TIDMTLY

RNS Number : 7735C

Totally PLC

19 June 2019

19 June 2019

Totally plc

("Totally", the "Company" or the "Group")

Result of General Meeting and Open Offer, Issue of Equity,

Acquisition of Greenbrook Healthcare and Directorate Change

Totally plc (AIM: TLY), a leading provider of a range of out of

hospital services to the healthcare sector in the UK, is pleased to

announce that further to its announcement of 31 May 2019, at the

General Meeting held earlier today all resolutions were duly

passed. Accordingly, the acquisition of Greenbrook Healthcare, the

Placing and the Open Offer are expected to complete, conditional on

Admission, on 20 June 2019.

Placing and Open Offer

The Open Offer closed for acceptances at 9.00 a.m. on 17 June

2019 in accordance with its terms. The Company therefore announces

that it has received valid acceptances in respect of 7,390,939

Offer Shares from Qualifying Shareholders, including applications

under the Excess Application Facility, representing approximately

74 per cent. of the Offer Shares offered. Accordingly, Qualifying

Shareholders who have validly applied for Offer Shares will receive

their full Open Offer Entitlement and any Offer Shares applied for

under the Excess Application Facility.

As a consequence, the Company has conditionally raised

approximately GBP9.74 million (before expenses) in aggregate

through the Placing and Open Offer.

Issue of Equity, Admission and Total Voting Rights

A total of 122,390,939 Ordinary Shares are being issued and

allotted pursuant to the Proposals comprising the Consideration

Shares, the Placing Shares and the Offer Shares. The Consideration

Shares, the Placing Shares and the Offer Shares are being credited

as fully paid and will be identical to and rank pari passu in all

respects with the Existing Ordinary Shares.

Application has been made to the London Stock Exchange for the

enlarged issued share capital of 182,186,111 ordinary shares of 10

pence each in the Company to be admitted to trading on AIM.

Admission is expected to take place at 8.00 a.m. on 20 June

2019.

Following Admission, the issued share capital of the Company

will consist of 182,186,111 Ordinary Shares, with one voting right

each. The Company does not hold any shares in treasury.

The above figure may be used by shareholders in the Company as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or a change to

their interest in, the share capital of the Company under the FCA's

Disclosure Guidance and Transparency Rules.

Director Appointment

As set out in the Admission Document, the appointment of Michael

Steel to the Board of the Company as Executive Director will take

effect from 20 June 2019.

Michael Steel is Chief Executive Officer of Greenbrook

Healthcare and co-founded the business in 2007. Prior to Greenbrook

Healthcare, Michael spent 14 years in strategy consulting as a

partner for Roland Berger Strategy Consultants and as a project

manager for Booz Allen and Hamilton where he focused on growth

strategy. He also founded and built his own 30 person consulting

firm which was successfully sold to Roland Berger. Michael has an

MBA from INSEAD business school and a master's degree in Economics

from Oxford University.

Michael Robert Steel, aged 49, holds and has held over the last

five years the following directorships / partnerships:

Current Directorships/Partnerships Past Directorships/Partnerships

Edison Trust Limited Experts in Healthcare

Coleraine Residents Company Products Limited

Limited

Greenbrook Healthcare (Harrow) Limited

Greenbrook Healthcare (Earl's Court)

Limited

Greenbrook Healthcare (Surrey) Limited

Greenbrook Healthcare Limited

Greenbrook Healthcare (Hounslow)

Limited

Greenbrook Capital LLP

Upon Admission, Michael Steel will have an interest in 7,676,851

Ordinary Shares equivalent to 4.21 per cent. of the issued share

capital. This interest comprises his entitlement to 7,676,851

Consideration Shares as a registered member of Greenbrook Capital.

It is anticipated that the 7,676,851 Consideration Shares will be

transferred from Greenbrook Capital to Michael Steel shortly after

Admission.

General Meeting

At the General Meeting held earlier today all resolutions were

duly passed on a show of hands with the following table summarising

proxy votes:

TOTAL % OF TOTAL % OF TOTAL VOTES VOTES WITHHELD

VOTES VOTES VOTES VOTES CAST (EXCLUDING

FOR CAST AGAINST CAST VOTES WITHHELD)

ORDINARY RESOLUTIONS

1. To approve

the Acquisition. 23,012,171 100.00 0 0.00 23,012,171 10,000

----------- -------- --------- ------- ----------------- ---------------

2. To authorise

the Directors

to allot shares. 23,012,171 100.00 0 0.00 23,012,171 10,000

----------- -------- --------- ------- ----------------- ---------------

SPECIAL RESOLUTION

3. To disapply

pre-emption rights. 22,985,033 99.97 6,100 0.03 22,991,133 31,038

----------- -------- --------- ------- ----------------- ---------------

Notes:

Any proxy votes that were at the discretion of the Chairman are

included in the "Total Votes For" each resolution

Percentage of votes cast excludes Votes Withheld

Votes Withheld are not votes in law and do not count in the

number of votes counted for or against a resolution

The same definitions apply throughout this announcement, unless

the context requires otherwise, as are applied in the Admission

Document, published on 31 May 2019, and which is available on the

Company's website, www.totallyplc.com

-ENDS-

For further information please contact:

Totally plc 020 3866 3335

Wendy Lawrence, Chief Executive

Bob Holt, Chairman

Allenby Capital Limited (Nominated Adviser

& Joint Corporate Broker) 020 3328 5656

Nick Athanas

Liz Kirchner

Canaccord Genuity Limited (Joint Corporate

Broker) 020 7523 8000

Bobbie Hilliam

Alex Aylen

Yellow Jersey PR 020 3004 9512

Georgia Colkin

Joe Burgess

Notes to Editors

Totally plc aims to become a leading out of hospital healthcare

service provider in the UK, helping to address some of the biggest

challenges faced by the UK healthcare sector.

By working to deliver preventative and responsive care through

its subsidiaries across multiple disciplines, Totally's goal is to

improve people's health, reduce healthcare reliance, re-admissions

and emergency admissions.

Totally, via its subsidiaries, operates within the UK's

outsourced healthcare market, estimated to be worth in excess of

GBP20bn per year for the NHS alone. Out of hospital services

include care in the community, GP surgeries, patients' homes,

prisons and other public sector organisations, places of work as

well as mobile locations and urgent care solutions.

The Company is currently engaged in delivering a progressive buy

and build consolidation strategy within the UK's fragmented

healthcare market and looks to further capitalise on the attractive

opportunities that its disruptive, outcome-based, outsourced

healthcare service model offers, to ultimately deliver value to

shareholders as it continues to build critical mass.

www.totallyplc.com

Premier Physical Healthcare and Optimum Physiotherapy -

occupational physiotherapy to NHS, prisons and the police force as

well as private clients

Wholly owned subsidiaries of Totally plc, providing a

comprehensive range of treatments and advice for musculoskeletal

injuries and conditions. The businesses deliver physiotherapy and

podiatry to NHS patients, have contracts with various police forces

and prison sites and provide occupational health and ergonomic

services to corporate and private clients. Totally completed the

acquisition of Premier Physical Healthcare Limited on 1 April 2016

and Optimum Sports Performance Centre Limited on 14 November

2016.

www.premierphysicalhealthcare.co.uk

www.optimum-hcs.com

About Health Limited - provider of community based dermatology

services and referral management services

A wholly owned subsidiary of Totally plc and a leading provider

of dermatology and referral management services to the NHS in the

UK. About Health has been providing community based health services

under contract to the NHS since 2009 and the company is CQC

registered. Totally completed the acquisition of About Health

Limited on 15 June 2016.

www.abouthealthgroup.com

Vocare Limited - leading UK urgent care provider

A wholly owned subsidiary of Totally plc, the Vocare Group is

one of the leading national specialist providers of urgent care

services in the country. Headquartered in Newcastle upon Tyne, it

provides innovative healthcare services to approximately 9.2

million patients across the UK through urgent care centres, GP

out-of-hours services, integrated urgent care centres and the NHS

111 service - working in close collaboration with the NHS and other

healthcare providers in local areas nationwide. Totally completed

the acquisition of Vocare Limited on 24 October 2017.

www.vocare.org.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBGGDLSDBBGCC

(END) Dow Jones Newswires

June 19, 2019 06:26 ET (10:26 GMT)

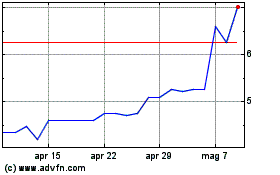

Grafico Azioni Totally (LSE:TLY)

Storico

Da Mar 2024 a Apr 2024

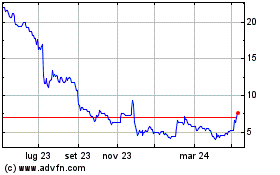

Grafico Azioni Totally (LSE:TLY)

Storico

Da Apr 2023 a Apr 2024