia.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

May 15, 2018 03:57 ET (07:57 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

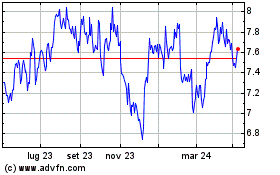

Grafico Azioni Santos (ASX:STO)

Storico

Da Mar 2024 a Apr 2024

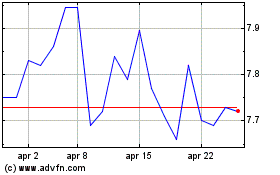

Grafico Azioni Santos (ASX:STO)

Storico

Da Apr 2023 a Apr 2024