By Joe Flint and Suzanne Vranica

For 21st Century Fox, this year's World Cup was essentially

decided when the U.S. men's team lost to Trinidad and Tobago last

October, and so failed to qualify for the tournament for the first

time since 1986.

Without a U.S. team, early World Cup rounds on Fox's networks

drew nearly a third fewer viewers than in 2014, and the company is

now expected to lose money on the 2018 tournament, according to

people familiar with the situation.

The ratings suggest that the growth in soccer's popularity in

the U.S. in recent years doesn't translate to TV viewing unless the

national team is involved. They also are a reminder that big-ticket

sports media deals, seen as among the safer bets in a pay-TV

industry buffeted by viewership fragmentation and cord-cutting, can

carry risks. Ratings for this year's Winter Olympics were down, and

the Super Bowl had its smallest audience in nearly a decade.

Fox will spend some $900 million on soccer rights through the

2026 World Cup, and plans to focus even more on sports if it

follows through on a sale of entertainment assets to either Walt

Disney Co. or Comcast Corp.

A Fox spokesman said ad revenue for this World Cup is on pace to

beat the 2014 figure, and the company is doing better than it

initially projected when the U.S. failed to qualify. Still,

viewership of the 2018 tournament on Fox's broadcast network and

its cable channel Fox Sports 1 averaged 2.6 million through the

quarterfinals, down about 32% from the 2014 tournament, which aired

on Disney's ESPN and ABC.

"The fact that the U.S. team didn't make it was a real setback

for Fox," said sports and media industry consultant Marc Ganis.

When the U.S. team failed to qualify, Fox cut its production

budget significantly and adjusted its ratings estimates for

advertisers, people familiar with the matter said. But it hasn't

been able to deliver the audiences it guaranteed in ad deals,

forcing it to provide additional ad time -- "make goods" -- as

compensation to some advertisers, ad executives said.

The ratings are also being hurt by the early start times for

games. The 2014 tournament was in Brazil, a much more convenient

time zone for U.S. viewers than this year's venue, Russia.

Even factoring out the U.S. team's absence, the audience for

much of the 2018 tournament has been smaller than in 2014. Ratings

have ticked up recently, and last Saturday's quarterfinal matches

on Fox scored higher ratings than the corresponding games in the

2014 tournament.

Fox and News Corp, parent of The Wall Street Journal, share

common ownership.

World Cup telecasts on Comcast Corp.'s Telemundo, which has the

Spanish-language rights -- and paid even more than Fox -- have

similarly drawn smaller audiences than the 2014 games on

Univision.

Like Fox, Telemundo won't show a profit for the World Cup,

people familiar with the matter said. A Telemundo spokesman

declined to comment on the profitability of telecasts.

But Telemundo executives said its ratings are new highs for the

network. "The World Cup is Broadway, it gets you noticed" said

Telemundo Sports President Ray Allen.

Fox and Telemundo have generated strong online viewership.

Telemundo's digital streams have racked up 14.4 million unique

users to date and 125 million live streams.

As of July 7, Fox's World Cup TV ad revenue was roughly $107

million and Telemundo's about $127 million, ad research firm iSpot

estimates, based on in-game ads. Both generate additional revenue

through promotional and marketing partnerships.

Ad revenue from the 2014 tournament was roughly $336 million for

Univision and $187 million for Disney, ad-tracking firm Kantar

Media estimates, including pregame and postgame ads.

Both Fox and Telemundo are roughly 7% to 10% below the ratings

they projected for advertisers, according to one ad buyer.

"Our goal is to have everybody come out of this delivered and

whole with what they purchased from us," said Mike Petruzzi, senior

vice president of ad sales for Fox Sports, referring to

advertisers.

Joanne Bradford, chief marketing officer at World Cup advertiser

Social Finance Inc., knew the tournament "was a ratings risk" but

is pleased with how the online lender's ads have performed.

"True soccer fans will tune in to world-class games even if

America isn't involved," she said. "If anything, this provides us

an advantage, since we get the best of both worlds -- a big stage,

and a more-targeted audience."

Fox outbid ESPN for English-language rights to the World Cup and

other FIFA properties in 2011. It offered $425 million, people with

knowledge of the deal said at the time, dwarfing the $100 million

ESPN had paid in the previous FIFA deal.

Fox's pact started with the World Cup women's finals in 2015 and

was to run through the 2022 men's tournament in Qatar. Fox

subsequently extended its deal through the men's finals in 2026,

when the tournament will be in North America, at a price of roughly

$500 million.

Telemundo shelled out $600 million for Spanish-language rights

between 2015 and 2022, almost twice what Univision had paid in the

previous deal, and extended to 2026 for an additional $415

million.

Write to Joe Flint at joe.flint@wsj.com and Suzanne Vranica at

suzanne.vranica@wsj.com

(END) Dow Jones Newswires

July 11, 2018 08:40 ET (12:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

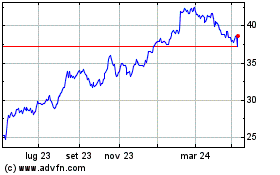

Grafico Azioni News (ASX:NWS)

Storico

Da Mar 2024 a Apr 2024

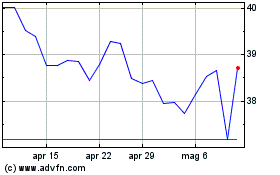

Grafico Azioni News (ASX:NWS)

Storico

Da Apr 2023 a Apr 2024