LVMH achieves 3% organic revenue growth in the first quarter

Paris, April 16th, 2024

LVMH Moët Hennessy Louis Vuitton, the world

leader in high-quality products, recorded revenue of €20.7 billion

in the first quarter of 2024. Organic revenue growth came to 3%.

LVMH had a good start to the year despite a geopolitical and

economic environment that remains uncertain.Europe and the United

States achieved growth on a constant currency and consolidation

scope basis over the quarter; Japan recorded double-digit revenue

growth; the rest of Asia reflected the strong growth in spending by

Chinese customers in Europe and Japan.

Revenue by business group changed

as follows:

|

In millions of euros |

Q1 2024 |

Q1 2023 |

ChangeQ12024/2023

Reported Organic* |

|

Wines & Spirits |

1 417 |

1 694 |

-16% |

-12% |

|

Fashion & Leather Goods |

10 490 |

10 728 |

-2% |

+2% |

|

Perfumes & Cosmetics |

2 182 |

2 115 |

+3% |

+7% |

|

Watches & Jewelry |

2 466 |

2 589 |

-5% |

-2% |

|

Selective Retailing |

4 175 |

3 961 |

+5% |

+11% |

|

Other activities and eliminations |

(36) |

(52) |

- |

- |

|

Total LVMH |

20 694 |

21 035 |

-2% |

+3% |

* On a constant consolidation scope and currency

basis. For the Group, the structural impact was ‑1%;the

currency effect was -4%.

The Wines & Spirits

business group saw a revenue decline (-12% organic) in the first

quarter of 2024. Champagne was down, reflecting the normalization

of post-Covid demand. Moreover, the beginning of the year was

compared to strong growth in the first quarter of 2023, due in

particular to restocking among distributors. Hennessy cognac was

once again hampered by a cautious attitude among retailers, which

limited their orders in an environment that remained uncertain in

the United States. Among Provence rosé wines, the prestigious

Minuty estate was included in the first-quarter accounts for the

first time.

The Fashion & Leather Goods

business group achieved organic revenue growth of 2% in the first

quarter of 2024. Louis Vuitton made an excellent start to the year,

once again buoyed by the creativity and quality of its products.

The Maison celebrated ten years of Nicolas Ghesquière’s designs for

Louis Vuitton at his latest Women’s show, held in the Louvre’s Cour

Carrée courtyard in Paris. Pharrell Williams presented his new

Men’s collection, inspired by the classic American West wardrobe.

His vision of the Speedy P9 bag, featuring a range of new colors,

was a major success. Illustrating Louis Vuitton’s support for Paris

2024 and its long history as a master trunk-maker, the Maison

unveiled the unique trunks designed to house the medals and torches

for the Paris 2024 Olympic and Paralympic Games. Christian Dior

continued to show remarkable creative momentum in all its products.

Maria Grazia Chiuri and Kim Jones continued to pay tribute to the

Maison’s iconic designs, raising Dior’s visibility to record levels

– with as many as 390 million views for the livestream show of its

Women’s Winter 2024 ready-to-wear collection – while a new series,

entitled The New Look, retraced the creation and rise of the House

of Dior. The opening in Geneva of an exceptional store designed by

architect Christian de Portzamparc was a highlight of the quarter.

Celine’s new Collection de l’Arc de Triomphe, designed by Hedi

Slimane, continued to elevate the brand’s desirability. Loewe

launched its first major exhibition in Shanghai, commissioned by

Jonathan Anderson, as a tribute to the Maison’s Spanish heritage.

Fendi expanded its Selleria leather goods line. Loro Piana once

again achieved excellent momentum in all its product categories.

Rimowa and Berluti experienced a good start to the year.

The Perfumes & Cosmetics

business group achieved organic revenue growth of 7%, driven by its

powerful innovative momentum and selective distribution strategy.

Christian Dior delivered an excellent performance, spurred by the

ongoing success of iconic fragrances Sauvage, J’adore and Miss

Dior, the new Parfum edition of which showed remarkable results.

The relaunch of Rouge Dior in makeup and the Capture skincare line

also contributed to the Maison’s rapid growth. Guerlain was buoyed

by robust demand for its Aqua Allegoria fragrances, enriched with a

new Florabloom version, as well as its new Abeille Royale creams

and the success of Terracotta in makeup. Parfums Givenchy was

boosted by the expansion of its L’Interdit fragrance. Maison

Francis Kurkdjian posted solid growth, driven in particular by its

iconic Baccarat Rouge 540.

The Watches & Jewelry

business group was down slightly (-2% organic) in the first quarter

of 2024. In jewelry, Tiffany & Co. continued the global rollout

of its new store concept inspired by The Landmark in New York,

where it launched its first exhibition, Culture of Creativity,

celebrating the Maison’s long-standing commitment to artistic

excellence. A comprehensive communication campaign, showcasing its

icons, has just been launched worldwide and has met with great

success. Bulgari continued to showcase the iconic Serpenti and

relaunch its B.zero1 collection. The Maison announced the launch of

Fondazione Bulgari, a foundation dedicated to preserving cultural

and craft heritage, and to passing on skills in Italy. Chaumet

unveiled the medals for the Paris 2024 Olympic and Paralympic

Games, created by the Maison’s design studio, and Fred launched its

new “Sunshine Jeweler” communication campaign. Creative momentum

remained strong in watchmaking, with a wide range of innovations by

TAG Heuer, Hublot and Zenith presented in Miami at the fifth LVMH

Watch Week.

In Selective Retailing, organic

revenue growth was 11% in the first quarter of 2024. Sephora once

again achieved remarkable growth, continuing to gain market share.

Growth remained particularly strong in North America, Europe and

the Middle East. The store network continued to expand,

particularly in North America. DFS remained below its 2019

pre-Covid level of business activity, with international travel

only partially recovering in Europe and at flagship destinations

Hong Kong and Macao.

In an uncertain geopolitical and economic

environment, LVMH remains both vigilant and confident at the start

of the year. The Group will continue to pursue its strategy focused

on the development of its brands, driven by a sustained policy of

innovation and investment as well as by a constant quest for

quality in its products, their desirability and their

distribution.

LVMH will rely on the talent and motivation of

its teams, the diversity of its businesses and the good

geographical balance of its revenue to further strengthen its

global leadership position in luxury goods in 2024.

Regulated information related to this press

release and presentation available at www.lvmh.com.

Details from the webcast on the publication of

revenue for the first quarter of 2024 available at

www.lvmh.com.

LVMHLVMH Moët Hennessy Louis

Vuitton is represented in Wines and Spirits by a portfolio of

brands that includes Moët & Chandon, Dom Pérignon, Veuve

Clicquot, Krug, Ruinart, Mercier, Château d’Yquem, Domaine du Clos

des Lambrays, Château Cheval Blanc, Colgin Cellars, Hennessy,

Glenmorangie, Ardbeg, Belvedere, Woodinville, Volcán de Mi Tierra,

Chandon, Cloudy Bay, Terrazas de los Andes, Cheval des Andes,

Newton, Bodega Numanthia, Ao Yun, Château d’Esclans, Château

Galoupet, Joseph Phelps and Château Minuty. Its Fashion and Leather

Goods division includes Louis Vuitton, Christian Dior, Celine,

Loewe, Kenzo, Givenchy, Fendi, Emilio Pucci, Marc Jacobs, Berluti,

Loro Piana, RIMOWA, Patou, Barton Perreira and Vuarnet. LVMH is

present in the Perfumes and Cosmetics sector with Parfums Christian

Dior, Guerlain, Parfums Givenchy, Kenzo Parfums, Perfumes Loewe,

Benefit Cosmetics, Make Up For Ever, Acqua di Parma, Fresh, Fenty

Beauty by Rihanna, Maison Francis Kurkdjian and Officine

Universelle Buly. LVMH's Watches and Jewelry division comprises

Bulgari, Tiffany & Co., TAG Heuer, Chaumet, Zenith, Fred and

Hublot. LVMH is also active in selective retailing as well as in

other activities through DFS, Sephora, Le Bon Marché, La

Samaritaine, Groupe Les Echos, Cova, Le Jardin d’Acclimatation,

Royal Van Lent, Belmond and Cheval Blanc hotels.

“This document may contain certain forward

looking statements which are based on estimations and forecasts. By

their nature, these forward looking statements are subject to

important risks and uncertainties and factors beyond our control or

ability to predict, in particular those described in LVMH’s

Universal Registration Document which is available on the website

(www.lvmh.com). These forward looking statements should not be

considered as a guarantee of future performance, the actual results

could differ materially from those expressed or implied by them.

The forward looking statements only reflect LVMH’s views as of the

date of this document, and LVMH does not undertake to revise or

update these forward looking statements. The forward looking

statements should be used with caution and circumspection and in no

event can LVMH and its Management be held responsible for any

investment or other decision based upon such statements. The

information in this document does not constitute an offer to sell

or an invitation to buy shares in LVMH or an invitation or

inducement to engage in any other investment activities.”

LVMH CONTACTS

|

Analysts and investors Rodolphe Ozun LVMH+ 33 1 44

13 27 21 |

Media Jean-Charles Tréhan LVMH + 33 1 44 13 26

20 |

|

MEDIA CONTACTS |

|

|

France Charlotte Mariné / +33 6 75 30 43 91Axelle

Gadala / +33 6 89 01 07 60Publicis Consultants+33 1 44 82 46

05 |

France Michel Calzaroni / + 33 6 07 34 20

14Olivier Labesse / Hugues Schmitt / Thomas Roborel de Climens / +

33 6 79 11 49 71 |

|

Italy Michele Calcaterra / Matteo Steinbach SEC

and Partners + 39 02 6249991 |

UK Hugh Morrison / Charlotte McMullen Montfort

Communications + 44 7921 881 800 |

|

US Nik Deogun / Blake Sonnenshein Brunswick Group

+ 1 212 333 3810 |

China Daniel Jeffreys Deluxewords +

44 772 212 6562 + 86 21 80 36 04 48 |

- LVMH 2024 First Quarter Revenue

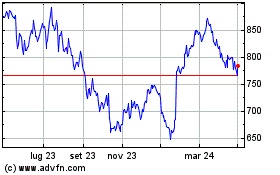

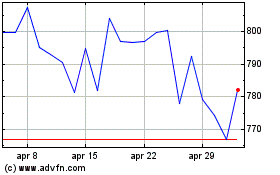

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Lvmh Moet Hennessy Louis... (EU:MC)

Storico

Da Nov 2023 a Nov 2024