TIDMTRP

RNS Number : 9551C

Tower Resources PLC

21 June 2019

THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN, INTO

OR FROM THE UNITED STATES, CANADA, AUSTRALIA, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A BREACH OF THE RELEVANT SECURITIES LAWS OF SUCH

JURISDICTION.

This announcement does not constitute a prospectus or offering

memorandum or an offer in respect of any securities and is not

intended to provide the basis for any decision in respect of Tower

Resources PLC or other evaluation of any securities of Tower

Resources PLC or any other entity and should not be considered as a

recommendation that any investor should subscribe for or purchase

any such securities.

21 June 2019

Tower Resources plc

Cameroon Financing Update

Proposed Subscription to raise approximately GBP150,000

Tower Resources plc (the "Company" or "Tower" (TRP.L, TRP LN)),

the AIM listed oil and gas company with its focus on Africa,

announces an update with respect to the financing of its Cameroon

operation and an intention to raise gross proceeds of approximately

GBP150,000 through a subscription of approximately 15 million new

ordinary shares of 1 pence each (the "Subscription Shares") at a

subscription price of 1.00 pence per Subscription Share (the

"Subscription Price").

Admission of the Subscription Shares to trading on AIM is

expected to take place at 08:00 on or around 26 June 2019.

Cameroon Financing Update

Tower's near-term focus remains the financing and drilling of

the NJOM-3 well on its Thali license, offshore Cameroon, which is

planned to spud in Q3 2019. The Company is in negotiations with

several parties to finance some or all of the NJOM-3 well, which it

hopes will be concluded soon. The Company is also continuing to

explore longer-term options for debt, equity or pre-financing of

the remainder of the first phase development of the Njonji

structure, which might or might not be linked to the financing of

the current well. The Company's preferred route of financing is to

conclude a transaction with an industry partner on terms that are

favourable to shareholders, and that may obviate or minimise the

need for further equity financing. However, depending on the terms

of the asset-level deal achieved, it may also be necessary or in

shareholders' interests to raise a portion of the additional

finance via the issue of further corporate equity.

Background to the Subscription

Whilst financing negotiations continue regarding the Thali

license, the Company is proposing to raise approximately GBP150,000

for working capital purposes via a subscription for shares.

A further announcement is expected to be made shortly in

connection with the proposed subscription.

The Board can confirm that the proposed subscription will not

affect the repayment terms of the bridging loan of $750,000 (the

"Bridging Loan"), announced on 16 April 2019. The Bridging Loan

will remain due for repayment on or before 30 June 2019 subject to

a grace period of 21 business days which would extend to 29 July

2019

The Board looks forward to providing further updates in due

course.

Note regarding forward-looking statements

This announcement contains certain forward-looking statements

relating to the Company's future prospects, developments and

business strategies. Forward-looking statements are identified by

their use of terms and phrases such as "targets" "estimates",

"envisages", "believes", "expects", "aims", "intends", "plans",

"will", "may", "anticipates", "would", "could" or similar

expressions or the negative of those, variations or comparable

expressions, including references to assumptions.

The forward-looking statements in this announcement are based on

current expectations and are subject to risks and uncertainties

which could cause actual results to differ materially from those

expressed or implied by those statements. These forward-looking

statements relate only to the position as at the date of this

announcement. Neither the Directors nor the Company undertake any

obligation to update forward looking statements, other than as

required by the AIM Rules for Companies or by the rules of any

other applicable securities regulatory authority, whether as a

result of the information, future events or otherwise. You are

advised to read this announcement and the information incorporated

by reference herein, in its entirety. The events described in the

forward-looking statements made in this announcement may not

occur.

Neither the content of the Company's website (or any other

website) nor any website accessible by hyperlinks on the Company's

website (or any other website) is incorporated in, or forms part

of, this announcement.

Any person receiving this announcement is advised to exercise

caution in relation to the Placing. If in any doubt about any of

the contents of this announcement, independent professional advice

should be obtained.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

Contacts

Tower Resources plc info@towerresources.co.uk

Jeremy Asher

Chairman and CEO

Andrew Matharu

VP - Corporate Affairs

SP Angel Corporate Finance

LLP

Nominated Adviser and Joint

Broker

Stuart Gledhill

Caroline Rowe +44 20 3470 0470

Turner Pope Investments

(TPI) Limited

Joint Broker

Andy Thacker +44 20 3621 4120

Whitman Howard Limited

Joint Broker

Nick Lovering

Hugh Rich +44 20 7659 1234

Yellow Jersey PR Limited +44 20 3735 8825

Tim Thompson

Notes:

Tower Resources Cameroon S.A, a wholly-owned subsidiary of Tower

Resources plc, holds a 100% interest in the shallow water Thali

(formerly known as "Dissoni") Production Sharing Contract (PSC), in

the Rio del Rey basin, offshore Cameroon. Tower was awarded the PSC

on 15 September 2015 for an Initial Exploration Period of 3

years.

The Thali PSC covers an area of 119.2 km(2), with water depths

ranging from 8 to 48 metres, and lies in the prolific Rio del Rey

basin, in the eastern part of the Niger Delta. The Rio del Rey

basin has, to date, produced over one billion barrels of oil and

has estimated remaining reserves of 1.2 billion barrels of oil

equivalent ("boe"), primarily within depths of less than 2,000

metres. The Rio del Rey is a sub-basin of the Niger Delta, an area

in which over 34.5 billion barrels of oil has been discovered, with

2.5 billion boe attributed to the Cameroonian section.

An independent Reserve Report conducted by Oilfield

International Limited (OIL) have highlighted the contingent and

potential resources on the Thali licence and the associated

Expected Monetary Value (EMV) as follows:

-- Gross mean contingent resources of 18 MMbbls of oil across

the proven Njonji-1 and Njonji-2 fault blocks;

-- Gross mean prospective resources of 20 MMbbls of oil across

the Njonji South and Njonji South-West fault blocks;

-- Gross mean prospective resources of 111 MMbbls of oil across

four identified prospects located in the Dissoni South and Idenao

areas in the northern part of the Thali licence;

-- Calculated EMV10s of US$118 million for the contingent

resources, and US$82 million for the prospective resources,

respectively.

In accordance with the guidelines for the AIM market of the

London Stock Exchange, Dr Mark Enfield, BSc, PhD, FGS, Advisor to

the Board of Tower Resources plc, who has over 30 years' experience

in the oil & gas industry, is the qualified person that has

reviewed and approved the technical content of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCZMGZVVGKGLZM

(END) Dow Jones Newswires

June 21, 2019 02:00 ET (06:00 GMT)

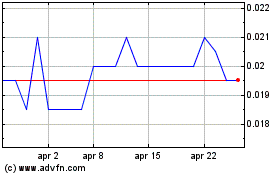

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Apr 2023 a Apr 2024