Wealthy Shoppers Push Aside Trade Dispute Fears to Fuel LVMH -- Update

24 Luglio 2018 - 8:19PM

Dow Jones News

By Matthew Dalton

The world's well-heeled shoppers sent first-half revenue at

luxury conglomerate LVMH Moët Hennessy Louis Vuitton SE to a record

high, brushing aside worries of a trade dispute between the U.S.

and China to splurge on everything from handbags and jewelry to

fine wines.

Revenue in the first six months of the year hit EUR21.8 billion

($25.5 billion), up 10% compared with the same period a year ago,

LVMH said Tuesday. LVMH's net profit jumped 41% to EUR3

billion.

LVMH is the world's biggest luxury-goods company by sales, and

its results are seen as a bellwether for the industry. LVMH owns

leather-goods giant Louis Vuitton, couture house Christian Dior,

high-end jeweler Bulgari, cognac label Hennessy and dozens of other

brands.

The results reflect solid economic growth across major economies

that has prompted wealthier consumers world-wide to open their

wallets. The Trump administration's tax cut has sent the U.S. stock

market to record highs. Chinese growth has defied expectations of a

slowdown. And the eurozone is recovering after years of crisis.

Shoppers splurged even as the U.S. and China kicked off a trade

fight that has roiled stock markets and fueled fears of a global

slowdown. During the half, the two countries have imposed tariffs

on dozens of products.

LVMH Chief Executive Bernard Arnault, whose family is the

company's controlling shareholder, struck a cautious note amid the

record results.

"Despite buoyant global demand, monetary and geopolitical

uncertainties remain," Mr. Arnault said.

Investors worry that an economic slowdown in China could dampen

spending by Chinese shoppers, who are the luxury industry's most

important clientele. Beijing has launched a campaign to curb

lending, leading economists to predict that the economy is set to

slow.

But LVMH executives Tuesday said there were no signs of a

Chinese slowdown hitting its business.

Still, Jean-Jacques Guiony, LVMH's chief financial officer, told

investors that maintaining first-half growth rates for the rest of

the year would be a challenge, given LVMH's strong performance in

the second half of last year and the threat of a spillover effect

from U.S. and Chinese tariffs.

"The current trends cannot realistically be extrapolated to the

rest of the year," Mr. Guiony said.

LVMH's fashion-and-leather-goods division, which includes Louis

Vuitton, the world's biggest luxury brand by revenue, led the way

in the half. Revenue at the division rose 25% to EUR8.6 billion,

though the increase is partly due to LVMH taking full control of

Dior last year.

Revenue at LVMH's wine and spirits division lagged behind other

divisions, slipping 1% to EUR2.3 billion. The company has been

struggling with poor harvests in the Cognac region of France,

limiting production of the liquor despite strong demand in the U.S.

and China.

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

July 24, 2018 14:04 ET (18:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

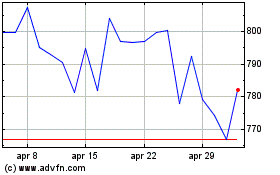

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Apr 2024 a Mag 2024

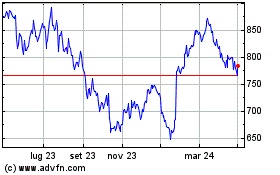

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Mag 2023 a Mag 2024